|

|

【TOPGLOV 7113 交流专区】顶级手套

[复制链接]

[复制链接]

|

|

|

发表于 6-1-2008 12:29 AM

|

显示全部楼层

发表于 6-1-2008 12:29 AM

|

显示全部楼层

回复 678# c56733 的帖子

首季淨利揚18%‧旗下業務表現佳 頂級手套可應對賺幅縮窄

• 大馬財經

2008-01-04 18:29

(吉隆坡訊)頂級手套(TOPGLOV,7113)中國業務與子公司Medi-Flex轉虧為盈,使其2008年財政年首季淨季按年增長18.3%,分析員看好在工廠持續擴充與需求強穩下,可抵銷馬幣走強導致幅縮窄窘境。

分析員指出,該公司首季表現符合預期,基於未來幾季是傳統旺季,加上生產線不斷擴漲,表現將會更加出色。

不過,分析員普遍保留原先的財測,也維持早前的評級。

聯昌研究分析,首季淨利成長18.3%是營業額成長9%一倍,主要是馬幣兌美元走高影響,加上國內銷售偏高,而較低售價促使乳膠濃縮業務營業額下滑56%。

至於手套業務,營業額則按年漲16.8%,淨利成長19%,因該公司透過提高價格,抵銷美元走弱利空。

僑豐研究指出,膠乳價格下滑,使頂級手套首季營運賺幅從前期的13.8%提高到14.2%。

分析員欣慰的是,頂級手套中國業務與Medi-Flex業務成功轉虧為盈,其中前者由前期淨虧損440萬令吉扭轉為10萬令吉淨利,後者也有70萬令吉淨利,主要是中國供過於求問題因許多小型廠商陸續關閉而解決,乙烯基手套售價也穩定在每千件15美元水平。

在產能方面,該公司目前擁有19個工廠330條生產線,目前年產量可達280至290億件手套,前期為220至230億件手套。

其中,中國興化第15家工廠新增的8條生產線料會在今年3月完成。在大馬方面,第14家與第19工廠生產線已在去年12月完成,至於新增16條生產線也即將於5月動工。

分析員補充,仍看好膠手套未來需求,惟一隱憂是馬幣持續走強可能影響頂級手套海外業務獲利。

至於生產成本天然氣價格方面,大馬研究認為問題不大,因能源成本僅佔生產成本的8%,因此天然氣價格若調漲10%,僅提高其生產成本0.48%。

經紀簡評

建議 目標價

聯昌研究 跑贏大市 8令吉90仙

僑豐研究 買進 7令吉40仙

大馬研究 守住 6令吉90仙

SJ證券 中和 7令吉50仙 |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-1-2008 06:47 PM

|

显示全部楼层

发表于 6-1-2008 06:47 PM

|

显示全部楼层

原帖由 留下眼镜 于 4-1-2008 09:38 PM 发表

The Overlook Partners Fund LP - 什么公司来的,谁可以介绍?不会是洗黑钱的吧?SAAG它好像也炒一手。

The Overlook Partners Fund LP是Top Glove的长期投资者,于06/08/2004成为Top Glove的大股东 (5.07%股份),之后很少买卖本身的股份。

24/01/2007

The Overlook Partners Fund LP宣布本身的股份被冲淡至5%以下,所以不再是大股东。

16/10/2007

根据Top Glove的2007年报,The Overlook Partners Fund LP仍拥有13,820,580股,4.66%的股份。

12/12/2007

The Overlook Partners Fund LP宣布再次成为Top Glove的大股东 (拥有15,045,880股,5.07%股份)

这表示在这两个月的期间,The Overlook Partners Fund LP在市场收购了1,225,300股。

04/012008

The Overlook Partners Fund LP宣布于12/12/2007到24/12/2007这段时间再买进342,600股,现拥有15,415,580股,5.2%股份。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-1-2008 06:50 PM

|

显示全部楼层

发表于 6-1-2008 06:50 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 6-1-2008 06:52 PM

|

显示全部楼层

发表于 6-1-2008 06:52 PM

|

显示全部楼层

Share buy back:

Top Glove于2008财政年 (到04/01/2008为止)共花费了RM26.57 million来回购股票,已经买回4,328,200股,1.44% (Top Glove的股票票数是300.552 milion股)。

XXXXX

关于回购股票的一篇文章 (origen兄推荐):

Saturday January 5, 2008

Why buybacks fail

Investment Scents

By S. DALI

EVERY now and then, Bursa Malaysia and the business papers highlight the share buyback activities carried out by listed companies. Also,there have been many articles written on the merits (and demerits) of such programmes.

So, do share buybacks work?

To answer that, we need to be mindful of why there is a need for a stock market in the first place? There are two main reasons for the establishment of a stock market. First and foremost, it allows companies to raise cheap funds to fund their growth strategies.Secondly, it is to allow for individuals and other entities to participate in the growth of these companies. All other reasons are secondary in nature.

A company raises funds to facilitate corporate strategies with the hope that it will make money, preferably higher than the prevailing interest rate. Successful companies keep accumulating profits to prepare for two eventualities – market down cycles or to take advantage of opportunities when there is a market/industry correction/sell-down.

Companies should only indulge in share buybacks when accumulated funds are in excess for the two reasons stated above. This is because share buybacks will deplete reserves and may not be easily convertible to cash when there is a down cycle or market correction – the time when funds may be needed.

Companies doing share buybacks must and should consider this aspect before embarking on the exercise. Even then, the company can still decide on other options to utilise the excess cash – give back to shareholders in the form of dividends or bonus – especially in a matured industry.

Companies raise cash for investing in growth. If they find no good investing opportunities after a prolonged period and cash flow is healthy, the funds ought to be returned to shareholders. Essentially,when companies embark on a share buyback programme, they are saying that it is the best way to utilise their excess cash. To arrive at that decision, they must be convinced that their share is undervalued compared to their company's prospects.

A company's share price may not reflect its true potential. Who knows the company's fundamentals better than the people running them? Then we have to look at why management is doing it: Is it to improve the share price via reducing the free float; and/or improve the earnings per share (which only happens when the shares are subsequently cancelled).

If a company has to resort to improving its share price by reducing free float, it is rarely successful. By reducing free float, it is a futile exercise as the company will have to accumulate a significant amount to prop up the share price – that seems artificial no matter how you look at it as the only group really keen to own the shares is the company themselves.

Of course, share buybacks can successfully engineer higher share prices by massively reducing free float but they will have to meet regulations for minimum free float in the market place as well. The danger is that share buybacks can be taken advantage as “insider trading” by management as it involves market timing – hence the authorities must be more vigilant when it comes to the timing of share buybacks. If acompany buys back the shares and do not cancel them, are they waiting to unload when price is higher? That is tantamount to trading in their own shares or having an investment portfolio. Is that part of the company's normal course of business? Can this activity account for a substantial amount of profit for the company? How should analysts regard this profit – probably not enthusiastically as it is consideredas a “one-off.”

It is then easy to appreciate the call for companies to make their intentions known to the public when carrying out share buybacks – is it for future placements to institutions; to be cancelled? and if so, a time frame needs to be stipulated; not to be cancelled?; to be soldback into the market when price is higher?; or to be disbursed as bonus? To me, that is vital information and I believe investors will rate the stock accordingly with the new information.

Bottom line, if it is not going to be cancelled, share buybacks are not really that big a positive in rating the company. Most times, companies who carry out share buybacks do not see significant improvements in their share price. Investors do not rate a company higher because of such an exercise as they are not buying the stock in the first place for various other reasons. In addition, the free float is not really a major factor. A worthwhile share buyback is one that subsequently involves the cancellation of the shares that have been bought back.Companies that do not do that, need to ask themselves why their share price is not at a level where it should be. Are investors not happy with the management's vision? Is the company not communicating its plans effectively? Has the company not been able to chart a credible track record? Have the financial results for the company been haphazard or inconsistent? Is the company unfocused or too diverse that nobody wants to follow/research the company? What is the management's track record in dealing with minority shareholders? Have transactions or deals been fair to all shareholders or been forced down investors' throats?

Chances are the stock will be rated properly and accordingly if the above concerns are addressed. With emphasis on that, it is likely that most share buybacks may not be entirely successful as it is fighting against the “enemy” when the “enemy” is really internal and not external.

# S Dali is a pseudonym. He is an ex analyst/fund manager and active blogger. (malaysiafinance.blogspot.com) who says he is too young, tooold, too sacarstic, too dark, too funny, too charismatic, too poor, too Cantonese, too Malaysian, too frank, ...too bad.

http://biz.thestar.com.my/bizwee ... izweek/19902309&

[ 本帖最后由 Mr.Business 于 6-1-2008 07:24 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-1-2008 08:22 PM

|

显示全部楼层

发表于 6-1-2008 08:22 PM

|

显示全部楼层

更新: January 6, 2008 17:45

頂級手套前景仍看好

(吉隆坡6日訊)頂級手套(TOPGLOV,7113,主板工業)積極擴充廠房提高產能,中國業務及子公司Medi-Flex提早轉虧為盈,前景備受看好。

頂級手套08財年首季,營業額按年上揚9%至3億3650萬令吉,淨利錄得2940萬令吉,按年漲18.3%。

聯昌證券研究分析報告指出,營業額增長收窄,主要是美元走低及乳膠業務下滑56%所致。

成本或上揚

此外,ECM艾文紐分析報告指出,頂級手套19號廠房已在去年厎竣工,預計兩年內積極擴充至16條生產線。

“管理層冀新增生產線,可提高08財年及09財年產能25%至26%。”

大馬證券研究分報告指出,頂級手套原預計08財年次季,將中國業務及Medi-Flex轉虧為盈,惟現在兩者已提前貢獻淨利。

“Medi-Flex取得70萬令吉淨利,中國業務則賺進10萬令吉淨利。”

展望未來,美元兌亞洲匯率持續走低,因此,該行預計,這或將對手套製造商的收益造成衝擊。

“加上天然氣價格調漲與否仍未敲定,一旦落實,這也將加重業者生產成本,影響收益。”

大馬證券研究預測,頂級手套08財年淨利將按年上揚16%至1億1990萬令吉,09財年則上揚23%至1億4740萬令吉。

截至上週五閉市,頂級手套平盤報6.50令吉,全日成交量為88萬1800股。

http://www.chinapress.com.my/con ... mp;art=0107bs02.txt |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-1-2008 08:51 PM

|

显示全部楼层

发表于 6-1-2008 08:51 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 7-1-2008 11:46 AM

|

显示全部楼层

发表于 7-1-2008 11:46 AM

|

显示全部楼层

回复 676# pya_ch 的帖子

1. 股票拆细=split

面值改变,(保留盈利, 股票溢价,股票资本)都没有改变。

2. 给红股=bonus share

面值不变,(保留盈利 或 股票溢价)将会减少,股票资本将会增加。 |

评分

-

查看全部评分

|

|

|

|

|

|

|

|

|

|

|

发表于 7-1-2008 11:55 AM

|

显示全部楼层

发表于 7-1-2008 11:55 AM

|

显示全部楼层

原帖由 34350 于 7-1-2008 11:46 AM 发表

1. 股票拆细=split

面值改变,(保留盈利, 股票溢价,股票资本)都没有改变。

2. 给红股=bonus share

面值不变,(保留盈利 或 股票溢价)将会减少,股票资本将会增加。

那我看的那本书有误导之嫌 |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-1-2008 12:25 PM

|

显示全部楼层

发表于 7-1-2008 12:25 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 7-1-2008 12:50 PM

|

显示全部楼层

发表于 7-1-2008 12:50 PM

|

显示全部楼层

顶级 05年到07年的ROE(%)

2005 = 26.24%

2006 = 27.59%

2007 = 16.29%

会不会因为ROE的减少使到有些基金减持顶级的股票. |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-1-2008 01:11 PM

|

显示全部楼层

发表于 7-1-2008 01:11 PM

|

显示全部楼层

原帖由 8years 于 7-1-2008 12:25 PM 发表

688楼很正确,没有错。

我说书错,不是说他 |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-1-2008 07:16 PM

|

显示全部楼层

发表于 7-1-2008 07:16 PM

|

显示全部楼层

Notice of Shares Buy Back - Immediate Announcement

| Date of buy back | : | 07/01/2008 | | Description of shares purchased | : | Ordinary Shares of RM0.50 | | Total number of shares purchased (units) | : | 59,000 | | Minimum price paid for each share purchased (RM) | : | 6.350 | | Maximum price paid for each share purchased (RM) | : | 6.500 | | Total consideration paid (RM) | : | 375,410.00 | | Number of shares purchased retained in treasury (units) | : | 59,000 | | Number of shares purchased which are proposed to be cancelled (units) | : | 0 | | Cumulative net outstanding treasury shares as at to-date (units) | : | 4,387,200 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-1-2008 11:26 AM

|

显示全部楼层

发表于 8-1-2008 11:26 AM

|

显示全部楼层

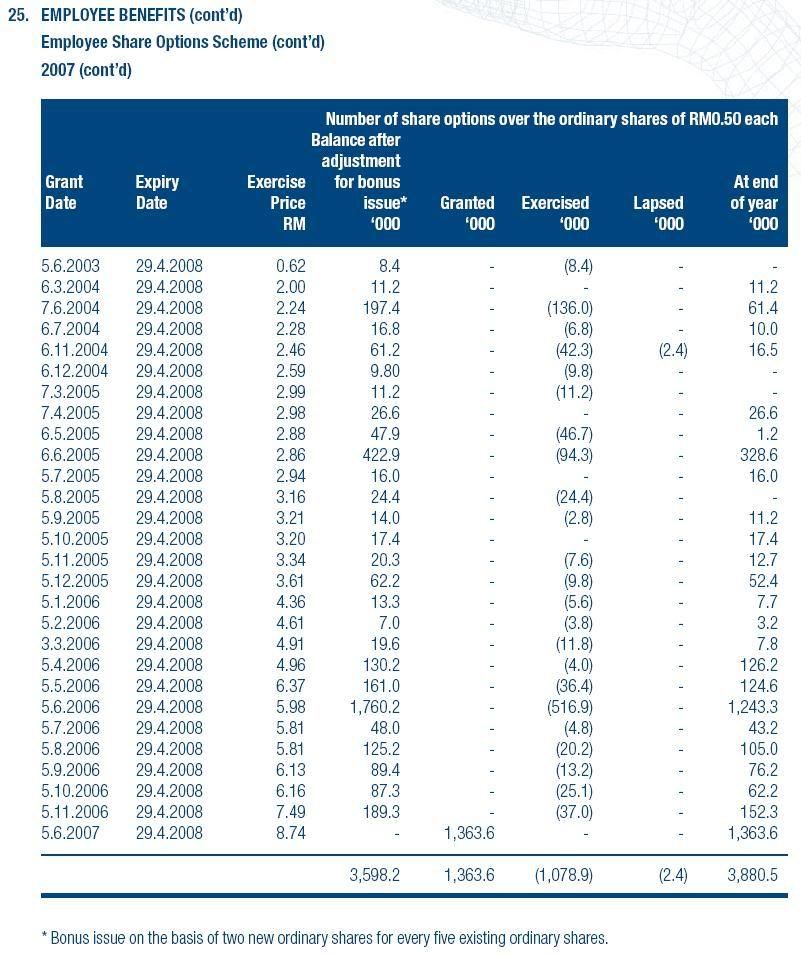

顶级有一批行使的 ESOS 将要上市了。

Kindly be advised that the abovementioned Company’s additional 63,300 new ordinary shares of RM0.50 each issued pursuant to the aforesaid Scheme will be granted listing and quotation with effect from 9.00 a.m., Wednesday, 9 January 2008.

[ 本帖最后由 34350 于 8-1-2008 12:38 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 8-1-2008 02:41 PM

|

显示全部楼层

发表于 8-1-2008 02:41 PM

|

显示全部楼层

回复 694# 34350 的帖子

这些ESOS将在29/04/2008到期,所以员工们兑现这些ESOS。在29/04/2008之前至少还有2.5 million的ESOS (in the money的ESOS)新股上市,应该会对股价造成压力。

等5月吧,到时候新ESOS的价钱决定了,Top Glove的股价就将在股东和公司员工的期待下向上升了。。。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-1-2008 03:24 PM

|

显示全部楼层

发表于 8-1-2008 03:24 PM

|

显示全部楼层

Topglov內部的人在分猪肉嗎 ?

無視小股東的存在 :@ |

|

|

|

|

|

|

|

|

|

|

|

发表于 8-1-2008 03:34 PM

|

显示全部楼层

发表于 8-1-2008 03:34 PM

|

显示全部楼层

回复 696# peterg 的帖子

不明白你的意思,请解释。

Top Glove现在的股价处于跌势。如果员工有in the money的ESOS,一定会在期限到期之前兑现,并在公开市场卖出。

等29/04/2008到了之后,Top Glove将会定下新的ESOS的价钱,那对员工来说,行使价自然是越低越好,那将是多数人的想法,所以那时候股价很难起。

等行使价定好,那时员工自然是希望股价越高越好,那也是多数人的想法。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 8-1-2008 04:01 PM

|

显示全部楼层

发表于 8-1-2008 04:01 PM

|

显示全部楼层

原帖由 Mr.Business 于 8-1-2008 03:34 PM 发表

不明白你的意思,请解释。

太多 ESOS, 對股東不利 |

|

|

|

|

|

|

|

|

|

|

|

发表于 8-1-2008 04:13 PM

|

显示全部楼层

发表于 8-1-2008 04:13 PM

|

显示全部楼层

回复 698# peterg 的帖子

The maximum number of new ordinary shares of RM0.50 each in Top Glove (“Shares” or “Top Glove Shares”) to be granted under the Proposed New ESOS shall not exceed 15% of the total issued and paid-up share capital of the Company at any point in time during the duration of the Proposed New ESOS. As at 2 October 2007, the issued and paid-up share capital of the Company stood at RM150,239,916 comprising 300,479,831 new Top Glove Shares.

新的ESOS将发出最多不超过45 million股。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 8-1-2008 07:05 PM

|

显示全部楼层

发表于 8-1-2008 07:05 PM

|

显示全部楼层

Notice of Shares Buy Back - Immediate Announcement

| Date of buy back | : | 08/01/2008 | | Description of shares purchased | : | Ordinary Shares of RM0.50 | | Total number of shares purchased (units) | : | 38,000 | | Minimum price paid for each share purchased (RM) | : | 6.300 | | Maximum price paid for each share purchased (RM) | : | 6.450 | | Total consideration paid (RM) | : | 240,670.00 | | Number of shares purchased retained in treasury (units) | : | 38,000 | | Number of shares purchased which are proposed to be cancelled (units) | : | 0 | | Cumulative net outstanding treasury shares as at to-date (units) | : | 4,425,200 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-1-2008 08:58 PM

|

显示全部楼层

发表于 8-1-2008 08:58 PM

|

显示全部楼层

原帖由 Mr.Business 于 8-1-2008 04:13 PM 发表

新的ESOS将发出最多不超过45 million股。

對股東而言, ESOS 愈少愈好.

Topglove 太頻密了, 有自肥之嫌. |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|