|

|

发表于 16-6-2018 05:58 AM

|

显示全部楼层

发表于 16-6-2018 05:58 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2018 08:28 PM

来自手机

|

显示全部楼层

发表于 22-6-2018 08:28 PM

来自手机

|

显示全部楼层

本帖最后由 Weida 于 22-6-2018 08:30 PM 编辑

Astro服务差有可能会降低收费! |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2018 08:34 PM

来自手机

|

显示全部楼层

发表于 22-6-2018 08:34 PM

来自手机

|

显示全部楼层

icy97 发表于 16-6-2018 05:58 AM

下个星期一Astro股价有很大可能会大跌到停牌! |

评分

-

查看全部评分

|

|

|

|

|

|

|

|

|

|

|

发表于 23-6-2018 04:41 AM

|

显示全部楼层

发表于 23-6-2018 04:41 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 29-6-2018 05:26 AM

|

显示全部楼层

发表于 29-6-2018 05:26 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 11-8-2018 06:12 AM

|

显示全部楼层

发表于 11-8-2018 06:12 AM

|

显示全部楼层

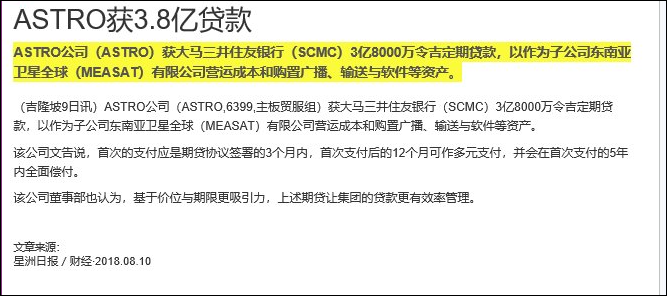

Type | Announcement | Subject | OTHERS | Description | ASTRO MALAYSIA HOLDINGS BERHAD ("ASTRO")- ACCEPTANCE OF TERM LOAN OF RM380 MILLION BY MEASAT BROADCAST NETWORK SYSTEMS SDN BHD ("MBNS") | ASTRO is pleased to announce that its wholly-owned subsidiary, MBNS, has today accepted a term loan of RM380 million (“the Term Loan”) from Sumitomo Mitsui Banking Corporation Malaysia Berhad (“SMBC”). The Term Loan is granted to MBNS on a clean basis.

The 1st drawdown will be made within 3 months from the date of the Term Loan agreement. The Term Loan is available for multiple drawdowns within 12 months from the date of the 1st drawdown.

The Term Loan shall be fully repaid on or before the expiry of 5 years from the date of 1st drawdown.

The purpose of the Term Loan is to finance MBNS’ :- - cost relating to the production, purchase and licensing of content, program or channels and its purchase of set-top boxes, including the settlement of the vendor financing thereof; and

- operating expenditure and its capital expenditure, including asset acquisition for broadcast and transmission and acquisition of software and platforms.

The Board, after having considered all aspects of the Term Loan, is of the opinion that the Term Loan will facilitate the group’s borrowings to be managed efficiently due to attractive pricing and tenure.

This announcement is dated 9 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-9-2018 04:52 AM

|

显示全部楼层

发表于 9-9-2018 04:52 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 9-9-2018 06:26 AM

|

显示全部楼层

发表于 9-9-2018 06:26 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-9-2018 05:58 AM

|

显示全部楼层

发表于 27-9-2018 05:58 AM

|

显示全部楼层

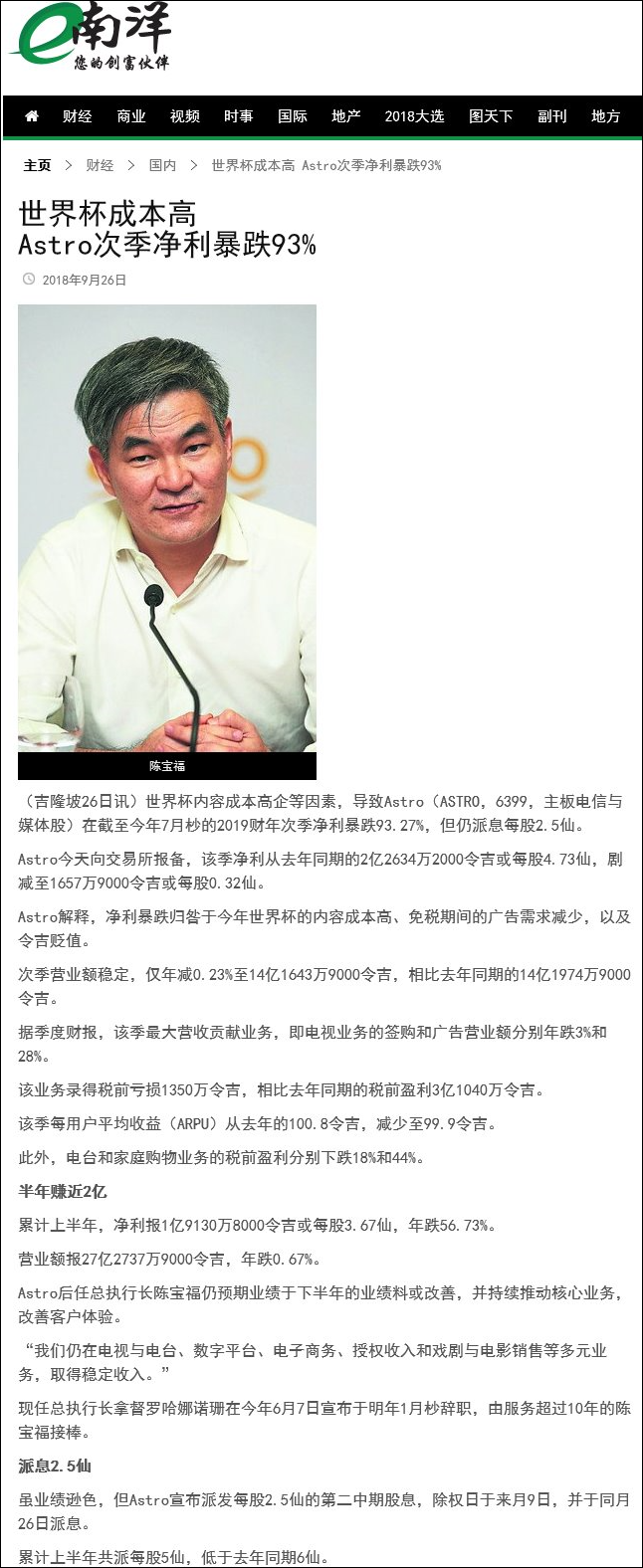

本帖最后由 icy97 于 30-9-2018 05:32 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jul 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jul 2018 | 31 Jul 2017 | 31 Jul 2018 | 31 Jul 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,416,439 | 1,419,749 | 2,727,379 | 2,745,843 | | 2 | Profit/(loss) before tax | 29,204 | 339,216 | 264,095 | 608,716 | | 3 | Profit/(loss) for the period | 14,689 | 245,090 | 188,564 | 437,442 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 16,579 | 246,342 | 191,308 | 442,165 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.32 | 4.73 | 3.67 | 8.49 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.50 | 3.00 | 5.00 | 6.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1113 | 0.1254

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-9-2018 06:02 AM

|

显示全部楼层

发表于 27-9-2018 06:02 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | ASTRO MALAYSIA HOLDINGS BERHAD - PRESS RELEASE ON THE FINANCIAL RESULTS FOR THE SECOND QUARTER ENDED 31 JULY 2018. | Please find attached Astro Malaysia Holdings Berhad's Press Release in relation to its Financial Results for the second quarter ended 31 July 2018.

This announcement is dated 26 September 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5923301

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-9-2018 06:06 AM

|

显示全部楼层

发表于 27-9-2018 06:06 AM

|

显示全部楼层

EX-date | 09 Oct 2018 | Entitlement date | 11 Oct 2018 | Entitlement time | 05:00 PM | Entitlement subject | Second interim dividend | Entitlement description | Second Interim Single-Tier Dividend of 2.5 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Jan 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 26 Oct 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 11 Oct 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.025 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-9-2018 06:55 AM

|

显示全部楼层

发表于 30-9-2018 06:55 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 31-10-2018 05:10 AM

|

显示全部楼层

发表于 31-10-2018 05:10 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 4-1-2019 02:47 AM

|

显示全部楼层

发表于 4-1-2019 02:47 AM

|

显示全部楼层

本帖最后由 icy97 于 11-1-2019 05:03 AM 编辑

净利增4.45%--astro第三季派息2.5仙

http://www.enanyang.my/news/20181205/净利增4-45-br-astro第三季派息2-5仙

SUMMARY OF KEY FINANCIAL INFORMATION

31 Oct 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Oct 2018 | 31 Oct 2017 | 31 Oct 2018 | 31 Oct 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,383,868 | 1,396,657 | 4,111,247 | 4,142,500 | | 2 | Profit/(loss) before tax | 215,694 | 205,996 | 479,789 | 814,712 | | 3 | Profit/(loss) for the period | 153,619 | 145,999 | 342,183 | 583,441 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 153,215 | 146,684 | 344,523 | 588,849 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.94 | 2.81 | 6.61 | 11.30 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.50 | 3.00 | 7.50 | 9.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1179 | 0.1254

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-1-2019 02:48 AM

|

显示全部楼层

发表于 4-1-2019 02:48 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | ASTRO MALAYSIA HOLDINGS BERHAD - PRESS RELEASE ON THE FINANCIAL RESULTS FOR THE THIRD QUARTER ENDED 31 OCTOBER 2018. | Please find attached Astro Malaysia Holdings Berhad's Press Release in relation to its Financial Results for the third quarter ended 31 October 2018.

This announcement is dated 5 December 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5997145

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-1-2019 02:48 AM

|

显示全部楼层

发表于 4-1-2019 02:48 AM

|

显示全部楼层

EX-date | 18 Dec 2018 | Entitlement date | 20 Dec 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Third Interim Single-Tier Dividend of 2.5 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Jan 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 04 Jan 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 20 Dec 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.025 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-1-2019 04:44 AM

|

显示全部楼层

发表于 4-1-2019 04:44 AM

|

显示全部楼层

本帖最后由 icy97 于 11-1-2019 05:50 AM 编辑

astro推自愿离职计划

http://www.enanyang.my/news/20181207/astro推自愿离职计划/

Type | Announcement | Subject | OTHERS | Description | ASTRO MALAYSIA HOLDINGS BERHAD - PRESS RELEASE ENTITLED "ASTRO STRENGTHENS MARKET POSITION WITH STRATEGIC REVIEW OF BUSINESS" |

Astro Strengthens Market Position with Strategic Review of Business

KUALA LUMPUR, 7 December 2018 – The media and entertainment industry is currently operating in an environment that is experiencing an unprecedented rate of disruption. Industry players are required to reinvent and adapt swiftly to remain relevant in this new reality.

Henry Tan, CEO Designate, Astro Malaysia Holdings Berhad said, “In an increasingly borderless and digital world, competition is relentless. Astro continues to be proactive to reinvigorate the Group in order to strengthen its position in the market and to remain relevant in the years ahead.”

Given the challenging overall economic landscape, Astro Malaysia Holdings Berhad will be undertaking a Voluntary Separation Scheme (VSS) that will allow the Group to further simplify the organisation, enhance operational efficiency and reduce annual operating expenses. The VSS is offered purely on a voluntary basis.

Notwithstanding this exercise, the Company will put in place measures to ensure that the customer experience will not be impacted by this exercise.

The Company has put in place a transition programme that will provide the right support to employees who opt for the VSS including coaching and skills upgrading training programmes. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-2-2019 05:09 AM

|

显示全部楼层

发表于 11-2-2019 05:09 AM

|

显示全部楼层

Date of change | 01 Feb 2019 | Name | MR HENRY TAN POH HOCK | Age | 55 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Executive Officer |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Business (Marketing) and Arts (Communications) | Chisholm Institute of Technology Australia (now known as Monash University) | |

| | | Working experience and occupation | Mr. Henry Tan has held various responsibilities in the Astro Group. Prior to his appointment as the Chief Executive Officer of Astro, he held the positions of Group Chief Content & Consumer Officer and Chief Operating Officer. He is currently the Chairman of Go Shop, Astro's home shopping platform. He played a key role in introducing Malaysians to high definition (HD) with Astro B.yond and launching the first free satellite multichannel service, NJOI. As content chief, Henry raised the bar on storytelling and championed vernacular and Asian originals, from film to TV to digital, to ensure consumer relevance, reach and engagement. He has pioneered many firsts including Malaysia's first free academic learning channels, Tutor TV, Astro First, cinema in your home service, eGG Network, the first regional eSports channel, Boo, the first Asian horror channel, and local Hua Hee Hokkien entertainment and Malay "Lawak" comedy brands. He focused on creating digital content experiences for Astro's customers via Gempak, Xuan, Ulagam, Zayan, Awani, Stadium Astro and was also responsible for the group's airtime sales. Henry believes in the potential of Malaysian movies and was instrumental in the success of The Journey, OlaBola, Hantu Kak Limah, Paskal, Abang Long Fadil and Polis Evo. Henry was previously the Chief Executive Officer of Mindshare Malaysia and GroupM (Malaysia and Singapore) and prior to that, he held the position of the Media Director, Ogilvy & Mather and General Manager, HVD Entertainment. | Directorships in public companies and listed issuers (if any) | None | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | He holds 1,863,500 ordinary shares in Astro Malaysia Holdings Berhad ("AMH") representing 0.036% of the total issued shares in AMH. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-2-2019 04:44 AM

|

显示全部楼层

发表于 12-2-2019 04:44 AM

|

显示全部楼层

Date of change | 31 Jan 2019 | Name | DATO ROHANA BINTI TAN SRI DATUK HAJI ROZHAN | Age | 55 | Gender | Female | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Resignation | Reason | To pursue other goals |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-4-2019 06:48 AM

|

显示全部楼层

发表于 7-4-2019 06:48 AM

|

显示全部楼层

本帖最后由 icy97 于 17-9-2019 05:32 AM 编辑

astro次季净利翻9.2倍-赚1.69亿·派息2仙

https://www.enanyang.my/news/20190913/astro次季净利翻9-2倍-br赚1-69亿·派息2仙/

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jan 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jan 2019 | 31 Jan 2018 | 31 Jan 2019 | 31 Jan 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,367,801 | 1,388,253 | 5,479,048 | 5,530,753 | | 2 | Profit/(loss) before tax | 171,356 | 258,439 | 651,145 | 1,073,151 | | 3 | Profit/(loss) for the period | 118,641 | 180,535 | 460,824 | 763,976 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 118,398 | 181,787 | 462,921 | 770,636 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.27 | 3.49 | 8.88 | 14.79 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.50 | 3.50 | 9.00 | 12.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1122 | 0.1254

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|