|

|

【TOPGLOV 7113 交流专区】顶级手套

[复制链接]

[复制链接]

|

|

|

发表于 29-11-2007 02:15 PM

|

显示全部楼层

发表于 29-11-2007 02:15 PM

|

显示全部楼层

原帖由 invest_klse 于 29-11-2007 02:06 PM 发表

对。。。但员工们只能“希望”。。。不能做什么。

林博士的立场则是ESOS应该订高价,因为可以改善公司的Balance Sheet 和营运。

与员工不同,林博士身为CEO,能动用公司资金回购股票,撑住股价。

只是不知道,他会不会倾全力。。。或能撑多久。。。

林博士拿到的ESOS应该是最大份的。。。

另外,关于公司回购股票,林博士是有讲过的。。。

Top Glove's lower earnings targets stay

Updated : 18-10-2007

Media : The Edge

Story By : Gan Yen Kuan

KLANG: Top Glove Corporation Bhd does not foresee an imminent upward revision of its earnings targets for financial years 2007 to 2009 although it expects its Chinese subsidiaries to return to the black by March 2008.

The world¡¦s largest glove maker lowered its FY07-FY09 earnings forecasts last month by between 8% and 14%, following the losses incurred at its subsidiaries in China and the effects of foreign exchange exposure.

Its chairman Tan Sri Lim Wee-Chai (pic) said any upward revision to its earnings targets would hinge on the market condition and global supply and demand trend. Top Glove controls 23% of the world¡¦s glove market.

¡§We have to judge the market condition. We cannot tell you exactly when we will revise the (earnings) targets upward,¡¨ he told The Edge Financial Daily in an interview here recently.

However, Lim said the company expected its two Chinese subsidiaries to return to the black by next year, as the slowdown in China was ¡§temporary¡¨, and that it would further improve the production processes there.

¡§According to our experience, for the past 10 years, the PVC glove market (in China) showed there will be a cycle every two years.

¡§We expect a better result (at the Chinese subsidiaries) probably by March 2008. We think there will be turnaround,¡¨ he said.

Top Glove initially targeted a net profit of RM110 million for the financial year ended Aug 31, 2007 (FY07), and RM145 million and RM180 million for FY08 and FY09, respectively.

Last month, it lowered these targets to RM101 million, RM125 million and RM155 million from FY07 to FY09, respectively, as a result of the unexpected losses incurred at its factories in Jiangsu province, China.

Lim said losses from its Chinese subsidiaries, mainly due to increasing raw materials costs, could amount to some RM9 million in FY07, versus profits of RM9.38 million in FY06 and RM7.79 million in FY05.

It has one factory each in Zhangjiagang and Xinghua. The Xinghua factory began operations only in July this year. Its Chinese factories export all their production mainly to the United States, Europe and the Middle East.

The slowdown in China had also prompted Top Glove to scale back its expansion plan there. It initially planned to install an additional 40 production lines in the Xinghua factory, but subsequently cut it to only eight lines.

Lim said the company had grown into such a size that a consistent 40% annual growth in net profit would be ¡§quite impossible.¡¨ Top Glove posted a compounded annual growth rate of 30% to 40% in its net profit for the past 10 years.

¡§We cannot forever grow non-stop. We target 25% growth for the next three years. Even with that (targeted FY07 net profit of) RM101 million, there will still be a good growth of about 29%, compared with previous year,¡¨ he said.

The company¡¦s fourth quarter results are slated to be announced tomorrow.

Analysts and investors were generally surprised by Top Glove¡¦s move to lower its earnings targets, Lim said, which had led to the lacklustre performance of its share price recently.

He said the downside in its share price currently was also due to the sharp increase last year, and allegations of patent infringements by US-based rival Tillotson Corp in July.

¡§It appreciated so much last year, so it is quite natural that they have technical adjustment now,¡¨ he said.

For the past three months, the share price of Top Glove has depreciated by some 20%. The stock fell 15 sen to RM6.35 yesterday, with 425,900 shares done.

The company has been actively buying back its shares since Sept 21. Between Sept 21 and Oct 16, it has bought back a total of 1.25 million shares for RM7.96 million, or an average of RM6.35 per share.

¡§When the price reaches (a) certain level, then we may have to stop (buying back shares). Market sentiment is very important. We have to see the market sentiment,¡¨ Lim said.

On its plan to acquire rubber plantations, Lim said it was still waiting for a better proposal that could enable it to enter the business with lower costs.

¡§This is a long-term investment. We already have more than 10 proposals, but so far the proposals are not up to our expectation. We are still looking at better land (in Malaysia or Indonesia) at a lower cost,¡¨ he said.

He added that it had no mergers and acquisitions plan in the medium term, as it wanted to focus on organic growth, as well as turning around the newly acquired subsidiary Medi-Flex Ltd. |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2007 02:28 PM

|

显示全部楼层

发表于 29-11-2007 02:28 PM

|

显示全部楼层

原帖由 shuhjiunho 于 29-11-2007 01:36 PM 发表

请问为什么RM 4.50以下,。。。valuation方式是什么?

每人都知道,若两间公司的基本因素完全一样,PE低的是好的投资选择。

通常,保守的人都会选择 PE<10 的公司。

但,对于优质和高成长公司,PE高些却是可以接受的。

PE 到底能高到多少,那是见仁见智。

我的Valuation方法:若 (PE/成长率)< 0.5, 可算很值得投资。

(计算时,必须考虑未来好几年的成长率,不要只预测一两年。)

举例:

若我认为Topglov 未来5年平均成长率为30%,为得到(PE/成长率)< 0.5,

买入价应该要让 PE<15. 以Topglov 的 EPS 为 35sen 来看,安全买入价应为 RM5.20。

当然,公式是死的。还有很多别的因素需考虑。

我对Topglov成长潜能的估计比较保守,所以我会等到 RM4.50。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2007 02:32 PM

|

显示全部楼层

发表于 29-11-2007 02:32 PM

|

显示全部楼层

回复 #442 invest_klse 的帖子

谢谢invest_klse兄的见解,能从这一点来分享和推算成长价值也是一个方式。

Topglove不为Bursa的好公司,这个我赞成。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2007 02:33 PM

|

显示全部楼层

发表于 29-11-2007 02:33 PM

|

显示全部楼层

回复 #442 invest_klse 的帖子

你指的成长率是:

1. Profit 成长率

2. Revenue 成长率

3. EPS 成长率

????????????????????? |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2007 02:39 PM

|

显示全部楼层

发表于 29-11-2007 02:39 PM

|

显示全部楼层

原帖由 Mr.Business 于 29-11-2007 02:15 PM 发表

另外,关于公司回购股票,林博士是有讲过的。。。

其实,那一段话讲了等于没讲。

原帖由 Mr.Business 于 29-11-2007 02:15 PM 发表

林博士拿到的ESOS应该是最大份的。。。

他是企业家,该会把公司利益排在个人利益之前。

且他不像小员工那么短视。现把公司搞好,股价哪怕不会跟着水涨船高? |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2007 02:40 PM

|

显示全部楼层

发表于 29-11-2007 02:40 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2007 03:13 PM

|

显示全部楼层

发表于 29-11-2007 03:13 PM

|

显示全部楼层

回复 #446 invest_klse 的帖子

|

林博士宣布缓慢扩展计划 !!! 30% 的成长率可能太高了!!!! |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2007 03:29 PM

|

显示全部楼层

发表于 29-11-2007 03:29 PM

|

显示全部楼层

回复 #447 chengyk 的帖子

Top Glove的2007财政年的总盈利是RM102 million, 营收是RM1.23 billion。Net Profit Margin是8.3%。

Top Glove的总票数是300.48 million股,所以EPS是33.95sen, PE是17.4(现在市价是RM5.90时买进)

Top Glove的预测:

2008财政年的总盈利增加23%,达到RM125 million, 营收增加27%,达到RM1.56 billion。Net Profit Margin是8%。

EPS是41.6sen, PE是14.2 (现在市价是RM5.90时买进)。

2009财政年的总盈利增加24%,达到RM155 million, 营收增加22%,达到RM1.9 billion。Net Profit Margin是8.2%。

EPS是51.58sen, PE是11.4 (现在市价是RM5.90时买进)。

我想Top Glove的预测是保守和可以达到的。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2007 04:19 PM

|

显示全部楼层

发表于 29-11-2007 04:19 PM

|

显示全部楼层

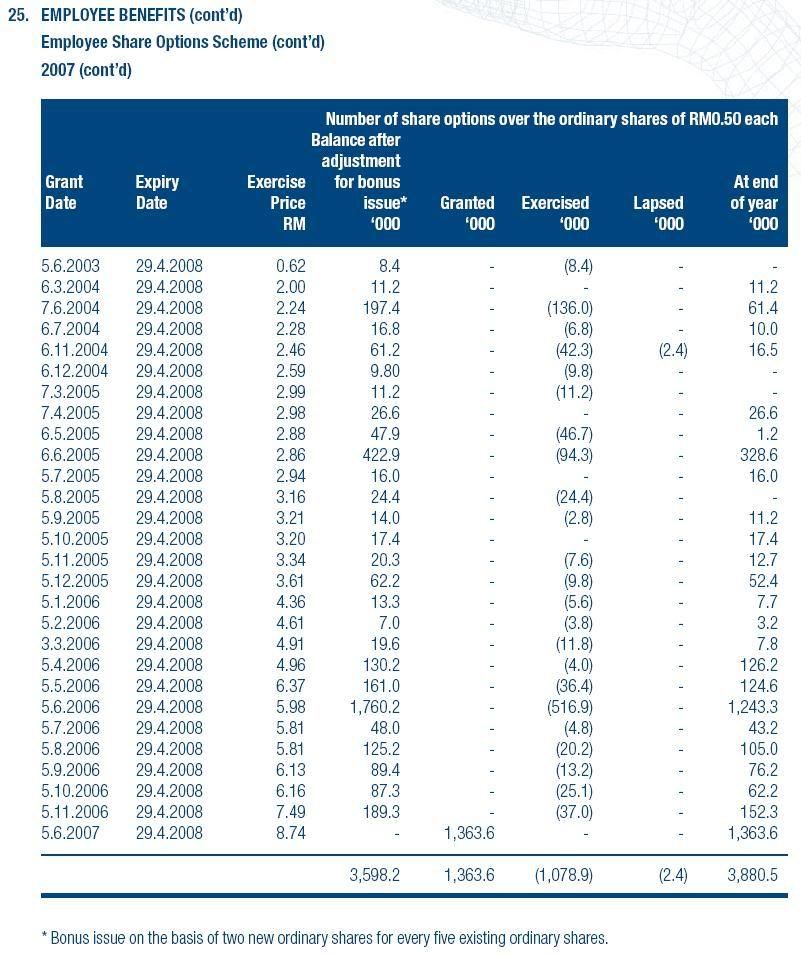

Top Glove的ESOS

Top Glove的ESOS还有3880500股,其中有3170400股 (82%)是out of money的。这批out of money的ESOS价钱在RM5.81-RM8.74之间。所有ESOS将在29/04/2008到期。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2007 04:39 PM

|

显示全部楼层

发表于 29-11-2007 04:39 PM

|

显示全部楼层

原帖由 invest_klse 于 29-11-2007 01:57 PM 发表

所以,Topglov股价若不能撑住或回弹,ESOS的价格必须订得很低。

所筹到的钱也会少很多,所以我才说,效益大打折扣。

不过,通常ESOS 有20% -30% discount 就够了。

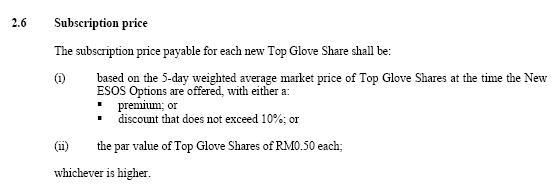

ESOS 最多只有 10% discount |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2007 04:48 PM

|

显示全部楼层

发表于 29-11-2007 04:48 PM

|

显示全部楼层

回复 #450 mjchua 的帖子

奇怪,既然是选较高的价钱,那新ESOS的价钱一定是平均市价加10%的差价咯? |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2007 04:53 PM

|

显示全部楼层

发表于 29-11-2007 04:53 PM

|

显示全部楼层

invest_klse不是普通人,有很强的深入了解投资的每个方面。

感谢你的意见。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2007 06:01 PM

|

显示全部楼层

发表于 29-11-2007 06:01 PM

|

显示全部楼层

再谈 ESOS 的效果

假设 Topglov 明年成功发行 15% ESOS,价格 RM4。

若所有ESOS都被执行的话,Topglov 可能变成零债务公司。

单单每年节省的financial expense, 就大约能使profit 增加10至20%。

可是,因股票数量增加,每股盈利应没什么影响。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2007 06:12 PM

|

显示全部楼层

发表于 29-11-2007 06:12 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2007 06:16 PM

|

显示全部楼层

发表于 29-11-2007 06:16 PM

|

显示全部楼层

Topglov 可能会跌到 RM4.50 吗?

以目前情况看,短期内不会。主要有两大支持:

1。有Topglov在回购本身股票。

2。很多“基本分析”的投资者,仍看好Topglov。对他们来说,PE=20 不算高,可以买进。

Topglov 要跌到 RM4.50,我们需要:

1。股灾 (eg. 911恐袭,金融风暴,中国股市泡沫破裂,。。。)

2。一些“技术分析专家”一同唱衰Topglov + 一些媒体炒作。

看来,需要耐心等待。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2007 06:19 PM

|

显示全部楼层

发表于 29-11-2007 06:19 PM

|

显示全部楼层

原帖由 Mr.Business 于 29-11-2007 04:48 PM 发表

http://i198.photobucket.com/albums/aa34/mrbusiness2000/Forum/TopGlove4.jpg

奇怪,既然是选较高的价钱,那新ESOS的价钱一定是平均市价加10%的差价咯?

ESOS的价格是:

1)平均市价的10% Discount。

如果平均市价的10% Discount跌低过PAR value (Topglove的是RM 0.50),那么ESOS的价格则是

2)PAR value |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2007 06:23 PM

|

显示全部楼层

发表于 29-11-2007 06:23 PM

|

显示全部楼层

原帖由 8years 于 29-11-2007 04:53 PM 发表

invest_klse不是普通人,有很强的深入了解投资的每个方面。

感谢你的意见。

见笑了,

比起 8year兄, Mr.Business兄,小弟仍是新手,资金更是有限的很。

我时常会在买了一家股票后才发现自己犯了严重错误,所以来此希望能听取多点意见,顺便向各位偷师一下。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2007 06:35 PM

|

显示全部楼层

发表于 29-11-2007 06:35 PM

|

显示全部楼层

回复 #462 invest_klse 的帖子

呵呵,你太谦虚了,你的分析可以看得出是用了很多时间做出来的。希望你能更多分享你的看法。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2007 06:40 PM

|

显示全部楼层

发表于 29-11-2007 06:40 PM

|

显示全部楼层

原帖由 shuhjiunho 于 29-11-2007 06:19 PM 发表

ESOS的价格是:

1)平均市价的10% Discount。

如果平均市价的10% Discount跌低过PAR value (Topglove的是RM 0.50),那么ESOS的价格则是

2)PAR value

我也是这么认为。。。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2007 07:28 PM

|

显示全部楼层

发表于 29-11-2007 07:28 PM

|

显示全部楼层

Top Glove回购股票。。。

| Company Name | : | TOP GLOVE CORPORATION BHD | | Stock Name | : | TOPGLOV | | Date Announced | : | 28/11/2007 |

|  |  | | Date of buy back | : | 28/11/2007 | | Description of shares purchased | : | Ordinary Shares of RM0.50 | | Total number of shares purchased (units) | : | 20,000 | | Minimum price paid for each share purchased (RM) | : | 5.900 | | Maximum price paid for each share purchased (RM) | : | 6.000 | | Total consideration paid (RM) | : | 118,910.00 | | Number of shares purchased retained in treasury (units) | : | 20,000 | | Number of shares purchased which are proposed to be cancelled (units) | : | 0 | | Cumulative net outstanding treasury shares as at to-date (units) | : | 3,047,600 | Adjusted issued capital after cancellation

(no. of shares) (units) |

| Last Done | 5.900 | | Change | -0.050 | | Day High | 5.950 | | Day Low | 5.850 | | Best Buy | 5.850 | | Best Sell | 5.900 | | Volume(Lot) | 842 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|