|

|

发表于 28-12-2017 05:08 AM

|

显示全部楼层

发表于 28-12-2017 05:08 AM

|

显示全部楼层

本帖最后由 icy97 于 28-12-2017 06:55 AM 编辑

岩石汽車次季獲利大減58%

2017年12月27日

(吉隆坡27日訊)銷售收入下滑和開支提高,拖累岩石汽車(SOLID,5242,主要板貿服)截至10月底2018財年次季淨利按年減少58.3%至57萬令吉。

岩石汽車向馬證交所報備,次季營業額下滑6%至3061萬令吉,因出口銷售下降所致。

根據報備文件,汽車電器零件貢獻該公司約76%營業額,剩下的24%營業額來自汽車引擎和機械零件業的收入。

該公司首半財年淨賺118萬令吉,相比去年同期跌了53%;營業額則升1.5%至6308萬令吉。

該公司指出,儘管我國經商和生活成本雙雙加劇,海外市場也受到影響,但希望通過數項努力,可改善本財年的業績表現。

其中,包括將繼續注重海內外市場的銷售和營銷策略,以推廣自家品牌,擴大產品系列。

同時,該公司將增加國內分行,及擴大海外市場的滲透率,並改善供應鏈管理、生產力及成本管理。【中国报财经】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Oct 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Oct 2017 | 31 Oct 2016 | 31 Oct 2017 | 31 Oct 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 30,614 | 32,539 | 63,080 | 62,167 | | 2 | Profit/(loss) before tax | 920 | 2,124 | 1,886 | 3,825 | | 3 | Profit/(loss) for the period | 570 | 1,366 | 1,190 | 2,521 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 569 | 1,366 | 1,184 | 2,521 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.34 | 0.82 | 0.71 | 1.52 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.30 | 0.00 | 0.30 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8400 | 0.8300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-3-2018 04:24 AM

|

显示全部楼层

发表于 21-3-2018 04:24 AM

|

显示全部楼层

本帖最后由 icy97 于 25-3-2018 06:48 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jan 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jan 2018 | 31 Jan 2017 | 31 Jan 2018 | 31 Jan 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 35,853 | 31,115 | 98,933 | 93,282 | | 2 | Profit/(loss) before tax | 2,187 | 1,316 | 4,073 | 5,141 | | 3 | Profit/(loss) for the period | 1,429 | 585 | 2,619 | 3,106 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,431 | 608 | 2,615 | 3,129 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.37 | 0.16 | 0.67 | 0.81 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.30 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.3600 | 0.8300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-4-2018 04:26 AM

|

显示全部楼层

发表于 3-4-2018 04:26 AM

|

显示全部楼层

本帖最后由 icy97 于 3-4-2018 06:30 AM 编辑

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | SOLID AUTOMOTIVE BERHAD ("SOLID" OR "COMPANY") - MEMORANDUM OF UNDERSTANDING IN RELATION TO THE PROPOSED SUBSCRIPTION OF 90% EQUITY INTEREST IN BORNEO TECHNICAL CO. (M) SDN. BHD. BY SOLID ("PROPOSED SUBSCRIPTION") | The Board of Directors of SOLID wishes to announce that SOLID has today entered into a Memorandum of Understanding ("MOU") with Toyota Tsuho Corporation ("TTC") and Toyota Tsusho (Malaysia) Sdn. Bhd. ("TTM") (collectively known as "TT") and Borneo Technical Co (M) Sdn. Bhd. ("BORNEO") to outline the basic principles for the negotiation in relation to the Proposed Subscription.

Please refer to the file attached for further salient details of the MOU. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5743537

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-6-2018 02:47 AM

|

显示全部楼层

发表于 28-6-2018 02:47 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Apr 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Apr 2018 | 30 Apr 2017 | 30 Apr 2018 | 30 Apr 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 30,482 | 32,165 | 129,415 | 125,447 | | 2 | Profit/(loss) before tax | 413 | 2,981 | 4,486 | 8,122 | | 3 | Profit/(loss) for the period | 53 | 1,987 | 2,672 | 5,093 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 46 | 1,984 | 2,661 | 5,113 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.01 | 0.51 | 0.68 | 1.32 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.20 | 0.50 | 0.20 | 0.80 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.3600 | 0.8300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2018 05:53 AM

|

显示全部楼层

发表于 30-8-2018 05:53 AM

|

显示全部楼层

本帖最后由 icy97 于 4-9-2018 02:20 AM 编辑

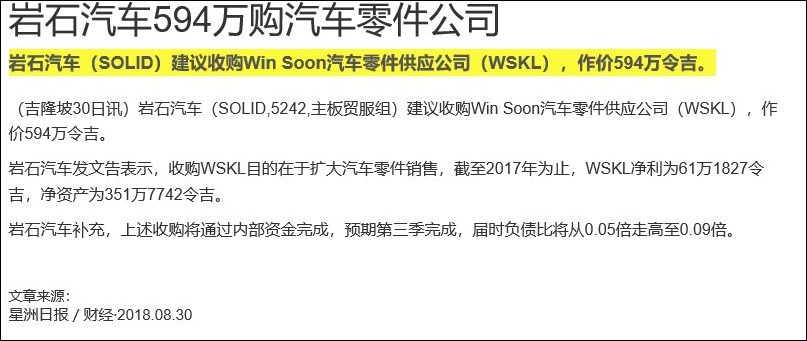

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | Proposed Acquisition of 100% equity interest in Win Soon Auto Suppliers Sdn Bhd (WSKL) and 100% equity interest in Win Soon Auto Suppliers (JB ) Sdn Bhd (WSJB) by Solid Automotive Berhad for a total cash consideration of RM5,940,000. | The Board of Directors of Solid Automotive Berhad ("SOLID") wishes to announce that SOLID has today entered into the following agreements :-

(i) Conditional share sale agreement ("SSA") with Kwee Choon Wah, Mah Kok Ming, Loo Chee How ("WSKL Vendors") for the proposed acquisition of 100% equity interest in

WSKL for a cash consideration of RM5,700,000 ("WSKL Purchase Consideration") ("Proposed Acquisition I") ("WSKL SSA"); and

(ii) Conditional SSA with Kwee Choon Wah, Mah Kok Ming, Loo Chee How and Chu Kian Hoo ("WSJB Vendors") for the proposed acquisition of 100% equity interest in WSJB

for a cash consideration of RM240,000 ("WSJB Purchase Consideration") ("Proposed Acquisition II") ("WSJB SSA").

Please refer to the file attached for further salient details of the Proposed Acquisition I and II.

This announcement is dated 28 August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5896269

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2018 06:04 AM

|

显示全部楼层

发表于 1-9-2018 06:04 AM

|

显示全部楼层

EX-date | 10 Oct 2018 | Entitlement date | 12 Oct 2018 | Entitlement time | 04:00 PM | Entitlement subject | Final Dividend | Entitlement description | FINAL SINGLE TIER DIVIDEND OF 0.2 SEN PER ORDINARY SHARE | Period of interest payment | to | Financial Year End | 30 Apr 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 25 Oct 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 12 Oct 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.002 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-9-2018 06:45 AM

|

显示全部楼层

发表于 7-9-2018 06:45 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | Additional Announcement on the Proposed Acquisition of 100% equity interest in Win Soon Auto Suppliers Sdn Bhd (WSKL) and 100% equity interest in Win Soon Auto Suppliers (JB) Sdn Bhd (WSJB) by Solid Automotive for a total cash consideration of RM5,940,000. | Reference is made to the previous announcement on 28 August 2018 with Reference No. GA1-28022018-00069. In relation thereto, the Board of Solid Automotive Berhad ("SOLID") wishes to make further announce to disclose the following information :-

1. The age of the double storey semi-detached factory is approximately 4 years.

2. Based on Solid’s internal preliminary discussion, the indicative quantum of the funding is set out below: | Source of funding | RM'000 | % | | Internally generated funds | 594 | 10.0 | | Bank borrowings | 5,346 | 90.0 | | Total | 5,940 | 100.0 |

This announcement is dated 4 September 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-9-2018 05:44 AM

|

显示全部楼层

发表于 28-9-2018 05:44 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jul 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jul 2018 | 31 Jul 2017 | 31 Jul 2018 | 31 Jul 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 29,493 | 32,466 | 29,493 | 32,466 | | 2 | Profit/(loss) before tax | 339 | 966 | 339 | 966 | | 3 | Profit/(loss) for the period | 136 | 620 | 136 | 620 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 136 | 615 | 136 | 615 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.03 | 0.16 | 0.03 | 0.16 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.3600 | 0.3600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-10-2018 06:38 AM

|

显示全部楼层

发表于 27-10-2018 06:38 AM

|

显示全部楼层

本帖最后由 icy97 于 31-10-2018 05:12 AM 编辑

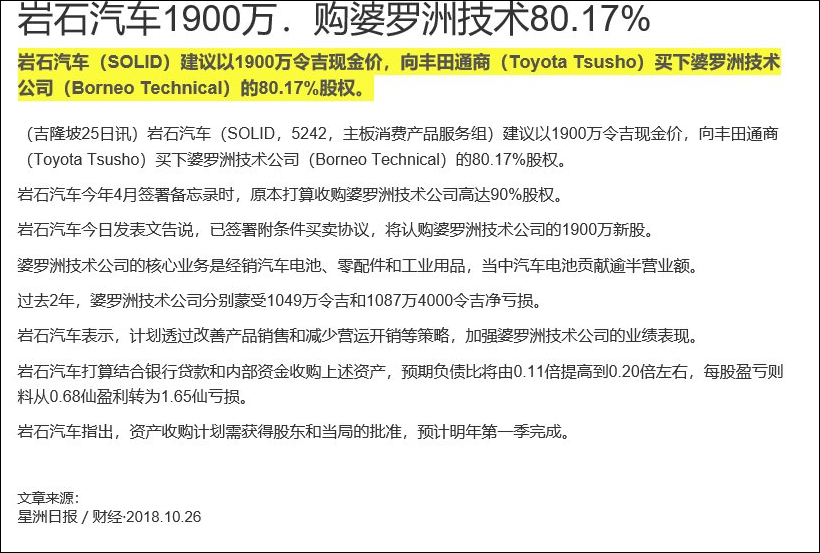

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | SOLID AUTOMOTIVE BERHAD ("SOLID" OR THE "COMPANY")PROPOSED SUBSCRIPTION BY SOLID OF 19,000,000 NEW ORDINARY SHARES IN BORNEO TECHNICAL CO (M) SDN BHD ("BORNEO"), REPRESENTING APPROXIMATELY 80.17% OF THE ENLARGED ISSUED SHARES OF BORNEO, FOR A TOTAL CONSIDERATION OF RM19,000,000 TO BE SATISFIED ENTIRELY BY WAY OF CASH ("PROPOSED SUBSCRIPTION") | We refer to the announcement made by the Company on 2 April 2018 pertaining to the memorandum of understanding entered into between the Company, Borneo, Toyota Tsusho Corporation ("TTC") and Toyota Tsusho (Malaysia) Sdn Bhd ("TTM") (TTM and TTC are collectively referred to as the "Promoters") to outline the basic principles for the negotiation in relation to the proposed subscription by Solid of equity interest in Borneo.

On behalf of the Board of Directors of Solid, UOB Kay Hian Securities (M) Sdn Bhd is pleased to announce that Solid had, on 25 October 2018, entered into a conditional subscription agreement ("Subscription Agreement") with Borneo and the Promoters to subscribe for 19,000,000 new ordinary shares in Borneo ("Subscription Share(s)" or "Borneo Share(s)"), representing approximately 80.17% of the enlarged issued shares of Borneo, for a total consideration of RM19,000,000 to be satisfied entirely by way of cash ("Proposed Subscription").

Please refer to the attachment for further details of the Proposed Subscription.

This announcement is dated 25 October 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5953949

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-1-2019 07:51 AM

|

显示全部楼层

发表于 24-1-2019 07:51 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Oct 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Oct 2018 | 31 Oct 2017 | 31 Oct 2018 | 31 Oct 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 35,862 | 30,614 | 65,355 | 63,080 | | 2 | Profit/(loss) before tax | 934 | 920 | 1,273 | 1,886 | | 3 | Profit/(loss) for the period | 715 | 570 | 851 | 1,190 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 715 | 569 | 851 | 1,184 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.18 | 0.15 | 0.22 | 0.30 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.3600 | 0.3600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-1-2019 07:08 AM

|

显示全部楼层

发表于 30-1-2019 07:08 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | SOLID AUTOMOTIVE BERHAD ("SOLID" OR THE "COMPANY"):SUBSCRIPTION BY SOLID OF 19,000,000 NEW ORDINARY SHARES IN BORNEO TECHNICAL CO (M) SDN BHD ("BORNEO"), REPRESENTING APPROXIMATELY 80.17% OF THE ENLARGED ISSUED SHARES OF BORNEO, FOR A TOTAL CONSIDERATION OF RM19,000,000 TO BE SATISFIED ENTIRELY BY WAY OF CASH ("SOLID SUBSCRIPTION") | We refer to our announcements dated 2 April 2018, 25 October 2018 and 4 December 2018 in respect of the subscription by Solid of 19,000,000 new ordinary shares in Borneo Technical Co (M) Sdn Bhd ("Borneo"), representing approximately 80.17% of the enlarged issued shares of Borneo, for a total consideration of RM19,000,000 to be satisfied entirely by way of cash ("Solid Subscription").

The board of directors of Solid wishes to announce that the subscription amounts of RM19,000,000 and RM4,700,000 (totaling RM23,700,000) has been received by Borneo from Solid and Toyota Tsusho Corporation respectively and the amount of owing to Toyota Tsusho (Malaysia) Sdn Bhd has been fully settled. As such, the proposed subscription has been completed on 8 January 2019. Subsequent to the Solid Subscription, Borneo becomes a 80.17% held subsidiary of Solid.

This announcement is dated 8 January 2019. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-1-2019 07:18 AM

|

显示全部楼层

发表于 30-1-2019 07:18 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 11-2-2019 05:15 AM

|

显示全部楼层

发表于 11-2-2019 05:15 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | Proposed Acquisition of 100% equity interest in Win Soon Auto Suppliers Sdn. Bhd. and 100% equity interest in Win Soon Auto Suppliers (JB) Sdn. Bhd. by Solid Automotive Berhad for a total cash consideration of RM5,940,000. | We refer to our announcements dated 28 August 2018 and 4 September 2018 in respect of the acquisition of 100% equity interest in Win Soon Auto Suppliers Sdn. Bhd. ("WSKL") and 100% equity interest in Win Soon Auto Suppliers (JB) Sdn. Bhd. ("WSJB") by Solid Automotive Berhad (“Solid”) for a total consideration of RM5,940,000 to be satisfied entirely by way of cash.

The board of directors of Solid wishes to announce that all conditions precedent has been complied with and the balance of the purchase consideration has been fully settled on 31 January 2019.

As such, the proposed acquisition has been completed on 31 January 2019. Subsequent to the acquisition, WSKL and WSJB becomes a 100% held subsidiary of Solid.

This announcement is dated 31 January 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-4-2019 07:21 AM

|

显示全部楼层

发表于 5-4-2019 07:21 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jan 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jan 2019 | 31 Jan 2018 | 31 Jan 2019 | 31 Jan 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 42,163 | 35,853 | 107,518 | 98,933 | | 2 | Profit/(loss) before tax | 433 | 2,187 | 1,706 | 4,073 | | 3 | Profit/(loss) for the period | 281 | 1,429 | 1,132 | 2,619 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 281 | 1,429 | 1,132 | 2,619 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.05 | 0.37 | 0.26 | 0.67 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.3600 | 0.3600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-7-2019 08:42 AM

|

显示全部楼层

发表于 17-7-2019 08:42 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Apr 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Apr 2019 | 30 Apr 2018 | 30 Apr 2019 | 30 Apr 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 59,301 | 30,482 | 166,819 | 129,242 | | 2 | Profit/(loss) before tax | 741 | 413 | 2,447 | 4,486 | | 3 | Profit/(loss) for the period | 527 | 53 | 1,659 | 2,672 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 421 | 46 | 1,450 | 2,661 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.11 | 0.01 | 0.37 | 0.68 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.20 | 0.00 | 0.20 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.3600 | 0.3600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-10-2019 08:36 AM

|

显示全部楼层

发表于 11-10-2019 08:36 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jul 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jul 2019 | 31 Jul 2018 | 31 Jul 2019 | 31 Jul 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 65,057 | 29,493 | 65,057 | 29,493 | | 2 | Profit/(loss) before tax | 1,271 | 339 | 1,271 | 339 | | 3 | Profit/(loss) for the period | 1,186 | 136 | 1,186 | 136 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 975 | 136 | 975 | 136 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.25 | 0.03 | 0.25 | 0.03 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.3600 | 0.3600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-10-2019 08:36 AM

|

显示全部楼层

发表于 11-10-2019 08:36 AM

|

显示全部楼层

Date of change | 26 Sep 2019 | Name | MR ONG KHENG SWEE | Age | 61 | Gender | Male | Nationality | Malaysia | Type of change | Resignation | Designation | Chief Financial Officer | Reason | Step down from the position as Chief Financial Officer and remain as an Executive Director overseeing other aspects or interest of the Solid Automotive Berhad's Group. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-4-2020 06:30 AM

|

显示全部楼层

发表于 2-4-2020 06:30 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Oct 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Oct 2019 | 31 Oct 2018 | 31 Oct 2019 | 31 Oct 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 72,025 | 35,862 | 137,082 | 65,355 | | 2 | Profit/(loss) before tax | 517 | 934 | 1,788 | 1,273 | | 3 | Profit/(loss) for the period | 313 | 715 | 1,499 | 851 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 112 | 715 | 1,087 | 851 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.08 | 0.18 | 0.33 | 0.22 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.3600 | 0.3600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-4-2020 07:24 AM

|

显示全部楼层

发表于 24-4-2020 07:24 AM

|

显示全部楼层

Date of change | 21 Feb 2020 | Name | MR ONG KHENG SWEE | Age | 62 | Gender | Male | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Resignation | Reason | To pursue personal interests |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-6-2020 01:00 AM

|

显示全部楼层

发表于 2-6-2020 01:00 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jan 2020 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jan 2020 | 31 Jan 2019 | 31 Jan 2020 | 31 Jan 2019 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 63,493 | 42,163 | 200,575 | 107,518 | | 2 | Profit/(loss) before tax | 691 | 433 | 2,479 | 1,706 | | 3 | Profit/(loss) for the period | 527 | 281 | 2,026 | 1,132 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 500 | 178 | 1,587 | 1,029 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.13 | 0.05 | 0.40 | 0.26 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.3800 | 0.3700

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|