|

|

【GASMSIA 5209 交流专区】大马天然气

[复制链接]

[复制链接]

|

|

|

发表于 18-10-2018 05:10 AM

|

显示全部楼层

发表于 18-10-2018 05:10 AM

|

显示全部楼层

本帖最后由 icy97 于 19-10-2018 07:19 AM 编辑

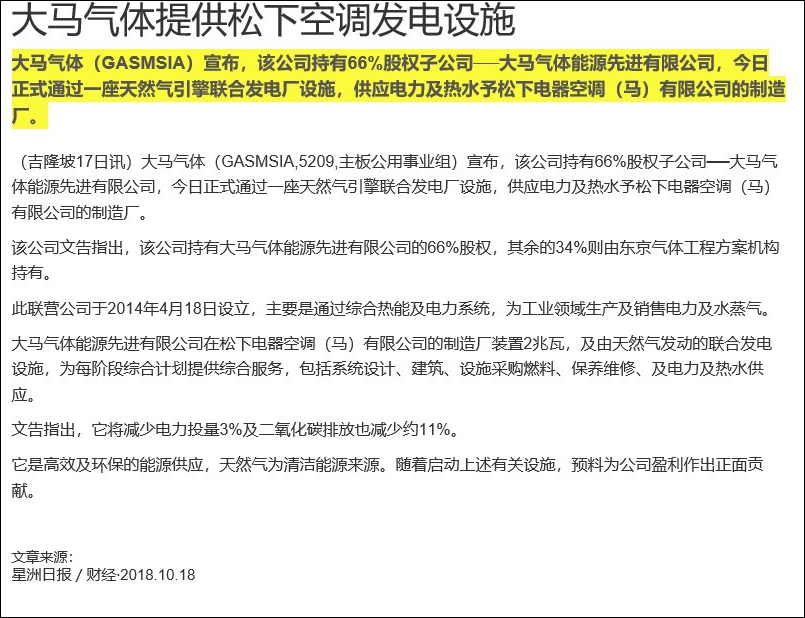

Type | Announcement | Subject | OTHERS | Description | PROVISION OF 2MW CO-GENERATION BY GAS MALAYSIA ENERGY ADVANCE SDN BHD | 1.0 INTRODUCTION Gas Malaysia Berhad (“Gas Malaysia” or “the Company”) wishes to announce that its 66% joint venture company with Tokyo Gas Engineering Solutions Corporation (“TGES”), Gas Malaysia Energy Advance Sdn Bhd (“GMEA”) has officially today supplied electricity and hot water to Panasonic Appliances Air-Conditioning Malaysia Sdn Bhd’s (“PAPAMY”) manufacturing plant through a gas engine co-generation plant.

2.0 INFORMATION ON GMEA A joint venture between Gas Malaysia Berhad (66%) and TGES (34%), GMEA was incorporated on 18 April 2014 to generate and sell electricity and steam through the Combined Heat and Power ("CHP") system to the industrial sector. CHP is a simultaneous production of electricity and usable thermal energy from one single fuel source. This contrasts with conventional ways of generating electricity where a vast amount of heat is simply wasted.

3.0 INFORMATION ON PAPAMY PAPAMY is the Panasonic Corporation’s (“Panasonic”) air conditioner company established in Malaysia in 1972 and its primary activities are in the production of room air conditioners and component parts. Currently, Panasonic and TGES have commenced its operation of power generator and air conditioning system in combination with energy service by gas co-generation and non-Freon air conditioner at Panasonic’s manufacturing plant in Malaysia.

4.0 INFORMATION ON THE PROJECT GMEA installed 2MW co-generation fuelled by natural gas on the manufacturing plant of PAPAMY and provides comprehensive services for each phase of the Project, from system design, construction, procurement of fuel to facility, maintenance, and to electricity and hot water supply. PAPAMY utilizes waste hot water from co-generation plant as a heat source. With this system, PAPAMY aims to reduce energy inputs by approximately 3% and CO2 emissions by approximately 11%. The system is expected to continue contributing to highly-efficient and environmentally-friendly energy supply with natural gas as a clean energy source.

5.0 FINANCIAL EFFECTS The commencement of operation of the Project is expected to contribute positively to earnings of the Group and will not have any material effects on the issued and paid up share capital and net assets of the Company for the financial year ending 31 December 2018.

6.0 DIRECTORS' AND MAJOR SHAREHOLDERS' INTERESTS None of the directors and/or major shareholders of the Company and/or persons connected to them have any interest, direct or indirect, in the project.

This announcement is dated 17 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-11-2018 06:34 AM

|

显示全部楼层

发表于 28-11-2018 06:34 AM

|

显示全部楼层

本帖最后由 icy97 于 14-12-2018 03:17 AM 编辑

大马天然气第三季净利涨22%

http://www.enanyang.my/news/20181115/大马天然气第三季净利涨22/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,556,281 | 1,392,528 | 4,494,716 | 3,859,869 | | 2 | Profit/(loss) before tax | 54,401 | 44,425 | 172,879 | 133,829 | | 3 | Profit/(loss) for the period | 41,028 | 33,436 | 129,314 | 99,345 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 41,028 | 33,608 | 129,314 | 99,793 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.20 | 2.62 | 10.07 | 7.77 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 4.50 | 4.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7578 | 0.7919

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-1-2019 08:19 AM

|

显示全部楼层

发表于 3-1-2019 08:19 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | JOINT VENTURE AGREEMENT BETWEEN GAS MALAYSIA VENTURE 1 SDN BHD AND SIME DARBY ENERGY SOLUTIONS SDN BHD (FORMERLY KNOWN AS SIME DARBY OFFSHORE ENGINEERING SDN BHD) - INCORPORATION OF A JOINT VENTURE COMPANY | This announcement should be read in conjunction with the earlier announcements made on 7 November 2017, 9 November 2017 and 12 November 2018, in respect of the Joint Venture Agreement (“JVA”) entered into between Gas Malaysia Venture 1 Sdn Bhd (“GMV1”) and Sime Darby Energy Solutions Sdn Bhd (formerly known as Sime Darby Offshore Engineering Sdn Bhd) (“SDES”).

Pursuant to Paragraph 9.19(23) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, Gas Malaysia Berhad (“Gas Malaysia” or “the Company”) wishes to announce the incorporation of the joint venture company, namely Gas Malaysia Synergy Drive Sdn Bhd (“GMSD”), on 4 December 2018. The Notice of Registration pursuant to Section 15 of the Companies Act 2016 under the name of GMSD dated 4 December 2018, issued by the Companies Commission of Malaysia was received by the Company, on even date.

GMSD (Company No. 1306162-X) was incorporated as a private company limited by shares in Malaysia under the Companies Act, 2016. The issued share capital of GMSD is RM2.00 divided into two (2) ordinary shares of RM1.00 each held by GMV1 and SDES respectively. The principal activities of GMSD are to undertake the business of provision of electricity, steam, chilled water, hot water, hot air and/or any other utilities to customer through Combined Heat and Power System to industries in Malaysia. The eventual issued and paid up capital of GMSD shall be increased to RM5,000,000 in accordance to the proportion of each joint venture party based on the JVA, which is 70% by GMV1 and 30% by SDES.

The incorporation of GMSD is not expected to have a material effect on earnings per share, net assets per share, gearing, share capital and substantial shareholders’ shareholding of Gas Malaysia for the financial year ending 31 December 2018. None of the Directors or substantial shareholders of Gas Malaysia or persons connected with them has any interest, direct or indirect, in the incorporation.

This announcement is dated 4 December 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-1-2019 07:02 AM

|

显示全部楼层

发表于 24-1-2019 07:02 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | NATURAL GAS TARIFF REVISION FOR NON-POWER SECTOR IN PENINSULAR MALAYSIA | Gas Malaysia Berhad (“Gas Malaysia” or “the Company”) wishes to inform that the Government on 26 December 2018 issued an instruction, and as confirmed in Suruhanjaya Tenaga’s website (www.st.gov.my), for Gas Malaysia to effect the revision of the natural gas tariff for the non-power sector in Peninsular Malaysia from 1 January 2019.

The Government has prescribed the Incentive-Based Regulation (“IBR”) framework which sets the Base Tariff for a Regulatory Period of three years from January 2017 and allows changes in the gas costs to be passed through via the Gas Cost Pass-Through (“GCPT”) mechanism every six months.

The average Base Tariff will be set to RM32.69/MMBtu. The Tariff Schedule for the period commencing 1 January 2019 to 30 June 2019 is as follows:

Tariff Category | Annual Gas Consumption (in MMBtu) | Current Base Tariff (RM/MMBtu)

| Current Tariff After Surcharge (RM/MMBtu)

| Base Tariff For Period 1 January – 30 June 2019 (RM/MMBtu)

| Tariff After Surcharge For Period 1 January – 30 June 2019 (RM/MMBtu)

| A | Residential | 23.03 | 23.80 | 23.49 | 23.72 | B | 0-600 | 29.73 | 30.50 | 30.35 | 30.58 | C | 601 – 5,000 | 29.88 | 30.65 | 30.51 | 30.74 | D | 5,001 – 50,000 | 30.19 | 30.96 | 30.81 | 31.04 | E | 50,001 – 200,000 | 31.49 | 32.26 | 32.15 | 32.38 | F | 200,001 – 750,000 | 31.49 | 32.26 | 32.15 | 32.38 | L | Above 750,000 | 32.55 | 33.32 | 33.23 | 33.46 | Average | 31.92 | 32.69 | 32.69 | 32.92 |

Under the GCPT mechanism, a surcharge of RM0.23/MMBtu will apply to all tariff categories for the period beginning 1 January 2019 to 30 June 2019. This translates to an average effective tariff of RM32.92/MMBtu, which is an increase of 0.70% from the current average tariff after surcharge.

While the tariff revision has no material impact on Gas Malaysia’s business operations, it is expected to contribute positively towards the financial position of the Company for the financial year ending 31 December 2019.

This announcement is dated 26 December 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-1-2019 08:58 AM

|

显示全部楼层

发表于 28-1-2019 08:58 AM

|

显示全部楼层

Date of change | 03 Jan 2019 | Name | ENCIK MOHAMED SOPHIE BIN MOHAMED RASHIDI | Age | 60 | Gender | Male | Nationality | Malaysia | Type of change | Retirement | Designation | Chief Financial Officer |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information |

| | | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Hold 16,000 shares in Gas Malaysia Berhad |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-1-2019 08:59 AM

|

显示全部楼层

发表于 28-1-2019 08:59 AM

|

显示全部楼层

Date of change | 03 Jan 2019 | Name | ENCIK ZAFIAN BIN SUPIAT | Age | 44 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Financial Officer |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Professional Qualification | Chartered Accountant | The Institute of Chartered Accountants in England and Wales | | | 2 | Degree | Bachelor of Science in Accounting and Finance | London School of Economics and Political Science, United Kingdom | |

| | | Working experience and occupation | 2016 to 2018 - MMC Corporation Berhad (General Manager, Finance)2010 to 2016 - Johor Port Berhad (Chief Financial Officer)2008 to 2010 - MMC Corporation Berhad (Senior Manager, Group Reporting Unit)2004 to 2008 - Pos Malaysia Berhad (Group Accountant)1997 to 2004 - Ernst & Young (Audit Manager) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-2-2019 08:05 AM

|

显示全部楼层

发表于 21-2-2019 08:05 AM

|

显示全部楼层

本帖最后由 icy97 于 22-2-2019 04:22 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,738,527 | 1,455,455 | 6,233,243 | 5,315,324 | | 2 | Profit/(loss) before tax | 61,240 | 80,855 | 234,119 | 214,684 | | 3 | Profit/(loss) for the period | 51,078 | 61,309 | 180,392 | 160,654 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 51,078 | 61,348 | 180,392 | 161,141 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.98 | 4.77 | 14.05 | 12.55 | | 6 | Proposed/Declared dividend per share (Subunit) | 4.50 | 4.00 | 9.00 | 8.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7976 | 0.7919

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-2-2019 08:06 AM

|

显示全部楼层

发表于 21-2-2019 08:06 AM

|

显示全部楼层

EX-date | 07 Mar 2019 | Entitlement date | 11 Mar 2019 | Entitlement time | 04:00 PM | Entitlement subject | Second interim dividend | Entitlement description | Single-tier second interim dividend of 4.50 sen per share on the 1,284,000,000 ordinary shares, amounting to RM57,780,000 in respect of the financial year ended 31 December 2018. | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | Boardroom Share Registrars Sdn Bhd (Company No. 378993-D)(formerly known as Symphony Share Registrars Sdn Bhd)Level 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaSelangorTel: 03-78490777Fax: 03-78418151 | Payment date | 28 Mar 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 11 Mar 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.045 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-4-2019 03:47 AM

|

显示全部楼层

发表于 3-4-2019 03:47 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED SINGLE-TIER FINAL DIVIDEND FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2018 | Pursuant to Paragraph 9.19(2) of the Main Market Listing Requirements, the Company wishes to announce that the Board of Directors has resolved to recommend a single-tier final dividend of 4.50 sen per ordinary share for the financial year ended 31 December 2018, subject to the approval of the Company’s shareholders at the forthcoming Annual General Meeting.

The dates of entitlement and payment in respect of the aforesaid dividend will be determined and announced by the Company in due course.

This announcement is dated 14 March 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-5-2019 07:27 AM

|

显示全部楼层

发表于 14-5-2019 07:27 AM

|

显示全部楼层

EX-date | 04 Jun 2019 | Entitlement date | 10 Jun 2019 | Entitlement time | 04:00 PM | Entitlement subject | Final Dividend | Entitlement description | Proposed single-tier final dividend of 4.50 sen per ordinary share in respect of the financial year ended 31 December 2018, subject to Shareholders' approval at the forthcoming Twenty-Eighth Annual General Meeting to be held on 16 May 2019. | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaTel : 0378418088Fax : 0378418100 | Payment date | 03 Jul 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 10 Jun 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.045 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2019 07:44 AM

|

显示全部楼层

发表于 22-6-2019 07:44 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,715,570 | 1,435,249 | 1,715,570 | 1,435,249 | | 2 | Profit/(loss) before tax | 54,980 | 54,778 | 54,980 | 54,778 | | 3 | Profit/(loss) for the period | 41,169 | 40,212 | 41,169 | 40,212 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 41,169 | 40,212 | 41,169 | 40,212 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.20 | 3.13 | 3.20 | 3.13 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7842 | 0.7976

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-7-2019 08:37 AM

|

显示全部楼层

发表于 23-7-2019 08:37 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | NATURAL GAS TARIFF REVISION FOR NON-POWER SECTOR IN PENINSULAR MALAYSIA | Gas Malaysia Berhad (“Gas Malaysia” or “the Company”) wishes to inform that the Government has issued an instruction, via a letter from Suruhanjaya Tenaga dated 12 July 2019, and as confirmed in Suruhanjaya Tenaga’s website ( www.st.gov.my), for Gas Malaysia to effect the revision of the natural gas tariff for the non-power sector in Peninsular Malaysia from 15 July 2019.

The Government has prescribed the Incentive-Based Regulation (“IBR”) framework which sets the Base Tariff for a Regulatory Period of three years from January 2017 and allows changes in the gas costs to be passed through via the Gas Cost Pass-Through (“GCPT”) mechanism every six months.

The average Base Tariff will be set to RM32.74/MMBtu. The Tariff Schedule for the period commencing 15 July 2019 to 31 December 2019 is as follows:

Tariff Category | Annual Gas Consumption (in MMBtu) | Current Base Tariff (RM/MMBtu) | Current Tariff After Surcharge (RM/MMBtu) | Base Tariff for Period 15 July – 31 December 2019

(RM/MMBtu) | Tariff After Surcharge For Period 15 July – 31 December 2019 (RM/MMBtu) | A | Residential | 23.49 | 23.72 | 23.52 | 25.44 | B | 0 - 600 | 30.35 | 30.58 | 30.40 | 32.32 | C | 601 - 5,000 | 30.51 | 30.74 | 30.56 | 32.48 | D | 5,001 - 50,000 | 30.81 | 31.04 | 30.86 | 32.78 | E | 50,001 - 200,000 | 32.15 | 32.38 | 32.20 | 34.12 | F | 200,001 - 750,000 | 32.15 | 32.38 | 32.20 | 34.12 | L | Above 750,000 | 33.23 | 33.46 | 33.28 | 35.20 | Average | 32.69 | 32.92 | 32.74 | 34.66 |

Under the GCPT mechanism, a surcharge of RM1.92/MMBtu will apply to all tariff categories for the period stated above. This translates to an average effective tariff of RM34.66/MMBtu, which is an increase of 5.3% from the current average tariff after surcharge.

Gas Malaysia wishes to clarify that this tariff revision is not applicable to sales of natural gas for natural gas vehicle (“NGV”) and liquefied petroleum gas (“LPG”) supplied in gas cylinder or in bulk supply.

While the tariff revision has no material impact on Gas Malaysia’s business operations, it is expected to contribute positively towards the financial position of the Company for the financial year ending 31 December 2019.

This announcement is dated 12 July 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-8-2019 07:01 AM

|

显示全部楼层

发表于 20-8-2019 07:01 AM

|

显示全部楼层

本帖最后由 icy97 于 20-8-2019 08:10 AM 编辑

大马天然气次季赚4901万

https://www.enanyang.my/news/20190819/大马天然气次季赚4901万/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,736,740 | 1,503,186 | 3,452,310 | 2,938,435 | | 2 | Profit/(loss) before tax | 65,761 | 63,700 | 120,740 | 118,478 | | 3 | Profit/(loss) for the period | 49,009 | 48,074 | 90,177 | 88,286 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 49,009 | 48,074 | 90,177 | 88,286 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.82 | 3.74 | 7.02 | 6.88 | | 6 | Proposed/Declared dividend per share (Subunit) | 4.80 | 4.50 | 4.80 | 4.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7792 | 0.7976

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-8-2019 07:04 AM

|

显示全部楼层

发表于 20-8-2019 07:04 AM

|

显示全部楼层

EX-date | 08 Oct 2019 | Entitlement date | 09 Oct 2019 | Entitlement time | 04:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | Proposed single-tier first interim dividend of 4.80 sen per ordinary share in respect of the financial year ending 31 December 2019. | Period of interest payment | to | Financial Year End | 31 Dec 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaSelangor Darul EhsanTel: 0378418088Fax: 0378418100 | Payment date | 30 Oct 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 09 Oct 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.048 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-1-2020 05:48 AM

|

显示全部楼层

发表于 24-1-2020 05:48 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2019 | 30 Sep 2018 | 30 Sep 2019 | 30 Sep 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,755,872 | 1,556,281 | 5,208,183 | 4,494,716 | | 2 | Profit/(loss) before tax | 53,157 | 54,401 | 173,900 | 172,879 | | 3 | Profit/(loss) for the period | 41,997 | 41,028 | 132,177 | 129,314 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 46,484 | 41,415 | 138,803 | 129,460 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.27 | 3.20 | 10.29 | 10.07 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 4.80 | 4.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7674 | 0.7976

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-3-2020 08:12 AM

|

显示全部楼层

发表于 19-3-2020 08:12 AM

|

显示全部楼层

Date of change | 30 Nov 2019 | Name | CIK SHARIFAH SOFIA BINTI SYED MOKHTAR SHAH | Age | 26 | Gender | Female | Nationality | Malaysia | Designation | Non-Independent Director | Directorate | Non Independent and Non Executive | Type of change | Resignation | Reason | Ceased as nominee director of indirect major shareholder of the Company. | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Masters | Master in Development Management | London School of Economics and Political Science, United Kingdom ("UK") | | | 2 | Degree | Bachelor of Science in Economics | University of York, UK | |

Working experience and occupation | January 2017 to October 2017 - Pos Malaysia Berhad - Special Officer to the Group Chief Executive Officer.October 2015 to May 2016 - Bill & Melinda Gates Foundation (External Consultant).June 2014 to August 2014 - Morgan Stanley, Singapore (Summer Analyst, Investment Banking).March 2014 to April 2014 - Grameen Bank, Bangladesh.July 2013 - Congressional Internship, Washington DC.March 2013 to April 2013 - Islamic Arts Museum, MalaysiaFebruary 2013 - Insight Day at PricewaterhouseCoopers, Manchester, UK. | Family relationship with any director and/or major shareholder of the listed issuer | She is the daughter to YBhg. Tan Sri Dato' Seri Syed Mokhtar Shah bin Syed Nor, an indirect major shareholder of Anglo Oriental (Annuities) Sdn Bhd, which is a major shareholder of the Company. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-3-2020 05:10 AM

|

显示全部楼层

发表于 25-3-2020 05:10 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | NATURAL GAS SELLING PRICE FOR GAS MALAYSIA ENERGY AND SERVICES SDN. BHD. IN PENINSULAR MALAYSIA | Gas Malaysia Berhad (“Gas Malaysia” or “the Company”) wishes to inform that the Government has issued a directive, via a letter from Suruhanjaya Tenaga dated 6 December 2019, and as published on Suruhanjaya Tenaga’s website ( www.st.gov.my), to effect the average natural gas selling price for the distribution segment by Gas Malaysia’s wholly-owned subsidiary, Gas Malaysia Energy and Services Sdn. Bhd. (“GMES”). The directive is for a period of two years beginning 1 January 2020 to 31 December 2021, with an annual review of such average natural gas selling price.

In view of the above, the Government has approved for the average natural gas selling price applicable for GMES for the first year beginning 1 January 2020 to 31 December 2020, to be set at RM33.65/MMBtu, which is lower by 2.91% or RM1.01/MMBtu compared to the current average natural gas selling price for the distribution segment.

The selling price schedule for GMES to its customers for the period beginning 1 January 2020 to 31 December 2020 is as follows:

Category | Annual Gas Consumption (in MMBtu) | Current Selling Price | Selling Price from 1 January 2020 – 31 December 2020 (RM/MMBtu) | Base Price (RM/MMBtu) | Price after Surcharge (RM/MMBtu) | A | Retailer for residential users | 23.52 | 25.44 | 25.10 | B | 0 – 600 | 30.40 | 32.32 | 31.71 | C | 601 – 5,000 | 30.56 | 32.48 | 31.86 | D | 5,001 – 50,000 | 30.86 | 32.78 | 32.15 | E | 50,001 – 200,000 | 32.20 | 34.12 | 33.45 | F | 200,001 – 750,000 | 32.20 | 34.12 | 33.45 | L | Above 750,000 | 33.28 | 35.20 | 33.99 | Average | 32.74 | 34.66 | 33.65 |

Gas Malaysia wishes to clarify that this selling price revision is not applicable to sales of natural gas for natural gas vehicle (“NGV”) and liquefied petroleum gas (“LPG”) supplied in gas cylinder or in bulk supply.

The selling price revision is expected to continue contributing positively towards the financial position of the Company for the financial year ending 31 December 2020.

This announcement is dated 9 December 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-3-2020 07:54 AM

|

显示全部楼层

发表于 31-3-2020 07:54 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | DISTRIBUTION TARIFFS FOR GAS MALAYSIA DISTRIBUTION SDN. BHD. IN PENINSULAR MALAYSIA | Gas Malaysia Berhad (“Gas Malaysia” or “the Company”) wishes to inform that the Government has issued a directive, via a letter from Suruhanjaya Tenaga dated 6 December 2019 for Gas Malaysia to effect the approval of the average Base Tariff for the utilisation of the natural gas distribution system of Gas Malaysia’s wholly-owned subsidiary, Gas Malaysia Distribution Sdn. Bhd. (“GMD”) under the Incentive-Based Regulation (“IBR”) framework. The average Base Tariff will be applicable for the next three-years’ Regulatory Period beginning 1 January 2020 to 31 December 2022.

In addition, Gas Malaysia will be recovering its Gas Cost Pass-Through (“GCPT”) amount for the variation in gas costs incurred up to 31 December 2019 through a surcharge to GMD’s average Base Tariff over the next two years. The surcharge will not be applicable for the utilisation of GMD’s natural gas distribution system to deliver gas to Natural Gas Vehicle (“NGV”) and Gas District Cooling (“GDC”).

The approved average Base Tariff for GMD for the Regulatory Period beginning 1 January 2020 to 31 December 2022 is RM1.573/GJ/day. Meanwhile, the approved surcharge to GMD’s average Base Tariff for the period beginning 1 January 2020 to 31 December 2021 is RM0.520/GJ/day.

Gas Malaysia wishes to clarify that the tariffs approval is not applicable to sales of liquefied petroleum gas supplied in gas cylinder or in bulk supply.

The distribution tariffs for this Regulatory Period is expected to contribute positively towards the financial position of the Company for the next Regulatory Period of three years.

This announcement is dated 24 December 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-4-2020 07:36 AM

|

显示全部楼层

发表于 1-4-2020 07:36 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | ISSUANCE OF SHIPPING LICENCE TO GAS MALAYSIA ENERGY AND SERVICES SDN. BHD. AND DISTRIBUTION LICENCE TO GAS MALAYSIA DISTRIBUTION SDN. BHD. | Gas Malaysia Berhad (“Gas Malaysia” or “the Company”) wishes to inform that Suruhanjaya Tenaga has granted, via a letter dated 26 December 2019, the following licences to the Company’s wholly-owned subsidiaries pursuant to the implementation of Third-Party Access system:

- Shipping Licence to Gas Malaysia Energy and Services Sdn. Bhd. (“GMES”), valid for a period of 10 years, which allows GMES to carry out activity of a shipping licensee including making an arrangement with a regasification, transportation or distribution licensee for gas to be processed or delivered through a regasification terminal, transmission pipeline or distribution pipeline to consumers’ premises; and

- Distribution Licence to Gas Malaysia Distribution Sdn. Bhd. (“GMD”), valid for a period of 20 years, which permits GMD to carry out the activity of operating and maintaining the distribution pipeline to deliver gas through the distribution pipeline.

These licences have been granted under the Gas Supply Act 1993 (as amended by the Gas Supply (Amendment) Act 2016).

Both licences will take effect commencing 1 January 2020.

This announcement is dated 27 December 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-4-2020 08:15 AM

|

显示全部楼层

发表于 20-4-2020 08:15 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2019 | 31 Dec 2018 | 31 Dec 2019 | 31 Dec 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,678,270 | 1,738,527 | 6,886,453 | 6,233,243 | | 2 | Profit/(loss) before tax | 68,245 | 61,240 | 242,145 | 234,119 | | 3 | Profit/(loss) for the period | 57,928 | 51,078 | 190,105 | 180,392 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 57,928 | 51,078 | 190,105 | 180,392 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.51 | 3.98 | 14.81 | 14.05 | | 6 | Proposed/Declared dividend per share (Subunit) | 4.80 | 4.50 | 9.60 | 9.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8123 | 0.7976

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|