|

查看: 11448|回复: 79

|

【专题讨论】我国的外汇储备金新闻记录与讨论。

[复制链接]

|

|

|

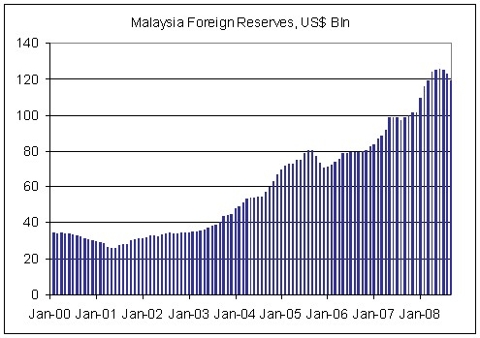

以下我想讲的应该是很多网友都懂的,可是在论坛很少提到的话题,就是外汇储备金对股市的影响。

我国的外汇储备金增加与减少由很多因素决定,例如出口所得,FDI(正正经经进入我国要开厂投资的外资),兑换率。除了这些因素,还有一个重要因素就是热钱了。热钱进来我国,大部分是进入政府债券,但也有些钱进入股市和房地产,大抄股票和房地产。因此,通过观察我国的外汇储备将大约知道热钱的动向。

热钱通常只有在有赚钱的可能性高时才会进入个别国家,例如有投资主题 (BRIC,MENA),或是有currency gain的可能性。例如我国在2005年宣布不再peg美元(之前是1美元兑换3.8马币),每个人都知道当时马币是undervalued了,将来的方向一定是升值,所以热钱就进来了。

我国的外汇储备金于31/12/2005时是USD70.5 billion;

31/12/2006时是USD82.5 billion;

31/12/2007时是USD101.3 billion;

31/03/2008时是USD120.3 billion (急促增加)。

在31/12/2005到31/03/2008这段期间大家可以看到我国股市非常的牛,热钱/外资大抄股票。

可惜好景不长,我国的外汇储备金从最顶峰的USD125.8 billion (30/06/2008)逐渐下跌到15/10/2008的USD107.6 billion,而且还没有停止下跌的感觉。外资离开我国,所以我国股市也进入熊市。

讲了这么多,结论呢?

我的结论是通过观察我国的外汇储备金增加或减少的趋势,我们可以大约预知下场牛市的到来,并提早做好准备!

欢迎大家讨论。

[ 本帖最后由 Mr.Business 于 24-10-2008 02:44 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-10-2008 08:26 AM

|

显示全部楼层

我国的外汇储备金记录 (国家银行的资料):

USD70.5 billion as at 31 December 2005

USD70.8 billion as at 13 January 2006

USD71.3 billion as at 27 January 2006

USD71.6 billion as at 15 February 2006

USD72.2 billion as at 28 February 2006

USD72.9 billion as at 15 March 2006

USD73.7 billion as at 31 March 2006

USD74.9 billion as at 14 April 2006

USD75.7 billion as at 28 April 2006

USD78.6 billion as at 15 May 2006

USD78.6 billion as at 15 May 2006

USD78.4 billion as at 15 June 2006

USD78.8 billion as at 30 June 2006

USD78.9 billion as at 14 July 2006

USD79.1 billion as at 31 July 2006

USD79.2 billion as at 15 August 2006

USD79.3 billion as at 30 August 2006

USD79.3 billion as at 15 September 2006

USD79.5 billion as at 29 September 2006

USD79.6 billion as at 13 October 2006

USD79.6 billion as at 31 October 2006

USD79.8 billion as at 15 November 2006

USD80 billion as at 30 November 2006

USD80.3 billion as at 15 December 2006

USD82.5 billion as at 31 December 2006

USD82.7 billion as at 15 January 2007

USD83.5 billion as at 31 January 2007

USD85.1 billion as at 15 February 2007

USD86.9 billion as at 28 February 2007

USD87.3 billion as at 15 March 2007

USD88.6 billion as at 30 March 2007

USD89.5 billion as at 13 April 2007

USD91.6 billion as at 30 April 2007

USD94.5 billion as at 15 May 2007

USD98.4 billion as at 31 May 2007

USD98.4 billion as at 15 June 2007

USD98.4 billion as at 29 June 2007

USD98.4 billion as at 13 July 2007

USD98.5 billion as at 31 July 2007

USD98.4 billion as at 15 August 2007

USD96.8 billion as at 30 August 2007

USD97 billion as at 14 September 2007

USD98.2 billion as at 28 September 2007

USD98.5 billion as at 12 October 2007

USD99.6 billion as at 31 October 2007

USD101.2 billion as at 15 November 2007

USD101.1 billion as at 30 November 2007

USD101.1 billion as at 14 December 2007

USD101.3 billion as at 31 December 2007

USD104.3 billion as at 15 January 2008

USD109.3 billion as at 31 January 2008

USD110.9 billion as at 15 February 2008

USD116.3 billion as at 29 February 2008

USD119.1 billion as at 14 March 2008

USD120.3 billion as at 31 March 2008

USD122 billion as at 15 April 2008

USD124.1 billion as at 30 April 2008

USD125.1 billion as at 15 May 2008

USD125.2 billion as at 30 May 2008

USD124.6 billion as at 13 June 2008

USD125.8 billion as at 30 June 2008

USD125.1 billion as at 15 July 2008

USD125.1 billion as at 31 July 2008.

USD123.7 billion as at 15 August 2008

USD122.6 billion as at 29 August 2008

USD119.1 billion as at 15 September 2008

USD109.7 billion as at 30 September 2008

USD107.6 billion as at 15 October 2008

USD100.2 billion as at 31 October 2008

USD99.7 billion as at 14 November 2008

USD97.7 billion as at 28 November 2008

USD96 billion as at 15 December 2008

USD91.4 billion as at 31 December 2008

USD91.5 billion as at 15 January 2009

USD91.3 billion as at 30 January 2009

USD91.6 billion as at 13 February 2009

USD91.1 billion as at 27 February 2009

USD90.6 billion as at 13 March 2009

USD87.8 billion as at 31 March 2009

USD87.7 billion as at 15 April 2009

[ 本帖最后由 Mr.Business 于 5-5-2009 02:49 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-10-2008 08:26 AM

|

显示全部楼层

新闻摘要:

06/10/2008:

Citi in a report described foreign capital as holdings of domestic equity, local bonds and short-term debts.

As at June 30 this year, foreigners held RM104.8 billion of Malaysian debt securities. Zheng said, however, that the figure might have fallen to RM80 billion to RM90 billion by the end of last month, an indication of further capital outflows.

09/10/2008:

The foreign reserve dropped US$9.3 billion (RM32.55 billion) in the second half of September to US$109.7 billion on Sept 30. According to CIMB Research, last month’s drop marked a record pace of contraction since the last time foreign reserves fell as sharply was in the fourth quarter 2005, when it dropped US$9.8 billion.

Foreign holdings in fixed income instruments fell to RM100.6 billion at end-July from RM104.8 billion at end-June 2008 and its peak of RM126.5 billion at end-April, said RHB Research in a research note.

It observed that foreign holdings of debt papers had declined by RM4.2 billion in July. Although the July drop was smaller than the decline in June where foreign holdings decreased by RM7.6 billion, it did however continue a multi-month downward trend.

“This (the drop in July) was the third straight month of decline, suggesting that they are likely to have continued unwinding their positions in the months ahead,” the research house said in a note yesterday.

20/10/2008:

In a recent report, Kenanga Research said with the expectation of a large net outflow of portfolio funds of about another RM30 billion to RM50 billion in the second half of 2008, Bank Negara Malaysia’s (BNM) foreign reserves may see at least a US$10 billion to US$20 billion reduction back to the US$90 billion level by year-end.

As at Sept 30, 2008, BNM’s foreign reserves stood at RM379.3 billion (US$109.7 billion), versus the peak at RM408.5 billion as at July 31, 2008.

24/10/2008:

國家銀行昨日宣佈,截至08年10月15日,大馬的外匯儲備金達1076億美元,相等於3718億令吉。與9月杪相比,外匯儲備金下滑2%,或76億令吉。

外資在7月份所持有的債券減少42億令吉,雖然與6月份的76億令吉下跌相比,是個小幅度的下跌,但這是連續3個月的下滑,這意味著外資極有可能在未來繼續撤離。

因此,外資截至7月杪持有的定期收入投資從6月杪的1048億令吉,下挫至1006億令吉。

[ 本帖最后由 Mr.Business 于 24-10-2008 08:36 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-10-2008 08:27 AM

|

显示全部楼层

保留。。。

[ 本帖最后由 Mr.Business 于 24-10-2008 09:39 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-10-2008 08:28 AM

|

显示全部楼层

新闻。

'Reserves enough to meet risk of capital inflow halt'

By Rupa Damodaran

Published: 2008/10/06

Malaysia's foreign reserves are seen to be more than adequate to defendthe value of the ringgit even if the entire stock of mobile foreigncapital in the country were to reverse, says Citi

MALAYSIA may have recently dug into its foreign exchange reserves todefend the ringgit from an outflow of capital, but it still has enoughreserves to handle any total stoppage of foreign capital inflow, saysCiti.

"The reserve buffer remains substantial and should be more thanadequate to cover the risk of an outright exit of all mobile foreigncapital in the country," Citi said in a report.

It described foreign capital as holdings of domestic equity, local bonds and short-term debts.

The risk of a sudden halt of financial inflows is measured by the sizeof a country's external financing requirements relative to its foreignexchange reserves.

Malaysia's significant current account surplus and limited externaldebt would put it among the most resilient economies in Asia iffinancial flows should dry up.

This contrasts with more vulnerable economies such as South Korea,which faces a huge repayment of debt principles, and Vietnam and Indiawhich have large current account deficits.

Malaysia's external position is still relatively resilient despite significant portfolio outflows.

"Malaysia's foreign reserves are seen to be more than adequate todefend the value of the ringgit even if the entire stock of mobileforeign capital in the country were to reverse," Citi vice-presidentfor Asia Pacific economics and market analysis Kit Wei Zheng said.

Unlike other Asian countries such as China and Thailand, portfoliocapital flows are more important in determining the value of theringgit as the reserves are relatively small compared to foreign hotmoney.

Citi noted that much of the foreign exchange intervention has been through forward book rather than spot reserves.

In the second quarter of this year, Bank Negara Malaysia's forward bookdeclined by US$4.9 billion (RM17 billion), while its spot foreignexchange reserve position rose by US$5.5 billion (RM19 billion).

Between July and mid-September, however, spot foreign exchange reservesdeclined US$6 billion to US$119 (RM21 billion to RM414 billion), whileforward foreign exchange reserves fell US$3.55 billion (RM12 billion)in July, suggesting a cummulative loss of at least US$9.55 billion(RM33 billion) in the third quarter.

Citi has revised its end-2008 forecast for the ringgit to RM3.60against the US dollar from RM3.45, reflecting its revised Singaporedollar forecast to S$1.50 versus the greenback.

Since the Singapore dollar is the second largest currency in theringgit trade weighted basket, any weakness in the Singapore dollarwill likely pull the ringgit down as well.

Zheng said that lingering concerns over inflation, structuraldeterioration of the fiscal deficit and political uncertainties wouldalso likely impede foreign inflows into the Malaysian GovernmentSecurities market and, perhaps, the equity market.

As at June 30 this year, foreigners held RM104.8 billion of Malaysiandebt securities. Zheng said, however, that the figure might have fallento RM80 billion to RM90 billion by the end of last month, an indicationof further capital outflows.

http://www.btimes.com.my/Current ... p030a1.xml/Article/

09-10-2008: Foreign reserve continues to shrink

by Fong Min Hun

KUALA LUMPUR: Rising outflow of foreign investment money and shrinking trade surplus as a result of lower commodity prices are draining the country’s foreign exchange reserve.

The foreign reserve dropped US$9.3 billion (RM32.55 billion) in the second half of September to US$109.7 billion on Sept 30. According to CIMB Research, last month’s drop marked a record pace of contraction since the last time foreign reserves fell as sharply was in the fourth quarter 2005, when it dropped US$9.8 billion.

In terms of ringgit, the foreign reserve fell by a smaller magnitude of RM8.7 billion in the second half of September to RM379.4 billion as at end-September, compared with a decline of RM12.1 billion in the first half of September.

The smaller contraction was due to the foreign exchange revaluation gain, following the strengthening of major currencies against the ringgit during the quarter.

“The bearish market sentiment that has been trampling both domestic bond and equity markets arising from the severity of the global credit crisis has caused massive liquidation of foreign portfolio holdings of Malaysian stocks,” said CIMB.

“Besides that, investors’ sentiments were dampened by the unsettling political situation and macro concerns over the higher fiscal deficit,” it added.

CIMB Research said the bearish sentiment in the debt and equity markets as well as Bank Negara Malaysia’s (BNM) efforts in propping up the ringgit had also contributed to the decline in foreign reserves. The ringgit, according to the research house, had depreciated 5.3% year-to-date.

Foreign holdings in fixed income instruments fell to RM100.6 billion at end-July from RM104.8 billion at end-June 2008 and its peak of RM126.5 billion at end-April, said RHB Research in a research note.

It observed that foreign holdings of debt papers had declined by RM4.2 billion in July. Although the July drop was smaller than the decline in June where foreign holdings decreased by RM7.6 billion, it did however continue a multi-month downward trend.

“This (the drop in July) was the third straight month of decline, suggesting that they are likely to have continued unwinding their positions in the months ahead,” the research house said in a note yesterday.

The foreign divestments were mostly government bills and Malaysian Government Securities.

http://www.theedgedaily.com/cms/ ... a-98350a00-74d64170

[ 本帖最后由 Mr.Business 于 24-10-2008 09:39 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-10-2008 08:28 AM

|

显示全部楼层

新闻。

20-10-2008: Najib’s top priority is to avert recession

......

Unhindered capital flows threaten the effectiveness of any monetary easing. In this information age and globalised world, with the click of a mouse, millions of dollar can be instantaneously taken out of the country for higher yielding assets and financial instruments overseas.

In a recent report, Kenanga Research said with the expectation of a large net outflow of portfolio funds of about another RM30 billion to RM50 billion in the second half of 2008, Bank Negara Malaysia’s (BNM) foreign reserves may see at least a US$10 billion to US$20 billion reduction back to the US$90 billion level by year-end.

As at Sept 30, 2008, BNM’s foreign reserves stood at RM379.3 billion (US$109.7 billion), versus the peak at RM408.5 billion as at July 31, 2008.

Any downward adjustment of interest rates may weaken the ringgit further, adding to inflationary pressure. The central bank may have no choice but to act if the slowdown in the last three months of the year pointed to a marked decline in the first quarter of next year.

......

http://www.theedgedaily.com/cms/ ... a-687ea900-6257f6ae |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-10-2008 08:28 AM

|

显示全部楼层

新闻。

維持充裕外匯儲備金 銀行受促監督資金轉移

2008年10月24日

報導 - 李斯美

(吉隆坡23日訊)由於大馬截至08年10月15日的外匯儲備金進一步下滑,經濟學家呼籲銀行在全球金融危機爆發的情況下,應該謹慎監督資金轉移,以確保我國維持充裕的外匯儲備金。

與此同時,經濟學家也預測,外資還會進一步從股市和債券市場撤離,而導致我國的外匯儲備減少。

另一方面,他們表示,美元逐步走強,造成外資減持債券,使令吉面對被貶值的壓力。因此,拉昔胡申研究經濟學家預測,令吉在逐漸復甦前,將進一步走軟至3.60令吉。

國家銀行昨日宣佈,截至08年10月15日,大馬的外匯儲備金達1076億美元,相等於3718億令吉。與9月杪相比,外匯儲備金下滑2%,或76億令吉。

經濟學家普遍認為,令吉貶值導致資金流出,使大馬的外匯儲備金在10月中進一步減少。

達證券分析員表示,國家銀行應該更加謹慎地監督資金轉移,因全球經濟放緩,我們必須維持充足的外匯儲備。

除了原產品及原油價格下跌導致較小的貿易盈餘外,拉昔胡申研究經濟學家認為,外資還會從證券和債券市場上撤離資金組合,導致外匯儲備金減少。

外資在7月份所持有的債券減少42億令吉,雖然與6月份的76億令吉下跌相比,是個小幅度的下跌,但這是連續3個月的下滑,這意味著外資極有可能在未來繼續撤離。

因此,外資截至7月杪持有的定期收入投資從6月杪的1048億令吉,下挫至1006億令吉。

經濟學家透露,美元走強也令外資拋售債券,進一步惡化令吉兌主要貨幣的貶值。令吉兌美元在第3季走軟2.1%,令吉同時也兌日圓、人民幣、泰銖和新元貶值,下滑幅度分別為5.3%、5.6%、3.8%和0.2%。

他預測,令吉在短期內將面對賣壓,因外資在定期收入和證券市場的佔有率巨大,並受美元走強的動力刺激。

http://www2.orientaldaily.com.my ... Ywf1bdQ0nDb2asK49Rk |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-10-2008 08:44 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-10-2008 08:44 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 24-10-2008 09:09 AM

|

显示全部楼层

发表于 24-10-2008 09:09 AM

|

显示全部楼层

不知政府有否储备欧元或澳元呢?

应该把部分转去澳元或欧元。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 24-10-2008 09:43 AM

|

显示全部楼层

发表于 24-10-2008 09:43 AM

|

显示全部楼层

|

感觉热钱非常的不受控制,他们是弄乱市场正常运作的凶手吗?? |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-10-2008 09:45 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 24-10-2008 10:34 AM

|

显示全部楼层

发表于 24-10-2008 10:34 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-10-2008 10:35 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 24-10-2008 10:40 AM

|

显示全部楼层

发表于 24-10-2008 10:40 AM

|

显示全部楼层

谢谢大大分享  |

|

|

|

|

|

|

|

|

|

|

|

发表于 24-10-2008 10:46 AM

|

显示全部楼层

发表于 24-10-2008 10:46 AM

|

显示全部楼层

Total Gross International Reserves = 外汇储备金 ???

是这样吗? |

|

|

|

|

|

|

|

|

|

|

|

发表于 25-10-2008 12:07 PM

|

显示全部楼层

发表于 25-10-2008 12:07 PM

|

显示全部楼层

外汇的组成成分是关键.

现在有很多国家的外汇储备由于投资错误而遭受惨重亏损.实际数目其实没有帐面数目多. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 25-10-2008 04:08 PM

|

显示全部楼层

展望未来,我相信我国的经济应该会放慢,甚至衰退,股市会继续下跌。下跌到几时呢?我也不知道,让市场告诉我们吧。我也许会预测,可是我不会根据预测来作出投资决定,因为预测通常是不准确的。

我国股市对外资的吸引力一向不大,而且双油主题又已经不再,现在是外资卖出获利的时候,不要去接她们的货。市场会安静很久一段时间。。。

不要相信或等待大牛市来临,每个股票都大起的时候。我国股市似乎已经没有这种条件了,请追随趋势,等新的题材来临时 (例如最近这次是双油),选择其中的领袖股来投资。在牛市的初期买进,在顶峰过后卖出,重复几次,你离发达不远。而且这不难做,拿KLCI和你买进股票的图看看就可以了。

现在是熊市的过程,我们可以看到外汇储备金继续减少,等下次外汇储备金再渐渐增加时,或许就是新一轮牛市的来临了。请记得,没有外资来玩,我国股市只是死水。外资做的跟我们想做的是一样的 (或者说我们在跟随外资)。现在外资卖出股票获利离开,股市进入熊一熊二,外汇储备金减少。熊三时股市静得可怕,外资或者在熊三或牛一时静静的进来,外汇储备金渐渐增加,外资开始根据新题材 (或自创题材)买股。当一切准备好了,外资就将市场弄热闹,牛市宣布到来。。。牛市熊市,来来去去。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 25-10-2008 09:58 PM

|

显示全部楼层

发表于 25-10-2008 09:58 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 25-10-2008 11:06 PM

|

显示全部楼层

发表于 25-10-2008 11:06 PM

|

显示全部楼层

原帖由 flyingfish 于 25-10-2008 09:58 PM 发表

请教网友们如何找到国际间的fund流动?

有没有网站介绍?

有一个网站:

http://www.epfr.com/

但要收钱的,只能看看news release和fund flow图。

这种报告书,多数要钱的。

证卷行、基金等,应该有基本的报告书。

比较大型的机构,各种类的报告都有。

这些几千元甚至几十千的报告,它们愿意买。

要下手,唯有想在这些机构当研究员的朋友拿。佳礼论坛好像有一个研究员,是吗?

不然,多阅读各类国外财经杂志,偶尔会放出一些报告出来让读者参考。 |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|