|

|

【PESONA 8311 交流专区】(前身 MITHRIL)

[复制链接]

[复制链接]

|

|

|

发表于 23-5-2017 11:52 PM

|

显示全部楼层

发表于 23-5-2017 11:52 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 160,480 | 99,886 | 160,480 | 99,886 | | 2 | Profit/(loss) before tax | 8,662 | 8,492 | 8,662 | 8,492 | | 3 | Profit/(loss) for the period | 6,017 | 6,178 | 6,017 | 6,178 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,017 | 6,178 | 6,017 | 6,178 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.91 | 0.94 | 0.91 | 0.94 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.2287 | 0.2192

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-8-2017 05:44 AM

|

显示全部楼层

发表于 26-8-2017 05:44 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 180,982 | 84,701 | 341,462 | 184,587 | | 2 | Profit/(loss) before tax | 8,093 | 7,884 | 16,755 | 16,376 | | 3 | Profit/(loss) for the period | 6,058 | 5,598 | 12,075 | 11,776 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,058 | 5,598 | 12,075 | 11,776 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.91 | 0.86 | 1.81 | 1.80 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 1.00 | 0.00 | 1.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.2279 | 0.2192

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-10-2017 04:24 AM

|

显示全部楼层

发表于 7-10-2017 04:24 AM

|

显示全部楼层

| PESONA METRO HOLDINGS BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Acquisitions | Details of corporate proposal | PESONA METRO HOLDINGS BERHAD ("PMHB" OR THE "COMPANY") (I) ACQUISITION OF THE ENTIRE EQUITY INTEREST IN SEP RESOURCES (M) SDN BHD ("SEP") FOR A PURCHASE CONSIDERATION OF RM29,150,000 ("ACQUISITION OF SEP"); AND (II) VARIATION VIA THE SUPPLEMENTAL AGREEMENT DATED 9 AUGUST 2016 TO ADD ON, AMEND AND VARY CERTAIN TERMS AND CONDITIONS OF THE SHARE SALE AGREEMENT DATED 29 AUGUST 2014 IN RELATION TO THE ACQUISITION OF SEP (COLLECTIVELY, "CORPORATE EXERCISES") | No. of shares issued under this corporate proposal | 27,650,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.7000 | Par Value($$) (if applicable) | Malaysian Ringgit (MYR) 0.000 | | Latest issued share capital after the above corporate proposal in the following | Units | 694,890,959 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 186,165,239.750 | Listing Date | 09 Oct 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2017 12:44 AM

|

显示全部楼层

发表于 29-11-2017 12:44 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 117,142 | 102,640 | 458,605 | 287,228 | | 2 | Profit/(loss) before tax | 7,838 | 5,828 | 24,592 | 22,205 | | 3 | Profit/(loss) for the period | 4,983 | 3,873 | 17,058 | 15,650 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,983 | 3,873 | 17,058 | 15,650 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.75 | 0.59 | 2.56 | 2.39 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 1.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.2353 | 0.2192

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-1-2018 04:44 AM

|

显示全部楼层

发表于 27-1-2018 04:44 AM

|

显示全部楼层

本帖最后由 icy97 于 27-1-2018 05:59 AM 编辑

百盛纳获1.6亿合约

2018年1月27日

(吉隆坡26日讯)百盛纳(PESONA,8311,主板建筑股)宣布,获森那美产业(梳邦)私人有限公司颁发合约,总值1亿6186万2000令吉。

百盛纳向交易所报备,上述合约是由子公司Pesona Metro私人有限公司所获得。

根据合约,百盛纳将负责在雪州梳邦再也发展一个服务式公寓项目,当中包括两栋20层楼高的住宅楼、一层设施楼、3层商业单位、9层停车场和1层地下室停车场。

项目为期39个月,将从1月30日开始动工。百盛纳相信,这能贡献期间的净利,并强化净资产。【e南洋】

Type | Announcement | Subject | OTHERS | Description | LETTER OF AWARD - MAIN BUILDING WORKS FOR THE PROPOSED DEVELOPMENT OF 30 STOREY SERVICED APARTMENTS CONSISTING OF 2 BLOCK OF 20 STOREY RESIDENTIAL TOWERS (361 UNITS), 1 LEVEL OF FACILITIES, 3 LEVELS OF COMMERCIAL UNITS, 9 LEVELS OF ELEVATED CARPARK AND 1 LEVEL OF BASEMENT CARPARK ON LOT 15, JALAN KEMAJUAN SUBANG SS16, SUBANG JAYA, SELANGOR DARUL EHSAN ("Project") | Pesona Metro Holdings Berhad (“PMHB” or “the Company”) is pleased to announce that Pesona Metro Sdn Bhd, a wholly owned subsidiary of the Company, has on 26 January 2018, accepted the Letter of Award from Sime Darby Property (Subang) Sdn Bhd for the above Project for a contractual sum of RM161,862,000.00.

Please refer to the attachment for the full text of the announcement pertaining to the Project.

This announcement is dated 26 January 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5677365

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-1-2018 03:19 AM

|

显示全部楼层

发表于 30-1-2018 03:19 AM

|

显示全部楼层

百盛纳

冀今年赢5亿合约

2018年1月30日

分析:丰隆投行研究

目标价:70仙

最新进展:

百盛纳(PESONA,8311,主板建筑股)获得森那美产业(梳邦)私人有限公司颁发合约,总值1亿6186万令吉。

根据合约,百盛纳将负责在雪州梳邦再也发展一个服务式公寓。

行家建议:

这是百盛纳在经历没有任何新合约的2017财年后的首个合约。该公司在上财年输掉3项竞标,因为这些项目的赚幅过低。

按2017财年末季资金消耗率1.5亿令吉,加上上述新合约,我们预计,目前手持订单为16亿令吉,是2016财年建筑业务营业额的4.3倍。

展望未来,该公司放眼今年获得5亿令吉项目,潜在项目包括医院、政府设备、公寓以及可负担房屋建筑项目,也有望从姐妹公司Juta Asia所推出新产业项目的建筑订单。

另外,百盛纳在去年9月杪完成收购SEP公司70%股权,后者握有设计、发展与维修大马玻璃市大学(UNIMAP)学生宿舍的特许经营合约。

我们预计,UNIMAP项目能为百盛纳在末季贡献约200万令吉盈利,而收购剩余30%股权活动料在今年3月完成。

维持“买入”投资评级和70仙目标价。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 4-3-2018 05:48 AM

|

显示全部楼层

发表于 4-3-2018 05:48 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 90,155 | 105,790 | 548,760 | 393,018 | | 2 | Profit/(loss) before tax | 4,643 | 6,500 | 29,235 | 28,705 | | 3 | Profit/(loss) for the period | 3,625 | 4,380 | 20,683 | 20,030 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,112 | 4,380 | 19,170 | 20,030 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.30 | 0.67 | 2.76 | 3.06 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.00 | 1.00 | 1.00 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.2557 | 0.2192

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-3-2018 05:51 AM

|

显示全部楼层

发表于 4-3-2018 05:51 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PESONA METRO HOLDINGS BERHAD - PROPOSED SINGLE TIER FINAL DIVIDEND | The Board of Directors of Pesona Metro Holdings Berhad (“the Company”) is pleased to announce that the Company is proposing a single tier final dividend of 1.0 sen per ordinary share in respect of the financial year ended 31 December 2017, subject to the shareholders' approval at the forthcoming Annual General Meeting.

The dividend entitlement and payment date will be announced later. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-3-2018 05:07 AM

|

显示全部楼层

发表于 25-3-2018 05:07 AM

|

显示全部楼层

本帖最后由 icy97 于 26-3-2018 02:32 AM 编辑

Type | Announcement | Subject | OTHERS | Description | Letter of Award to Pesona Metro Sdn. Bhd. ("PMSB") for Main Building, Mechanical and Electrical ("M&E") Services, External Works, Landscape and Ancillary Works for the "Cadangan Pembangunan Pangsapuri Rumah Mampu Milik (1,260 unit) yang mengandungi: 2 Blok Pangsapuri Rumah Mampu Milik 42 Tingkat dan 1 Blok Tempat Letak Kereta 8 Tingkat Di Atas Sebahagian Lot 46040, Mukim Petaling, Bukit Jalil, Kuala Lumpur" from GDP Architects Sdn Bhd, on behalf of Gaya Kuasa Sdn Bhd ("GKSB") ("the Project") | Pursuant to Paragraph 9.03 of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad ("Listing Requirements"), the Board of Directors of Pesona Metro Holdings Berhad ("PMHB" or "the Company") wishes to announce that PMSB, a wholly-owned subsidiary of the Company, had on 23 March 2018, accepted the Letter of Award dated 23 March 2018 for the Project for a contractual sum of RM216,377,516.00, excluding 6% GST, from GDP Architects Sdn Bhd, on behalf of GKSB ("Letter of Award").

The Project is regarded as a recurrent related party transaction ("RRPT") of a revenue or trading nature which is necessary for the day-to-day operations and in the ordinary course of business of the Company pursuant to Paragraph 10.09 of the Listing Requirements.

Details of the full announcement is attached.

This announcement is dated 23 March 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5733973

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-3-2018 07:41 AM

|

显示全部楼层

发表于 30-3-2018 07:41 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2018 03:37 AM

|

显示全部楼层

发表于 27-4-2018 03:37 AM

|

显示全部楼层

本帖最后由 icy97 于 4-5-2018 03:43 AM 编辑

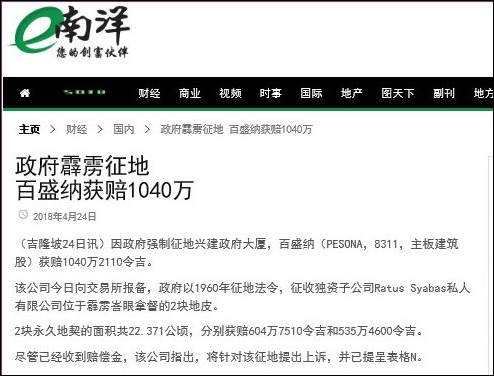

Type | Announcement | Subject | OTHERS | Description | PESONA METRO HOLDINGS BERHAD ("COMPANY")- COMPULSORY LAND ACQUISITION BY JABATAN KETUA PENGARAH TANAH DAN GALIAN PERSEKUTUAN NEGERI PERAK ("JKPTG") | The Board of Directors of the Company wishes to announce that the land held by its wholly owned subsidiary, Ratus Syabas Sdn. Bhd., has been compulsorily acquired by JKPTG under the Land Acquisition Act, 1960 for the construction of government complex.

The details of the compulsory land acquisition are as follows: Description of the Freehold Land | Land Size (Hectare) | Compensation Sum (RM) | HSD 117, Lot PT 1279 (17258), Mukim Bagan Datuk, Daerah Bagan Datoh. | 12.311 | 5,047,510.00 | HSD 103, Lot PT 1280 (17259), Mukim Bagan Datuk, Daerah Bagan Datoh. | 13.06 | 5,354,600.00 | Total | 22.371 | 10,402,110.00 |

The Company had on 23 April 2018 received the Compensation Sum. Accordingly, the Company has accepted the Compensation Sum with protest and has filed the Form N on the same day.

This announcement is dated 24 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-5-2018 06:45 AM

|

显示全部楼层

发表于 1-5-2018 06:45 AM

|

显示全部楼层

| PESONA METRO HOLDINGS BERHAD |

EX-date | 18 Jun 2018 | Entitlement date | 20 Jun 2018 | Entitlement time | 04:00 PM | Entitlement subject | Final Dividend | Entitlement description | Single Tier Final Dividend of 1.0 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | 20 Jun 2018 to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 12 Jul 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 20 Jun 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-5-2018 03:29 AM

|

显示全部楼层

发表于 13-5-2018 03:29 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 29-5-2018 05:54 AM

|

显示全部楼层

发表于 29-5-2018 05:54 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 170,622 | 160,480 | 170,622 | 160,480 | | 2 | Profit/(loss) before tax | 3,851 | 8,662 | 3,851 | 8,662 | | 3 | Profit/(loss) for the period | 3,161 | 6,017 | 3,161 | 6,017 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,959 | 6,017 | 2,959 | 6,017 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.43 | 0.91 | 0.43 | 0.91 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.2600 | 0.2557

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-8-2018 05:13 AM

|

显示全部楼层

发表于 18-8-2018 05:13 AM

|

显示全部楼层

本帖最后由 icy97 于 21-8-2018 05:17 AM 编辑

Type | Announcement | Subject | OTHERS | Description | LETTER OF ACCEPTANCE - "CADANGAN PEMBANGUNAN 1 BLOK MENARA PERDAGANGAN BERCAMPUR 41 TINGKAT YANG MENGANDUNGI 1 BLOK PEJABAT/SUITE 32 TINGKAT (DI ARAS 9 HINGGA ARAS 41) DI ATAS BLOK PODIUM 8 TINGKAT (DI ARAS BAWAH HINGGA ARAS 7) DENGAN SATU TINGKAT RUANG KEMUDAHAN DAN 5 TINGKAT PODIUM TEMPAT LETAK KERETA DENGAN 3 TINGKAT BESMEN TEMPAT LETAK KERETA (DI ARAS BESMEN 1 HINGGA ARAS BESMEN 3) DI ATAS SEBAHAGIAN LOT 301, SEKSYEN 63, JALAN CONLAY, KUALA LUMPUR" | Pesona Metro Holdings Berhad is pleased to announce that Intrasegi Sdn Bhd – Pesona Metro Sdn Bhd JV, an unincorporated joint venture formed by Pesona Metro Sdn Bhd and Intrasegi Sdn Bhd, has on 17 August 2018 accepted the Letter of Acceptance from Pembinaan Kery Sdn Bhd for the construction and completion of superstructure works, external works within boundary, associated works and ancillary buildings for RM218,222,569.58 (“the Project”).

Please refer to the attachment for the full text of the announcement pertaining to the Project.

This announcement is dated 17 August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5886845

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-8-2018 03:52 AM

|

显示全部楼层

发表于 24-8-2018 03:52 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 143,352 | 180,982 | 313,974 | 341,462 | | 2 | Profit/(loss) before tax | 5,522 | 8,093 | 9,372 | 16,755 | | 3 | Profit/(loss) for the period | 3,931 | 6,058 | 7,092 | 12,075 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,568 | 6,058 | 6,527 | 12,075 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.51 | 0.91 | 0.94 | 1.81 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.2651 | 0.2557

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-9-2018 07:58 AM

|

显示全部楼层

发表于 7-9-2018 07:58 AM

|

显示全部楼层

本帖最后由 icy97 于 9-9-2018 04:43 AM 编辑

Type | Announcement | Subject | OTHERS | Description | LETTER OF AWARD FOR EXECUTION AND COMPLETION OF THE MAIN BUILDING AND EXTERNAL WORKS FOR THE "CADANGAN MEMBINA 2 BLOK PANGSAPURI PERKHIDMATAN 33 TINGKAT DAN 28 TINGKAT DI ATAS 10 TINGKAT PODIUM YANG MENGANDUNGI 1 TINGKAT KEMUDAHAN PENDUDUK, 9 TINGKAT TEMPAT LETAK KENDERAAN BERSERTA KEDAI DAN 4 TINGKAT BESMEN TEMPAT LETAK KENDERAAN DI ATAS SEBAHAGIAN PT 72994 (PARSEL 1F), JALAN PJU 9/1, BANDAR SRI DAMANSARA, MUKIM SUNGAI BULOH, DAERAH PETALING, SELANGOR DARUL EHSAN" | Pesona Metro Holdings Berhad is pleased to announce that Pesona Metro Sdn Bhd, a wholly owned subsidiary of the Company has on 4 September 2018 accepted the Letter of Award from Indo Aman Bina Sdn Bhd for execution and completion of the main building and external works for RM264,300,000.00 (“the Project”).

Please refer to the attachment for the full text of the announcement pertaining to the Project.

This announcement is dated 4 September 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5905669

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-9-2018 04:54 AM

|

显示全部楼层

发表于 9-9-2018 04:54 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-9-2018 03:08 AM

|

显示全部楼层

发表于 14-9-2018 03:08 AM

|

显示全部楼层

Name | KOMBINASI EMAS SDN BHD | Address | No. 19, Jalan SB Indah 1/18

Taman Sungai Besi Indah

Seri Kembangan

43300 Selangor

Malaysia. | Company No. | 956182-K | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 07 Sep 2018 | 10,000,000 | Acquired | Direct Interest | Name of registered holder | Kenanga Nominees (Tempatan) Sdn Bhd - Pledged Securities Account for Kombinasi Emas Sdn Bhd | Address of registered holder | Level 15 Kenanga Tower 237 Jalan Tun Razak 50400 Kuala Lumpur Wilayah Persekutuan Malaysia | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Purchase of shares | Nature of interest | Direct Interest | Direct (units) | 275,506,700 | Direct (%) | 39.645 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 275,506,700 | Date of notice | 13 Sep 2018 | Date notice received by Listed Issuer | 13 Sep 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-12-2018 06:37 AM

|

显示全部楼层

发表于 29-12-2018 06:37 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 137,914 | 117,142 | 451,887 | 458,605 | | 2 | Profit/(loss) before tax | 6,535 | 7,838 | 15,907 | 24,592 | | 3 | Profit/(loss) for the period | 5,204 | 4,983 | 12,295 | 17,058 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,861 | 4,983 | 11,387 | 17,058 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.70 | 0.75 | 1.64 | 2.56 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.2621 | 0.2557

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|