|

|

楼主 |

发表于 7-10-2010 10:01 PM

|

显示全部楼层

最低1.16 |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-10-2010 10:03 PM

|

显示全部楼层

发表于 7-10-2010 10:03 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 7-10-2010 10:06 PM

|

显示全部楼层

发表于 7-10-2010 10:06 PM

|

显示全部楼层

最低1.16

roberto 发表于 7-10-2010 10:01 PM

見到有2單很大的Block賣出。

股價立刻就跌到1.16。

Last Done 1.17 |

|

|

|

|

|

|

|

|

|

|

|

发表于 8-10-2010 12:05 AM

|

显示全部楼层

发表于 8-10-2010 12:05 AM

|

显示全部楼层

回复 1362# 葉芬

你看...又弹回$1.2了..... |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 8-10-2010 08:30 AM

|

显示全部楼层

本帖最后由 roberto 于 8-10-2010 08:33 AM 编辑

SAMSON OIL & GAS ADVISES ON STRATEGIC GROWTH PLAN, CAPITAL EXPENDITURES AND OPERATIONS

Denver 1700 hours 7 October, 2010, Perth 0700 hours, 8 October, 2010

Samson Oil & Gas Limited (ASX: SSN, NYSE AMEX: SSN) advises that its Board of Directors held a three-day management meeting the week of September 23, 2010, including a field tour of the Company’s primary operations, meetings with the Company’s outside advisors and a comprehensive strategic review meeting. At the conclusion of the meeting, the Board approved the Company’s growth strategy, capital budget, an operational plan and other initiatives described in this announcement. In summary, Samson intends to focus on developing its two oil plays in the Bakken in North Dakota and in the Niobrara play in Wyoming, rationalizing its existing gas producing portfolio and developing a suite of new prospects in the onshore Gulf Coast Basin.

Since closing the sale of 24,066 acres of its Goshen County, Wyoming acreage position with Chesapeake Energy Corporation, which is prospective for the Niobrara oil shale play, Samson has accumulated a cash balance of approximately US$70 million. Samson’s Board of Directors, after conducting a comprehensive review of operational, financial, economic and technical data, has developed a sustainable growth plan that calls for the investment of Samson’s new capital resources into a conservative and measured exploration and development program focused on developing and extending its existing oil assets and building an inventory of new prospects and other attractive opportunities.

North Stockyard Oil Field, North Dakota

This field contains six 640-acre sections in which Samson has participated in the drilling of five Bakken wells, including the Earl #1-13H, which is currently being drilled, and the recently drilled Rodney #1-14H well, which is waiting on a fracture stimulation. Assuming 640-acre spacing, the sixth well (the Harstad #2-15H) is expected to be spud in late 2010 or in the early part of 2011 and would be the final Bakken well drilled in the company’s existing leasehold. The Harstad #2-15H would twin the existing Harstad #1-15H well, which was completed in the Mission Canyon Formation. Because Samson believes that the field will ultimately be approved for development on 320 acres, it is likely that there will be an additional four drilling locations. The timing of these wells, however, depends on significant regulatory and commercial arrangements and is therefore uncertain.

Bakken Extension, North Dakota and Montana

Samson continues to examine projects for extending and expanding the company’s exposure to the middle Bakken horizon in both western North Dakota and eastern Montana as a partner or an operator. The Bakken oil shale play is well-established in the region and current acreage values remain attractive, primarily because the play is so extensive it continues to provide an adequate supply of quality acreage.

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 8-10-2010 08:37 AM

|

显示全部楼层

Capital Budget

The Board of Directors has approved an initial capital budget of US$11.2 million for fiscal year 2010/2011, which ends on June 30, 2011, for drilling and for seismic data acquisition. This budget assumes that the North Stockyard development is completed as outlined above, the North Platte 3-D seismic is acquired, and the initial two wells in Hawks Springs are fully carried, along with the drilling of Diamondback. The Board of Directors also reviewed a conditional budget which assumed that the initial appraisal of Hawks Springs was successful and that full-field development was initiated based on a determination that the appraisal well results demonstrate the viability of commercial development. In this event, the capital budget would increase to approximately US$ 36.7 million, reflecting the additional drilling that would proceed in Hawks Springs. It should be emphasized that this

expenditure has not yet been approved by the Board.

Asset Disposal

The Directors approved offering the Company’s existing gas assets for sale. Besides streamlining the Company’s portfolio, such sales would be expected to result in tax losses that offset a portion of the tax liability that the Company incurred as a result of the recent land sale in Goshen County. These assets are expected to be marketed towards the end of the calendar year 2010.

No definitive advice as to the Company’s ultimate tax liability for the year can be given at this point because Samson’s tax advisors are completing an analysis of the Company’s cumulative tax liability from current and prior years and the tax loss generated from the sale of existing gas assets will depend on the ultimate sale price of the assets.

Debt

Samson has a term debt facility with an outstanding balance of US$ 10.6 million which matures in May 2011, this facility is being repaid at US$0.2 million per month and the expected balance at maturity of US$9.4 million will be repaid on that date.

For and on behalf of the board of

SAMSON OIL & GAS LIMITED

TERRY BARR

Managing Director

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-10-2010 08:57 AM

|

显示全部楼层

发表于 8-10-2010 08:57 AM

|

显示全部楼层

为什么近来SSN好像吃了泻药酱...?几乎每天开市都插水.... |

|

|

|

|

|

|

|

|

|

|

|

发表于 8-10-2010 09:09 AM

|

显示全部楼层

发表于 8-10-2010 09:09 AM

|

显示全部楼层

回复 葉芬

你看...又弹回$1.2了.....

SUNNY仔 发表于 8-10-2010 12:05 AM

謝謝 幸好聽你話沒有玩先賣後買。不然  |

|

|

|

|

|

|

|

|

|

|

|

发表于 8-10-2010 09:12 AM

|

显示全部楼层

发表于 8-10-2010 09:12 AM

|

显示全部楼层

为什么近来SSN好像吃了泻药酱...?几乎每天开市都插水....

SUNNY仔 发表于 8-10-2010 08:57 AM

6-7月份時也是調整了好久時間。

這次希望是2-3星期就好了。

記住哦 調整是為了走更長的路。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 8-10-2010 09:12 AM

|

显示全部楼层

发表于 8-10-2010 09:12 AM

|

显示全部楼层

SAMSON OIL & GAS ADVISES ON STRATEGIC GROWTH PLAN, CAPITAL EXPENDITURES AND OPERATIONS

Denver 170 ...

roberto 发表于 8-10-2010 08:30 AM

謝謝 Roberto 小弟。  |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 8-10-2010 09:54 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 8-10-2010 10:09 AM

|

显示全部楼层

发表于 8-10-2010 10:09 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 8-10-2010 11:10 AM

|

显示全部楼层

本帖最后由 roberto 于 11-10-2010 02:43 PM 编辑

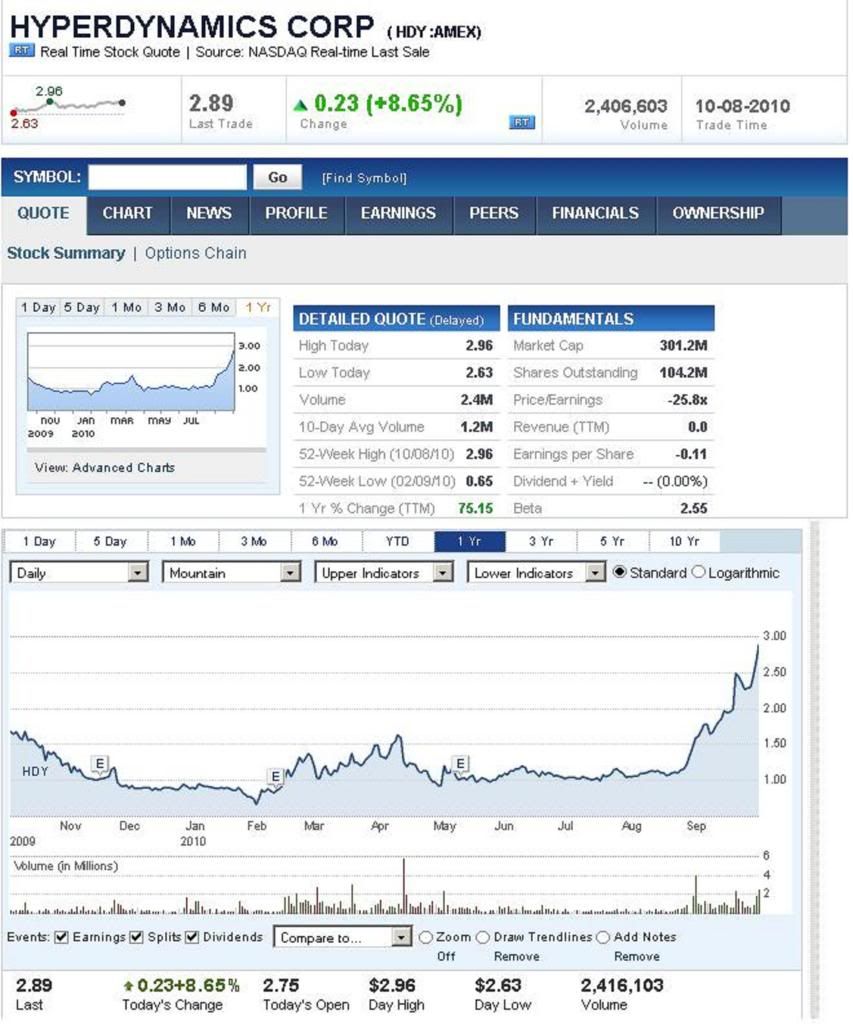

投资者请看,投机者勿看

Thursday, October 7, 2010

Hyperdynamics (HDY) Stock - 2011 Price Target

Shares of Hyperdynamics Corporation (HDY) are surging again today after the stock broke up through $2.50 and hit a new 52 week high at $2.64. Hyperdynamics Corporation (HDY) now has support located at $2.50 as well as $2.38.

I started looking into Hyperdynamics over a month ago when the company came out with news regarding their potential oil reserves off the shore of West Africa. It is important to note that the company does not currently have any revenue which makes the stock risky. How risky? Well, the stock has run up on anticipation on the company drilling their first well in December 2011 and finding another partner in additional to Dana Petroleum.

Based on the recent news, I feel the stock can hit $4.00-$6 in the next 12 months on what we know right now. Besides a weak oil market, factors that would put a damper in my price target would be further dilution by selling stock, a downgrade on the amount of surveyed oil, or any Government interference regarding their leasing area. In my opinion, Hyperdynamics has better potential at It's current price of $2.60 then Samson Oil & Gas (SSN) did at $0.70. Having said that, the risk is a lot higher.

I have a small position and will continue to buy HDY stock on pullbacks or breakouts. As we get more positive news on what they are actually sitting on, I will get more confident and the price should rise.

P/S : 強力推薦給投資者

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-10-2010 11:13 AM

|

显示全部楼层

发表于 8-10-2010 11:13 AM

|

显示全部楼层

本帖最后由 葉芬 于 8-10-2010 11:18 AM 编辑

回复 1373# roberto

小弟,P/s那裡的字體要放大,芬姐看不到呢。

請別刪除,再來個加大字。謝謝。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 8-10-2010 11:20 AM

|

显示全部楼层

本帖最后由 roberto 于 8-10-2010 11:36 AM 编辑

回复 1374# 葉芬

够大吗???  |

|

|

|

|

|

|

|

|

|

|

|

发表于 8-10-2010 01:36 PM

|

显示全部楼层

发表于 8-10-2010 01:36 PM

|

显示全部楼层

回复 葉芬

够大吗???

roberto 发表于 8-10-2010 11:20 AM

看見了,謝謝你。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 8-10-2010 02:02 PM

|

显示全部楼层

发表于 8-10-2010 02:02 PM

|

显示全部楼层

本帖最后由 葉芬 于 8-10-2010 02:04 PM 编辑

貼上來給大家認識下 HDY 是什麼來歷。

http://www.epmag.com/Magazine/2010/10/item68745.php

Oct 1, 2010

What a year it has been!

CEO Ray Leonard is taking formerly struggling Hyperdynamics in a new direction.

Rhonda Duey, Senior Editor

A year ago, Hyperdynamics was a small company with a huge concession. And it was running out of time.

The company had signed a production-sharing contract (PSC) with the government of Guinea in 2006 for 30,888 sq miles (80,000 sq km) of unexplored offshore acreage. The contract stated that Guinea’s national assembly could request a 64% relinquishment. But the national assembly was abolished soon after the contract was signed.

So Hyperdynamics hung onto the largest concession in Africa, desperately seeking partners to help it develop the acreage. By 2009, the Guinean government was growing impatient, and the company was nearly broke.

That was when Ray Leonard was brought onboard as CEO. He had his work cut out for him from the beginning.

“The company was a mess,” he said. “It was almost bankrupt, and the government was about to take over the asset. There was no good technical story, the stock was in danger of being delisted, and they desperately needed partners but couldn’t attract any.”

Leonard, a geologist by training, looked at the existing data, which included some vintage 2-D data from the 1970s and ‘80s and more recent 2-D data shot by Hyperdynamics between 2002 and 2008. He liked what he saw.

“The asset is excellent,” he said. “Not only is it large, but there are probably multiple prospects.” He also was interested in the geochemistry, which found numerous oil seeps. “I felt like the company could be fixed,” he said.

Over the past year, Leonard has replaced everyone in a position higher than secretary to bring in a strong management and technical team, most of them former co-workers from Amoco. After reviewing the geology and prospectivity, they enthusiastically agreed to join a high-risk, high-reward venture. A strong board was recruited, including former Texaco E&P president Bob Solberg and former UK Foreign Secretary Lord David Owen. Only one of the original directors remains.

But solving internal problems was only part of the battle. Leonard also had to work with the Guinean government. |

|

|

|

|

|

|

|

|

|

|

|

发表于 8-10-2010 02:03 PM

|

显示全部楼层

发表于 8-10-2010 02:03 PM

|

显示全部楼层

‘Renegotiation and relinquishment’

Leonard traveled to Guinea in September 2009 to discuss the PSC with the government. “The first two words out of my mouth were ‘renegotiation’ and ‘relinquishment,’” he said. “I was given to understand from one of the officials that if those hadn’t been the first two words, any other words would have been my last.”

Leonard’s willingness to negotiate; his industry experience; and his partner Hank Cohen, a Hyperdynamics board member and former Assistant Secretary of State for Africa under the Bush administration, were enough to allow talks to continue. Leonard said the government officials were reasonable and agreed to give him until the end of the year to get a better handle on the prospectivity of the acreage so that he could relinquish 70% of it back to the government. They also gave him six months to renegotiate the contract. Leonard, in turn, hired the consulting firm Moyes and Associates to compile a chart showing contractual terms in neighboring countries.

“We said, let’s make sure that your contract is right in the mainstream and consistent with the others,” he said. “If that means changing what we had before, we’ll change it.”

It took the full six months to renegotiate the contract, but, he said, “At the end of the day, we had something that both sides agreed on.”

Taking a chance

With a usable contract in place, the next challenge was finding partners. And finding partners meant shooting new seismic over the remaining acreage. Bergen Oilfield Services, a new Norwegian-based geophysical contractor, took a chance on Hyperdynamics.

“Here’s a company planning a (US) $10 million program that had less than a million dollars in the bank and was several million dollars in debt,” he said. “We pledged 2.5 million shares so they knew they’d get something, at least their mobilization fee.”

Once the technical story was in place, the company began looking for industry partners. Dana Petroleum and Repsol signed letters of intent (LOIs), which helped to pay for their share of the 2-D survey, and Hyperdynamics went out to the market and raised another $8 million. The two companies took different approaches: Dana was enthusiastic about the project and negotiated all of its contracts quickly, and it worked with Bergen Oilfield Systems in the seismic processing and interpretation.

Repsol was more reluctant and would not sign anything until negotiations with the government were complete. Its guarantee of exclusivity outlined in the LOI expired before the PSC amendment was signed. “At that point, we felt that the value of the project had significantly increased, so we ended up not consummating the deal with Repsol,” Leonard said.

Once the 2-D survey was shot, senior geophysicists set about planning a 3-D survey. By this time, Hyperdynamics had money in the bank, and all of the major geophysical contractors bid on the job, which eventually was awarded to PGS.

The survey, covering 1,420 sq miles (3,675 sq km), will be complete in October 2010, with time-migrated processing complete by the end of the year and depth-migrated processing available in March 2011. Leonard said there are two prospects that half of the survey will cover; the other half will cover a prospective area on the southern edge of the concession that is cut by very deep channels at the seafloor. “Without poststack 3-D depth migration, we’re not going to see anything,” he said. “The 3-D is going to image that subsurface for the first time.”

To get an independent view on the prospectivity, he hired Nederland Sewell and Associates (NSAI) to compile a Competent Persons Report. NSAI conducted a three-month assessment of the prospective oil resources in selected prospects that resulted in “best estimates” of 2.3 Bbbl of recoverable unrisked prospective oil resources.

Then what?

While Hyperdynamics is seeking additional partners, it is not in a rush. The first well needs to be spudded, but not completed, in 2011, so it is scheduled to spud in 4Q 2010. And until the seismic processing is complete, the total value of the project is hard to determine.

“We firmly believe the value of the prospect will increase as that data comes in,” Leonard said.

Meanwhile, things in Guinea are improving as well. After 50 years of turmoil, the government now is being run by a combination of military and civilian personnel, and Guinea had its first democratic election in the country’s history in June. A run-off election is scheduled soon.

“The transition government is made up of a general and a civilian who pledged that they would not be running in the new elections so that they can run things without having a political bias,” he said. “This renegotiation was done with the new regime. They’re excited about the new contract and the fact we’re moving forward.”

Overall, despite a rough beginning, the Hyperdynamics story seems destined for a happy ending. “The company is on a solid financial footing, we’ve got a good technical staff, we’ve got an excellent partner in Dana, and the concession is solid,” Leonard said. “That’s what we did in one year.” |

|

|

|

|

|

|

|

|

|

|

|

发表于 8-10-2010 02:31 PM

|

显示全部楼层

发表于 8-10-2010 02:31 PM

|

显示全部楼层

回复 1328# 葉芬

芬姐,你建议的bac,和ssn是什么股来的呢? |

|

|

|

|

|

|

|

|

|

|

|

发表于 8-10-2010 02:43 PM

|

显示全部楼层

发表于 8-10-2010 02:43 PM

|

显示全部楼层

回复 1379# Changchang

BAC-Bank of America..应该是美国甚至全球几个最大的银行之一...SSN恻是一间规模很小,而又有很大潜能的能源公司. |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|