|

|

发表于 17-4-2018 05:41 AM

|

显示全部楼层

发表于 17-4-2018 05:41 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 17-4-2018 05:42 AM

|

显示全部楼层

发表于 17-4-2018 05:42 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 20-4-2018 03:09 AM

|

显示全部楼层

发表于 20-4-2018 03:09 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-4-2018 04:41 AM

|

显示全部楼层

发表于 22-4-2018 04:41 AM

|

显示全部楼层

本帖最后由 icy97 于 24-4-2018 01:26 AM 编辑

吉打建筑利用3.4亿令吉未发展地库

Wong Ee Lin/theedgemarkets.com

April 19, 2018 20:36 pm +08

(吉隆坡19日讯)吉打建筑(Bina Darulaman Bhd)有信心应对当前挑战重重的商业环境,因为其可利用价值3亿4440万令吉的尚未发展地库支撑未来发展。

该集团指出,现在的主要焦点是制定长期增长和可持续性策略。

该集团主席Datuk Paduka Rasli Basir在股东常年大会上,向股东表示:“产业市场仍然充满挑战,预计今年市场情绪将保持暗淡。”

“我们的产业业务必须在策略与行动计划中保持敏捷。产业业务将专注于清理现有单位的库存,并引入符合市场要求的新型创新产品。”

他续称,该集团约75%产品是售价40万令吉及以下的可负担房屋。

他说:“作为长期可持续发展策略的一部分,(独资子公司)BDB Land私人有限公司将继续在综合城镇提供优质生活服务,并加入商业发展,以提高这些城镇社区的生活方式。”

吉打建筑指出,认可度较低的发展中项目以及持续严格的房贷申请,导致截至2017年12月31日(2017财年)的产业发展业务收入比2016财年猛挫62%。

这导致客户取消订单,甚至很多客户为了获得房贷不得不妥协,将售价超过40万令吉的首选产品转换为可负担产品。

市场情绪疲弱,导致吉打建筑展延了原定于去年推出市场的几个项目。去年,BDB Land继续在Bandar Darulaman、Darulaman Perdana及Darulaman Utama推出产业,而另一家子公司Kedah Holdings私人有限公司则在霹雳瓜拉江沙推出首个小型项目。

吉打建筑在2017财年净亏781万令吉,2016财年则净赚3400万令吉。营业额从3亿5660万令吉,按年下挫29.41%至2亿5170万令吉。

负债权益比率从2016年的0.66,跌至2017年的0.31。

(编译:魏素雯) |

|

|

|

|

|

|

|

|

|

|

|

发表于 25-5-2018 06:20 AM

|

显示全部楼层

发表于 25-5-2018 06:20 AM

|

显示全部楼层

本帖最后由 icy97 于 26-5-2018 04:53 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 47,021 | 63,867 | 47,021 | 63,867 | | 2 | Profit/(loss) before tax | -10,622 | 382 | -10,622 | 382 | | 3 | Profit/(loss) for the period | -10,772 | 267 | -10,772 | 267 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -10,769 | 279 | -10,769 | 279 | | 5 | Basic earnings/(loss) per share (Subunit) | -3.55 | 0.09 | -3.55 | 0.09 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6600 | 1.6600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-6-2018 12:05 AM

|

显示全部楼层

发表于 14-6-2018 12:05 AM

|

显示全部楼层

本帖最后由 icy97 于 16-6-2018 06:48 AM 编辑

icy97 发表于 10-6-2015 03:03 AM

吉打建築獲逾2億合約

財經股市9 Jun 2015 23:00

(吉隆坡9日訊)吉打建築(BDB,6173,主要板建築)獲得價值2億990萬令吉意向書(LOA),以維修吉打州內部分道路。

該公司向馬證交所報備,通過子公司BDB Infr ...

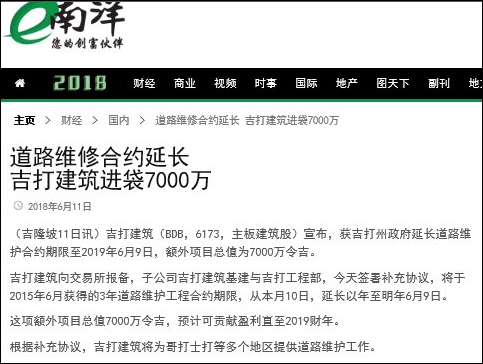

Type | Announcement | Subject | OTHERS | Description | BINA DARULAMAN BERHAD ("BDB OR THE COMPANY")Extension of Contract on State Road Maintenance Contract -PENYELENGGARAAN JALAN-JALAN NEGERI DI NEGERI KEDAH DARUL AMAN BAGI TEMPOH TIGA (3) TAHUN DAERAH KOTA SETAR/PADANG TERAP, KUALA MUDA/SIK, KUBANG PASU, KULIM/BANDAR BAHARU, PENDANG/YAN DAN BALING. (The SRM Contract) - SUPPLEMENTAL AGREEMENT DATED 10 JUNE 2018 | Previous annnouncement dated 9 June 2015 is referred to.

The Company wishes to announce that the SRM contract has been extended for a further one (1) year commencing 10 June 2018 to 9 June 2019. Detailed information is attached as Appendix 1 to this announcement.

This announcement is dated 11 June 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5822421

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-6-2018 03:57 AM

|

显示全部楼层

发表于 21-6-2018 03:57 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-8-2018 03:21 AM

|

显示全部楼层

发表于 22-8-2018 03:21 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 52,981 | 78,947 | 100,002 | 142,814 | | 2 | Profit/(loss) before tax | -9,053 | 556 | -19,675 | 938 | | 3 | Profit/(loss) for the period | -9,457 | 428 | -20,229 | 695 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -9,445 | 433 | -20,213 | 716 | | 5 | Basic earnings/(loss) per share (Subunit) | -3.11 | 0.14 | -6.66 | 0.23 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6300 | 1.7000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-12-2018 07:43 AM

|

显示全部楼层

发表于 30-12-2018 07:43 AM

|

显示全部楼层

Date of change | 01 Dec 2018 | Name | ENCIK MOHD ISKANDAR DZULKARNAIN BIN RAMLI | Age | 34 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Operating Officer |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Bachelor Degree in Finance/ Accounting/ Banking Malaysia | International Islamic University of Malaysia (IIUM) | | | 2 | Professional Qualification | Qualified Risk Manager, BCM(2017) | Institute of Enterprise Risk Practitioners (IERP) | |

| | | Working experience and occupation | Encik Mohd Iskandar is currently holding a position of Senior Management in BDB and is responsible for the Group Corporate Planning & Enterprise Risk Management (CP&ERM). Under his portfolio as Head CP&ERM, he has provided the day to day leadership and management to the Group's business strategy, corporate finance and its initiatives and focusing on BDB Recovery Plan on this current year. During his tenure in BDB, he had led several corporate exercises within the Group.Effective from 16 March 2018, he was entrusted by the Board to soar further the Property Division that covers BDB Land Sdn Bhd and Kedah Holdings Sdn Bhd and to up skill the Division during the challenging years.Prior to BDB, Iskandar has served numerous companies including Khazanah Nasional Berhad Group of Companies, East Coast Economic Region Development Council, Kumpulan Perangsang Selangor Berhad, Sapuracrest Berhad and many others. Iskandar's experience includes a broad range of Strategic, Financial and Development Risk Management in reviewing Key Projects i.e. East Coast Hi-tech Industrial Park, Port Expansion, and Restructuring and Reviewing Water Companies, and Other Business Initiatives. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-12-2018 07:54 AM

|

显示全部楼层

发表于 30-12-2018 07:54 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 30-12-2018 07:55 AM

|

显示全部楼层

发表于 30-12-2018 07:55 AM

|

显示全部楼层

Date of change | 01 Dec 2018 | Name | ENCIK FAKHRUZI BIN AHMAD | Age | 43 | Gender | Male | Nationality | Malaysia | Type of change | Others | Designation | Chief Financial Officer | Description | Re-designation of title as Group Financial Officer to Chief Financial Officer |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-1-2019 07:34 AM

|

显示全部楼层

发表于 2-1-2019 07:34 AM

|

显示全部楼层

本帖最后由 icy97 于 7-1-2019 02:37 AM 编辑

吉打建筑第三季亏638万

http://www.enanyang.my/news/20181201/吉打建筑第三季亏638万/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'00 |

| 1 | Revenue | 49,261 | 54,214 | 149,263 | 197,028 | | 2 | Profit/(loss) before tax | -5,938 | 2,561 | -25,613 | 3,499 | | 3 | Profit/(loss) for the period | -6,399 | 1,894 | -26,628 | 2,589 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -6,379 | 1,906 | -26,604 | 2,617 | | 5 | Basic earnings/(loss) per share (Subunit) | -2.11 | 0.62 | -8.76 | 0.85 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.5600 | 1.7000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-1-2019 07:37 AM

|

显示全部楼层

发表于 2-1-2019 07:37 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 26-1-2019 05:42 AM

|

显示全部楼层

发表于 26-1-2019 05:42 AM

|

显示全部楼层

Date of change | 31 Dec 2018 | Name | DATO PADUKA HAJI RASLI BIN BASIR | Age | 65 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Non Independent and Non Executive | Type of change | Retirement |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-2-2019 04:42 AM

|

显示全部楼层

发表于 12-2-2019 04:42 AM

|

显示全部楼层

Date of change | 03 Feb 2019 | Name | ENCIK FARIS NAJHAN BIN HASHIM | Age | 52 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Group Chief Executive Officer |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Economics (Majoring in Accounting) | University of Sydney Australia | |

| | | Working experience and occupation | Prior to joining Bina Darulaman Berhad, Encik Faris Najhan bin Hashim has more than 25 years experience as senior positions with listed companies as well as other non-listed companies. He has vast experience in strategic corporate planning, restructuring, turnaround, mergers and acquisitions as well as operations management in industries including construction, property development and telecommunications during his stint with the previous listed companies namely Ayer Molek Rubber Company Berhad, Mun Loong Berhad, Ho Hup Construction Company Berhad and other non-listed companies. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-3-2019 08:08 AM

|

显示全部楼层

发表于 9-3-2019 08:08 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 54,126 | 54,679 | 203,390 | 251,707 | | 2 | Profit/(loss) before tax | -13,723 | -14,409 | -39,335 | -10,910 | | 3 | Profit/(loss) for the period | -15,600 | -14,867 | -42,228 | -12,278 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -15,571 | -14,849 | -42,196 | -12,244 | | 5 | Basic earnings/(loss) per share (Subunit) | -5.13 | -4.89 | -13.90 | -4.03 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.5100 | 1.6500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-4-2019 06:04 AM

|

显示全部楼层

发表于 9-4-2019 06:04 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 24-6-2019 07:49 AM

|

显示全部楼层

发表于 24-6-2019 07:49 AM

|

显示全部楼层

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | MEMORANDUM OF UNDERSTANDING ("MOU") BETWEEN KOPERASI TELEKOM MALAYSIA BERHAD ("KOTAMAS") AND BINA DARULAMAN BERHAD ("BDB" OR THE "COMPANY") | BDB wishes to announce that on 16 May 2019 entered into a Memorandum of Understanding ("MOU") with Koperasi Telekom Malaysia Berhad (“KOTAMAS”) as detailed attached.

This announcement is dated 16 May 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6163473

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-7-2019 07:27 AM

|

显示全部楼层

发表于 8-7-2019 07:27 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 39,685 | 47,021 | 39,685 | 47,021 | | 2 | Profit/(loss) before tax | -5,510 | -10,622 | -5,510 | -10,622 | | 3 | Profit/(loss) for the period | -5,848 | -10,772 | -5,848 | -10,772 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -5,848 | -10,769 | -5,848 | -10,769 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.92 | -3.55 | -1.92 | -3.55 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4900 | 1.5100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2019 08:14 AM

|

显示全部楼层

发表于 30-8-2019 08:14 AM

|

显示全部楼层

Date of change | 01 Sep 2019 | Name | DATO' MOHAMED SHARIL BIN MOHAMED TARMIZI | Age | 50 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Independent and Non Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | LLB(Hons)/Law | University College of Wales, Aberystwyth | | | 2 | Professional Qualification | Barrister-at-Law | Gray's Inn, London, United Kingdom | | | 3 | Professional Qualification | Advocate & Solicitor | Bar Council, Malaysia | |

Working experience and occupation | Dato' Sharil was called to the Malaysian Bar in 1994 and was formerly an advocate & solicitor of the High Court of Malaya. He started his career as an advocate & solicitor with established legal firms, Azman Davidson & Co. and later, Zaid Ibrahim & Co. specialising in construction, property development and privatisation before becoming a partner in an investment advisory firm. Thereafter, he held the position of Chairman and Chief Executive of the Malaysian Communications and Multimedia Commission (MCMC), an independent regulatory body set up by a Malaysian Act of Parliament to develop, oversee and regulate the communications and multimedia sector in Malaysia from 16 October 2011 to 31 December 2014 and MCMC was also the regulator for the postal and courier industry.Please refer to "Remarks" column for Dato' Sharil's detailed working experience in the international arena and occupation. | Directorships in public companies and listed issuers (if any) | 1. PrivAsia Technology Berhad2. OPCOM Holdings Berhad |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|