|

|

发表于 26-9-2017 03:42 AM

|

显示全部楼层

发表于 26-9-2017 03:42 AM

|

显示全部楼层

| POH HUAT RESOURCES HOLDINGS BERHAD |

EX-date | 27 Dec 2017 | Entitlement date | 29 Dec 2017 | Entitlement time | 04:00 PM | Entitlement subject | Special Dividend | Entitlement description | Special single-tier dividend of 2% equivalent to 1 sen per share in respect of the financial year ending 31 October 2017. | Period of interest payment | to | Financial Year End | 31 Oct 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 15 Jan 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 29 Dec 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-9-2017 03:42 AM

|

显示全部楼层

发表于 26-9-2017 03:42 AM

|

显示全部楼层

EX-date | 13 Nov 2017 | Entitlement date | 15 Nov 2017 | Entitlement time | 04:00 PM | Entitlement subject | Second interim dividend | Entitlement description | Second interim single-tier dividend of 4% equivalent to 2 sen per share in respect of the financial year ending 31 October 2017. | Period of interest payment | to | Financial Year End | 31 Oct 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 30 Nov 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 15 Nov 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-9-2017 05:48 AM

|

显示全部楼层

发表于 27-9-2017 05:48 AM

|

显示全部楼层

堡发资源飓风提振家具销量

2017年9月27日

分析:达证券

目标价:2.50令吉

最新进展:

堡发资源(POHUAT,7088,主板消费产品股)截至今年7月杪第三季,净利按年下滑3.37%,并宣布派发3仙股息。

公司当季净赚965万6000令吉,或每股净利4.52仙,低于上财年同季的999万3000令吉。而营业额则年增20.56%,从上财年同季的1亿2564万7000令吉,提高至1亿5147万9000令吉。

累积首三季,净利按年上扬35.44%至3793万1000令吉,或每股净赚17.76仙。

行家建议:

若不算110万令吉的减值从新入账,堡发资源首9个月净利占我们全年预测的61.1%,我们认为符合预期,因为堡发资源末季表现应会强劲。

作为参考,2015和2016财年的末季净利占了全年预估的47.4%和37.6%。

我们维持2017至2019财年盈利预测不变,但上调今财年的股息预估,由6仙升至8仙。

另外,由于飓风刚席卷美国,我们预计在未来数月内家私的需求应会高涨,因为当地的灾民将需买入新家具。

同时,我们看好公司将可改善营运效率和赚幅,因为越南厂房正在经历新卧房家具生产的学习曲线。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-12-2017 06:29 AM

|

显示全部楼层

发表于 21-12-2017 06:29 AM

|

显示全部楼层

本帖最后由 icy97 于 22-12-2017 06:42 AM 编辑

堡发资源末季净利跌6%

2017年12月21日

(吉隆坡20日讯)堡发资源(POHUAT,7088,主板消费产品股)截至10月31日末季,净利按年下跌6.39%至1784万1000令吉,或每股8.35仙。

不过,营业额按年上涨12.91%,录得1亿7168万4000令吉。

累计全年,净利年增18.5%至5577万2000令吉;营业额则达6亿1426万9000令吉,年涨14.77%。

堡发资源今日向交易所报备,末季营业额增长,主要归功于大马的家具出货量提高。

大马业务营业额大涨72%,原因是为美国市场生产和出货的面板卧室套装增加,且传统办公室家具的出货量也强劲。

反观越南业务,营业额下跌8%,归咎于产品组合改变。

展望未来,美国是堡发资源的主要市场,该国的经济前景稳定,且失业率处于4.3%低位,加上家庭收入增加和低贷款利率,将能扶持美国房屋复苏,从而增加家庭家具开销。

有鉴于此,预计美国客户的订单会增加,包括办公室和房屋领域。

傅庆隆任主席

此外,为了保持竞争力,该公司继续调整所提供的产品,以迎合人口和市场趋势变化,同时致力于提高生产率,与客户一同努力缓解原料成本价格和劳动成本上涨的问题。

另一方面,堡发资源也宣布,把董事傅庆隆委任为独立非执行主席,并从今天开始生效。

现年56岁的傅庆隆,毕业于马来亚大学,持有法律系学士学位。他自1986年开始,成为执业律师,并合伙创办律师公司Messre.C.L. Boo & Associates。

目前,傅庆隆是宝翔(PRLEXUS,8966,主板消费产品股)的独立非执行董事,同时也在多家私人有限公司担任董事职务。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Oct 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Oct 2017 | 31 Oct 2016 | 31 Oct 2017 | 31 Oct 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 171,684 | 152,049 | 614,269 | 535,219 | | 2 | Profit/(loss) before tax | 21,827 | 24,698 | 67,214 | 58,614 | | 3 | Profit/(loss) for the period | 18,291 | 19,002 | 55,777 | 46,763 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 17,841 | 19,058 | 55,772 | 47,064 | | 5 | Basic earnings/(loss) per share (Subunit) | 8.35 | 8.93 | 26.11 | 22.05 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.00 | 2.00 | 8.00 | 8.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3338 | 1.1397

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-12-2017 06:42 AM

|

显示全部楼层

发表于 21-12-2017 06:42 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED FINAL SINGLE-TIER DIVIDEND FOR THE FINANCIAL YEAR ENDED 31 OCTOBER 2017 | The Board of Directors of Poh Huat Resources Holdings Berhad ("Poh Huat" or "the Company") wishes to announce that the Directors has on 20 December 2017 proposed a final single-tier dividend of 3 sen per share for the financial year ended 31 October 2017 ("Proposed Final Dividend"), subject to the approval of shareholders of the Company at the forthcoming Annual General Meeting.

The total dividends paid and proposed by Poh Huat in respect of the financial year ended 31 October 2017 is 8 sen per share.

The entitlement date and payment date is respect of the Proposed Final Dividend will be determined and announced by Poh Huat in due course.

This announcement is dated 20 December 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-12-2017 06:42 AM

|

显示全部楼层

发表于 21-12-2017 06:42 AM

|

显示全部楼层

Date of change | 20 Dec 2017 | Name | MR BOO CHIN LIONG | Age | 56 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Director | New Position | Chairman | Directorate | Independent and Non Executive | Qualifications | Mr Boo Chin Liong graduated with a Bachelor of Law (Honours) from the University of Malaya in 1985. | Working experience and occupation | Mr Boo Chin Liong is an advocate and solicitor and has been in active legal practice since 1986. He is the founding partner of Messrs. C.L. Boo & Associates. Mr Boo is currently an Independent Non-Executive Director of Prolexus Bhd. and is a director of several private limited companies. | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct Interest Boo Chin Liong - (39,000 Ordinary Shares) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-12-2017 02:55 AM

|

显示全部楼层

发表于 26-12-2017 02:55 AM

|

显示全部楼层

堡发资源美家私需求看涨

2017年12月22日

分析:达证券

目标价:2.18令吉

最新进展:

截至10月杪末季,堡发资源(POHUAT,7088,主板消费产品股)净利按年下跌6.39%至1784万1000令吉,或每股8.35仙。

不过,营业额按年上涨12.91%,录得1亿7168万4000令吉。

累计全年,净利年增18.5%至5577万2000令吉;营业额则达6亿1426万9000令吉,年涨14.77%。

行家建议:

若不算总值150万令吉的外汇损失和减值,堡发资源2017财年全年净利是5730万令吉,分别达到我们和市场全年预测的97.7%和102.9%,因此尚算符合预期。

美国家具市场的需求料在近期内会维持强劲势头。最新的美国消费者信心指数写129.5点,创下自次贷危机以来的新高。

另外,由于飓风在年初时席卷美国,我们预计未来数月内家私的需求应会高涨,因为当地的灾民将需买入新家具。

我们维持2018至2019年的财测不变,并重申“买入”公司的评级。不过,在为盈利估价模型做出些许调整后,将目标价下修至2.18令吉,或相等于2018年稀释每股净利的11倍。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 23-1-2018 01:06 AM

|

显示全部楼层

发表于 23-1-2018 01:06 AM

|

显示全部楼层

本帖最后由 icy97 于 23-1-2018 04:25 AM 编辑

堡发麻坡厂火患损失不详

2018年1月23日

(吉隆坡28日讯)堡发资源(POHUAT,7088,主板消费产品股)在柔佛麻坡的厂房遭遇火患。

根据文告,遭祝融光顾的工厂位于武吉巴希尔工业区,属大马主要营业子公司堡发家具工业(马)旗下。

工厂装卸货区和装置区受波及。

另外,其他生产区也受到轻微影响。

该场火患发生于星期日(21日)凌晨1点至1点半之间,火势之后成功在约2点半时被扑灭。

堡发资源称,麻坡的其他厂房不受影响,继续照常运作。

至于损失程度尚未能确定,但公司已为所有资产、材料和成品充分投保。

另外,堡发资源正在检视这场火患造成的营运和财务影响,并正在为该厂房寻找替代方案。【e南洋】

Type | Announcement | Subject | OTHERS | Description | POH HUAT RESOURCES HOLDINGS BERHAD ("Poh Huat" or "Company")POH HUAT FURNITURE INDUSTRIES (M) SDN BHDFIRE INCIDENT AT BUKIT PASIR MANUFACTURING FACILITIES, MUAR, JOHOR DARUL TAKZIM | We wish to announce that a fire incident has occurred at one (1) factory building belonging to Poh Huat Furniture Industries (M) Sdn Bhd, a major operating subsidiary of the Group.

The details of the announcement are as set out in the attachment below.

This announcement is dated 22 January 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5671065

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-1-2018 03:08 AM

|

显示全部楼层

发表于 24-1-2018 03:08 AM

|

显示全部楼层

堡发资源

工厂失火冲击微

2018年1月24日

分析:达证券

目标价:2.01令吉

堡发资源(POHUAT,7088,主板消费产品股)在柔佛麻坡的工厂遭遇火患。

根据文告,遭祝融光顾的工厂位于武吉巴希尔工业区,属大马主要营业子公司堡发家具工业(马)旗下。

厂房内受影响区域的包括装卸货区和装置区。

另外,其他生产区也受到轻微影响。

堡发资源称,麻坡的其他厂房不受影响,继续照常运作。

至于损失程度尚未能确定,但公司已为所有资产、材料和成品充分投保。

行家建议:

火患造成的损失,料对麻坡生产活动的影响极小。

不过,因为营运效率降低和带来不便,我们认为,堡发资源在进行重建该工厂时,营运成本可能会暂时提高。

因此,我们下调2018财年核心净利预测9.2%,从5620万令吉,调低至5120万令吉。

同时,我们也把目标价从2.18令吉,调低至2.01令吉,但维持“买入”评级。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-2-2018 01:20 AM

|

显示全部楼层

发表于 28-2-2018 01:20 AM

|

显示全部楼层

| POH HUAT RESOURCES HOLDINGS BERHAD |

EX-date | 26 Apr 2018 | Entitlement date | 30 Apr 2018 | Entitlement time | 04:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final single tier dividend of 3 sen per share in respect of the financial year ended 31 October 2017. | Period of interest payment | to | Financial Year End | 31 Oct 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 15 May 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 30 Apr 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.03 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-3-2018 02:05 AM

|

显示全部楼层

发表于 20-3-2018 02:05 AM

|

显示全部楼层

本帖最后由 icy97 于 20-3-2018 03:58 AM 编辑

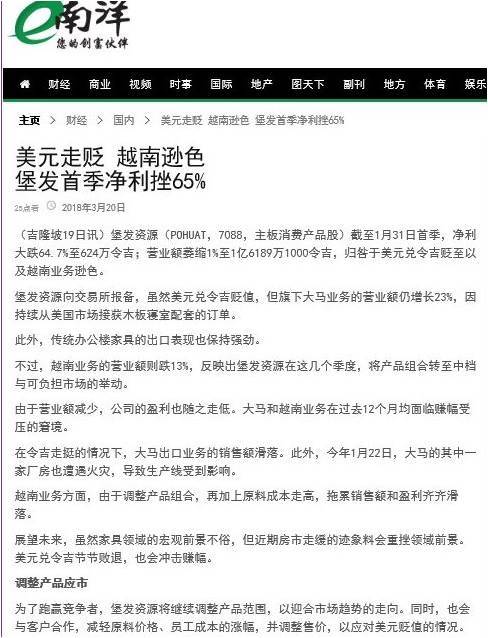

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jan 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jan 2018 | 31 Jan 2017 | 31 Jan 2018 | 31 Jan 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 161,891 | 163,459 | 161,891 | 163,459 | | 2 | Profit/(loss) before tax | 8,012 | 19,502 | 8,012 | 19,502 | | 3 | Profit/(loss) for the period | 6,100 | 17,520 | 6,100 | 17,520 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,240 | 17,670 | 6,240 | 17,670 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.84 | 8.28 | 2.84 | 8.28 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 2.00 | 0.00 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3104 | 1.3338

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-3-2018 06:39 AM

|

显示全部楼层

发表于 25-3-2018 06:39 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 1-5-2018 06:26 AM

|

显示全部楼层

发表于 1-5-2018 06:26 AM

|

显示全部楼层

本帖最后由 icy97 于 5-5-2018 03:24 AM 编辑

Type | Announcement | Subject | OTHERS | Description | POH HUAT RESOURCES HOLDINGS BERHAD ("Poh Huat" or "the Company")POH HUAT FURNITURE INDUSTRIES (M) SDN. BHD. FIRE INCIDENT AT BUKIT PASIR MANUFACTURING FACILITIES, MUAR, JOHOR DARUL TAKZIM | We refer to the announcement made on 22 January 2018 in relation to the above matter.

The Company wishes to announce that the total net book value of the assets affected by the fire comprising part of the factory building located at PTD No. 1547 & 1548, machinery and inventories has been ascertained to be RM3.02 million.

The compensation for the losses arising from the fire, after due assessment by and negotiation with the insurers, has been agreed at RM4.31 million.

The Group will hence recognise a gain of RM1.29 million arising from insurance compensation in the quarter ending 30 April 2018.

This announcement is dated 26 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-6-2018 12:29 AM

|

显示全部楼层

发表于 27-6-2018 12:29 AM

|

显示全部楼层

本帖最后由 icy97 于 27-6-2018 03:45 AM 编辑

次季净利扬2% 堡发资源派息2仙

Wong Ee Lin/theedgemarkets.com

June 26, 2018 20:19 pm +08

(吉隆坡26日讯)家具制造商堡发资源(Poh Huat Resources Holdings Bhd)在截至今年4月30日止第二季(2018财年第二季)净赚1084万令吉,比上财年同期的1060万令吉,按年上涨2%,归功于其他收入增加、所得税开支减少及外汇兑换亏损降低。

越南盾兑令吉贬值,拉低了越南业务的营业额贡献,导致堡发资源的季度营业额按年降低2%至1亿2553万令吉,上财年同期报1亿2765万令吉。

该集团宣布,在2018财年派发每股2仙首次中期股息,将于8月27日支付。

该集团在2018财年首半年净赚1708万令吉,较上财年同期的2828万令吉,按年劲挫40%,主要是销售成本从2亿2830万令吉增长7%至2亿4333万令吉所致。现财年首半年营业额则按年萎缩1%至2亿8742万令吉,上财年同期报2亿9111万令吉。该集团蒙受908万令吉的外汇兑换亏损也侵蚀了盈利。

展望未来,堡发资源表示,该集团看到其产品组合正转向更加可负担的范围,组织家庭的持续放缓可能会对其产品需求与定价产生不利影响。

“我们对原材料和劳动力成本的加速,以及美元兑令吉走势的变化保持警惕。集团将继续调整产品,以迎合人口和市场趋势的变化。”

该集团补充说:“虽然美国与中国之间的贸易战问题还没有解决,但这可能对我们有利,因为如果美国对中国家具征收关税,将会使我们的产品比中国产品更具竞争力。”

(编译:魏素雯)

SUMMARY OF KEY FINANCIAL INFORMATION

30 Apr 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Apr 2018 | 30 Apr 2017 | 30 Apr 2018 | 30 Apr 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 125,530 | 127,647 | 287,421 | 291,106 | | 2 | Profit/(loss) before tax | 12,646 | 14,212 | 20,658 | 33,714 | | 3 | Profit/(loss) for the period | 10,831 | 10,487 | 16,931 | 28,007 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 10,838 | 10,604 | 17,078 | 28,275 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.94 | 4.97 | 7.78 | 13.24 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.00 | 0.00 | 2.00 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3568 | 1.3338

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-6-2018 12:36 AM

|

显示全部楼层

发表于 27-6-2018 12:36 AM

|

显示全部楼层

| POH HUAT RESOURCES HOLDINGS BERHAD |

EX-date | 02 Aug 2018 | Entitlement date | 06 Aug 2018 | Entitlement time | 04:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First interim single-tier dividend of 2 sen per share in respect of the financial year ending 31 October 2018. | Period of interest payment | to | Financial Year End | 31 Oct 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 27 Aug 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 06 Aug 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-7-2018 11:58 PM

|

显示全部楼层

发表于 17-7-2018 11:58 PM

|

显示全部楼层

本帖最后由 icy97 于 18-7-2018 01:29 AM 编辑

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | POH HUAT RESOURCES HOLDINGS BERHAD ("Poh Huat" or "The Company") ACQUISITION OF WAREHOUSE CUM OFFICE-SHOWROOM IN CRANBOURNE WEST, VICTORIA, AUSTRALIA | The Board of Directors of Poh Huat wishes to announce that Company had on 17 July 2018 entered into a sale and purchase agreement with JSNJ Investment Pty Ltd, Australia, the owner and developer of a 3,212 sqm detached warehouse cum office-showroom in Cranbourne West, Victoria, Australia for a total consideration of AUD4,948,000 and Australian GST.

Please refer to the attached file for full text of the announcement.

This announcement is dated 17 July 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5856729

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-9-2018 05:44 AM

|

显示全部楼层

发表于 27-9-2018 05:44 AM

|

显示全部楼层

本帖最后由 icy97 于 30-9-2018 06:53 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jul 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jul 2018 | 31 Jul 2017 | 31 Jul 2018 | 31 Jul 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 144,997 | 151,479 | 432,417 | 442,584 | | 2 | Profit/(loss) before tax | 10,502 | 11,673 | 31,160 | 45,387 | | 3 | Profit/(loss) for the period | 9,203 | 9,479 | 26,133 | 37,486 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 9,200 | 9,656 | 26,278 | 37,931 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.19 | 4.52 | 11.97 | 17.76 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 3.00 | 2.00 | 5.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3594 | 1.3338

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-9-2018 07:33 AM

|

显示全部楼层

发表于 30-9-2018 07:33 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 30-10-2018 05:41 AM

|

显示全部楼层

发表于 30-10-2018 05:41 AM

|

显示全部楼层

| POH HUAT RESOURCES HOLDINGS BERHAD |

EX-date | 28 Nov 2018 | Entitlement date | 30 Nov 2018 | Entitlement time | 04:00 PM | Entitlement subject | Second interim dividend | Entitlement description | Second interim single-tier dividend of 2 sen per share in respect of the financial year ended 31 October 2018. | Period of interest payment | to | Financial Year End | 31 Oct 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 20 Dec 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 30 Nov 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2019 06:39 AM

|

显示全部楼层

发表于 13-1-2019 06:39 AM

|

显示全部楼层

本帖最后由 icy97 于 17-1-2019 08:04 AM 编辑

堡发资源末季多赚17%

http://www.enanyang.my/news/20181214/堡发资源末季多赚17/

SUMMARY OF KEY FINANCIAL INFORMATION

31 Oct 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Oct 2018 | 31 Oct 2017 | 31 Oct 2018 | 31 Oct 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 189,508 | 171,684 | 621,926 | 614,269 | | 2 | Profit/(loss) before tax | 26,369 | 21,827 | 57,529 | 67,214 | | 3 | Profit/(loss) for the period | 21,132 | 18,291 | 47,266 | 55,777 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 20,860 | 17,841 | 47,138 | 55,772 | | 5 | Basic earnings/(loss) per share (Subunit) | 9.50 | 8.35 | 21.47 | 26.11 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.00 | 3.00 | 6.00 | 8.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4437 | 1.3338

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|