|

|

发表于 19-4-2018 04:49 AM

|

显示全部楼层

发表于 19-4-2018 04:49 AM

|

显示全部楼层

本帖最后由 icy97 于 22-4-2018 03:01 AM 编辑

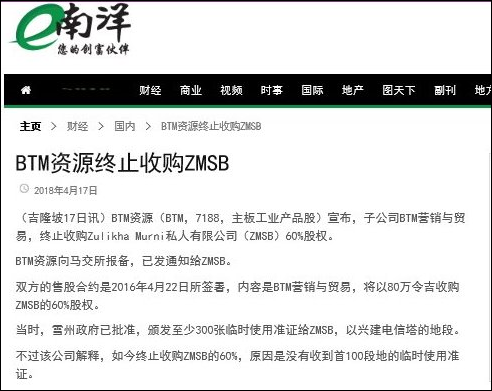

Type | Announcement | Subject | OTHERS | Description | PROPOSED ACQUISITION OF 60% EQUITY INTEREST IN ZULIKHA MURNI SDN BHD ("ZWSB") | With reference to the Company's announcements dated 22 April 2016, 26 April 2016 and 27 April 2016, the Board of Directors of BTM Resources Berhad wishes to announce that the Company 's subsidiary BTM Marketing & Trading Sdn Bhd sent a Notice of Termination dated 16 April 2018 to the Vendor of Shares of Zulikha Murni Sdn Bhd ("ZMSB") to terminate the Shares Sale Agreement dated 22 April 2016.

The Notice of Termination was sent to Vendor of Shares due to the non-receipt by the Company of the original Temporary Occupancy Licence ("TOL") for the first 100 plots of TOL Land duly issued by the Selangor State Authoruty in the Name of ZMSB.

This announcement is dated 17 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-5-2018 02:45 AM

|

显示全部楼层

发表于 27-5-2018 02:45 AM

|

显示全部楼层

本帖最后由 icy97 于 2-6-2018 07:45 AM 编辑

Type | Announcement | Subject | OTHERS | Description | BTM WESTERN POWER GREEN ENERGY SDN. BHD. AND SEPCO ELECTRIC POWER CONSTRUCTION CORPORATION FOR A PROPOSED MUNICIPAL SOLID WASTE TO ENERGY GENERATION PLANT IN THE STATE OF MELAKA | With reference to the Company's announcements made on 29 November 2017 and 2 January 2018, the Board of Directors of BTM Resources Berhad wishes to announce that on 23 May 2018, BTM Western Power Green Energy Sdn Bhd has received a letter dated 3 May 2018 from Jabatan Pengurusan Sisa Pepejal Negara ( Department of National Solid Waste Management) informing that the Department is not abled to consider the application of setting- up a Municipal Solid Waste To Energy Generation Plant in the State of Melaka.

This announcement is dated 23 May 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-6-2018 01:53 AM

|

显示全部楼层

发表于 11-6-2018 01:53 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,617 | 3,126 | 3,617 | 3,126 | | 2 | Profit/(loss) before tax | -426 | 102 | -426 | 102 | | 3 | Profit/(loss) for the period | -426 | 102 | -426 | 102 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -426 | 102 | -426 | 102 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.32 | 0.08 | -0.32 | 0.08 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.2200 | 0.2200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2018 05:19 AM

|

显示全部楼层

发表于 1-9-2018 05:19 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,650 | 3,295 | 7,267 | 6,421 | | 2 | Profit/(loss) before tax | -665 | 148 | -1,091 | 250 | | 3 | Profit/(loss) for the period | -665 | 148 | -1,091 | 250 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -662 | 148 | -1,088 | 250 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.47 | 0.12 | -0.80 | 0.20 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.2100 | 0.2200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-12-2018 05:45 AM

|

显示全部楼层

发表于 27-12-2018 05:45 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 4,663 | 3,163 | 11,930 | 9,584 | | 2 | Profit/(loss) before tax | 127 | 204 | -964 | 454 | | 3 | Profit/(loss) for the period | 127 | 202 | -964 | 452 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 127 | 202 | -961 | 452 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.09 | 0.16 | -0.70 | 0.36 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.2100 | 0.2200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-3-2019 06:55 AM

|

显示全部楼层

发表于 9-3-2019 06:55 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,685 | 3,179 | 15,615 | 12,763 | | 2 | Profit/(loss) before tax | -1,440 | -1,951 | -2,404 | -1,497 | | 3 | Profit/(loss) for the period | -1,440 | -1,279 | -2,404 | -827 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,438 | -1,273 | -2,399 | -821 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.02 | -0.99 | -1.73 | -0.65 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.2000 | 0.2200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-4-2019 07:13 AM

|

显示全部楼层

发表于 17-4-2019 07:13 AM

|

显示全部楼层

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | MEMORANDUM OF UNDERSTANDING BETWEEN A SUBSIDIARY COMPANY OF BTM RESOURCES BERHAD ("THE COMPANY"), BTM BIOMASS PRODUCTS SDN BHD AND KOREA SOUTH-EAST POWER CO., LTD , MOKPO CITY GAS CO., LTD AND MC BIO SDN BHD (COLLECTIVELY KNOWN AS "THE PARTIES") TO DEVELOP A COMPREHENSIVE COOPERATIVE FRAMEWORK FOR SUCCESSFUL EXECUTION OF A WOOD PELLET PROJECT IN THE STATE OF TERENGGANU IN MALAYSIA ("THE PROJECT") | |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-7-2019 05:36 AM

|

显示全部楼层

发表于 6-7-2019 05:36 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,903 | 3,617 | 1,903 | 3,617 | | 2 | Profit/(loss) before tax | -1,828 | -426 | -1,828 | -426 | | 3 | Profit/(loss) for the period | -1,828 | -426 | -1,828 | -426 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,828 | -426 | -1,828 | -426 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.29 | -0.32 | -1.29 | -0.32 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1900 | 0.2000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2019 04:50 AM

|

显示全部楼层

发表于 1-9-2019 04:50 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,137 | 3,650 | 4,040 | 7,267 | | 2 | Profit/(loss) before tax | -1,635 | -665 | -3,463 | -1,091 | | 3 | Profit/(loss) for the period | -1,635 | -665 | -3,463 | -1,091 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,634 | -662 | -3,462 | -1,088 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.16 | -0.47 | -2.45 | -0.80 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1800 | 0.2000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-11-2019 05:04 AM

|

显示全部楼层

发表于 13-11-2019 05:04 AM

|

显示全部楼层

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | MEMORANDUM OF AGREEMENT ("MOA" OR "THE AGREEMENT") BY AND AMONG KOREA SOUTH-EAST POWER CO., LTD. AND MOKPO CITY GAS CO., LTD. AND BTM BIOMASS PRODUCTS SDN. BHD. AND MC BIO SDN. BHD. | |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-1-2020 04:14 AM

|

显示全部楼层

发表于 22-1-2020 04:14 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | BTM RESOURCES BERHAD ("BTM" OR "COMPANY") HEADS OF AGREEMENT ("HOA") ENTERED INTO BETWEEN BTM AND MARKMORE ENERGY (LABUAN) LIMITED FOR THE PROPOSED PRODUCTION OF LIQUEFIED PETROLEUM GAS ("LPG") | On behalf of the Board of Directors of BTM, M&A Securities Sdn Bhd wishes to announce that the Company had on 13 November 2019 entered into a HOA with Markmore Energy (Labuan) Limited (“MELL”) (collectively “Party(ies)”) to set out the essential terms and conditions for BTM to participate in the proposed production of LPG (together with associated natural gas condensate (“Condensate”)) from the natural gas supplied from the Rakushechnoye Oil and Gas Field (“Proposed LPG Production”).

Please refer to the attachment for announcement details.

This announcement is dated 13 November 2019. |

https://www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3001747

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-1-2020 05:57 AM

|

显示全部楼层

发表于 24-1-2020 05:57 AM

|

显示全部楼层

Expiry/Maturity of the securities

Instrument Category | Securities of PLC | Instrument Type | Warrants | Type Of Expiry | Expiry/Maturity of the securities | Mode of Satisfaction of Exercise/Conversion price | Cash | Exercise/ Strike/ Conversion Price | Malaysian Ringgit (MYR) 0.9400 | Exercise/ Conversion Ratio | 1:1 | Settlement Type / Convertible into | Physical (Shares) | Last Date & Time of Trading | 04 Dec 2019 05:00 PM | Date & Time of Suspension | 05 Dec 2019 09:00 AM | Last Date & Time for Transfer into Depositor's CDS a/c | 13 Dec 2019 05:00 PM | Date & Time of Expiry | 20 Dec 2019 05:00 PM | Date & Time for Delisting | 23 Dec 2019 09:00 AM |

https://www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3001999

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-3-2020 07:14 AM

|

显示全部楼层

发表于 7-3-2020 07:14 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2019 | 30 Sep 2018 | 30 Sep 2019 | 30 Sep 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,062 | 4,663 | 7,102 | 11,930 | | 2 | Profit/(loss) before tax | -1,904 | 127 | -5,367 | -964 | | 3 | Profit/(loss) for the period | -1,919 | 127 | -5,382 | -964 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,918 | 127 | -5,380 | -961 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.36 | 0.09 | -3.81 | 0.70 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1600 | 0.2000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-4-2020 05:46 AM

|

显示全部楼层

发表于 14-4-2020 05:46 AM

|

显示全部楼层

Date of change | 22 Jan 2020 | Name | TAN SRI DATO' DR ABDUL AZIZ BIN ABDUL RAHMAN | Age | 86 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Independent and Non Executive | Type of change | Demised |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-5-2020 07:23 AM

|

显示全部楼层

发表于 3-5-2020 07:23 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2019 | 31 Dec 2018 | 31 Dec 2019 | 31 Dec 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,330 | 3,622 | 9,432 | 15,552 | | 2 | Profit/(loss) before tax | -1,054 | -1,388 | -6,421 | -2,352 | | 3 | Profit/(loss) for the period | -568 | -1,641 | -5,950 | -2,605 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -565 | -1,639 | -5,945 | -2,600 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.74 | -1.16 | -4.55 | -1.87 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1600 | 0.2000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-5-2020 07:14 AM

|

显示全部楼层

发表于 4-5-2020 07:14 AM

|

显示全部楼层

Date of change | 02 Mar 2020 | Name | DATUK MOHAMED IQBAL BIN M.M. MOHAMED GANEY | Age | 70 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Independent Director | New Position | Chairman | Directorate | Independent and Non Executive |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information |

Working experience and occupation | Y.Bhg Datuk Mohamed Iqbal Bin M.M. Mohamed Ganey has vast experience in banking and having worked with a foreign bank in various senior positions for 29 years. He had the opportunity to be exposed to various environment in the domestic as well as international markets whilst serving as the Head of Product Development,Trade Finance,Standard Chartered Bank Malaysia Berhad.He was also an active member of the Export Credit Refinancing (ECR) Committee chaired by Bank Negara Malaysia and currently by EXIM Bank, a committee member of Cross Border Barter Trade chaired by Malayan Banking Berhad, an examiner for the International Trade Finance (DPO6) a paper of the Institute of Bankers Malaysia Diploma in Banking and Finance Services examination and a resident trainer for the Inatitute's International Trade.His immediate contribution to the banking fraternity and to Bank Negara Malaysia has been well received and recognized.He was the Group Executive Director of SPM Holdings Sdn Bhd, a major recycler in the country in the country.Chairman of Patchee Bakery Sdn Bhd, a company involved in food production.He is also the Chairman of MIG Resources Sdn Bhd, an investment holding company with investment in properties,food production and restaurants. Currently the Vice Chairman of Malaysian Indian Muslim chamber of commerce and Industry (MIMCOIN), Director of Cahaya Haramain Travel Sdn Bhd,whose Head office is based in Jakarta,Indonesia,and a Senior Independent Licensed Money Service Business.He has been involved in a number of social and religious bodies such as Persatuan Muslimin India Malaysia (PERMIM),Angkatan Kemajuan Islam PJ and Selangor. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-6-2020 07:43 AM

|

显示全部楼层

发表于 4-6-2020 07:43 AM

|

显示全部楼层

icy97 发表于 22-1-2020 04:14 AM

https://www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3001747

Type | Announcement | Subject | OTHERS | Description | BTM RESOURCES BERHAD (BTM OR COMPANY) HEADS OF AGREEMENT ("HOA") ENTERED INTO BETWEEN BTM AND MARKMORE ENERGY ("LABUAN") LIMITED ("MELL") FOR THE PROPOSED PRODUCTION OF LIQUEFIED PETROLEUM GAS ("LPG") | (Unless otherwise defined in this announcement, all terms used herein shall have the same meaning as those defined in the announcement dated 13 November 2019 in relation to the HOA.)

On behalf of the Board, M&A Securities Sdn Bhd wishes to announce that the HOA has been terminated as the Conditions Precedent is not being fulfilled by the Conditions Cut-Off Date (i.e. 6 months from the date of the HOA, 12th May 2020) (“Termination”).

Upon the Termination, the HOA shall have no further force or effect and neither party shall have or make any claim against the other whatsoever, save and except for any antecedent breaches under the HOA which none is identified as of the date of this announcement.

The Termination will not have any material financial impact on BTM and its subsidiaries.

This announcement is dated 12 May 2020.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-8-2020 08:28 AM

|

显示全部楼层

发表于 1-8-2020 08:28 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | BTM RESOURCES BERHAD ("BTM" OR THE "COMPANY") PROPOSED PRIVATE PLACEMENT OF UP TO 20% OF THE ISSUED SHARES IN BTM | On behalf of the Board of Directors of BTM, M&A Securities Sdn Bhd wishes to announce that the Company proposes to undertake a private placement of up to 20% of the issued shares of BTM (“Proposed Private Placement”).

Kindly refer to the attachment for further details of the Proposed Private Placement.

This announcement is dated 5 June 2020. |

https://www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3056636

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-10-2020 08:24 AM

|

显示全部楼层

发表于 11-10-2020 08:24 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2020 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2020 | 31 Mar 2019 | 31 Mar 2020 | 31 Mar 2019 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,436 | 1,903 | 2,436 | 1,903 | | 2 | Profit/(loss) before tax | -1,978 | -1,828 | -1,978 | -1,828 | | 3 | Profit/(loss) for the period | -1,978 | -1,828 | -1,978 | -1,828 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,978 | -1,828 | -1,978 | -1,828 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.40 | -1.29 | -1.40 | -1.29 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1500 | 0.1600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-10-2020 09:11 AM

|

显示全部楼层

发表于 14-10-2020 09:11 AM

|

显示全部楼层

本帖最后由 icy97 于 7-6-2021 08:32 AM 编辑

Type | Announcement | Subject | OTHERS | Description | FEED-IN TARIFF APPROVAL GRANTED TO BTM BIOMASS PRODUCTS SDN BHD BY SUSTAINABLE ENERGY DEVELOPEMENT AUTHORITY MALAYSIA (SEDA) FOR ELECTRICAL POWER GENERATION | BTM Biomass Products Sdn Bhd, a wholly-owned subsidiary of BTM Resources Berhad has obtained approval from SEDA to build and operate a renewable electrical power plant with a capacity to supply 10 MW per hour of electricity to Tenaga Nasional Berhad. The Company received the Feed-in Tariff "FIT" Approval Certificate dated 01 July 2020 on 02 July 2020. The approval granted is for a period of 21 years commencing no later than 23 January 2023.

The expected date of signing of the Power Purchase Agreement ("PPA") with Tenaga Nasional Berhad is October 2020 at a fixed tariff rate of RM 0.3486 per kWh for twenty one (21) years. The Electrical Energy Power Plant ("EEPP") will be located at Lot 153-C, Mukim Hulu Chukai,Teluk Kalong,24007 Chukai, Terengganu Darul Iman.

The construction of the EEPP is targeted to commence in June 2021 and is expected to be completed in December 2022.

THe sources of funds for the cost of construction will be bank loan and / or proceeds to be raised from corporate exercise.The breakdown of the sources of funding has yet to be determined. The FIT approval / PPA will not have any significant impact on the performance of the Group for the Fiancial Year ending 31 December 2020 .However it shall contribute positively to the future earnings of the Group during the effective period i.e from January 2023 ,the commenced date of FIT up to the end of twenty first (21) years.

None of the Directors and/ or major shareholders and/ or persons connected with a director or major shareholders have any interest,direct or indirect in the FIT approval.

This announcement is dated 2 July 2020.

|

Type | Announcement | Subject | OTHERS | Description | BTM RESOURCES BERHAD (" BTM" OR "THE COMPANY") 'S RENWABLE ENERGY POWER GENERATION PROJECT | Further to the announcement made on 2 July 2020, the Board of Directors of BTM Resources Berhad wishes to announce that BTM Biomass Products Sdn. Bhd. ("Feed-in Approval Holder") , the Company's wholly-owned subsidiary has entered into a renewable energy power purchase agreement with Tenaga Nasional Berhad ("Distribution Licensee") on 27 July 2020.

This announcement is dated 29 July 2020. |

Type | Announcement | Subject | OTHERS | Description | BTM RESOURCES BERHAD (" BTM" OR "THE COMPANY") 'S RENEWABLE ENERGY POWER GENERATION PROJECT | With reference to the announcements made on 2 July 2020 and 29 July 2020, the Board of Directors of BTM Resources Berhad wishes to state the certain salient terms and conditions of the renewable energy power purchase agreement entered into by BTM Biomass Products Sdn. Bhd. (" Feed-in Approval Holder") with Tenaga Nasional Berhad ("Distribution Licensee") on 27 July 2020 as follows :- 1) The Agreement is entered into pursuant to Subsection 12(1) of the Renewable Energy Act 2011.

2) The Location of Renewable Energy Installation at 153-C ,Mukim Hulu Chukai, Teluk Kalong, 24007 Cukai, Terengganu Darul Iaman.

3)Net Export Capacity of the Installation is 10.000 Mega Watt.

4)Sceduled Feed-in Tariff Commencement Date is 23 January 2023.

5)Effective Period is 21 years ( years commencing from The Feed-in Tariff Commencement Date).

6)Feed-in Tariff Rate is RM 0.3486 per kWh.

7)The Feed-in Approval Holder shall meet the Milestone dates: a) Registration of REPPA with SEDA & SI Public Licence (Provisional) by 23 August 2020, b)Financing Agreements by 23 January 2021, c) First payment to EPC Contractor by 23 July 2021, d) Initial Operation Date (IOD) by 23 Janury 2022, e)Feed-in Tariff Commencement Date by 23 January 2023.

This announcement is dated 30 July 2020. |

Type | Announcement | Subject | OTHERS | Description | BTM RESOURCES BERHAD ("BTM" OR THE "COMPANY")RENEWABLE ENERGY POWER GENERATION PROJECT | With reference to the announcements made on 2 July 2020, 29 July 2020 and 30 July 2020, the Board of Directors of BTM is pleased to announce that BTM Biomass Products Sdn. Bhd., a wholly-owned subsidiary of BTM has on 23 November 2020,awarded the engineering, procurement, construction and commissioning works in relation to the development of its 10 MWac biomass renewable energy power plant at Lot 153-C,Mukim Hulu Chukai, Telok Kalong, 24007 Cukai, Terengganu Darul Iman to Samaiden Sdn. Bhd., a wholly-owened subsidiary of Samaiden Group Berhad for a contract sum of RM 115,000,000.00.

None of the Directors and / or major shareholders and /or persons connected with a director or major shareholders have any interest, direct or indirect in relation to the award of EPCC works.

This announcement is dated 23 November 2020.

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|