|

|

发表于 17-10-2017 02:02 AM

|

显示全部楼层

发表于 17-10-2017 02:02 AM

|

显示全部楼层

Date of change | 16 Oct 2017 | Name | MR CHOONG CHOO HOCK | Age | 54 | Gender | Male | Nationality | Malaysia | Type of change | Others | Designation | Chief Operating Officer | Description | Re-designation as Chief Executive Officer of IRIS Trusted Identification & Information Technology Division | Qualifications | Bachelor of Science from the National University of Singapore | Working experience and occupation | He began his career as a Process Engineer with Meter Kitamura in 1984 in Singapore. He was promoted as Production Manager (Factory Manager Designate) and assigned to set up their new factory in Seremban in 1985.In 1992 he then joined Associated Pan Malaysia Cement, a public listed company as Quality Manager responsible for implementing Quality Management Systems (ISO9000) for the group.In 1995, he joined Possehl Electronic, a European Semiconductor Multinational as Operations Manager and has since progressively gained extensive experience and served in several senior management positions, until he left and joined IRIS Technologies (M) Sdn Bhd as Director of Manufacturing in 2009. He was promoted as Director of Operations in 2010 and has assumed his current position as Group Director of Manufacturing of IRIS Corporation Berhad and Chief Operating Officer of IRIS Koto IBS since 2014. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-12-2017 05:04 AM

|

显示全部楼层

发表于 9-12-2017 05:04 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 112,265 | 87,927 | 214,976 | 167,682 | | 2 | Profit/(loss) before tax | -17,156 | -22,252 | -13,165 | -26,599 | | 3 | Profit/(loss) for the period | -17,168 | -22,190 | -13,696 | -27,255 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -14,684 | -21,294 | -9,474 | -25,242 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.62 | -0.96 | -0.40 | -1.14 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1248 | 0.1282

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-12-2017 06:24 AM

|

显示全部楼层

发表于 20-12-2017 06:24 AM

|

显示全部楼层

本帖最后由 icy97 于 22-12-2017 05:41 AM 编辑

艾力斯获496万移民局合约

2017年12月19日

(吉隆坡18日讯)艾力斯(IRIS,0010,创业板)获颁总值约496万令吉合约,负责为移民局提供维护服务。

艾力斯今日向交易所报备,独资子公司IRIS Information Technology Systems私人有限公司,于上周五(15日)接获内政部信件,负责为移民局所有护照接收和签发办公室,提供机械、软件和面容活体信息截取应用系统的维护服务。

合约为期3年,从明年1月1日至2020年12月31日。

艾力斯称,这项合约料不会影响股本和股权结构,且从合约生效起至截止的这段期间,将贡献净利和每股净资产。【e南洋】

Type | Announcement | Subject | OTHERS | Description | IRIS Corporation Berhad (IRIS) or (the Company)- Award of Contract from Ministry of Home Affairs (MOHA) to IRIS wholly-owned subsidiary, IRIS Information Technology Systems Sdn. Bhd. (Company No. 222819-K) | 1. Introduction The Board of Directors of IRIS is pleased to announce that IRIS Information Technology Systems Sdn. Bhd. (“IITS”), a wholly owned subsidiary of IRIS had on 15 December 2017 received an Acceptance Letter from MOHA dated 12 December 2017 for the provision of maintenance services of equipment, software, and Facial Live Capture Image (application system) at all Passport Recipient and Issuance Offices of Immigration Department of Malaysia (“the Contract”) for a total contract sum of Ringgit Malaysia Four Million Nine Hundred Sixty Thousand Three Hundred Forty Two and Cent Eight (RM4,960,342.08) (inclusive of 6% GST) for a period of three (3) years from 1 January 2018 to 31 December 2020 and submission of performance bond to MOHA.

2. Financial effects The Contract will not have any effect on the share capital and shareholding structure of IRIS. The Contract, however, is expected to contribute positively to the earnings and net assets per share of IRIS for the financial years ending 31 March 2018 onwards until the expiry of the Contract.

3. Risks The risk factors affecting the Contract include changes in economic, political and regulatory environment and operational risks such as completion risk and shortage of materials and skilled labour which IRIS and IITS would take appropriate measures to minimise.

4. Directors’ and Major Shareholders’ Interest None of the Directors, major shareholders and persons connected to them has any interest, direct or indirect, in the Contract.

This announcement is dated 18 December 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-3-2018 04:25 AM

|

显示全部楼层

发表于 7-3-2018 04:25 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 66,552 | 135,457 | 281,529 | 303,139 | | 2 | Profit/(loss) before tax | -48,070 | 6,345 | -61,234 | -20,254 | | 3 | Profit/(loss) for the period | -48,079 | -2,922 | -61,775 | -30,177 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -45,507 | -1,790 | -54,982 | -27,031 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.90 | -0.08 | -2.30 | -1.21 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1054 | 0.1282

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-3-2018 04:41 AM

|

显示全部楼层

发表于 18-3-2018 04:41 AM

|

显示全部楼层

Name | FELDA INVESTMENT CORPORATION SDN BHD | Address | Level 4, Balai Felda

Jalan Gurney 1

Kuala Lumpur

54000 Wilayah Persekutuan

Malaysia. | Company No. | 1052445-A | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 14 Mar 2018 | 25,000,000 | Disposed | Direct Interest | Name of registered holder | Felda Investment Corporation Sdn Bhd | Address of registered holder | Level 4, Balai Felda Jalan Gurney 1 54000 Kuala Lumpur | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Disposed via Direct Business Transaction | Nature of interest | Direct Interest | Direct (units) | 454,360,281 | Direct (%) | 18.381 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 454,360,281 | Date of notice | 14 Mar 2018 | Date notice received by Listed Issuer | 16 Mar 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-3-2018 04:42 AM

|

显示全部楼层

发表于 18-3-2018 04:42 AM

|

显示全部楼层

Name | CAPRICE DEVELOPMENT SDN BHD | Address | 5-0-2, BLOCK B, MEGAN SALAK PARK

JALAN 1/125E, DESA PETALING

KUALA LUMPUR

57100 Selangor

Malaysia. | Company No. | 302232-X | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 14 Mar 2018 | 25,000,000 | Acquired | Direct Interest | Name of registered holder | CIMSEC NOMINEES (TEMPATAN) SDN BHD | Address of registered holder | 17th Floor Menara CIMB, No.1 Jalan Stesen Sentral 2, Kuala Lumpur Sentral, 50470 Kuala Lumpur | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Direct Business Transfer | Nature of interest | Direct Interest | Direct (units) | 253,718,405 | Direct (%) | 10.26 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 253,718,405 | Date of notice | 16 Mar 2018 | Date notice received by Listed Issuer | 16 Mar 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-5-2018 07:08 AM

|

显示全部楼层

发表于 9-5-2018 07:08 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | IRIS CORPORATION BERHAD (IRIS OR THE COMPANY)DISPOSAL OF SUBSIDIARIES | The Board of Directors of IRIS wishes to announce that IRIS has on 3 May 2018 entered into a Shares Sales Agreement with REGAL ROTARY SDN BHD to dispose of the equity interest in four (4) subsidiaries for a total cash consideration of RINGGIT MALAYSIA ONE HUNDRED THOUSAND AND THREE (RM100,003-00).

Please refer to the attached file for the full text of annoucement.

This annoucement is dated 4 May 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5784537

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-5-2018 12:50 AM

|

显示全部楼层

发表于 12-5-2018 12:50 AM

|

显示全部楼层

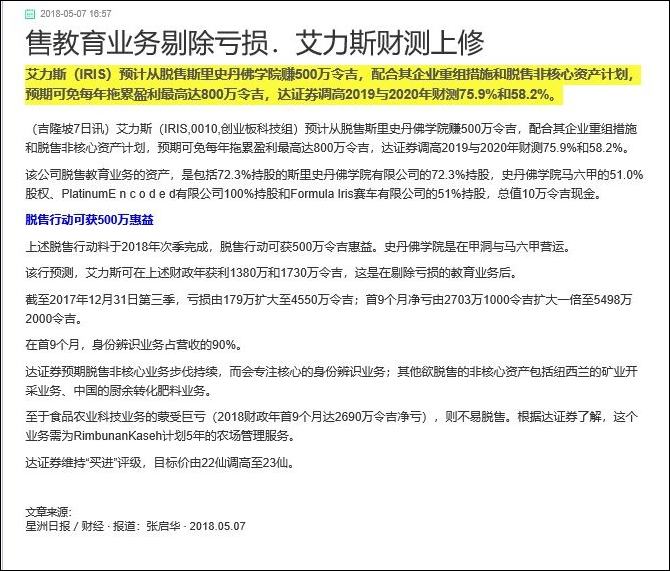

本帖最后由 icy97 于 13-5-2018 03:27 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-5-2018 06:34 AM

|

显示全部楼层

发表于 31-5-2018 06:34 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 58,711 | 134,536 | 340,239 | 437,675 | | 2 | Profit/(loss) before tax | -69,796 | -286,571 | -131,031 | -306,825 | | 3 | Profit/(loss) for the period | -59,068 | -288,422 | -120,284 | -314,475 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -66,771 | -265,109 | -121,753 | -292,140 | | 5 | Basic earnings/(loss) per share (Subunit) | -2.77 | -11.80 | -5.05 | -13.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-6-2018 01:02 AM

|

显示全部楼层

发表于 21-6-2018 01:02 AM

|

显示全部楼层

本帖最后由 icy97 于 21-6-2018 04:11 AM 编辑

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | IRIS CORPORATION BERHAD ("IRIS" OR THE "COMPANY")PROPOSED ISSUANCE AND ALLOTMENT OF 494,380,400 NEW ORDINARY SHARES IN IRIS ("PROPOSED SHARE ISSUANCE") | On behalf of the Board of Directors of IRIS, CIMB Investment Bank Berhad wishes to announce that the Company had, on 14 June 2018 entered into a subscription agreement with Dato’ Sri Robin Tan Yeong Ching, Dato’ Poh Yang Hong and Dato’ Rozabil @ Rozamujib Bin Abdul Rahman for the proposed issuance and allotment of 494,380,400 new ordinary shares in IRIS (“IRIS Shares” or “Shares”) (“Subscription Share(s)”), representing approximately 20% of the total number of issued shares of the Company, at an issue price of RM0.12 per Subscription Share to be satisfied in cash (“Proposed Share Issuance”).

Please refer to the attachment for further details of the Proposed Share Issuance.

This announcement is dated 14 June 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5827441

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-6-2018 01:03 AM

|

显示全部楼层

发表于 21-6-2018 01:03 AM

|

显示全部楼层

Date of change | 14 Jun 2018 | Name | DATO' ROZABIL @ROZAMUJIB BIN ABDUL RAHMAN | Age | 46 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Executive Deputy Chairman | New Position | Executive Director | Directorate | Executive | Qualifications | Executive Diploma in Plantation Management from University of Malaya Centre for Continuing Education, Kuala Lumpur | Working experience and occupation | He is currently the Group Managing Director of Destini Berhad (DesB).He has been on Board as Group Managing Director of DesB since 7 January 2014 and was initially appointed as independent & non-executive director on 11 November 2010. He was re-designated as Managing Director of DesB on 3 January 2011.He has diversified interests ranging from construction and property development to trading and serves as director of several other private companies. He started his career as Managing Director and owner of Benar Prima Holdings Sdn Bhd, a holding company that has businesses in engineering, property development and investments. | Family relationship with any director and/or major shareholder of the listed issuer | Nil | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | Indirect Interest : 270,031,405 ordinary shares (10.924%) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-6-2018 01:03 AM

|

显示全部楼层

发表于 21-6-2018 01:03 AM

|

显示全部楼层

Date of change | 14 Jun 2018 | Name | DATO' POH YANG HONG | Age | 45 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Non-Independent Director | New Position | President | Directorate | Executive | Qualifications | Bachelor in Economics from University Of Monash, Melbourne | Working experience and occupation | Dato' Poh Yang Hong is currently the Chief Executive Officer of Caprice Capital International Ltd.He is also a Director of GLM Reit Management Sdn Bhd, the Manager of Tower Real Estate Investment Trust which is listed on Main Market of Bursa Malaysia Securities Berhad.He had held variuos position in Hong Leong Group, including as the Managing Director of GuocoLand (Malaysia) Berhad, Managing Director of Corporate and Private Equity Department, Group Investment Office of HL Management Co Sdn Bhd. | Family relationship with any director and/or major shareholder of the listed issuer | Nil | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct Interest - 17,000,000 Ordinary Shares (0.690%)Indirect Interest - 253,718,405 Ordinary Shares (10.260%) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2018 04:29 AM

|

显示全部楼层

发表于 22-6-2018 04:29 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | IRIS CORPORATION BERHAD ("IRIS" OR THE "COMPANY")PROPOSED ISSUANCE AND ALLOTMENT OF 494,380,400 NEW ORDINARY SHARES IN IRIS ("PROPOSED SHARE ISSUANCE") | We refer to the announcement made on 14 June 2018 in relation to the Proposed Share Issuance (“Announcement”). All abbreviations used herein shall have the same meanings as those used in the Announcement unless stated otherwise.

Further to the Announcement, on behalf of the Board of Directors (“Board”) of IRIS, CIMB Investment Bank Berhad wishes to provide further information in relation to the basis of determining and justification for the issue price of the Subscription Shares for the Proposed Share Issuance.

As disclosed in the Company’s interim financial report for the fourth quarter ended 31 March 2018 (“Interim Report”), the current business environment for financial year 2019 (“FY2019”) is expected to remain challenging for IRIS and its subsidiaries (“IRIS Group”). For the Proposed Share Issuance, the Subscribers namely Dato’ Sri Robin Tan Yeong Ching, Dato’ Poh Yang Hong and Dato’ Rozabil @ Rozamujib Bin Abdul Rahman have expressed their acceptance to participate in the Proposed Share Issuance at an issue price of RM0.12 per IRIS Share. The Board recognises that the Proposed Share Issuance will enable IRIS to raise funds to meet its working capital requirements and to capitalize on future business projects/investments, as and when such opportunity arises, without incurring additional interest costs as compared to bank borrowings.

After due consideration of IRIS Group’s financial position and the rationale for the Proposed Share Issuance as disclosed in Section 4 of the Announcement, the Board decided to apply a discount rate of approximately 11.0% to the 5-day VWAMP of IRIS Shares up to and including 13 June 2018 of RM0.1349 to derive the issue price of RM0.12 per Subscription Share as it was necessary to secure the participation of the Subscribers in the Proposed Share Issuance.

The Board wishes to highlight that the Proposed Share Issuance will be subject to the approval of the shareholders of IRIS at an extraordinary general meeting to be convened, the approval of Bursa Malaysia Securities Berhad (“Bursa Securities”) for the listing of and quotation for the Subscription Shares on the ACE Market of Bursa Securities and the approval/consent of any other relevant authorities/parties, if required.

This announcement is dated 20 June 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-7-2018 04:18 AM

|

显示全部楼层

发表于 28-7-2018 04:18 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | IRIS CORPORATION BERHAD (IRIS OR THE COMPANY)DISPOSAL OF THE ENTIRE EQUITY INTEREST IN REGAL ENERGY LIMITED | The Board of Directors of IRIS wishes to announce that IRIS had on 26th July 2018 entered into a Shares Sales Agreement with SPEEDY K-GITAL CO., LTD., a company incorporated in Kingdom of Cambodia to dispose of the equity interests in REGAL ENERGY LIMITED for a total cash consideration of RINGGIT MALAYSIA ONE (RM1-00) ONLY.

Please refer to the attached file for the full text of annoucement.

This annoucement is dated 27 July 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5867201

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2018 04:39 AM

|

显示全部楼层

发表于 28-8-2018 04:39 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 75,811 | 101,049 | 75,811 | 101,049 | | 2 | Profit/(loss) before tax | 3,284 | 6,194 | 3,284 | 6,194 | | 3 | Profit/(loss) for the period | 3,284 | 3,472 | 3,284 | 3,472 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 8,676 | 5,209 | 8,676 | 5,209 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.35 | 0.23 | 0.35 | 0.23 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0826 | 0.0784

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-9-2018 05:23 AM

|

显示全部楼层

发表于 14-9-2018 05:23 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-9-2018 01:53 AM

|

显示全部楼层

发表于 22-9-2018 01:53 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Private Placement | Details of corporate proposal | PRIVATE PLACEMENT | No. of shares issued under this corporate proposal | 494,380,400 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1200 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 2,966,282,862 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 539,602,143.000 | Listing Date | 21 Sep 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-9-2018 05:10 AM

|

显示全部楼层

发表于 25-9-2018 05:10 AM

|

显示全部楼层

Name | DATO' POH YANG HONG | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 21 Sep 2018 | 197,190,200 | Acquired | Direct Interest | Name of registered holder | CIMSEC NOMINEES (TEMPATAN) SDN BHD | Address of registered holder | 17TH FLOOR, MENARA CIMB NO 1 JALAN STESEN SENTRAL 2 KUALA LUMPUR SENTRAL 50470 KUALA LUMPUR | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Acquired via Private Placement | Nature of interest | Direct Interest | Direct (units) | 212,190,200 | Direct (%) | 7.153 | Indirect/deemed interest (units) | 253,718,405 | Indirect/deemed interest (%) | 8.553 | Total no of securities after change | 465,908,605 | Date of notice | 24 Sep 2018 | Date notice received by Listed Issuer | 24 Sep 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-9-2018 07:30 AM

|

显示全部楼层

发表于 25-9-2018 07:30 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 26-9-2018 04:47 AM

|

显示全部楼层

发表于 26-9-2018 04:47 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)Particulars of Substantial Securities HolderName | DATO SRI ROBIN TAN YEONG CHING | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Name & address of registered holder | CIMSEC Nominees (Tempatan) Sdn Bhd17th Floor, Menara CIMB No 1 Jalan Stesen Sentral 2 Kuala Lumpur Sentral 50470 Kuala Lumpur |

| Date interest acquired & no of securities acquired | Date interest acquired | 21 Sep 2018 | No of securities | 247,190,200 | Circumstances by reason of which Securities Holder has interest | Acquired via Private Placement | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 247,190,200 | Direct (%) | 8.333 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Date of notice | 25 Sep 2018 | Date notice received by Listed Issuer | 25 Sep 2018 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|