|

|

【CDB 6947 交流专区】(前名 DIGI)

[复制链接]

[复制链接]

|

|

|

发表于 15-9-2018 05:14 AM

|

显示全部楼层

发表于 15-9-2018 05:14 AM

|

显示全部楼层

4大优势 跑贏同行 数码网络前景佳股价涨

財经 最后更新 2018年09月14日 21时56分

(吉隆坡14日讯)数码网络(DIGI,6947,主板基建股)的业务成长能力、成本效率、强稳基本面以及谨慎的资本管理,都是该公司未来能够跑贏同行的本钱,促使分析员看好该股前景。

数码网络盘中急升3.45%或16仙,至4.80令吉;该股最终以4.78令吉掛收,劲扬3.02%或14仙,是第13大上升股,成交量为412万8600股。

大华继显分析员表示,管理层透露今年將专注提升核心电讯营收的成长,尤其是在后付及中小型企业方面。另外,该公司也將积极削减成本,並提高成本效率。数码网络同时也將专注数码转型,並增加更多来自数据方面的营收。

整体而言,预付业务的竞爭仍然激烈,因此,数码网络也避开国际直拨电话(IDD)价格战,而专注在预付配套的网络业务上,致使该业务营收在次季按年大涨21%,至4亿零500万令吉,相等於预付业务营收的47%。

预付免SST利好

该股在过去6个月下跌5%左右,主要是市场担心电讯公司必须吸纳6%的服务税。惟目前预付配套已確定豁免销售服务税(SST),对公司股价走势而言是好事。

另一方面,在后付业务上,数码网络也计划通过「入门级配套」,来吸引更多预付配套的客户。同时,该公司也升级后付配套,並推出「无国界漫游服务」。

「我们预计公司未来3年净利的年復合率成长(CAGR)將达到5%,主要是服务营收每年4%的成长,以及更好的成本管控所带动。我们也预计公司的息税折旧摊销前盈利(EBITDA)赚幅將企稳在44至45%左右。」

另外,分析员相信,700MHz的光谱预计將在2019年重新分配。数码网络的净负债对EBITDA的比例只有0.7倍,低於同行平均的1.5倍。这有助於公司支付未来的光谱费用。

该公司的资本开销对营收比例也持续升高,目前达到12%的水平。

分析员相信,数码网络將会持续斥资加强建筑物光纤网络设施以及4G-LTE的覆盖网络。

截至上半年,该公司的4G-LTE和LTE-A的覆盖网络达到89%和59.8%,而其全国光纤网络的线路总长度达到8300公里。

分析员认为,马电讯(TM,4863,主板贸服股)通过Webe进军预付配套、经济放缓以及行业內的光谱竞標战,都是数码网络面临的风险。

该分析员给予该股「买进」评级,目標价为5.40令吉。【东方网财经】 |

|

|

|

|

|

|

|

|

|

|

|

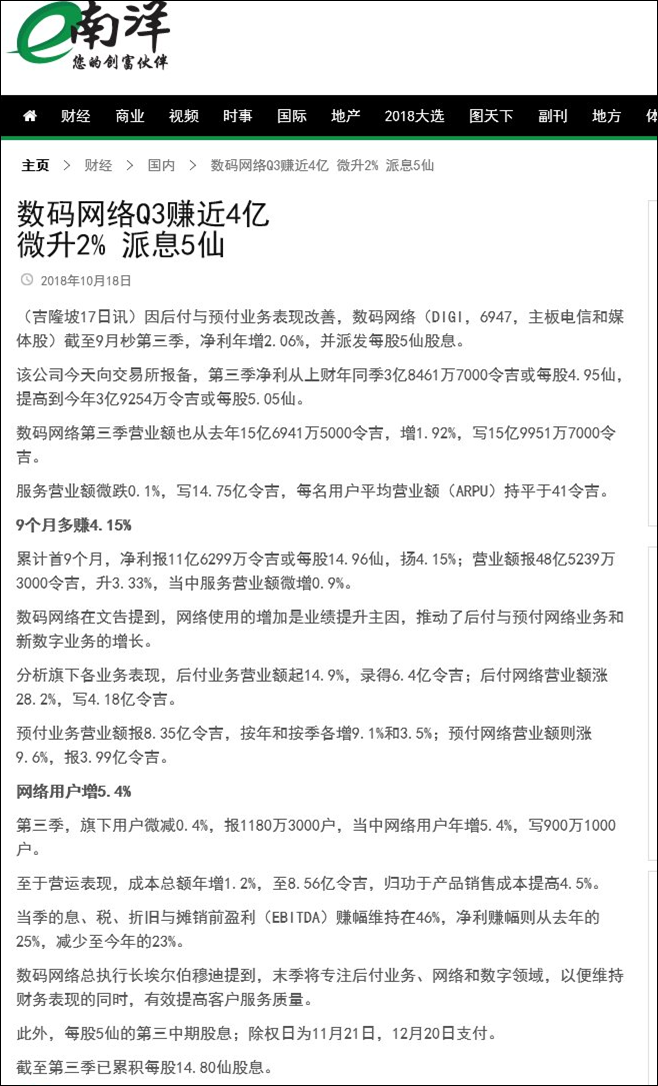

发表于 18-10-2018 05:05 AM

|

显示全部楼层

发表于 18-10-2018 05:05 AM

|

显示全部楼层

本帖最后由 icy97 于 18-10-2018 06:16 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,599,517 | 1,569,415 | 4,852,393 | 4,695,942 | | 2 | Profit/(loss) before tax | 529,103 | 511,219 | 1,561,073 | 1,504,191 | | 3 | Profit/(loss) for the period | 392,540 | 384,617 | 1,162,990 | 1,116,618 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 392,540 | 384,617 | 1,162,990 | 1,116,618 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.05 | 4.95 | 14.96 | 14.36 | | 6 | Proposed/Declared dividend per share (Subunit) | 5.00 | 4.90 | 14.80 | 14.20 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0900 | 0.0700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-10-2018 06:19 AM

|

显示全部楼层

发表于 18-10-2018 06:19 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Digi.Com Berhad - Media Release for Quarterly Results for the Financial Period Ended 30 September 2018 | |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-10-2018 06:20 AM

|

显示全部楼层

发表于 18-10-2018 06:20 AM

|

显示全部楼层

EX-date | 21 Nov 2018 | Entitlement date | 23 Nov 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Third interim tax exempt (single-tier) dividend of 5.0 sen per ordinary share for the financial year ending 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel: 0327839299Fax: 0327839222 | Payment date | 20 Dec 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 23 Nov 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.05 |

|

|

|

|

|

|

|

|

|

|

|

|

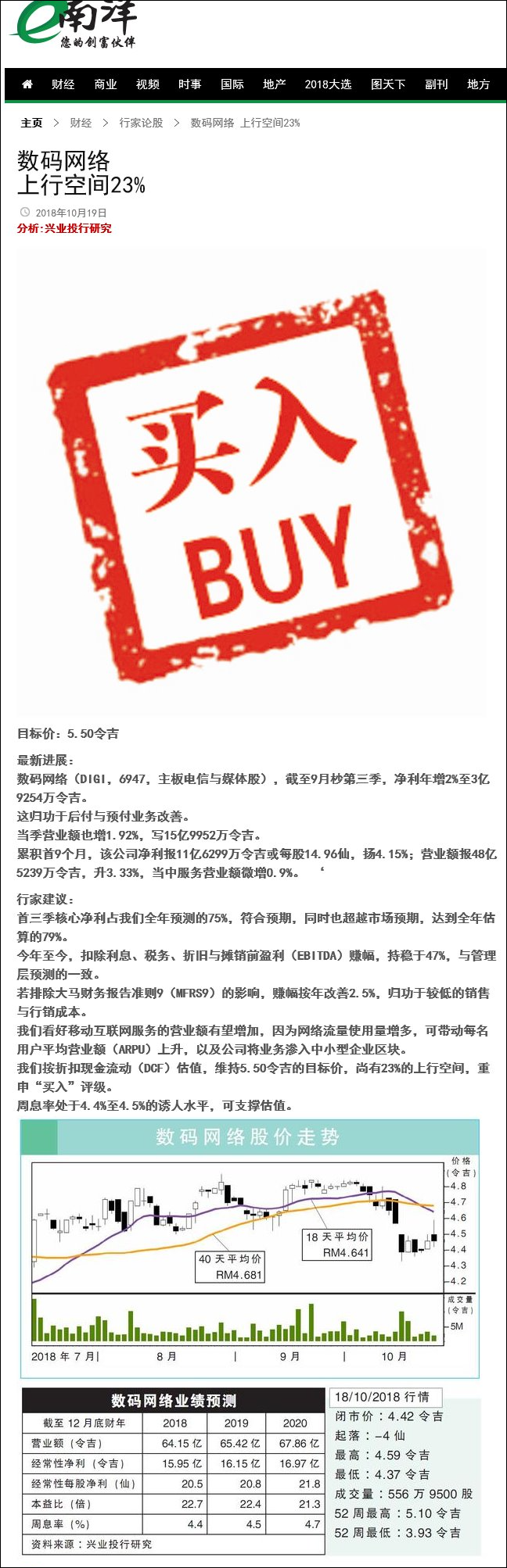

发表于 19-10-2018 07:10 AM

|

显示全部楼层

发表于 19-10-2018 07:10 AM

|

显示全部楼层

本帖最后由 icy97 于 19-10-2018 07:23 AM 编辑

数码网络参与5G试验 未决定拓展光纤业务

財经 最后更新 2018年10月18日 21时39分

(吉隆坡18日讯)数码网络(DIGI,6947,主板电讯媒体股)透露,將会参与布城与赛城的5G试验。而推出5G服务的时间,则要取决于技术、频谱分配、设备和市场准备的情况。但未决定是否涉足光纤业务。

管理层在昨日的分析员匯报会上表示,该公司和挪威电讯公司(Telenor)將参加在布城与赛城进行的5G新无线电(5G NewRadio)试验。

也透露该公司正在评估强制定价標准(MSAP)框架下的潜在机会,並表示它对3500兆赫频谱非常有兴趣。虽然数码网络尚未决定是否要拓展光纤业务,但丰隆投行分析员认为,该公司拥有的8300公里光纤或可在MSAP框架下,为该公司带来新的营收。

分析员表示,「相信MSAP將影响在固定网络,由於移动领域竞爭激烈,料该框架不会影响移动领域。」

数码网络2018財政年第3季(截至9月30日止)净利和营业额分別微增2.1%及1.9%,至3亿9254万令吉和15亿9952万令吉。首9个月,净利和营业额分別上升4.2%和3.3%,至11亿6299万令吉和48亿5239万令吉。

该公司也宣佈派发5仙的的第3次中期股息。2 0 1 8財政年9约,派息达到14.8仙,高於去年同期的14.2仙。

首9个月盈利表现佳,主要因为採用MFRS 15会计准则可认列的客户合同的前期收益较高。

若按之前的会计准则计算,该公司首9个月的净利將按年下跌3%,至7亿1100万令吉,主要归咎於4000万令吉的一次性的网络运营模式转换成本。另外,运营成本降低、服务营业额按年增加1.4%也推动盈利成长。

服务营收平平

管理层依然预测2018財政年的服务营业额成长將平平无奇。该公司也维持4 6 %至4 7 %的扣除利息、税项、折旧及摊销前盈利(EBITDA)赚幅预测。此外,该公司將资本支出占服务营业额的比重范围缩窄至11%至12%(早前比重为10%至12%)。管理层称,「近期成长的推动力包括核心业务成长、预付向后付的转换、高价后付配套的促销、手机数据签购率和智能手机渗透率。」

展望未来,虽然政府近期宣佈了5G愿景,但数码网络管理层认为,现在为此制定资本支出计划,为时尚早,因为5G技术生態和频谱尚未发展完全。

大部份分析员都维持该股「买入」或「守住/中和/与大市同步」的评级,只有达证券和JF艾毕斯分析员双双將评级从「买入」下调为「守住」。

由於首9个月的法定税率较高(按年增加1.2个百分点,至27%),达证券分析员將该公司2 0 1 8至2 0 2 0財政年盈利预测分別下调4%、3.7%和3.5%,至14亿6200万令吉、15亿1600万令吉和15亿9500万令吉,並隨之下修评级和目標价。JF艾毕斯分析员则认为,该股估值过高而下调评级。

此外,大眾投行分析员则认为,由於监管严苛、竞爭激烈,整个电讯领域的用户人均营收(ARPU)难以成长,因此成本撙节是关键。「虽然数码网络一贯在成本撙节方面表现不错,但相信该公司的成本效率提高的空间也有限,因此我们维持『中和』的评级。」

【东方网财经】

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-2-2019 07:48 AM

|

显示全部楼层

发表于 2-2-2019 07:48 AM

|

显示全部楼层

Date of change | 01 Feb 2019 | Name | MR NAKUL SEHGAL | Age | 38 | Gender | Male | Nationality | India | Type of change | Resignation | Designation | Chief Financial Officer | Reason | Resigned from Digi and leaving Telenor Group to rejoin his family in India. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-2-2019 07:48 AM

|

显示全部楼层

发表于 2-2-2019 07:48 AM

|

显示全部楼层

Date of change | 01 Mar 2019 | Name | MISS INGER GLOEERSEN FOLKESON | Age | 37 | Gender | Female | Nationality | Norway | Type of change | Appointment | Designation | Chief Financial Officer |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Masters | Master of Science | Institute of Industrial Economics and technology management, Norwegian University of Science and Technology (2001-2007) | | | 2 | Others | Exchange program | Université de Lausanne (Switzerland), HEC (2004-2005) | |

| | | Working experience and occupation | - Chief Financial Officer ("CFO") and Senior Vice President in Telenor Group Holdings/Digital Businesses (Nov 2017- present)- CFO in Norkring AS (100% owned by Telenor) (March 2016 Nov 2017)- Director Strategy, Telenor Group Strategy (2014-2016)- Director, Group Strategy and portfolio development, Telenor ASA. Business developer and project manager for M&A projects and spectrum valuation (2010 -2014)- Project Manager Operational Efficiency, Telenor Corporate Development (2009-2010)- Business analyst, Telenor Research and Innovation (2007-2009) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-2-2019 03:45 AM

|

显示全部楼层

发表于 8-2-2019 03:45 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,674,718 | 1,644,530 | 6,527,111 | 6,340,473 | | 2 | Profit/(loss) before tax | 518,369 | 481,158 | 2,079,442 | 1,985,350 | | 3 | Profit/(loss) for the period | 377,798 | 360,080 | 1,540,788 | 1,476,698 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 377,798 | 360,080 | 1,540,788 | 1,476,698 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.86 | 4.63 | 19.82 | 18.99 | | 6 | Proposed/Declared dividend per share (Subunit) | 4.80 | 4.60 | 19.60 | 18.80 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0900 | 0.0700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-2-2019 03:48 AM

|

显示全部楼层

发表于 8-2-2019 03:48 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 8-2-2019 03:53 AM

|

显示全部楼层

发表于 8-2-2019 03:53 AM

|

显示全部楼层

EX-date | 27 Feb 2019 | Entitlement date | 01 Mar 2019 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Fourth interim tax exempt (single-tier) dividend of 4.8 sen per ordinary share for the financial year ended 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower AVertical Business Suite, Avenue 3, Bangsar SouthNo. 8, Jalan Kerinchi59200 Kuala LumpurTel:03-27839299Fax:03-27839222 | Payment date | 29 Mar 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 01 Mar 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.048 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-5-2019 06:23 PM

|

显示全部楼层

发表于 6-5-2019 06:23 PM

|

显示全部楼层

(吉隆坡6日讯)数码网络(DiGi.Com Bhd)最大股东挪威Telenor Group与亚通(Axiata Group Bhd)正在就合并亚洲电讯和基础设施资产进行洽谈。

这证实了《The Edge》财经日报今日指两家电讯巨头就合并亚洲业务进行谈判的报道。

数码网络今日发布文告指出,Telenor和亚通将通过一家新的合并公司(MergedCo)进行合并,Telenor将持有多数股权。

[X] CLOSE

Sponsored Content

Men's Fashion Gallery Suria KLCC: First of its kind in Malaysia

Read more on volume_off

pause

fullscreen

根据股权价值,Telenor预计将持MergedCo的56.5%,而亚通将持43.5%,但双方承认这只是初步,会进行调整和精密审核。

Telenor今日向奥斯陆证券交易所报备:“电讯和基础设施资产的潜在非现金结合,旨在打造一家领先、多元化的泛亚电讯公司,业务遍布9个国家,拥有近10亿人口和3亿客户,并成为亚洲最大的流动基础设施公司之一,在亚洲各地经营约6万座电讯塔。”

然而,数码网络称,目前还不能确定这些洽商是否会促成双方达成任何交易协议。

数码网络补充,在完成相关精密审核后,Telenor和亚通将在今年第三季内敲定拟议交易的协议。

Telenor Group主席Gunn Wærsted说:“今日,我们宣布Telenor和亚通正在讨论在亚洲联合起来。目标是共同创建一个领先和多元化的泛亚电讯及基础设施公司,具有巨大的协同潜力和强大的区域业务。”

她补充:“Telenor的策略是从我们在北欧和亚洲地区的核心电讯资产中,开发和创造价值。这一潜在的合并符合董事部和管理层制定的策略。”

配合这项宣布,数码网络和亚通今天暂停交易,上周五分别挂于4.52令吉和4.04令吉。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-5-2019 11:03 PM

|

显示全部楼层

发表于 6-5-2019 11:03 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 20-5-2019 08:03 AM

|

显示全部楼层

发表于 20-5-2019 08:03 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,508,507 | 1,634,531 | 1,508,507 | 1,634,531 | | 2 | Profit/(loss) before tax | 452,572 | 515,018 | 452,572 | 515,018 | | 3 | Profit/(loss) for the period | 341,502 | 386,111 | 341,502 | 386,111 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 341,502 | 386,111 | 341,502 | 386,111 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.39 | 4.97 | 4.39 | 4.97 | | 6 | Proposed/Declared dividend per share (Subunit) | 4.30 | 4.90 | 4.30 | 4.90 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0800 | 0.0900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-5-2019 08:04 AM

|

显示全部楼层

发表于 20-5-2019 08:04 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Digi.Com Berhad - Media Release for Quarterly Results for the Financial Period Ended 31 March 2019 | |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-5-2019 08:04 AM

|

显示全部楼层

发表于 20-5-2019 08:04 AM

|

显示全部楼层

EX-date | 30 May 2019 | Entitlement date | 03 Jun 2019 | Entitlement time | 05:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First interim tax exempt (single-tier) dividend of 4.3 sen per ordinary share for the financial year ending 31 December 2019 | Period of interest payment | to | Financial Year End | 31 Dec 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower AVertical Business Suite, Avenue 3, Bangsar SouthNo. 8, Jalan Kerinchi59200 Kuala LumpurTel:03-27839299Fax:03-27839222 | Payment date | 28 Jun 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 03 Jun 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.043 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-6-2019 06:51 AM

|

显示全部楼层

发表于 16-6-2019 06:51 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Digi.Com Berhad (Digi) - Announcement relating to Telenor ASA's recent announcement on discussions with Axiata Group Berhad regarding a potential non-cash combination of their telecom and infrastructure assets in Asia (Proposed Transaction) | The Board of Directors of Digi (Board) was informed on 5 May 2019 by Telenor ASA (Telenor), the parent company of Digi’s largest shareholder, Telenor Asia Pte Ltd, that Telenor and Axiata Group Berhad (Axiata) are in discussions regarding a potential non-cash combination of their telecom and infrastructure assets in Asia in a new entity, MergeCo, in which Telenor will hold a majority stake.

In a statement to the Oslo Stock Exchange, Telenor has also announced that there is no certainty that these discussions will result in any transaction agreement between the parties.

Please refer to Telenor’s statement to the Oslo Stock Exchange and their press release dated 6 May 2019 for further information regarding the Proposed Transaction.

The Proposed Transaction may have a material impact on our Group, which will depend on the outcome of the on-going discussions between Telenor and Axiata, and various other factors including a due diligence exercise.

The Board has been informed that Telenor and Axiata will work towards finalising agreements in relation to the Proposed Transaction within the third quarter of 2019 following a due diligence exercise, and that the transaction will be subject to approval by their respective shareholders, receipt of regulatory approvals, and other customary terms and conditions.

The Board will make the appropriate announcements in relation to any material development of the Proposed Transaction as may be necessary or required in due course.

Please refer to the attachment below. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6152309

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-7-2019 08:34 AM

|

显示全部楼层

发表于 23-7-2019 08:34 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,548,722 | 1,618,345 | 3,057,229 | 3,252,876 | | 2 | Profit/(loss) before tax | 490,268 | 516,952 | 942,840 | 1,031,970 | | 3 | Profit/(loss) for the period | 392,478 | 384,339 | 733,980 | 770,450 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 392,478 | 384,339 | 733,980 | 770,450 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.05 | 4.94 | 9.44 | 9.91 | | 6 | Proposed/Declared dividend per share (Subunit) | 5.00 | 4.90 | 9.30 | 9.80 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0900 | 0.0900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-7-2019 08:35 AM

|

显示全部楼层

发表于 23-7-2019 08:35 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Digi.Com Berhad - Media Release for Quarterly Results for the Financial Period Ended 30 June 2019 | |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-7-2019 08:35 AM

|

显示全部楼层

发表于 23-7-2019 08:35 AM

|

显示全部楼层

EX-date | 30 Aug 2019 | Entitlement date | 03 Sep 2019 | Entitlement time | 05:00 PM | Entitlement subject | Second interim dividend | Entitlement description | Second interim tax exempt (single-tier) dividend of 5.0 sen per ordinary share for the financial year ending 31 December 2019 | Period of interest payment | to | Financial Year End | 31 Dec 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower AVertical Business Suite, Avenue 3, Bangsar SouthNo. 8, Jalan Kerinchi59200 Kuala LumpurTel:03-27839299Fax:03-27839222 | Payment date | 27 Sep 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 03 Sep 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.05 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-8-2019 02:39 AM

|

显示全部楼层

发表于 19-8-2019 02:39 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|