|

|

【RCECAP 9296 交流专区】RCE资本

[复制链接]

[复制链接]

|

|

|

发表于 21-7-2007 11:36 AM

|

显示全部楼层

发表于 21-7-2007 11:36 AM

|

显示全部楼层

| Organisation Name: | MALAYSIAN RATING CORPORATION | | News Type: | RATING ANNOUNCEMENT | | Reference Site: | None | | Embargo Date: | 02/02/2007 | | Embargo Time: | 05:12 PM | | Expiry Date: | 04/03/2007 | | Priority: | Medium | | Summary: | MARCREAFFIRMS RATINGS FOR RCE PREMIER SDN BHD'S (RCEP) RM45.0 MILLION FIXEDRATE SERIAL BONDS AND UP TO RM50.0 MILLION CP PROGRAMME | | Attachments: | No attachment available. | | Disclaimer: | Members shall strictly adhere to the Rules of FAST 2005 at all times when using FAST. Bank Negara Malaysia shall not be liable in contract, tort or otherwise for any direct, indirect or consequential loss or damage sustained by any members or others due to inaccuracy or error of data/ information disseminated by members via FAST. |

The ratings of RCE Premier Sdn Bhd's (RCEP) RM45.0 million Fixed Rate Serial Bonds and up to RM50.0 million CP programme has been reaffirmed at A/MARC-2 with stable outlook. The rating is supported by, amongst others, the collateral, comprising identified eligible receivables (IER) and cash balances in the designated accounts backing the bonds and CPs, of not less than 1.3 times the total outstanding facility amount; the required substitution of defaulted, delinquent and prepaid IER by RCE Marketing Sdn Bhd (RCEM); adequate cashflow protection during the tenure of the programme; as well as low job transfers and resignations in the public sector. Nonetheless, RCEM's high debt leverage position resulting from the rapid expansion of its financing business through external funding and the ensuing pressure on profit margins, continue to be moderating factors.

RCEP is a special purpose company wholly owned by RCEM, incorporated for the purpose of purchasing selected portfolios of IER from RCEM. The IER consist of scheduled repayments (principal plus interest) of consumer and personal loans financing disbursed to government servant members of Koperasi Belia Nasional Berhad (KOBENA) and Koperasi Sejati Berhad (KSB). The sale of the various portfolios of IER from time to time is by way of an absolute legal assignment of all of RCEM's rights, title and interest in, to and under the IER.

RCEM, as the servicer under the transaction; administers and monitors collections from ANGKASA. Monies in the cooperatives' accounts are directly remitted to RCEP's master collection account. As at 31st October 2006, the outstanding bonds and CPs of RM35 million and RM16 million, respectively, were backed by outstanding IER of RM45.0 million and balances in the designated accounts totalling RM16.4 million, thus satisfying the collateral cover requirement of 1.3 times. During the period under review (October 2005 to September 2006), actual collections exceeded scheduled collections on average, mainly due to prepayments and timing differences in payments received; the latter arising from double deductions in some months. MARC notes that the delinquent IER were mainly technical in nature brought about by the time lag between the date the loan is disbursed and the first instalment payment, which could extend up to four months. The average monthly prepayment, default and delinquency rates during the period were relatively low but demonstrated a rising trend compared to the previous corresponding period. Higher prepayments were attributed to intensifying competition in the personal loan financing market as refinancing activity grew among borrowers who were in search of better terms of interest and longer loan tenures.

Credit risk under the transaction partly hinges on the financial standing of RCEM, as credit support is provided for defaults and prepayments by way of substitution with performing IER. Therefore, RCEM's ability to generate new receivables to be made available for substitution is critical to this transaction. Nevertheless, the noteholders benefit from the undertaking by RCEM to top up any shortfall in the sinking fund account as well as a corporate guarantee from RCE Capital Berhad (RCEB).

RCEM is principally involved in the provision of personal loans to cooperative members and trading of electrical home appliances and other consumer durable products mainly on hire purchase terms. RCEM's debt leverage as at 31st October 2006 stood at 2.8 times and is expected to remain high following further issuances under the programme and under its other subsidiary, RCE Advance Sdn Bhd's RM420 million Fixed Rate Medium Term Notes Facility. Barring any deterioration in asset quality of the various portfolios of IER beyond MARC's expectation and unfavourable conditions in the personal loan financing market which may restrict RCEM's ability to generate new receivables for substitution, the rating outlook remains stable.

https://fast.bnm.gov.my/fastweb/public/PublicInfoServlet.do?chkBox=2007020200032&mode=DISPLAY&info=NEWS

[ 本帖最后由 Mr.Business 于 21-7-2007 11:42 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2007 11:38 AM

|

显示全部楼层

发表于 21-7-2007 11:38 AM

|

显示全部楼层

| Organisation Name: | MALAYSIAN RATING CORPORATION | | News Type: | RATING ANNOUNCEMENT | | Reference Site: | None | | Embargo Date: | 24/02/2006 | | Embargo Time: | 11:00 AM | | Expiry Date: | 10/03/2006 | | Priority: | Medium | | Summary: | MARCAFFIRMS THE RATINGS OF A TO RCE PREMIER SDN BHD'S RM45.0 MILLION FIXEDRATE SERIAL BONDS AND MARC-2 TO RM50.0 MILLION UNDERWRITTEN COMMERCIALPAPERS FACILITY | | Attachments: | No attachment available. | | Disclaimer: | Members shall strictly adhere to the Rules of FAST 2005 at all times when using FAST. Bank Negara Malaysia shall not be liable in contract, tort or otherwise for any direct, indirect or consequential loss or damage sustained by any members or others due to inaccuracy or error of data/ information disseminated by members via FAST. |

MARC has affirmed RCE Premier Sdn Bhd's (RCEP) ratings of RM45.0 million Fixed Rate Serial Bonds at A and RM50.0 million Underwritten Commercial Papers at MARC-2. The ratings reflect the overcollateralisation (OC) ratio of 1.3 times over the identified eligible receivables (IER) purchased by RCEP maintained at all times; provision for substitution of defaulted IER and/or early settlement with performing IER by RCE Marketing Sdn Bhd (RCEM); adequate cashflow protection during the tenure of the Facilities; and low job transfers and resignations in the public sector. These positives are, however, moderated by the historically high debt leverage position and historically moderate profitability of RCEM Group. Nevertheless, MARC notes that the Group demonstrated strong earnings growth over the last two financial years.

RCEP, a special purpose company, is a wholly owned subsidiary of RCEM, incorporated for the purpose of purchasing IER from RCEM. The IER comprise of scheduled repayments of consumer and personal loans financing disbursed to government servants who are members of Koperasi Belia Nasional Berhad (KOBENA) and Koperasi Sejati Berhad (KSB). At closing, RM45 million bonds and RM22 million CPs were drawndown for the purchase of RM58.5 million and RM28.6 million IER respectively. The sale of the receivables was by way of an absolute legal assignment of all of RCEM's rights, title and interest in, to and under the receivables.

The principal activities of RCEM are provision of personal loans to members of cooperatives and that of trading in electrical home appliances and other consumer durable products mainly on hire purchase terms. RCEM is a 87.5% subsidiary of RCE Capital Berhad (RCEB).

Under the transaction, the servicer function is undertaken by RCEM with the primary responsibility of administering and monitoring collections from ANGKASA. Monies in the cooperatives' accounts are directly remitted to RCEP's Master Collection Account. As at 30 September 2005, being the first year anniversary from issuance, the outstanding bonds and CPs stood at RM45 million and RM29 million respectively. The outstanding IER represented by the bonds and CPs were RM43.8 million and RM32.7 million respectively and the balance in the designated accounts were RM11.6 million and RM4.4 million respectively.

Based on the repayment schedule during the first year, MARC found that on average, actual collections exceeded the scheduled collections mainly due to prepayments and timing difference in payments received, the latter arising from double deductions in some months. The average monthly delinquent rate of the IER funded by the bonds and CPs was minimal at 0.07% and 0.06% respectively, whereas, the average monthly default rate was 1.6% and 1.7% respectively. Nevertheless, due to the time lag between the first instalment payment and the date the loan is disbursed, the IER would typically feature arrears of three to four months at the point of sale to RCEP. As such, it can be surmised that a fair proportion of the delinquent and defaulted IERs resulted from technical delinquencies and not an indication of the borrower's weak repayment capability. MARC noted that the prepayment rates recorded significant increase in the second half of the first year, averaging at 30% and 25% against total actual collections of the IER funded by the bonds and CPs respectively. This was primarily due to the competitive personal loan financing market in terms of interest rates on loans and longer loan tenures.

The requirement to substitute delinquent, defaulted and prepaid IERs on a monthly basis by RCEM, ensures that the minimum OC ratio is maintained thus sufficiently mitigating liquidity risk. Credit risk is mitigated, as financing is extended only to government servants subject to meeting a specified set of criteria.

RCEM group's debt leverage stood at 0.9 times as at 31 March 2005 and is expected to remain high following further issuance of the present Facility under RCEP and RCE Advance Sdn Bhd's RM420 million Fixed Rate Medium Term Notes. Nonetheless, MARC notes that this is in line with the growth of RCEM's financing business. RCEP's projections are fairly moderate throughout the tenure of the Facilities with average and minimum debt service coverage ratios (DSCR) at 3.38 times and 1.58 times.

https://fast.bnm.gov.my/fastweb/public/PublicInfoServlet.do?chkBox=2006022400017&mode=DISPLAY&info=NEWS

[ 本帖最后由 Mr.Business 于 21-7-2007 11:42 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2007 11:59 AM

|

显示全部楼层

发表于 21-7-2007 11:59 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2007 12:09 PM

|

显示全部楼层

发表于 21-7-2007 12:09 PM

|

显示全部楼层

RCE与合作社有很重要的合作关系。

2007/07/20

Opinion: Shaping up the co-operative movementBy : JENNIFER GOMEZ

Contributions to the CDA and CLF belong to the movement, says Angkasa general manager Nasir Khan Yahya.

The new Co-operatives Commission, passed by parliament in April, seeks to regulate co-operatives. But the verdict of a recent forum of co-operative societies was that ‘flaws’ in the new commission need to be rectified, writes JENNIFER GOMEZ

THE government recognises the co-operative movement as the third sector of the economy, after the public and private sectors. As at Dec 31, the movement’s 5,861,000 members in 4,918 co-op societies had generated RM7.359 billion in share capital with fixed assets of RM38.38 billion.

But all’s not well with the movement, still shakily recovering from the mismanagement and corruption scandals of the 1980s.

The new Co-operatives Commission, passed by parliament in April and now awaiting royal assent, seeks to oversee and regulate co-operatives under the Co-operatives Act 1963, which is also under amendment. But the verdict of a recent forum of co-operative societies was that "flaws" in the new commission need to be rectified.

Datuk Yidris Abdullah, the former secretary-general of the Land and Co-operative Development Ministry (now the Entrepreneur and Co-operative Development Ministry), moderated the panel session, which was organised by Shun Thuraisingham, a co-operative consultant.

The 50-odd participants were told that the details of the Co-operatives Commission had come as a surprise, especially the 26 areas of prosecution for those found in breach of co-operative laws. One of the panel speakers described this as "too severe", warning that it could cause officers of co-operative societies, many of whom held positions voluntarily, to shy away from top posts.

They also criticised the National Co-operative Organisation of Malaysia (Angkasa) for failing in its role as an apex body by not informing its members of the changes to come.

"According to the ministry, Angkasa was consulted on the proposed changes and inclusions, but we the members were kept in the dark," said one panel speaker.

The government should also stop scrounging from co-operative societies, Thuraisingham said. He claimed that more funds had been set up that required contribution from co-op societies under the new law.

"As it is, we have not been told how our contributions to two existing funds have been utilised."

Thuraisingham was referring to the Co-operative Development Trust Fund (CDTF) and the Co-operative Education Trust Fund (CETF).

The "new" funds referred to were the Co-operative Deposit Account (CDA) and the Central Liquidity Fund (CLF).

Under the new law, co-operative societies must now park their monies in their own statutory reserve fund and any other "excess" monies into the CDA.

Thuraisingham said the monies in their reserve fund were commonly used for investment, and parking it in the CDA would curtail their ability to grow their returns.

All these are valid concerns, especially since they affect Malaysians in the lower-income group and senior citizens.

Such stringent laws have come into play as a consequence of the collapse of the Central Co-operative Bank in the 1980s, which took with it many other co-operatives that had dealings with CCB. Many co-ops continue to be victims of mismanagement and misappropriation of funds by board members.

Questions sent to the ministry seeking clarification on the issues raised at the forum went unanswered, but Angkasa representatives were willing to tell the New Straits Times their side of the story.

Addressing the main issue of the severe penalties, Angkasa deputy president Prof Dr Mohd Ali Baharum said "there was nothing to worry about if co-op society leaders played by the book".

As for monies paid into the CDTF (which requires a one per cent contribution from co-op societies’ net profits) and the CETF (a two per cent contribution), Angkasa general manager Nasir Khan Yahaya explained that both were handled by committees appointed by the ministry.

"We request finances to fund our educational programmes from the CDTF through the committee," Nasir said. "We have nothing to do with the CETF that is used to run the Co-operative College of Malaysia.

"In all, only three per cent is going out of their coffers for the good of the movement as a whole."

Contributions to the CDA and CLF, Nasir said, would belong to the movement but be held in trust by the ministry for better usage.

The CLF, for example, would be used to help co-operative societies with liquidity problems as a last resort. And only large co-op societies and credit co-operatives need to contribute to the CLF.

Co-ops that need funds for investment purposes, meanwhile, could borrow from the CDA.

"At the end of the day, the interest earned from lending activities sourced from these two funds would filter back to co-op societies by way of returns on savings," Nasir explained.

And why were Angkasa members not kept in the loop of the changes to come? Ali said it was not their place to do so prematurely. "Even now, it has not received royal assent. When that is done, Angkasa will undertake programmes to orientate our members on how to deal with the changes."

On allegations that the members’ concerns and input were not solicited before Angkasa members went to the negotiating table to deliberate on the new act, Ali explained that as an apex body, it was aware of the issues faced by members as these were constantly raised at annual general meetings.

"For instance, our members had told us before that they wanted a fund set up as a back-up in case certain co-operatives need finances, and that is how the CDA and the CLF came to be."

Seen in this light, it is premature to fear that the Co-operative Commission and the amendments to the Co-operative Act 1963 might stifle the industry.

Clearly the "splinter group" at the forum had good intentions, with their call for de-regulation instead of over-regulation of the movement.

"It will be imperative for the guardians of the Co-operative Commission, especially those who will be looking after the CDA and CLF, to ensure that all contributing societies are given the same treatment when the time comes for them to dip into these funds.

"Transparency must be the keyword here."

In the meantime, it may be a good idea for co-op societies to first play by the new rules before they can cast their verdict. After all, there is provision in the law for the minister to "implement it accordingly".

http://www.nst.com.my/Current_News/NST/Friday/Columns/20070720074421/Article/index_html

[ 本帖最后由 Mr.Business 于 21-7-2007 12:14 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2007 12:46 PM

|

显示全部楼层

发表于 21-7-2007 12:46 PM

|

显示全部楼层

原帖由 Mr.Business 于 21-7-2007 10:40 AM 发表

June 4, 2007

Furthermore, RCE faces much less risk in its debt assets than banks because civil servants repay the loans through salary deduction. RCE experiences a very low default rate. It is therefore safe for it to expand and that is seen in its loans growth, with receivables rising 40% from Q4 last year to RM369mil in Q4 this year. Goldman Sachs saw this potential too and, with additional share purchases at the end of last month, raised its stake to 8.3% in RCE.

http://biz.thestar.com.my/news/story.asp?file=/2007/6/4/business/17912564&sec=business

其实也有银行 (人民银行Bank Rakyat, Bank Simpanan Nasional)是通过ANGKASA扣除向银行借贷的公务员的薪金。

http://www.bankrakyat.com.my/index.php?ch=6&pg=26&ac=2533〈=en

http://www.bankrakyat.com.my/index.php?ch=6&pg=26&ac=8〈=en

http://www.bsn.com.my/1-BPA.html

而且这两间银行的借贷利率还低过RCE,

Bank Rakyat的个人贷款的年利率是大约6.8%-7.8%。

http://www.bankrakyat.com.my/index.php?ch=18&pg=75&ac=236&lang=en

Bank Simpanan Nasional的个人贷款的年利率是大约5.6%-6.0%。

http://www.bsn.com.my/1-SPISPDiBPA.html

RCE的个人贷款的年利率却是15.8%!

RCE有什么强处可以让公务员向她借钱,而不向Bank Rakyat或Bank Simpanan Nasional借呢?

[ 本帖最后由 Mr.Business 于 21-7-2007 12:59 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2007 01:08 PM

|

显示全部楼层

发表于 21-7-2007 01:08 PM

|

显示全部楼层

RCE的竞争对手-MOCCIS

Koperasi Pegawai-Pegawai Melayu Malaysia Berhad (MOCCIS) atau dahulunya dikenali sebagai Malay Officers Cooperative Credit And Investment Society (MOCCIS) adalah sebuah koperasi dan badan pelaburan utama bagi Pegawai-Pegawai Melayu di perkhidmatan awam dan sektor swasta. Matlamat utamanya ialah untuk menggalakkan penyimpanan dan pelaburan bagi jangka panjang bagi pihak anggota. Keutamaan MOCCIS adalah membuat pelaburan dengan modal yang diperolehi melalui anggota MOCCIS dan melalui kemudahan pinjaman dari institusi kewangan.

Bangunan MOCCIS

Aktiviti perniagaan MOCCIS pula tertumpu kepada peningkatan keuntungan dan memenuhi keperluan negara dari segi perkhidmatan dan barangan dengan strategi perniagaan yang diatur rapi oleh pakar-pakar pengurusan yang diketuai oleh Pengerusi Anggota Lembaga iaitu Yg. Bhg. Tan Sri Datuk (Dr.) Arshad b. Ayub.

Ditubuhkan pada 4hb. Julai, 1934 dan MOCCIS mempunyai pengalaman yang luas dalam bidang pelaburan. Pada masa kini MOCCIS merupakan salah sebuah koperasi terbesar di Malaysia yang telah menyahut seruan Perdana Menteri kita untuk menjadikan sektor koperasi sebagai penyumbang ke arah pembangunan ekonomi Malaysia.

MOCCIS kini mempunyai anak syarikat dan beberapa syarikat usahasama yang terlibat dalam pelbagai aktiviti, seperti pendidikan, penjualan barang melalui skim ansuran Murabahah, perladangan kelapa sawit, perkilangan, kewangan dan hartanah.

http://www.moccis.org.my/mak-korp.htm

AKTIVITI PERNIAGAAN

Membuat kutipan deposit dan yuran bulanan anggota MOCCIS serendah RM50.00 sebulan. MOCCIS juga menyediakan kemudahan pembiayaan melalui Skim Pembiayaan Al-Aslah (peribadi) dan Skim Pembiayaan Al-Falah (pendidikan) mulai bulan Mei 2003. Manakala bagi Skim Pembiayaan Al-Manzur (pembelian barangan) telah dimulakan pada Mei 2004.

......

http://www.moccis.org.my/ak-labur.htm

Skim Pembiayaan Al-Aslah dan Skim Pembiayaan Al-Falah

Pembiayaan mengikut hukum syarak dengan had maksimum sehingga RM 50,000.00 dan tempoh bayaran balik pembiayaan sehingga 7 tahun untuk kedua-dua skim [Al-Aslah (peribadi) dan Al-Falah (pendidikan)]. Caj yang dikenakan juga adalah berpatutan.

http://www.moccis.org.my/ahli-faedah.htm

[ 本帖最后由 Mr.Business 于 21-7-2007 01:09 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2007 01:18 PM

|

显示全部楼层

发表于 21-7-2007 01:18 PM

|

显示全部楼层

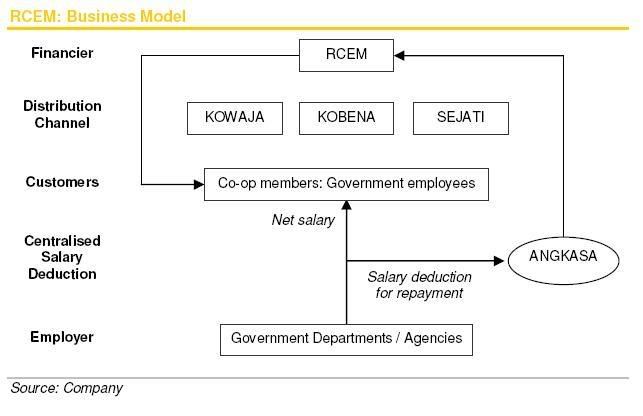

RCE通过以下合作社扣除向公务员提供个人贷款。

1. Koperasi Belia Nasional Berhad (KOBENA)

2. Koperasi Sejati Berhad (KSB)

3. Koperasi Wawasan Pekerja-Pekerja Bhd (KOWAJA) |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2007 01:21 PM

|

显示全部楼层

发表于 21-7-2007 01:21 PM

|

显示全部楼层

KOBENA合作社

KOBENA is one of the premier co-operative societies in the country. With more than 50,000 members throughout the country, we are the leading body entrusted to pursue youth aspirations. Being a co-operative society, KOBENA is ever ready to serve and always willing to listen to members prime concerns. Hard work and resilience are our roots that helped us achieve our success. We are proud to play a significant role and make contribution for the success of our country’s economic growth and prosperity.

KOPERASI BELIA NASIONAL BERHAD (KOBENA) was registered on November 26, 1976 under the Co-operative Ordinance 1948. The Youth Business Program, a section of Ministry of Cultural, Youth and Sports, inspired the formation with reason being to improve prestige and expertise of Bumiputera youth. Since then KOBENA has evolved and new development has taken its cause making KOBENA committed to face future challenges.

At the end of 1990, KOBENA formed a new management team with commendable support from the Ministry of Land and Co-operative Development. The new management team was honored to continue achievement and maintain competitiveness. It is the intention of our government that co-operative society is to become the third economic sector in the country. In line with that objective, we carry our duties with pride and assured commitment.

During the foundation of KOBENA, the business interest are in trading, development, construction, housing and industry. Other activities include transportation, warehousing and insurance. KOBENA also expand its activities by providing youth skill training held at National Youth Training Institute (IKBN), Pontian, Johor. KOBENA also expand its activities in the area of schools and hospitals development, plantation, building low cost housing especially to cater the needs of low and middle income group and involved in government privatization projects.

http://www.kobena.com.my/introduction.htm

KOBENA PERSONAL LOAN SCHEME (SKIM PEMBIAYAAN PERIBADI KOBENA)

Skim Pembiayaan Peribadi Kobena (SPPK) was launched on the 9th August 2002. This scheme offers personal loan to all members working in government or semi government and statutory body through salary deduction with Angkasa. The scheme offers loan up to RM 30, 000 upon eligibility of the member. At the moment Kobena have more than 10 branches throughout Malaysia & members can obtained all the information through our branches.

http://www.kobena.com.my/trading.htm

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2007 03:01 PM

|

显示全部楼层

发表于 21-7-2007 03:01 PM

|

显示全部楼层

RCE的大股东名单:

Tan Sri Azman Hashim 41.46%

HSBC Holdings plc 5.925%

JPMorgan 5.42%

Goldman Sachs 8.35%

总持股:61.155%

[ 本帖最后由 Mr.Business 于 23-7-2007 10:43 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2007 03:16 PM

|

显示全部楼层

发表于 21-7-2007 03:16 PM

|

显示全部楼层

回复 #89 Mr.Business 的帖子

大大请问哪里可以找到最update的大股东资料?

(不只是9296。。。。。其他的公司的) |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2007 03:24 PM

|

显示全部楼层

发表于 21-7-2007 03:24 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2007 03:36 PM

|

显示全部楼层

发表于 21-7-2007 03:36 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2007 10:44 AM

|

显示全部楼层

发表于 22-7-2007 10:44 AM

|

显示全部楼层

120萬公務員獲調薪

首相:調幅拉近高低薪差距

updated:2007-05-07 20:00:04 MYT

■首相宣佈,全國120萬名公務員將獲應得的調薪。

(布城訊)全國120萬名公務員將獲得加薪!

首相拿督斯里阿都拉今日(週一,7日)在作出這項宣佈時說,這是公務員們應得的。

他強調,政府在制訂公務員的調薪方程式時,高低級公務員薪金的差距問題將受到考慮,因為高生活水平已對低收入者帶來壓力。

他說:“公務員們應該獲得加薪,但是,加多少只有公共服務局總監丹斯里依斯邁知道。”

阿都拉表示政府迄今還未知公共服務局的調薪建議;不過,一旦建議獲得詳盡探討後,他就會公佈詳情。

顧及國家財務狀況

他在出席首相署常月集會時,一開始就提到公務員最關心的調薪課題。他表明選擇在集會上提此事,因為他瞭解到公務員不要聽其他的課題。

這是政府首次給予公務員肯定的調薪承諾;在這之前,政府只表示還在研究調薪事宜。

首相強調,在鑑定公務員調薪時,政府也必須顧慮到國家的財務狀況。

他說,有人說很久沒有調薪了,一些人則說公共傳遞服務系統還未提昇,怎樣可以調薪?也有人說因為生活成本日愈提高,薪水應該提高。

他說,政府瞭解到公務員已很久沒有調薪,但是,政府已發出一些津貼包括生活成本津貼,以減輕公務員的負擔。

促公務員改善服務

首相也呼吁公務員改善和提高服務素質,並著重於有效、精確和公正的執行任務,以使國家發展更具動力。

他認為公務員不能自行決定要處理10份文件或多少封上訴信;事實上,堆在案前要處理的文件和信件多不勝數。

阿都拉較後在吉隆坡會展中心為2007年世界回教徒可食用食品論壇(World Halal Forum)主持開幕後說,政府在制定和調整公務員薪金時,將致力於拉近低薪公務員與高薪公務員之間鴻溝。

他說,如果公務員薪金的水平出現鴻溝,並不是好事。

新聞背景:

公務員薪金多次調整

全國公共及民事僱員職工總會和政府協議,公務員新薪金制在1992年1月1日開始推行時,說明每5年檢討公務員薪金。

1994年9月,該會基於低級公務員薪金偏低,獻議加薪120億令吉。這項談判拖延了16個月才達致協議,雙方接受公務員加薪20億令吉的方案,由1995年1月1日開始追薪。

在這項獻議加薪下,84萬9586名公務員獲得加薪將近20%,低級公務員獲益最多,D級公務員加薪160令吉,加幅29至41%、C級公務員加薪12至15%、B級公務員的加薪幅度是8至10%、A級公務員加薪2.5至5.8%。

1996年4月,公務員獲得額外加薪20至50令吉;1999年6月5日宣佈5個法定機構的1萬多名僱員調整薪金150至200令吉,並由1995年1月1日追算起。

另外,前首相敦馬哈迪在2002年11月1日推行大馬薪金制(Sistem Saraan Malaysia)取代公務員新薪金制(SSB),所有公務員調薪15至110令吉。

政府在這幾年對公務員的薪金也進行多次調整,包括在2000年及2001年加薪10%。 (星洲日報‧2007.05.07)

http://www.sinchew.com.my/content.phtml?sec=1&artid=200705070905

XXXXX

Monday May 21, 2007

Govt servants get big raise

PUTRAJAYA: Government servants will get a pay raise of between 7.5% and35%, effective 1 July, Prime Minister Datuk Seri Abdullah Ahmad Badawi announced Monday.

The cost of living allowance will also be increased by 100%, he said.

Members of the police and the armed forces will receive 20% over and above the announced increase in pay.

http://thestar.com.my/news/story.asp?file=/2007/5/21/nation/20070521131733&sec=nation

XXXXX

Friday May 11, 2007

Affordability a factor in pay rise quantum for government servants, say PM

By DEVID RAJAH

PUTRAJAYA: The Government and the country's 1.2 million public servants, who have been promised a pay rise, will have to be realistic over the quantum of increase, Datuk Seri Abdullah Ahmad Badawi said.

The Prime Minister said affordability was a factor when deciding the quantum of the pay increase for government servants.

“We are considering various options. At the same time, we have to be realistic in terms of financial affordability,” he told newsmen after a Cabinet committee meeting on the establishment and salaries for the public service here yesterday.

The meeting, chaired by Abdullah, was also attended by Housing and Local Government Minister Datuk Seri Ong Ka Ting and Chief Secretary to the Government Tan Sri Mohd Sidek Hassan.

Abdullah said no decision had been made on the quantum of salary revision or increase.

“Being realistic is the most important factor as far as we are concerned,” he said, adding that the meeting also covered issues pertaining to the performance and productivity of civil servants besides the need to reward them.

On whether a decision on the increase would be made in time for the public sector Workers Day gathering on May 21, Abdullah said: “It depends.”

The Prime Minister had said on Monday that government servants would get a pay increase because they deserved it.

......

http://thestar.com.my/news/story.asp?file=/2007/5/11/nation/17694044&sec=nation

[ 本帖最后由 Mr.Business 于 22-7-2007 10:50 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2007 10:46 AM

|

显示全部楼层

发表于 22-7-2007 10:46 AM

|

显示全部楼层

原帖由 goodluck88 于 21-7-2007 03:36 PM 发表

bursa的网站有吗?怎么我找不到的??

来这里:

http://www.bursamalaysia.com/website/bm/listed_companies/company_announcements/changes_in_s_holding/ |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2007 10:51 AM

|

显示全部楼层

发表于 22-7-2007 10:51 AM

|

显示全部楼层

原帖由 cct2048 于 24-5-2007 03:33 AM 发表

公务员加薪受惠股项: RCE 资本贷款业务受益 2007/05/23 10:40:35 ●南洋商报

分析员披露,RCE 资本(RCECap,9296,二板贸易服务股)主要客户为公务员。截至2007年财政年的首9个月内,其贷款及分期付款业务,激增78%至3亿4千900万令吉。因此,公务员获加薪,该公司的贷款业务将进一步受益。

分析员指出,在2007年财政年首3季,该集团净利按年飙升145%至3千零50万令吉,若保持首3季的收益走势,其全年净利可能达4千350万令吉。

该证券行指出,该公司2008年财政年,将从2007年财政年较好的贷款表现取得收获,因此,预计会有双位数的增长。以每股84仙的价格计算,该股目前以2007年财政年12.5倍的本益比进行交易,根据其贷款帐面的增长,其本益比很容易下降至单位数。

分析员表示,目前,他们不给予该股任何评级,但是,他们认为,以目前的发展来看,该股还有上涨空间。

<RCECAP (9296) 戏演完了?>

http://chinese2.cari.com.my/myfo ... ;page=2#pid28584226 |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2007 10:54 AM

|

显示全部楼层

发表于 22-7-2007 10:54 AM

|

显示全部楼层

原帖由 goh772003 于 31-5-2007 07:37 PM 发表

Thursday, May 31, 2007

Goldman Sachs acquired additional shares in RCE

High profile foreign investment fund, Goldman Sachs acquired another 2,200,000 shares of RCE Capital Berhad.Goldman acquired the shares after RCE announced another good quarter result on 22 May. Filing to Bursa Malaysia shows that they acquired on 23 May (1.40mil units), 24 May (1.13mil units) and 25 May (0.67mil units). After these acquisitions, Goldman Sachs holds 54mil shares of RCE. This represents a total of 8.35% of total paid-up shares of the company.

The trading price range of the above 3 days is from RM0.82 to RM0.89.Goldman is comfortable to add weight in this company at the mentioned range. Once again, looking at the investment track records of Golman, I am very confident that RCE stock price will grow to another higher level. It closed at RM0.81 today and this should be a very attractive price for value investors to buy in now.

Will RCE stock price increase like E&O or AsiaEp?

<RCECAP (9296) 戏演完了?>

http://chinese2.cari.com.my/myfo ... ;page=2#pid28841293 |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2007 10:57 AM

|

显示全部楼层

发表于 22-7-2007 10:57 AM

|

显示全部楼层

原帖由 Mr.Business 于 21-7-2007 12:46 PM 发表

RCE的个人贷款的年利率却是15.8%!

RCE有什么强处可以让公务员向她借钱,而不向Bank Rakyat或Bank Simpanan Nasional借呢?

sogrlcc兄的看法能说明RCE的竞争能力吗?

原帖由 sogrlcc 于 7-6-2007 05:36 PM 发表

我是政府公务员。经常看到koperasi的借贷传单派来派去,通常都是友族在借贷。然而RCECAP提供的利息是最高之一,并非公务员的首选。Bank Rakyat的利息会比较低。

我相信RCECAP还是有潜能的。所谓狗急跳墙,不少公务员为了快拿钱还是愿意付高利息的。

紧接下来的好消息会是10亿的ABS和涉入SMEs的借贷。

合法的大耳聋,景不景气都是袋袋平安。更何况是加薪后公务员的钱特别好赚。

<RCECAP (9296) 戏演完了?>

http://chinese2.cari.com.my/myforum/viewthread.php?tid=862599&page=2#pid29101671

[ 本帖最后由 Mr.Business 于 22-7-2007 11:21 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2007 10:57 AM

|

显示全部楼层

发表于 22-7-2007 10:57 AM

|

显示全部楼层

RCE的强处:

1. Quick response time/ Short loan disbursement time (24-48 hours);

2. Products are "sold" rather than "bought"/ Its external marketing network consists mainly of highly incentivized cooperative members who may already be customers themselves;

3. Wide-ranging delivery network (60 co-op branches and 300 agents)/ Have established relationship with the cooperatives;

4. The ability to give pre-approved loan advances.

这些feature能为RCE建立强大的moat (不可超越的优势)吗?

[ 本帖最后由 Mr.Business 于 22-7-2007 11:20 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2007 10:59 AM

|

显示全部楼层

发表于 22-7-2007 10:59 AM

|

显示全部楼层

公务员下月正式加薪 RCE资本料从中受惠 2007/06/15 18:29:59

●南洋商报

(吉隆坡15日讯)我国公务员将于7月1日起正式获得加薪,专为公务员提供私人贷款的RCE资本(RCECap,9296,主板贸服股),有望从中受惠。

亚欧美投资银行指出,在过去数年来,该公司的放贷总额取得显著的增长,从截至2002年3月份的6千800万令吉,于2007年3月份增至5亿零100万令吉。

借贷市场250亿

分析员表示,我国的合法个人贷款或消费贷款市场总值250亿令吉,所以该公司还有很多机会去争取市场份额,而公务员加薪预料可加强该公司的业务。

该公司是透过独资子公司RCE行销和3家合作机构--KOWAJA、SEJATI及青年合作社(KOBENA)合作,为公务员提供个人贷款及分期贷款。

目前RCE行销共有3万5千名会员,平均贷款额为1万7千令吉,偿还期限为8年;最高贷款额为10万令吉,最高偿还期限为10年。

RCE行销计划在中期内透过和其他合作机构的合作来提高分发网络,同时也计划把个人贷款服务提供予官联机构、上市公司及跨国公司。

该公司的商业模式独特之处在于其分发与回收系统,所有贷款偿还是从每个月的薪金中扣除,以减低呆帐率(低于3%)。

在2006财年,该公司的储备金总额为5千600万令吉,或等于主要呆帐的17%。

征收15.8%利息

分析员指出,尽管该公司征收高达15.8%利息,比一般的金融机构还要高,惟其核心竞争力就是广泛的递送网络及短期的贷款偿还期限。

该公司所面对的风险计有(1)目前和合作机构实行的征收贷款事务出现变动、(2)来自银行等机构的竞争、(3)出现类似商业模式的新业者及(4)不适宜的条例。

分析员说:“尽管如此,随着经济成长及公务员拥有更好的消费能力,我们估计该公司在近期至中期内的业务前景一片光明,借款额将继续取得增长,预料可在2008财年及2009财年将分别取得30%及20%增长,而净利则分别增加13%及21%。”

分析员看好该公司独特商业模式,并相信该公司可从我国的消费领域复苏中受惠,再加上该公司还持有大马第一产托(AMFirst,5120,主板产业信托股)8.2%股权,总值3千400万令吉,遂给予该公司“买入”评级,合理价格为每股1.33令吉。

http://www.nanyang.com/index.php?ch=7&pg=12&ac=740532 |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2007 11:32 AM

|

显示全部楼层

发表于 22-7-2007 11:32 AM

|

显示全部楼层

RCE的生意模式:

现在共有三间合作社与RCE合作,她们是KOWAJA, KOBENA和SEJATI。合作社提供个人借贷给会员,而资金其实是RCE提供的,合作社则赚取中间人的费用。

因此这合作关系并不是不可替代的。如果有一天合作社不与RCE合作下去了,那RCE的生意将被影响。当然,我还没看到这个可能性会发生, 可是各位网友应该知道有这个风险。

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|