|

|

【YSPSAH 7178 交流专区】永信东南亚

[复制链接]

[复制链接]

|

|

|

发表于 28-2-2016 03:59 AM

|

显示全部楼层

发表于 28-2-2016 03:59 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2015 | 31 Dec 2014 | 31 Dec 2015 | 31 Dec 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 53,665 | 54,861 | 222,925 | 202,226 | | 2 | Profit/(loss) before tax | 7,395 | 9,977 | 39,527 | 25,230 | | 3 | Profit/(loss) for the period | 6,594 | 7,194 | 29,373 | 17,091 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,362 | 7,018 | 28,968 | 16,492 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.73 | 5.27 | 21.65 | 12.40 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 6.50 | 6.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.9200 | 1.7700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-3-2016 04:36 AM

|

显示全部楼层

发表于 1-3-2016 04:36 AM

|

显示全部楼层

本帖最后由 icy97 于 3-3-2016 02:41 AM 编辑

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | INVESTMENT IN GLOBECARE TRADING (SHANGHAI) CO., LTD. | 1. Introduction The Board of Directors of Y.S.P. Southeast Asia Holding Berhad (“YSPSAH” or “the Company”) wishes to announce that the Company was notified by the relevant China authority that approval was given for the Company to invest in the capital of Globecare Trading (Shanghai) Co., Ltd. (“GCT”) for an investment sum of USD1,000,000, representing 40% participation in the total enlarged capital of GCT of USD2,500,000. The existing total issued and paid-up capital of GCT is USD1,000,000 wholly owned by Yung Shin China Holding Co. Ltd. (“YSCH”). GCT is increasing its current total issued and paid-up capital by USD1,500,000 to USD2,500,000. YSPSAH will invest USD1,000,000 and YSCH will invest USD500,000 in GCT. Upon the completion of this exercise, there will be a participation of 60% by YSCH and 40% by YSPSAH in the total enlarged issued and paid-up capital of USD2,500,0000 in GCT. Yung Shin Global Holding Corporation (“YSGHC”) is the ultimate major shareholder of both YSPSAH and YSCH.

2. Information on GCT GCT was incorporated in People’s Republic of China on 14 August 2006. GCT is principally engaged in trading of cosmeceuticals, food supplements and healthcare products.

3. Rationale for the Investment in GCT The investment in GCT provides a synergistic opportunity for YSPSAH to collaborate with GCT to jointly promote healthcare products in both Malaysia and China markets.

4. Source of Funding The said investment of USD1,000,000 will be funded by both internally generated fund and bank borrowings in equal proportions.

5. Financial Effect The investment in GCT will not have any effect on YSPSAH’s share capital and substantial shareholders’ shareholdings. The said investment is not expected to have any material financial effect on the earnings per share, net assets per share and gearing of YSPSAH Group for the current financial year ending 31 December 2016.

6. Directors’ and Major Shareholders’ Interests The said investment is deemed related party transaction by virtue of YSGHC being the ultimate major shareholder of both YSPSAH and YSCH. Dato’ Dr. Lee Fang Hsin is a direct substantial shareholder of YSPSAH and indirect major shareholder of YSPSAH by virtue of his and his family’s interests in YSGHC. He is the common director in YSPSAH, GCT and YSGHC. Dr. Lee Fang Chuan @ Lee Fang Chen is an indirect major shareholder of YSPSAH by virtue of his and his family’s interests in YSGHC. He is the common director in YSPSAH, GCT, YSCH and YSGHC. Lee Ling Chin is an indirect major shareholder of YSPSAH by virtue of her and her family’s interests in YSGHC. She is the common director in YSPSAH, GCT, YSCH and YSGHC. Dr. Lee Fang Yu, Dr. Lee Fang Jen and Lee Ling Fen are indirect major shareholders of YSPSAH by virtue of their and their family’s interests in YSGHC. Except for the above, none of the other directors or major shareholders or persons connected with the directors and major shareholders have any interest, direct or indirect in the said investment in GCT.

7. Statement by Directors The Audit Committee and the Board of Directors of YSPSAH are of the opinion that the said investment is fair, reasonable and in the best interest of the Company.

8. Highest Percentage Ratio The highest percentage ratio pursuant to paragraph 10.02(g) of the Bursa Malaysia Securities Berhad Main Market Listing Requirements is 1.82%.

This announcement is dated 1 March 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-3-2016 02:51 AM

|

显示全部楼层

发表于 18-3-2016 02:51 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED FINAL DIVIDEND OF 6.5 SEN AND SPECIAL DIVIDEND OF 1.5 SEN PER ORDINARY SHARE OF RM1.00 EACH | The Board of Directors of Y.S.P. Southeast Asia Holding Bhd. has proposed a final dividend of 6.5 sen and a special dividend of 1.5 sen, making a total dividend of 8.0 sen per ordinary share of RM1.00 each in respect of financial year ended 31 December 2015.

The said proposed single tier dividend of 8.0 sen per ordinary share of RM1.00 each is subject to the shareholders’ approval at the forthcoming Annual General Meeting.

A further announcement will be made at a later date pertaining to the entitlement and payment dates once determined.

This announcement is dated 17 March 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-4-2016 08:37 PM

|

显示全部楼层

发表于 28-4-2016 08:37 PM

|

显示全部楼层

本帖最后由 icy97 于 28-4-2016 08:44 PM 编辑

| 7178 YSPSAH Y.S.P.SOUTHEAST ASIA HOLDING | | Final dividend (6.5 sen) & Final Special Dividend (1.5 sen) - Single Tier |

| | Entitlement Details: | 1. Final ordinary dividend (single tier) of 6.5 sen per ordinary share of

RM1.00 each2. Final Special Dividend (single tier) of 1.5 sen per ordinary

share of RM1.00 each

|

| | Entitlement Type: | Final Dividend | | Entitlement Date and Time: | 30/06/2016 05:00 AM | | Year Ending/Period Ending/Ended Date: | 31/12/2015 | | EX Date: | 28/06/2016 | | To SCANS Date: |

| | Payment Date: | 28/07/2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-5-2016 10:29 PM

|

显示全部楼层

发表于 27-5-2016 10:29 PM

|

显示全部楼层

本帖最后由 icy97 于 28-5-2016 01:12 AM 编辑

| 7178 YSPSAH Y.S.P.SOUTHEAST ASIA HOLDING | | Quarterly rpt on consolidated results for the financial period ended 31/03/2016 | | Quarter: | 1st Quarter | | Financial Year End: | 31/12/2016 | | Report Status: | Unaudited | | Submitted By: |

|

| | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 31/03/2016 | 31/03/2015 | 31/03/2016 | 31/03/2015 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 66,304 | 59,309 | 66,304 | 59,309 | | 2 | Profit/Loss Before Tax | 7,609 | 13,246 | 7,609 | 13,246 | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,886 | 9,346 | 4,886 | 9,346 | | 4 | Net Profit/Loss For The Period | 4,959 | 9,397 | 4,959 | 9,397 | | 5 | Basic Earnings/Loss Per Shares (sen) | 3.63 | 7.02 | 3.63 | 7.02 | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 1.9600 | 1.9200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-8-2016 04:57 AM

|

显示全部楼层

发表于 16-8-2016 04:57 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2016 | 30 Jun 2015 | 30 Jun 2016 | 30 Jun 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 51,848 | 50,632 | 118,152 | 109,941 | | 2 | Profit/(loss) before tax | 8,657 | 5,393 | 16,266 | 18,639 | | 3 | Profit/(loss) for the period | 7,020 | 3,474 | 11,979 | 12,871 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,818 | 3,422 | 11,704 | 12,768 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.06 | 2.57 | 8.69 | 9.59 | | 6 | Proposed/Declared dividend per share (Subunit) | 8.00 | 6.50 | 8.00 | 6.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.9300 | 1.9200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-10-2016 06:55 AM

|

显示全部楼层

发表于 28-10-2016 06:55 AM

|

显示全部楼层

永信东南亚觅新合作伙伴

By Liew Jia Teng / The Edge Financial Daily | October 24, 2016 : 11:22 AM MYT

(吉隆坡24日讯)拿督李芳信对于台湾的新南向政策感到振奋。该政策旨在改善与东南亚及南亚国家的贸易和投资关系,为该公司与台湾同行提供合作机会。

永信东南亚控股(YSP Southeast Asia Holding Bhd)创办人暨总裁兼集团董事经理李芳信指出,该公司正与3、4个台湾当地伙伴洽谈潜在的合作,包括代理权、经销和联营。

永信东南亚主要从事进口、出口和制造药品和动物药物。

这位57岁的台湾人接受《The Edge》财经日报专访时说:“台湾制造商生产许多好的(保健)产品。我相信,通过成为他们的代理商或经销商,可协助他们把产品带到东南亚,尤其是马来西亚。我们甚至可以在未来联合建立一个制造工厂。”

“事实上,有几家有兴趣与我们合作的台湾公司接洽我们,因我们在本地区的长期地位和广泛的网络。”

对截至12月杪的本财政年,永信东南亚希望维持去年的净利水平,因汇率持续波动,2016年的市场前景预计保持挑战。

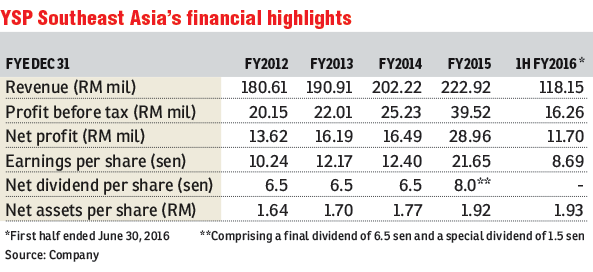

该集团在2015财年取得2897万令吉净利,较2014财年的1649万令吉,劲扬75.6%;营业额从2亿223万令吉,增10.2%至2亿2293万令吉。

然而,今年首半年的净利下滑8.3%至1170万令吉,相比去年同期的1277万令吉。这是尽管营业额由1亿994万令吉,升7.5%至1亿1815万令吉。

盈利表现疲弱归因于产品组合的销售成本增加,以及2015财年首半年确认的未实现外汇收益出现反转。

李芳信表示:“我们将努力保持今年的获利。去年因为消费税(促使消费者囤积医药品),所以我们在第一个季度表现特别好。但我们预计去年的高基数效应将在今年正常化。”

与此同时,他注意到,大多数台商要扩展至新市场时,通常会探讨中国、日本和美国,因这些国家的国内消费强劲。

“但我相信,东南亚是一个新兴市场。大多东南亚国家没有面临人口老化,所以越早进入这个市场越好。”

他寄望台湾第一位女总统蔡英文所提出的新南向政策带路。

台湾是我国第八大贸易伙伴,去年双边贸易大136亿美元。在今年首7个月,双边贸易额为86亿7000万美元,按年起2.2%。目前,我国有1700家台湾公司。

也是大马台北投资者协会、亚洲台商会及世界台湾商会联合会总会名誉总会长的李芳信敦促台湾公司,将东南亚视为台湾的新后院,并认为蔡英文的新政策不会错。

“我们预期大马未来将有更多台湾投资,使这个国家成为他们在东南亚建立业务的理想跳板。”

鉴于其在大马的30年历史,李芳信认为,永信东南亚是台湾制药公司探索东南亚市场的最佳合作伙伴。

“一个外人要进来并争夺市场份额并不容易。不像他们,我不是外人。我住在大马,这里是我的基地。”他指的是他拥大马的永久居留权。

自新南向政策在5月推出以来,永信东南亚与超过10家的台湾公司商讨潜在的联营或合作。目前为止,没有任何定案。

“我们不久前才互相认识,所以需要更多的时间。在考虑在这里设厂之前,大部分公司希望我们成为他们的销售代理或经销商。”

然而,他表示,永信东南亚无惧来自其他生产商的新竞争,因潜在的合作关系将专注于膳食补充剂、有机食品、无化学产品和益生菌。该公司在这些领域都不是一个主要业者。

他解释说:“目前,我们有销售其中一些产品,但占我们的产品组合比重仍然很小。非专利药依然占产品组合的80%,所以不会担心市场被蚕食。”

永信东南亚控股是我国四大制药公司之一,还包括发马(Pharmaniaga Bhd)、CCM Duopharma Biotech Bhd和Apex Healthcare Bhd。

在本地,该集团产品销售至诊所、药店、药房、中医和私人医院。该集团也出口至新加坡、缅甸、泰国、柬埔寨、菲律宾,以及一些中东和非洲国家。

台湾上市公司永信国际投资控股(YungShin Global Holding Co Ltd)持有永信东南亚的38.9%股权,也从事药品、化妆品、食品和测试剂的生产和经销。

永信国际由李芳信的父亲在60多年前创立。在7个兄弟姐妹中,排行老么的李芳信,是唯一一个有兴趣探索东南亚市场。

今年至今,永信东南亚股价从去年12月31日的2.39令吉,跌8.4%至上周五收盘的2.19令吉,市值为2亿9490万令吉。

该股在1月15日扬至2.91令吉的52周高位。

(编译:陈慧珊) |

|

|

|

|

|

|

|

|

|

|

|

发表于 16-11-2016 04:53 AM

|

显示全部楼层

发表于 16-11-2016 04:53 AM

|

显示全部楼层

本帖最后由 icy97 于 18-11-2016 04:03 AM 编辑

永信东南亚Q3净利挫60%

外汇波动前景挑战

2016年11月17日

(吉隆坡16日讯)永信东南亚(YSPSAH,7178,主板消费产品股)截止9月30日第三季,净利从上财年同季的983万3000令吉,按年暴跌59.95%至394万令吉,或每股净利2.93仙。

同时,营业额微跌0.21%,从上财年同季的5931万9000令吉,减少至5919万4000令吉。

累计首9个月,净利按年下跌30.8%,从上财年的2260万6000令吉,下跌至1564万4000令吉。

营业额上扬4.78%,报1亿7734万6000令吉,主要是海外市场与越南子公司取得较高销售额。

展望未来,集团料2016年市场前景仍具挑战性,持续受到外汇波动影响。

但集团仍致力于提高营运效率和增加产品注册,并采取更积极的营销、促销和销售战略,以促进全年可持续的绩效。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2016 | 30 Sep 2015 | 30 Sep 2016 | 30 Sep 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 59,194 | 59,319 | 177,346 | 169,260 | | 2 | Profit/(loss) before tax | 6,060 | 13,493 | 22,326 | 32,132 | | 3 | Profit/(loss) for the period | 4,043 | 9,908 | 16,022 | 22,779 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,940 | 9,838 | 15,644 | 22,606 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.93 | 7.32 | 11.62 | 16.92 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 8.00 | 6.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.9700 | 1.9200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-2-2017 06:03 AM

|

显示全部楼层

发表于 24-2-2017 06:03 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2016 | 31 Dec 2015 | 31 Dec 2016 | 31 Dec 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 59,719 | 53,665 | 237,065 | 222,925 | | 2 | Profit/(loss) before tax | 13,991 | 7,395 | 36,317 | 39,527 | | 3 | Profit/(loss) for the period | 11,896 | 6,594 | 27,918 | 29,373 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 11,950 | 6,362 | 27,594 | 28,968 | | 5 | Basic earnings/(loss) per share (Subunit) | 8.87 | 4.73 | 20.49 | 21.65 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 8.00 | 6.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.0400 | 1.9200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-3-2017 02:49 AM

|

显示全部楼层

发表于 15-3-2017 02:49 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED FINAL SINGLE-TIER DIVIDEND OF 7.0 SEN AND SPECIAL DIVIDEND OF 1.5 SEN PER ORDINARY SHARE | The Board of Directors of Y.S.P. Southeast Asia Holding Bhd. is pleased to propose a final single-tier dividend of 7.0 sen and a special dividend of 1.5 sen, making a total dividend of 8.5 sen per ordinary share for financial year ended 31 December 2016. The proposed final single-tier dividend and special dividend is subject to the shareholders’ approval at the forthcoming Annual General Meeting.

A further announcement will be made at a later date pertaining to the entitlement and payment dates once determined.

This announcement is dated 13 March 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-5-2017 05:18 AM

|

显示全部楼层

发表于 1-5-2017 05:18 AM

|

显示全部楼层

| Y.S.P.SOUTHEAST ASIA HOLDING BERHAD |

EX-date | 28 Jun 2017 | Entitlement date | 30 Jun 2017 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | 1. Final ordinary dividend (single tier) of 7.0 sen per ordinary share 2. Final special dividend (single tier) of 1.5 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Dec 2016 | Share transfer book & register of members will be | 30 Jun 2017 to 30 Jun 2017 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | MEGA CORPORATE SERVICES SDN BHDLevel 15-2, Bangunan Faber Imperial CourtJalan Sultan Ismail50250 Kuala LumpurTel:03-26924271Fax:03-27325388 | Payment date | 28 Jul 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 30 Jun 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.085 | Par Value | Malaysian Ringgit (MYR) 0.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-5-2017 05:12 AM

|

显示全部楼层

发表于 26-5-2017 05:12 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 67,539 | 66,304 | 67,539 | 66,304 | | 2 | Profit/(loss) before tax | 11,674 | 7,609 | 11,674 | 7,609 | | 3 | Profit/(loss) for the period | 8,644 | 4,959 | 8,644 | 4,959 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 8,767 | 4,886 | 8,767 | 4,886 | | 5 | Basic earnings/(loss) per share (Subunit) | 6.51 | 3.63 | 6.51 | 3.63 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.1000 | 2.0400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-5-2017 05:13 AM

|

显示全部楼层

发表于 29-5-2017 05:13 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 2-6-2017 06:31 AM

|

显示全部楼层

发表于 2-6-2017 06:31 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | ACQUISITION OF 60% EQUITY INTEREST IN ALPHA ACTIVE INDUSTRIES SDN. BHD. | With reference to the Company's announcement made on 24 May 2017 ("Announcement"), the Company wishes to provide the following additional information:- (Unless otherwise stated, defined terms used in this reply shall carry the same meaning as defined in the Announcement.)

1. The Net Assets (unaudited) of AAI as at 31 March 2017 was RM1,418,983.50

2. AAI, with rather limited marketing capabilities, has a range of more than 100 product items including food, health supplement and traditional herb all manufactured under its Halal certified facilities. YSPSAH, on the other hand, has strong branding and extensive marketing networks covering Malaysia, Southeast Asia, China, Middle East, Africa and some other parts of the world. In arriving at the decision of the acquisition, the Board and Management of YSPSAH have considered fully and are confident of the synergetic growth and earning potentials that can be achieved from a combined and integrated business operation of the two companies in the longer run.

This announcement is dated 26 May 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-8-2017 03:03 AM

|

显示全部楼层

发表于 2-8-2017 03:03 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | ACQUISITION OF 60% EQUITY INTEREST IN ALPHA ACTIVE INDUSTRIES SDN. BHD. ("AAI") | With reference to the announcements made on 24 May 2017 and 26 May 2017 in relation to the Acquisition of 60% equity interest in AAI (“Acquisition”), the Board of Directors of Y.S.P. Southeast Asia Holding Berhad ("YSPSAH") wishes to announce that the Acquisition has been completed and with effect from 1 August 2017, AAI is a 60% owned subsidiary of YSPSAH. YSPSAH takes management control in AAI with immediate effect.

This announcement is dated 1 August 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2017 04:51 AM

|

显示全部楼层

发表于 30-8-2017 04:51 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 59,907 | 51,848 | 127,446 | 118,152 | | 2 | Profit/(loss) before tax | 4,563 | 8,657 | 16,237 | 16,266 | | 3 | Profit/(loss) for the period | 3,036 | 7,020 | 11,680 | 11,979 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,165 | 6,818 | 11,932 | 11,704 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.34 | 5.07 | 8.85 | 8.69 | | 6 | Proposed/Declared dividend per share (Subunit) | 8.50 | 8.00 | 8.50 | 8.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.0400 | 2.0400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-9-2017 06:09 AM

|

显示全部楼层

发表于 28-9-2017 06:09 AM

|

显示全部楼层

海外业务有起色.永信东南亚钱景向好

(吉隆坡26日讯)永信东南亚(YSPSAH,7178,主板消费品组)涉足的学名药市场前景正面,加上海外业务开始有所起色,联昌研究看好集团未来盈利增长强劲。

联昌研究表示,永信东南亚管理层相信学名药在国内外市场前景依旧正面,其中国内需求将由产品种类增加及医疗保健业务增购支撑。

“此外,该公司计划在人口大国和低学名药渗透率的主要市场增加产品种类,加大行销来提高产品能见度来攫取更大的海外市场大饼。”

联昌研究说,通过扩大产品种类,永信东南亚自2011年持续蒙亏的越南业务在今年上半年开始出现好转迹象,而印尼工厂则开始试营运,产品注册工作则仍在进行中。

“基于产品注册程序可能需时一年半至两年,我们相信印尼业务最快在2019下半年才能带来显著盈利贡献。”

整体来看,联昌研究认为,永信东南亚盈利增长前景强劲,同时估值遭低估,建议投资者“增持”,目标价为3令吉50仙。

文章来源:

星洲日报/财经‧2017.09.27 |

|

|

|

|

|

|

|

|

|

|

|

发表于 18-11-2017 03:48 AM

|

显示全部楼层

发表于 18-11-2017 03:48 AM

|

显示全部楼层

本帖最后由 icy97 于 19-11-2017 06:51 AM 编辑

永信东南亚

第三季净利跌15%

2017年11月19日

(吉隆坡18日讯)永信东南亚(YSPSAH,7178,主板消费产品股)截至9月30日第三季,净利按年减少15.51%至332万9000令吉,或每股2.44仙。

该公司向交易所报备,营业额年增11.65%,报6609万3000令吉。

首9个月净利则取得1526万1000令吉,按年跌2.45%;营业额达1亿9353万9000令吉,年升9.13%。

税前盈利按年减3.16%,达2162万1000令吉,归咎于营运开销增加,和未实现外汇损失。

展望未来,全球经济不稳定因素犹在,加上竞争加剧和外汇波动持续,永信东南亚年底的营运环境将继续备受压力和挑战。

但公司仍致力于提高营运效率、增加产品注册和加强竞争力,并采取更积极的营销和销售策略,以促进市占率。

公司持谨慎乐观态度,如无意外,料今年表现可令人满意。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 66,093 | 59,194 | 193,539 | 177,346 | | 2 | Profit/(loss) before tax | 5,384 | 6,060 | 21,621 | 22,326 | | 3 | Profit/(loss) for the period | 3,299 | 4,043 | 14,979 | 16,022 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,329 | 3,940 | 15,261 | 15,644 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.44 | 2.93 | 11.26 | 11.62 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 8.50 | 8.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.0700 | 2.0400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-3-2018 05:11 AM

|

显示全部楼层

发表于 7-3-2018 05:11 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 68,017 | 59,719 | 261,556 | 237,065 | | 2 | Profit/(loss) before tax | 8,067 | 13,991 | 29,688 | 36,317 | | 3 | Profit/(loss) for the period | 5,085 | 11,896 | 20,064 | 27,918 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,121 | 11,950 | 20,382 | 27,594 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.75 | 8.87 | 15.01 | 20.49 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 8.50 | 8.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.1200 | 2.0400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-3-2018 01:11 AM

|

显示全部楼层

发表于 12-3-2018 01:11 AM

|

显示全部楼层

进军医学美容市场

永信制药推介NUViT药妆

2018年3月8日

(吉隆坡7日讯)深获医药界信赖的永信制药(YSP)迎合国际趋势与消费者需求,今天隆重推介全新NUViT药妆品牌,宣布正式进军医学美容市场。

永信东南亚(YSPSAH,7178,主板消费产品股)总裁兼集团董事经理拿督李芳信指出,“提供高品质药品·增进全人类健康”为该公司的经营理念,NUViT品牌是这个理念的延伸。

他致开幕词道:“本公司过去30年致力开发生产医药和保康食品,旨在照顾人体内在的健康,如今NUViT的诞生,将进一步照顾人体外貌的健康美丽。”

针对时下消费者对控油祛痘、美白祛斑的高需求,该品牌目前率先推出NUViT抗痘系列,包括粉刺水、抗痘乳液与痘快消;以及NUViT净白系列包括斑渐消、美白精华乳与美白亮肤霜,未来还将陆续开发NUViT医美护肤品全套系列。

千人体验满意度90%

NUViT通过生物科技与天然植物萃取精华,展开科学性独家研发配方,且所有产品皆经第三方验证合格,确认有效与安全。早前亦展开为期7天的千人体验活动,在舒适度及效果方面都取得90%以上满意度。

同台主持推介礼者为李芳信夫人廖妙溶、永信东南亚主席拿督阿尼斯医生、副总裁叶燕美、永信工业(马)私人有限公司营销高级总经理阿南达,以及咏丽生化科技股份有限公司赵莉惠。

受邀贵宾包括驻马台北经济文化办事处代表章计平、吉隆坡台湾贸易中心主任萧春雁丶大马台湾商会联合总会总会长林永昌与曲慧琴伉俪,以及咏丽生化科技股份有限公司执行董事程淑兰。【e南洋】 |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|