|

|

发表于 30-12-2017 04:19 PM

|

显示全部楼层

发表于 30-12-2017 04:19 PM

|

显示全部楼层

2016 RM9.85 (+rm4.66 89.79%) ,2017 RM19.50 (+rm9.65 97.97%)  如果我有就好咯。。。 如果我有就好咯。。。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-1-2018 07:17 AM

|

显示全部楼层

发表于 12-1-2018 07:17 AM

|

显示全部楼层

KESM今年厂房全智能

可从事复杂测试工作

2018年1月12日

(吉隆坡11日讯)从事汽车微晶片的预烧(burn-in)和提供检测相关服务的KESM科技(KESM,9334,主板科技股),计划在2018财年增加资本开销,将旗下工厂打造成智能厂房。

执行主席兼总执行长林信赐,今天出席股东大会后向媒体指出,计划在2018财年以内,将旗下厂房全面智能化。

“升级之后,智能厂房将可进行更复杂的半导体测试。同时,会增添更多自动化系统。”

林信赐在去年的股东大会曾透露,2017财年的资本开销会介于8200万至9000万令吉之间。

不会裁员

今年,他称厂房的智能升级不会影响公司的日常运作。另外,在完成升级后也不会裁减人手。

另一方面,林信赐点出,KESM科技已超标达成2017财年3亿令吉的销售目标。展望2018,他认为要维持相同的增长有些挑战,但相信公司有能力维持强劲的销售势头。

他也援引相关权威机构数据,预测全球半导体领域的营业额在未来两年内,可维持在420亿美元(1677亿令吉)之上。

根据年报,KESM科技的2017财年销售达3.38亿令吉,按年增18%。

专注汽车半导体业务

至于未来发展,他称KESM科技依然会继续专注在汽车领域的半导体业务。

该项业务除了是公司的强项,而且全球汽车领域也正朝向高科技发展,如车联网技术等,因此将继续支持该领域的前景。【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 10-3-2018 06:46 AM

|

显示全部楼层

发表于 10-3-2018 06:46 AM

|

显示全部楼层

本帖最后由 icy97 于 13-3-2018 07:54 AM 编辑

KESM工業次季淨利1118萬

2018年3月08日

(吉隆坡8日訊)預燒(burn-in)及測試服務供應商KESM工業(KESM,9334,主要板科技)宣布最新業績,截至今年1月31日2018財年次季,營業額按年成長10%至9147萬令吉,淨利則增加12%報1118萬令吉。

KESM工業向馬證交所報備文告,該集團2018財年首半年營業額按年增加了12%至1億8218萬令吉,淨利則增加13%至2255萬令吉。

同時,該集團次季每股收益從去年同期的23.20仙提高至26仙,首半年每股收益也從去年同期的46.50仙提高至52.40仙。

KESM工業執行主席兼總執行長林信賜透過文告指出:“我們的預燒及測試服務持續錄得強勁增長,因為旗下客戶持續生產更多功能的先進設備予汽車制造商,以生產無人駕駛汽車。”

“同時,目前汽車製造商也需要遵守更多新的安全條例,以確保車輛數據在遠程黑客和故障中更安全,這增加了對聯網汽車的需求。”

各種的數碼系統如全球定位系統(GPS)追蹤系統、燃油管理系統和駕駛人士信息系統,已不再只是高端汽車的標準功能,反而許多汽車已開始加入這些功能。因此,這些要求也推動了對更多半導體的需求。

他說:“汽車行業的這些變化給汽車半導體行業帶來了強勁的需求,而專注在這個市場的KESM因此得到了強勁的回報。”

林信賜表示,汽車半導體部件增長前景的改善將繼續為KESM帶來良好的機會。【中国报财经】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jan 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jan 2018 | 31 Jan 2017 | 31 Jan 2018 | 31 Jan 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 91,473 | 83,115 | 182,184 | 163,227 | | 2 | Profit/(loss) before tax | 13,022 | 11,602 | 26,476 | 22,774 | | 3 | Profit/(loss) for the period | 11,177 | 9,975 | 22,552 | 19,987 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 11,177 | 9,975 | 22,552 | 19,987 | | 5 | Basic earnings/(loss) per share (Subunit) | 26.00 | 23.20 | 52.40 | 46.50 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 8.0726 | 7.6518

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-3-2018 06:47 AM

|

显示全部楼层

发表于 10-3-2018 06:47 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 12-3-2018 05:47 AM

|

显示全部楼层

发表于 12-3-2018 05:47 AM

|

显示全部楼层

本帖最后由 icy97 于 13-3-2018 03:09 AM 编辑

车半导体需求增.KESM潜在派高息

(吉隆坡9日讯)KESM科技(KESM,9334,主板科技组)2018财政年上半年盈利表现符合市场预期,分析员认为下半年盈利表现受汽车半导体需求增加料加速,而潜在派发高股息将是重估催化剂。

KESM科技连续12个季度营业额录得增长,2018财政年上半年盈利表现符合市场预测,录得2260万令吉净利,且一如预期没有派发股息。

肯纳格研究表示,预计KESM科技2018财政年下半年盈利表现将更好,主要是因为该公司在2017财政年进行产能扩张计划。

艾芬黄氏研究认同,KESM科技的营业额及盈利表现在下半年将会加速,相信前期投入的资本开支足以维持短期内营业额和盈利的扩张。

联昌研究认为,KESM科技受汽车领域对半导体的需求增加和供应链改善,将推高2018财政年下半年盈利表现。

KESM科技在短暂歇息后,再度重启扩展计划,肯纳格预计该公司2018财政年的资本开支料达1亿200万令吉,主要作为提升大马及中国厂房至“智能工厂”。

肯纳格探悉,KESM科技的智能产房不仅仅是自动化,同时,也给予汽车工业在线即时制造讯息、必要的测试和测试及预烧复杂的半导体服务。

新设计料推高销量

联昌表示,KESM科技管理层预计,2018财政年资本开支将正常化至7000万至8000万令吉,并预计受新设计带动,料推高小型汽车半导体销量。

肯纳格看好KESM科技,主要是其涉及在汽车工业半导体业务中,并相信可从全球汽车产量增加和汽车晶片含量增加中获益。

联昌相信,一旦KESM科技录得强劲盈利表现和派发高股息,则潜在带来重估催化剂。

肯纳格则预计,KESM科技全年将派发14仙股息。

联昌也认为,马币兑美元汇率走扬,预计不会对KESM科技带来实际影响,主要是因为其大部份交易都以马币进行。

受惠于业绩表现大好,KESM科技走扬80仙,收在20令吉30仙。

文章来源:

星洲日报/财经 ‧ 报道:刘玉萍 ‧ 2018.03.09

KESM科技

全年料投资1.2亿

2018年3月10日

分析:肯纳格投行研究

目标价:18.40令吉

最新进展

KESM科技(KESM,9334,主板科技股)截至1月31日次季,净利年增12%至1118万令吉;营业额涨10%,报9147万令吉。

累计上半年,净利按年增12.8%至2255万令吉;营业额升11.6%,报1亿8218万令吉。

KESM科技指,当季营业额走高,归功于预烧和测试服务的需求走高。其中,折旧费用扬22%,因启用了更多机械和测试设备。

行家建议

KESM科技在次季的表现符合预测。虽然预测今年派出每股总额14仙的股息,但该季没有派息也是预期之中。

展望未来,我们预计该公司在来季重启扩展计划,全年的资本开销料达1亿2000万令吉,重点提升本地和中国的厂房至“智能厂房”。

我们维持财测,看好KESM科技未来表现,因为在高增长汽车半导体市场上拥有独特地位。

该公司能够受惠于两个市场趋势,包括全球汽车制造商产量增加,及相关晶片需求量增加。

虽然近期股价出现跌势,但其估值仍高,本益比高达15.5倍,高于我们的预测的15倍,因此维持“低于大市”投资评级,保留目标价18.40令吉。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 11-6-2018 01:57 AM

|

显示全部楼层

发表于 11-6-2018 01:57 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Apr 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Apr 2018 | 30 Apr 2017 | 30 Apr 2018 | 30 Apr 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 82,328 | 84,995 | 264,512 | 248,222 | | 2 | Profit/(loss) before tax | 7,235 | 12,251 | 33,711 | 35,025 | | 3 | Profit/(loss) for the period | 5,470 | 10,604 | 28,022 | 30,591 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,470 | 10,604 | 28,022 | 30,591 | | 5 | Basic earnings/(loss) per share (Subunit) | 12.70 | 24.70 | 65.10 | 71.10 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 8.2000 | 7.6518

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-6-2018 02:06 AM

|

显示全部楼层

发表于 11-6-2018 02:06 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 12-7-2018 01:18 AM

|

显示全部楼层

发表于 12-7-2018 01:18 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 12-7-2018 01:19 AM

|

显示全部楼层

发表于 12-7-2018 01:19 AM

|

显示全部楼层

EX-date | 24 Jul 2018 | Entitlement date | 26 Jul 2018 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim Dividend of 12.5 sen per share in respect of the financial year ending 31 July 2018. | Period of interest payment | to | Financial Year End | 31 Jul 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM CORPORATE SERVICES (KL) SDN BHDLot 6.05, Level 6, KPMG Tower8, First AvenueBandar Utama47800 Petaling JayaTel:0377201188Fax:0377201111 | Payment date | 17 Aug 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 26 Jul 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.125 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-9-2018 05:30 AM

|

显示全部楼层

发表于 22-9-2018 05:30 AM

|

显示全部楼层

本帖最后由 icy97 于 23-9-2018 02:31 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jul 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jul 2018 | 31 Jul 2017 | 31 Jul 2018 | 31 Jul 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 85,265 | 89,766 | 349,777 | 337,988 | | 2 | Profit/(loss) before tax | 9,975 | 12,818 | 43,686 | 47,843 | | 3 | Profit/(loss) for the period | 11,316 | 13,403 | 39,338 | 43,994 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 11,316 | 13,403 | 39,338 | 43,994 | | 5 | Basic earnings/(loss) per share (Subunit) | 26.30 | 31.20 | 91.50 | 102.30 | | 6 | Proposed/Declared dividend per share (Subunit) | 6.00 | 6.00 | 18.50 | 12.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 8.2881 | 7.6518

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-9-2018 05:34 AM

|

显示全部楼层

发表于 22-9-2018 05:34 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 25-9-2018 07:10 AM

|

显示全部楼层

发表于 25-9-2018 07:10 AM

|

显示全部楼层

本帖最后由 icy97 于 25-9-2018 07:37 AM 编辑

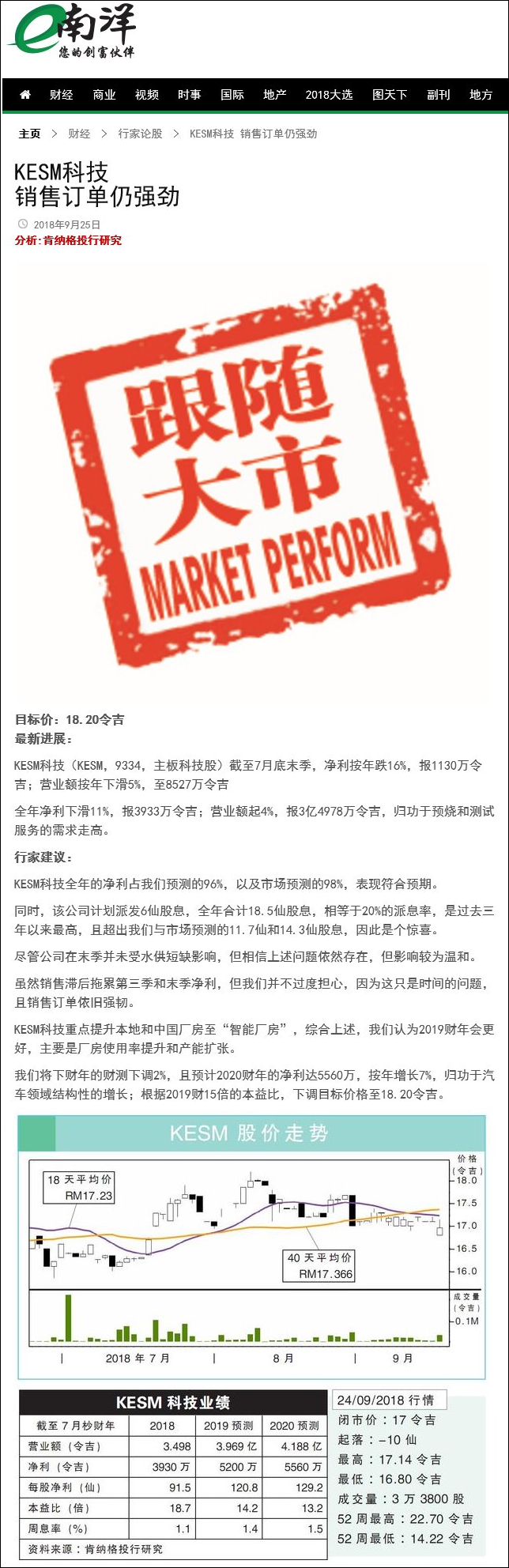

业绩滑坡 科仪盘中暴跌30仙

財经 最后更新 2018年09月24日 22时11分

(吉隆坡24日讯)末季业绩表现下滑导致科仪工业(KESM,9334,主板科技股)股价在週一(24日)一度大跌30仙或1.75%,至16.80令吉的全天最低水平。

该股今日甫开市就下探16.80令吉的全天最低水平;之后逐步收窄跌幅,最后以17.00令吉掛收,全天下滑10仙或0.58%,共有3万3800股易手。

科仪工业上週五公佈的2018財政年末季(截至7月31日止)净利按年下跌15.57%,至1132万令吉;营业额也按年减少5.01%,至8527万令吉。

全年而言,其净利按年下滑10.58%,至3934万令吉;营业额则按年上扬3.49%,至3亿4978万令吉。同时,该公司宣布派发6仙股息。

肯纳格研究分析员表示,儘管2018財政年第3季盈利落后预期,而末季也仍缓慢成长,但分析员並不太担心销售停滯的状况,因为延迟交货只是暂时的问题,该公司的订单量仍强劲。

「投资方面, 该公司计划提升大马和中国现有工厂为智能工厂,届时会有更高的自动化水平,有望提高营运效率。」

同时, 艾芬黄氏资本分析员也认为,儘管科仪工业末季核心净利按季飆升51%,至990万令吉,但仍低于预期。

「由于未能实现强劲復甦,该公司2018財政年业绩仅佔我们预测的91%。受到晶圆和材料短缺及客户新设备產量低的影响,该公司全年净利按年下跌12%,至3800万令吉。」

不仅如此,管理层谨慎看待公司账户,担忧半导体领域的贸易战升级和併购活动会破坏材料供应。

財测下调

此外,因2018財政年较低的资本开销,管理层决定將多余现金回退给股东,2018財政年全年每股股息为18.5仙,相比2017財政年的12.5仙,超出分析员预期。

而肯纳格研究分析员则认为,產能扩充及更高的使用率,將支撑2019的表现。

艾芬黄氏资本分析员將2019至2020財政年每股盈利预测分別下调16%到19%。基于2019年每股盈利17倍预测,下砍目標价至18.55令吉,並下修至「守住」评级。

肯纳格研究分析员则將2019財政年盈利预测下调2%,並预测2020財政年净利將成长7%至5560万令吉。也將目標价下调至18.20令吉,但维持「与大市同步」投资评级。【东方网财经】

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2018 04:18 AM

|

显示全部楼层

发表于 26-10-2018 04:18 AM

|

显示全部楼层

EX-date | 15 Jan 2019 | Entitlement date | 17 Jan 2019 | Entitlement time | 04:00 PM | Entitlement subject | Final Dividend | Entitlement description | Proposed final tax exempt dividend of 6 sen per share in respect of the financial year ended 31 July 2018, subject to shareholders' approval at the forthcoming Annual General Meeting | Period of interest payment | to | Financial Year End | 31 Jul 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM CORPORATE SERVICES (KL) SDN BHDLot 6.05, Level 6, KPMG Tower8, First AvenueBandar Utama47800 Petaling JayaTel:0377201188Fax:0377201111 | Payment date | 13 Feb 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 17 Jan 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-10-2018 09:21 PM

|

显示全部楼层

发表于 29-10-2018 09:21 PM

|

显示全部楼层

‼️KESM科技 – 公司要垮了吗?

KESM的股东们经历一个难熬的10月份,其股价几乎每天都在下跌,从RM17.00急挫至RM10.00,相等于41%的跌幅。投资者想要捞底,但是却越捞越低,仿佛是个无底洞。早前更有一名股友问道,“KESM是不是要倒闭了?!”

对于市场流通量非常低的股票,一旦引发恐慌性抛售,下跌的速度往往都会比较快,而幅度也比较大。KESM就是其中一支,其股票数量仅有43m。

回归基本面/价值,KESM的FY18收入按年增长3.5%,连续7年创下历史新高,主要归功于晶片烧焊和检测需求走高。然而,其盈利却按年下滑11%,主要因为客户受到晶圆 (Wafer) 供应短缺的冲击。

普遍上,Q4一直都是KESM的传统旺季,但是这一个现象却未在FY18出现。其客户面临晶圆供应短缺的问题,无法顺利生产和装配,因此无法及时把芯片交给KESM烧焊和监测,而导致后者的厂房使用率从80%下降至70%。值得一提,晶圆是制造集成电路 (IC) 芯片的关键基础材料。

此前,KESM预计其客户将以更快的速度推出新的创新芯片以满足市场的需求,但是情况却事与愿违。尽管如此,随着客户逐步提高产量,KESM的预烧和检测效率有望得到改善。我们认为,客户延迟把晶片交给KESM检测只是时间上的问题,目前整体订单仍然保持强劲。

换句话说,只要客户面临的问题获得改善或解决,KESM的业绩有望回到之前的水平,甚至更好。然而,全球晶圆供应吃紧却是不争的事实,何时能解决仍未知数。集团决定暂时推迟部分扩张计划,已经说明FY19或许不会有显著的增长。

另一方面,潜在风险包括中美贸易战影响原料供应,以及客户放缓生产,但是目前一切依然言之过早;是否会造成影响,仍未指数。然而,股价的暴跌似乎已反映出市场的担忧。

仅供参考,今年9月,本地3家投行一致给予KESM“买入”评级,并设下12个月内的目标价,如下:

✅ Affin Hwang Research – RM18.55,根据17倍PE推算

✅ Kenanga Research – RM18.20,根据15倍PE推算

✅ CIMB Research – RM18.50

现阶段的市场要钱,不要股票;无论其他个股的基本面好或坏,统统都遭到抛售。可以肯定的是,KESM的价值已经浮现,只不过不知道股价是否会进一步走低。可以承受高风险的股友,不妨考虑开始分批买入;

|

评分

-

查看全部评分

|

|

|

|

|

|

|

|

|

|

|

发表于 2-12-2018 08:09 AM

|

显示全部楼层

发表于 2-12-2018 08:09 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Oct 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Oct 2018 | 31 Oct 2017 | 31 Oct 2018 | 31 Oct 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 81,558 | 90,711 | 81,558 | 90,711 | | 2 | Profit/(loss) before tax | 3,796 | 13,454 | 3,796 | 13,454 | | 3 | Profit/(loss) for the period | 2,641 | 11,375 | 2,641 | 11,375 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,641 | 11,375 | 2,641 | 11,375 | | 5 | Basic earnings/(loss) per share (Subunit) | 6.10 | 26.40 | 6.10 | 26.40 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 8.3683 | 8.2881

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-12-2018 06:26 AM

|

显示全部楼层

发表于 20-12-2018 06:26 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 1-4-2019 08:29 PM

|

显示全部楼层

发表于 1-4-2019 08:29 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jan 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jan 2019 | 31 Jan 2018 | 31 Jan 2019 | 31 Jan 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 81,105 | 91,473 | 162,663 | 182,184 | | 2 | Profit/(loss) before tax | 1,644 | 13,022 | 5,440 | 26,476 | | 3 | Profit/(loss) for the period | 474 | 11,177 | 3,115 | 22,552 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 474 | 11,177 | 3,115 | 22,552 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.10 | 26.00 | 7.20 | 52.40 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 8.3404 | 8.2881

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-4-2019 08:30 PM

|

显示全部楼层

发表于 1-4-2019 08:30 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 11-7-2019 05:15 AM

|

显示全部楼层

发表于 11-7-2019 05:15 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Apr 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Apr 2019 | 30 Apr 2018 | 30 Apr 2019 | 30 Apr 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 73,803 | 82,328 | 236,466 | 264,512 | | 2 | Profit/(loss) before tax | 1,594 | 7,235 | 7,034 | 33,711 | | 3 | Profit/(loss) for the period | 870 | 5,470 | 3,985 | 28,022 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 870 | 5,470 | 3,985 | 28,022 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.00 | 12.70 | 9.30 | 65.10 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 8.3439 | 8.2881

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-7-2019 04:56 AM

|

显示全部楼层

发表于 25-7-2019 04:56 AM

|

显示全部楼层

EX-date | 02 Aug 2019 | Entitlement date | 05 Aug 2019 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim Dividend of 3 sen per share in respect of the financial year ending 31 July 2019. | Period of interest payment | to | Financial Year End | 31 Jul 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaSelangorTel: 03-78418088Fax: 03-78418100 | Payment date | 27 Aug 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 05 Aug 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.03 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|