|

|

发表于 13-6-2017 12:41 AM

|

显示全部楼层

发表于 13-6-2017 12:41 AM

|

显示全部楼层

Date of change | 29 May 2017 | Name | MR KHAIRUL IDHAM BIN ISMAIL | Age | 41 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Independent Director | New Position | Chairman | Directorate | Independent and Non Executive |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-6-2017 05:20 AM

|

显示全部楼层

发表于 13-6-2017 05:20 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,384 | 3,152 | 12,772 | 11,132 | | 2 | Profit/(loss) before tax | -763 | -417 | 1,136 | 757 | | 3 | Profit/(loss) for the period | -763 | -421 | 1,136 | 753 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -530 | -518 | 2,007 | 1,837 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.17 | -0.17 | 0.66 | 0.64 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0800 | 0.0700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-6-2017 07:10 AM

|

显示全部楼层

发表于 17-6-2017 07:10 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED DISPOSAL BY THE COMPANY OF ITS 15% EQUITY INTERESTS IN YIKON (HK) LIMITED | All definitions in this announcement, unless otherwise stated, shall have the same meaning as defined in the earlier announcements made on 12 May 2017 and 26 May 2017.

The Board of Directors of NICE wishes to announce that the relevant documents and stamp duty have been presented to the local authority in Hong Kong SAR.

Accordingly, the Proposed Disposal is now completed.

This announcement is dated 9 June 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-7-2017 02:01 AM

|

显示全部楼层

发表于 7-7-2017 02:01 AM

|

显示全部楼层

Expiry/Maturity of the securities| NICHE CAPITAL EMAS HOLDINGS BERHAD |

Instrument Category | Securities of PLC | Instrument Type | Warrants | Type Of Expiry | Expiry/Maturity of the securities | Mode of Satisfaction of Exercise/Conversion price | Cash | Exercise/ Strike/ Conversion Price | Malaysian Ringgit (MYR) 0.1600 | Exercise/ Conversion Ratio | 1:1 | Settlement Type / Convertible into | Physical (Shares) | Last Date & Time of Trading | 24 Jul 2017 05:00 PM | Date & Time of Suspension | 25 Jul 2017 09:00 AM | Last Date & Time for Transfer into Depositor's CDS a/c | 02 Aug 2017 04:00 PM | Date & Time of Expiry | 09 Aug 2017 05:00 PM | Date & Time for Delisting | 10 Aug 2017 09:00 AM |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5479753

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-7-2017 05:00 AM

|

显示全部楼层

发表于 30-7-2017 05:00 AM

|

显示全部楼层

Notice of Person Ceasing (Section 139 of CA 2016)| NICHE CAPITAL EMAS HOLDINGS BERHAD |

Particulars of Substantial Securities HolderName | MR FOONG CHEE HOE | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | ORDINARY SHARES | Date of cessation | 27 Jul 2017 | Name & address of registered holder | FOONG CHEE HOEC-17-2, ABADI VILLA CONDO, JALAN 2/109C, TAMAN ABADI INDAH, 58100 KUALA LUMPUR, WILAYAH PERSEKUTUAN KUALA LUMPUR |

No of securities disposed | 8,000,000 | Circumstances by reason of which a person ceases to be a substantial shareholder | DISPOSAL OF SHARES | Nature of interest | Direct Interest |  | Date of notice | 28 Jul 2017 | Date notice received by Listed Issuer | 28 Jul 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-8-2017 12:11 AM

|

显示全部楼层

发表于 11-8-2017 12:11 AM

|

显示全部楼层

本帖最后由 icy97 于 12-8-2017 05:38 AM 编辑

利资金1配4附加股送2凭单

(吉隆坡10日讯)利资金(NICE,7139,主板消费品组)建议1配4附加股和附送2张凭单,从中集资至多5994万6000令吉。

同时该公司建议发出10亿8007万7000张股新股(每股发售价5仙)以偿还拖欠4名债权人的5400万3850令吉。

利资金在文告中表示,该公司将发售至多13亿3215万股附加股,每股附加股售价为4.5仙,相等于该股理论除权价5.3仙的15.4%折价。

该公司建议每4股附加股附送2张凭单,共发送至多6亿6607万张凭单,行使价7仙,相等于理论除权价5.3仙的31.5%溢价。

筹5995万

该公司有意从中筹集至少约1330万令吉和至多5994万6000令吉,其中至多4970万令吉用作扩张珠宝业务和871万6000令吉用作营运资本。

完成附加股和资本化计划后,该公司股本将从至多3亿3303万8000股(3285万令吉)扩大至34亿1134万2000股(1亿9342万6000令吉)。

文章来源:

星洲日报/财经·2017.08.11

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

COMBINATION OF NEW ISSUE OF SECURITIES | Description | (I) PROPOSED RIGHTS ISSUE WITH WARRANTS(II) PROPOSED CAPITALISATION(COLLECTIVELY REFERRED TO AS THE "PROPOSALS") | On behalf of the Board of Directors of NICE, Mercury Securities Sdn Bhd is pleased to announce that the Company proposes to undertake the following corporate proposals: (i) proposed renounceable rights issue of up to 1,332,151,400 new ordinary shares in NICE (“NICE Shares”) (“Rights Shares”) on the basis of 4 Rights Shares for every 1 existing NICE Share, together with up to 666,075,700 free detachable warrant (“Warrants”) on the basis of 2 Warrants for every 4 Rights Shares subscribed for at an issue price of RM0.045 per Rights Share; and

(ii) proposed capitalisation of RM54,003,850 in aggregate of the amount owing to certain creditors of NICE via the issuance of 1,080,077,000 new NICE Shares (“Settlement Shares”) at an issue price of RM0.05 per Settlement Share.

Please refer to the attachment for further details on the Proposals.

This announcement is dated 10 August 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5512077

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-8-2017 12:04 AM

|

显示全部楼层

发表于 15-8-2017 12:04 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

OTHER ISSUE OF SECURITIES | Description | (I) PROPOSED RIGHTS ISSUE WITH WARRANTS(II) PROPOSED CAPITALISATION(COLLECTIVELY REFERRED TO AS THE "PROPOSALS") | (Unless the context otherwise requires, the defined terms used herein are the same as those defined in the announcement in relation to the Proposals dated 10 August 2017)

We refer to the announcement made by the Company on 10 August 2017 in relation to the Proposals.

This amended announcement is to correct sections 2.1.2, 2.2.2 and 5.4 of the said announcement.

This announcement is dated 14 August 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5514293

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-9-2017 06:17 AM

|

显示全部楼层

发表于 3-9-2017 06:17 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,018 | 2,704 | 14,791 | 13,837 | | 2 | Profit/(loss) before tax | -4,515 | -1,206 | -3,379 | -449 | | 3 | Profit/(loss) for the period | -4,903 | -1,206 | -3,767 | -453 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -4,645 | -927 | -2,638 | 910 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.39 | -0.31 | -0.85 | 0.31 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0600 | 0.0700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-9-2017 06:23 AM

|

显示全部楼层

发表于 3-9-2017 06:23 AM

|

显示全部楼层

Date of change | 01 Sep 2017 | Name | MR MAH WENG KEE | Age | 55 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Executive Director | New Position | Non Executive Director | Directorate | Non Independent and Non Executive |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-9-2017 06:23 AM

|

显示全部楼层

发表于 3-9-2017 06:23 AM

|

显示全部楼层

Date of change | 01 Sep 2017 | Name | MR JULIAN FOO KUAN LIN | Age | 33 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Executive Director | New Position | Chief Executive Officer | Directorate | Executive |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-9-2017 05:22 AM

|

显示全部楼层

发表于 18-9-2017 05:22 AM

|

显示全部楼层

利资本有望转盈

请教者EG问:

(1)想请教利资本(NICE,7139,主板消费品组)这间公司。这几年有投资者投入大约两千多万进这间公司。大股东JULIAN FOO KUAN LIN,它的家族生意是CROSS BORDER ALLIANCE(M)SDN BHD、2016年报第十大股东是SATVINDER SINGH,请问这间公司可以投资吗?

答:(1)利资本是否可以投资,看最新业绩表现、财务情况、未来前景等以供参考。

截至2017年6月30日为止第四季,该公司蒙受净亏损464万5000令吉(每股净亏损1.39仙),前期净亏损为92万7000令吉(每股净亏损为0.31仙)。第四季营业额为201万8000令吉,前期为270万4000令吉。

全年净亏损为263万8000令吉(每股净亏损为0.85仙),前期还取得净利91万令吉(每股净利为0.31仙)。全年营业额为1479万1000令吉,前期为1383万7000令吉。

财务情况方面,公司总资产为8550万6000令吉,主要是库存7330万1000令吉。其他应收款项/存款/预付付款为939万3000令吉。现金及等同现金为116万6000令吉。

截至2017年6月30日为止,公司总流动负债为6233万7000令吉,其他应付款项及权责发生额即占326万令吉。

谈到未来前景,该公司表示,短期内的公司业务商业环境料继续具挑战性,因中国经济放缓、疲弱的消费者需求及珠宝零售商的竞争激烈。

该公司董事部已检讨及调整其未来的业务策略,其中包括通过其香港特区独资子公司-利资本(香港)有限公司启动其硬玉石的批发贸易活动。

最近,公司采取脱售其在中国大陆的一些业务,缩小及整合公司在中国的曝光率。管理层计划于2017年第四季在大马设立珠宝百货公司,以便在国内市场建立及加强公司的地位。

其他子公司赚钱

有鉴于此,公司尚有的其他赚钱子公司,料在下个财政年有望转亏为盈。

至于最近推行的企业活动,该公司是于8月10日宣布,以1配4附加股和附送2张凭单,从中集资至多5994万6000令吉。

同时,该公司建议发出10亿8007万7000张股新股(每股发售价5仙)以偿还拖欠4位债权人的5400万3850令吉。

该公司将发售至多13亿3215万附加股,每股附加股售价为4.5仙,每4股附加股附送2张凭单,共发送至多6亿6607万张免费凭单,行使价7仙。

该公司有意从中筹集至少约1330万令吉和至多5994万6000令吉,其中至多4970万令吉充当扩张珠宝业务及871万6000令吉用作营运资本。

完成附加股和资本化计划后,该公司股本将从至多3亿3303万8000股(3285万令吉)大幅度扩大至34亿1134万2000股(1亿9342万6000令吉)。

文章来源:

星洲日报‧投资致富‧投资问诊‧文:李文龙‧2017.09.17 |

|

|

|

|

|

|

|

|

|

|

|

发表于 5-12-2017 03:19 AM

|

显示全部楼层

发表于 5-12-2017 03:19 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,225 | 6,197 | 2,225 | 6,197 | | 2 | Profit/(loss) before tax | -500 | 2,883 | -500 | 2,883 | | 3 | Profit/(loss) for the period | -500 | 2,883 | -500 | 2,883 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -500 | 3,158 | -500 | 3,158 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.15 | 1.04 | -0.15 | 1.04 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0600 | 0.0600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-12-2017 03:59 AM

|

显示全部楼层

发表于 5-12-2017 03:59 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 6-3-2018 05:34 AM

|

显示全部楼层

发表于 6-3-2018 05:34 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 5,001 | 3,191 | 7,226 | 9,388 | | 2 | Profit/(loss) before tax | -2,038 | -984 | -2,538 | 1,899 | | 3 | Profit/(loss) for the period | -2,038 | -984 | -2,538 | 1,899 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,038 | -621 | -2,538 | 2,537 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.61 | -0.21 | -0.76 | 0.84 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0500 | 0.0600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-5-2018 04:04 AM

|

显示全部楼层

发表于 16-5-2018 04:04 AM

|

显示全部楼层

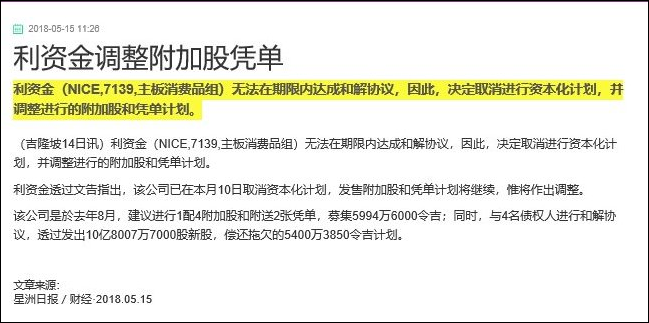

本帖最后由 icy97 于 21-5-2018 06:35 AM 编辑

icy97 发表于 11-8-2017 12:11 AM

利资金1配4附加股送2凭单

(吉隆坡10日讯)利资金(NICE,7139,主板消费品组)建议1配4附加股和附送2张凭单,从中集资至多5994万6000令吉。

同时该公司建议发出10亿8007万7000张股新股(每股发售价5仙)以偿还 ...

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

COMBINATION OF NEW ISSUE OF SECURITIES | Description | NICHE CAPITAL EMAS HOLDINGS BERHAD ("NICE" OR "COMPANY")(I) PROPOSED RIGHTS ISSUE WITH WARRANTS(II) PROPOSED CAPITALISATION(COLLECTIVELY REFERRED TO AS THE "PROPOSALS") | (Unless the context otherwise requires, the defined terms used herein are the same as those defined in the announcement in relation to the Proposals dated 10 August 2017)

We refer to the announcements made in relation to the Proposals dated 10 August 2017, 14 August 2017 and 16 August 2017 (collectively referred to as “Announcements”).

On behalf of the Board, Mercury Securities wishes to announce that the conditions precedent of the Settlement Agreements have not been fulfilled within the period stipulated in the Settlement Agreements. As such, the Settlement Agreements have, ipso facto, been terminated effective 10 May 2018.

Pursuant thereto, the Company will not be proceeding with the Proposed Capitalisation. Notwithstanding the above, the Company intends to proceed with the Proposed Rights Issue with Warrants and is revising the Proposed Rights Issue with Warrants in view of the termination of the Settlement Agreements. The details of the revised rights issue proposal will be announced upon finalisation of the same.

This announcement is dated 14 May 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-5-2018 04:28 AM

|

显示全部楼层

发表于 26-5-2018 04:28 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,536 | 3,384 | 9,762 | 12,772 | | 2 | Profit/(loss) before tax | -2,542 | -763 | -5,080 | 1,136 | | 3 | Profit/(loss) for the period | -2,542 | -763 | -5,080 | 1,136 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,542 | -530 | -5,080 | 2,007 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.76 | -0.17 | -1.53 | 0.66 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0400 | 0.0600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2018 05:16 AM

|

显示全部楼层

发表于 22-6-2018 05:16 AM

|

显示全部楼层

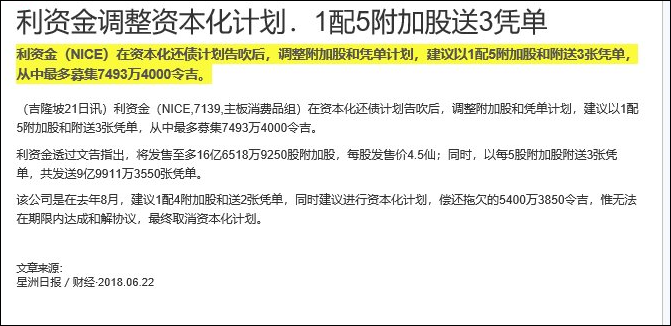

本帖最后由 icy97 于 23-6-2018 08:01 AM 编辑

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | NICHE CAPITAL EMAS HOLDINGS BERHAD ("NICE" OR THE "COMPANY")PROPOSED RIGHTS ISSUE WITH WARRANTS | We refer to the announcements dated 10 August 2017, 14 August 2017, 16 August 2017 and 14 May 2018 in relation to the Proposals (as defined therein) (collectively, the “Announcements”). Unless otherwise defined, all expressions used in this announcement shall carry the same meaning as defined in the Announcements. On 14 May 2018, Mercury Securities had, on behalf of the Board, announced that:

(i) the conditions precedent of the Settlement Agreements had not been fulfilled within the period stipulated therein. As such, the Settlement Agreements have, ipso facto, been terminated effective 10 May 2018 and thus, the Company will not be proceeding with the Proposed Capitalisation; and

(ii) the Company intended to proceed with the Proposed Rights Issue with Warrants, subject to revision in view of the termination of the Settlement Agreements. Pursuant thereto, Mercury Securities, on behalf of the Board, wishes to announce that after further deliberation, the Company has resolved to amongst others, revise the number of Rights Shares and Warrants to be issued following a revision to the basis of entitlement of the Rights Shares and Warrants as well as revise the minimum subscription level and undertaking from certain shareholders in respect of the Proposed Rights Issue with Warrants (“Revisions”).

The Revisions would entail a renounceable rights issue of up to 1,665,189,250 Rights Shares on the basis of 5 Rights Shares for every 1 existing NICE Share held on the Entitlement Date, together with up to 999,113,550 Warrants on the basis of 3 Warrants for every 5 Rights Shares subscribed for at an issue price of RM0.045 per Rights Share.

Please refer to the attachment for further details on the Revisions.

This announcement is dated 21 June 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5832401

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-9-2018 02:07 AM

|

显示全部楼层

发表于 2-9-2018 02:07 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 3,396 | 2,018 | 13,159 | 14,791 | | 2 | Profit/(loss) before tax | 6,327 | -4,515 | 1,247 | -3,379 | | 3 | Profit/(loss) for the period | 6,026 | -4,903 | 946 | -3,767 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,026 | -4,645 | 946 | -2,638 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.81 | -1.39 | 0.28 | -0.85 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0600 | 0.0600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-12-2018 07:24 AM

|

显示全部楼层

发表于 30-12-2018 07:24 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,201 | 2,225 | 2,201 | 2,225 | | 2 | Profit/(loss) before tax | 168 | -500 | 168 | -500 | | 3 | Profit/(loss) for the period | 168 | -500 | 168 | -500 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 168 | -500 | 168 | -500 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.05 | -0.15 | 0.05 | -0.15 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0600 | 0.0600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2019 07:22 AM

|

显示全部楼层

发表于 13-1-2019 07:22 AM

|

显示全部楼层

| NICHE CAPITAL EMAS HOLDINGS BERHAD |

EX-date | 24 Dec 2018 | Entitlement date | 27 Dec 2018 | Entitlement time |

| | Entitlement subject | Rights Issue | Entitlement description | RENOUNCEABLE RIGHTS ISSUE OF UP TO 1,665,189,250 NEW ORDINARY SHARES IN NICHE CAPITAL EMAS HOLDINGS BERHAD ("NICE") ("NICE SHARES") ("RIGHTS SHARES") ON THE BASIS OF 5 RIGHTS SHARES FOR EVERY 1 EXISTING NICE SHARE HELD BY THE ENTITLED SHAREHOLDERS AS AT 5.00 P.M. ON THURSDAY, 27 DECEMBER 2018, TOGETHER WITH UP TO 999,113,550 FREE DETACHABLE WARRANTS ("WARRANTS") ON THE BASIS OF 3 WARRANTS FOR EVERY 5 RIGHTS SHARES SUBSCRIBED FOR AT AN ISSUE PRICE OF RM0.045 PER RIGHTS SHARE ("RIGHTS ISSUE WITH WARRANTS") | Period of interest payment | to | Financial Year End |

| | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | AGRITEUM Share Registration Services Sdn Bhd2nd Floor, Wisma Penang Garden42 Jalan Sultan Ahmad Shah10050 George TownPenangTel: +604 228 2321Fax: +604 227 2391 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 27 Dec 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Ratio | Ratio | 5 : 1 | Rights Issue/Offer Price | Malaysian Ringgit (MYR) 0.045 |

Despatch date | 31 Dec 2018 | Date for commencement of trading of rights | 28 Dec 2018 | Date for cessation of trading of rights | 07 Jan 2019 | Date for announcement of final subscription result and basis of allotment of excess Rights Securities | 22 Jan 2019 | Listing Date of the Rights Securities | 28 Jan 2019 |

Last date and time for | Date | Time | Sale of provisional allotment of rights | 04 Jan 2019 | | 05:00:00 PM | Transfer of provisional allotment of rights | 09 Jan 2019 | | 04:00:00 PM | Acceptance and payment | 14 Jan 2019 | | 05:00:00 PM | Excess share application and payment | 14 Jan 2019 | | 05:00:00 PM |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|