|

|

【ANCOMNY 4758 交流专区】(前名 ANCOM )

[复制链接]

|

|

|

发表于 3-1-2018 01:37 AM

|

显示全部楼层

发表于 3-1-2018 01:37 AM

|

显示全部楼层

Date of change | 02 Jan 2018 | Name | DATO' AHMAD JOHARI BIN ABDUL RAZAK | Age | 63 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Non Executive Chairman | New Position | Executive Director | Directorate | Executive | Qualifications | Dato' Johari holds a Bachelor of Laws degree from the University of Kent, United Kingdom and was called to the Bar of England and Wales at Lincolns Inn in 1976. The following year, he was admitted as an Advocate and Solicitor of the High Court of Malaya. | Working experience and occupation | He practised law with Shearn Delamore & Co from 1979 and was a partner of the firm in the Corporate and Commercial Department from 1981 to 1994. He re-joined the firm as a Partner on 1 August 2007 and heads the Competition Law Practice Group of the firm. He retired from Shearn Delamore & Co on 31 December 2017. | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Ancom Berh |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-1-2018 01:38 AM

|

显示全部楼层

发表于 3-1-2018 01:38 AM

|

显示全部楼层

Date of change | 02 Jan 2018 | Name | MR LEE CHEUN WEI | Age | 43 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Executive Officer | Qualifications | MSc Finance (Distinction)BA (Hons) Accounting and Finance ACCA | Working experience and occupation | Managing Director of Ancom Crop Care Sdn. Bhd., a subsidiary company of Ancom Berhad (Current)Chief Financial Officer, Ancom Group (2009-2014)Director Corporate Finance, Tamco Corporate Holding Berhad (2005-2009)Chief Financial Officer, EPE Power Corporate Bhd (2001-2003)Group Accountant, EPE Group (1997-2001) | Directorships in public companies and listed issuers (if any) | None | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Ancom Berhad - 3,150,000 ordinary shares (Direct)Ancom Logistics Berhad - 200,000 ordinary shares (Direct) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-1-2018 04:27 AM

|

显示全部楼层

发表于 27-1-2018 04:27 AM

|

显示全部楼层

本帖最后由 icy97 于 30-1-2018 03:15 AM 编辑

安康次季净利飙63%

2018年1月30日

(吉隆坡29日讯)安康(ANCOM,4758, 主板工业产品股)截至11月杪财年次季,净利年劲扬63.49%至142万4000令吉,或每股0.66仙。

安康向交易所报备,营业额年增23.28%至4亿9773万1000令吉。

累计半年营业额扬20.71%,报9亿1726万6000令吉,净利上升62.06%至253万3000令吉。

安康指出,农业与工业及聚合物业务,都交出不俗表现,虽然媒体领域前景备受挑战,但相信会交出令人满意的成绩。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2017 | 30 Nov 2016 | 30 Nov 2017 | 30 Nov 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 497,731 | 403,753 | 917,266 | 759,902 | | 2 | Profit/(loss) before tax | 12,820 | 14,949 | 19,836 | 19,152 | | 3 | Profit/(loss) for the period | 5,783 | 5,829 | 8,337 | 6,084 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,424 | 871 | 2,533 | 1,563 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.66 | 0.40 | 1.18 | 0.72 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4000 | 1.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-3-2018 03:34 AM

|

显示全部楼层

发表于 28-3-2018 03:34 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | ANCOM BERHAD :Acquisition of a Company by Puncak Berlian Sdn. Bhd. | Ancom Berhad (“Ancom” or "Company") wishes to announce that Puncak Berlian Sdn. Bhd., a 75%-owned subsidiary of the Company, has on today acquired one (1) ordinary share representing the entire equity interest in Novaberry Sdn. Bhd. (Company No. 1268093-W) (“Novaberry”) for RM1.00 cash.

Novaberry was incorporated in Malaysia on 12 February 2018 under the Companies Act 2016, and is currently dormant.

The acquisition will not have any material effect on the earnings, net assets and gearing of Ancom Group for the financial year ending 31 May 2018.

None of the Directors and major shareholders of Ancom and the persons connected to them has any direct or indirect interest in the acquisition.

This announcement is dated 27 March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-5-2018 05:50 PM

|

显示全部楼层

发表于 8-5-2018 05:50 PM

|

显示全部楼层

本帖最后由 icy97 于 12-5-2018 07:24 AM 编辑

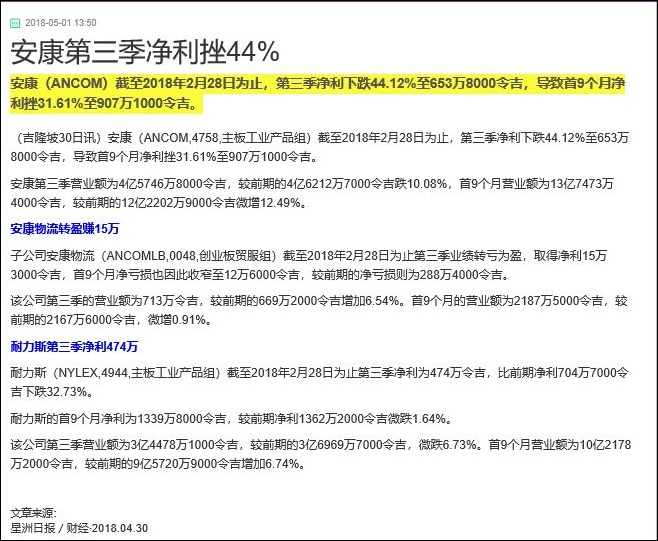

SUMMARY OF KEY FINANCIAL INFORMATION

28 Feb 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 28 Feb 2018 | 28 Feb 2017 | 28 Feb 2018 | 28 Feb 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 457,468 | 462,127 | 1,374,734 | 1,222,029 | | 2 | Profit/(loss) before tax | 14,326 | 21,015 | 34,162 | 40,167 | | 3 | Profit/(loss) for the period | 10,509 | 15,320 | 18,846 | 21,404 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,538 | 11,702 | 9,071 | 13,265 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.04 | 5.44 | 4.22 | 6.16 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4200 | 1.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-7-2018 12:42 AM

|

显示全部楼层

发表于 27-7-2018 12:42 AM

|

显示全部楼层

本帖最后由 icy97 于 27-7-2018 05:04 AM 编辑

安康第四季净利倍增

Emir Zainul/theedgemarkets.com

July 26, 2018 20:19 pm +08

(吉隆坡26日讯)农业和工业化学品、物流及资讯科技(IT)业务报捷,提振安康(Ancom Bhd)截至今年5月31日止第四季净利倍增至851万令吉,上财年同期报420万令吉。

每股盈利从1.95仙,增至3.95仙。

该集团向大马交易所报备,农业和工业化学品盈利上扬,归功于某些工业化学品的销量增加。

Nylex 1船的表现有所改善及外汇兑换盈利增加,是推高物流业务盈利的关键因素。

然而,安康的投资控股、媒体及聚合物业务均蒙亏。

该集团的季度营业额报5亿8008万令吉,比上财年同期的4亿7823万令吉,按年弹升了21.3%。

该集团全年净赚1758万令吉,上财年则净赚1747万令吉。全年营业额则按年上升15%至19亿5000万令吉,上财年为17亿令吉。

展望未来,该集团估计,农业和工业化学品业务及聚合物业务将维持积极的表现,因为这些业务在现财年取得令人满意的表现。

“但媒体业务的近期前景将充满挑战,因为本地市场情绪疲弱。”

(编译:魏素雯)

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2018 | 31 May 2017 | 31 May 2018 | 31 May 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 580,075 | 478,232 | 1,954,809 | 1,700,261 | | 2 | Profit/(loss) before tax | 12,866 | 11,275 | 47,028 | 51,442 | | 3 | Profit/(loss) for the period | 6,815 | 7,873 | 25,661 | 29,277 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 8,510 | 4,201 | 17,581 | 17,466 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.95 | 1.95 | 8.17 | 8.11 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4700 | 1.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-7-2018 01:21 AM

|

显示全部楼层

发表于 27-7-2018 01:21 AM

|

显示全部楼层

Type | Announcement | Subject | MULTIPLE PROPOSALS | Description | ANCOM BERHAD ("ANCOM" OR THE "COMPANY")I. PROPOSED BONUS ISSUE; ANDII. PROPOSED ESOS(COLLECTIVELY REFERRED TO AS THE "PROPOSALS") | On behalf of the Board of Directors of Ancom, UOB Kay Hian Securities (M) Sdn Bhd wishes to announce that the Company proposes to undertake the following:- (i) proposed bonus issue of up to 21,895,634 new ordinary shares in Ancom ("Ancom Share(s)" or "Share(s)") ("Bonus Share(s)") to be credited as fully paid-up on the basis of 1 Bonus Share for every 10 existing Ancom Shares held on an entitlement date to be determined later ("Proposed Bonus Issue"); and

(ii) proposed establishment of an employees' share option scheme ("ESOS") of up to 10% of the total number of issued shares of Ancom at any point in time ("Proposed ESOS").

Further details on the abovementioned Proposals are set out in the attachment enclosed.

This announcement is dated 26 July 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5866277

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-9-2018 03:42 AM

|

显示全部楼层

发表于 8-9-2018 03:42 AM

|

显示全部楼层

Type | Announcement | Subject | MATERIAL LITIGATION | Description | Claim by Redberry Sdn. Bhd. ("Redberry") against Utusan Melayu (Malaysia) Berhad ("Utusan") | The Board of Directors of Ancom Berhad (“Ancom” or “Company”) wishes to announce that its subsidiary, Redberry had, vide its solicitors, served a Writ of Summons and Statement of Claim against Utusan on 4 September 2018 to claim for return of deposits totaling RM8,500,000.00 for the proposed “advertisement, branding and communication” exercise vide letter dated 30 April 2018.

The amount claimed for includes:

(i) Refund for the sum of RM8,500,000.00;

(ii) Interest at the rate of 5% per annum on the amount of judgment, which to be assessed from the date of judgment to the date of full repayment;

(iii) Cost on a full indemnity basis; and

(iv) Such further and/or other relief as the Court deems fit.

The case has been fixed for case management at Kuala Lumpur High Court on 25 September 2018.

The Company will make further announcements in relation to any material development in this matter from time to time.

This announcement is dated 6 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-10-2018 01:33 AM

|

显示全部楼层

发表于 20-10-2018 01:33 AM

|

显示全部楼层

EX-date | 01 Nov 2018 | Entitlement date | 05 Nov 2018 | Entitlement time | 05:00 PM | Entitlement subject | Bonus Issue | Entitlement description | BONUS ISSUE OF NEW ORDINARY SHARES IN ANCOM ("ANCOM SHARE(S)" OR "SHARE(S)") ("BONUS SHARE(S)") TO BE CREDITED AS FULLY PAID-UP ON THE BASIS OF 1 BONUS SHARE FOR EVERY 10 EXISTING ANCOM SHARES ("BONUS ISSUE") | Period of interest payment | to | Financial Year End |

| | Share transfer book & register of members will be | 05 Nov 2018 to 05 Nov 2018 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 05 Nov 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Ratio | Ratio | 1 : 10 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-10-2018 05:48 AM

|

显示全部楼层

发表于 27-10-2018 05:48 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2018 | 31 Aug 2017 | 31 Aug 2018 | 31 Aug 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 527,587 | 419,535 | 527,587 | 419,535 | | 2 | Profit/(loss) before tax | 12,430 | 7,016 | 12,430 | 7,016 | | 3 | Profit/(loss) for the period | 8,464 | 2,554 | 8,464 | 2,554 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 7,018 | 1,109 | 7,018 | 1,109 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.26 | 0.52 | 3.26 | 0.52 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4800 | 1.4700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-1-2019 04:50 AM

|

显示全部楼层

发表于 4-1-2019 04:50 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | ANCOM BERHAD: Acquisition of Companies by Ancom Crop Care Sdn. Bhd. | Ancom Berhad (“Ancom” or “Company”) wishes to announce that Ancom Crop Care Sdn. Bhd., a wholly-owned subsidiary of the Company, has acquired the following:- - one (1) ordinary share representing 100% of the equity interest in Budi Prospek Sdn. Bhd. (Company No. 1298732-U) (“BPSB”) for a cash consideration of RM1.00; and

- one (1) ordinary share representing 100% equity interest in Rimbun Prospek Sdn. Bhd. (Company No. 1301053-P) (“RPSB”) for a cash consideration of RM1.00.

BPSB and RPSB were incorporated in Malaysia on 10 October 2018 and 25 October 2018 respectively under the Companies Act 2016, and are currently dormant.

The acquisitions of BPSB and RPSB will not have any material effect on the earnings, net assets and gearing of the Company and of the Ancom group for the financial year ending 31 May 2019.

None of the Directors and major shareholders of the Company and the persons connected to them has any direct or indirect interest in the acquisitions of BPSB and RPSB.

This announcement is dated 7 December 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-1-2019 08:03 AM

|

显示全部楼层

发表于 30-1-2019 08:03 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | ANCOM BERHAD ("Ancom" or "Company"): Business As Usual | The Board of Directors (“Board”) of Ancom wishes to announce that the Malaysian Anti-Corruption Commission (“MACC”) has been granted a 4-day remand order involving the Company’s Executive Chairman, Dato’ Siew Ka Wei (“Dato’ Siew”), to assist MACC in its investigation during Dato’ Siew’s tenure as Chairman of the Tourism Board of Malaysia.

The Board has convened an Emergency Board Meeting this afternoon to assess the implications of the above on the Group’s operations, its shareholders and other stakeholders who may be affected directly and indirectly and to determine the possible course of action to be taken.

The Board wishes to inform the shareholders and other stakeholders that the operations of the Group remain unaffected by the above event. The Group’s various operating units have been and are under the care of the various Unit Heads with proven track record.

This announcement is dated 9 January 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-2-2019 05:01 AM

|

显示全部楼层

发表于 8-2-2019 05:01 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2018 | 30 Nov 2017 | 30 Nov 2018 | 30 Nov 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 545,482 | 497,731 | 1,073,069 | 917,266 | | 2 | Profit/(loss) before tax | 7,141 | 12,820 | 19,571 | 19,836 | | 3 | Profit/(loss) for the period | 872 | 5,783 | 9,336 | 8,337 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,802 | 1,424 | 8,820 | 2,533 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.84 | 0.66 | 4.11 | 1.18 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3500 | 1.4800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-3-2019 07:27 AM

|

显示全部楼层

发表于 13-3-2019 07:27 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Acquisition of Dormant Company | Ancom Berhad (“Ancom” or “Company”) wishes to announce that the Company has on today acquired one (1) ordinary share representing the entire equity interest in Media Works Sdn. Bhd. (Company No. 1307492-K) (“MWSB”) for RM1.00 cash.

MWSB was incorporated in Malaysia on 13 December 2018 and is currently dormant.

The acquisition of MWSB will not have any material effect on the earnings, net assets and gearing of the Company and of the Ancom group for the financial year ending 31 May 2019.

None of the Directors and major shareholders of the Company and the person connected to them has any direct or indirect interest in the acquisition of MWSB.

This announcement is dated 1 March 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-5-2019 02:10 AM

|

显示全部楼层

发表于 21-5-2019 02:10 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED DISPOSAL OF 40% EQUITY INTEREST IN PUNCAK BERLIAN SDN. BHD. HELD BY REDBERRY SDN. BHD. | Ancom Berhad (“the Company” or “Ancom”) wishes to announce that Redberry Sdn. Bhd. (“RSB”), a wholly-owned subsidiary of the Company and the Company had on 19 April 2019, entered into a Share Sale Agreement (“SSA”) with VGI Global Media (Malaysia) Sdn. Bhd. (“VGI Malaysia”) for the disposal of 6,850,042 ordinary shares, representing 40% of the issued and paid-up share capital, in Puncak Berlian Sdn. Bhd. held by RSB to VGI Malaysia at a consideration of RM9,600,000 only, subject to the terms and conditions stipulated in the SSA.

Please refer to the attachment below for further details on the announcement.

This announcement is dated 22 April 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6133557

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-6-2019 03:47 AM

|

显示全部楼层

发表于 5-6-2019 03:47 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

28 Feb 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 28 Feb 2019 | 28 Feb 2018 | 28 Feb 2019 | 28 Feb 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 433,730 | 457,468 | 1,506,799 | 1,374,734 | | 2 | Profit/(loss) before tax | -5,786 | 14,326 | 13,785 | 34,162 | | 3 | Profit/(loss) for the period | -11,579 | 10,509 | -2,243 | 18,846 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -3,867 | 6,538 | 4,953 | 9,071 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.84 | 3.04 | 2.32 | 4.22 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3100 | 1.5100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-6-2019 02:50 AM

|

显示全部楼层

发表于 6-6-2019 02:50 AM

|

显示全部楼层

Date of change | 26 Apr 2019 | Name | MR SIEW KA KHEONG | Age | 59 | Gender | Male | Nationality | Malaysia | Designation | Alternate Director | Directorate | Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Chemical Engineering | University College London | |

Working experience and occupation | Ka Kheong is the Executive Director of IEnterpise Online Sdn. Bhd., a subsidiary of the Company and heading the IT Division. Prior to this, he was the Managing Director of a company involving in IT industry, which he set up since 1982. Ka Kheong has more than 30 years of experience in the IT industry. His experience spans across industries such as Financial Services, Manufacturing, Distribution and Retail. He is the Chairman of a local company certifying many IT professionals in Malaysia for project management (for Project Management Institute, USA). | Directorships in public companies and listed issuers (if any) | Nil | Family relationship with any director and/or major shareholder of the listed issuer | Brother to Dato' Siew Ka Wei, the Executive Chairman and a major shareholder | Any conflict of interests that he/she has with the listed issuer | No | Details of any interest in the securities of the listed issuer or its subsidiaries | Indirect Interest (Held through Quek Lay Kheng and Siew Nim Chee & Sons Sdn Bhd) in :- Ancom Berhad (7.256%)- Nylex (Malaysia) Berhad (2.817%)- Ancom Logistics Berhad (0.141%)- HSO Business Systems Sdn Bhd (Subsidiary of Ancom Berhad) (39.05%) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-6-2019 06:49 AM

|

显示全部楼层

发表于 6-6-2019 06:49 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED DISPOSAL OF 40% EQUITY INTEREST IN PUNCAK BERLIAN SDN. BHD. HELD BY REDBERRY SDN. BHD. | Reference is made to the Company's announcement dated 22 April 2019 (Reference No. GA1-22042019-00104) in relation to the proposed disposal.

Please refer to the attachment below for further details of the announcement.

This announcement is dated 29 April 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6142813

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-7-2019 07:16 AM

|

显示全部楼层

发表于 8-7-2019 07:16 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | Share Exchange between Ancom Berhad and Lee Nan Phin in relation to IEnterprise Online Sdn Bhd and Advanced Technology Studies Centre Sdn Bhd | Ancom Berhad (“Ancom” or “Company) wishes to announce that the Company and Mr Lee Nan Phin has entered into arrangement to reverse a transaction that was completed in July 2012.

Please refer to the attachment below for further details.

This announcement is dated 31 May 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6181045

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-7-2019 05:00 AM

|

显示全部楼层

发表于 10-7-2019 05:00 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|