|

|

发表于 27-6-2015 04:23 AM

|

显示全部楼层

发表于 27-6-2015 04:23 AM

|

显示全部楼层

本帖最后由 icy97 于 28-6-2015 11:03 PM 编辑

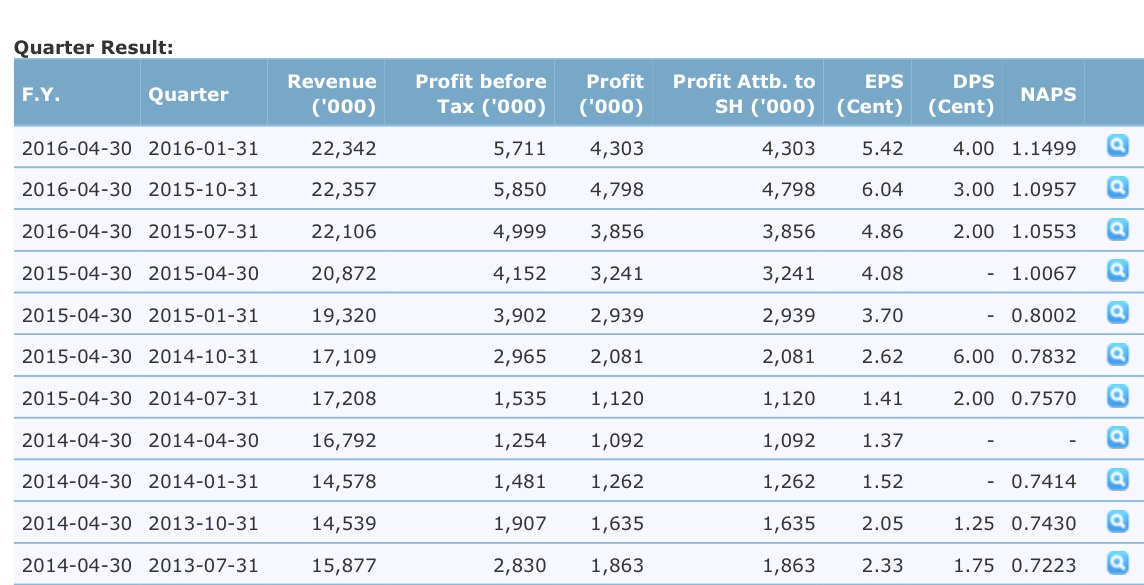

世霸龙净利翻近2倍

财经新闻 财经 2015-06-28 10:23

(吉隆坡27日讯)世霸龙(SUPERLN,7235,主板工业产品股)截至4月30日末季,净利飙涨197%,归功于制造和贸易业务表现向好,以及外汇转换所得。

根据文告,末季净利报324万1000令吉,或相等每股4.08仙,胜于去年同期的109万2000令吉,或每股1.37仙。

同时,当季营业额从1679万2000令吉,年增24.30%,至2087万2000令吉。

全年方面,净利取得60.33%的涨幅,达938万1000令吉,或每股11.81仙;营业额则报7450万9000令吉,年涨20.59%。

产业重估盈余1792万

另一方面,世霸龙也重估巴生的三项工业产业价值,原本截至4月30日的未审计净账面价值为2035万7000令吉,经重估后达4027万令吉,意味着纳入净递延税项的重估盈余,有1792万3000令吉。

这将会把每股净资产,提高约23仙,至97仙。【南洋网财经】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Apr 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Apr 2015 | 30 Apr 2014 | 30 Apr 2015 | 30 Apr 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 20,872 | 16,792 | 74,509 | 61,787 | | 2 | Profit/(loss) before tax | 4,152 | 1,254 | 12,554 | 7,472 | | 3 | Profit/(loss) for the period | 3,241 | 1,092 | 9,381 | 5,851 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,241 | 1,092 | 9,381 | 5,851 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.08 | 1.37 | 11.81 | 7.34 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 8.00 | 1.25 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.0067 | 0.7428

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-6-2015 04:24 AM

|

显示全部楼层

发表于 27-6-2015 04:24 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SUPERLON HOLDINGS BERHAD ("SUPERLON" OR "THE COMPANY")REVALUATION OF LAND AND BUILDINGS | The Board of Directors (“the Board”) of Superlon wishes to announce that the Board has approved the incorporation of the revaluation surplus, net of deferred tax, of approximately RM17.9 million in the Consolidated Financial Statements of Superlon for the financial year ended 30 April 2015.

Please refer to the attached file for full text of the announcement.

This announcement is dated 25 June 2015. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/4784021

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-6-2015 04:50 AM

|

显示全部楼层

发表于 27-6-2015 04:50 AM

|

显示全部楼层

EX-date | 20 Jul 2015 | Entitlement date | 22 Jul 2015 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | An interim dividend of 2 sen per ordinary share of RM0.50 each, tax exempt under single-tier system in respect of the financial year ending 30 April 2016 | Period of interest payment | to | Financial Year End | 30 Apr 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | Tricor Investor & Issuing House Services Sdn Bhd(formerly known as Equiniti Services Sdn Bhd)Level 17, The Gardens North TowerMid-Valley City, Lingkaran Syed Putra59200 Kuala Lumpur Tel: 603-22643883 | Payment date | 06 Aug 2015 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 22 Jul 2015 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0200 | Par Value | Malaysian Ringgit (MYR) 0.500 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-7-2015 12:14 PM

|

显示全部楼层

发表于 6-7-2015 12:14 PM

|

显示全部楼层

本帖最后由 icy97 于 6-7-2015 04:30 PM 编辑

Insider Asia’s Stock Of The Day: Superlon Holdings

By Asia Analytica / The Edge Financial Daily | July 6, 2015 : 10:57 AM MYT

http://www.theedgemarkets.com/my/article/insider-asia%E2%80%99s-stock-day-superlon-holdings

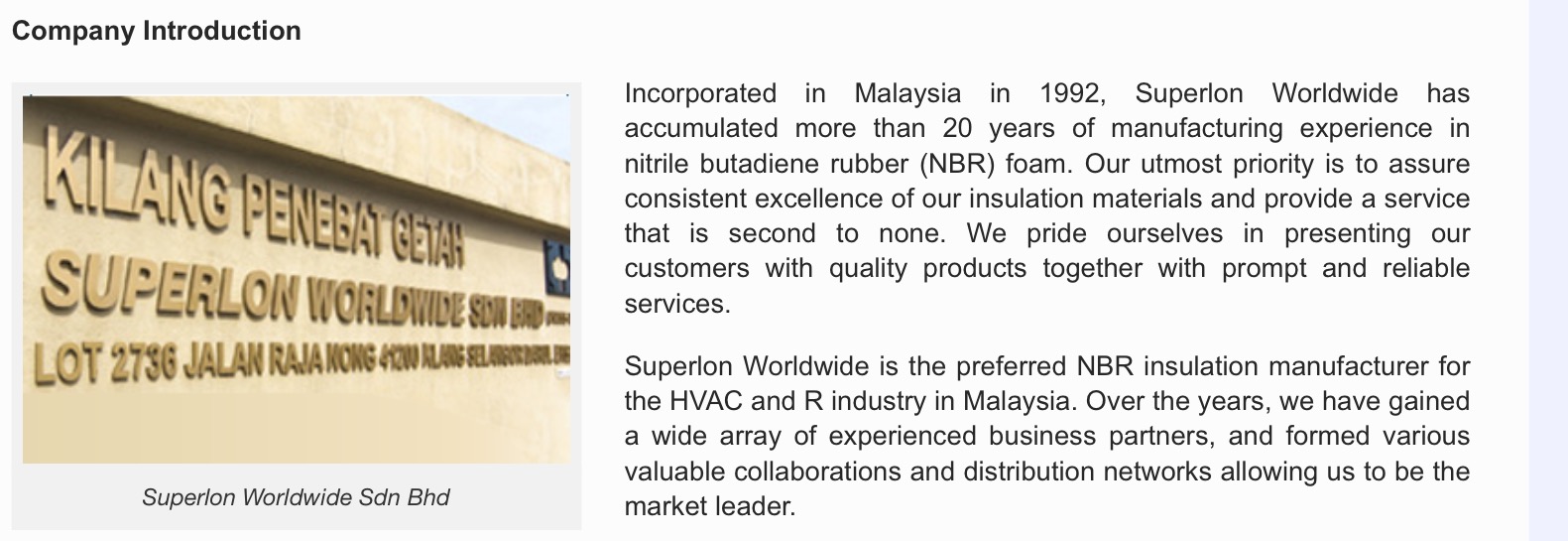

SUPERLON (Fundamental: 3.0/3, Valuation: 2.0/3) manufactures nitrile butadiene rubber (NBR) foam insulation materials for the heating and air conditioning industry. Based in Klang, it exports about 70% of its production, mostly to other Asian countries.

Last December, the company declared an interim dividend of 2 sen per share and a special dividend of 4 sen per share — compared with total dividends of 3.25 sen for FYApril2014.

This means that dividends totalled 8 sen per share in the past 12 months, translating into an attractive yield of 5.4%.

The higher-than-market average yield generated investor interest in the relatively low-profile manufacturer — its share price has more than doubled since then, to RM1.49 currently.

Besides the generous dividends, its improving financial performance has also not gone unnoticed. After exiting from the loss-making steel pipes division in FY12, the company has turned around, from a net loss of RM0.6 million in FY12 to net profit of RM5.9 million in FY14.

For FY15, net profit climbed 60% to RM9.4 million, lifted by a 21% increase in turnover. Margins expanded on the back of economies of scale and strengthening of the US dollar. The company declared an interim dividend of 2 sen per share for FY2016, which will go ex on 20 July 2015

Stronger operating cash flow enabled the company to pare its debts. It now has net cash of RM11.7 million, a reversal from net debt of RM4.1 million in FY12.

Going forward, Superlon intends to focus on expanding its domestic and regional market shares as well as strengthen its distribution network. In anticipation of a recovery in global demand, Superlon plans to invest RM12 million in the next two years to expand production capacity.

The stock is trading at a trailing 12-month P/E of 12.6 times — low relative to the 43% earnings growth in FY14 and 60% growth in FY15

This article first appeared in The Edge Financial Daily, on July 6, 2015.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-9-2015 01:26 AM

|

显示全部楼层

发表于 30-9-2015 01:26 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jul 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jul 2015 | 31 Jul 2014 | 31 Jul 2015 | 31 Jul 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 22,106 | 17,208 | 22,106 | 17,208 | | 2 | Profit/(loss) before tax | 4,999 | 1,535 | 4,999 | 1,535 | | 3 | Profit/(loss) for the period | 3,856 | 1,120 | 3,856 | 1,120 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,856 | 1,120 | 3,856 | 1,120 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.86 | 1.41 | 4.86 | 1.41 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.00 | 0.00 | 2.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.0553 | 1.0067

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-10-2015 04:07 AM

|

显示全部楼层

发表于 1-10-2015 04:07 AM

|

显示全部楼层

世霸龍衝上1個月新高

財經股市30 Sep 2015 23:00

(吉隆坡30日訊)世霸龍(SUPERLN,7235,主要板工業)淨利表現取得3倍成長,並派發每股2仙股息,提振股價一度漲16仙至1.66令吉,改寫一個月新高價位。

世霸龍早盤以1.56令吉開市,隨后持續攀升16仙至1.66令吉一個月新高水平,休市報1.61令吉,起11仙,半日交投63萬7900股。閉市時,該股報1.60令吉,起10仙,成交量113萬5200股。

該公司向馬證交所報備,截至7月底首季淨利取得超過3倍成長,從112萬令吉增至386萬令吉,由旗下製造業務提振。營業額從1721萬令吉,按年攀升28.49%至2211萬令吉。

世霸龍指出,旗下製造業務營業額和稅前盈利,分別達2100萬令吉和500萬令吉,相較去年同期為1520萬令吉和160萬令吉。

該公司指利好匯率波動,提振整體業績成長,並相信在現有產品趨勢下可交出正面2016財年業績表現。【中国报财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-10-2015 02:10 AM

|

显示全部楼层

发表于 7-10-2015 02:10 AM

|

显示全部楼层

Name | MADAM LIU LEE, HSIU-LIN (ALSO KNOWN AS JESSICA H.LIU) | Address | MR 1-15-04 Sri Acapella Service Apartment

No. 1 Jalan Lompat Tinggi 13/33

Seksyen 13

Shah Alam

40100 Selangor

Malaysia. | NRIC/Passport No/Company No. | 300743268 | Nationality/Country of incorporation | Australia | Descriptions (Class & nominal value) | Ordinary Share of RM0.50 each | Name & address of registered holder | LIU LEE, HSIU-LIN (ALSO KNOWN AS JESSICA H.LIU)MR 1-15-04 Sri Acapella Service ApartmentNo. 1 Jalan Lompat Tinggi 13/33Seksyen 13 40100 Shah Alam Selangor |

Details of changesCurrency: Malaysian Ringgit (MYR) | Type of transaction | Description of Others | Date of change | No of securities

| Price Transacted (RM)

| | Transferred | | 02 Oct 2015 | 3,570,000

| 1.730

|

Circumstances by reason of which change has occurred | Direct business deal | Nature of interest | Direct interest | Direct (units) | 17,930,274 | Direct (%) | 22.58 | Indirect/deemed interest (units) | 7,140,000 | Indirect/deemed interest (%) | 9 | Total no of securities after change | 25,070,274 | Date of notice | 06 Oct 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-10-2015 12:04 AM

|

显示全部楼层

发表于 20-10-2015 12:04 AM

|

显示全部楼层

| Type of transaction | Description of Others | Date of change | No of securities

| Price Transacted (RM)

| | Disposed | | 30 Sep 2015 | 1,800,000

| 1.600

|

Circumstances by reason of which change has occurred | Via married deal | Nature of interest | Benefical owner | Direct (units) | 4,368,308 | Direct (%) | 5.502 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 4,368,308 | Date of notice | 19 Oct 2015 |

Notice of Person Ceasing (29C)Particulars of Substantial Securities HolderName | MR LIU MAN-TIEN | Address | Lot 2736 Jalan Raja Nong

Klang

41200 Selangor

Malaysia. | NRIC/Passport No/Company No. | 213110135 | Nationality/Country of incorporation | China | Descriptions (Class & nominal value) | Ordinary shares of RM0.50 each | Date of cessation | 02 Oct 2015 | Name & address of registered holder | HLIB Nominees (Asing) Sdn Bhdpledged securities account for Liu Man-Tien |

Currency | Malaysian Ringgit (MYR) | No of securities disposed | 500,000 | Price Transacted ($$) | 1.730 | Circumstances by reason of which Securities Holder has interest | Via direct deal | Nature of interest | Benefical owner |

| Date of notice | 19 Oct 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-12-2015 11:45 PM

|

显示全部楼层

发表于 10-12-2015 11:45 PM

|

显示全部楼层

本帖最后由 icy97 于 11-12-2015 01:49 AM 编辑

世霸龍每股派息3仙

2015年12月10日

(吉隆坡10日訊)世霸龍(SUPERLN,7235,主要板工業)截至10月底次季淨利取得雙倍成長,從208萬令吉增130%至480萬令吉,同時每股派息3仙。

該公司營業額亦按年攀升30.7%,從1711萬令吉增至2236萬令吉,由銅製管銷售增加帶動。同時,旗下製造業務在較高營業額和利好匯率因素提振,有較優異表現。

世霸龍上半年淨利交出170%增長,至865萬令吉,對比去年同期為320萬令吉。營業額從3432萬令吉,攀升29.6%至4446萬令吉。【中国报财经】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Oct 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Oct 2015 | 31 Oct 2014 | 31 Oct 2015 | 31 Oct 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 22,357 | 17,109 | 44,463 | 34,318 | | 2 | Profit/(loss) before tax | 5,850 | 2,965 | 10,848 | 4,500 | | 3 | Profit/(loss) for the period | 4,798 | 2,081 | 8,654 | 3,201 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,798 | 2,081 | 8,654 | 3,201 | | 5 | Basic earnings/(loss) per share (Subunit) | 6.04 | 2.62 | 10.90 | 4.03 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.00 | 6.00 | 5.00 | 6.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.0957 | 1.0067

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-12-2015 11:46 PM

|

显示全部楼层

发表于 10-12-2015 11:46 PM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SUPERLON HOLDINGS BERHAD ("SHB" or "the Company")A second interim dividend of 3 sen per ordinary share of RM0.50 each, tax exempt under single-tier system in respect of the financial year ending 30 April 2016 | The Board of Directors of SHB wishes to announce that the Directors has on 10 December 2015 approved a second interim dividend of 3 sen per ordinary share of RM0.50 each, tax exempt under single-tier system ("Dividends") in respect of the financial year ending 30 April 2016 to the shareholders of the Company.

The entitlement date and date of payment in respect of the Dividends will be determined and announced by SHB in due course.

This announcement is dated 10 December 2015. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-1-2016 04:08 AM

|

显示全部楼层

发表于 1-1-2016 04:08 AM

|

显示全部楼层

EX-date | 14 Jan 2016 | Entitlement date | 18 Jan 2016 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | A second interim dividend of 3 sen per ordinary share of RM0.50 each, tax exempt under single-tier system in respect of the financial year ending 30 April 2016 | Period of interest payment | to | Financial Year End | 30 Apr 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01 Level 32 Tower A Vertical Business Suite Avenue 3 Bangsar South No. 8 Jalan Kerinchi 59200 Kuala Lumpur Wilayah Persekutuan Malaysia | Payment date | 02 Feb 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 18 Jan 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0300 | Par Value | Malaysian Ringgit (MYR) 0.500 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-2-2016 05:01 AM

|

显示全部楼层

发表于 6-2-2016 05:01 AM

|

显示全部楼层

本帖最后由 icy97 于 6-2-2016 05:51 AM 编辑

Notice of Interest Sub. S-hldr (29A)Particulars of Substantial Securities Holder

Name | MR CHAN KENG CHUNG | Address | 33A-07 Northshore Gardens Condo

Persiaran Residen

Desa Parkcity 52200 Kuala Lumpur

Kuala Lumpur

52200 Wilayah Persekutuan

Malaysia. | NRIC/Passport No/Company No. | 710827065125 | Nationality/Country of incorporation | Malaysia | Descriptions (Class & nominal value) | Ordinary shares of RM0.50 each | Name & address of registered holder | CHAN KENG CHUNG33A-07 Northshore Gardens CondoPersiaran ResidenDesa Parkcity 52200 Kuala Lumpur |

| Date interest acquired & no of securities acquired | Currency | Malaysian Ringgit (MYR) | Date interest acquired | 03 Feb 2016 | No of securities | 220,000 | Circumstances by reason of which Securities Holder has interest | Open market deal | Nature of interest | Direct | Price Transacted ($$) | 1.788 |

| | Total no of securities after change | Direct (units) | 4,185,000 | Direct (%) | 5.271 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Date of notice | 05 Feb 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-2-2016 08:17 PM

|

显示全部楼层

发表于 12-2-2016 08:17 PM

|

显示全部楼层

本帖最后由 icy97 于 13-2-2016 03:39 AM 编辑

買進券商心頭好.世霸龍 料可維持股息派發率

2016年2月12日

券商 :肯納格證券研究

合理價:2.03令吉

儘管世霸龍(SUPERLN,7235,主要板工業)尚未定下股息政策,但基于銷售獲改善,本財年獲利料刷新高,相信在接下來2個財年提供5.1%股息回酬,我們維持“短期買進”評級。

雖然該公司未提供股息政策,不過由于強勁業績表現,在2015財年仍將51%盈利撥出來派發股息回饋股東。該股2015財年的股息達6仙,相等于3.2%股息回酬。

如果該公司能夠持續改善銷售表現,我們有信心該公司有能力維持有關股息派發率。

我們估計,該公司股東將分別在2016和2017財年,同時獲9仙股息,股息回酬為5.1%。

從該公司2016財年上半年取得4450萬令吉營業額,及870萬令吉淨利看來,已達到2015財年營業額的60%比重,及淨利的92.5%比重。

世霸龍管理層指說,公司已實施舉措簡化廠房的運作,改善效率,並提高產量,我們相信這可改善該公司的賺幅。

我們因而相信,該公司2016財年將交出最亮眼的盈利表現。

除了股息有看頭,我們認為該股具吸引力,因為成長前景強勁、可持續性盈利賺幅。

我們維持該股“短期買進”評級,合理價為2.03令吉。【中国报财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 18-2-2016 02:04 AM

|

显示全部楼层

发表于 18-2-2016 02:04 AM

|

显示全部楼层

本帖最后由 icy97 于 18-2-2016 02:37 PM 编辑

世霸龍逾千萬興建新倉庫

2016年2月17日

(吉隆坡17日訊)世霸龍(SUPERLN,7235,主要板工業)宣布,將新倉庫建設合約頒發予Total Modern工程私人有限公司(Total Modern Engineering Sdn Bhd),總值1030萬令吉。

世霸龍向馬證交所報備,子公司世霸龍全球私人有限公司(Superlon Worldwide Sdn Bhd)將在巴生雙溪加蒂路(Jalan Sungai Jati)建設新倉庫。

根據報備文件,新倉庫的建設將有助世霸龍擴大旗下儲備設施,加強生產設施的格局,以縮短交貨時間。

世霸龍預計,新倉庫建設將在今年末季完成,並正面貢獻公司未來收益。【中国报财经】

Type | Announcement | Subject | OTHERS | Description | SUPERLON HOLDINGS BERHAD ("SUPERLON" OR "THE COMPANY")CONSTRUCTION OF A NEW WAREHOUSE BUILDING | The Board of Directors of Superlon wishes to announce that its wholly-owned subsidiary, Superlon Worldwide Sdn Bhd is constructing a new warehouse building situated at Lot 2568 Jalan Sungai Jati, Klang Bandar Diraja, Selangor Darul Ehsan, which is adjacent to its existing factory (“the New Warehouse”).

The construction of the New Warehouse is awarded to Total Modern Engineering Sdn Bhd for a total contract sum of approximately RM10.3 million inclusive of 6% GST. The New Warehouse is expected to be completed in the 4th quarter of 2016.

The construction of the New Warehouse would enable Superlon to expand its storage facilities and improve the layout of its manufacturing facilities. This is expected to reduce the response and delivery time to its customers.The New Warehouse is expected to contribute positively to the Group’s future earnings.

The construction will be financed by a combination of bank borrowings and internally generated funds.

This announcement is dated 17 February 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-3-2016 03:07 AM

|

显示全部楼层

发表于 25-3-2016 03:07 AM

|

显示全部楼层

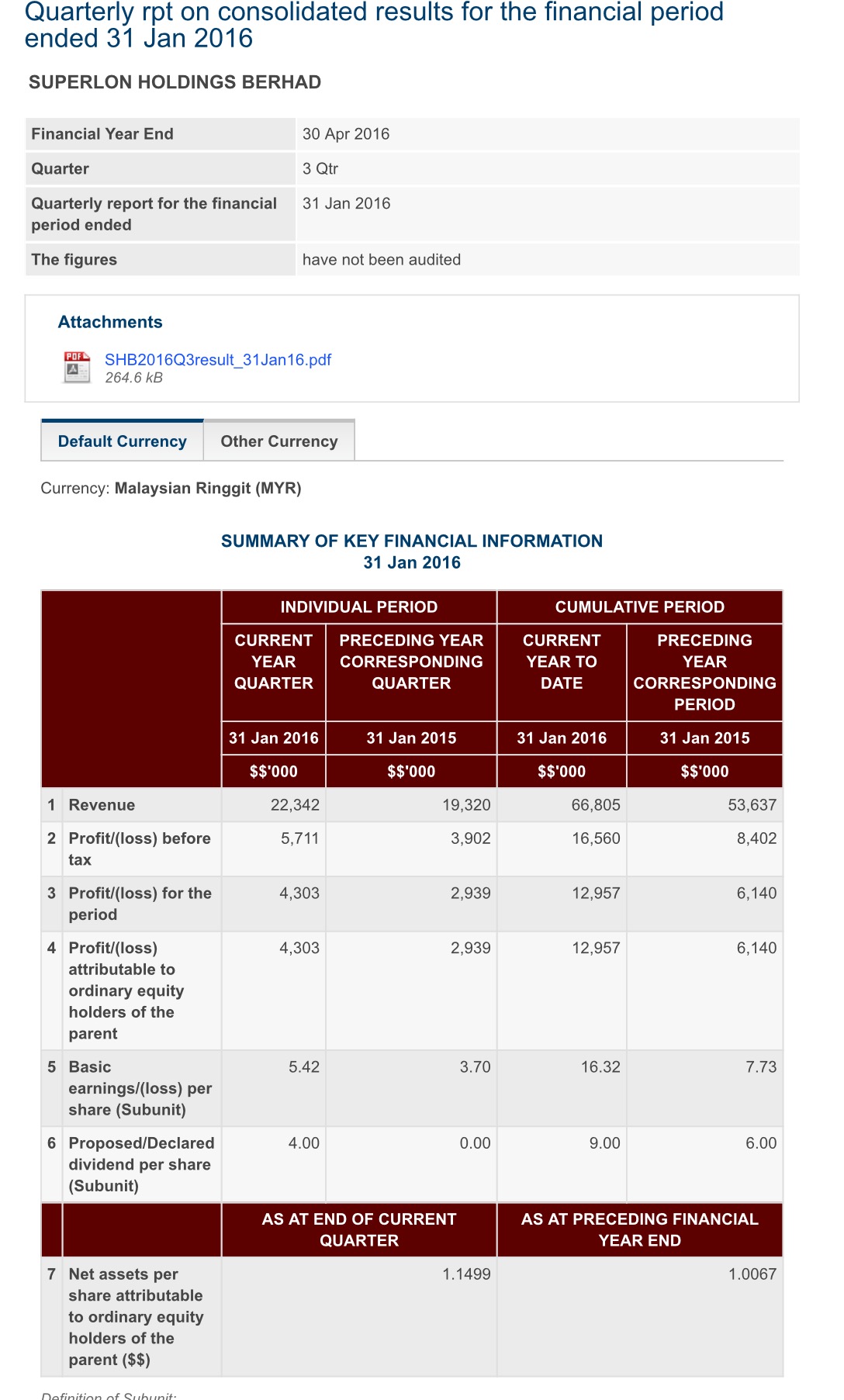

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jan 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jan 2016 | 31 Jan 2015 | 31 Jan 2016 | 31 Jan 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 22,342 | 19,320 | 66,805 | 53,637 | | 2 | Profit/(loss) before tax | 5,711 | 3,902 | 16,560 | 8,402 | | 3 | Profit/(loss) for the period | 4,303 | 2,939 | 12,957 | 6,140 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,303 | 2,939 | 12,957 | 6,140 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.42 | 3.70 | 16.32 | 7.73 | | 6 | Proposed/Declared dividend per share (Subunit) | 4.00 | 0.00 | 9.00 | 6.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1499 | 1.0067

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-3-2016 03:07 AM

|

显示全部楼层

发表于 25-3-2016 03:07 AM

|

显示全部楼层

EX-date | 08 Apr 2016 | Entitlement date | 12 Apr 2016 | Entitlement time | 04:00 PM | Entitlement subject | Special Dividend | Entitlement description | A Special dividend of 4 sen per ordinary share of RM0.50 each, tax exempt under single-tier system in respect of the financial year ending 30 April 2016 | Period of interest payment | to | Financial Year End | 30 Apr 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01 Level 32 Tower A Vertical Business Suite Avenue 3 Bangsar South No. 8 Jalan Kerinchi 59200 Kuala LumpurWilayah Persekutuan Malaysia | Payment date | 03 May 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 12 Apr 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0400 | Par Value | Malaysian Ringgit (MYR) 0.500 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-6-2016 11:30 AM

|

显示全部楼层

发表于 20-6-2016 11:30 AM

|

显示全部楼层

本帖最后由 icy97 于 20-6-2016 07:31 PM 编辑

This gem fits into the high ROIC requirement of i3 sifu KC Chong

Author: smallcapgem2016 | Publish date: Sun, 19 Jun 2016, 12:02 AM

http://klse.i3investor.com/blogs/Smallcapgem/98206.jsp

http://klse.i3investor.com/blogs/kcchongnz/50101.jsp

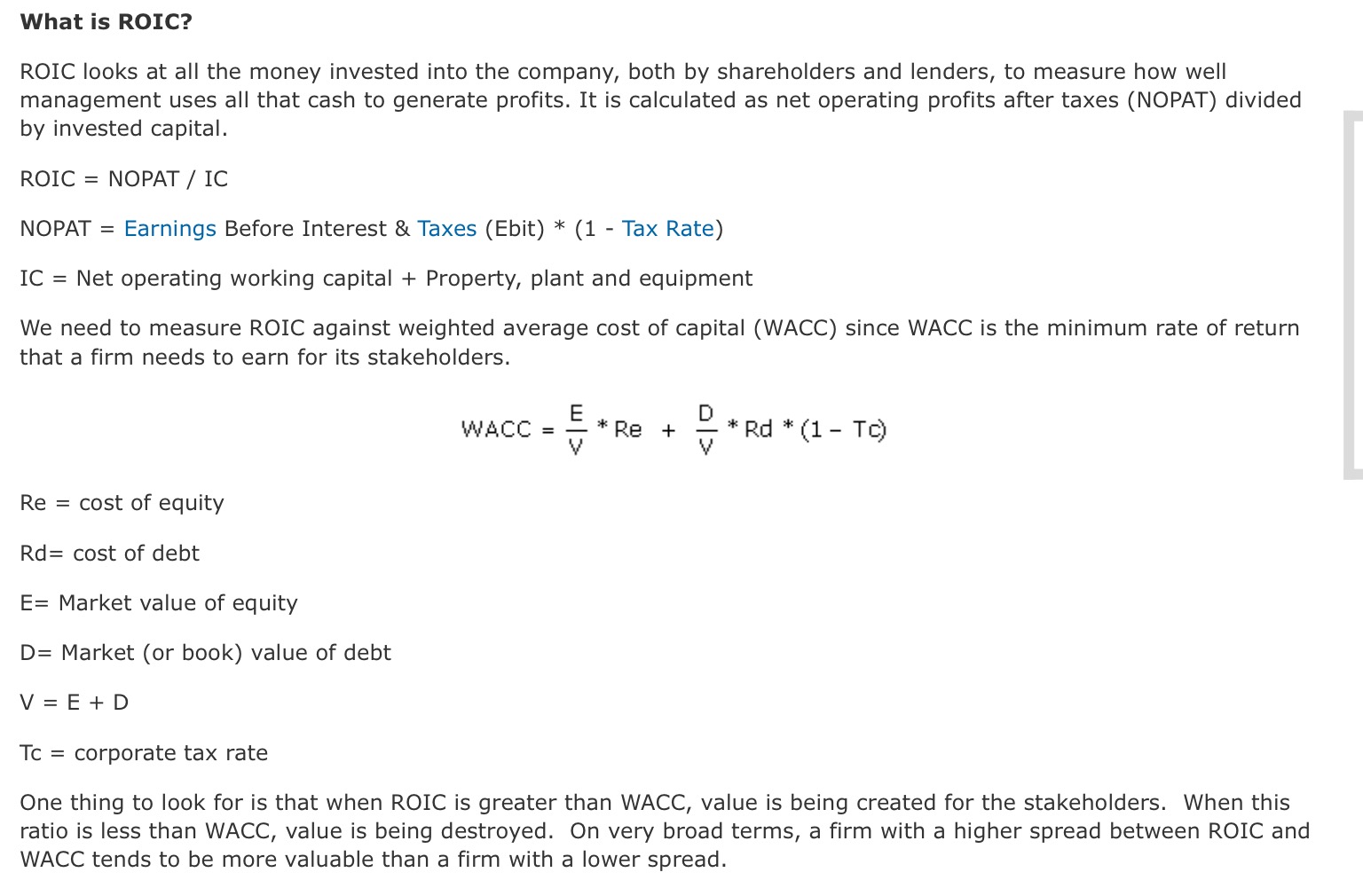

Computation of ROIC

Using ROIC formula given by value investor and sifu of many i3 bloggers KC Chong, I calculated the ROIC for this gem!

ROIC = NOPAT / IC

IC = Net operating working capital + Property, plant and equipment

|

| Ebit (in thousands)

|

| 21068 | Tax rate

|

| 21.8% | NOPAT

|

| 16475 | | | | | Net working capital

|

| 12406 | PPL

|

| 55478 | IC

|

| 67884 | | | | | ROIC=NOPAT/IC

|

| 24.3% |

The computation shows that the ROIC for this gem is 24.3%, more than twice its WACC. My required return or WACC is 10%, not very high as it has strong profit growth and free cash flows. The ROIC for this gem is higher than most rubber glove stocks.

One thing to look for is that when ROIC is greater than WACC, value is being created for the stakeholders. When this ratio is less than WACC, value is being destroyed. On very broad terms, a firm with a higher spread between ROIC and WACC tends to be more valuable than a firm with a lower spread. - KC Chong

In conclusion, this gem created value for the stakeholders and is more valuable than most rubber glove stocks. Let's look at the price of this gem to decide whether it is still undervalued.

The stock price just started to move, but quite flat YTD.

Big buyer of shares in this gem last week. Could it be the famous investor? To beat the famous investor is to buy before he becomes a major shareholder!

Continuous Growth in Quarterly revenues and profits for past two years! A key requirement for the famous investor. And dividend paid every quarter in FY 2016-4-30!

This gem is the rising star Superlon, a leading insulation material manufacturer.

For the first nine months of its financial year ending April 30, 2016 (9MFY16),

Superlon's net profit doubled to RM12.96 million or 16.32 sen a share versus RM53.64 million or 7.73 sen a share a year ago. Revenue meanwhile grew by 24.55% to RM66.81 million, from RM53.64 million a year ago. The significant improvement was mainly due to increased efficiency leveraging on better machinery and higher volumes. (MIDF Research)

Balance sheet analysis SUPERLON has a super-strong balance sheet! With current ratio of 5 times and net cash position of RM 27.3 mil.

Huge growth potential According to Panasonic, demand for airconds are expected to increase 120% in second quarter of the year. This is great news for SUPERLON. It has the largest market share, 55% to 60% of domestic rubber thermal insulation industry. To cope with huge demand, SUPERLON is expanding production capacity and building a new 70,000 square feet warehouse next to its existing factory.

Concluding Remarks Superlon will announce Quarter 4 result this month. Based on historical data, Quarter 4 is the best quarter! If you annualise the past 3 quarter EPS, you will arrive at EPS of 21.76 sen for FY2016. At current price of RM2.09, prospective PER is 9.6 times. This PER is low compared to other rubber-product stocks where PER is 15 to 25 times. This also fits into the requirement of KC Chong and the famous investor, PER less than 10 times! Based on the high ROIC of 24.3%, Superlon deserves higher PER valuation. A final dividend of 3 Sen per share in 4Q FY16 will bring total dividend to 12 Sen per share or dividend yield to 5.7%, highest in the industry. If you input a lower PER of 13 times for its smaller market capitalisation, fair value for SUPERLON is RM2.82, a big 35% upside!

Big buyers are accumulating...Looks set to cross RM2.30 by end of this month!

Information is for educational and informational purposes only and is not be interpreted as financial advice. This does not represent a recommendation to buy, sell, or hold any security. Please consult your financial advisor.

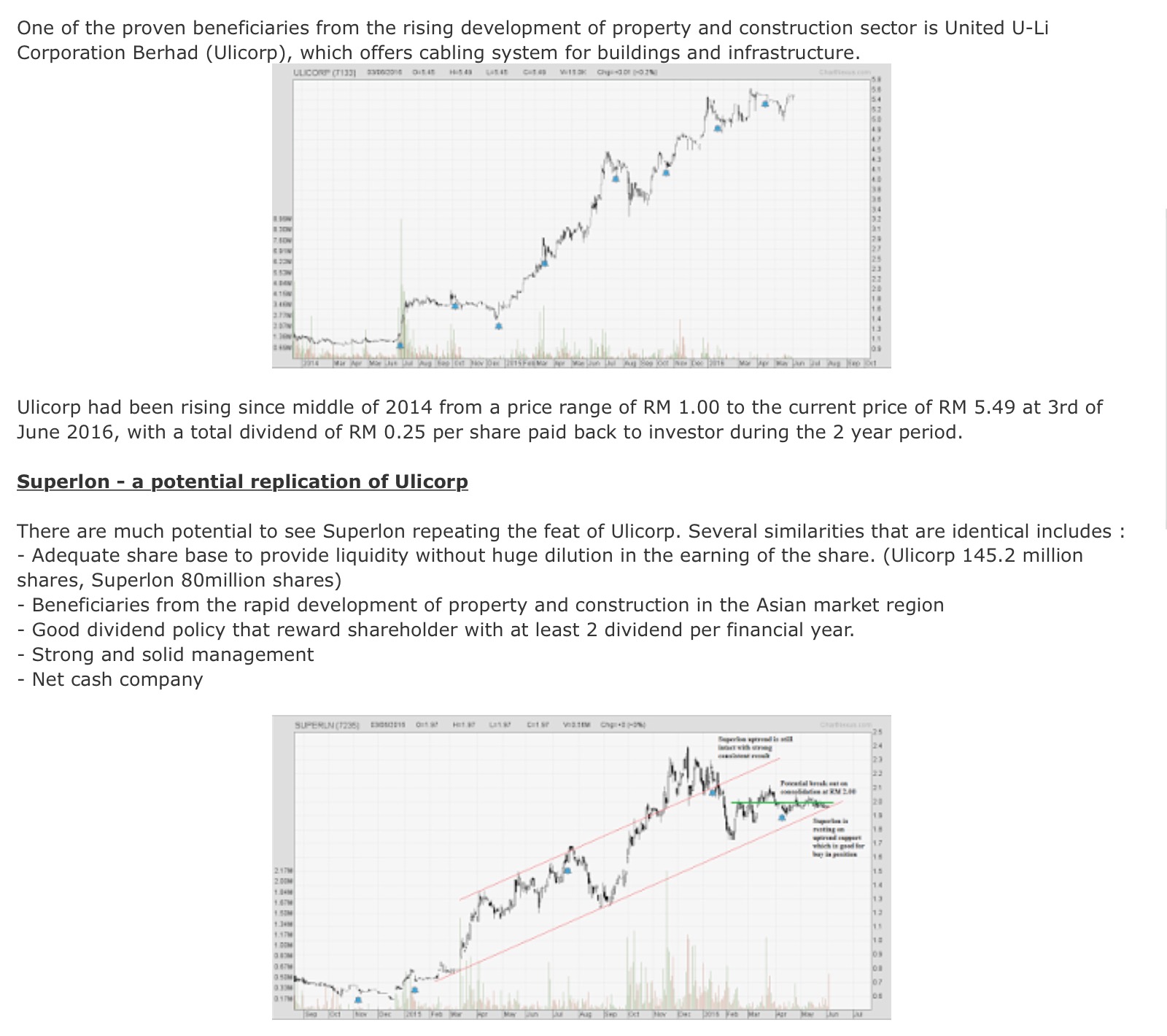

Superlon - a potential replication of Ulicorp (closed at Rm6.10 last Friday)

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-6-2016 03:10 AM

|

显示全部楼层

发表于 26-6-2016 03:10 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Apr 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Apr 2016 | 30 Apr 2015 | 30 Apr 2016 | 30 Apr 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 23,606 | 20,872 | 90,411 | 74,509 | | 2 | Profit/(loss) before tax | 4,802 | 4,152 | 21,362 | 12,554 | | 3 | Profit/(loss) for the period | 3,703 | 3,241 | 16,660 | 9,381 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,703 | 3,241 | 16,660 | 9,381 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.66 | 4.08 | 20.98 | 11.81 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 9.00 | 6.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1265 | 1.0067

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-6-2016 03:28 AM

|

显示全部楼层

发表于 26-6-2016 03:28 AM

|

显示全部楼层

EX-date | 13 Jul 2016 | Entitlement date | 15 Jul 2016 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | An interim dividend of 2.5 sen per ordinary share of RM0.50 each, tax exempt under single-tier system in respect of the financial year ending 30 April 2017 | Period of interest payment | to | Financial Year End | 30 Apr 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200 Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 04 Aug 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 15 Jul 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.025 | Par Value | Malaysian Ringgit (MYR) 0.500 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-6-2016 02:03 AM

|

显示全部楼层

发表于 28-6-2016 02:03 AM

|

显示全部楼层

拥强劲现金流扩建仓库‧世霸龙明后年财测看俏

(吉隆坡27日讯)世霸龙控股(SUPERLN,7235,主板工业产品组)2016财政年盈利表现超越市场预期,加上拥有强劲现金流以扩建仓库,获分析员看好2017及2018财政年盈利表现。

业绩超预期

世霸龙控股2016财政年盈利按年增长77.55%至1666万令吉,表现超越预期,相等于MIDF研究全年财测的124%及市场全年财测的116%。

MIDF研究说,受销量增加及获得更好的汇率所推动,该公司截至2016年4月30日止末季盈利按年增长14.2%至370万令吉,核心税前盈利赚幅也由前季的23%增长至23.8%。

该行说,世霸龙控股拥有强劲现金流,约2435万令吉,将有助于该公司在其工厂毗邻扩建新的仓库,预计费用约1200万至1400万令吉之间。

该行认为,该计划将能促使世霸龙控股更有效率及增加30%产能,并能在2018财政年贡献正面盈利。

MIDF研究预测该公司在高核心税前盈利赚幅下,2017财政年盈利将能由1430万令吉增加至1616万令吉,并调高每股盈利至20.36仙。

该行认为该公司能在充满挑战的环境下,维持销售额的增长,并维持核心税前盈利赚幅及盈利增长,同时相信管理层能够维持强劲的现金流。

MIDF研究基于世霸龙控股于2017财政年12倍本益比交易,提高合理价至2令吉50仙,惟没有给予评级。

文章来源:

星洲日报‧财经‧报道:刘玉萍‧2016.06.27 |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|