|

|

发表于 1-3-2016 09:47 PM

|

显示全部楼层

发表于 1-3-2016 09:47 PM

|

显示全部楼层

本帖最后由 icy97 于 1-3-2016 10:26 PM 编辑

Heveaboard to spend RM20m capex to increase capacity by 15%

By Chen Shaua Fui / theedgemarkets.com | March 1, 2016 : 1:57 PM MYT

http://www.theedgemarkets.com/my/article/heveaboard-spend-rm20m-capex-increase-capacity-15

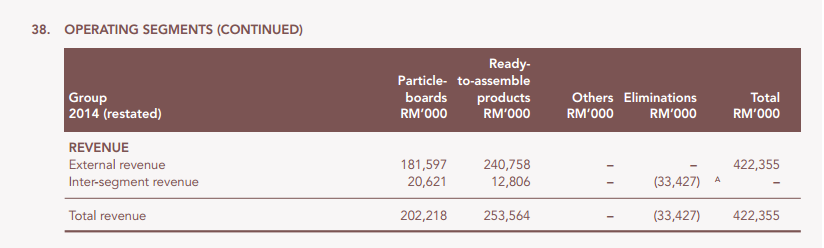

KUALA LUMPUR (March 1): Heveaboard Bhd, which is currently in net cash position, plans to spend RM20 million in financial year 2016, to upgrade its factories and expects an increase of capacity by 10-15% by the end of this year.

Heveaboard group managing director Yoong Hau Chun said RM20 million capital expenditure (capex) would be used to upgrade the existing line, in this financial year ending Dec 31, 2016 (FY16).

From that amount, RM8 million would be used for Heveaboard to upgrade its production line for particleboard, while the other RM12 million would be allocated to its wholly-subsidiary HeveaPac Sdn Bhd for its ready-to-assemble (RTA) furniture products.

“The main objective is to further distinguish ourselves in the market. We will carry out upgrades to the existing line to further improve of quality level. We are looking at capacity increase of about 10-15%, by end of this year or beginning of next year,” Yoong said in a briefing to media and analysts here today.

He added that the group would continue to spend on upgrading in two years to come.

Yoong said the group will also introduce a new product, which is the health, environment and children friendly “KREA Kids” under its RTA segment this year.

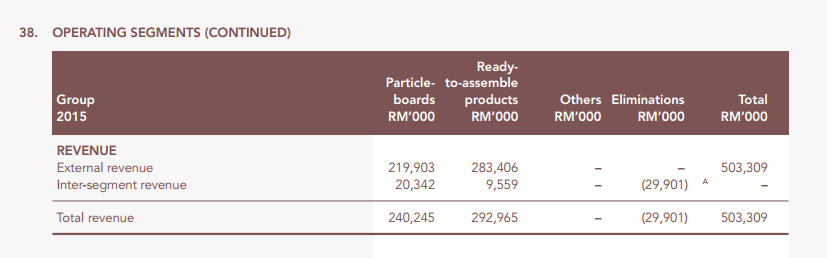

Heveaboard’s main revenue streams come from its particle board production, of which 80% of total production is exported overseas; and RTA of which 90% are exported and 10% sold in the local market.

For the particle board, the group mainly exports to China (43.85%), Japan (12.28%), Korea (11.74%), India (10.56%) and other countries (8.21%), the remaining 13.36% being for the local market.

Under the RTA segment, the main importers of its products are Japan (62.46%), Europe (11.45%), Australia (11.86%) and United States (2.69%).

As at Dec 31, 2015, Heveaboard was in a net cash position, first time since the group was set up since 1993. The group has a cash and equivalence of RM124.97 million, and a long term borrowing and long term liabilities of RM38.89 million.

Yoong said the group would use the cash to settle its loan ahead of schedule.

“We plan to have it (the loan) settle very soon, before second half of 2016 (2H16),” he added.

The group had declared 0.75 sen interim dividend per ordinary share of 25 sen each, in respect of the FY15, which would go ex on March 8.

Although the group was in a net cash position, Yoong said the group would adopt a “prudent” strategy in spending its cash, to cater to some unexpected capex expenses.

He said it was difficult to give guidance on the dividend payout in FY16 now.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-3-2016 11:22 PM

|

显示全部楼层

发表于 1-3-2016 11:22 PM

|

显示全部楼层

本帖最后由 icy97 于 2-3-2016 12:40 AM 编辑

计划提前偿债 亿维雅提高派息

财经 2016年03月01日

http://www.orientaldaily.com.my/business/cj200016726

(吉隆坡1日訊)億維雅(HEVEA,5095,主闆工業股)有意提前償還達750萬美元(約3130萬令吉)債務,從而可拿出更多的盈利來派發股息。

截至2015財政年(12月31日結賬),億維雅手頭上持有1億2497萬令吉的現金,並且已經處于淨現金狀態。該集團董事經理熊豪俊指出,計劃在今年下半年提前償還美元貸款,以便有能力派發更多股息。目前,該公司共有3680萬令吉的長期債務與2156萬令吉的短期債務。

熊豪俊週二是在億維雅的媒體與分析員匯報會上,作如此表示,共同出席的包括該公司執行董事熊俐彥及首席財務員丘美英。

作為一家逾80%產品作出口用途的企業,億維雅去年從令吉兌美元匯率大貶中受惠不少。令吉匯率目前已出現止跌跡象,詢及這對該公司未來盈利的潛在影響時,熊豪俊透露說,該公司在去年取得逾1倍的盈利增長,其中約有50%的漲幅是由美元走強而帶動。

他相信,隻要令吉企於1美元兌4.2令吉,億維雅的產品平均售價(ASP)將可維持在目前的水平。他坦承,若令吉匯率回升,該公司的盈利將受影響,但目前難以估計,因為其他的因素也將影響該公司的盈利。

另一方面,熊豪俊披露,中國客戶的需求相當強勁,有者甚至曾要求該公司擴大產能。不過,考慮到增加生產線將耗資不斐,動輒超過1億令吉,加上其它風險考量,因此,該公司決定每年增加10%至15%的產能。

至于今年的資本開銷(Capex)計劃,億維雅計劃撥出2000萬令吉,其中1200萬令吉用以開發新產品,而800萬令吉則用來提升現有設備。

另一方面,詢及近期的外勞課題對億維雅的影響,熊豪俊表示,最低薪金在7月調漲將把該公司的每年成本推高240萬令吉,而若政府目前擱置的外勞人頭稅調漲措施重新生效,則將另外增加200萬令吉的開銷。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 3-3-2016 05:51 PM

|

显示全部楼层

发表于 3-3-2016 05:51 PM

|

显示全部楼层

本帖最后由 icy97 于 3-3-2016 10:05 PM 编辑

Warrants Update:Hevea-WB offers cheaper entry into company

By Liew Jia Teng / The Edge Malaysia | March 2, 2016 : 2:00 PM MYT

http://www.theedgemarkets.com/my/article/warrants-updatehevea-wb-offers-cheaper-entry-company

SHARES of Negeri Sembilan-based particleboard maker HeveaBoard Bhd, against which a financial blog made several accusations recently, are down 18% year to date.

This presents a higher upside potential for HeveaBoard and the company’s warrant, Hevea-WB, which could be a cheaper alternative for investors looking to ride its prospects despite the allegations in the blog.

Hevea-WB carries a strike price of 25 sen and a one-to-one conversion ratio. The 10-year warrant expires on March 1, 2020.

At its closing price of RM1.06 last Wednesday, Hevea-WB was trading at a slight discount of 1.5% to the mother share, which closed at RM1.33 that day.

In a Jan 12 research note, CIMB Research maintains an “add” call on HeveaBoard with a target price of RM2. If the research house is right, there is 50% upside potential from the stock’s RM1.33 close last Wednesday.

That means at zero premium, Hevea-WB would theoretically be worth RM1.75 if its mother share hits the target price. This presents an even higher upside of 65% for the warrant.

To recap, early last month, a financial blog posted articles with three allegations against HeveaBoard: (i) the non-payment of dividends; (ii) that 700 of the company’s containers were stranded at a South Korean port in October last year due to non-compliance with quality standards; and (iii) its failure to disclose an inter-company loan extended by its major shareholder.

On Jan 13, HeveaBoard issued an official statement in response, saying the contents of the blog posts were “untrue, defamatory and malicious in nature”.

CIMB Research analyst Marcus Chan reckons that management addressed the issues well and his sense is that institutional investors were comfortable with the explanation. “We urge investors not to be distracted by these ongoing non-fundamental and frivolous allegations. In our view, any share price correction is an excellent opportunity for bottom fishing,” he says.

In an exclusive interview with The Edge last month, group managing director Yoong Hau Chun said it was business as usual at HeveaBoard and stressed that the company’s fundamentals were intact.

In fact, he said, HeveaBoard had a happy problem — its production plants in Gemas, despite having two manufacturing lines with a combined annual capacity of 525,000 cu m, were unable to keep up with the strong demand.

“We are actually being pressured by our customers, especially from China, to expand our capacity. Initially, we were quite serious about adding a new line. But later on, we decided to upgrade our existing line and not concentrate so much on volume,” says Yoong. |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-3-2016 07:46 PM

|

显示全部楼层

发表于 21-3-2016 07:46 PM

|

显示全部楼层

本帖最后由 icy97 于 21-3-2016 10:50 PM 编辑

HeveaBoard: Assembling A Better Future

Publish date: Fri, 18 Mar 2016, 12:15 PM

http://www.bfm.my/bg-yoong-hau-chun-heveaboard-assembling-a-better-future.html

Yoong Hau Chun, Group Managing Director, HeveaBoard Berhad 18-Mar-16 11:04

HeveaBoard Berhad, which manufactures and exports particleboard and ready-to-assemble furniture, has been a prime beneficiary of the strong US dollar and weaker Ringgit, as 95% of its revenues are USD-based, while its cost is RM-based. We ask Group Managing Director Yoong Hau Chun how long the good times will last, for the company.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-3-2016 04:08 AM

|

显示全部楼层

发表于 30-3-2016 04:08 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | HEVEABOARD BERHAD ("HEVEABOARD")RECOMMENDATION FOR DECLARATION OF A FINAL DIVIDEND IN RESPECT OF THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 | The Board of Directors of HeveaBoard is pleased to announce the recommendation for the declaration and payment of a single-tier final dividend of 1.0 sen per ordinary share of RM0.25 each in respect of the financial year ended 31 December 2015, which is subject to the approval of the shareholders of HeveaBoard at its forthcoming Annual General Meeting. The date of entitlement and date of payment in respect of the aforesaid dividend will be announced in due course.

This announcement is dated 29 March 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-4-2016 09:40 PM

|

显示全部楼层

发表于 6-4-2016 09:40 PM

|

显示全部楼层

本帖最后由 icy97 于 6-4-2016 10:04 PM 编辑

浅谈HEVEA(5095), 每股净现金15仙的成长股!

Wednesday, April 6, 2016

http://harryteo.blogspot.my/2016/04/1235-hevea5095-15.html

HEVEA - 億維雅刨花板在2015年是丰收的一年,因为HEVEA的净盈利从2014年的30.478 mil进步到2015年的73.827 mil马币,按年增长了142.23%。因此去年股价上涨了290.36%,但是今年的股价却从去年12月31日的1.62下跌到今天的RM1.23, 股价足足下跌了24.07%。股价一度更是下跌到1.15的地点,主要是因为美金走跌以及网络Blogger - Robert的攻击导致。

不过以上的利空消息几乎出尽,股价的大幅度下滑也消化了马币从4.40下跌到3.90的因素。反向思考的话,现在的股价是否吸引人呢??

以下是HEVEA的基本资料@ 2016 April 4:

Share Price : RM1.23

EPS: 16.46

PE : 7.43

Cash Per Share: 0.15

ROE: 21.44

*以上图表的模式是学习自乡下佬前辈,谢谢前辈之前的分享

以基本面来看,HEVEA的估值其实已经变得非常吸引人了。过去一年多的成长让它从负债公司转为净现金公司,Net Cash为66.6 mil。此外,管理层也表明会在今年还清美金债务以及减低Interest Expense。

此外,公司主要的客户来自日本以及中国。中国的客户的需求不断增加,因此公司将会花费20 mil去提升以及优化产线,相信2017年有望增加10 - 15%的产量。

管理层在接受BFM访谈的时候,他曾经说明2015年的盈利成长有60%受益于美金走 强,40%来自Automation。2016年Q1的Quarterly Rate是4.192左右,这比去年同期的Q1的3.60足足高了60仙,相当于16.6%。所以可以预测16年Q1的业绩盈利会比去年同期进步不少。

这个时候大家又会问,美金现在3.90左右,HEVEA不就完蛋了??如果投资单单只靠美金的话,一家公司就完蛋了。公司表明已经进行一度程度的Hedging,借此可以减低外汇的风险。

大家可以看到最新的Q4跟Q3相比,REVENUE以及NET Profit分别成长了21.96%以及41.82%,但是外汇的增长却只有5.68%。虽然Q4是HEVEA的旺季,但是这次飞跃性的成长除了外汇的功劳,客户的需求增长也是其中一个主因。

HEVEA的Profit Margin从之前Q1的12.01%进步到Q4的17.01%,。只要公司在2016全年的Profit Margin可以进步到18%。就算营业额保持不变,盈利都可以有20%的增长。

HEVEA下个月就会公布业绩了,期待会有不错的业绩。

以上纯属分享,买卖自负。

Harryt30

09.25a.m.

2016.04.05

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-4-2016 05:56 PM

|

显示全部楼层

发表于 8-4-2016 05:56 PM

|

显示全部楼层

Year: 2016

| 2016

| 07-Apr-2016

| 04-Apr-2016

| Acquired

| MR YOONG HAU CHUN

| 100,000

| 1.160

|

| 2016

| 07-Apr-2016

| 04-Apr-2016

| Acquired

| MISS YOONG LI YEN

| 100,000

| 1.160

|

| 2016

| 07-Apr-2016

| 04-Apr-2016

| Acquired

| MR YOONG TEIN SENG @ YONG KIAN SENG

| 100,000

| 1.160

|

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-4-2016 03:23 PM

|

显示全部楼层

发表于 18-4-2016 03:23 PM

|

显示全部楼层

本帖最后由 icy97 于 18-4-2016 03:32 PM 编辑

Trading Idea: Poised for a decisive downtrend line breakout - HEVEA (RM1.17/1.23m)

Publish date: Mon, 18 Apr 2016, 10:04 AM

Business profile. Hevea manufactures and exports particleboard and readyto- assemble (RTA) furniture. Over 90% of its revenues are US$-based, while its cost is RM-based. It major markets are Japan, China, Korea, India, Australia and US.

Negatives

largely discounted. YTD, share price tumbled 28% to RM1.17 (underperforming the KLCI by almost 30%-pts), mainly on a stronger MYR (against the US$). While we are cognizant that a sharp recovery in RM (again the US$) does not bode well for exporters ’ earnings growth, we believe recent selldown is overdone due to the following:

i. HEVEA is more than a US$ play, given strong consensus earnings CAGR of 13% for FY15-17, underpinned by its ongoing cost rationalization exercise and investment into new RTA production line as well as continuing focus on producing wider range of higher value products ;

ii. Current valuation of 5.2x FY16 P/E is attractive ( vs its neares t peer’s EVERGREEN 7.9x) and its 10-year historical P/E of 8x;

iii. The negative USD weakness factor has largely priced in, as reflected by s tabilization in HEVEA’s s hare price vs USD chart (FIG3); and

iv. Hevea is also expected to benefit from the rebuilding in Japan in the aftermath of recent earthquake given that the company exports ~50% of its products to the country.

Poised for a downtrend line breakout. Having corrected 35% from 52-week high of RM1.79 to close at RM1.17 last Friday, we believe HEVEA is at the tail end of its 2-month sideways consolidation. A decisive breakout above RM1.22 (30-d SMA) will spur prices higher towards next targets at RM1.26 (50-d SMA) and RM1.37 (38.2% FR) before reaching our LT objective near RM1.45 (50% FR). Key supports are RM1.11-1.15. Cut loss at RM1.09.

Attractive risk to reward ratio with 23.9% upside against 6.8% downside. All in, we see a good risk to reward ratio for investor with a theoretical entry price of RM1.17 given that the downside to the cut loss zone of RM1.09 is 8 sen (-8%) while the upside to the LT target of RM1.45 is 28sen (+23.9%).

Source: Hong Leong Investment Bank Research - 18 Apr 2016 |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-4-2016 03:04 PM

|

显示全部楼层

发表于 22-4-2016 03:04 PM

|

显示全部楼层

本帖最后由 icy97 于 22-4-2016 03:09 PM 编辑

By Surin Murugiah / theedgemarkets.com | April 21, 2016 : 10:16 AM MYT

http://www.theedgemarkets.com/my/article/天灾推高-evergreen购兴-股价起189

(吉隆坡21日讯)日本和厄瓜多尔发生一系列地震后,推高 Evergreen Fibreboard Bhd的购兴,股价起1.89%。

截至10时14分,该股起2仙,至1.08令吉,有37万4500股成交。

丰隆投资银行研究今日在报告指出,日本和厄瓜多尔最近发生一系列地震,可能带动建材股如亿维雅(Heveaboard Bhd)和Evergreen Fibreboard的购兴。

亿维雅则平盘于1.19令吉,交投量有41万1400股。

(编译:陈慧珊)

值得买吗??? |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-4-2016 08:24 PM

|

显示全部楼层

发表于 28-4-2016 08:24 PM

|

显示全部楼层

本帖最后由 icy97 于 28-4-2016 08:28 PM 编辑

EX-date | 13 Jun 2016 | Entitlement date | 15 Jun 2016 | Entitlement time | 04:00 PM | Entitlement subject | Final Dividend | Entitlement description | Single-Tier Final Dividend of 1.0 sen per ordinary share of RM0.25 each in respect of the financial year ended 31 December 2015 | Period of interest payment | to | Financial Year End | 31 Dec 2015 | Share transfer book & register of members will be | 15 Jun 2016 to 15 Jun 2016 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BINA MANAGEMENT (M) SDN. BHD.Lot 10, The Highway CentreJalan 51/20546050 Petaling JayaSelangor Darul EhsanTel:03-77843922Fax:03-77841988 | Payment date | 13 Jul 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 15 Jun 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0100 | Par Value | Malaysian Ringgit (MYR) 0.250 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-5-2016 11:31 PM

|

显示全部楼层

发表于 9-5-2016 11:31 PM

|

显示全部楼层

本帖最后由 icy97 于 10-5-2016 12:03 AM 编辑

Why I think Hevea Is Undervalue

Author: noobnnew | Publish date: Mon, 9 May 2016, 07:02 PM

http://klse.i3investor.com/blogs/noobnnew/96194.jsp

Before you continue to read on the article below, I am oblige to tell you that I am currently hold some position in Hevea. Hence my view might be biased.

Below are the reason that why I think Hevea currently is undervalue:

a) Financial Performance Review

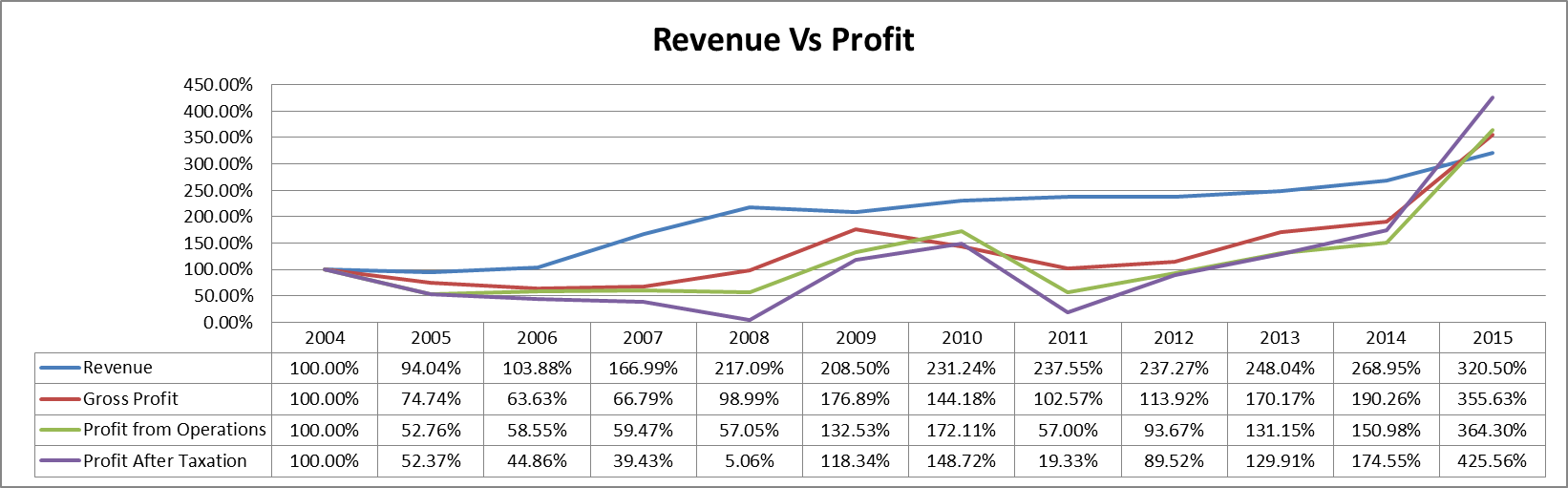

1. Strong Revenue and Profit Growth

Looking at the income statement, the revenue and profit of Hevea Bhd had growth strongly and consistently since 2004. It is obvious that the revenue of the company had growth consistently at CAGR of around 10% per year which resulted in triple their revenue in 12 years. As we can see, the both Profit from Operation (EBIT) and Profit after Tax (PAT) had grown consistently and only shrunk during 2008 and 2011 financial crisis. The net profit for the group had quadruple during 12 year period with CAGR of more than 12% per year. The net profit for Hevea as at 2015 was 14.62% which was almost double compare to 2014 that recorded only 7% net profit.

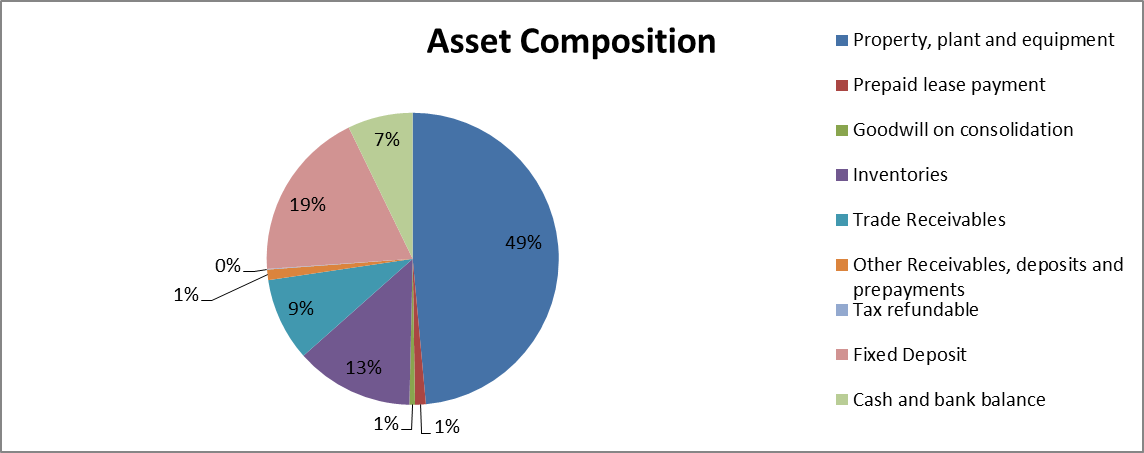

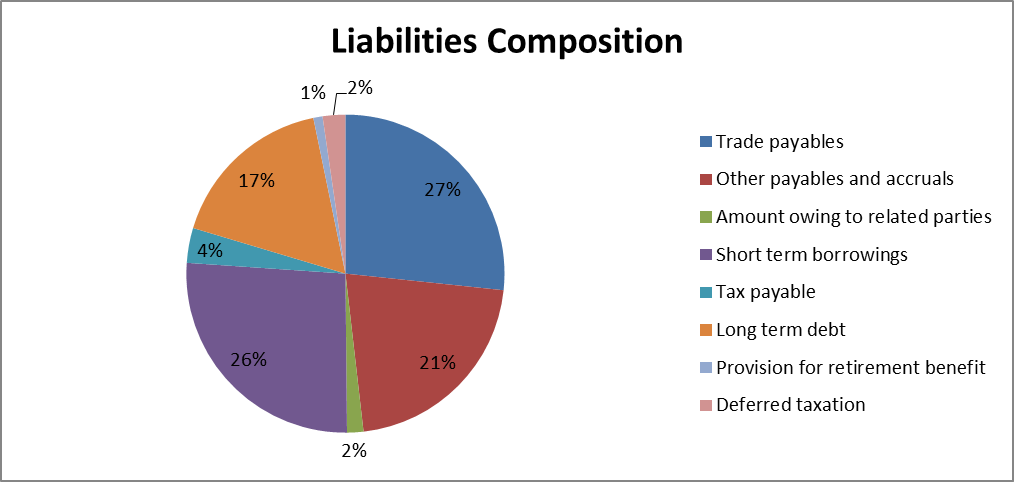

2. Strong Balance Sheet

Above was the balance sheet of Hevea Bhd as at 2015. As usual, property, plant and equipment had made up of most of the asset composition and follow by cash and fixed deposit which is more than 25%. The company currently had RM125million of cash sitting in their bank account compare to total debt of RM61 million. Besides that the total liabilities of Hevea Bhd was only RM135 million and most of it was trade payables. Hence there are no worries on the liquidity position on Hevea Bhd.

3. Strong Cash Management

We always said that ‘Cash is King’, it is not important that how much revenue a company would be able to generate but the ability to collect payment and payback supplier on times are matter. Hevea Bhd had done a good job in their cash management throughout the year. Based on their latest quarterly report, it only took Hevea Bhd around 60 days to convert their product to cash.

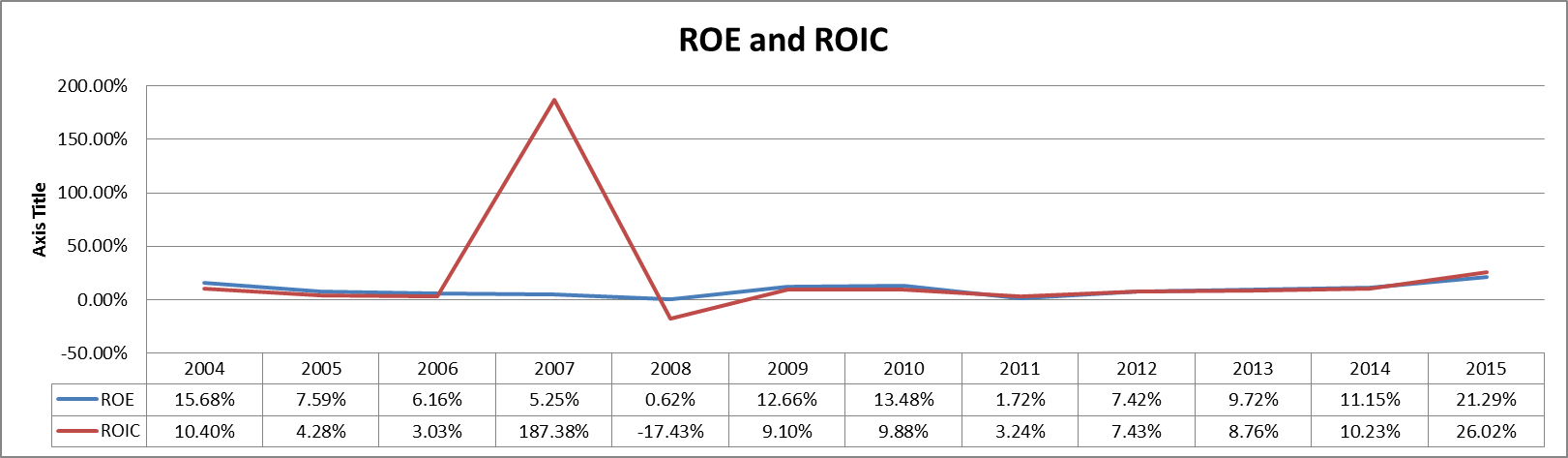

4. High Return on Equity and Invested Capital

The return on equity (ROE) and Return on Invested Capital (ROIC) of Hevea Bhd was doubled in 2015 compared to 2014. Apart from that, it was growing consistently after the company crisis in 2011. The high growth in ROE and ROIC had shown that Hevea Bhd was able to generate higher return for investor in long term period.

b) Outlook and Prospect Summary

Above are the excerpts of Outlook and Prospects towards Hevea Bhd from the management. Key points from the excerpt above were:

- Focus on Research and Development

- Allocation of RM20.0 million in 2016 for CAPEX Spending (RM8.0 million in upgrade facility, RM12.0million for expanding product range in RTA)

- Introduction of new furniture line (KREA Kids)

The RM12.0 million of CAPEX spending on expanding of RTA Furniture line was reasonable if we compare the revenue breakdown in 2014 and 2015.

The RTA product had contributed more than half of the revenue to Hevea Bhd. The RM18.0 million of CAPEX spending on RTA product line estimate will generate more revenue for Hevea in the future. Furthermore, the current net cash of Hevea in balance sheet are more than enough to support the RM20million of CAPEX Spending after repayment of all the debt. Hence, it is reasonable to forecast a huge improvement of cash and cash equivalent in the balance sheet in 2016.

According to the country segmentation reporting, Japan was the largest customer of Hevea Bhd and followed by China. The sales of Malaysia only accounted for 7% of total revenue. The ratification of TPPA and coming soon Tokyo Olympic were estimate to generate more revenue for Hevea in the upcoming period. Besides that, the revenue growth in India and Australia in 2015 was 162% and 55% respectively compare to 2014 might have shown sign that Hevea successfully tap into Indian and Australia market that further diversify their revenue stream.

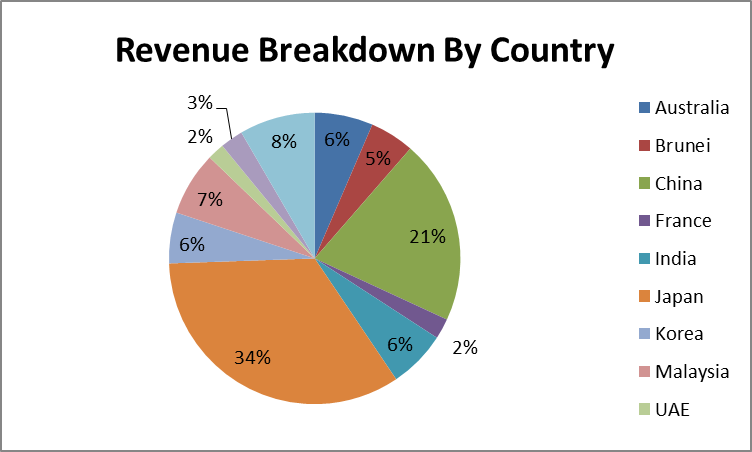

For those who are worry on the effect of foreign currency exchange on the profitability of Hevea Bhd, that would be unnecessary, because according to their annual report the 10% weakened in USD only decreased their profit of RM1.7 million. Based on the net profit of RM73.6 million in 2015 it means that 10% of weakened in USD only weakened around 2.6% of their net profit. Hence, unless the MYR suddenly strengthen 50% against USD, there is no worry on the foreign currency effect on the net profit.

c) Conclusion

In concluded, based on the closing price of RM1.23 today, Hevea had a P/E Ratio of 6.8 and P/B ratio of 1.46 which is cheap compare to it historical record and also future prospect. Hence, I would consider that Hevea is currently undervalue.

Disclaimer: I wrote this article myself, and it expresses my own opinions. The author does not guarantee the performance of any investments and potential investors should always do their own due diligence before making any investment decisions. Although the author believes that the information presented here is correct to the best of his knowledge, no warranties are made and potential investors should always conduct their own independent research before making any investment decisions. Investing carries risk of loss and is not suitable for all individuals.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-5-2016 12:02 AM

|

显示全部楼层

发表于 13-5-2016 12:02 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 19-5-2016 11:44 PM

|

显示全部楼层

发表于 19-5-2016 11:44 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 23-5-2016 11:17 PM

|

显示全部楼层

发表于 23-5-2016 11:17 PM

|

显示全部楼层

本帖最后由 icy97 于 24-5-2016 12:35 AM 编辑

【外汇风暴】- 浅谈HEVEA的【美金】现金以及借贷对公司外汇【盈利/亏损】的影响!!

Monday, May 23, 2016

http://harryteo.blogspot.my/2016/05/1263-hevea.html

最近出炉的不少出口股都因为美金走低而蒙受了外汇亏损,当中就有FLBHD, LIIHEN, JCY 以及LCTH等。这个weekend努力研究了FLBHD以及LIIHEN的外汇亏损来源,趁着HEVEA这家出口股还没有出业绩前,我们来看看这个2016Q1的外汇表现会是如何?

首先,我会列出HEVEA以美金结算的现金,债务,Trade receivables and Trade Payable。借此我们可以看到这些资产以及债务对公司外汇的影响。

HEVEA在2014年是没有美金Deposit placed with licensed banks的,2015年增加到了8.584 mil。

因为公司的盈利大爆发,所以HEVEA在2015年的美金现金从15.362 mil进步到26.287 mil。

而美金债务从2014年的74.27 mil减低到45.236 mil, 总债务也价绍了接近24 mil。因此公司也从负债股变成了Net cash company。

公司的Trade payable其实很少,只有2.852 mil。所以公司大部分的成本都是来自马币,也就是赚美金还马币的意思。

而Trade Receivables有31.216 mil是以美金结算,2015年收回了不少账目。Trade receivables介绍了9 mil左右。

上图是美金兑换马币在2014年底,2015年底以及2016年3月31日的汇率。2015年马币上涨22.5%,2016年3个月里下跌了9.09%左右。

为了方便大家阅读,我把2015年以及2016年3个月里的美金现金+债务的数据放进了以下两个图表。

在2015年1月1日,公司拥有60.809 mil的USD现金+ Trade Receivables(别人欠公司的钱), 美金借贷高达74.27 mil,美金Trade Payable(欠别人的钱) 只有1.012 mil。

在笔者计算外汇盈利/亏损之前,大家要明白:

- 当公司拥有大笔美金现金的时候,美元上涨代表转换成马币会增加,所以造成Forex Translation Gain。反之,如果美金下跌,公司拥有大笔美金资产以及现金,那么就会蒙受Foreign Currency Translation Loss, 最佳例子: FLBHD.

- 而当公司有大笔美金债务,美金上涨代表unrealized forex losses增加,反之unrealized forex gain增加。

在2015年,马币上涨22.5%, 可是HEVEA的美金债务在年头多过现金以及Trade Receivables。因此美金Net欠债是14.473 mil,以22.5%的美金涨幅计算,公司蒙受了3.256 mil的外汇亏损。

不过不要忘记笔者使用的数据是2015年年头,所以公司在中间还清了接近29 mil的美金债务。因此Hevea正式的外汇亏损是2.848 mil,差别RM408,000。

来到了2016年,笔者以为美金下跌,HEVEA应该会受益了吧。但是仔细算了之后,发现HEVEA还是【可能】会蒙受外汇亏损。

原因是因为HEVEA赚了很多钱,所以美金现金增加了不少,过后2014年又减少接近29 mil的美金债务。所以2015年12月31,HEVEA的USD现金 多过美金债务。

大家看看上图,美金在1 - 3月下跌了9.09%,扣除了美金借贷以及美金Trade Receivables,HEVEA还多出了17.999 mil美金资产。结果美金今年下跌,所以又再度蒙受外汇亏损。

所以笔者预测HEVEA【可能】会蒙受1.5 mil - 2mil的Forex losses。不过以HEVEA上个季度高达25 mil的盈利,1.5 - 2mil的外汇亏损是可以接受的。假设笔者算错就更好,HEVEA如果有外汇盈利当然是好事,但是看来机率不大。

上个季度HEVEA在美金巅峰的Net Profit是25 mil,这次美金下跌以及少许的外汇亏损。所以几个mil的外汇亏损应该不会把盈利拉低太多。

如果笔者的【估算+预测】是正确的,那么HEVEA也够可怜的。不过美金起获跌都亏钱,但是还好亏不多。共勉之。

以上纯属分享,买卖自负。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-5-2016 06:23 PM

|

显示全部楼层

发表于 27-5-2016 06:23 PM

|

显示全部楼层

本帖最后由 icy97 于 28-5-2016 01:09 AM 编辑

| 5095 HEVEA HEVEABOARD BHD | | Quarterly rpt on consolidated results for the financial period ended 31/03/2016 | | Quarter: | 1st Quarter | | Financial Year End: | 31/12/2016 | | Report Status: | Unaudited | | Submitted By: |

|

|

| Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period |

| 31/03/2016 | 31/03/2015 | 31/03/2016 | 31/03/2015 |

| RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 145,911 | 116,373 | 145,911 | 116,373 | | 2 | Profit/Loss Before Tax | 23,612 | 14,600 | 23,612 | 14,600 | | 3 | Profit/Loss After Tax and Minority Interest | 20,268 | 13,976 | 20,268 | 13,976 | | 4 | Net Profit/Loss For The Period | 20,268 | 13,976 | 20,268 | 13,976 | | 5 | Basic Earnings/Loss Per Shares (sen) | 4.53 | 3.51 | 4.53 | 3.51 | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 |

|

|

| As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) |

|

| 0.8200 | 0.8400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-5-2016 12:28 AM

|

显示全部楼层

发表于 29-5-2016 12:28 AM

|

显示全部楼层

本帖最后由 icy97 于 29-5-2016 01:48 AM 编辑

Heveaboard Berhad: From an ugly duckling to a beautiful swan

Author: kcchongnz | Publish date: Sat, 28 May 2016, 11:19 PM

http://klse.i3investor.com/blogs/kcchongnz/97409.jsp

Heveaboard’s share price shot up to a peak of RM1.73 on 5 January 2016, and finally retreated to close at RM1.18 on 27th May 2016. The gain to date is a whopping 410% in less than three years.

What causes the spike of its share price? Is it still worth investing?

Company Business

HeveaBoard Berhad engages in the manufacture and trading of particle board. The company also produces rubber wood based particleboard and manufactures 'Ready-To-Assemble' (RTA) furniture. It also manufactures furniture for home and office applications. The company's furniture components are used for manufacturing dining sets, speaker boxes, door manufacturing, and office systems. The company markets its products in China, Vietnam, India, Korea, Japan, Singapore, Sri Lanka, Philippines, Hong Kong, Taiwan, Australia, Africa, France, and United States, with Japan its biggest export market.

Hevea has gradually shifted its particleboard product range from conventional to higher value low-emission eco-friendly products which serve higher-tier customers, resulted in higher revenue and profit margin for the company. HEVEA has also made substantial capital expenses in its ready to assemble sector for FY13 & FY14 to the tune of RM20m in order to achieve higher automation and wider range of higher value product diversifications.

I first wrote about Hevea just three years ago when its adjusted share price was just 23.5 sen apiece, together with other furniture stocks as appended in the link below.

http://klse.i3investor.com/blogs/kcchongnz/66908.jsp

All those furniture companies mentioned in the article, including Hevea were performing very well with high return on capitals and selling dirt cheap with low single digit price-earnings ratios and enterprise value (EV) with respect to their earnings before interest and tax (Ebit) at that time.

With its explosive earnings the last couple of years, Hevea’s earnings per share (EPS) has increased by four folds from 4.2 sen in 2012 to 16.9 sen for FY ended 31st December 2015, coupled with the subsequent expansion of its valuation, its share price shot up like a rocket. What has happened?

Financial Performance and position

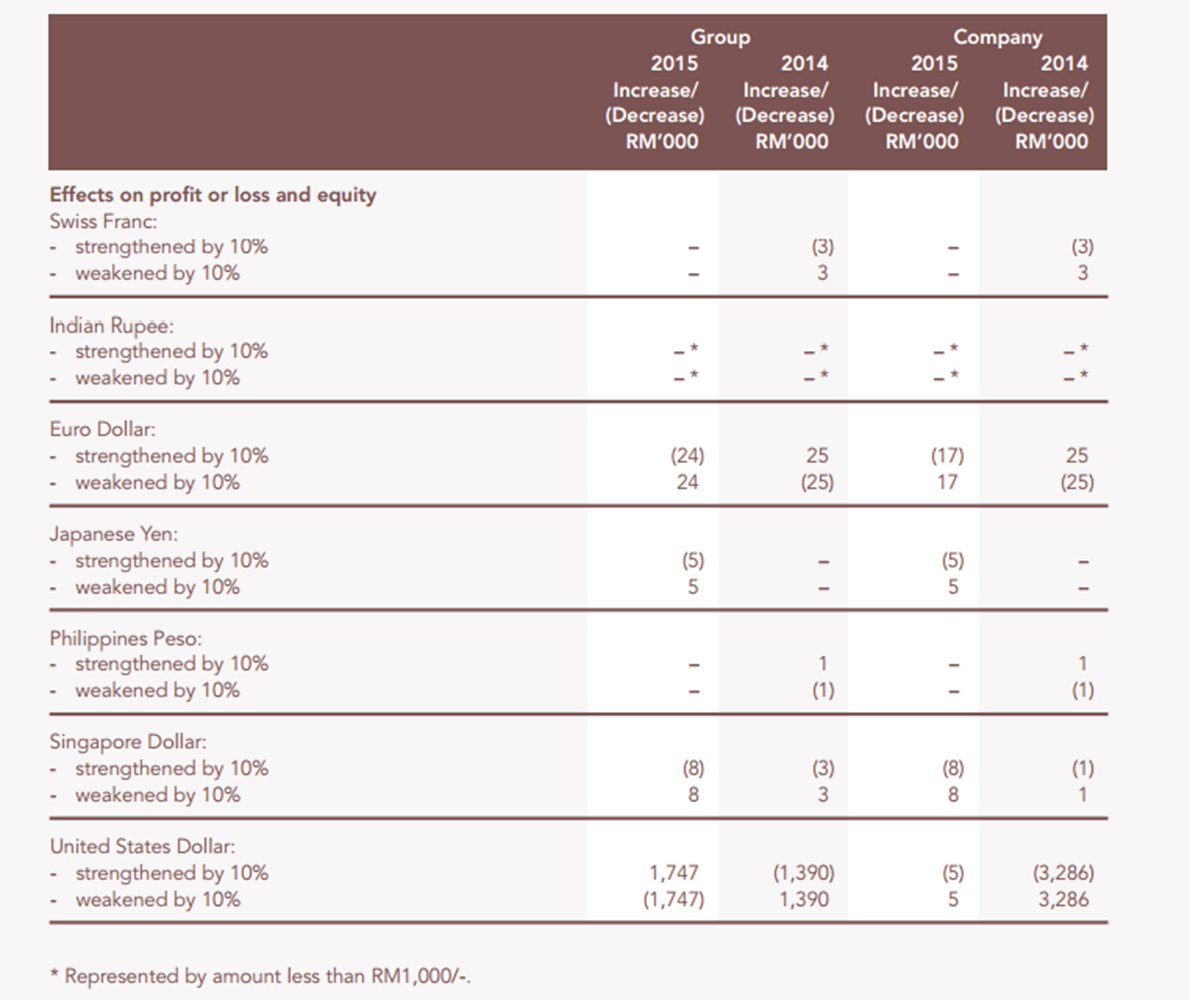

For the past 10 years, Hevea’s revenue has been increasing steadily from RM148m in 2005 to RM503m in 2015, or a good compounded annual growth rate (CAGR) of 13% as shown in Table 1 in the appendix. Net profit increased by a much higher CAGR of 23% from RM9.1m in 2005 to RM73.8m for the year ended 31 December 2015. Thanks to the spike of its net profit margin to 14.7%, a historical high due to the drop in oil price and hence its main cost in resin, not because of the strengthening of USD against Ringgit in the past as most people think as it was having a high loan denominated in USD.

The great growth story of Hevea was accompanied with some hardship tough. From 2005 to 2007, it spent a huge amount of capital expenses to the tune of RM250m and incurring interest expenses of more than RM13m a year. It couldn’t even earn enough to pay for this interest. Just when the roof was leaking, the rain not only fell, but it poured, when the US subprime housing crisis hit hard world-wide soon after that in 2008 and Hevea went into first time losses. Hevea was at the brink of bankruptcy when it owed bankers RM225m in debts when its share price dropped to just a few sen.

Thanks for the swift recovery of the US and the world-wide markets, Hevea was making increasing profit soon after from RM18.9m in 2009 to RM73.8m for the last financial year. Free cash flows (FCF) have improved by leaps and bounds to RM140m from a huge negative of RM100m in 2005 as shown in Figure 1 below. This FCF now amounts to a whopping 27% of revenue and 47% of its invested capital. What a great cash generating machine!

The precarious financial position of Hevea with a huge debt of RM225m in 2007 has turned into a net cash position of RM66.6m for the most recent financial year.

With this healthy balance sheet and excellent FCF, Hevea, which has not been paying much dividend, but instead doing the right thing by paying down debts, has started to pay dividends now for FY2015.

The return on equity and invested capitals, both of which are my favourite metrics to measure “goodness” of a company, have both shot up to 22%, way above its costs.

A good company is not necessary a good investment. It all depend on what the offer price is, in relation to its value. That is why FA practitioners always carry out some valuations to have a feel of the value of the company, and hence to compare with its price.

“The success of investing is not from buying something good, but from buying something right.”

Some Simple Valuation of Hevea

Table 2 below shows some simple valuation metrics for Hevea with its closing price of RM1.18 on 27th May 2016.

Table 2: Some simple valuation metrics for Hevea

The attractiveness of investing in Hevea is its cheap market valuation as shown in Table 2 above. Despite its high return on capitals, stable earnings and good cash flows, its market valuations are all below some relatively stringent benchmarks. The enterprise value of just 5.2 times its earnings before interest and tax, or earnings yield of 19.1%, is particularly attractive. The cash yield (FCF/P) of Hevea, using the average FCF of last 5 years, of more than 10%, double that of my requirement of 5%, is befitting to be a No-Brainer investment.

Let us carry out a discounted cash flow analysis of Hevea using a conservative model to get a feel of its value to compare with its price.

Gordon Constant Growth Model (GCGM) for Hevea

The Gordon growth model is a model for determining the intrinsic value of a stock, based on a future series of free cash flows that grow at a constant rate in perpetuity, the model solves for the present value of the infinite series of future free cash flows. Here we value the enterprise value of entire firm, and then add its excess cash and then deduct the total debts. We will also use the Black-Scholes Option Pricing Model to estimate the value of its outstanding warrants to be deducted from the equity value.

This is quite a conservative valuation method by ignoring any super normal growth, and assume the company has become matured and its revenue and earnings are growing according to rate of inflation. Besides the 5-year average FCF of RM53.5m is used for the initial FCF, instead of the high FCF of RM135m for the most recent year.

The formula for the GCGM is as shown,

FCFF= FCF0 * (1+G) / (WACC-G)

Where,

FCFF is the free cash flows for the firm

FCF0 = Normalized Free cash flows for this year using the average of the past 5 years FCF

G = Constant growth

WACC= Weighted average cost of capital of the whole firm

Table 3 in the Appendix shows the computation of WACC to be 9.44%.

Table 4 shows the step-by step calculation of the intrinsic value of Hevea. After obtaining the enterprise value of the firm, the excess cash is added, total debts and option value of warrants holder deducted to get the present value of FCF due to equity shareholder in the amount of RM952m, or RM2.18 per share. The margin of safety in investing in Hevea at RM1.18 is at 46% as shown.

Hevea first quarter 2016 results

Hevea Board reported its first quarter 2016 financial results on 27th May 2016. A summary of its results is shown in Table 5 in the Appendix.

Revenue for the period increases by 25.4% to RM146m while profit before tax improved by 61.7% to RM23.6m compared to the corresponding period last year. Both business segments have increased revenue and increase in profit.

The particleboard segment registered an increase in revenue and PBT of 8.3% and 31.5% to RM51.7 and RM10.2m respectively. The Ready-to-assemble (RTA) products segment has a higher increase in revenue of 37.2% to RM94.2m with its PBT almost doubled to RM13.5m.

Compared to the immediate preceding period, revenue dropped marginally by 3.3% while PBT decreased by 22%. This is due to the seasonality as a result of festive seasons which reduced the number of working days in this period.

Basing on the latest trailing twelve months’ result, return on equity and return on invested capital have improved further to 22% and 28% respectively, more than double that of its cost of capitals.

The company has further paid up and reduced its debt to just a nominal RM13.2m, from RM58.4m during the end of last year. It now has a net cash of RM80m, or 18 sen per share. Besides it has started to pay better dividend, a dividend of 2.75 sen for last financial year, or a reasonable dividend yield of 2.3% at the present price of RM1.18, commensurate to what one can get from bank interest. Going forward, I would expect Hevea to increase its dividend due its healthy balance sheet, good earnings and cash flows.

Conclusions

Hevea, in the past few years, has transformed itself from a very risky company with huge debts facing a financial crisis in 2008 to a highly profitable and safe company with net cash now. It exhibits high growth in recent years and earns high return on capital with excellent cash flows and free cash flows. In another words, Hevea has transformed itself into a great company.

The investment thesis of Hevea lies in its low market valuation with earnings yield of 19.3% and its high cash yield of more than 10%, more than twice that an investor can get from putting his money in bank fixed deposit.

The conservative GCGM with growth assumption just matching the rate of inflation shows that Hevea is worth RM2.18 per share, or a margin of safety of 46% investing in it at RM1.18.

I see little risk in investing in a good company at a cheap price, but potential in extra-ordinary gain.

“The secret to successful investing is to figure out the value of something and then-pay a lot less” Joel Greenblatt

K C Chong (29th May 2016)

Appendix

Table 1: Financial performance of Hevea

Table 3: Computation of weighted average cost of capital

Table 4: Gordon Constant Growth Model for Hevea

Table 5: Hevea first quarter 2016 results

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-5-2016 12:29 AM

|

显示全部楼层

发表于 29-5-2016 12:29 AM

|

显示全部楼层

本帖最后由 icy97 于 29-5-2016 01:49 AM 编辑

【无债一身轻】- HEVEA(5095) 盈利y-o-y上涨45%,每股现金18仙!

Saturday, May 28, 2016

http://harryteo.blogspot.my/2016/05/1268-hevea5095-y-o-y4518.html

最近出口相关股都想续出炉,许多都交出了不菲的外汇亏损,当中就有FLBHD, LATITUD, LCTH, KAREX等公司。而笔者之前也预测了HEVEA会有一些外汇亏损,但是相比强劲的盈利影响其实并不大。HEVEA最新的盈利是20.268 mil,yoy进步了45%,不过比上个季度的25.693mil 下跌了21.11%。但是笔者非常满意这个季度的盈利,因为Q4一向来都是最强的季度。

笔者做了一些HEVEA的功课,在这里跟大家分享HEVEA最近的表现以及外汇的亏损。

上图是HEVEA最新5个季度的表现对比:

- 营业额145.911 mil, 跟去年Q1相比上涨了25%,盈利上涨了45%。

- 而profit margin跟之前相比也从12.01%进步到13.89%, 有了不错的进步。

- 2015Q1的quarterly rate是3.60,2016Q1上升到4.22,这也是推高了营业额以及盈利主要推手。

- 不过按年相比,quarterly rate下跌了1.4%,而12月31以及3月31日的汇率比较更是下跌了9.09%左右。

- 通常在转换外国资产+债务成为马币时,公司都会使用当个季度的最后一天的汇率。

- 因此HEVEA去年在清还了许多债务之后,USD的asset > liabilites, 也是所谓的USD positive exposure。

- 笔者在5月23日提到HEVEA的大约有18 mil的exposure to USD, 所以乘9.09%的美金跌幅大约会有1.636 mil的外汇亏损。

- 结果真实的外汇亏损是1.163 mil,比笔者当初预测少了0.5 mil左右。主要原因是笔者使用的是12月31日的数据,而在1 - 3月的时候公司几乎偿还了所有的美金债务,也意味着着公司使用了大笔美金还债。

- 公司的Borrowing从58 .364mil减少到最新的13.231 mil, 突显出管理层还债的决心。

- Net cash 增加到79.233 mil, 相等于每股18仙现金。最算扣除了即将开跑的20mil capex, 公司还有接近60 mil的流动现金。公司是时候要给更多的股息了,嘿嘿。。

- 此外, 公司请还17 mil的Trade payable 以及减少了4 mil trade receivable, 一切看起来都很不错。

- 而2016年公司的share outstanding 从436.328增加到455.617 mil, 管理层转换了接近20 mil的warrant。是否意味着公司有什么好消息, 所以要转换成母股得到利益.

公司的盈利连续5年成长, 希望2016可以继续交出出色的成长。

公司1 - 3月偿还45.6 mil的Borrowing, 也从warrant conversion获得了3.24 mil的现金。而共司也开始share buy back , 释放出公司股价被低估的讯息。

公司的指出盈利上涨主要归功美金走高以及产线优化+自动化。Automation都是制造业的主要趋势, 这样可以减少成本以及增加profit margin.

公司的营业额减低因为Festival season 所以导致工作日减少, 这是否意味着Q2的业绩会突破新高呢, 这让笔者非常期待。

上图是这个季度的外汇亏损 = 1.163 mil, 跟笔者预测的1.5 - 2.0 mil少了一些。不过相比去年同期, 外汇亏损增加了1 mil左右, 也意味着Hevea 去年美金起有外汇亏损, 今年美金下跌还是有外汇亏损, 跟TGUAN的情形很相似。

外汇只是一个Bonus, 生意量以及产能增加才是刺激公司盈利进步的主因。现在公司已经处于net cash的情况, 未来美金下跌外汇会有一些外汇亏损, 但是公司的销售却会因此走高。

最后就是Taxation, 不知道大家有没有注意到Tax比去年多了足足2.72 mil。问了两位accountant的朋友, 他们说这笔Tax 可以在未来offset taxable statutory income。也是说未来公司赚了钱, 税务是可以offset掉的。由于不是annual report, 所以没有详细的说明。不过笔者会在星期一询问管理层, 希望会获得更加详细的说明。

总结公司的Balance sheet已经变得非常强健,加上20 mil的capex,未来无疑可以继续成长进步。现在低于7的PE是非常便宜的, 也难怪冯大师增持了HEVEA-WB. 无债一身轻, HEVEA解脱了美金债务的枷锁之后是时候再度启航。

以上纯属分享, 买卖自负。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-5-2016 12:21 AM

|

显示全部楼层

发表于 31-5-2016 12:21 AM

|

显示全部楼层

本帖最后由 icy97 于 31-5-2016 12:59 AM 编辑

【AGM游记】- HEVEA(5095) 双喜临门 , Minimum 30%派息政策 ,FY 2016 最少4%的Dividend Yield。

Monday, May 30, 2016

http://harryteo.blogspot.my/2016/05/1270agm-hevea5095-minimum-30-fy-2016.html

HEVEA的业绩在上个星期五公布了出色的业绩,今天笔者就出席了在芙蓉, Royale Bintang Hotel的股东大会。9.30抵达会场,不少股东已经在吃着Tea time了。

而笔者等级过后先拿了RM30的KFC Voucher,过后还拿到了一套小型的Kid Wall Shelf。对这次的Door Gift笔者觉得满意,因为价值至少RM50以上。

上图就是HEVEA的几位管理层,主持的Chairman是83岁的Dato Chan Choong Tack。会场虽然准备了可以容纳150个人以上的椅子,但是出席的人数大致上是60 - 80人左右。可能是因为地点在芙蓉,所以人数会比较少。

股东大会开始之前,他们播放了一段5分钟左右的影片,大致上是介绍公司的业务以及2011-2015年的成长。以下是一些笔者记录下的重点:

- 公司主要的客户来自中国以及日本,90%的产品出口至国外。

- 在过去两年花了RM 20 mil在CAPEX以及R&D。

- 公司的产量已经是接近Optimum capacity。

- 公司过2011 - 2015年的Revenue CAGR是7.77%,而Profit CAGR是116.02%。

- 而公司现在还剩下RM187 mil的Tax incentive,这也是公司在这近可以告诉成长的原因。

开始5分钟过后,我们就开始了Q and A的环节:

- 笔者觉得气氛有点严肃,因为全场发问问题的只有3个人,其中一个就是本人。

- 一位年龄28 - 30岁的印度人开始发问问题,他准备了大约5 - 6个问题。这些问题主要围绕着公司的CAPEX开销,机器维修费用,公司在做着什么同行没有做得事情?最后也问了我最想问的问题,那就是要如何花HEVEA每股18仙的现金。

- Mr Yoong的回答是公司的机器都可以运作30年左右,所以Depreciation的期限是20年,维修费用也不高。大部分的资金都是用来研发新的产品并增加产品的价值。此外也买进新机器以减低成本。

- 这些解释符合笔者价值基本面的胃口,因为他们注重产品的品质多过Volume。产品品质进步了,售价自然会增加并提高Profit Margin。

- 关于79.233的净现金,公司说会善用这笔钱来增加公司的营运能力,借此也可以提升营业额。此外,管理层在两天前meeting的时候通过了 Minumum 30%的派息政策以回馈股东。

- MR Yoong最保守的方式计算,假设公司今年的Net profit是RM 70 mil,那么30%的派息政策就是21 mil。以现在455.62 mil的股数以及星期闭市价格RM1.18计算,大约是4.6仙, 大约3.9%左右。

- 不过HEVEA最新季度的盈利大约是80 mil的盈利,加上未来3个季度也会会持续成长。笔者预测2016财政年的盈利可以进步20%,73.827 mil(2015 profit) x 1.2 = 88.5 mil。

- 假设2016财政年可以达到90 mil的盈利,那么股息大约可以有6仙,周息率可以4.5 - 5%左右。

- 另外一位Uncle股东又问,公司share buy back是不是觉得公司股价被低估。管理层回答是,那位Uncle又问,那么你觉得合理价格是多少??? (全场发出笑声)

- Mr Yoong回答说,当初IPO的PE = 8, 现在的PE才 7 左右,所以他的意思是股价最少可以PE 8 。现在EPS = 17.58 , PE =8 股价大约会是RM1.41。

- 笔者却认为,今年1月头股价一度上涨到RM1.79, 而公司已经在2月以及5月交出了出色的盈利。理论上回到当初的RM.179应该是有可能吧,我们就拭目以待吧。

而笔者本身发问了两个问题:

1. 请问Mr Yoong,为什么在中国经济走低的情况下,中国客户对你们产品的需求却不断在增加呢?

答:其实中国有上千间做Particleboard的公司,但是中国客户却非常喜爱我们的产品。主要是因为我们的品质优良(Value) ,中国的竞争对手的胜场不出像我们一样的高端产品,这也是我们公司的优势。

2. 其实公司的Capacity已经接近饱和,那么是否意味着今年的Volume成长会放慢,公司会比较注重品质来拉高Margin?

答:公司将会耗资20 mil capex增加产量并生产出更高品质的产品。所以Volume也会跟上,股东不必过于担心。

而且公司生产Super E0 , E0, E1以及E2的 Particleboard -刨花板。日本主要只要高品质的E0 ,而中国也偏向E0和E1,。因此公司可能会减低E2的产量并提高E1和E0的产量,这样就可以符合中国+日本的需求。同时间也可以提高销售额和Margin。

以下是HEVEA产品的简介,大家可以去参考:

http://www.heveaboard.com.my/zh-hans/product-range

总结:

- 管理层回答问题非常清晰,而笔者在股东大会后也跟Executive Director Yoong Li Yen有交流。

- 大致上公司的订单都是满满的,只要产量跟上,未来的销售并不是问题。

- 不过2015年有 50 -60的盈利成长是来自美金增值,剩下的40%是来自Automation以及成本控制。

- 因此Miss Yoong解释说HEVEA会继续提高产品的品质,努力为股东创造更高的价值。

- 最近季度的营业额是145.911 mil, 假设全年都可以维持这样的销售额,全年就有580 mil。不过以保守一点的估计,10%的增长 = 555 mil其实就很不错了。

- 现在公司定下minimum 30%的派息政策,希望这点可以吸引更多的股息投资者。毕竟公司也有可能派发35%的股息,那时dividend yield是可以超过50%的。

- 冷眼前辈增持了HEVEA-WB, 也意味着他很看好HEVEA的未来。我们来看看假设HEVEA的派息政策30%,冷眼前辈的Dividend Yield有多少。

- 星期五出色的业绩+ 今天公布的Minimum 30% 派息政策,这真是【双喜临门】!

笔者在2013年的财报看到了冷眼前辈有持有HEVEA, 那时候2014年4月份财报出炉的时候股价大约1.35。据说冷眼前辈可能在2013年50仙就买进,我们就算算两个不同价位买进,冷眼前辈的Dividend Yield会是多少。

假设2016年财政年HEVEA可以派发5仙的股息,调整后会是20仙( 2015 1分4).

假设买进价格1.35, Dividend Yield = 20/1.35 = 14.8%.

假设买进价格0.50, Dividend Yield = 20/0.50 = 40.0%.

所以这就是长期持有的威力啦,不过要从50仙守到今天不卖真的很具有挑战。共勉之。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-5-2016 01:48 AM

|

显示全部楼层

发表于 31-5-2016 01:48 AM

|

显示全部楼层

Date of change | 27 May 2016 | Name | MR LOO CHIN MENG | Age | 38 | Gender | Male | Nationality | Singapore | Designation | Alternate Director | Directorate | Non Independent and Non Executive | Type of change | Appointment | Qualifications | Mr Loo Chin Meng graduated in 1998 with a Bachelor Degree in Communication Business from Bond University, Australia, majoring in marketing and public relations. He enlisted into Singapore Arms Forces in 1998 and received training in Officer Cadet School. He was commissioned as 2nd Lieutenant in 1999 and was promoted as Lieutenant in 2000. | Working experience and occupation | Mr Loo Chin Meng started his career in 2001 in sawmill and timber industry. He has been in sawmill and timber industry throughout the years and is currently Directors of a number of companies involve in sawmill and timber export business. He also engages in housing development and is currently Directors for a few property development companies. | Directorships in public companies and listed issuers (if any) | None | Family relationship with any director and/or major shareholder of the listed issuer | Mr Loo Chin Meng is the son of Dato' Loo Swee Chew who is the Non-Independent Non Executive Director and substantial shareholder of HeveaBoard Berhad. | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct Interest-------------------370,000 ordinary shares of RM0.25 each*Indirect Interest---------------------592,000 ordinary shares of RM0.25 each | Due Date for MAP | 27 Sep 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-6-2016 02:48 AM

|

显示全部楼层

发表于 6-6-2016 02:48 AM

|

显示全部楼层

主要貸款還清 億維雅擬定股息政策30%

2016年5月30日

(吉隆坡30日訊)億維雅(HEVEA,5095,主要板工業)擬定新股息政策,2016財年每股派息將不少過淨利的30%。

億維雅發表文告指出,較早前,公司宣布于2015財年派發3期終期股息,合共每股1.75仙或762萬令吉。該公司今日在常年股東大會上獲得股東批准,將于2015財年末派發每股1仙股息。

因此,億維雅2015財年總共派發2.75仙股息,為史上最高股息派發紀錄。

億維雅董事經理熊豪俊稱:“目前的時機恰到好處,因為我們已經在2016年3月還清主要貸款,目前的負債股權比率只有3.6%。”

他補充,新股息政策是為了讓股東知道,他們將從公司的盈利中獲得回饋。

“剩余的盈利將運用在億維雅和旗下子公司需要大筆資本開銷進行業務擴張之時。”

另外,該公司于2015財年取得19.2%的營業額成長,達5億330萬令吉,為歷史新高紀錄;淨利則由3020萬令吉暴漲143.7%至7360萬令吉。【中国报财经】

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|