|

|

发表于 19-11-2015 05:39 PM

|

显示全部楼层

发表于 19-11-2015 05:39 PM

|

显示全部楼层

盈利超標‧億維雅強化派息

2015-11-19 11:37

(吉隆坡18日訊)億維雅刨花板(HEVEA,5095,主板工業產品組)2015財政年首9個月財報再捎驚喜,分析員看好強勢美元將持續烘托盈利增長,加上公司資產負債表轉向強穩,強化可持續派息能力,將是未來股價重估因素。

聯昌研究表示,刨花板和準備安裝(RTA)業務雙雙表現良好,帶動億維雅刨花板2015財政年首9個月核心淨利達5千830萬令吉,若扣除1千零20萬令吉的外匯虧損,公司已連續3個季度繳出超標盈利。

“我們在調高美元平均價至4令吉後,上修公司2015至2017財政年每股盈利17至23%。”

此外,億維雅刨花板資產負債表轉為淨現金,聯昌研究預見集團可能在明年杪還清所有債務,將大大強化持續派息能力,將是股價重估因素,維持其“增持”

評級,目標價則提高至2令吉。

股價:1令吉47仙

總股本:4億2千413萬5千400股

市值:6億2千347萬9千零38令吉

30天日均成交量:378萬股

最新季度營業額:1億2千383萬令吉

最新季度盈虧:淨利1千811萬6千令吉

每股淨資產:82仙

本益比:7.77倍

周息率:2.57%

大股東:億維雅刨花板工業私人有限公司(約25.53%)(星洲日報/財經) |

|

|

|

|

|

|

|

|

|

|

|

发表于 1-12-2015 12:52 AM

|

显示全部楼层

发表于 1-12-2015 12:52 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Exercise of Warrants | Details of corporate proposal | Conversion of Warrants (HEVEA-WB) | No. of shares issued under this corporate proposal | 9,145,790 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.2500 | Par Value ($$) | Malaysian Ringgit (MYR) 0.250 | | Latest issued and paid up share capital after the above corporate proposal in the following | Units | 433,281,190 | Currency | Malaysian Ringgit (MYR) 108,320,297.500 | Listing Date | 01 Dec 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-1-2016 06:28 PM

|

显示全部楼层

发表于 6-1-2016 06:28 PM

|

显示全部楼层

本帖最后由 icy97 于 6-1-2016 06:58 PM 编辑

HEVEA, Internal Cracks Emerging 亿维雅,股东内鬨

Author: robertl | Publish date: Wed, 6 Jan 2016, 02:38 PM

http://klse.i3investor.com/blogs/heveatimetoalight/89220.jsp

Civil Appeal No. N-02(IM)(NCVC)-836-05/2015

Civil Appeal No. N-02(IM)(NCVC)-1143-07/2015

Civil Appeal No. N-02(NCVC)(A)-1425-09/2015

between Dato' Loo Swee Chew, Liang Chong Wai and Sung Lee Timber Trading Sdn Bhd

and

Yong Kian Seng @ Yoong Tein Seng, Yoong Hau Chun, Tenson Holdings Sdn Bhd, Firama Holdings Sdn Bhd and HeveaWood Industries Sdn Bhd

and

Seremban High Court Originating Summon No. 24NCVC-197-09/2014

A friend of mine who works for Heveapac Sdn. Bhd., one of the main subsidiaries of Hevea Board Berhad, sent me the above civil suit cases which are still ongoing. He knows that I bought a lot of Hevea shares since early 2014 and was concerned for my investment as a friend because of these suits.

I must admit that I was taken aback when I first saw these. I thought Hevea was a well governed company with its management and the major shareholder cum the ultimate shareholding company Heveawood Industries Sdn. Bhd. (which owned about 28% shareholding in Hevea) enjoying a courteous and harmanious relationship among them all this while. But thing does not seem what it perceived to be. In fact, the internal fight has already started way back in mid 2014 itself, after the shares price of Hevea was slowly climbing from $1.05 to $1.50 (pre-Split).

As an outsider, I am not privy to what is the real crux of the disputes such that the shareholders of Heveawood Industries must bring this matter up to the court of laws to sort it out. I am dismayed, sad and disappointed that Hevea as a listed entity had chosen to conceal and hide these law suits away from the knowledge of all of us, both as an individual shareholder and as a general investing public.

The Bursa Listing Requirement would have dictates that on any matter, trivial or major, that may cause the shares price of a listed entity to have moved either way, the same must be disseminated to the investing public at once. And I believe these suits wherein the major shareholders of the ultimate shareholding company are involved, warrant Hevea to have make the announcement immediately then.

But Hevea chose not to.

In fact, the management and the Board of Directors of Heveawood (consists of Yoong Hau Chun and Dato' Yoong Tein Seng) chose to take the matter into their own hands. And sacked Dato' Loo Swee Chew who owned a 21.66% stake in Heveawood Industries in it's last AGM in or around October 2015. The dispute has gone so ugly that the said AGM was forced to convene twice!

Words around the privileged inner corporate circle disclosed that in one occassion, drinking glasses were thrown in a Heveawood Industries shareholders meeting at their Company Secretary's office at Bangsar South and thugs behaving violent manner rampantly displayed. Yoong Hau Chun, the MD of Hevea was even threatened at a shattered glass' point to tone down his word by Dato' Loo Swee Cheong. Needless to say, the meeting ended abruptly unresolved and unpleasant for neither rivalling shareholders.

There was instance where underworld henchmen were solicited in at least one occassion when Dato' Loo Swee Cheong went for a Committees' Meeting of Heveaboard at its plant in Gemas, Negeri Sembilan about 2 months ago.

Mahatma Gandhi once said : "The earth provides enough to satisfy every man's need, but not every man's greed". And the root to this debacle, and potentially Hevea's inferno if not restrained or allowed to go unabated, the way I see it, is none other than the greed of money, arising from the ever escalating Hevea shares price. Thanks in part to my good friends Wikileaks and 1Mtalkingkangkung.

I do not know I should be happy or disheartened with my investment in Hevea. I was once thrilled to have found an unpolished gem, as I have wrote in my 2014 blog, in the name of Heveaboard Berhad. But now although I should be delighted with its shares price performance, I do not embrace or feel the supposedly satisfaction cum feeling-great effect of this new wealth that I have found in Hevea.

Right now, I would conclude that Hevea is just another wealth creating stock for me. It has lost miserably my respect, the righteousness and courage to take on something bigger in its corporate life. And become a Good Company along the way.

I think I would do much better by taking the money off the Hevea's table now, realising the investment gains and move on. After all, Hevea's shares price is at its peak now since it was listed in 2008.

For now, I may have to look out for another company that meet my definition of a real Good Company in terms of good fundamentals and good governance, that I will treasure for life.

I have made the call to buy Hevea in 2014, it is only righteous that I must similarly make the call to exit when I myself is doing it now.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-1-2016 11:31 PM

|

显示全部楼层

发表于 6-1-2016 11:31 PM

|

显示全部楼层

本帖最后由 icy97 于 7-1-2016 12:23 AM 编辑

Hevea (5095):优质股之路遥知马力

2016年1月6日星期三

http://e2engineer92.blogspot.my/2016/01/hevea-5095.html

某投资分享论坛近日出现一位仁兄,以狙击个股为趣,继XingQuan后,于今日中午将枪头瞄准Hevea。该位仁兄以Hevea股东内讧为题材,讲述股东之间于2014年9月向森州法院提交民事诉讼案,而该案件至今仍在审理中。此话题在下午开盘后开始发酵,将Hevea从中午开盘的高点1.76拉扯至闭市的1.63。因此,笔者也想在此分享个人观点,也借此机会重新检验Hevea的价值。

众所皆知,众多的美元概念股于2015年的趋势是无论优劣,一概借用强势美元概念吸引投资者的资金流入,带动股价在2015年取得一段大涨幅。随着2016年的降临,市场充斥着许多关于强势美元的疑问,其一无疑是诸多美元概念股的好景还能维持多久?笔者以为美国的升息政策乃是美联储的重要抉择,所谓宜静不宜动,一动则已,美联储即已经选择升息,相信在2016年仍会继续实行该政策,而后逐步调升美国利率。此举将保障强势美元的稳定,短期内美元预测将继续站稳于4.2以上,也让美元概念得以继续横行于大马股市。但凡事总得顾前瞻后,笔者以为2016年应将目光专注于拥有稳定业务成长的美元概念股,以防不测。

外围

首先,亿维雅刨花板有限公司(HEVEA)是一家生产碎木板(Chip board)和组装(Ready-to-Assemble, RTA)家具制造的公司。公司产品主要是出口到日本, 日本在2014财政年贡献了60.88%的营业额,且该公司营业收入绝大部分以美元计算,所以该公司的业绩在过去的一年于强势美元下得益不少。截至2015年9月30日止第3季度,公司的营业额和净盈利分别按年增长14.43%和123.21%,净利已经超越2014年全年的净利。由此可见,疲弱的马币和强势的美元分别显著的提升了该公司的营业额及净利。

除此之外,基于日本为2020年夏季奥林匹克运动会的主办国,公司计划扩大日本出口,同时预测,这可捎来额外10%至15%的营业额贡献。日本政府也决定在2017年4月提升消费税10%,这有助于在消费税调高前激励产品销量,进而保障公司的营业额也于未来也将继续提升。根据近期国家贸易部出口日本的数据,于10月至12月也显有不断地成长,此数据预料将强化Hevea于来临二月业绩报告的营业额。

Hevea将于二月尾公布其2015财政年的第四季财政报告,而该报告是基于该公司于2015年10月至12月的业绩。如往常般的参考美元兑换马币的图表,于此前的第三季财政,美元浮动于平均价4.00,而后于10月至12月则站稳4.2以上,目前报4.41。以此推测,该公司于来临2月的业绩也将继续得益于强势美元。

同行比较

其二,该公司采用自动化的生产线和其他降低成本的举措,所销售的环保概念产品也提高了赚幅和日本市场的占有率,以上措施都有助于继续提高公司的赚幅(profit margin)。比较同行Evergreen和Mieco,笔者以为Hevea的数据显得优秀多了。基于业绩的不稳定性,笔者将先把Mieco除外。再者,比较业绩稳定的Evergreen和Hevea,可以一目了然的看见Hevea拥有比较优秀的本益比,净利赚幅及ROE。除此之外,Hevea的管理层也显得比较大方,在公司尚未成功转型净现金公司的时候,也已经不断的派发利息。该公司于第三季财政报告显示,公司目前已经成为净现金公司,未来的派息率预料也将不断增加,有望得以每季派发利息回馈股东。

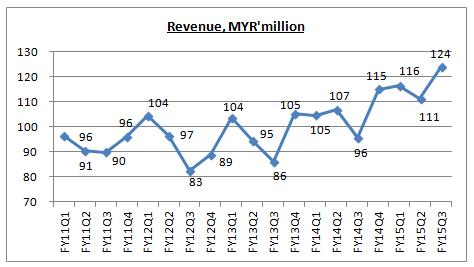

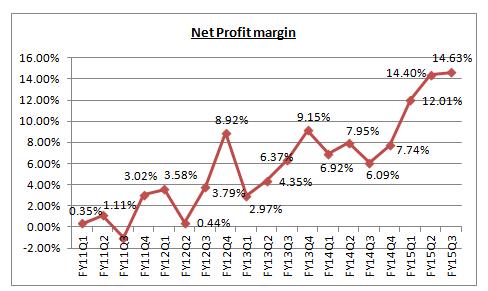

公司业绩

再看看该公司稳定的业绩发展,公司连续五个季度财政都取得营业额和净利双成长,每股净利更是不断的创新高。此外,公司的净利赚幅更是连续五年取得成长,归功于公司的环保概念产品,公司也得于在净利赚幅上遥遥领先同行的Evergreen和Mieco。随着成本的降低与净利赚幅的提升,公司的ROE数据也显得比较优秀。

注:Hevea于第三季从1股拆4股

于第三季财政报告曾记录有高达一笔RM10,230,000的外汇亏损,但该公司在第三季度仍然的在净利上创新高,每股净利也达每股4.63仙。根据数据,来临的第四季财政历来都拥有每年最优秀的业绩,因此预测Hevea于来临的第四季最少获取每股4.63仙净利。以此推算,2015财政年每股净利将最少达16.73仙,再于本益比12推算,合理价位应该是2.00。

法人资金流

根据2014财政年报,该公司共有7家基金持有,此外还拥有数家退休团体持有该股。众所皆知,退休团体所投资的目标极度要求公司的稳定性,选择Hevea也证明该公司的稳定性是公认的。为了追求众基金于该股的目前的资金流,笔者请求一名资深前辈的帮忙,获得Hevea目前的基金持有表。在此,笔者欲再度感谢该资深前辈的援手,敬上无限的谢意。

从上图显示,并无基金抛售如此优秀素质的公司。相反,该公司还不断有基金注入资金,代表基金也在追求拥有良好前景的亿维雅刨花板有限公司,注上图显示近期一家名EVLI的基金开始进驻Hevea。EVLI 基金是家十分擅长发掘优质公司的基金公司,该基金所选择的个股的方面也拥有极高的标准,不会轻易将资金注入没有前景的公司。如果有注意近期飙股Gadang的投资者,相信也发现EVLI基金于11月尾也进注前景良好的Gadang,目前该股的价值也不断的水涨船高,也再度证明该基金的眼光及其良好的选股标准。

笔者是个墙头草,风往哪边吹,笔者就往哪边倒。于选股方面,笔者也十分喜欢跟随优秀的基金选择。亿维雅刨花板有限公司拥有如此多家的基金进驻,也让笔者坚定了该公司的前景是良好的,不会因为一时的恶意负面品论而始乱终弃。

总概

1. 疲弱的马币将提高公司的营业额。

2. 日本即将举办奥运会,需求增加,未来营业额得以保障。

3. 日本2017年提升消费税10%,所以2017前将刺激消费,该公司的营业额也会再度提升。

4. 强势美元继续增强公司净利,美联储升息政策更是确保公司盈利得以继续提升。

5. 拥有较同行高的净利赚幅,也显得该公司擅长降低成本及推动高利润产品。

6. 优秀的管理层,让公司于ROE上遥遥领先其他同行。

7. 拥有派息政策,公司目前成功转为净现金公司,预料得以每季派息。

8. 稳定的业绩,连续五个季度于营业额和净利上取得成长,每股净利更是不断创高。

9. 传统的第四季财政都是最亮眼的,预测来临业绩将再创营业额和净利双新高。

10. 拥有多家基金持有公司股份,代表前景良好,稳定性也极高。

故三国有郭嘉于官渡战前论曹之十胜,袁之十败,未战已算出曹操将得胜于此战。现笔者不才,但也欲以此十优点,论亿维雅刨花板有限公司将立必胜之地于将来。谢谢。

个人观点:

笔者以为该仁兄所指的官司是属民事诉讼,不会牵连亿维雅刨花板有限公司。但欲加之罪,何患无辞,加上星泉效应,让投资者们于恐慌中以廉价抛售如此优质且有良好前景的公司,可正所谓流言也能杀人,而且还是杀人于无形,罪过罪过。星泉公司是家红筹股,前者之鉴有中国文具CSL,但亿维雅刨花板有限公司(HEVEA)是家位于大马的公司。目前,我国的投资法则相比中国还是比较完善的,笔者以为不应将星XingQuan和优质的Hevea比较。此外,众人可参考某资深投资前辈的观点,参考Liihen于2013年遭遇他人恶意散播流言,结果目前的股价是当时的三倍,300%。如果该民事诉讼案会影响业绩,为何2015年各季度财政仍屡次创新高呢?事实证明民事诉讼案对该公司业绩绝无影响!再加上今天笔者所得的资料显示,多家优秀基金都仍继续持有该公司,因此笔者以为众人于买卖前,还是想想您是为何进行此交易吧。

以上纯属个人观点,非买卖建议,任何决定请自负。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-1-2016 11:04 AM

|

显示全部楼层

发表于 7-1-2016 11:04 AM

|

显示全部楼层

本帖最后由 icy97 于 7-1-2016 01:47 PM 编辑

HEVEA : 700 Containers Stranded in Korean Port

Author: robertl | Publish date: Thu, 7 Jan 2016, 08:26 AM

http://klse.i3investor.com/blogs/Heveafromzeroto/89325.jsp

In October 2015, the MD of Heveaboard Berhad and one of the Executive Directors of Heveapac Sdn Bhd (one of the two main subsidiaries of Hevea) flown secretly to Korea on an urgent basis.

Their mission : to rescue and resolve some 700 stranded containers of particleboard and MDF, held up by the Korean Customs in a Korean port. The reasons cited by the Korean Custom was that these Hevea products infringed, does not conform and or violated the strict wooden products import regulations of the Republic of Korea, as a hazardous product. And these Hevea exports failed to meet this standard.

These stranded containers was held up for a prolonged period of more than a month and further exports that are already on water or about to be shipped were diverted to China, in part to avoid piling up the Korean port with more stranded containers of unapproved and potentially banned import.

Already these 700 containers are costing Hevea the pains in storage charges and potential hefty fines by the Korean Custom. You can picture the immense area required to warehouse these 700 containers. Each 14-wheelers container-hauling lorry that we used to see on the road carries one container. And the Korean Custom is withhelding 700 of them now.

To aggravate the already burgeoning headache, major Korean television network and news agencies started reporting about this news, no thanks to Hevea's Korean importer's competitors who took the opportunity to blow up the issue. Free advertising for the wrong reason, indeed.

I see that some of you may not believe the news that Kannibu has posted yesterday, and possibly this news that I am now breaking cover.

Here is what I propose and my bona fide challenge to Hevea for the sake of clearing the accusation on any of us : Please come clean and speak out in the public if yesterday's report and this report is inaccurate or false. I stand corrected and willing to face the music by any enforcement agencies, if proven otherwise.

I have no intention to benefit from the slide in Hevea shares price, if this article or Kannibu's or the rest of the forthcoming articles that I am currently working on, would cause it on a downward slope. Any one who knows me knew that I don't even have a securities trading or margin account to start with. I am doing it for a friend. I am also doing it to enable the general investing public to see the real picture of what is in Hevea, so that all will have a fair understanding and a fair chance to decide whether to invest, to continue investing or to exit Hevea.

And in the process brings out the culprits and increase the investing standard in Malaysia as a whole.

P. S. : I read with a good laugh that a so-called investing sifu (name withheld to prevent it from public humiliation) in this forum who said that some large percentage of Hevea product goes to the USA. I like to say to him : Go do your homework carefully, before proclaiming the sifu title.

Hevea exports 0% to the USA. |

|

|

|

|

|

|

|

|

|

|

|

发表于 8-1-2016 12:20 AM

|

显示全部楼层

发表于 8-1-2016 12:20 AM

|

显示全部楼层

本帖最后由 icy97 于 8-1-2016 01:03 AM 编辑

Copied from I3 Ooi Teik Bee's post:

I understand many of you are so worried about your investment in Hevea. In order to help you all, I take the initiative to write to Hevea management to clarify 2 items here.

1 - Court case

2 - 700 containers of reject (Actual is 700 m3 not containers).

Below are the answers to both items.

1 - Court case.

The court case is involving our minor shareholders in HeveaWood claiming no dividends after many years despite HB gave limited dividends. We are unable to pay as we have a loan governance to pay borrowers first. The case was won twice but the plaintiffs still brought it to appeal court. This is non issue if we pay up all loans in June this year.

2 - 700 containers of reject (Actual is 700 m3 not containers).

We had an issue that 700m3 of our PB to Korea were held up in Korean port over quality problem last October due to wrong testing method. This is resolved after our protest, our test, local labs, and Korean labs subsequently prove us right. The results are better that requirements. Thus all cargo cleared.

Dear valued readers, I am not siding any party here. I just get the explanation from Hevea management so that all my subscribers are happy with my explanation.

Since I have the answer, I hope to share with all readers here. If you do not believe, please ignore it.

I am not asking you to buy or hold the shares, final decision is yours.

Thank you.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-1-2016 01:50 PM

|

显示全部楼层

发表于 8-1-2016 01:50 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 8-1-2016 11:04 PM

|

显示全部楼层

发表于 8-1-2016 11:04 PM

|

显示全部楼层

本帖最后由 icy97 于 8-1-2016 11:16 PM 编辑

(RICHE HO) HeveaBoard Berhad

Author: RicheHo | Publish date: Fri, 8 Jan 2016, 06:00 PM

http://klse.i3investor.com/blogs/rhinvest/89467.jsp

HeveaBoard was incorporated in year 1993 as a private limited company under the name of HeveaBoard Sdn Bhd. The Company was converted into a public limited company in year 2004 and assumed its present name, and was subsequently listed on the main board of Bursa Malaysia Securities Berhad in year 2005.

HeveaBoard Berhad (“HEVEA”) and its subsidiaries are involving in manufacturing, trading and distributing a wide range of particleboard, particleboard-based products and ready-to-assemble (“RTA”) products.

Financial Performance

The higher revenue in FY15Q3 is contributed by an increase sales in value added products and higher USD exchange rate to MYR.

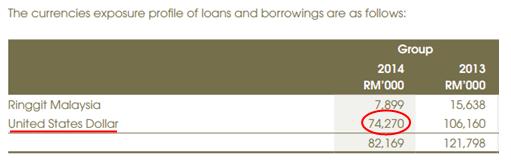

However, do note that even though higher USD/MYR had increased revenue amount, overall HEVEA is actually not benefited from strengthening of USD. In the latest quarter, it had an unrealized exchange loss of MYR10.23m from the translation of the USD denominated term loan!

Among its MYR82m loans and borrowings, HEVEA has MYR74m loan which denominated in USD!

As extracted from HEVEA annual report - currency sensitivity analysis, for every 10% strengthening of USD, HEVEA will actually have a loss of MYR1.4m!

So, even though 92% of its revenue is contributed from overseas, please stop saying HEVEA is a beneficiary of strengthening of USD.

Having said so, HEVEA net profit margin is still showing an improvement despite of the foreign exchange translation loss! In other words, HEVEA is developing higher margin products.

FYI, HEVEA’s ready to assemble sector had been through two aggressive years, FY13 & FY14, of capital expenditure worth almost MYR20m in order to achieve higher automation and wider range of higher value product diversifications.

Finally, HEVEA had started to see result from this. It was able to mitigate the labor cost increase and contribute additional revenue stream to the Group. As a result, HEVEA net profit margin had shown significant improvement in FY15.

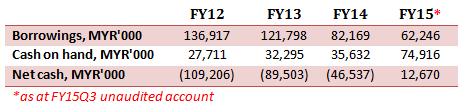

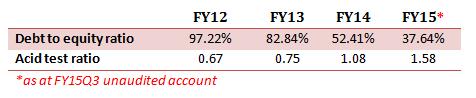

Financial Strength

To be easy to understand, I extracted out HEVEA’s borrowing and cash on hand over the past 3 years. As in its latest quarter, HEVEA had finally turned into a cash positive position. HEVEA had slowly improved its financial strength from year to year.

As we can seen above, its debt to equity had reduced from 97.22% in FY12 to 37.64% in FY15! Its acid test ratio of 1.58 indicated that HEVEA is liquid enough to meets it short term liabilities even though without its inventories.

In short, HEVEA financial strength is considered good and stable.

Conclusion

Despite being a victim of strengthening of USD, HEVEA is still able to improve continuously on its net profit margin.

Do note that, HEVEA had turned its business into higher automation and higher productivity. The mitigation of labor cost is definitely not a one-time contribution. So, I believe HEVEA net profit margin will be able to sustain above 14%.

Furthermore, HEVEA borrowing had been decreased from time to time as shown at above table. When its USD loan is able to cut down, it will reduce its unrealized exchange loss as well. It is definitely a good sign and good catalyst for HEVEA.

Currently, with a share price of MYR1.59, HEVEA had a PE of 12.16 and ROE of 17.78%. HEVEA is still growing in its financial performance. Compared to its peers EVERGREEN and MIECO, HEVEA performed better than them and it is also the cheapest.

Overall, as value investors, this is all we can do to study a company. The rest of it is beyond our control. Don’t easily influence by rumors and news which is still not confirmed.

KISS principle - Keep Investment as Simple as Possible

Happy investing! |

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2016 10:58 PM

|

显示全部楼层

发表于 11-1-2016 10:58 PM

|

显示全部楼层

本帖最后由 icy97 于 11-1-2016 11:30 PM 编辑

O’Mighty did added shares of HEVEA into its flagship fund and there are a couple of reason to this position. Comparing HEVEA against EVERGRN, we see that HEVEA trades cheaper and the recent crash might be due to floating rumours and strengthening USD.

But recently, the featured blog post on klsei3investor did brought up a few issues regarding problems within HEVEA. Let’s address these issue one by one.

1. The first post http://klse.i3investor.com/blogs/heveatimetoalight/89220.jsp.

It’s regarding a court case where Dato Loo Swee Chew is going against the Yoongs and HeveaWood Ind. Sdn Bhd.

The writer portrayed that it’s war between shareholders and they chose to hide this issue from the public. Well, Securities Commission did not specify that arguments between shareholders should be displayed on the announcement board. Putting myself in their shoes, I wouldn’t want to present this embarrassing matter to the public as well.

In short, even if the shareholders fight to their death. The business should continue running if you trust in how it’s structured. Indeed good companies are best to have great leadership and I don’t see anything shaky happening to its biggest substantial holder.

I’ll give a daring conclusion that Dato’ Loo’s timber no longer interest the company causing this problem.

2. The second issue is the attack on the company about 700 containers stranded in Korean port. http://klse.i3investor.com/blogs/Heveafromzeroto/89325.jsp

The latest info from 2014 Annual Report stated that Korea’s revenue is only 7.9% of their whole revenue. The expectation was probable that this year’s Korean revenue percentage should be more.

No idea on this issue. But to sum it up, I believe that the overall impact would be estimated at 10% on earnings at most. That translates to a PE of around 14.92 comparing to what EVERGRN is trading at 16.36. Not happy? Use 16.36 and that translate to EPS of only 0.08924. That’s a whopping 21.75% decrease in earnings per share.

3. The third one, accounting scandal (damn I hate to use this word). http://klse.i3investor.com/blogs/heveatimetoalight/89413.jsp

I have problems understanding what the writer is trying to portray. HeveaWood Industries is the shareholder of HEVEA but that doesn’t mean that HeveaWood placed funds into HEVEA. It just doesn’t make sense and readers have to be careful on that.

As investors, we can ignore chances of fraud because out of so many listed companies in the world, it happens only in less than 0.1% of the time. If we go into every stock like forensic accountants, it’s likely that we can’t invest in many.

Over and over again, companies have funds coming in and out where a good management knows that at times, taking only one simple move on focusing a key product would change the course of the company. The accounts for this might scare you as you see money moving in and out and you have no idea where it went. Some investments, some repayment of short term high interest debt.

With all that, we think that it’s a good time to pick up some shares. We still feel that ringgit could rise in the future and earnings would improve for the company. In the meantime, improving export numbers due to weaker ringgit could be the only catalyst in next quarter’s results.

One last thing! Dato’ Loo might be unloading his shares since he is no longer interested in dealing with the company. The reason why I have this idea is that over the course of dumping, buyers are queuing in huge numbers meaning that there are many people awaiting to grab those shares but the number of sellers are limited. With equivalent amount of volume on the bid and ask the number of buyers exceed sellers by a ratio of 4 to 1.

转载自:O'Mighty Capital |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-1-2016 10:28 PM

|

显示全部楼层

发表于 12-1-2016 10:28 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2016 12:02 PM

|

显示全部楼层

发表于 13-1-2016 12:02 PM

|

显示全部楼层

Hevea Interviewed by CIMB: TP RM2.00: BUY

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2016 12:05 PM

|

显示全部楼层

发表于 13-1-2016 12:05 PM

|

显示全部楼层

本帖最后由 icy97 于 13-1-2016 01:56 PM 编辑

Hevea Under Attack

Wednesday, 13 January 2016

http://bursadummy.blogspot.my/2016/01/hevea-under-attack.html

Recently Hevea has been under relentless attacks by a few people in i3investor.

I'm alert to this as I'm also a small shareholder of Hevea.

Last week I wanted to write about my opinion on this issue but finally I did not do so. I thought that I should not let my decision affecting other readers since the reliability of those information are in doubt.

A few people made the allegation, and some people tried to counter it by posting feedback from Hevea's management. All these information might not be true.

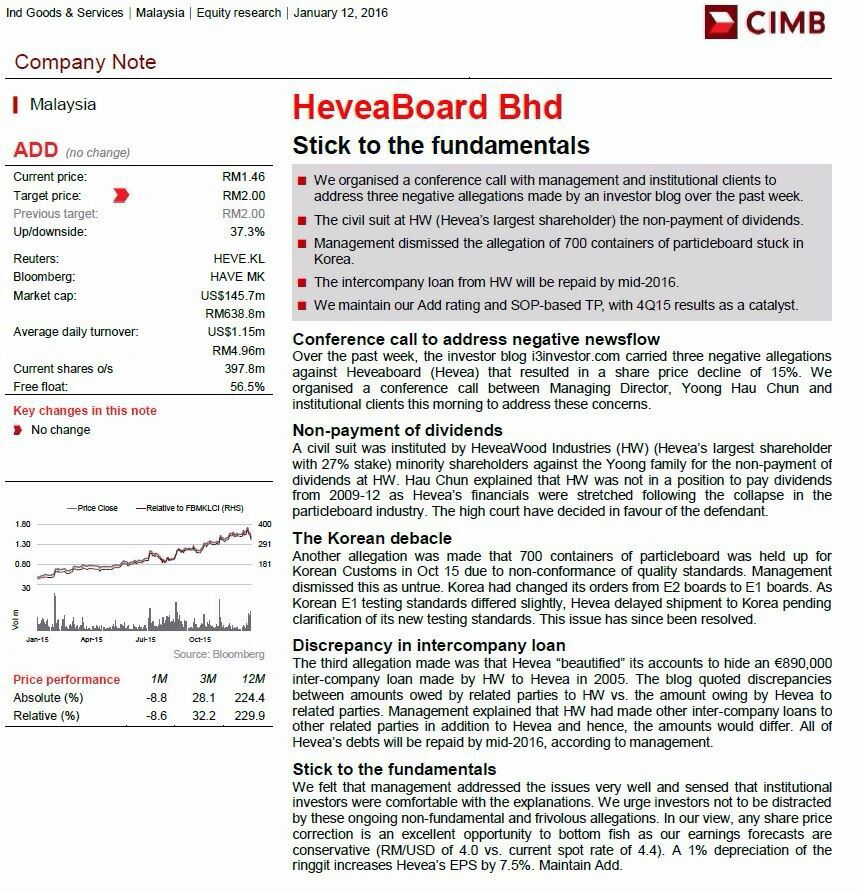

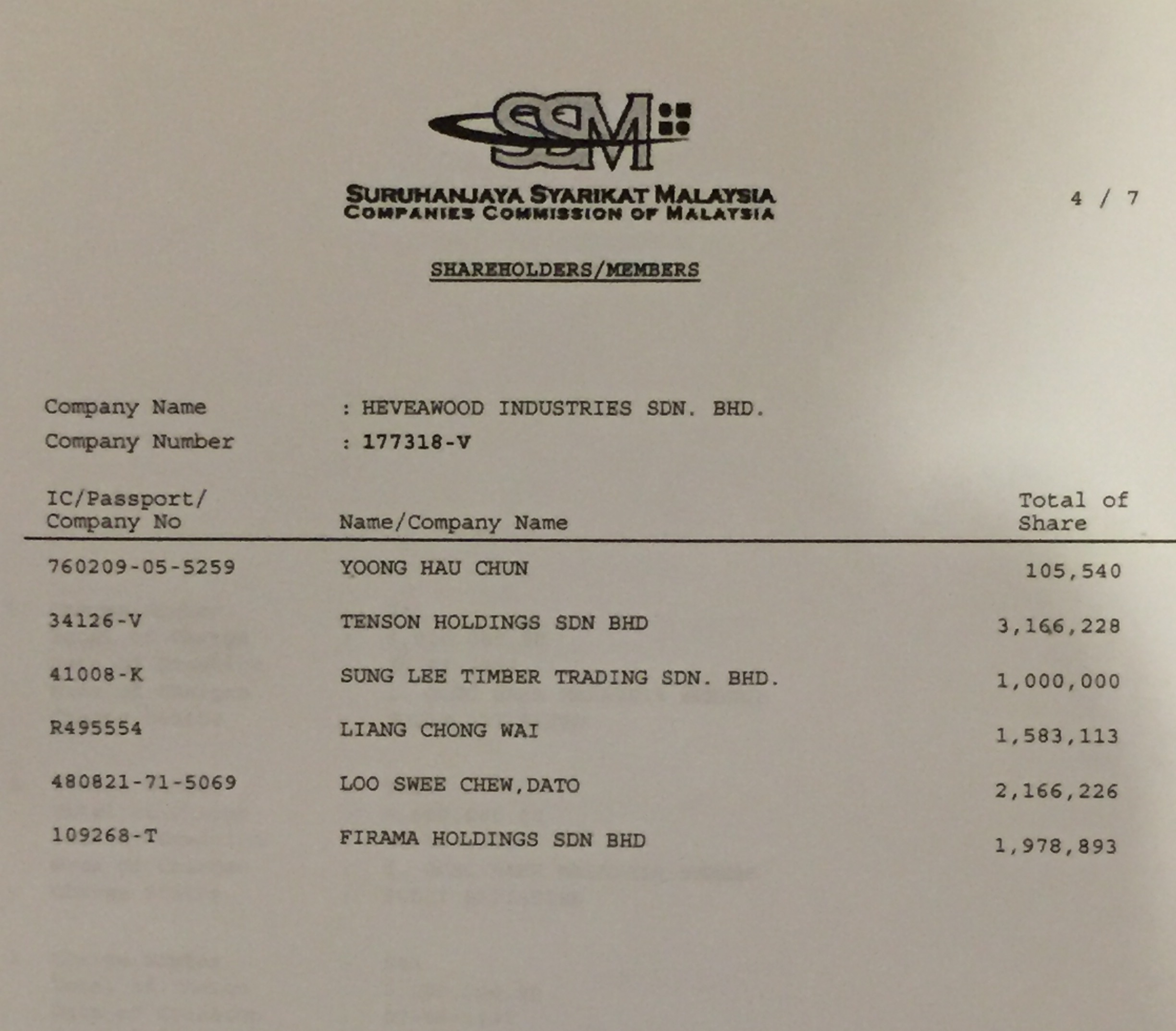

Yesterday, the first reliable source of information finally came out. CIMB organised a conference call with Hevea management and its institutional investors, and published the note today.

Last week, the first allegation was that Hevea's directors & major shareholders had some physical conflict and are involved in a few civil suits.

The major issue the author wished to bring out was that Hevea tried to hide these law suits from the shareholders/investors by not disclosing them to Bursa when they are obliged to do so.

Both parties consist of HeveaWood controlled by HeveaBoard's MD Yoong's family, and Dato Loo who is a non-executive director & founding member of HeveaBoard.

Those who know Hevea well should know that HeveaWood is not a subsidiary of HeveaBoard but is a major shareholder of HeveaBoard.

This is just some personal conflict among HeveaWood shareholders who also happen to be HeveaBoard shareholders.

So I think Hevea has no obligation to reveal these law suits under material litigation in their financial report as they do not involve Hevea directly.

After CIMB's report, we know that the law suits are because of non-payment of dividends at HeveaWood and the court has actually decided in favour of Yoong's family.

Of course these conflict among directors is not good for Hevea. However, it should not affect Hevea's operation as Dato Loo is not an executive director and this case were already closed even though an appeal seems to be on-going.

Yoong Hau Choon & Dato Loo Swee Chew

The second allegation was about 700 containers stuck in Korea port and Hevea could potentially face hefty fines and was alleged to sell hazardous products!

I opined that this could not be true. The number of 700 is too huge and how can Hevea passes Japan test but fails in Korea?

Finally it turned out that it was 700m3 containers and the Korean custom actually used the wrong testing method. This issue has also been resolved.

From the 2 allegation above, we can know that the attacker has close relationship with Hevea as he can gain access to those information.

However, why did he only tell half of the story? Didn't he know that the Korea issue is just a misunderstanding and has been resolved without "hefty fines"?

He either knows only a bit and inevitably gave inaccurate information, or knows the issues well but chose to mislead the public deliberately by posting and exaggerating only on the negatives.

If he is really a neutral person who is trying to help the investing public as he claimed to be, he should quickly write another article to support his earlier claims or apologize for his mistakes, especially the 700 containers story.

However, he didn't.

So to me, there is a well-organised plot to attack Hevea & its current executive directors for whatever reason I'm not sure but it seems to me that it is related to earlier law suits.

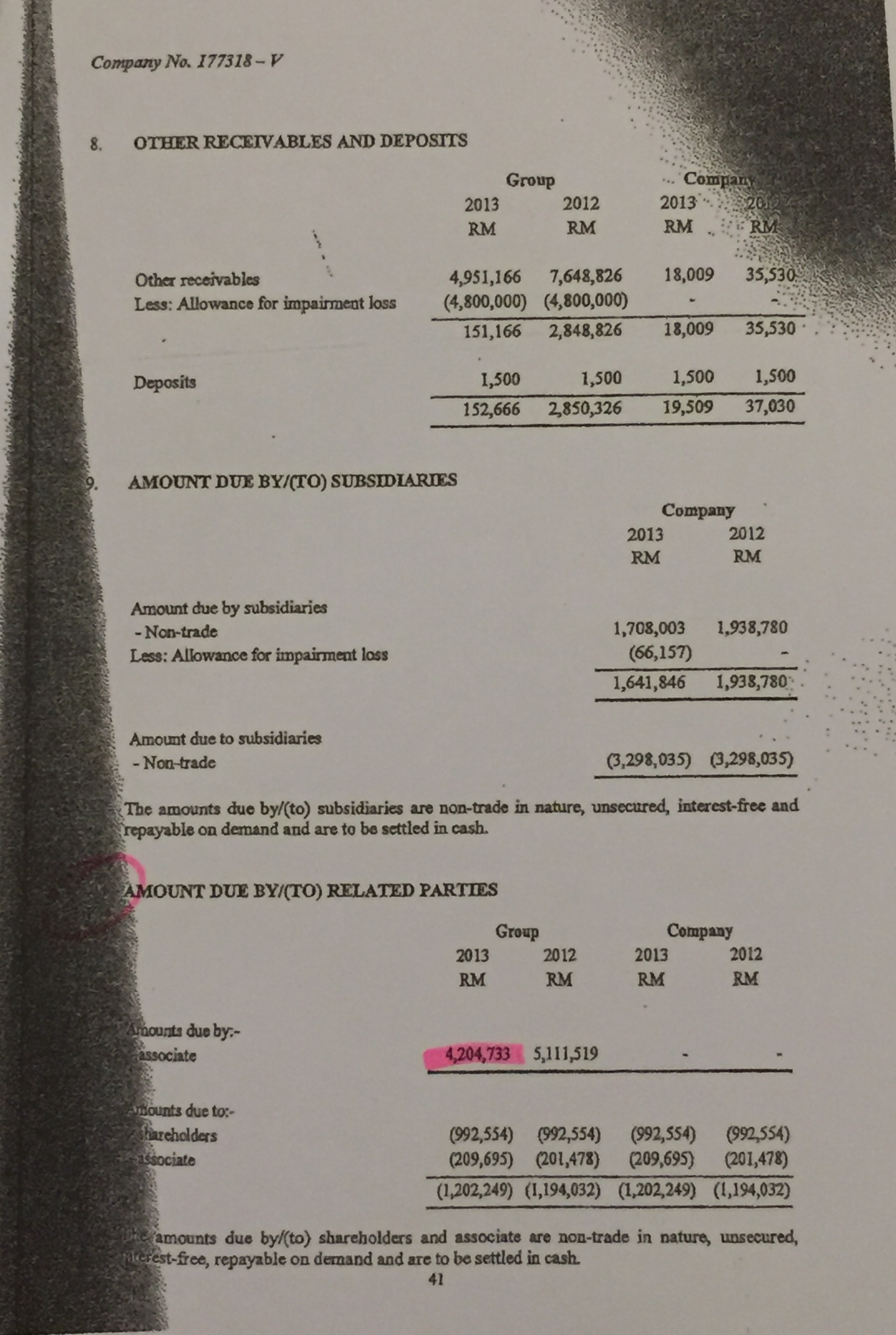

As for the accounting fraud part, though I'm not good at accounting, I wonder why the "amount due to/by related parties of HeveaWood & HeveaBoard must be the same. Can't there be other parties involve other than these two?

Now CIMB has reported that there are other parties involved so this allegation is a joke.

Similarly, the attackers should counter CIMB report or Hevea MD's clarification by giving concrete evidence. If they fail to do so, this just exposes their desperate plot to down Hevea with purpose.

There might be more allegation coming out but the credibility of those attacking authors are surely waning.

I just write my view on one of my company I'm investing in and I might also be wrong.

Hevea's MD might cheat those institutional investors and gave empty promise if he is really that bad & "no big no small" as described by the attackers.

The attackers will surely continue to find faults in Hevea and we can't rule out that they might find something real in the future, as I don't think a big organisation can do things 100% right.

We as outsiders can only use our own brain to think and make a decision on who is right or wrong.

Please be reminded that this is not a buy or sell recommendation on Hevea. |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-1-2016 12:31 AM

|

显示全部楼层

发表于 14-1-2016 12:31 AM

|

显示全部楼层

本帖最后由 icy97 于 14-1-2016 02:26 AM 编辑

反駁投資網站傳聞 億維雅強調業務如常

2016年1月13日

http://www.chinapress.com.my/20160113/反駁投資網站傳聞-億維雅強調業務如常/

(吉隆坡13日訊)億維雅(HEVEA,5095,主要板工業)反駁近期投資網站傳聞不屬實,強調公司業務如常並且不受影響,將保留法律追究權。

該公司針對近期網上傳聞及《The Edge財經日報》報導,向馬證交所澄清傳聞,並強調與子公司業務如常進行,並沒有受到傳聞影響。

文告指出,市場傳該公司在芙蓉高庭的民事訴訟,實際上來自大股東HeveaWood工業內部派息糾紛,不應將兩家公司混為一談。

“芙蓉高庭已判HeveaWood工業大股東勝訴,目前小股東仍在上訴中,但這宗官非並不影響億維雅營運,加上是大股東公司內部糾紛,公司亦無需向馬證交所報備。”

該公司亦逐一反駁另2項指控,其中包括旗下700貨櫃箱滯留韓國港口,以及賬目不實,前者是受韓國當局更換貨櫃標準影響,並且在釐清后已解決。

“至于賬目不一,據了解是因為其他公司亦積欠HeveaWood債務,故在不同層面上構偏差,不過公司積欠HeveaWood的款項會在2016年內還清。”【中国报财经】

Type | Announcement | Subject | OTHERS | Description | Clarification of the allegations. | The Board of Directors of HeveaBoard Berhad ("the Company") wishes to draw the attention of the public on the above allegations against the Company.

Please refer to the attached Official Statement by HeveaBoard Berhad for details.

This announcement is dated 13 January 2016. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/4974797

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-1-2016 01:12 AM

|

显示全部楼层

发表于 14-1-2016 01:12 AM

|

显示全部楼层

本帖最后由 icy97 于 14-1-2016 01:56 AM 编辑

【独立思考】- 浅谈HEVEA(5095) ,剧情好看过TVB的港剧!

Wednesday, January 13, 2016

http://harryteo.blogspot.tw/2016/01/1199-hevea5095-tvb.html

今天笔者就不谈HEVEA的基本面有多好了,相信在MR.R 大大在I3的出现之后,许多的部落客都已经出来分析HEVEA的基本面了。这几天很多朋友以及读者都询问我对HEVEA的看法,所以笔者就出来献丑了。首先HEVEA的管理层在BURSA给出了Official的公告,解释了MR.R 的指控。

首先,我真的很震惊Blogger - 部落客的威力原来可以这么大。因为MR. R在I3invesntor分享了HEVEA的各种负面消息,股价可以从上个星期三最高的RM1.79插水到最低的RM1.42。今天才站稳在RM1.57, 5天的上下高达20%,可谓非常夸张。

第2点,据我所知,部落客是不可以给Buy Call/Sell Call的,最多只是分享自己的功课。不过MR.R 的标题直接出现【是时候下车了】的标题。这很明显是要把散户们吓下车,因为散户们是最好吓的。有人的地方就有江湖,这时候就会看到八仙过海,各显神通。看好看坏的的网友通通出现,这时候就到了考验HEVEA小股东们的【独立思考】。基本上只有三个选择:

1.趁低买进,因为对公司的前景超级有信心

2.继续持有,等待剧情落幕

3.不想冒险,先卖掉股票套利。等风平浪静再买回。

因为选择权是在我们自己手里,到时候真相大白,发现是这些都是假象。我相信被洗下车的股友们都会在家打小人了。

第3点,MR.R 肯定是非常熟悉HEVEA的内部运作。不然普通人根本是不可能会得到这些内部的文件以及消息。根据我的了解,公司的员工就算是辞职了,他们也不可以随意泄露前公司的文件。以MR.R 这种手法来看,HEVEA是可以采取法律行动的。而今天HEVEA也出来澄清了,他们是有权追究这件事情的。

第4点,MR.R 口中的苦主大股东MR LOO在1月4号卖出了300,000股的持股,过后在1月7号公布。大家看到大股东卖票一定会觉得很恐慌,这可能是一个信号。结果MR LOO在1月7号又再度买回20,000股HEVEA,这个消息昨天才在BURSA出现。卖股的时间未免也太“巧合”了吧,时间拿捏得很准下。

第5点,其实从以上的剧情开看,这主要是大股东之间的纷争。到底谁对对错,我们这些小虾米是不知道的。但是MR.R口中的苦主MR.R 手中持有27.65%的HEVEA,大家觉得HEVEA股价下跌20%,他会亏损多少呢?我算过了,MR. LOO持有120,959,890units的HEVEA, 在HEVEA股价下跌20%的状况下,他的paper losses是24 mil。你觉得如果你是大股东,你会自己拿刀插自己吗??

是不是有第3方的存在,是不是精彩过TVB剧情呢??

以上纯属个人分析,本人还持有一些HEVEA的股票。所以我写的东西大家也要【独立思考】,不要被我给【仙家】了。共勉之。

魔法师Harryt30

21.30p.m.

2016.01.13 |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-1-2016 10:37 AM

|

显示全部楼层

发表于 14-1-2016 10:37 AM

|

显示全部楼层

本帖最后由 icy97 于 14-1-2016 04:45 PM 编辑

亿维雅 回应质疑处理得宜

财经 股市 行家论股 2016-01-14 11:14

http://www.nanyang.com/node/743820?tid=462

目标价:2令吉

最新进展

亿维雅(HEVEA,5095,主板贸服股)董事经理熊豪俊针对在网上部落客的3项质疑,与联昌国际投行的机构顾客会面。

持有亿维雅27%股权的Hevea Wood工业,有小股东先前控告熊氏家族没有支付股息,熊豪俊表示,亿维雅在2009至12年期间,因刨花板领域低迷,造成财政压力无法派息,高庭也宣判熊氏家族胜诉。

另外,有700个刨花板集装箱因品质标准不符,去年10月滞留于韩国海关的说法,并不准确,韩国将订单从E2板,转去E1板,E1板在韩国的测试标准稍有不同,因此亿维雅延迟送货以达新标准,问题已经解决。

网上也指,亿维雅“美化”

账目,隐藏了Hevea Wood工业在2005年贷款予亿维雅的89万欧元(423万令吉),两家公司的账目不一样。他解释,这是因为HeveaWood工业不止是贷款给亿维雅,因此数额自然不一样。

行家建议

我们认为,管理层将上述问题处理得宜,机构投资者也满意这些解释。我们呼吁投资者,切勿受这些没有根据基本面指控影响。

任何股价下跌都是吸纳时机,因为我们的财测相当保守,是根据1令吉兑4美元的预估来算,令吉每贬值1%,亿维雅每股净利则可提高7.5%。

分析:联昌国际投行研究 |

|

|

|

|

|

|

|

|

|

|

|

发表于 15-1-2016 01:05 AM

|

显示全部楼层

发表于 15-1-2016 01:05 AM

|

显示全部楼层

本帖最后由 icy97 于 15-1-2016 01:18 AM 编辑

HEVEA : Answering Your Official Statement

Author: robertl | Publish date: Thu, 14 Jan 2016, 03:19 PM

http://klse.i3investor.com/blogs/heveatimetoalight/89764.jsp

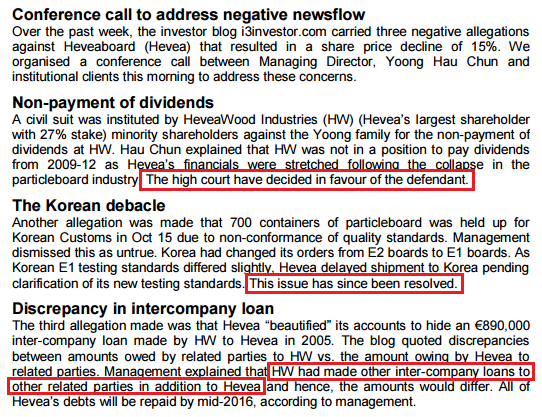

As the above SSM search clearly shows, the major shareholders of Heveawood Industries are the Yoong family (Yoong Hau Chun, Tenson Holdings Sdn. Bhd. and Firama Holdings Sdn. Bhd.) with a combined 52.51% stakes. On the other hand, the parties that made up the minority shareholders with a combined stakes of 47.49% are Sung Lee Timber Trading Sdn. Bhd (10.00%), Mr. Liang Chong Wai (25.83%) and Dato' Loo Swee Cheong (21.66%).

It is noteworthy to point out that Sung Lee Timber Trading Sdn. Bhd. is the investment vehicle of Dato' Seri Yong Tu Sang, who is also the majority shareholder of another public listed company BTM Resources Berhad.

Seasoned market players with a preying instinct should now be able to draw an inkling about the delicate relationships among some of Heveawood Industries shareholders. And why certain shareholders wanted to break-up Heveawood Industries and part ways. I will stop this point here and let your own imagination run wild....

[/align

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-1-2016 10:42 PM

|

显示全部楼层

发表于 15-1-2016 10:42 PM

|

显示全部楼层

小狗英文有限公司....

请问是说没问题吗?

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-1-2016 03:16 AM

|

显示全部楼层

发表于 23-1-2016 03:16 AM

|

显示全部楼层

常青纖維板 今年有望派特別股息

2016年1月22日

(吉隆坡22日訊)常青纖維板(EVERGRN,5101,主要板工業)2送1紅股于20日除權,促進股票流通量,加上券商看好有望以特別股息回饋股東,故給予“增持”建議,目標價為2.06令吉。

聯昌證券研究認為,通過常青纖維板旗下橡膠園和其他非核心資產的出售,該公司股東今年有望獲得特別股息作為回酬。

另外,常青纖維板的已發行股本從5億6400萬股增至8億4600萬股,有助提高股票的交易流動性。

該研究報告稱,常青纖維板正被許多有利因素包圍,包括美元走強帶動強勁的盈利增長、原材料成本如橡膠原木和膠水價格急挫、運費下降以及公司內部結构調整所帶來的好處。

多項利多支持

“該公司約70%的收入是美元計價。根據我們的分析,美元每走強1%,常青纖維板2015財年的每股盈利將增10%。不過,這是依據1令吉兌4美元的匯率和4.40的即期匯率所得出的預測,因此仍趨于保守。”

同時,該公司正關閉其無利可圖的廠房,為節省人力和能源成本購買新設備,并擴大其刨花板和家具產量。【中国报财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 24-1-2016 05:16 PM

|

显示全部楼层

发表于 24-1-2016 05:16 PM

|

显示全部楼层

本帖最后由 icy97 于 21-2-2016 01:12 AM 编辑

发奋图强积极经营 亿维雅冀夺一哥地位

经济新闻

20/02/201619:18

(吉隆坡20日讯)源自森美兰州的塑合板制造商亿维雅刨花板有限公司(HEVEA,5095,工业产品组)最近遭受骇客袭击,造成股价在一周内一度下滑近15%。

不过,该公司执行董事熊豪俊表示:“我们的业务一切正常,并坚定地表明公司在根基上并无动摇。”

“我们已就此事件作出澄清,而我认为最合适的选择就是以官方的说词与联昌研究行的文告为准。”

近期亿维雅在一项官方文告中驳斥了某些博客文章的指责性内容,并指这些内容含有“不实、中伤与恶意”的意图。

一位联昌研究行分析师在一份文告中建议投资者,应趁低买入该公司的股票。

熊豪俊也表明不会再针对上述指控作出任何发言,并表示与其浪费时间在无关痛痒的文章上,不如积极开发更好的产品。

实际上,亿维雅正面对着令人鼓舞的‘烦恼’,因为其设于森州金马士城的工厂生产力已无法赶上市场的强烈需求。

“我们面对着特别是来自中国的强大压力,要求我们扩充以应付额外的产能。的确,我们最初曾认真考虑过增设生产线,不过,我们最后还是决定提升原本的生产线,而不再纠结于生产量上。”

作为国内最大的刨花板生产商之一,亿维雅拥有两条生产线,年产量达到52万5000立方米。

操作逾20年的第一生产线产能可以达到年度产量达11万立方米,不过由于仅使用在特制品上,所以利用率也较低,相比之下,其第二生产线则根据产品类别而订,每年产能达到38万至41万立方米。

中国的经济放缓与产业过剩并未影响亿维雅的生产输出量,反而持续收到由中国顾客提出增加产能的要求。

“来自中国的需求量远超估计。大部分顾客群的家具产品是属于高档路线,更有利于捕获与增加市场占有率。作为局外者,我们或许有许多疑虑,不过实际上,需求量确实很多。”

经历了2000年初期生产能力过剩的困境后,熊豪俊对于过度增加产能的想法有所保留。

“我们情愿保守一点。我们有近40%刨花板是输出到中国。这已是我们能承担的限度,再高一点,就太冒险了。正所谓,‘覆巢之下无完卵’啊。”

虽然存在多种选择,但是熊豪俊还是认为提升现有生产线能力是最佳保障。

“暂时,比起一个或须耗费1亿令吉的全新生产线,我们还是选择集中在产品品质上。同时间,我们也在寻找可以加快提升生产能力,或许反而可以增加我们的产能。”

在美元走强的趋势下,橡胶原木与黏合剂价格下跌,加上木质家具需求量提升,已使亿维雅的盈利增加一倍,由2014年首3个财季的2150万令吉盈利按年提升至4810万令吉。

超过90%的盈利实际上是以美元来计算,因为亿维雅80%的刨花板产量都是输出海外。该公司在前年第3季度还清了750万美元的定期贷款后,变成净现金流动状况。

迄今,亿维雅已获得共2亿令吉的减税奖励,并在无时间限制下,抵消来自未来的刨花板业务所取得的可纳税利润。

相比一年前,亿维雅刨花板、长青纤维板(EVERGRN,5101,工业产品组)与美固木屑板(MIECO,5001,工业产品组)的股价已各自上升了180%、178%与107%,分别在本周五达到1.43令吉、1.27令吉与88仙。

有趣的是,虽然长青纤维板的市值(逾12亿令吉)是亿维雅市值(逾6亿1700万令吉)的一倍,不过熊豪俊并不掩饰后者欲取代前者位置的野心。

“我的梦想就是要变成如长青纤维板般庞大的规模,甚至是更大,但是我们还是需要设定比较实际的目标。暂时或许是不太可能,但是长远来说,或许可实现。”【光华日报财经】

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-2-2016 09:59 AM

|

显示全部楼层

发表于 2-2-2016 09:59 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|