|

|

【CEPCO 8435 交流专区】协固工程产品

[复制链接]

|

|

|

发表于 27-4-2016 03:27 AM

|

显示全部楼层

发表于 27-4-2016 03:27 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

29 Feb 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 29 Feb 2016 | 28 Feb 2015 | 29 Feb 2016 | 28 Feb 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 37,433 | 40,481 | 96,520 | 89,317 | | 2 | Profit/(loss) before tax | -1,556 | -686 | -7,941 | -5,187 | | 3 | Profit/(loss) for the period | -1,579 | -1,095 | 6,336 | -6,241 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,579 | -1,095 | 6,336 | -6,241 | | 5 | Basic earnings/(loss) per share (Subunit) | -3.53 | -2.45 | 14.15 | -13.94 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.5300 | 2.3900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-7-2016 04:48 AM

|

显示全部楼层

发表于 29-7-2016 04:48 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2016 | 31 May 2015 | 31 May 2016 | 31 May 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 37,232 | 70,714 | 133,752 | 160,031 | | 2 | Profit/(loss) before tax | 4,473 | 6,408 | 12,414 | 1,221 | | 3 | Profit/(loss) for the period | 3,573 | 4,162 | 9,909 | -2,079 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,573 | 4,162 | 9,909 | -2,079 | | 5 | Basic earnings/(loss) per share (Subunit) | 7.98 | 9.30 | 22.13 | -4.64 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.5300 | 2.3900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-10-2016 05:40 AM

|

显示全部楼层

发表于 27-10-2016 05:40 AM

|

显示全部楼层

Date of change | 25 Oct 2016 | Name | MR KHOO KAY ONG | Age | 65 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Executive Director | New Position | Non-Independent Director | Directorate | Non Independent and Non Executive | Qualifications | B.Sc. (Dundee) CivilMember of The Institution of Engineers, MalaysiaProfessional Engineer, Malaysia | Working experience and occupation | He started his career with the Public Works Department (JKR) and Drainage & Irrigation Department (JPS) in design and site exploratory works.Subsequently, he became a civil and structural consultant before joining a reowned local property and housing developer for 5 years.He was a General Manager and also a Director of subsidiary of Wah Seong Group until 2007.He is a professional Engineer by profession and an active member of the Board of Engineers, Malaysia in the Investigating Committee. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-10-2016 11:55 PM

|

显示全部楼层

发表于 31-10-2016 11:55 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2016 | 31 Aug 2015 | 31 Aug 2016 | 31 Aug 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 58,623 | 62,508 | 192,375 | 222,539 | | 2 | Profit/(loss) before tax | 538 | 3,182 | 12,952 | 4,403 | | 3 | Profit/(loss) for the period | 2,096 | 4,446 | 12,005 | 2,367 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,096 | 4,446 | 12,005 | 2,367 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.68 | 9.93 | 26.81 | 5.29 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.6500 | 2.3900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-1-2017 04:59 AM

|

显示全部楼层

发表于 20-1-2017 04:59 AM

|

显示全部楼层

强美元不利海外拓展.协固专注大马

(吉隆坡19日讯)正竞标2亿5000万令吉合约的协固工程(CEPCO,8435,主板工业产品组)认为,美元强势不利于海外拓展计划,因此该公司虽有意开发斯里兰卡等市场,未来仍倾向于以大马市场为重心。

该公司董事经理梁桂华周三在股东大会后向《星洲财经》表示,美元走强,并非只是影响大马,区域国家的货币也一同弱化,因此区域国家也暂时减少海外进口,因此公司未来会把业务重心放在大马。

“目前,大马与海外贡献的营业额比例各为80%及20%。”

梁桂华补充,虽然该公司有意将业务拓展至斯里兰卡、巴布新几内亚及汶莱,但未来仍会保持这个比例。

协固工程核心业务主要生产建筑材料,供应海内外市场需求,提供混凝土桩和电线杆,该公司的出口市场包括新加坡、汶莱和印尼。

梁桂华表示,该公司70%的合约来自基建贡献,30%则来自房屋。

“基建类型合约以发电厂、港口等为主。”

梁桂华表示,大马基建领域处于蓬勃发展,因此该公司有信心可从中受惠。

手握1.5亿合约

询及合约方面,梁桂华说,目前该公司手握1亿5000万令吉合约,平均每个月消耗量约2000万令吉,竞标中的合约规模则约2亿5000万令吉。

此外,梁桂华表示,该公司40%的材料成本以人民币计价,虽然没有进行护盘,但该公司已与相关业者达成协议,锁定交易价格,因此原材料价格波动,在6个月内不会对该公司造成太大影响。

梁桂华表示,基于目前营运环境艰钜,因此该公司暂时没有派息的意愿,待市况好转之时,董事部会再做定夺。

文章来源:

星洲日报‧财经‧报道:谢汪潮‧2017.01.19 |

|

|

|

|

|

|

|

|

|

|

|

发表于 25-1-2017 03:43 AM

|

显示全部楼层

发表于 25-1-2017 03:43 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2016 | 30 Nov 2015 | 30 Nov 2016 | 30 Nov 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 51,869 | 59,087 | 51,869 | 59,087 | | 2 | Profit/(loss) before tax | -2,952 | 9,497 | -2,952 | 9,497 | | 3 | Profit/(loss) for the period | -3,087 | 7,915 | -3,087 | 7,915 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -3,087 | 7,915 | -3,087 | 7,915 | | 5 | Basic earnings/(loss) per share (Subunit) | -6.89 | 17.68 | -6.89 | 17.68 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.5900 | 2.6500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2017 02:52 AM

|

显示全部楼层

发表于 27-4-2017 02:52 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

28 Feb 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 28 Feb 2017 | 29 Feb 2016 | 28 Feb 2017 | 29 Feb 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 34,744 | 37,433 | 86,613 | 96,520 | | 2 | Profit/(loss) before tax | -1,697 | -1,556 | -4,649 | 7,941 | | 3 | Profit/(loss) for the period | -1,697 | -1,579 | -4,784 | 6,336 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,697 | -1,579 | -4,784 | 6,336 | | 5 | Basic earnings/(loss) per share (Subunit) | -3.79 | -3.53 | -10.68 | 14.15 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.5500 | 2.6500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-7-2017 12:07 AM

|

显示全部楼层

发表于 27-7-2017 12:07 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2017 | 31 May 2016 | 31 May 2017 | 31 May 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 50,042 | 37,232 | 136,655 | 133,752 | | 2 | Profit/(loss) before tax | -820 | 4,473 | -5,469 | 12,414 | | 3 | Profit/(loss) for the period | -820 | 3,573 | -5,604 | 9,909 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -820 | 3,573 | -5,604 | 9,909 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.83 | 7.98 | -12.52 | 22.13 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.5300 | 2.6500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-11-2017 04:31 AM

|

显示全部楼层

发表于 1-11-2017 04:31 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2017 | 31 Aug 2016 | 31 Aug 2017 | 31 Aug 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 42,757 | 58,623 | 179,412 | 192,375 | | 2 | Profit/(loss) before tax | 181 | 538 | -5,311 | 12,952 | | 3 | Profit/(loss) for the period | 396 | 2,096 | -5,231 | 12,005 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 396 | 2,096 | -5,231 | 12,005 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.88 | 4.68 | -11.68 | 26.81 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.5400 | 2.6500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-1-2018 01:35 AM

|

显示全部楼层

发表于 30-1-2018 01:35 AM

|

显示全部楼层

本帖最后由 icy97 于 30-1-2018 03:11 AM 编辑

协固工程首季亏损收窄

2018年1月30日

(吉隆坡29日讯)协固工程产品(CEPCO,8435,主板工业产品股)在2018财年首季,净亏按年收窄52.8%。

该公司今天向交易所报备,净亏从上财年同期的308万7000令吉或每股6.89仙,减少至145万7000令吉或每股3.25仙。

营业额也从上财年的5186万9000令吉,减少至4074万7000令吉,跌幅21.4%。

据财报,该季营收减少归咎于国内销售额按年减少201万令吉。当中,国内销售额减少983万令吉,不过部分被782万令吉的出口销售增长抵消。

展望今年表现,协固工程产品指出,手持订单和来自国内与区域的潜在新合约,将左右协固工程产品表现。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2017 | 30 Nov 2016 | 30 Nov 2017 | 30 Nov 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 40,747 | 51,869 | 40,747 | 51,869 | | 2 | Profit/(loss) before tax | -1,457 | -3,087 | -1,457 | -3,087 | | 3 | Profit/(loss) for the period | -1,457 | -3,087 | -1,457 | -3,087 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,457 | -3,087 | -1,457 | -3,087 | | 5 | Basic earnings/(loss) per share (Subunit) | -3.25 | -6.89 | -3.25 | -6.89 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.5000 | 2.5400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-5-2018 05:09 AM

|

显示全部楼层

发表于 2-5-2018 05:09 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

28 Feb 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 28 Feb 2018 | 28 Feb 2017 | 28 Feb 2018 | 28 Feb 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 42,524 | 34,744 | 83,271 | 86,613 | | 2 | Profit/(loss) before tax | -793 | -1,697 | -2,250 | -4,649 | | 3 | Profit/(loss) for the period | -793 | -1,697 | -2,250 | -4,784 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -793 | -1,697 | -2,250 | -4,784 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.77 | -3.79 | -5.03 | -10.68 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.4900 | 2.5400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-7-2018 01:37 AM

|

显示全部楼层

发表于 31-7-2018 01:37 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2018 | 31 May 2017 | 31 May 2018 | 31 May 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 42,793 | 50,042 | 126,064 | 136,655 | | 2 | Profit/(loss) before tax | -2,343 | -820 | -4,593 | -5,469 | | 3 | Profit/(loss) for the period | -2,343 | -820 | -4,593 | -5,604 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,343 | -820 | -4,593 | -5,604 | | 5 | Basic earnings/(loss) per share (Subunit) | -5.23 | -1.83 | -10.26 | -12.52 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.4300 | 2.5400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-10-2018 05:37 AM

|

显示全部楼层

发表于 30-10-2018 05:37 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2018 | 31 Aug 2017 | 31 Aug 2018 | 31 Aug 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 35,888 | 42,757 | 161,952 | 179,412 | | 2 | Profit/(loss) before tax | -1,928 | 181 | -6,521 | -5,311 | | 3 | Profit/(loss) for the period | -978 | 396 | -5,571 | -5,231 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -978 | 396 | -5,571 | -5,231 | | 5 | Basic earnings/(loss) per share (Subunit) | -2.18 | 0.88 | -12.44 | -11.68 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.4100 | 2.5400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-11-2018 12:23 AM

|

显示全部楼层

发表于 6-11-2018 12:23 AM

|

显示全部楼层

本帖最后由 icy97 于 10-11-2018 07:31 AM 编辑

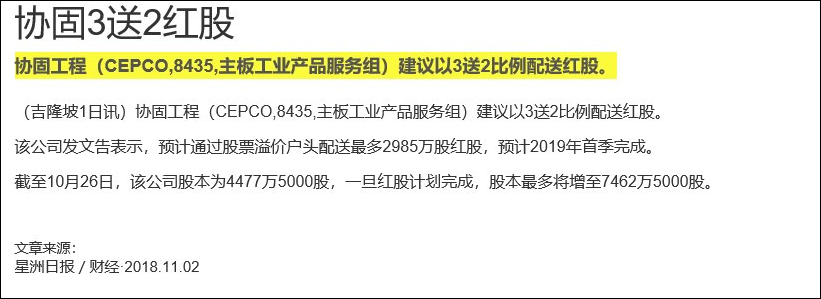

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

BONUS ISSUES | Description | CONCRETE ENGINEERING PRODUCTS BERHAD ("CEPCO" OR THE "COMPANY") PROPOSED BONUS ISSUE OF 29,850,000 NEW ORDINARY SHARES IN CEPCO ("BONUS SHARES") ON THE BASIS OF 2 BONUS SHARES FOR EVERY 3 EXISTING ORDINARY SHARES IN CEPCO ("CEPCO SHARES") HELD ON AN ENTITLEMENT DATE TO BE DETERMINED LATER ("PROPOSED BONUS ISSUE") | On behalf of the Board of Directors of CEPCO, Hong Leong Investment Bank Berhad wishes to announce that the Company proposes to undertake the Proposed Bonus Issue.

Kindly refer to the attached document for further details.

This announcement is dated 1 November 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5963121

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-1-2019 04:18 AM

|

显示全部楼层

发表于 30-1-2019 04:18 AM

|

显示全部楼层

| CONCRETE ENGINEERING PRODUCTS BERHAD |

EX-date | 17 Jan 2019 | Entitlement date | 22 Jan 2019 | Entitlement time | 05:00 PM | Entitlement subject | Bonus Issue | Entitlement description | Bonus issue of 29,850,000 new ordinary shares in Concrete Engineering Products Berhad ("CEPCO") ("Bonus Shares") on the basis of 2 bonus shares for every 3 existing ordinary shares held in CEPCO ("Bonus Issue") | Period of interest payment | to | Financial Year End | 31 Aug 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | MESTIKA PROJECT (M) SDN BHD22nd Floor, Menara PrometJalan Sultan Ismail50250 Kuala LumpurTel: 03-21444446Fax: 03-21418463 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 22 Jan 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Ratio | Ratio | 2 : 3 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-2-2019 06:49 AM

|

显示全部楼层

发表于 10-2-2019 06:49 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2018 | 30 Nov 2017 | 30 Nov 2018 | 30 Nov 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 31,212 | 40,747 | 31,212 | 40,747 | | 2 | Profit/(loss) before tax | -2,697 | -1,457 | -2,697 | -1,457 | | 3 | Profit/(loss) for the period | -2,697 | -1,457 | -2,697 | -1,457 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,697 | -1,457 | -2,697 | -1,457 | | 5 | Basic earnings/(loss) per share (Subunit) | -6.02 | -3.25 | 6.02 | -3.25 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.3500 | 2.4100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-6-2019 03:21 AM

|

显示全部楼层

发表于 5-6-2019 03:21 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

28 Feb 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 28 Feb 2019 | 28 Feb 2018 | 28 Feb 2019 | 28 Feb 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 24,593 | 42,524 | 55,805 | 83,271 | | 2 | Profit/(loss) before tax | -1,688 | -793 | -4,385 | -2,250 | | 3 | Profit/(loss) for the period | -1,688 | -793 | -4,385 | -2,250 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,688 | -793 | -4,385 | -2,250 | | 5 | Basic earnings/(loss) per share (Subunit) | -2.24 | -1.05 | -5.82 | -2.99 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3800 | 1.4300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-7-2019 06:29 AM

|

显示全部楼层

发表于 27-7-2019 06:29 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2019 | 31 May 2018 | 31 May 2019 | 31 May 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 25,086 | 42,793 | 80,891 | 126,064 | | 2 | Profit/(loss) before tax | -3,098 | -2,343 | -7,483 | -4,593 | | 3 | Profit/(loss) for the period | -3,098 | -2,343 | -7,483 | -4,593 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -3,098 | -2,343 | -7,483 | -4,593 | | 5 | Basic earnings/(loss) per share (Subunit) | -4.11 | -3.11 | -9.93 | -6.10 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3300 | 1.4300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-12-2019 07:55 AM

|

显示全部楼层

发表于 21-12-2019 07:55 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2019 | 31 Aug 2018 | 31 Aug 2019 | 31 Aug 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 20,974 | 35,888 | 101,865 | 161,952 | | 2 | Profit/(loss) before tax | -4,080 | -1,928 | -11,563 | -6,521 | | 3 | Profit/(loss) for the period | -4,080 | -1,928 | -11,563 | -6,521 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -4,080 | -1,928 | -11,563 | -6,521 | | 5 | Basic earnings/(loss) per share (Subunit) | -5.41 | -1.30 | 15.35 | -7.39 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2800 | 1.4300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-4-2020 05:41 AM

|

显示全部楼层

发表于 14-4-2020 05:41 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2019 | 30 Nov 2018 | 30 Nov 2019 | 30 Nov 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 31,346 | 31,212 | 31,346 | 31,212 | | 2 | Profit/(loss) before tax | -1,417 | -2,697 | -1,417 | -2,697 | | 3 | Profit/(loss) for the period | -1,417 | -2,697 | -1,417 | -2,697 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,417 | -2,697 | -1,417 | -2,697 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.90 | -3.61 | -1.90 | -3.61 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2700 | 1.2900

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|