|

|

发表于 25-7-2018 05:03 AM

|

显示全部楼层

发表于 25-7-2018 05:03 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 02:20 AM

|

显示全部楼层

发表于 31-8-2018 02:20 AM

|

显示全部楼层

本帖最后由 icy97 于 3-9-2018 02:19 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

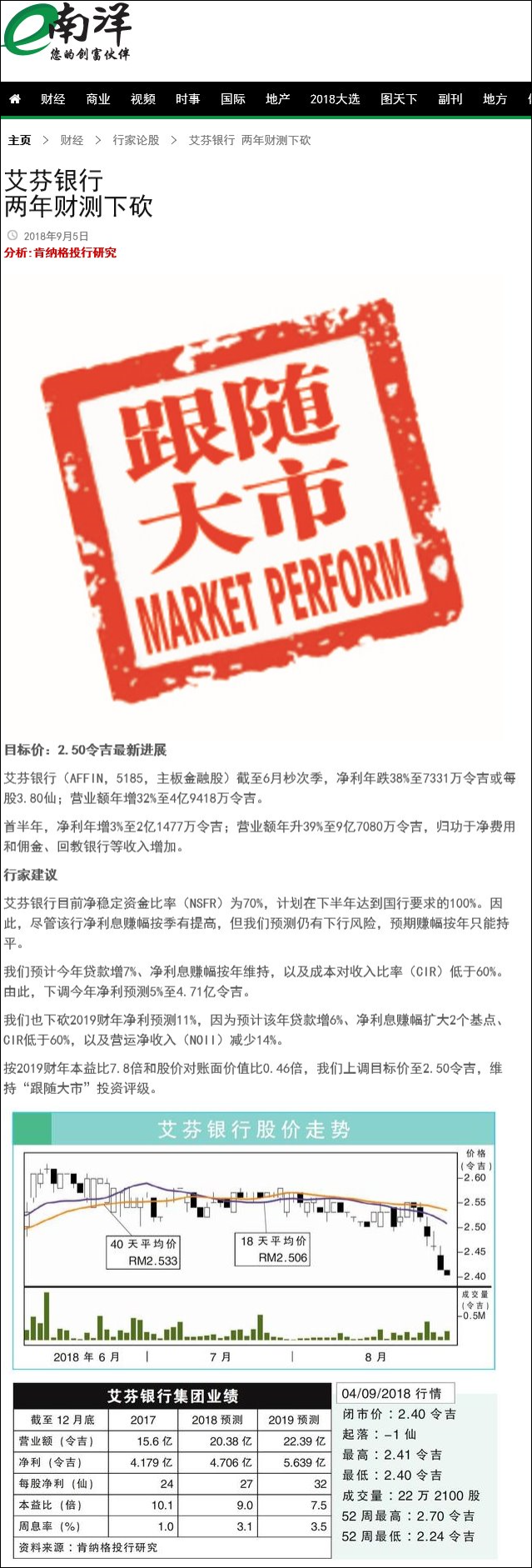

| 1 | Revenue | 494,178 | 375,766 | 970,795 | 697,798 | | 2 | Profit/(loss) before tax | 113,900 | 146,456 | 300,650 | 271,788 | | 3 | Profit/(loss) for the period | 79,001 | 118,184 | 224,988 | 208,417 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 73,306 | 118,184 | 214,773 | 208,417 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.80 | 7.00 | 11.10 | 12.30 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.2800 | 4.2600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-9-2018 01:04 AM

|

显示全部楼层

发表于 8-9-2018 01:04 AM

|

显示全部楼层

本帖最后由 icy97 于 10-9-2018 05:52 AM 编辑

Type | Announcement | Subject | OTHERS | Description | Letter of Award to IJM Construction Sdn Bhd for the Construction and Completion of the Superstructure Works of the Proposed 47-Storey Office Building (Package 4 - Main Building Works) at Tun Razak Exchange, Jalan Tun Razak, Kuala Lumpur, Wilayah Persekutuan | Affin Bank Berhad (the Bank) wishes to announce that the Bank has issued a letter of award to IJM Construction Sdn Bhd, a wholly-owned subsidiary company of IJM Corporation Berhad for the construction and completion of the superstructure works of the proposed 47-storey office building (Package 4 – Main Building Works) at Tun Razak Exchange, Jalan Tun Razak, Kuala Lumpur, Wilayah Persekutuan (Project) for a contract sum of RM505 million. IJM Construction Sdn Bhd has accepted the said letter of award on 4 September 2018.

The duration of the Project is 26 months and is expected to be completed by December 2020.

The Project is not subject to the approval of shareholders or any regulatory authorities.

This announcement is dated 5 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-9-2018 04:36 AM

|

显示全部楼层

发表于 9-9-2018 04:36 AM

|

显示全部楼层

本帖最后由 icy97 于 9-9-2018 07:05 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-10-2018 04:53 AM

|

显示全部楼层

发表于 19-10-2018 04:53 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | AFFIN BANK BERHAD ("Affin Bank")ISSUANCE OF ADDITIONAL TIER 1 CAPITAL SUKUK WAKALAH ("AT1 SUKUK WAKALAH") UNDER AN ISLAMIC MEDIUM TERM NOTES PROGRAMME OF RM5.0 BILLION IN NOMINAL VALUE FOR THE ISSUANCE OF SENIOR SUKUK MURABAHAH, TIER 2 SUKUK MURABAHAH AND/OR AT1 SUKUK WAKALAH BY AFFIN ISLAMIC BANK BERHAD ("SUKUK PROGRAMME") | We wish to announce that Affin Islamic Bank Berhad (“Affin Islamic”), a wholly-owned subsidiary of Affin Bank, had on 18 October 2018 issued AT1 Sukuk Wakalah with a nominal value of RM300,000,000 under the Sukuk Programme. The tenure of the AT1 Sukuk Wakalah issued is perpetual on a non-callable 5 years basis. The AT1 Sukuk Wakalah has been assigned a long-term rating of A3 by RAM Rating Services Berhad.

The AT1 Sukuk Wakalah issued under the Sukuk Programme will qualify as Basel III-compliant Additional Tier 1 capital of Affin Islamic, in accordance with the Capital Adequacy Framework for Islamic Banks (Capital Components) issued on 2 February 2018 by Bank Negara Malaysia.

Affin Islamic had on 3 October 2018 lodged the Sukuk Programme with the Securities Commission Malaysia (“SC”) pursuant to the SC’s Guidelines on Unlisted Capital Market Products under the Lodge and Launch Framework.

The Sukuk Programme will give Affin Islamic the flexibility to raise funds via issuance of Senior Sukuk Murabahah, Tier 2 Sukuk Murabahah and/or AT1 Sukuk Wakalah from time to time and shall be utilized for the general banking working capital requirements and business purposes of the Affin Islamic, which shall be Shariah compliant.

Affin Hwang Investment Bank Berhad is the Principal Adviser, Lead Arranger and Lead Manager for the Sukuk Programme.

The Principal Terms and Conditions of the Sukuk Programme is available on Affin Islamic’s website at www.affinislamic.com.my.

This announcement is dated 18 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-12-2018 06:54 AM

|

显示全部楼层

发表于 30-12-2018 06:54 AM

|

显示全部楼层

本帖最后由 icy97 于 7-1-2019 12:53 AM 编辑

派息5仙-艾芬银行q3净利翻2.6倍

http://www.enanyang.my/news/20181129/派息5仙-艾芬银行q3净利翻2-6倍/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 496,249 | 327,954 | 1,467,044 | 1,025,752 | | 2 | Profit/(loss) before tax | 187,319 | 55,427 | 487,969 | 327,215 | | 3 | Profit/(loss) for the period | 150,518 | 39,902 | 375,506 | 248,319 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 144,563 | 39,902 | 359,336 | 248,319 | | 5 | Basic earnings/(loss) per share (Subunit) | 7.44 | 2.36 | 18.49 | 14.70 | | 6 | Proposed/Declared dividend per share (Subunit) | 5.00 | 2.34 | 5.00 | 2.34 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.4000 | 4.2600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2019 02:36 AM

|

显示全部楼层

发表于 13-1-2019 02:36 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

OTHER ISSUE OF SECURITIES | Description | AFFIN BANK BERHAD ("ABB")DIVIDEND REINVESTMENT PLAN THAT GIVES THE SHAREHOLDERS OF ABB THE OPTION TO REINVEST THEIR CASH DIVIDENDS DECLARED BY ABB IN NEW ORDINARY SHARES IN ABB ("DRP") | The terms used herein shall have the same meaning as those defined in the announcement dated 28 November 2018, unless otherwise stated.

We refer to the announcements dated 28 November 2018, 30 November 2018 and 7 December 2018 in relation to the 1st DRP.

On behalf of the Board, Affin Hwang IB wishes to announce that the issue price of the new ABB Shares to be issued pursuant to the 1st DRP has been fixed today (“Price-Fixing Date”) at RM2.09 per new ABB Share. The issued price is based on the 5-day volume weighted average market price (“VWAP”) of RM2.37 per ABB Share up to and including 7 December 2018, being the latest trading day prior to the Price-Fixing Date for the issue price of new ABB Shares after adjusting the following:

(i) a dividend adjustment of RM0.05 to the 5-day VWAP (“Ex-Dividend VWAP”); and

(ii) a discount of RM0.23 which is approximately 9.91% discount to the Ex-Dividend VWAP of RM2.32.

On behalf of the Board, Affin Hwang IB also wishes to announce that the books closure date for Interim Dividend and the 1st DRP has been fixed on 24 December 2018.

A copy of the DRP statement and the Notice of Election (including the Dividend Reinvestment Form) will be despatched to all the entitled shareholders of ABB (save for foreign-addressed shareholders of ABB) on 27 December 2018 and the election period for the 1st DRP will close on 10 January 2019.

Barring any unforeseen circumstances, the new ABB Shares arising from the 1st DRP will be listed on the Main Market of Bursa Malaysia Securities Berhad on 23 January 2019.

This announcement is dated 10 December 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2019 03:25 AM

|

显示全部楼层

发表于 13-1-2019 03:25 AM

|

显示全部楼层

EX-date | 20 Dec 2018 | Entitlement date | 24 Dec 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend (with Dividend Re-Investment Plan) | Entitlement description | Single-tier interim cash dividend in respect of the financial year ending 31 December 2018 of RM0.05 per ordinary share of ABB | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower AVertical Business Suite, Avenue 3, Bangsar SouthNo. 8 Jalan Kerinchi 59200 Kuala LumpurTel: 03 2783 9299Fax: 03 2783 9222 | Payment date | 22 Jan 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 24 Dec 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.05 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-1-2019 07:47 AM

|

显示全部楼层

发表于 18-1-2019 07:47 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 6-2-2019 05:12 AM

|

显示全部楼层

发表于 6-2-2019 05:12 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Others | Details of corporate proposal | Dividend reinvestment plan applicable to the interim cash dividend in respect of the financial year ended 31 December 2018 ("1st DRP") | No. of shares issued under this corporate proposal | 43,071,576 | Issue price per share ($$) | Malaysian Ringgit (MYR) 2.0900 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 1,986,020,123 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 4,774,771,836.000 | Listing Date | 23 Jan 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-2-2019 03:50 AM

|

显示全部楼层

发表于 9-2-2019 03:50 AM

|

显示全部楼层

Name | BOUSTEAD HOLDINGS BERHAD | Address | 28th Floor, Menara Boustead

69, Jalan Raja Chulan

Kuala Lumpur

50200 Wilayah Persekutuan

Malaysia. | Company No. | 3871-H | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 22 Jan 2019 | 9,617,524 | Others | Direct Interest | Name of registered holder | BOUSTEAD HOLDINGS BERHAD | Address of registered holder | 28TH FLOOR, MENARA BOUSTEAD, 69 JALAN RAJA CHULAN 50200 KUALA LUMPUR | Description of "Others" Type of Transaction | Dividend Reinvest |

Circumstances by reason of which change has occurred | Dividend Reinvestment Plan | Nature of interest | Direct Interest | Direct (units) | 411,630,053 | Direct (%) |

| | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Total no of securities after change | 411,630,053 | Date of notice | 22 Jan 2019 | Date notice received by Listed Issuer | 23 Jan 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-2-2019 03:51 AM

|

显示全部楼层

发表于 9-2-2019 03:51 AM

|

显示全部楼层

Name | THE BANK OF EAST ASIA LIMITED | Address | 10 Des Voeux Road Central

NA

NA NA

Hong Kong. | Company No. | 255 | Nationality/Country of incorporation | Hong Kong | Descriptions (Class) | Ordinary shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 22 Jan 2019 | 10,931,638 | Others | Direct Interest | Name of registered holder | THE BANK OF EAST ASIA LIMITED | Address of registered holder | MAYBANK NOMINEES (ASING) SDN BHD 8TH FLOOR MENARA MAYBANK 100, JALAN TUN PERAK 50050 KUALA LUMPUR | Description of "Others" Type of Transaction | Dividend Reinvest |

Circumstances by reason of which change has occurred | Dividend Reinvestment Plan | Nature of interest | Direct Interest | Direct (units) | 467,874,131 | Direct (%) |

| | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Total no of securities after change | 467,874,131 | Date of notice | 23 Jan 2019 | Date notice received by Listed Issuer | 23 Jan 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-2-2019 07:59 AM

|

显示全部楼层

发表于 9-2-2019 07:59 AM

|

显示全部楼层

Name | LEMBAGA TABUNG ANGKATAN TENTERA | Address | TINGKAT 10-12, BANGUNAN LTAT, JALAN BUKIT BINTANG

KUALA LUMPUR

55100 Wilayah Persekutuan

Malaysia. | Company No. | ACT101 1973 | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 22 Jan 2019 | 16,475,914 | Others | Direct Interest | Name of registered holder | LEMBAGA TABUNG ANGKATAN TENTERA | Address of registered holder | TINGKAT 10-12, BANGUNAN LTAT, JALAN BUKIT BINTANG, 55100 KUALA LUMPUR | Description of "Others" Type of Transaction | DIVIDEND REINVEST |

Circumstances by reason of which change has occurred | Dividend Reinvestment Plan | Nature of interest | Direct Interest | Direct (units) | 705,169,155 | Direct (%) |

| | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Total no of securities after change | 705,169,155 | Date of notice | 29 Jan 2019 | Date notice received by Listed Issuer | 29 Jan 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-3-2019 07:29 AM

|

显示全部楼层

发表于 12-3-2019 07:29 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 453,558 | 534,703 | 1,920,602 | 1,560,455 | | 2 | Profit/(loss) before tax | 187,027 | 223,484 | 674,996 | 550,699 | | 3 | Profit/(loss) for the period | 151,914 | 176,119 | 527,420 | 424,438 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 143,750 | 169,536 | 503,086 | 417,855 | | 5 | Basic earnings/(loss) per share (Subunit) | 7.40 | 8.92 | 25.89 | 23.98 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 5.00 | 2.34 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.4600 | 4.2600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-7-2019 06:32 AM

|

显示全部楼层

发表于 6-7-2019 06:32 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 472,516 | 476,617 | 472,516 | 476,617 | | 2 | Profit/(loss) before tax | 184,976 | 186,750 | 184,976 | 186,750 | | 3 | Profit/(loss) for the period | 143,745 | 145,987 | 143,745 | 145,987 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 137,231 | 141,467 | 137,231 | 141,467 | | 5 | Basic earnings/(loss) per share (Subunit) | 6.90 | 7.30 | 6.90 | 7.30 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.5800 | 4.4600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-7-2019 08:51 AM

|

显示全部楼层

发表于 17-7-2019 08:51 AM

|

显示全部楼层

Date of change | 01 Jul 2019 | Name | GEN. (R) DATO' SERI DIRAJA TAN SRI (DR.) MOHD ZAHIDI BIN HAJI ZAINUDDIN | Age | 71 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Non Independent and Non Executive | Type of change | Resignation | Reason | Relinquish his position as Chairman and Board Member of Affin Bank Berhad (ABB). He is currently the Chairman of Lembaga Tabung Angkatan Tentera (LTAT), a major shareholder of ABB. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2019 08:27 AM

|

显示全部楼层

发表于 28-8-2019 08:27 AM

|

显示全部楼层

本帖最后由 icy97 于 29-8-2019 04:17 AM 编辑

信贷回拨推高净利倍增‧艾芬银行次季赚1.56亿

https://www.sinchew.com.my/content/content_2107316.html

(吉隆坡27日讯)信贷回拨,推高艾芬银行(AFFIN,5185,主板金融服务组)净利,截至2019年6月30日止第二季,该公司净利翻倍走高1.13倍至1亿5603万1000令吉,首半年净利增36.55%至2亿9326万2000令吉。

第二季营业额报4亿9792万7000令吉,微增0.76%,首半年则跌10.34%至9亿7044万3000令吉,归咎前期业绩拖累。

公司首席执行员卡玛鲁透过文告表示,首半年业绩走强,归功策略奏效及转型成功,包括多元化产品及数码化业务。该公司除了一站式金融服务外,亦会竞争激烈的银行与金融业寻找机会。

展望未来,卡玛鲁表示,今年下半年银行业贷款预期成长放缓,资本市场亦疲软。全球与国内状况亦面对波动及不确定。基于经济放缓及特定成长资产将成为银行关注所在。

截至今年上半年,公司总资产按年增0.4%至763亿令吉,总贷款期按起3.3%至592亿令吉,每股净资产报4令吉70仙,对比2018年,每股净资产为4令吉50仙。

该公司一级缴足资本(CET1)为7%、一级资本比率为8.5%、总资本比率为10.5%,此前,三者分别为6.375%、7.875%及9.875%。

该公司也在提升营运效率,特别是客户数码化体验,且今年下半年将会推出更多数码产品包括AFFIN Pay电子钱包,零售客户方面,新的网络银行亦在筹备中。企业客户方面,新的交易系统亦能提升客户体验。中小企业方面亦在进行中,该公司亦会与著名的金融科技和合作。

艾芬银行亦会最大化协同效应,并制定更多策略以驱动成长。2019年的重点仍是零售及商业银行业务,特别是中小企业。

文章来源 : 星洲日报 2019-08-28

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 497,927 | 494,178 | 970,443 | 970,795 | | 2 | Profit/(loss) before tax | 215,040 | 113,900 | 400,016 | 300,650 | | 3 | Profit/(loss) for the period | 163,078 | 79,001 | 306,823 | 224,988 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 156,031 | 73,306 | 293,262 | 214,773 | | 5 | Basic earnings/(loss) per share (Subunit) | 7.90 | 3.80 | 14.80 | 11.10 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.6500 | 4.4600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-9-2019 07:14 AM

|

显示全部楼层

发表于 6-9-2019 07:14 AM

|

显示全部楼层

本帖最后由 icy97 于 6-9-2019 07:31 AM 编辑

传艾芬安盛欲售大马保险业务·交易值料达27.3亿

https://www.sinchew.com.my/content/content_2111655.html

(吉隆坡5日讯)艾芬银行(AFFIN,5185,主板金融服务组)和法国的安盛保险(AXA)传出有意脱售两家公司在大马的联营保险业务,交易值可高达6亿5000万美元(约27亿3000万令吉)。

根据消息人士指出,艾芬银行和安盛保险为大马保险业务寻求包括脱售在内的选择,并且为潜在交易委任了顾问。

这位不愿意具名的消息人士说,两家公司有意以5亿美元(约21亿令吉)脱售安盛艾芬普险公司,并且寻求以1亿5000万美元(约6亿3000万令吉)脱售安盛艾芬人寿保险公司。

不过消息人士也透露,一切探讨还在初步阶段,两家公司最终也可能决定保留他们在大马保险公司的股权。

安盛在安盛艾芬普险公司持有49.99%股权,而艾芬银行持有另外的49.95%股权;至于盛艾芬人寿保险公司,艾芬银行持有51%股权,安盛持有另外的49%股权。

根据《彭博社》报道,安盛代表对脱售消息不欲置评,而艾芬银行的代表尚未回复询问。

在大马政府决定开始严格实行外资保险公司必须减持在大马业务持股权后,艾芬银行可以和安盛联合持有大马普险公司,其他外资保险公司,诸如保诚保险和苏黎世保险集团,都在寻求减持在大马保险业务的持股。

安盛艾芬普险公司是大马最主要的医药保险公司,全国共有5000位代理,2018年,该公司人总保单14亿4000万令吉,净收入1亿令吉。

安盛艾芬人寿保险公司成立于2006年,去年保单为4亿6340万令吉,较2017年的4亿9000万令吉略减,不过净亏损从前年的1770万令吉收窄至810万令吉。

文章来源 : 星洲日报 2019-09-05 |

|

|

|

|

|

|

|

|

|

|

|

发表于 15-1-2020 03:14 AM

|

显示全部楼层

发表于 15-1-2020 03:14 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 15-1-2020 03:14 AM

|

显示全部楼层

发表于 15-1-2020 03:14 AM

|

显示全部楼层

Date of change | 08 Nov 2019 | Name | DATO' MD AGIL BIN MOHD NATT (DATO' AGIL NATT) | Age | 68 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Independent and Non Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Masters | Masters of Science (Finance) | Cass Business School, City, University of London | | | 2 | Degree | Bachelor of Science in Economics (Hons) | Brunel University, London | | | 3 | Others | Advanced Management Program | Harvard Business School, United States | |

Working experience and occupation | Dato' Agil Natt possesses in-depth banking knowledge and strong leadership capability. He has vast experience in the areas of Corporate Banking, Investment Banking as well as Islamic Finance. He started his career in Corporate Finance with Bumiputra Merchant Bankers Berhad in 1977 prior to serving as Senior General Manager with Island & Peninsular Berhad. He was also the Regional Chief Representative of Kleinwort Benson Limited before joining the Maybank Group in 1995. He had served as Senior General Manager of Corporate Banking, Managing Director/Chief Executive Officer of Aseambankers Berhad (now known as Maybank Investment Bank Berhad), and Deputy President/Executive Director of Maybank. He left the Maybank Group to assume the position of President and Chief Executive Officer of The International Centre for Education in Islamic Finance (INCEIF), The Global University of Islamic Finance established by Bank Negara Malaysia. He currently serves as Chairman of Credit Guarantee Corporation Malaysia Berhad, Manulife Insurance Berhad and Manulife Asset Management Services Berhad. He also sits on the Board of Cagamas Berhad and Sogo (KL) Department Store Sdn Bhd. Besides these appointments, he is a Member of the Investment Panel of the Employees Provident Fund Board (EPF). | Directorships in public companies and listed issuers (if any) | 1. Credit Guarantee Corporation Malaysia Berhad2. Cagamas Berhad 3. Manulife Insurance Berhad 4. Manulife Asset Management Services Berhad |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|