|

|

发表于 22-11-2017 05:10 AM

|

显示全部楼层

发表于 22-11-2017 05:10 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 24-11-2017 05:18 AM

|

显示全部楼层

发表于 24-11-2017 05:18 AM

|

显示全部楼层

齐力

盈利看涨至明年

2017年11月23日

分析:肯纳格投行

目标价:5令吉

最新进展

齐力(PMETAL,8869,主板工业产品股)截至9月30日第三季,净赚1亿5438万3000令吉或每股4.14仙,年增25.47%,并宣布派息每股1.5仙。 营业额年增22.39%至21亿2861万2000令吉。

累计首九个月,净利年增24.45%至4亿5260万令吉;营业额报60亿1945万5000令吉,年增30.13%。

行家建议

由于调整护盘加上碳原料价格逐步上涨,齐力首九个月核心净利4亿4200万令吉,稍微弱于预期。

无论如何,营运前景维持正面,因管理层继续增加成本节约和赚幅扩展计划,例如升级钢坯和输送带,预计2018财年带来贡献,以及通过新厂房和合约取得原材料供应,这将能加强2019财年净利。

价格方面,若铝价持续维持在每公吨2000美元以上,加上2018财年的总销售量约有50-60%已经锁定,我们预测,齐力的盈利动力至少会延续到明年上半年。

同时,我们观察到,市场正在押注齐力可能会纳入富时隆综指,这也支撑了股价,自9月杪以来高涨了38%,来到5.20令吉高位。

有鉴于此,我们将未来本益比预测上调至19倍,并将目标价从4.05令吉提高至5令吉。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-12-2017 05:30 AM

|

显示全部楼层

发表于 14-12-2017 05:30 AM

|

显示全部楼层

| PRESS METAL ALUMINIUM HOLDINGS BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Exercise of Warrants | Details of corporate proposal | Conversion of Warrants C 2011-2019 to ordinary shares | No. of shares issued under this corporate proposal | 50,111,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.3900 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 3,818,394,051 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 976,451,620.740 | Listing Date | 06 Dec 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-12-2017 03:52 AM

|

显示全部楼层

发表于 15-12-2017 03:52 AM

|

显示全部楼层

Name | ALPHA MILESTONE SDN BHD | Address | Suite 61 & 62, Setia Avenue

No. 2, Jalan Setia Prima S U13/S

Setia Alam Seksyen U13

Shah Alam

40170 Selangor

Malaysia. | Company No. | 916040-K | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary share |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 04 Dec 2017 | 50,000,000 | Others | Direct Interest | Name of registered holder | Alpha Milestone Sdn Bhd | Address of registered holder | Suite 61 & 62, Setia Avenue No. 2, Jalan Setia Prima S U13/S Setia Alam Seksyen U13 40170 Shah Alam Selangor Darul Ehsan | Description of "Others" Type of Transaction | Exercise of Warrants |

Circumstances by reason of which change has occurred | Exercise of Warrants | Nature of interest | Direct Interest | Direct (units) | 868,812,115 | Direct (%) | 22.75 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 868,812,115 | Date of notice | 06 Dec 2017 | Date notice received by Listed Issuer | 06 Dec 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-12-2017 03:01 PM

|

显示全部楼层

发表于 31-12-2017 03:01 PM

|

显示全部楼层

2017大涨了239%(+rm 3.80) 报Rm 5.39。。。市值从58.8亿大涨到206.59亿。!! |

|

|

|

|

|

|

|

|

|

|

|

发表于 2-2-2018 03:10 AM

|

显示全部楼层

发表于 2-2-2018 03:10 AM

|

显示全部楼层

齐力冀多产增值铝品

比例提高至50%

2018年2月1日

(吉隆坡1日讯)齐力(PMETAL,8869,主板工业产品股)将在2018年底,把整体增值铝产品占总产量比重提高至50%。

根据《星报》报道指出,总执行长丹斯里管保强近期出席2018年国际能源周的“砂拉越走廊再生能源论坛”时指出,目前增值产品占总产量比重介于30%至35%之间。

该公司主要产品是供于国内和出口市场的高质铝锭。

他说,目前三大主要增值产品是用于汽车领域的铝合金车轮锭、挤压行业的铝坯,还有输电业的铝丝。

铝坯铝丝产能翻倍

“我们的目标是进一步走向下游业,制造更多增值产品,因为这是一项可永续发展的业务。”

齐力冶炼产能达76万吨,为东南亚最大综合炼铝厂。近期完成新生产线之后,铝坯和铝丝每年产能分别扩大一倍,达24万吨和4万8000吨。

该公司也在雪兰莪和中国广州持有挤压厂,每年产能分别达4万吨和12万吨。

管保强指出:“齐力欢迎投资者进军下游铝业,我们将会供应高温金属这原料给他们。”

他指出,由于铝材具备优点,如重量比铜轻,所以使用率在增加。

他说,齐力是苹果的铝材供应商,用于生产iPads,也有制造商使用铝窗打造太阳能电池板。同时,铝材也用于高铁。

要数字化加强效率

管保强指出,已在厂房营运系统推出更多人工智能及机器人技术,以加强效率和安全。

“我们走向移动网络,进行离站监视和控制。”

他说,齐力目前正与科技供应商接洽进行数字化,以搜集数据提升效率和改善安全。

询及齐力是否会在沙马拉祖(Samalaju)工业园投资第三间炼铝厂,管保强指出,公司必须等待砂拉越能源公司增加电力供应。

目前,砂拉越能源在Baleh兴建着第二项大型水电站坝,发电量达1285兆瓦,将在2025年开始投入营运。【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 1-3-2018 05:12 AM

|

显示全部楼层

发表于 1-3-2018 05:12 AM

|

显示全部楼层

本帖最后由 icy97 于 5-3-2018 12:29 AM 编辑

派息1.5仙

齐力末季净利扬14%

2018年2月28日

(吉隆坡27日讯)由于金属价格走高,齐力(PMETAL,8869,主板工业产品股)截至去年12月杪2017财年末季,净利按年上扬14%,同时宣布派息每股1.5仙。

齐力今天向交易所报备,净利从2016财年末季的1亿3177万9000令吉或每股3.57仙,提高至1亿5018万9000令吉或每股3.98仙。

营业额也从前年同期的19亿9975万5000令吉,年增7.2%至21亿4417万3000令吉。

累计全年,净利录得6亿278万9000令吉或每股16.13仙,年升24.7%;营业额报81万7036万4000令吉,年涨22.9%。

齐力也宣布派发每股1.5仙的,除权日在3月13日,派息日于4月3日。

9600万购铝产品产销公司

另一方面,齐力旗下持有80%股权的子公司齐力民都鲁(Press Metal Bintulu)私人有限公司,在今天与HNG资本私人有限公司达成股权收购协议。

据该协议,齐力民都鲁向HNG资本收购本地铝产品产销公司Leader Universal Aluminium私人有限公司2700万股全数股权,总值9600万令吉。

齐力相信,这项收购能够让该公司扩大铝产品制造规模,同时有望带来协同效应,为旗下产品增值。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,144,173 | 1,999,755 | 8,170,364 | 6,649,451 | | 2 | Profit/(loss) before tax | 200,697 | 200,469 | 819,531 | 674,832 | | 3 | Profit/(loss) for the period | 188,674 | 173,997 | 755,408 | 605,770 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 150,189 | 131,779 | 602,789 | 483,572 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.98 | 3.57 | 16.13 | 13.22 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.50 | 1.50 | 6.00 | 8.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5900 | 0.6000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-3-2018 12:33 AM

|

显示全部楼层

发表于 5-3-2018 12:33 AM

|

显示全部楼层

EX-date | 13 Mar 2018 | Entitlement date | 15 Mar 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Fourth interim single tier dividend of 1.5 sen per share for the financial year ended 31 December 2017 | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200 Kuala LumpurTel: 03 27839299Fax: 03 27839222 | Payment date | 03 Apr 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 15 Mar 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.015 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-3-2018 12:34 AM

|

显示全部楼层

发表于 5-3-2018 12:34 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | PRESS METAL ALUMINIUM HOLDINGS BERHAD ("PMAH" OR "THE COMPANY")- PROPOSED ACQUISITION OF 27,000,000 ORDINARY SHARES, CONSTITUTING 100% OF THE ISSUED AND PAID-UP SHARE CAPITAL OF LEADER UNIVERSAL ALUMINIUM SDN. BHD. (COMPANY NO.: 36093-H) BY PRESS METAL BINTULU SDN BHD, A 80%-OWNED SUBSIDIARY OF THE COMPANY | The Board of Directors of PMAH is pleased to announce that Press Metal Bintulu Sdn Bhd (“PMBintulu” or “the Purchaser”), a 80%-owned subsidiary of the Company, has on 27 February 2018 entered into a Share Purchase Agreement (“SPA”) with HNG Capital Sdn. Bhd. (Company No.: 961828-H) (“HNG”), for the acquisition of 27,000,000 ordinary shares, constituting 100% of the issued and paid-up share capital of Leader Universal Aluminium Sdn. Bhd. (Company No.: 36093-H) (‘LUA’) for a total cash purchase consideration of Ringgit Malaysia Ninety Six Million (RM96,000,000.00) only (‘Purchase Consideration’), subject to the terms and conditions as stipulated in the SPA (the “Proposed Acquisition”).

Please refer to the attachment for further details on the Proposed Acquisition.

This announcement is dated 27 February 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5705541

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-3-2018 12:35 AM

|

显示全部楼层

发表于 5-3-2018 12:35 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Press Metal Aluminium Holdings Berhad - Media Release for Quarterly Results for the Financial Quarter Ended 31 December 2017 | |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-3-2018 06:34 AM

|

显示全部楼层

发表于 9-3-2018 06:34 AM

|

显示全部楼层

本帖最后由 icy97 于 13-3-2018 01:45 AM 编辑

齐力:美征税影响轻微

(吉隆坡5日讯)美国总统特朗普扣下贸易战第一枪,对铝钢业课重税,齐力工业(PMETAL,8869,主板工业产品组)连续第二天遭卖压袭击,促使该公司特别发出文告强调,对美国市场曝险极低。

盘后该公司发文告澄清,该公司出口至美国市场的原铝矿材料非常少,占总营业额不到1%。

“加拿大、俄罗斯和中东是出口铝制品至美国最多的地区,占了该国进口铝制品80至90%以上。”

文章来源:

星洲日报/财经‧2018.03.06

Type | Announcement | Subject | OTHERS | Description | Press Metal Aluminium Holdings Berhad - Press Release: Press Metal Unperturbed by U.S. Tariff | |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-4-2018 05:18 AM

|

显示全部楼层

发表于 2-4-2018 05:18 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | PRESS METAL ALUMINIUM HOLDINGS BERHAD ("PMAH" OR "THE COMPANY")- PROPOSED ACQUISITION OF 27,000,000 ORDINARY SHARES, CONSTITUTING 100% OF THE ISSUED AND PAID-UP SHARE CAPITAL OF LEADER UNIVERSAL ALUMINIUM SDN. BHD. (COMPANY NO.: 36093-H) BY PRESS METAL BINTULU SDN BHD, A 80%-OWNED SUBSIDIARY OF THE COMPANY | Unless otherwise stated, all abbreviations and definitions used herein shall have the same meanings as defined in the Company’s announcement dated 27 February 2018 except where the context otherwise defined herein.)

Further to the announcement made on 27 February 2018, the Board of Directors of the Company wishes to announce that the Company’s 80%-owned subsidiary, PMBintulu, has on 30 March 2018 completed the acquisition of 27,000,000 ordinary shares, constituting 100% of the issued and paid up share capital of LUA for a total cash purchase consideration of RM96,000,000-00 only, without any adjustments. The existing banks and key management staff of LUA have stayed on with LUA and LUA continues to operate its business as a going concern.

This announcement is dated 30 March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-4-2018 03:33 AM

|

显示全部楼层

发表于 15-4-2018 03:33 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-4-2018 04:39 AM

|

显示全部楼层

发表于 22-4-2018 04:39 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 7-5-2018 01:46 AM

|

显示全部楼层

发表于 7-5-2018 01:46 AM

|

显示全部楼层

铝价创8年最大跌幅 齐力迎好景股价遇冷

財经 最后更新 2018年04月24日 19时42分

(吉隆坡24日讯)美国考虑有条件地减轻俄铝(Rusal)制裁力度,铝价创8年来最大单日跌幅,制铝主要原料矾土(alumina)价格有望下降,扭转了本地铝业公司之前不受看好的前景。

一些分析员相信,齐力工业(PMETAL,8869)短期內可因此受惠。不过,市场今日却未对此消息感到正面,齐力工业週二一度重挫44仙或8.63%。

该股闭市下挫31仙或6.08%,以4.79令吉掛收,是全场第6大下跌股,全天成交量为1834万股。其凭单--齐力工业WC也以全天最低收市,报4.28令吉,跌幅高达53仙或11.03%,是下跌榜第3名。

美国对制裁俄铝態度软化,美国財政部开出条件,如果俄铝的大股东愿意撤资及放弃集团控制权,美国或將减轻对俄铝的制裁,同时美国財政部將美国公司与俄铝解除交易的最后期限延长5个月。

消息公布后,伦敦金属交易所3个月期铝曾下挫逾9%,收市则跌7%,报每吨2295美元,是2010年4月以来最大单日跌幅。去年全球铝產量中,有超过6%由俄铝生產,上周期铝急升,主要因为市场担心美国制裁俄铝后,全球市场可能面临铝材短缺。

美国暗示放宽制裁俄铝

大华继显分析员指出,美国暗示有意降低对俄铝的制裁力度,令铝价从近期每公吨2500美元以上的高位,下滑到週一(23日)的每公吨2300美元水平,而矾土作为主要炼铝原料,预料也会隨之走低。

「自美国4月初宣布制裁俄铝和其他德里帕斯卡相关公司后,铝价从年初至今低点,即每公吨1960美元,升至每公吨2500美元之上,而每吨矾土价格也自本月12日的480美元,起至20日的670美元。」

该分析员表示,炼製1吨的铝需要2吨的矾土,而矾土占了齐力工业大约35%的货物销售成本。

分析员指出,齐力工业已確保了2018年所需的绝大部份矾土,价格以特定方程式,套用伦敦金属交易所(LME)现价计算,而且,该公司今年销售的部份铝金属並未被对冲。

他亦补充道,齐力工业增值铝產品的溢价在每公吨300美元之上,远超大华继显原先预测的每公吨120美元。无论如何,该分析员坦言,铝和矾土价格在这期间大幅波动,目前难以预测对齐力工业盈利方面造成的实际衝击。

另一方面,分析员指出,占齐力工业销售成本18%的碳素阳极(carbon anode),近年来价格显著上涨,去年12月更起至7年新高的每公吨4500人民幣水平,不过,近期有所回落。

「碳素阳极並无远期合约,通常以现价交易,无论如何,据上海金属市场资料,各地的碳素阳极价格目前正徘徊在每公吨3500人民幣至4300人民幣区间。」

同时,分析员指出,齐力工业与中国索通公司(Sunstone)联营建设的预培碳素阳极工厂將在今年杪开始营运,虽说齐力工业仍需以市场现价,向索通购买碳素阳极,但部份盈利將回流至前者,而有关联营工厂亦將確保碳素阳极的稳定供应。

根据联营协议,齐力工业持有上述工厂的20%股权,並可在3年后增持至40%。保守起见,分析员维持齐力工业的盈利预测,並建议「守住」与5令吉的目標价。【东方网财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 19-5-2018 02:43 AM

|

显示全部楼层

发表于 19-5-2018 02:43 AM

|

显示全部楼层

本帖最后由 icy97 于 20-5-2018 06:20 AM 编辑

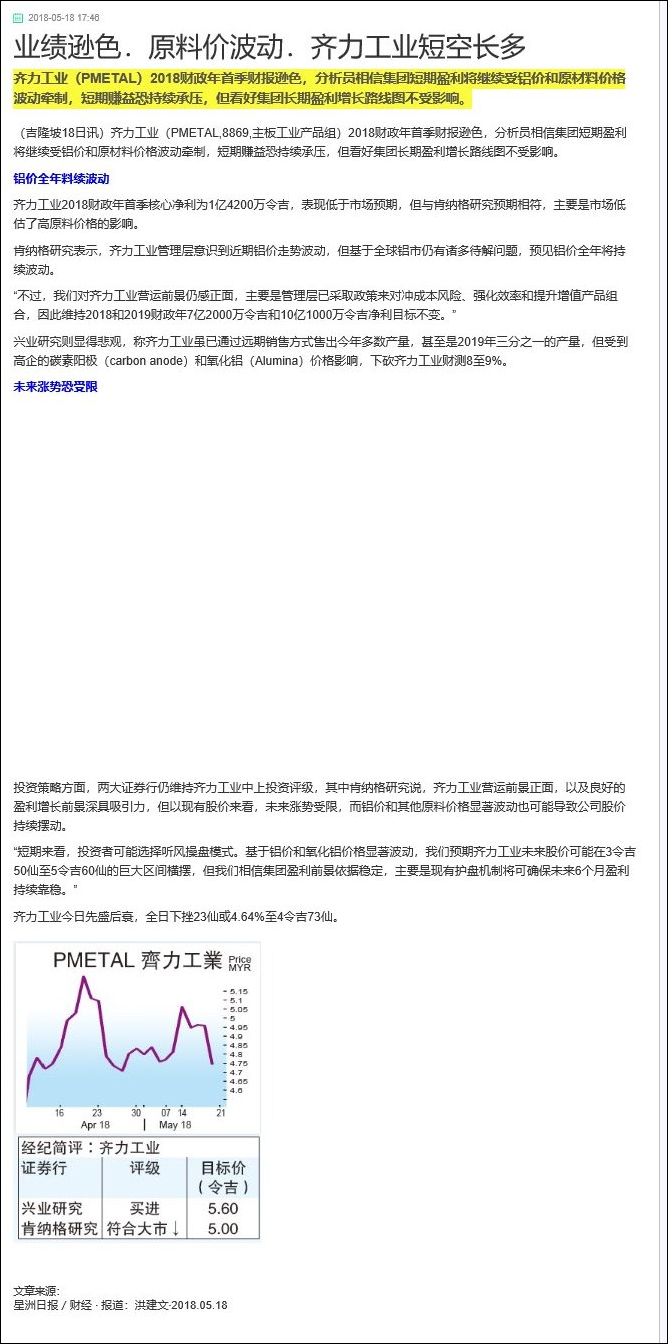

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,125,436 | 1,934,224 | 2,125,436 | 1,934,224 | | 2 | Profit/(loss) before tax | 210,239 | 199,330 | 210,239 | 199,330 | | 3 | Profit/(loss) for the period | 192,564 | 185,162 | 192,564 | 185,162 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 150,477 | 148,049 | 150,477 | 148,049 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.90 | 3.99 | 3.90 | 3.99 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.50 | 1.50 | 1.50 | 1.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7900 | 0.6100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-5-2018 03:25 AM

|

显示全部楼层

发表于 19-5-2018 03:25 AM

|

显示全部楼层

EX-date | 01 Jun 2018 | Entitlement date | 05 Jun 2018 | Entitlement time | 05:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First interim single tier dividend of 1.5 sen per share for the financial year ending 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200 Kuala LumpurTel:03 27839299Fax:03 27839222 | Payment date | 19 Jun 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 05 Jun 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.015 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-5-2018 03:37 AM

|

显示全部楼层

发表于 19-5-2018 03:37 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Press Metal Aluminium Holdings Berhad - Media Release for Quarterly Results for the Financial Quarter Ended 31 March 2018 | |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-5-2018 03:47 AM

|

显示全部楼层

发表于 21-5-2018 03:47 AM

|

显示全部楼层

本帖最后由 icy97 于 21-5-2018 07:37 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2018 03:31 AM

|

显示全部楼层

发表于 22-6-2018 03:31 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Press Metal Aluminium Holdings Berhad - Media Release: Press Metal Optimistic on further growth after record profits in 2017 | |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|