|

|

【RGB 0037 交流专区】RGB国际(DGATE 0037)

[复制链接]

[复制链接]

|

|

|

发表于 9-6-2016 12:38 PM

|

显示全部楼层

发表于 9-6-2016 12:38 PM

|

显示全部楼层

|

RGB International Bhd forms bullish "Price Crosses Moving Average" chart pattern

Jun 08, 2016

Recognia has detected a "Price Crosses Moving Average" chart pattern formed on RGB International Bhd (0037:MYX).

This bullish signal indicates that the stock price may rise from the close of 0.17.

Tells Me: The price is generally in an established trend (bullish or bearish) for the time horizon represented by the moving average period (21, 50 or 200 bars). Moving averages are used to smooth out the volatility or "noise" in the price series, to make it easier to discover the underlying trend. By plotting the average price over the last several bars, the line is less "jerky" than plotting the actual prices. A bullish event is generated when the price crosses above the moving average, and in this state, the price is likely in an established uptrend. The opposite is true when the price crosses below the moving average, triggered a bearish event.

This bullish pattern can be seen on the following chart and was detected by Recognia proprietary pattern recognition technology.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-6-2016 12:39 PM

|

显示全部楼层

发表于 9-6-2016 12:39 PM

|

显示全部楼层

推高了jhm現在要來rgb?

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-6-2016 12:14 AM

|

显示全部楼层

发表于 17-6-2016 12:14 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 4-7-2016 12:35 AM

|

显示全部楼层

发表于 4-7-2016 12:35 AM

|

显示全部楼层

RGB国际

资产负债表强劲

http://www.sinchew.com.my/node/1543286/

RGB国际是一家以东盟为核心市场的角子机(俗称老虎机)供应和经营商,我们曾在去年12月的《股海捞月》中谈到这家公司,入选组合主要因其业务稳定成长,且现金流非常强大,攻守亦可。

官网资料显示,RGB国际仍在努力壮大其东盟业务网中,近期进展包括获澳洲Aristocrat娱乐有限公颁发寮国和印度果阿邦经销权,以及在菲律宾和尼泊尔赢得新角子机经营权,加上在现有市场推出新游戏和产品,相信会对未来业绩带来正面影响。

另外,截至今年3月31日止首季业绩显示,RGB国际营业额按年成长44.83%至5609万令吉,净利则扬37.05%至593万令吉,相当于每股盈利0.45仙;年化计算,全年每股盈利可望有1.8仙,现有股价相当于9.16倍本益比。

在强大现金流加持下,RGB国际目前共握有5552万令吉净现金在手,相当于每股4.2仙,资产负债表非常强劲,我们望其强化整体组合的“稳中求胜”元素。

文章来源:

星洲日报‧投资致富‧股海捞月‧文:李三宇‧2016.07.03 |

|

|

|

|

|

|

|

|

|

|

|

发表于 26-8-2016 05:27 PM

|

显示全部楼层

发表于 26-8-2016 05:27 PM

|

显示全部楼层

本帖最后由 icy97 于 27-8-2016 01:16 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2016 | 30 Jun 2015 | 30 Jun 2016 | 30 Jun 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 57,997 | 49,880 | 114,087 | 88,609 | | 2 | Profit/(loss) before tax | 8,635 | 7,426 | 16,080 | 12,766 | | 3 | Profit/(loss) for the period | 7,095 | 6,643 | 13,149 | 11,012 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,979 | 6,559 | 12,909 | 10,886 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.53 | 0.53 | 0.98 | 0.90 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1300 | 0.1300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2016 11:53 PM

|

显示全部楼层

发表于 31-8-2016 11:53 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2016 11:57 PM

|

显示全部楼层

发表于 31-8-2016 11:57 PM

|

显示全部楼层

本帖最后由 icy97 于 1-9-2016 12:16 AM 编辑

RGB Berhad (0037) - An analysis on RGB Berhad. Subdued but a Possible Hidden Gem???

Author: Spencer88 | Publish date: Sun, 21 Aug 2016, 05:26 PM

http://klse.i3investor.com/blogs/spencer88/102583.jsp

RGB is an investment holding company with subsidiary companies (“RGB Group” or “the Group”) primarily involved in:

• Sales & marketing, and manufacturing of electronic gaming machines and equipment (“SSM”)

SSM primary involves in sales and marketing of internationally well-known electronic gaming machines, amusement Machines, and casino equipment and accessories in Asia.

RGB is also the leading distributor of these well-known gaming brands:

• Machine concession programs & technical support management (“TSM”).

TSM is a unique business model which focuses on concession and leasing of electronic gaming machines as well as providing operational management and support at targeted casinos and clubs.

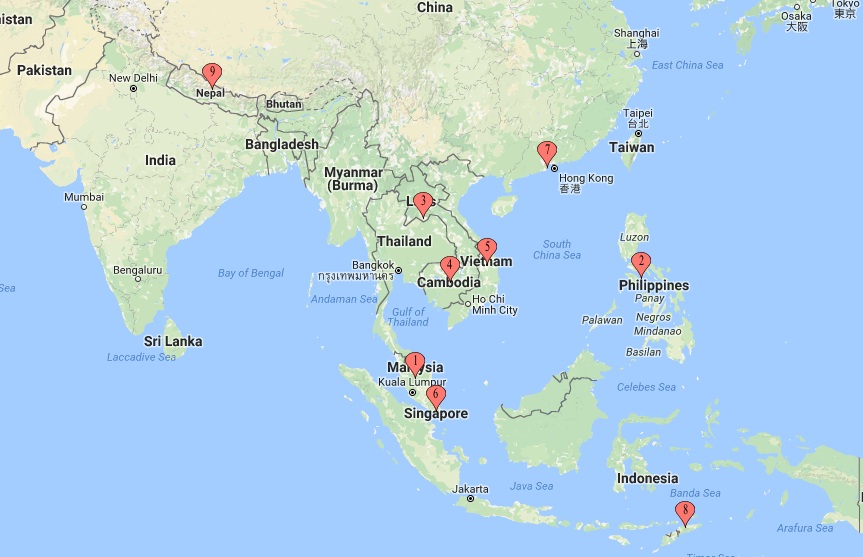

The history of RGB’s involvement in the gaming industry began way back in 1986 through its wholly owned subsidiary, RGB Sdn. Bhd. (“RGBSB”). Through RGBSB, RGB is acknowledged as a leading supplier of electronic gaming machines and casino equipment in Asia region. Today, the Group is also a major machine concession programs provider in Asia. RGB has marked its presence in Malaysia (1) and also operates in Cambodia (4), Lao PDR (3), Vietnam (5), Singapore (6), the Philippines (2), Macau (7), Timor-Leste (8) and Nepal (9).

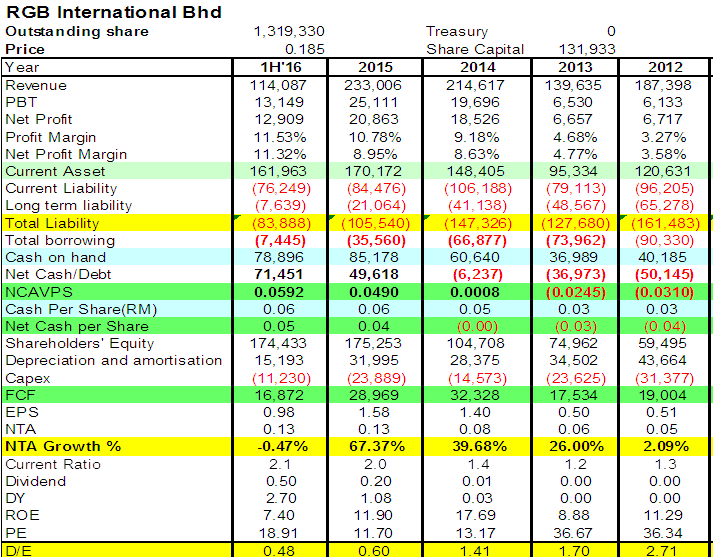

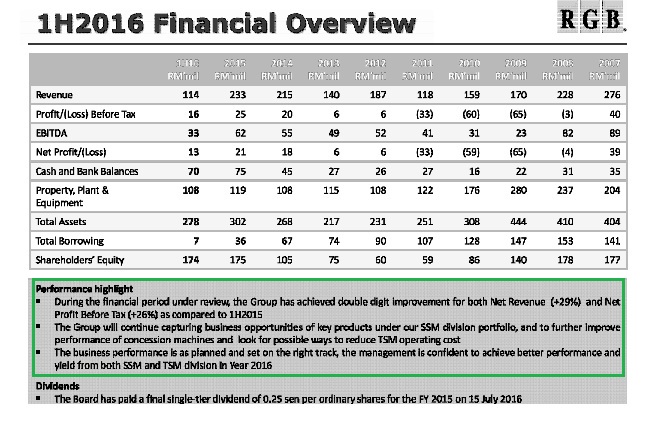

Financial overview

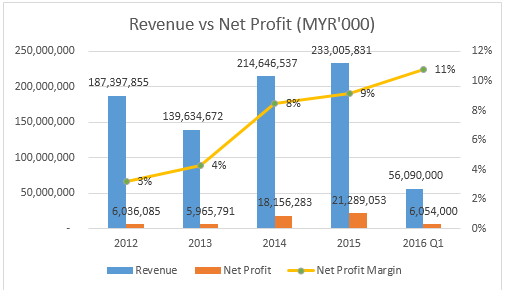

The group first recorded RM187 million of revenue in FY2012 before retreating to RM139 million in FY2013 and subsequently recovered to RM214 million in FY2014 and then rose to RM233 million in FY2015. What about its growth in net profit? Does it keep pace with revenue growth?

As you can see from the chart, the growth of net profit is on the same pace with the growth of revenue from RM6 million in FY2012 rose to RM21 million in FY2015. However, it is worth mentioning that its growth of net profit margin is showing an impressive CAGR of 30% each year over the past 5 years from 3% net profit margin in FY2012 to 11% net profit margin in FY2016 Q1.

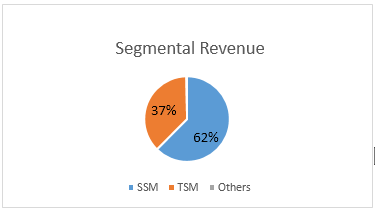

RGB overall revenues are mostly contributed by its SSM division (62%) and followed by TSM division (37%) and others (1%) belonged to the revenue from leasing of Chateau building, manufacturing activities, research & development activities and inter-segment transaction.

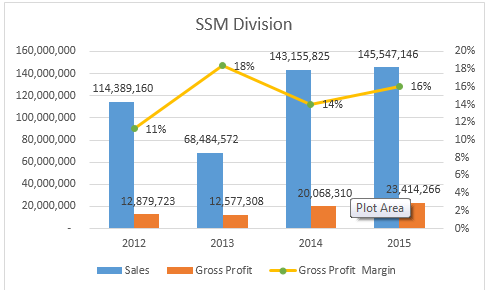

SSM division

SSM division is able to generate consistent revenue which is above RM140 million for the past 2 years since FY2014. The division first recorded RM114 million of revenue in FY2012 and dropped significantly in the subsequent year to RM68 million as there was a drop of sales in Cambodia, Vietnam and the Philippines according to the management.

However, the gross profit for FY2013 does not vary much with the gross profit of FY2012 despite the significant drop of revenue in FY2013. According to the management, they were able to maintain RM12 million of gross profit in FY2013 mainly because of the decrease in expenses and improvement in profit margin from products sold.

if you notice carefully, the gross profit margin of 18% for FY2013 was actually the highest gross profit margin ever archived among all the financial years in the chart.

The gross profit margin of SSM division had grown steadily over the years from 11% in FY2012 to 18% in FY2013 and then retracted to 14% in FY2014 and grew slightly higher to 16% in FY2015. Overall, I believe the SSM division is able to perform well in the future as long as the group is able to sell more gaming machines and the Group Managing Director Datuk Chuah had mentioned that the group was targeting to sell more machines than FY2015’s 1,300 units, which generated RM145 million in revenue during an interview with The Star Online.

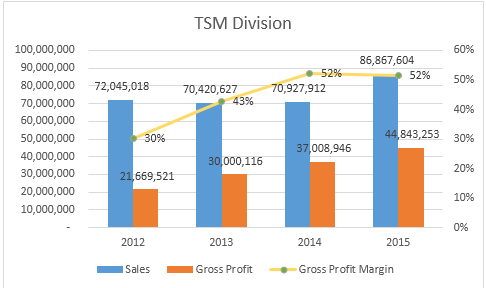

TSM Division

Out of all the component in the chart of TSM Division, the growth of gross profit margin was what really caught my eye. As you can see from the chart, the revenue of the TSM division had remained flat at RM70 million since FY2012 to FY2014 and then rose to RM86 million in FY2015. However, the gross profit margin is showing a significant improvement from 30% in FY2012 to 52% in FY2015. From the significant improvement of gross profit margin, we can see that the management really did a great job in keeping their direct cost as low as possible for TTM division. Hence, it leads to the increased of gross profit from RM21 million in FY2012 to RM44 million in FY2015 despite the flat revenues over the years. TSM division should be the crown jewel of RGB and the division RGB should really focus on as I believe TSM division is now on the peak of the learning curve where they are able to produce highest output with the lowest input as possible and thus results in higher gross profit. Other than that, TSM division also made nearly double of SSM division’s gross profit over the years.

Currently, RGB’s business is only serving the Asia Pacific region, so they might have plenty of room for growth if they manage to venture out of the Asia Pacific region and this is exactly what they are going to do as they have already mentioned it in 2015 annual report saying that “The Group aims to expand its markets by growing geographically as well as through strategic partnership and acquisitions. The Group will continue to seek for new markets for its products and identify viable partners to grow our TSM business beyond our current boundary.”

The next question is will they fulfill their promise?

Well, here is the extraction from The Star Online Business News dated 1st August 2016. They seem to make it happen and fulfill their promise.

Electronic gaming machine and equipment maker RGB International Bhd is eyeing new businesses in Europe and South America, as the company seeks to expand its market reach. RGB derives 95% of its sales from the Asia-Pacific region. “We want to move away from our traditional markets to broaden the revenue base for the group,” said group managing director Datuk Chuah Kim Seah.

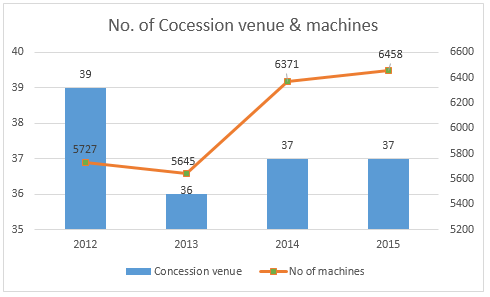

The number of concession venues of RGB seem to reach a stagnant stage staying at 37 concessions for 2 consecutive years, and thus they really need to broaden their revenue base in term of concession venues in order to create more values for the shareholders. Number of machines put into operation is keeping pace with the growth of concession venues and did not vary much for the past 2 years.

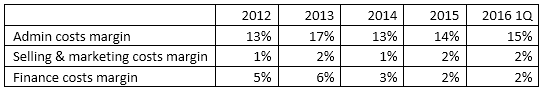

Other operating expenses

We will not discuss much about the other operating expenses as you can see from the table above, all the margin does not vary much over the years except for the finance cost margin. There is a gradual decrease in financing cost as the result of aggressive repayment of debt by the group, the group is expected to enhance its balance sheet, which already has a net cash position of RM55 million as at the first quarter of 2016.

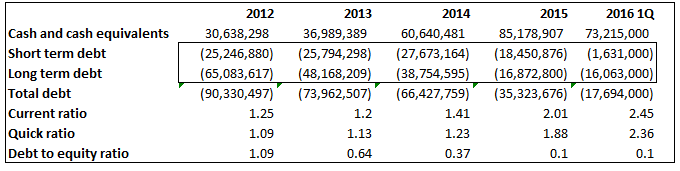

Balance sheet valuation

The group’s cash and cash equivalents currently are staying in a very healthy level at RM73 million as at FY2016 1Q while having only RM17 million of financial liabilities. Both the current ratio and quick ratio of the group has improved significantly and currently staying at 2.45 times and 2.36 times as at 2016 1Q and therefore they will have no problem in meeting their short term liabilities. The aggressive repayment of debt by the group has reduced the debt to equity ratio to just 10% in FY2016 1Q which is a healthy sign that RGB is in good financial health.

Discounted cash flow analysis (DCF)

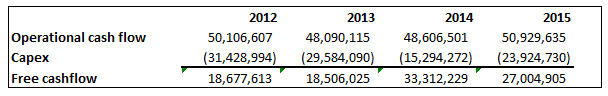

In this DCF analysis, we are going to use the average free cash flow (FCF) of the group for the last 4 years from FY2012 to FY2015 as the base for the calculation of the future FCF. In this case, the average free cash flow for the last 4 years would be RM25 million. By using the three-stage discounted cash flow analysis model, we assume that the FCF will grow at a 4% rate every year for the first 5 years, a 3% rate for the next 5 years, and a 2% rate for the final 5 years period and then a 1% rate for terminal growth rate.

Based on the DCF analysis I did, the present value of all future FCF of the group would be RM343 million after deducted its total debt and translated into RM0.25 per share. The RM0.25 per share would be the intrinsic value of RGB and represents a margin of safety of 26% based on RGB’s closing price of RM0.185 on 19 August 2016.

Bonus

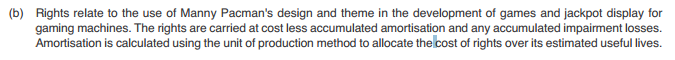

Based on my findings, it seems to me that the management is really putting effort to get their product sold. However, this is just my personal opinion so please correct me if I am wrong. I found out there is a “right” being included in the intangible assets of RGB and hence I try to find out what is that.

This is what I found:

FYI, Manny Pacman is the nick name of Manny Pacquiao, the Filipino world boxing champion. The charismatic “Pac-Man” was an idol and unifying force in the Philippines, where his unprecedented popularity led to commercial endorsements, movies, television shows, CDs, and his image on a postage stamp. Most of the RGB’s revenue is derive from Philippines and this is why RGB is willing to pay for the right to use Manny Pacman’s design and theme. Imagine if you are one of the casino operator in Philippines, which kind of gaming machine would you prefer to buy from RGB? Gaming machine with Manny Pacman design? Or gaming machine without Manny Pacman design? The management of RGB could have save up the cost of right by developing games and selling gaming machine without Manny Pacman’s design and theme. However, instead of saving up the cost, the management is trying to create long term value for shareholders, serving the Philippines customers with what they want and create a recurring income stream by selling them the right thing instead of cheap thing.

Conclusion

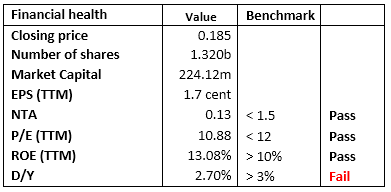

RGB seems to have plenty of room for growth if they manage to venture out of the Asia Pacific region. As renowned investor Warren Buffett put it, “Price is what you pay, value is what you get”. So you must ask yourself how much are you willing to pay for its future growth? The table below will help you make better decision.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-10-2016 01:03 PM

|

显示全部楼层

发表于 7-10-2016 01:03 PM

|

显示全部楼层

本帖最后由 icy97 于 7-10-2016 11:57 PM 编辑

[The No.2 cheapest stock in Bursa] RGB International Berhad

Author: GoldenEggs | Publish date: Wed, 5 Oct 2016, 02:08 PM

http://klse.i3investor.com/blogs/Goldeneggs/105780.jsp

RGB International Berhad 是一家制造,销售与维修 Gaming Machine 的公司,旗下有多家知名的赌博游戏机品牌(请看下图),业务主要位于东南亚,照片中是Datuk Chuah, 也就是 RGB 的 MD. 营业额的62%来自于销售而37%是维修服务那里取得。其他大家可以在年报里看到的资料我就不多说了。

主要还是专注于我的看法与分析。我注意到很多人分析,会去project 那个公司的 earnings, 我其实不明白为什么要 project,因为未来的东西是无法预测的,我们能照顾的只有风险,也就是在那些 2 块钱 卖 1 块的公司去买,然后如果公司赚更多钱,其他投资者就会发现公司的价值,慢慢发现这间公司值两块,再加上成长,那就更好了。而当盈利下跌的话,也能亏少一些,比如说 FAVCO 这家公司,上个季度公司的盈利跌了一半,照理来说股价肯定是崩盘的,可是股价是下滑了13.7%,而且在 Oil & Gas 的不景气之下,估计股价还是会被严重低估一阵子了。

现在是牛市的尾端,距离上次股灾已经是8年了,我提醒各位跟我一样的散户,记得买有价值的股票,不要去追那些 PE 很高的股,不然准备烧手。

RGB 在我看来,不是一块买两块的问题,目前的盈利和基本面可以说,接近三倍,也就是一块买三块,投资的话,风险极低 (注意:不是包赚,是亏的可能性低)。我知道很多血气方刚的人又要骂我分析烂啦什么的,那请你看完我的分析,比较一下你手上持有的股,心里就会有答案了。

以今天的股价计算,买完所有RGB 的股票是 224.32M, 而目前 RGB 的现金是 70.32M。自己除来看,我是不是吹水?31.3%的 CASH。。。债务是7.45M,所以是一家 NET CASH 公司,知道那些人又要骂了,冷静点,不要每次都要生气,自己看看你买的公司,比较一下再来发脾气。

公司近一年的Free Cash Flow 是51.57M , 就是公司在过去一年修理机器等等的开销后的现金,是你买下整间公司的22.9%,定存的四倍多。

那我们用 LOGIC 来想一下,买下整间公司以后,还完所有债务,再除以每年的现金流,3.13 年就回本了(盈利下跌,慢一点,上升,就缩短)。我知道很多人又要骂了,三年这样慢!,那我祝你好运,因为这已经是Bursa 第二便宜的股了,你要多的话,就是在做梦,准备烧手~

公司方面也是非常小心使用公司的现金,平均每放一块钱下去,就能每年赚回0.46仙左右~ 但是有一点是 RGB 的致命弱点,就是太多 CASH, 一定有人又要骂了, CASH 你都嫌多?

我要表达的是,公司有这么多钱,放着定存又无法为股东创造利益,倒不如把钱还给股东,留一部分应急就好。这么多的 CASH 又无法赚钱,其实董事局就是失职。这也是为什么,公司的股价可以那么的低,因为董事局无法为股东创造利益,放任股价随意漂泊。公司有两位董事领着一年 700千的薪水~(对这样一间比较小的上市公司,是蛮高的了)

我的看法是,公司要提高股价,第一要增加派息,毕竟钱多~ 第二,大量 share buy back, 因为公司股价已经是应有价值的 三份之一,公司 buy back 的话对公司的股东可以说是风险低,又能提高股价,以回馈股东。

这就是我没有买入这家公司的原因,风险很低,现金很多,但是在我看来,一家公司如果无法利用现金去赚更多的钱,又不把多余的钱派息,又不 buy back, 就是没有对股东的利益着想,也是算有些失职了。

我的分析主要在于我的看法,而不是从annual report 里 copy 一大堆 facts, 因为如果想知道这些 facts, 倒不如自己去看? |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-10-2016 01:03 PM

|

显示全部楼层

发表于 7-10-2016 01:03 PM

|

显示全部楼层

本帖最后由 icy97 于 7-10-2016 11:58 PM 编辑

RGB International (1) 一只当前买少见少的潜能股

Author: dudu | Publish date: Thu, 6 Oct 2016, 01:48 PM

http://klse.i3investor.com/blogs/都督征战股海/105849.jsp

第一篇就先写写有关RGB的债务和现金情况 :

RGB是一家近年来非常积极还债的公司。从2008年债务高峰期的1.5亿,减至目前的7百万。每年都积极还债的公司,其背后的意义是公司每年有大量的现金流入。更重要的是,还债的现金无法造假。反而是多年高现金的公司可造假,尤其是中国的银行提供假现金票据。公司除了还债,暂时没有更好的投资项目,或者说公司之前已经capex过多,短期已无需再投入大量capex,目前是还债,还完后等收成? 或再求发展?

其实,RGB是在2015年第一季度,第一次转变成净现金公司。这是公司历史性转变。更值得赞叹的是,从2015年初到2016年6月30日,在短短一年半内,净现金流入高达7千万。这是少数公司所能办到的,更何况RGB只是个市值2.3亿的小小公司。一家现金流如此棒的公司,意味着其行业得天独厚,非比寻常 。

公司在短期内把净现金提到7千万。至9月30日第3季度,有望再提高到9千万。小股东们看到浮出水面的大量现金,难免会怪罪老板为何不分多点股息。但我想大家无需操之过急。试想公司在短期一年半内就把现金提升,也许还来不及回馈股东们。2015财年已经派发6.6百万股息,2016财年股息也还未宣布,就让我们耐心等候吧。如果每年股息没增加,大家再唱衰它也不迟。

由于债务还清,今年的finance cost将低于1.5million。估计可省下3 million。也就是说如果业绩没有成长,保持2015年 21 million的净利,那么2016年的净利是24 milliom。2015年 Free cash flow是41 million,2016年FCF至少会是44 million。

截至9月30日为止,预计公司手握2千万美金。公司手握美金,其目的明显,正积极在国外寻求并购计划来发展旗下的TSM业务。目前美金从6月30日的3.99汇率,上涨到9月30日的4.127。对于第3季度财报的账面上看,拥有美元的增值已经为RGB赚取3%的盈利,相等于RM2 million左右。

一家高现金流,高现金的小公司,其发展潜能非常大。因为企业可以进行很多活动,如:企业收购或入股当伙伴、扩展新区域市场、Capex、share buy back和派发更高股息。目前公司规模很小,除了菲律宾每年150 million的revenue,其他国家只有区区的一两千万而已。当公司有了足够的cash,尤其在风暴期间,大有可能与其他业者作伙伴,扩大其业务,把更多的 slot machine以高margin的TSM方式,扩大其营业额和盈利,让股东们受惠。

| Year | Borrowing | Net Cash | Finance cost | Profit | FCF | | 1st Half 2016 | 7,445 | 71,451 | 1,102 | 12,909 | 17,654 | | 2015 | 35,560 | 49,619 | 4,639 | 20,863 | 41,389 | | 2014 | 66,877 | -6,237 | 7,002 | 18,526 | 39,734 | | 2013 | 73,963 | -36,973 | 8,219 | 6,637 | 24,222 | | 2012 | 90,331 | -59,693 | 9,377 | 6,717 | 27,789 | | 2011 | 106,176 | -73,671 | 9,570 | -30,849 | 22,019 | | 2010 | 128,319 | -107,144 | 10,639 | -50,884 | 14,386 | | 2009 | 147,383 | -120,547 | 9,231 | -57,847 | -106,651 | | 2008 | 152,633 | -116,497 | 9,555 | -2,874 | 85,207

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-10-2016 06:12 PM

|

显示全部楼层

发表于 10-10-2016 06:12 PM

|

显示全部楼层

本帖最后由 icy97 于 10-10-2016 07:47 PM 编辑

RGB International (2) 未来是否经得起金融风暴的考验

Author: dudu | Publish date: Mon, 10 Oct 2016, 02:07 PM

http://klse.i3investor.com/blogs/都督征战股海/106117.jsp

第二篇写写RGB未来是否经得起金融风暴的考验:

目前大多数投资者,有如惊弓之鸟,一看到世界负面新闻,股市大跌,真不知要卖出持股,还是要趁便宜买入。卖出要亏钱,买入又怕选错股中套。明明是秉持着冷眼大师的投资哲学,但是又怕选股不到家,买入烂股大跌,尤其自己心态又不好,也没经历过每十年一次的金融风暴,投资真的让人难熬。

a)Finance position : 也只有那些经得起金融风暴的公司,能屹立不倒,才能够做长期投资。所以选对股、还要买对价码,变得很重要。无可否认。目前RGB强大的现金流,是这股的卖点。没有大笔债务的拖累,也是轻易能通过金融风暴的因属之一。保留大笔现金来应对金融风暴的冲击,在市场低潮时收购业务,也是上上之策。总的来说,RGB在finance position这方面,无可置疑是已经能轻易通过考验。

Year

| Rev | EPS | FCF pershare | Net cash pershare | | 2016 1st half | 114,087 | 0.97 | 1.33 | 5.37 | | 2015 | 233,006 | 1.57 | 3.11 | 3.73 | | 2014 | 214,646 | 1.39 | 2.98 | -0.47 | | 2013 | 139,635 | 0.5 | 1.82 | -2.78 | | 2012 | 187,398 | 0.5 | 2.09 | -4.48 | | 2011 | 118,211 | -2.32 | 1.65 | -5.53 | | 2010 | 158,614 | -3.82 | 1.08 | -8.05 | | 2009 | 170,202 | -4.34 | -8.01 | -9.05 | | 2008 | 227,809 | -0.22 | 6.4 | -8.75 | | 2007 | 276,307 | 2.88 | -2.91 | -7.35 |

b) 行业 : 以行业来看,RGB是否也一样通关?也许有人会说没问题。经济不好,尤其是发展或刚起步开发中国家,中低层的人民在经济不景时更好赌。其实这种说法也无法证明。也许我们可以试用之前的数据来探讨。看看我提供的图表,可以看到RGB在2008年到2011年都是连年亏损。这期间适逢金融风暴之年。是否跟2008年风暴有关系?这个需要看回之前发生的事项了。之前菲律宾并非RGB主要营收来源国,反而柬埔寨才是主要营收来源国,哪里也有属于RGB本身的Clubhouse。RGB把大部分的老虎机都置放在柬埔寨。2009年,柬埔寨新政府不再更新赌博执照于国内所有Clubhouse,只颁发给Casino。结果来自柬埔寨的营收大跌。除了柬埔寨,2008年的金融风暴对老虎机的生意影响,并不显著。也许只能说越南有影响。(到目前为止,只能看到这些)

| Year | 菲律槟 | 柬埔寨 | 越南 | 辽国 | 大马 | | 2016 1st half |

|

|

|

|

| | 2015 | 156m | 28m | 17m | 12m | 12m | | 2014 | 169m | 27m | 3m | 9m | 3m | | 2013 | 92m | 21m | 3m | 8m | 8m | | 2012 | 129m | 32m | 6m | 6m | 4m | | 2011 | 47m | 35m | 12m | 3m | 9m | | 2010 | 58m | 46m | 8m | 6m | 8m | | 2009 | 82m | 48m | 1m | 4m | 13m | | 2008 | 62m | 124m | 8m | 3m | 8m | | 2007 | 93m | 103m | 10m | 2m | 28m |

c) 管理层处理风险的行为 : 由于之前管理层大量把老虎机置放在柬埔寨,当新政府拒绝更新赌博执照后,大概有2000架老虎机无法运作,不止营收大跌,现金流大缩水,每年还需作庞大的depreciation。2009,2010,2011年大亏。Depreciation从高峰的72m降到目前的30m,capex也控制在20m的舒适水平。很明显这些年来,管理层已经得到之前的教训: 1)不敢乱借贷 2)不敢乱Capex

| Year | Capex | Depreciation | Profit | | 2016 1st half | 11,230 | 15,193 | 12,909 | | 2015 | 23,889 | 28,360 | 20,863 | | 2014 | 14,573 | 27,211 | 18,526 | | 2013 | 23,626 | 34,501 | 6,637 | | 2012 | 31,337 | 43,664 | 6,717 | | 2011 | 25,120 | 49,824 | -30,849 | | 2010 | 17,513 | 71,780 | -50,884 | | 2009 | 135,524 | 52,215 | -57,847 | | 2008 | 98,965 | 59,824 | -2,874 | | 2007 | 121,037 | 41,009 | 38,302 |

当然这也限制了公司的发展。但是,是否真没大发展了?与其说没发展,不如说管理层更谨慎发展。看看菲律宾的营收增加,越南和辽国也看到成长。今明年,Nepal这新市场相信也会报捷。目前菲律宾营收160m,远远胜过其他国家的10~30m。RGB如此依赖菲律宾,难道不怕历史重演,像柬埔寨那样赌博执照被政府拒绝更新?原来菲律宾的赌博执照和新加坡颇为相识,都是20~50年给与经营。而其他国家是yearly renew,所以居于风险关系,置放在这些国家的老虎机数量不会多。这也是让我觉得安心的地方。最近Datuk Chuah有在The Star 有意扩大生意范围至东欧和南美洲市场。(下一集分享,也许可以来谈谈公司的发展。)

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-10-2016 07:53 PM

|

显示全部楼层

发表于 12-10-2016 07:53 PM

|

显示全部楼层

本帖最后由 icy97 于 13-10-2016 12:05 AM 编辑

RGB -- 初生之犊转换变为稳重青年的成长故事

Author: 荷兰客栈 | Publish date: Tue, 11 Oct 2016, 03:38 PM

http://klse.i3investor.com/blogs/helanke/106210.jsp

股价 – RM0.185

股数 -- 1.319bil shares

业务:

1) 代理销售各大名牌(主要aristocrat & shuffle master)老虎机 (2015 – 1300units)– gross profit margin ~10%

2) 出租老虎机置放在club house/casino, 收取固定租金或profit sharing (37 outlets, 6460 units – 2015) -- gross profit margin ~60%

历史:

1) 2008年之前的鼎盛时期,公司主力市场都放在柬埔寨的各地俱乐部,盈利曾经去到接近40mil和股价60分。当时的RGB犹如一只初生之犊,野心勃勃的追求快速成长。结果当时公司借贷了过亿来扩充老虎机出租生意。当时的柬埔寨,很多地方老虎机不太受政府管制。之后柬埔寨换新政府后突然禁止老虎机在俱乐部的经营,结果导致他们收入大跌。靠大笔借贷买来的老虎机突然闲置,失去收入的同时又要承受高折旧和大笔利息支出,就这样把公司打入了深渊,承受了三年严重亏损。

2) 幸好,这只小牛死不去,还重新爬起再成长。之后公司转移阵地,把机器搬到菲律宾和一些金三角地区。目前主力都在菲律宾。有了前车之鉴,公司在菲律宾的生意合作对象都是有菲律宾政府支持的。有了这一层保护网,公司的投资比较有保障。另外,现在的RGB也不再像十年前那般过度举债来扩充生意拼成长,反而是一步步稳打稳扎的利用手上资源去扩充。

买点:

1) 公司近几年的operating cash flow都基本超过50mil.每年现金流平均会拿两千多万来投资新老虎机来出租,还债千多万。

2) 今年五月,公司提前清掉一笔千多万(7% interest)的commercial paper.目前总贷款只剩7mil, 而手上现金已经去到78mil。就是说公司从net debt过亿,短短几年就变成net cash 70mil。

3) 2017开始,公司已经没有债务需要偿还,而据公司透露目前计划每年的capex还是会保持大概20mil.就是说每年会有剩余30mil以上的净现金流。公司目前没有设立任何dividend policy.但管理层透露如果有多余的钱,他们会考虑增加派息。以目前的现金流,绝对有能力派发一分以上股息(1分=13mil)

4) 贷款没了,现金多了,之前每个季度需要付的百万利息,现在可以省下,存款利息收入也会增加一点。

5) 目前老虎机出租收入平均每个月7.6mil, up from 2015 7mil.

6) 代理销售方面,2016上半年拿到700架机总共80mil订单,delivered了500架(recognized revenue 68mil)。其余200架会在Q3交货。直到八月头为止,又多拿到400架总值45mil订单。就是说公司手上还没交货的订单有600 units -- ~57mil (gross profit 5.7mil). 公司目前也在积极争取多至少300架订单以便超越去年的总订单。

7) 他今年刚在nepal开拓到新的出租市场,机器正在运过去,Q4会开始营业。

8) 据管理层回复,今年新增加的出租老虎机是250台。这些都是可以增加recurring income的重要收入。

9) 他刚拿到aristocrat(澳洲名牌)在laos和gao的独家代理权和shuffle master在新加坡的分销权。据知也已带来了一些生意。

10) 老板正在开发南美洲和东欧的SSM市场。

11) 老板去年公开说要在2018/19前把公司盈利和股价带回到2008前的高峰,目前的前进脚步也很正面

12) Mr Cool也在去年成为了其中一个大股东。

风险

1. 公司销售市场主要在菲律宾和其他一些东南亚地区,而机器售价和拿货都是以美元记价。美元的大幅波动可能会对短期业绩制造一些额外的forex loss. 美元如果起太厉害,也可能会对他们销售量或profit margin有一些影响。

2. 老虎机出租收入主要是Thai Bath和Philippines Peso.这两国对马币的变动也会影响收租的盈利。

3. 突然历史重演,出现老虎机被禁止营业的现象。(不过短期可能性不大)

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-10-2016 08:16 PM

|

显示全部楼层

发表于 18-10-2016 08:16 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 28-10-2016 01:16 AM

|

显示全部楼层

发表于 28-10-2016 01:16 AM

|

显示全部楼层

本帖最后由 icy97 于 28-10-2016 07:32 PM 编辑

RGB International (3) 积沙成塔,何惧之有?Author: dudu | Publish date: Wed, 26 Oct 2016, 02:31 PM

第3篇写写RGB业务发展 :

公司主要业务是SSM和TSM

SSM :代理销售各大品牌和自家品牌老虎机

- 今年上半年,老虎机主要销售到菲律宾,大马,辽国,印度,东帝汶,尼泊尔,澳门,新加坡,越南,柬埔寨

- 今年上半年,主要各户有PAGCOR,SJM,Star Cruise,Resort World,Solaire Manila,City of Dreams

- 老板说,今年销售预计达到1,400台老虎机,上半年出了500台的货,下半年再出货800~900台

- 去年卖出1,230台老虎机,80%是旧机更换,20%是新增老虎机

- 有望成长的市场包括新加坡俱乐部Shuffle Master老虎机,澳门table game, 印度和辽国Aristocrat老虎机

- 未来开发东欧和南美洲市场

风险 :

- 估计18个月以内短期金融风暴对SSM业务影响不大。两年以上的经济萧条会带来较大影响

- 某国赌博执照终止,从该国的营收来源也终止

- 任何情况销售萎缩,比如说没有新的赌场和俱乐部开幕,或是公司没有开阔新的区域市场,那么就没有新的老虎机售出。但是只要目前公司能卖出越多的老虎机,未来旧机的更新也相对的越多。而且更多的维修费用,对TSM业务发展也受益更多

TSM :与赌场或俱乐部以联营方式经营老虎机

- 今年RGB在菲律宾、柬埔寨、辽国、缅甸、尼泊尔和东帝汶等国经营TSM业务。其中尼泊尔是新的开发区域

- 今年上半年经营40个outlets,共6,517台老虎机。(去年37个outlets,共6,458台)

- 下半年计划再增加281台老虎机

- 到目前为止,在尼泊尔正经营2个outlets,共65台老虎机。年尾在加德满都再增加一个更大的outlet

- 如果开发东欧和南美洲SSM市场成功,下个焦点将是开启TSM成长旅程碑

- TSM也包括老虎机维修和游戏软件销售,更多的SSM销售,也为TSM带来售后维修和软件盈利。

| 年度 | 营业额 | 毛利 | 毛利率 | | 2016 上半年 | 45,862 | 14,675 | 32% | | 2015 | 86,868 | 23,484 | 27% | | 2014 | 70,928 | 19,413 | 27% | | 2013 | 70,421 | 17,201 | 24% | | 2012 | 72,042 | 7,728 | 11% | | 2011 | 63,019 | -17,864 | -28% |

风险 :

- 估计18月以内短期金融风暴对TSM业务影响不大。两年以上的经济萧条会带来较大的影响

- 某国赌博执照终止,会对RGB带来比较大的冲击,因为除了营收停止,也涉及自家老虎机的成本。如果老虎机本身折旧已经完毕,那就是零成本,那么影响比较小。目前RGB未经折旧完毕的老虎机,有6.6千万左右

- 老虎机玩家减少,如果是因金融风暴或是国家经济萧条造成,那么RGB随时可以减少capex。目前capex在2千万水平,而公司Operation profit 6千万水平,扣除了capex和利息,FCF达到4千万水平。如果长期经济萧条,Operation profit会减半,但Capex可以减少,无须再植入新老虎机。RGB已是净现金公司,也无须支付利息。每年FCF还是可以达到3千万左右。当然折旧还得每年继续2~3千万。净利有可能亏损,但是公司的Net cash还是能够每年增加2~3千万。而且未折旧完毕的老虎机值6.6千万,用3年的时间就能折旧完毕,net profit很快又回到正数。

| 假设 | 一般情况 | 经济萧条 | | Operation profit | 60,000 | 30,000 | | Capex | 20,000 | 3,000 | | FCF | 40,000 | 27,000 | | FCF per share | 3 sen | 2 sen |

总结:

此股目前还没被疯狂炒高,股价大跌风险颇低,与去年大起大落的情况,已经不能同日而言。去年7~8月,RGB还未纳入净现金公司,而散户看的不外是EPS。只因EPS只有区区的1.4~1.6分之间,没爆发力,引不起人注意。诸不知其隐藏的每股自由现金流高达3分的内在价值所在,是EPS的两倍。去年跌至10sen,是买入最佳时期。我想冷眼前辈就是当时逢低买入的。对我个人而言,RGB经得起金融风暴,是属于长期投资的股项之一。但是我想这股短期业绩不会有爆发性成长,是属于一步一步,累计成长型公司。故被称为 “积沙成塔,何惧之有?”。低价买入收藏,会有比FD 3%更高回酬。也许再等个3~5年后,还能追求到预想不到的财务自由梦。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-10-2016 09:17 PM

|

显示全部楼层

发表于 30-10-2016 09:17 PM

|

显示全部楼层

本帖最后由 icy97 于 31-10-2016 02:40 AM 编辑

RGB aiming South America - Argentina

Author: excelyou | Publish date: Sun, 30 Oct 2016, 12:21 AM

http://klse.i3investor.com/blogs/myrgb3/107554.jsp

RGB mentioned they are eyeing South America as below.

The Star, Monday, 1 August 2016

RGB eyes new markets in Europe, S. America

GEORGE TOWN: Electronic gaming machine and equipment maker RGB International Bhd is eyeing new businesses in Europe and South America, as the company seeks to expand its market reach.

RGB derives 95% of its sales from the Asia-Pacific region.

“We want to move away from our traditional markets to broaden the revenue base for the group,” said group managing director Datuk Chuah Kim Seah (pic).

The company, he said had secured orders for 700 units of gaming machines valued at RM80mil for the first half 2016.

So how big is South America market?

Source: Worldcasinodirectory

South America Casinos and Gaming Guide

Saturday Oct 29th, 2016

This section of World Casino Directory deals specificially with South American casinos and gambling. The continent of South America has 9 countries with casinos in them and 4 countries with pari-mutuel facilities in them, including horse racing and dog racing or the newer racinos which have slots or video poker terminals within reach of the gamblers. Click the following articles for a run-down on specific gambling in this continent. South American Poker for the poker guide, or South American Lottery for South American lottery results and lottery information and last but not least visit this page for the current gambling news in South America.

Largest Casino in South America

In South America you will find the country of Argentina to have more casinos than any other country in South America, with 79 casinos and 12318 slots.

The largest casino in the continent of South America is Casino de Tigre which is located in Tigre, Argentina. Casino de Tigre has 74 table games and 1700 casino slot machines / video poker games

(or other video terminal gaming machines).

South American casinos

South American casinos are quite popular and today offer luxurious new locations for people to gamble, meet and enjoy. Usually food and beverages here are priced much lower to lure common customers to the place and make them play the game.

The largest casino in the continent of South America is which is located in , . has table games and casino slot machines / video poker games (or other video terminal gaming machines).

Is RGB really penetrated South America market as at 30 June 2016?

Based on their Corporate Presentation for 1H2015 below, RGB partner for casino equipment & parts is GPI. SHFL, Cartamundi, Suzo and many.

CORPORATE PRESENTATION - 1H2015

If we look at RGB latest Corporate Presentation for 1H2016 below, we will notice "IGT", the new partner appear in RGB latest corporate presentation as one of the product distributor.

Who is IGT?

International Game Technology PLC (IGT), formerly Gtech S.p.A. and Lottomatica S.p.A., is a multinational gaming company that produces slot machines and other gaming technology. The company is headquartered in London, with major offices in Rome, Providence, and Las Vegas. It is controlled with a 51 percent stake by De Agostini.[4]

Lottomatica acquired Gtech Corporation, a U.S. gaming company, in August 2006, and later changed its own name to Gtech. This transaction created one of the world's leading gaming solutions providers, with significant global market share and the broadest portfolio of technology, services, and content solutions. Gtech managed many state and provincial lotteries in the United States and also had contracts with local and national lotteries in Europe, Australia, Latin America, the Caribbean, and Asia.

In 2015, the company acquired American gaming company International Game Technology and again adopted the acquired company's name as its own.

CORPORATE PRESENTATION - 1H2016

Further investigate revealed that IGT have been promoting their products in Argentina since 2014 at the only gaming show in Argentina, SAGSE Argentina.

From, SAGSE website, we can see IGT have been participating SAGSE since 2014.

SAGSE website:

http://monografie.com/sagselatam/eng/?page_id=35854#listado-2014

http://monografie.com/sagselatam/eng/?page_id=35854#listado-2015

http://monografie.com/sagselatam/eng/?page_id=35854#listado-2016

CONCLUSION:

Will RGB able to derive significant revenue for South America?

Time will tell. |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-11-2016 02:36 PM

|

显示全部楼层

发表于 7-11-2016 02:36 PM

|

显示全部楼层

本帖最后由 icy97 于 7-11-2016 07:41 PM 编辑

冷眼的推荐

RGB國際(RGB,0037,主板貿服股)

-製造老虎機,過去幾年增長20%至30%,

-自由現金流出奇的高,3000萬令吉,雖然每年賺2分,但是其實賺5分錢,因為折舊很高。

-大股東說,在2018年回到60仙。

冷眼效應?

0.24了..

今天差不多要+10%了..

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-11-2016 08:32 PM

|

显示全部楼层

发表于 15-11-2016 08:32 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 17-11-2016 01:44 PM

|

显示全部楼层

发表于 17-11-2016 01:44 PM

|

显示全部楼层

本帖最后由 icy97 于 17-11-2016 08:47 PM 编辑

RGB - Mangement on track for FY2016

Author: excelyou | Publish date: Thu, 17 Nov 2016, 12:09 PM

http://klse.i3investor.com/blogs/myrgb/109114.jsp

RGB - Mangement on track for FY2016

Corporate presentation by RGB on 4th October 2016.

Please refer to the green highlight.

In 14 November 2016, RGB confirmed the Performace highlight for FY2016.

This article first appeared in The Edge Financial Daily, on November 14, 2016.

KUALA LUMPUR: RGB International Bhd is working hard to ensure it grows its revenue by at least 20% in the financial year ending Dec 31, 2017 (FY17).

That’s because the electronic gaming and amusement machine manufacturer hopes to benefit from the government’s incentives given under Budget 2017 for companies.

RGB is going after the maximum reduction in income tax of four percentage points for an increase in chargeable income of 20% and above for assessment year 2017-2018.

According to its managing director Datuk Chuah Kim Seah, who is also a major shareholder of the group with a 26.26% stake as at March 17, 2016, the group is on track to meet its target for FY16.

“We are positive that our [financial] performance in FY16 will not deviate too much from our expectations. We have targeted for double-digit growth in FY17 and with the latest Budget 2017 announcement, we are targeting to achieve a 20% growth [in revenue] to benefit from the tax incentives,” Chuah told The Edge Financial Daily in a telephone interview.

RGB’s financial results have grown from strength to strength in recent years, riding on the gaming-sector growth in Asia-Pacific. Since the group returned to the black in FY12 after four straight years of losses (FY08 to FY11), RGB has consistently maintained a growth of close to double digits in both its top-line and bottom line.

For FY15, the group’s net profit jumped 17.3% to RM21.3 million on the back of a revenue growth of 8.6% to RM233 million from the previous year.

It grew at a faster pace in the first half ended June 30, 2016 (1HFY16). It witnessed an 18.6% year-on-year (y-o-y) increase in net profit to RM12.9 million in 1HFY16, compared with 1HFY15, while revenue grew by 28.8% y-o-y to RM114.1 million.

Chuah shared that the group suffered losses in FY08 to FY11 as a result of impairment. Recall that the bulk of impairment was recorded due to closure of clubs by the Cambodian government in 2009.

Since then, the group has diversified into other countries to help mitigate any regulatory risk in a single country, said Chuah. According to its latest annual report, RGB has presence in the Philippines, Cambodia, Malaysia, Laos, Macau, Vietnam, Timor Leste and Nepal.

As part of plans to turn around, the group had also consolidated its gaming and amusement machines for markets with higher demand.

“With the consolidation process now complete, we can look for new areas to expand based on demand and potential growth. One of the regions that we are looking at is South America. The market is very big and has huge potential. We are looking at a one-year time frame for us to step foot in that region,” said Chuah.

He noted that RGB’s balance sheet had improved, with its borrowings having come down by 79.1% to RM7.44 million as of June 30, 2016, from RM35.6 million as of Dec 31, 2015, after the settlement of its commercial paper and medium term notes.

Recently, RGB has come under the spotlight as it was heavily traded in the market, with an average volume of about 33.6 million in the last four weeks. The group also triggered our momentum algorithm on Oct 31, 2016.

RGB’s share price has also risen in tandem with its improved financial performance, increasing from a low of seven sen in 2012 to close at 23 sen last Friday. At this level, RGB shares are trading at an attractive valuation, with a trailing price-earnings ratio of 13.1 times.

A technical analyst with a local brokerage is of the view that the group’s trading momentum remains strong and positive, in anticipation of its third-quarter earnings report on Nov 23.

“The momentum is strong with resistance at 27 sen, while [the] support level is at about 23.5 sen,” he told The Edge Financial Daily.

He added that the business model of RGB is attractive, as its technical support management segment will see recurring revenue for a long-term period, while its sales and marketing segment helps mitigate long-term risk with the collection of lump sum money for sales of gaming machines.

“I think the slot machine business is a game changer. It leases the machines out and gets steady income,” the technical analyst said.

The growth of RGB reflects that of the industry as a whole. The Association of Gaming Equipment Manufacturers (AGEM) Index posted another increase in October 2016 to 321.90 points after gaining 20.46 points in September 2016. The AGEM Index has reported a y-o-y increase for the 13th consecutive month, rising 124.68 points or 63.2% compared with October 2015.

With a growing industry in an expanding region, a strong balance sheet and attractive valuation, RGB’s growth story remains pretty much intact.

Conclusion: Hope for the best is coming.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-11-2016 07:02 PM

|

显示全部楼层

发表于 17-11-2016 07:02 PM

|

显示全部楼层

本帖最后由 icy97 于 17-11-2016 10:45 PM 编辑

RGB国际 – 浅谈业务和近期走势

RGB成立于1986年,在2004年以【DREAMGATE】的名称上市于大马创业板,之后在2008年转至主要板。RGB的主要业务是生产电子游戏机,以及提供电子游戏系统和技术管理。目前,它在大马、柬埔寨、菲律宾、澳门、新加坡、越南等等的国家都有其业务。

RGB和亚洲地区的博彩牌照持有者拥有长期合作伙伴关系。他们之间拥有多项电子游戏机合作模式,如租赁 (经常性收入)、利润共享和收费管理服务。在安装电子游戏机后, RGB的技术部门会提供技术和游戏系统支持、游戏系统的安装、预防性维护和各种游戏相关产品培训的服务。这些都是RGB主要的收入来源。

电子游戏系统服务占了FY15盈利的56%,而电子游戏机销售占了其余的44%。

RGB在一些亚洲地区的赌场获得特许经营权,其电子游戏机租赁预计能在2016年带来每月RM7.6m的收入。这比2015年的RM7m每月收入高出差不多10%。RGB租赁其游戏机的客户遍布于印度、菲律宾、东帝汶和尼泊尔。目前,菲律宾是它最大的市场。至于国内市场,RGB预计2016年的本地销售贡献将在3%左右。

近期网络上有不少人提到云顶赌场的扩充计划将采用RGB的电子游戏机。对于这点,本专页认为听听就好。根据RGB的官方网站,RGB不曾提供任何电子游戏机给予大马云顶。云顶的长期电子游戏机供应商是澳洲的【ARISTOCRAT】和【WMS GAMING】(参考附图)。

以下是RGB过去3年的经营权表现:

> FY15 - 37个特许经营权,6,458 部电子游戏机

> FY14 - 37个特许经营权,6,371 部电子游戏机

> FY13 - 36个特许经营权,5,645 部电子游戏机

RGB能在FY16的首2个季度交出标青的业绩主要归功于一些地区新赌场的优越表现所带来的额外收入。其FY16Q2的盈利更是创下上市以来的新高。然而,参考FY14和FY15的业绩表现,第2季度似乎是RGB的传统强劲季度。至于是否巧,真的不得而知。RGB能否持续交出稳定的盈利表现,有待观察。本专页对它有所保留。

估值方面,RGB在FY16Q2交出每股新高0.53仙的盈利。假设RGB在接下来的3个季度交出同个盈利表现,其一整年的每股盈利将会是2.12仙。以乐观的12倍PE计算,RGB的每股潜在价值是RM0.255。大家需注意的是,以上的估值是以最乐观的方式计算。2.12仙的每股盈利意味着RGB必须在一整年交出RM28m的盈利,相等于按年34%的成长。目前,真的看不到RGB有这个潜能。本专页所带出来的信息是RGB现在的股价已经偏贵了。

此外,RGB的股数也每年持续增加,从FY13的1.16b提升到目前的1.32b。当中增加的股数全都是来自于私下配售 (Private Placement) 和雇员认股权证 (ESOS) 。换句话说,假设你在FY13持有RGB,理论上你在FY16所分配的盈利已被稀化12%。这是本专页不喜欢的部分。

从技术图表来看,RGB近期的走势已经明显过热,处在超买区。根据斐波纳契 (Fibonacci Retracement) 的关键位置来看,RGB的阻力价位是在0.27,而支撑价位处在0.23。

无论从估值还是技术分析来看,RGB要突破0.27的可能性非常小,反而回调的可能性非常大。对于已持有的股友,可考虑套利离场。至于那些蠢蠢欲动想要投机RGB的股友,还是选择观望为佳。虽然RGB的业绩预计可达到市场预期,但是高于FY16Q2盈利的可能性不大。因此,本专页看不到目前15倍PE的RGB可上涨多高。

别再盲目追高了。

纯属分享!

RH Research

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-11-2016 08:00 PM

|

显示全部楼层

发表于 22-11-2016 08:00 PM

|

显示全部楼层

本帖最后由 icy97 于 29-11-2016 04:30 AM 编辑

By Gho Chee Yuan / theedgemarkets.com | November 17, 2016 : 4:26 PM MYT

http://www.theedgemarkets.com/my/article/rgb-international-falls-56-active-trade

KUALA LUMPUR (Nov 17): The Edge Financial Daily reported on Monday that RGB International is working hard to ensure it grows its revenue by at least 20% in the financial year ending Dec 31, 2017 (FY17).

This is because the electronic gaming and amusement machine manufacturer hopes to benefit from the government’s incentives given under Budget 2017 for companies, the financial daily reported.

According to its managing director Datuk Chuah Kim Seah, who is also a major shareholder of the group with a 26.26% stake as at March 17, 2016, the group is on track to meet its target for FY16.

“We are positive that our [financial] performance in FY16 will not deviate too much from our expectations. We have targeted for double-digit growth in FY17 and with the latest Budget 2017 announcement, we are targeting to achieve 20% growth [in revenue] to benefit from the tax incentives,” he added.

A technical analyst advised investors to be cautious when trading in the stock given the recent share price rally.

"It is difficult to chase the stock (in view of the) recent uptrend. As far as momentum is concern, it’s definitely overbought," the technical analyst said.

"The major support level (was at) 21 sen," he added.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2016 07:13 PM

|

显示全部楼层

发表于 29-11-2016 07:13 PM

|

显示全部楼层

本帖最后由 icy97 于 29-11-2016 08:20 PM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2016 | 30 Sep 2015 | 30 Sep 2016 | 30 Sep 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 94,547 | 79,666 | 208,634 | 168,275 | | 2 | Profit/(loss) before tax | 10,820 | 6,984 | 26,900 | 19,750 | | 3 | Profit/(loss) for the period | 9,459 | 5,836 | 22,608 | 16,848 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 9,327 | 5,717 | 22,236 | 16,603 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.71 | 0.44 | 1.69 | 1.34 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1400 | 0.1300

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|