|

|

【RCECAP 9296 交流专区】RCE资本

[复制链接]

[复制链接]

|

|

|

发表于 12-8-2007 11:34 AM

|

显示全部楼层

发表于 12-8-2007 11:34 AM

|

显示全部楼层

这几天RCE的股价大起大落,真是刺激。我想了想原因有哪些,可能是:

1. 外国资金在卖出股票,或有人担心外国资金会卖出股票,所以先卖出。

2. 投资者担心高盛 (Goldman Sachs)受美国次级房贷风波的影响。会脱售所拥有的RCE股份。

南洋商报报道说:"尽管本地银行不会受到美国次级房贷风波的影响,但鉴于避险基金可能尝试减持本地金融股项的举动,使金融股项今日纷纷走低,金融股指数跌幅更比综合指数显著。"

我是认为这只是市场投资情绪被影响。至于这是不是熊市的开始,老实说我也不知道。

至于高盛 (Goldman Sachs)会不会深受美国次级房贷风波的影响,这也得研究研究。

参考资料:

避险基金或减持银行股 金融指数跌幅惨重2007/08/10 18:15:46

●南洋商报

(吉隆坡10日讯)尽管本地银行不会受到美国次级房贷风波的影响,但鉴于避险基金可能尝试减持本地金融股项的举动,使金融股项今日纷纷走低,金融股指数跌幅更比综合指数显著。

达证券行分析员史习德向《南洋商报》表示:“由于次级房贷的风波,使避险基金纷纷套现,再加上法国巴黎银行在较早前宣布冻结三项次级房贷债券的赎回,可能导致避险基金减持本地金融股项,进而影响本地金融股项表现‘落后大市’。”

但是,SJ证券行研究经理谢京荣则认为,法国巴黎银行冻结三项次级房贷债券的赎回可能影响市场投资情绪,但并不会对本地金融股项带来很大的影响。

今日中午休市时,金融股指数挫跌2.11%或223.04点至10367.55点,并占据20最大跌幅股中的绝大部分。

中午休市时,马股大部分金融股项皆挫跌。其中包括大马交易所(Bursa,1818,主板金融股)下滑40仙至10.40令吉、伦平(LPI,8621,主板金融股)跌40仙至10.50令吉、兴业资本(RHBCap,1066,主板金融股)下滑25仙至5.30令吉、马银行(Maybank,1155,主板金融股)下滑10仙至11.70令吉、国贸资本(EONCAP,5266,主板金融股)下滑30仙至7.00令吉、大众银行(PbBank,1295,主板金融股)下滑25仙至9.45令吉以及土著联昌控股(Commerz,1023,主板金融股)下滑20仙至10.60令吉。

金融指数跌305点

全日闭市时,金融指数报10285.24点,全天下滑305.55点或2.89%;相对之下,综合指数跌25.69点或1.96%,以1287.70点挂收。

至于主要金融股方面,大马交易所以10.50令吉挂收,跌30仙,马银行跌40仙至11.40令吉,土著联昌控股下滑40仙至10.40令吉,兴业资本及国贸资本则分别跌25仙及30仙,报5.30令吉或7.00令吉。

在马股以为已摆脱美国次级房贷带来的影响当儿,却因法国巴黎较早前宣布冻结三项次级房贷债券的赎回,引起市场忧虑次级房贷阴影将会持续扩散,而再次挫跌。

马股今日甫开市即大跌22.34点,报1291.05点。

而二、三线股项今日的走势也深受影响,二板股项在早盘休市时大跌2.42%或2.65点,报106.63点。

http://www.nanyang.com/index.php?ch=7&pg=12&ac=758796

XXXXX

Monday August 6, 2007

The US housing market story

Back in 2001, the technology stock crash and “9/11” had resulted in aggressive interest rate cuts by the US Federal Reserve.

This led to the “good” part of the US housing market story – the chance to live up the American Dream as home ownership was made possible for virtually all and sundry.

In particular, mortgages became accessible and affordable to low-income groups, leading to rapid growth in subprime mortgages, whose share of the US mortgage market more than doubled to 20% between 2001 and 2006.

This is partly due to the relaxed credit standards as subprime lenders – from the non bank-backed companies to the divisions of Wall Street and global banks – dispensed with individual credit ratings, income documentation and down payments.

A residential property market boom ensued, and propelled the US economy directly through home construction activities, and indirectly through consumer spending, as the surge in property prices encouraged mortgage equity withdrawals via refinancing and high loan-to-value ratios.

Asset-backed securitisation ensured the party was not restricted to those directly in the subprime mortgage market.

Wall Street firms bought these higher risk loans which were then, as the financial jargon goes, “bundled”, “sliced”, “diced” and “packaged” with other assets and turned into high-yielding securities and collateralised debt obligations (CDOs), backed by the interest and principal payments of the underlying subprime mortgages.

Investors from individual Americans to global hedge funds snapped up this cocktail of newly-created mortgage-related assets for a piece of the housing boom.

But the story went “bad” few years later, as the surge in crude oil prices re-ignited inflation, prompting the Fed to make a U-turn on its monetary policy, beginning the summer of 2004.

Subprime mortgage borrowers were hit by rising costs of owning homes as the “honeymoon period” courtesy of the initial low “teaser” or “fixed” mortgage rates ended, replaced by “floating” or “adjustable” rates at the time when the Fed was busy hiking interest rates.

The housing market started to wobble in the second half of 2005 and became a drag on the US economy last year, culminating into the slowest real GDP growth in four years in the first quarter of this year.

Newsflow remains negative amid continued weak home sales and record-high numbers of unsold houses, which depressed residential construction activities and clobbered property prices.

Mortgage delinquencies and foreclosures are on the rise, especially in the sub-prime category, leading to over 100 subprime lenders in various stage of distress – filing for bankruptcy, halting operations, closing shop etc – since late 2006 up to last month.

As if holes in the sinking ship were not enough, the stricken vessel is further burdened with the recent rise in mortgage rates and tighter lending standards.

Confirming the housing boom-to-bust story, Countrywide Financials Corp recently reported weak second quarter earnings and set aside more money for loan losses as the largest mortgage lender in the US sees more borrowers falling behind on their payments and expects weak housing market conditions until 2009.

The Fed announced that it was going to team up with State regulators to police subprime mortgage lenders and brokers, even if somewhat late in the day.

But the subprime lenders and borrowers are not the only ones being hit.

Wall Street powerhouses and hedge funds are staring at billions if not trillions of dollars in losses via exposure to those mortgage-related debts.

The warning shot was fired in June when Bear Sterns had to bail out its two troubled hedge funds that bet on the subprime mortgage market.

Last month, rating agencies like Moody’s and S&;P started to review and cut ratings on bonds and CDOs backed by sub-prime home loans worth at least US$1.8 trillion.

And at the end of July, Bear Sterns was back in the limelight after it halted redemptions from another fund as the credit market slump prompted investors to demand their money back although the fund only invested less than 0.5% of its assets in subprime-linked securities.

The non-housing economic data of late seems to suggest the US economy is unlikely to tip into a recession, supported by the rebound in the second quarter real GDP growth, implying limited “direct” impact of the housing turmoil on the economy. But with the fallout in the US housing market battering Wall Street now, this may well be the “indirect” route taken by the housing sector to hit the US economy.

Worst still, the ripple effect is being felt worldwide, given the slump in the global financial markets recently and the spike in risk indicators such as the yield spread between emerging markets’ bonds and US Treasury. This is as worries over the impact of a prolonged US housing market slump on the US financial system and broad economy mounts, and considering that at least US$0.5 trillion subprime-linked CDOs were sold globally last year.

At the time of writing, news came out that subprime related losses have spread to banks, insurers and hedge funds in France and Australia, including one run by Macquarie Bank Ltd.

It looks like the US housing market story is turning into another chapter that may be “ugly”.

http://biz.thestar.com.my/news/s ... 45&sec=business

[ 本帖最后由 Mr.Business 于 12-8-2007 11:36 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-8-2007 11:35 AM

|

显示全部楼层

发表于 12-8-2007 11:35 AM

|

显示全部楼层

Just Say AAA

By PAUL KRUGMAN

Op-Ed Columnist

The New York Times

July 2, 2007

What do you get when you cross a Mafia don with a bond salesman? A dealer in collateralized debt obligations (C.D.O.’s) — someone who makes you an offer you don’t understand.

Seriously, it’s starting to look as if C.D.O.’s were to this decade’s housing bubble what Enron-style accounting was to the stock bubble of the 1990s. Both made investors think they were getting a much better deal than they really were. And the new scandal raises two obvious questions: Why were the bond-rating agencies taken in (again), and where were the regulators?

To understand the fuss over C.D.O.’s, you first have to realize that in the later stages of the great 2000-2005 housing boom, banks were making a lot of dubious loans. In particular, there was an explosion of subprime lending — home loans offered to people who wouldn’t normally have been considered qualified borrowers.

For a while, the risks of subprime loans were masked by the housing bubble itself: as long as prices kept going up, troubled borrowers could raise more cash by borrowing against their rising home equity. But once the bubble burst — and the housing bust is turning out to be every bit as nasty as the pessimists predicted — many of these loans were bound to go bad.

Yet the banks making the loans weren’t stupid: they passed the buck to other people. Subprime mortgages and other risky loans were securitized — that is, banks issued bonds backed by home loans, in effect handing off the risk to the bond buyers.

In principle, securitization should reduce risk: even if a particular loan goes bad, the loss is spread among many investors, none of whom takes a major hit. But with the collapse of the $800 billion market in bonds backed by subprime mortgages — the price of a basket of these bonds has lost almost 40 percent of its value since January — it’s now clear that many investors who bought these securities didn’t realize what they were getting into.

And it’s also becoming clear that in addition to failing to appreciate the risks of subprime loans, many investors were fooled by fancy financial engineering — those collateralized debt obligations — into believing they had protected themselves against risk, when they had actually done no such thing.

The details of C.D.O.’s are complicated, but basically they’re supposed to transfer most of the risk of bad loans to a small group of sophisticated investors, who are compensated for that risk with a high rate of return, while leaving other investors with a “synthetic” asset that is, well, safe as houses.

S.& P., Moody’s and Fitch, the bond-rating agencies, have gone along with the premise, telling investors that the synthetic assets created by C.D.O.’s are equivalent to high-quality corporate bonds. And investors have, in the words of a recent Bloomberg story, “snapped up” these securities “because they typically yield more than bonds with the same credit ratings.”

But the securities were never as safe as advertised, because the risk transfer wasn’t anywhere near big enough to protect investors from the consequences of a burst housing bubble. It’s not quite the metaphor I would have come up with, but here’s what the legendary bond investor Bill Gross had to say about C.D.O.’s in Pimco’s latest “Investment Outlook”:

“AAA? You were wooed Mr. Moody’s and Mr. Poor’s by the makeup, those six-inch hooker heels, and a ‘tramp stamp.’ Many of these good-looking girls are not high-class assets worth 100 cents on the dollar.”

Now we’re looking at huge losses to investors who thought they were playing it safe. Estimates of the likely losses on C.D.O.’s range from $125 billion to $250 billion, with some analysts warning that a wave of distress selling will deepen the housing slump even further.

Now, you might have thought that S.& P. and Moody’s, which gave Thailand an investment-grade rating until five months after the start of the Asian financial crisis, and gave Enron an investment-grade rating until days before it went bankrupt, would by now have learned to be a bit suspicious. And you would think that the regulators, in particular the Federal Reserve, would have learned from the stock bubble and the wave of corporate malfeasance that went with it to keep a watchful eye on overheated markets.

But apparently not. And the housing bubble, like the stock bubble before it, is claiming a growing number of innocent victims.

http://select.nytimes.com/2007/07/02/opinion/02krugman.html

http://greenpagan.blogspot.com/2007/07/just-say-aaa.html |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-8-2007 12:56 PM

|

显示全部楼层

发表于 12-8-2007 12:56 PM

|

显示全部楼层

原帖由 Mr.Business 于 12-8-2007 11:34 AM 发表

这几天RCE的股价大起大落,真是刺激。我想了想原因有哪些,可能是:

1. 外国资金在卖出股票,或有人担心外国资金会卖出股票,所以先卖出。

2. 投资者担心高盛 (Goldman Sachs)受美国次级房贷风波的影响。 ...

RCE 不是金融股的... 也因為他獨特的生意模式...

若在金融風暴到來的時候... 政府會來個大栽員的話... 那就考慮賣出 RCE 吧...

所以我想就算外資要抽回資金, RCE 也不會在 list 前面的那幾個

[ 本帖最后由 mjchua 于 12-8-2007 01:07 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-8-2007 01:01 PM

|

显示全部楼层

发表于 12-8-2007 01:01 PM

|

显示全部楼层

|

高盛 (Goldman Sachs)的分公司已經破產,而是否會被投資者告,法律追回資金。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-8-2007 01:41 PM

|

显示全部楼层

发表于 12-8-2007 01:41 PM

|

显示全部楼层

根据合作社代理员说,公务员薪金涨后,生意好了很多。都是来提高借贷上限。

假如之前薪水RM1000, 涨35%=RM1350. 借贷上限= 年薪60%.

之前= RM1000 x 12months x 60%= RM7200,

起薪后= RM1350 x 12 x 60%= RM9720

多借了RM2520 (i.e. 35%).

政府鲜少开除员工,如果你有读过general orders的话,就可以知道red tape有多么严重,开出一个人有多难。除非犯了很大的错,比如刑事案,破产,精神病。

即令1997时,政府也没有裁员。只是废除了很多津贴。裁员带来的是更多社会民生问题,我们的政府还没那么懵呆出此下策。如果你还不了解的话,政府工的另一个用意是“收募“这些人。

RCE的生意肯定有的做,不论经济好或坏。

经济好,消费高,来借钱吧!

经济坏,日子难过,再借钱吧!

我还找不到更好的公司在经济好或坏都赚钱的。

现在股价从RM1.14跌倒RM0.86, PE=9. 如果那最高的consolidation leve, RM1.05, 现在的折价是

(1.05-0.86/1.05) x 100%= 18%.

我只知道他是有看头的公司,不能建议你合理的内在价值。有兴趣的朋友可以到

http://www.moneychimp.com/articles/valuation/buffett_calc.htm参考。

现在股市走势不定,宜先按棋不定。现在收集子弹,等候整装待发。

祝旗开得胜。

相信你的公司。

Contratian theory绝对不是去买不能赚钱的公司来凸现你的与众不同。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-8-2007 01:46 PM

|

显示全部楼层

发表于 12-8-2007 01:46 PM

|

显示全部楼层

回复 #325 sogrlcc 的帖子

sogrlcc兄的投资功力很高,又是公务员,熟悉合作社借贷的情形,与你同为RCE的小股东,可以从你这儿知道更多详情,真是我和其他Kawan RCE的福气。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-8-2007 01:54 PM

|

显示全部楼层

发表于 12-8-2007 01:54 PM

|

显示全部楼层

有佳礼论坛的各位坛友交流讯息,看法,诚是广大股友的莫大福气。

希望大家踊跃发表,让论坛能够百花齐放。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-8-2007 02:14 PM

|

显示全部楼层

发表于 12-8-2007 02:14 PM

|

显示全部楼层

原帖由 sogrlcc 于 12-8-2007 01:41 PM 发表

政府鲜少开除员工,如果你有读过general orders的话,就可以知道red tape有多么严重,开出一个人有多难。除非犯了很大的错,比如刑事案,破产,精神病。

即令1997时,政府也没有裁员。只是废除了很多津贴。裁员带来的是更多社会民生问题,我们的政府还没那么懵呆出此下策。如果你还不了解的话,政府工的另一个用意是“收募“这些人。

1.2million的公务员,代表的是1.2million的家庭和至少6million的政府支持者 (绝大部分)和选票。政府是不会轻易伤害他们的。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-8-2007 02:18 PM

|

显示全部楼层

发表于 12-8-2007 02:18 PM

|

显示全部楼层

“

在这篇新闻内(http://www.rce.com.my/newsstuff/profitsfuture.pdf),Soo Kim Wai说 "When we first took over RCE, its market share was 2% andnow (July 2006) it is 6%. We are targeting to increase to 10% withinthree years."

我不清楚Soo是如何define市场的,可是我知道RCE过去的客户人数。

July 2004, 18570人。

May 2005, 25000人,比之前增加34.6%。

Sept 2006, 30000人,比之前增加20%。

June 2007, 35000人,比之前增加16%。“

再看回这些资料又看到一个不好的消息。人数一路来都只增加5000人,如果基础数越高那么成长就越少。34。6-〉20-〉16-〉??

人数一路攀升的原因是会员都是长期借贷,当然是有增无降。看来人数如果standardize到每年增加5000人的话,那么rcecap更不值得长期投资,因为成长空间越来越少,成长幅度也越来越少。

短期投资依然没有问题,尤其是牛市。

欺压善良愚笨的人民来赚钱的公司是不长久的。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-8-2007 02:25 PM

|

显示全部楼层

发表于 12-8-2007 02:25 PM

|

显示全部楼层

我想Soo指的market share是营业额,并非人数。

贷款人数的提升当然不是个很好的现象。

学校并没有教导我们如何理财,所以很多人还在捉襟见肘的过生活。

没有体会那种辛苦的人不会明白。

RCE能够提供解燃眉之急的一时权宜,我想不会被当作罪恶(sin)股。

[ 本帖最后由 sogrlcc 于 12-8-2007 02:35 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-8-2007 02:33 PM

|

显示全部楼层

发表于 12-8-2007 02:33 PM

|

显示全部楼层

原帖由 8years 于 12-8-2007 02:18 PM 发表

欺压善良愚笨的人民来赚钱的公司是不长久的

是嗎 ? 那信用卡公司基本上是應該倒了很久 |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-8-2007 04:30 PM

|

显示全部楼层

发表于 12-8-2007 04:30 PM

|

显示全部楼层

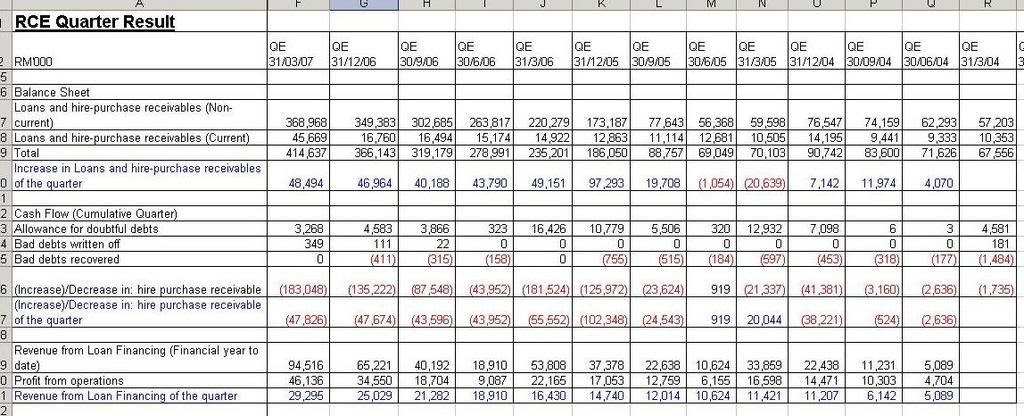

我研究RCE过去几个季度业绩的Balance sheet和Cash Flow,并做了一些分析。

1. 请注意"(Increase)/Decrease in: hire purchase receivable of the quarter"这个项目,红色的数目代表RCE在每个季度从Cash Flow发出去的贷款。

30/06/06季度,RM43952K

30/09/06季度,RM43596K

31/12/06季度,RM46674K

31/03/07季度,RM47826K

RCE在最近几个季度都分别发出大约RM4x million的贷款。对股东来说,我自然希望RCE能发出更多贷款。值得注意的是RCE的RM420million的medium term notes已经差不多用完了,所以我想RCE不久会宣布新的筹资计划 (最好就是久违的1.5亿ABS!)。

2. Revenue from Loan Financing of the quarter就是每个季度收到的利息。RCE发出去的贷款在每个季度都有增加,这表示她将收到越来越多的利息!

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-8-2007 04:39 PM

|

显示全部楼层

发表于 12-8-2007 04:39 PM

|

显示全部楼层

回复 #330 sogrlcc 的帖子

新闻。

更新: August 1, 2007 18:14

政府受促設合法公司

放寬借貸杜絕阿窿

(吉隆坡1日訊)約10個政府部門、機構及非政府組織代表,促請政府批准成立更多合法借貸公司,提供低收入群微型貸款,以解決我國日趨嚴重非法高利貸活動。

他們也促請政府允許成立一站式借貸中心,並且放寬及簡化借貸程序,為所有面對經濟問題的人民提供貸款服務。

大馬防範罪案基金會固定研究及出版委員會主席拿督迪尼申指出,今日的會議總結是,大馬人民對微型貸款的需求非常高。

他說,我國雖然有許多銀行及合法借貸公司,其貸款程序卻比向大耳窿貸款繁雜。

“這造成許多人民向非法高利貸公司(大耳窿)貸款做生意及解決個人問題,使到非法高利貸問題在大馬日趨嚴重。”

他今日主持杜絕非法高利貸圓桌會議后,在記者會上這么說。這項3小時圓桌會議是由大馬防範罪案基金會舉辦。

出席的各政府部門、機構及非政府組織代表,包括來自馬華公共服務與投訴部、國家銀行、大馬皇家警察、房屋與地方政府部、大馬人權委員會、合法注冊借貸協會及社會策略基金會等。

迪尼申說,房屋與地方政府已批准逾3000間合法借貸公司的成立,但仍有許多草根人民需要在短時間內獲得微型貸款。

提供微型貸款

他指出,為了解決這問題,政府應該成立更多合法借貸公司,提供低收入群微型貸款,解決他們生活經濟困難。

他說,他們發現,非法高利貸問題在大馬日趨嚴重,最令人關注的問題是,借貸者的家人被拖累,而成為被對付受害者。

迪尼申說,該基金會收集了意見后,將準備一份特別報告書,以提呈給有關政府部門及機構,包括首相署、房政部、國家銀行、國內安全部、大馬皇家警察等。

解決非法高利貸問題方案

1:成立更多提供微型貸款的合法借貸公司。

2:通過教育提高人民財務管理意識及懂得辨別合法與非法借貸公司。

3:警方及執法單位必須加強執法行動。

4:管制賭博活動。

5:管制借貸廣告。

6:修改現有相關法令,賦予執法當局展開執法權利。

7:國家銀行需加強角色,簡化及放寬批准微型借貸程序及條例。

8: 成立一站式借貸中心。

http://www.chinapress.com.my/con ... mp;art=0802mc66.txt

[ 本帖最后由 Mr.Business 于 12-8-2007 04:40 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-8-2007 05:17 PM

|

显示全部楼层

发表于 12-8-2007 05:17 PM

|

显示全部楼层

截止去年12月31日,共有4918间合作社向Kementerian Pembangunan Usahawan dan Koperasi登记,其中有474间合作社提供借贷服务。

KUALA LUMPUR 24 Julai - Sehingga 31 Disember lalu, sebanyak 4, 918 koperasi berdaftar direkodkan oleh Kementerian Pembangunan Usahawan dan Koperasi.

Setiausaha Parlimen kementerian, Datuk Samsu Baharun Ab. Rahman berkata, daripada jumlah itu, sebanyak 339 buah merupakan koperasi yang tidak aktif dan dianggap tidak berdaya maju.

Tambahnya, sebanyak 13 koperasi atau 3.38 peratus terlibat dalam aktiviti-aktiviti pinjam-meminjam.

"Semua koperasi ini akan diberi bimbingan dan khidmat nasihat yang secukupnya untuk dipulihkan dan sekiranya gagal, pendaftarannya akan dibatalkan.

"Daripada jumlah tersebut pada puratanya hanya sebanyak 10 peratus sahaja dapat dipulihkan," katanya ketika menjawab soalan Senator Tan Sri Muhammad Muhd. Taib pada persidangan Dewan Negara, hari ini.

Tambahnya, sejumlah 4,569 buah koperasi berjaya dan boleh dijadikan saluran tabungan berkesan di kalangan rakyat.

"Jumlah koperasi yang menjalankan aktiviti kredit yang menjadi saluran tabungan kepada rakyat ialah sebanyak 474 buah melibatkan keanggotaan seramai 1.6 juta orang dan jumlah aset sebanyak RM6 bilion," katanya.

http://www.jpk.gov.my/jpk/main.p ... cation=0&Page=1 |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-8-2007 06:43 PM

|

显示全部楼层

发表于 12-8-2007 06:43 PM

|

显示全部楼层

|

medium term notes是什么意识?可以详细讲解码? |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-8-2007 08:25 PM

|

显示全部楼层

发表于 12-8-2007 08:25 PM

|

显示全部楼层

“欺压善良愚笨的人民来赚钱的公司是不长久的。”呵呵,这只是讲讲笑。大家不用那么认真。

不过,“RCE能够提供解燃眉之急的一时权宜”是不正确的,因为没有人会用7-10年来解燃眉之急。。。。。。。

“那信用卡公司基本上是應該倒了很久”,我认为信用卡和rcecap的出发点都有很大差别。信用卡就真的是提供方便和解燃眉之急。

还有rcecap最大的力量是来自“政府自动扣薪“。

试想一想如果maybank,pbbank,hsbc,standard charted都有这种facility,那么rcecap到底算哪根葱??

然而为什么rcecap有那么特别的优待??这就是政治。那么为什么政治要穷人更穷??这还是政治。如果真正为人民好,就应该将“政府自动扣薪“分给所有银行,那么穷人就可以用超低利息来解燃眉之急。

这些政府出发点还不够说成是罪恶的公司吗??

还有,如果是政府工的,hsbc有特别借钱方法(personal loan),非常容易通过。这世界很现实,高利贷本来就是会借给风险比较高的顾客。但是rcecap有政府的特别对待,所以才能用高利贷来残害人民。如果政府是为了人民好,就不会出现高利贷了。这一却,还是政治。

rcecap会赚钱,也会成长,但是这种股的钱我不会喜欢赚。我们身为理财专家,没有教人如何理财也就算了,我可不能跑去叫人如何做更穷的人。如果我是那种人,今天我就不会讲那么多话。

“欺压善良愚笨的人民来赚钱的公司是不长久的。”这只是讲讲笑。但是我真的希望由一天这公司会消失,因为我不像看到穷人被高层欺压而越来越多,更不像看到聪明的人利用别人不懂理财的弱点来控制他们。我们应该教导而不是利用弱点,这是没有人性的做法。

有人骂soros没有人性,那么rcecap的人性又在那里??大家还不是一样??都是用自己的能力来赚穷人和比较蠢的人的钱而已。

唯一不同的只是soros害的人比较多,因为他的资金和智慧比较高层。而rcecap害的人比较少,因为他的资金比较少和他比较不那么聪明而已。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-8-2007 10:55 PM

|

显示全部楼层

发表于 12-8-2007 10:55 PM

|

显示全部楼层

忘了提到,合作社发出贷款是会买保险的。

保的是死亡和永久残废。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-8-2007 11:06 PM

|

显示全部楼层

发表于 12-8-2007 11:06 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 13-8-2007 12:19 AM

|

显示全部楼层

发表于 13-8-2007 12:19 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 13-8-2007 01:35 AM

|

显示全部楼层

发表于 13-8-2007 01:35 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|