|

|

发表于 19-5-2018 05:04 AM

|

显示全部楼层

发表于 19-5-2018 05:04 AM

|

显示全部楼层

本帖最后由 icy97 于 21-5-2018 03:49 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 7,070,116 | 6,776,966 | 7,070,116 | 6,776,966 | | 2 | Profit/(loss) before tax | 291,157 | 321,134 | 291,157 | 321,134 | | 3 | Profit/(loss) for the period | 220,331 | 254,603 | 220,331 | 254,603 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 218,478 | 253,152 | 218,478 | 253,152 | | 5 | Basic earnings/(loss) per share (Subunit) | 22.00 | 25.50 | 22.00 | 25.50 | | 6 | Proposed/Declared dividend per share (Subunit) | 13.00 | 14.00 | 13.00 | 14.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.7600 | 6.0400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-5-2018 05:05 AM

|

显示全部楼层

发表于 19-5-2018 05:05 AM

|

显示全部楼层

EX-date | 01 Jun 2018 | Entitlement date | 05 Jun 2018 | Entitlement time |

| | Entitlement subject | Interim Dividend | Entitlement description | The Board has declared an interim dividend of 13 sen per ordinary share for quarter ended 31 March 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 14 Jun 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 05 Jun 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.13 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-6-2018 02:52 AM

|

显示全部楼层

发表于 4-6-2018 02:52 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 18-6-2018 01:40 AM

|

显示全部楼层

发表于 18-6-2018 01:40 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 11-7-2018 02:30 AM

|

显示全部楼层

发表于 11-7-2018 02:30 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 16-8-2018 06:16 AM

|

显示全部楼层

发表于 16-8-2018 06:16 AM

|

显示全部楼层

国油贸易冀3年非燃料盈利增至30%

Justin Lim/theedgemarkets.com

August 15, 2018 15:53 pm +08

(吉隆坡15日讯)国家石油(Petroliam Nasional Bhd)行销臂膀国油贸易(Petronas Dagangan Bhd)放眼两、三年内,把非燃料盈利提高至30%。

国油贸易董事经理兼总执行长Datuk Seri Syed Zainal Abidin指出,燃料是一个日益减少的行业,因为全球正趋向电动汽车等再生能源发展,因此国油贸易需要关注非燃料业务。

这是为了确保公司能够填补燃料业务的空缺,从而继续为股东提供回酬。

根据Syed Zainal,国油贸易的盈利主要来自燃料业务,占总盈利的90%,非燃料业务仅贡献10%。

Syed Zainal表示,与我国最大的领先共同工作场所Common Ground的合作,标志着国油贸易计划将油站改造为创新枢纽,他希望最终可以提升公司的非燃料盈利。

他说:“The Place @ Ampang是国油贸易重塑零售业务的长期策略之一,专注于创造创新解决方案,以改善我们的客户体验。”

“虽然我们正在酝酿一些令人兴奋的想法,但我们也接受新的想法,因为我们希望鼓励本地创业公司的发展。这非常符合我们不断努力支持本地中小企业和供应商,成为我们商业生态系统的一部分。”

他补充说:“我们想要接触更多,这就是Common Ground将把我们与其他创业社区联系起来的核心作用,以进一步探索和创造更多的创新。”

他指出,国油贸易的目标是通过将其他6个站点转变为创新中心,包括Shah Alam Seksyen 26、Ampang、Solaris、Setiawangsa、Johor Bahru和Langkawi,来复制类似的商业创意。

(编译:魏素雯) |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-8-2018 02:35 AM

|

显示全部楼层

发表于 21-8-2018 02:35 AM

|

显示全部楼层

本帖最后由 icy97 于 21-8-2018 04:58 AM 编辑

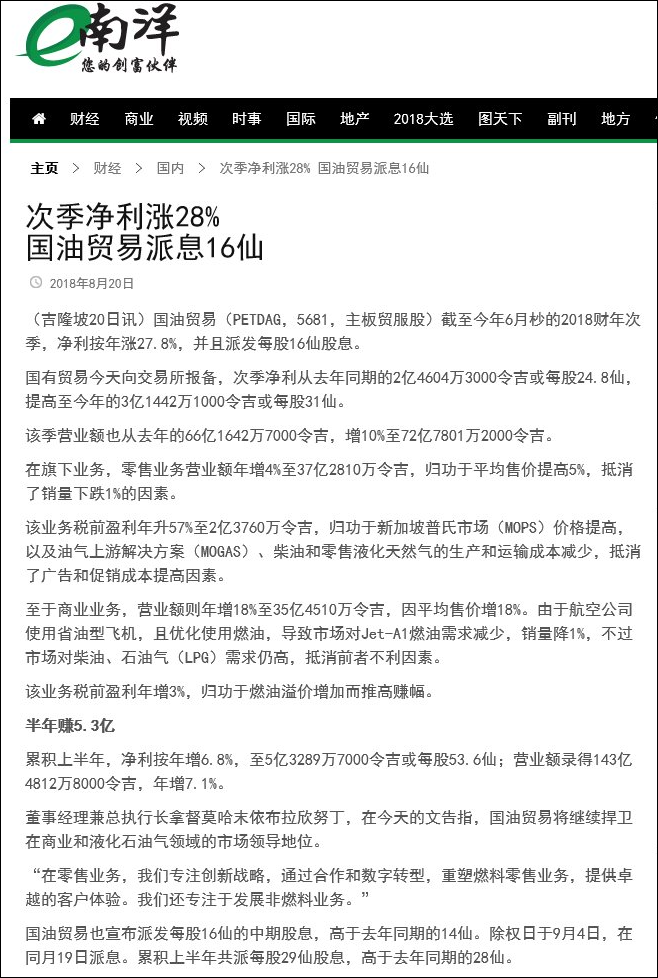

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 7,278,012 | 6,616,427 | 14,348,128 | 13,393,394 | | 2 | Profit/(loss) before tax | 424,258 | 307,508 | 715,414 | 628,641 | | 3 | Profit/(loss) for the period | 322,534 | 247,781 | 542,863 | 502,384 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 314,421 | 246,043 | 532,897 | 499,195 | | 5 | Basic earnings/(loss) per share (Subunit) | 31.60 | 24.80 | 53.60 | 50.20 | | 6 | Proposed/Declared dividend per share (Subunit) | 16.00 | 14.00 | 29.00 | 28.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.9300 | 6.0400 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-8-2018 02:55 AM

|

显示全部楼层

发表于 21-8-2018 02:55 AM

|

显示全部楼层

EX-date | 04 Sep 2018 | Entitlement date | 06 Sep 2018 | Entitlement time |

| | Entitlement subject | Interim Dividend | Entitlement description | The Board has declared an interim dividend of 16 sen per ordinary share for quarter ended 30 June 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaSelangor Darul EhsanTel:0378490777Fax:0378418151 | Payment date | 19 Sep 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 06 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.16 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-8-2018 06:00 AM

|

显示全部楼层

发表于 22-8-2018 06:00 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 10-9-2018 04:17 AM

|

显示全部楼层

发表于 10-9-2018 04:17 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 16-10-2018 04:21 AM

|

显示全部楼层

发表于 16-10-2018 04:21 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-12-2018 06:29 AM

|

显示全部楼层

发表于 27-12-2018 06:29 AM

|

显示全部楼层

EX-date | 10 Dec 2018 | Entitlement date | 12 Dec 2018 | Entitlement time |

| | Entitlement subject | Interim Dividend | Entitlement description | The Board has declared an interim dividend of 16 sen per ordinary share for quarter ended 30 September 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 26 Dec 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 12 Dec 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.16 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-12-2018 07:21 AM

|

显示全部楼层

发表于 27-12-2018 07:21 AM

|

显示全部楼层

本帖最后由 icy97 于 6-1-2019 04:34 AM 编辑

净利暴跌65%-国油贸易派息16仙

http://www.enanyang.my/news/20181128/净利暴跌65br-国油贸易派息16仙/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 7,819,296 | 6,866,387 | 22,167,424 | 20,259,780 | | 2 | Profit/(loss) before tax | 391,486 | 438,306 | 1,106,900 | 1,066,947 | | 3 | Profit/(loss) for the period | 271,116 | 762,554 | 813,979 | 1,264,938 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 270,270 | 761,726 | 803,167 | 1,260,921 | | 5 | Basic earnings/(loss) per share (Subunit) | 27.20 | 76.70 | 80.80 | 126.90 | | 6 | Proposed/Declared dividend per share (Subunit) | 16.00 | 20.00 | 45.00 | 48.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 6.0500 | 6.0400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-1-2019 07:28 AM

|

显示全部楼层

发表于 6-1-2019 07:28 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 18-1-2019 05:07 AM

|

显示全部楼层

发表于 18-1-2019 05:07 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 31-1-2019 06:51 AM

|

显示全部楼层

发表于 31-1-2019 06:51 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PETRONAS DAGANGAN BERHAD (PDB OR THE COMPANY) - INCORPORATION OF SETEL VENTURES SDN BHD, A WHOLLY-OWNED SUBSIDIARY OF THE COMPANY | INTRODUCTION

Pursuant to Paragraph 9.19(23) of Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of PDB (Board) wishes to announce that the Company had on 9 January 2019, incorporated a wholly-owned subsidiary namely Setel Ventures Sdn Bhd (Company No. 1310317-A) (SETEL) under the Companies Act, 2016 as a private company limited by shares with an issued share capital of 5,000 ordinary shares at a total cash consideration of RM5,000,000.00.

FINANCIAL EFFECTS

The incorporation of the company mentioned above is not expected to have any material impact on PDB Group's earnings and net assets for the financial year ending 31 December 2019.

DIRECTORS AND MAJOR SHAREHOLDERS' INTEREST

None of the Directors and/or major shareholders of the Company or persons connected with them have any interest, direct or indirect, in the above incorporation.

This announcement is dated 10 January 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-3-2019 06:20 AM

|

显示全部楼层

发表于 3-3-2019 06:20 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 7,901,329 | 7,160,866 | 30,068,753 | 27,420,647 | | 2 | Profit/(loss) before tax | 70,126 | 370,910 | 1,177,026 | 1,437,857 | | 3 | Profit/(loss) for the period | 47,480 | 280,032 | 861,459 | 1,087,940 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 46,682 | 278,576 | 849,849 | 1,539,496 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.70 | 28.00 | 85.50 | 155.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 25.00 | 49.00 | 70.00 | 97.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.9400 | 6.0400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-3-2019 06:21 AM

|

显示全部楼层

发表于 3-3-2019 06:21 AM

|

显示全部楼层

EX-date | 11 Mar 2019 | Entitlement date | 13 Mar 2019 | Entitlement time |

| | Entitlement subject | Interim Dividend | Entitlement description | The Board has declared an interim dividend of 25 sen per ordinary share for quarter ended 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378418088Fax:0378418100 | Payment date | 28 Mar 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 13 Mar 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.25 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-7-2019 06:37 AM

|

显示全部楼层

发表于 2-7-2019 06:37 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 7,085,905 | 7,070,116 | 7,085,905 | 7,070,116 | | 2 | Profit/(loss) before tax | 382,986 | 291,157 | 382,986 | 291,157 | | 3 | Profit/(loss) for the period | 293,584 | 220,331 | 293,584 | 220,331 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 291,196 | 218,478 | 291,196 | 218,478 | | 5 | Basic earnings/(loss) per share (Subunit) | 29.30 | 22.00 | 29.30 | 22.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 15.00 | 13.00 | 15.00 | 13.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.9100 | 5.9400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-7-2019 06:55 AM

|

显示全部楼层

发表于 2-7-2019 06:55 AM

|

显示全部楼层

EX-date | 13 Jun 2019 | Entitlement date | 14 Jun 2019 | Entitlement time |

| | Entitlement subject | Interim Dividend | Entitlement description | The Board has declared an interim dividend of 15 sen per ordinary share for quarter ended 31 March 2019 | Period of interest payment | to | Financial Year End | 31 Dec 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHD(formerly known as SYMPHONY SHARE REGISTRARS SDN BHD)Level 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:037849 0777Fax:037841 8151/8152 | Payment date | 27 Jun 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 14 Jun 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.15 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|