|

|

发表于 1-1-2016 03:54 AM

|

显示全部楼层

发表于 1-1-2016 03:54 AM

|

显示全部楼层

Date of change | 31 Dec 2015 | Name | MR QUAH BAN LEE | Age | 58 | Nationality | Malaysia | Designation | Director | Directorate | Executive | Type of change | Retirement | Qualifications | (1) Bachelor of Arts (Hons) in Economics and Accounting from the University of Reading in the United Kingdom.(2) Chartered Accountant of The Institute of Chartered Accountants of England and Wales (ICAEW) and a member of Malaysian Institute of Accountants (MIA) | Working experience and occupation | Mr Quah Ban Lee has more than 30 years of experience in finance, including a number of years in professional accounting firms, both in United Kingdom and Malaysia. | Family relationship with any director and/or major shareholder of the listed issuer | Nil | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct interest in Malayan Flour Mills Berhad:(1) 1,175,000 ordinary shares of RM0.50 each(2) 235,000 warrants |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-1-2016 12:05 AM

|

显示全部楼层

发表于 5-1-2016 12:05 AM

|

显示全部楼层

| MALAYAN FLOUR MILLS BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Acquisitions | Details of corporate proposal | (1) Proposed leasing of lands at Mukim Lumut, District of Manjung, Perak; (2) Proposed leasing of lands at Mukim Pengkalan Baharu, District of Manjung, Perak; (3) Proposed acquisition of approximately 2.96% of the equity interest in Dindings Poultry Processing Sdn Bhd; and (4) Proposed acquisition of approximately 17.55% of the equity interest in Dindings Soya & Multifeeds Sdn Berhad. | No. of shares issued under this corporate proposal | 12,010,930 | Issue price per share ($$) | Malaysian Ringgit (MYR) 1.2900 | Par Value ($$) | Malaysian Ringgit (MYR) 0.500 | | Latest issued and paid up share capital after the above corporate proposal in the following | Units | 550,239,010 | Currency | Malaysian Ringgit (MYR) 275,119,505.000 | Listing Date | 05 Jan 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-2-2016 01:21 AM

|

显示全部楼层

发表于 17-2-2016 01:21 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | 1. Proposed acquisition of approximately 2.96% of the equity interest in Dindings Poultry Processing Sdn Bhd (DPP); and 2. Proposed acquisition of approximately 17.55% of the equity interest in Dindings Soya & Multifeeds Sdn Berhad (DSM) (collectively referred to as the "Proposed Acquisitions") | Reference is made to the Company’s announcements dated 21 October 2015, 9 December 2015, 22 December 2015 and 31 December 2015, in relation to the Proposed Transactions. Unless otherwise stated, the abbreviations and definitions used in this announcement shall have the same meaning as defined in the abovementioned announcements. The Board of Directors of MFM wishes to announce that following the settlement of the consideration for the Proposed Acquisitions pursuant to the SSA dated 21 October 2015, the following equity interests have been transferred from PSADC to MFM on 16 February 2016: (i) 1,600,000 ordinary shares representing approximately 2.96% of the equity interest in DPP. Arising from this acquisition, MFM is now holding a total equity interest of 97.70% in DPP; and

(ii) 6,250,000 ordinary shares representing approximately 17.55% of the equity interest in DSM. Arising from this acquisition, MFM is now holding a total equity interest of 87.76% in DSM.

This announcement is dated 16 February 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-2-2016 03:16 PM

|

显示全部楼层

发表于 25-2-2016 03:16 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2015 | 31 Dec 2014 | 31 Dec 2015 | 31 Dec 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 602,079 | 574,142 | 2,301,907 | 2,286,575 | | 2 | Profit/(loss) before tax | -4,439 | 1,316 | 43,874 | 83,729 | | 3 | Profit/(loss) for the period | -6,810 | 8,230 | 29,404 | 79,494 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -7,907 | 4,644 | 20,545 | 67,778 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.47 | 0.86 | 3.82 | 12.59 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.00 | 3.50 | 4.00 | 6.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4000 | 1.3600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-2-2016 03:28 PM

|

显示全部楼层

发表于 25-2-2016 03:28 PM

|

显示全部楼层

EX-date | 09 Mar 2016 | Entitlement date | 11 Mar 2016 | Entitlement time | 05:00 PM | Entitlement subject | Second interim dividend | Entitlement description | Second Interim Single Tier Dividend of 2.0 sen per ordinary share of RM0.50 each | Period of interest payment | to | Financial Year End | 31 Dec 2015 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 25 Mar 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 11 Mar 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit | 09 Mar 2016 | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0200 | Par Value | Malaysian Ringgit (MYR) 0.500 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-5-2016 03:50 AM

|

显示全部楼层

发表于 18-5-2016 03:50 AM

|

显示全部楼层

馬麵粉廠展望謹慎‧吁撤銷1公斤麵粉津貼

2016-05-17 16:32

(吉隆坡17日訊)馬面粉廠(MFLOUR,3662,主板消費品組)認為,受不穩定因素影響,整體業務展望謹慎,並呼吁政府取消1公斤麵粉津貼,推動麵粉市場自由化。

該公司董事經理鄭偉財在股東大會後表示,隨著25公斤麵粉津貼取消,希望接下來政府也能撤銷1公斤麵粉的津貼,讓業者可轉嫁成本至消費者。

在該公司建議下,今年3月1日開始,政府同意取消25公斤麵粉津貼,但繼續補貼1公斤麵粉。

他坦言,政府已完成大部份津貼合理化活動,目前僅剩1公斤麵粉還享有津貼,若取消的話,可加強整體領域效率及競爭力。

他補充,包括該公司在內,大馬僅剩5家麵粉廠,大馬麵粉月產量8萬噸,人均消耗37公斤。

至於大馬業務,鄭偉財指出,銷售量雖然理想,但利潤難以估計,因獲利有賴於原料價格及匯率走勢。

“若小麥價格上漲,我們無法調漲麵粉售價,利潤將走低,但問題是我們無法預測接下來的原料及匯率走勢。”

目前,該公司在大馬有兩間麵粉廠,日產能約2千噸,廠房使用率60至70%。

該公司在海內外共有5間麵粉廠,除了國內兩間,印尼和越南各有1間和兩間,每年對外採購50萬噸的小麥供大馬及越南廠房處理,並對部份原料、匯率、物流進行護盤措施。

印尼麵粉廠首季轉盈

對於印尼聯營麵粉廠表現,他指出該廠已在今年第一季轉虧為盈,但接下來季度表現還需觀察,因目前市場已改變,波動已成為常態,令該業務存有許多不確定因素。

“雖然表現改善,但還需多幾個月觀察,確保獲利可持續,才進一步探討拓展印尼業務。”

該公司持有印尼麵粉聯營業務30%股權,廠房已全面使用。該廠於2014年8月開始投運,日產1千500噸。

養殖業務欠佳

養殖業務方面,鄭偉財指出,受水災及市場情緒謹慎影響,雞隻供應過剩導致售價下跌超過10%,令2015年表現欠佳。

不過,他坦言,受供需影響,目前還很難預測2016年養殖業產品的價格走勢。

“預計近期雞隻售價不會大幅度走跌,因受近期高溫氣候影響,供應及需求同步走跌。”

今年4月,雞隻售價走低至4令吉以下,但已在5月回揚,可是鄭偉財預見,即使進入齋戒月,雞隻需求將不如預期走揚,因人民對開齋節開銷將維持謹慎。

展望2016年,他認為麵粉及養殖業務為基礎食品,銷量料不會下跌,但售價及原料價格不在公司控制範圍,難以預測接下來業務表現。(星洲日報/財經) |

|

|

|

|

|

|

|

|

|

|

|

发表于 18-5-2016 05:18 AM

|

显示全部楼层

发表于 18-5-2016 05:18 AM

|

显示全部楼层

本帖最后由 icy97 于 20-5-2016 06:02 AM 编辑

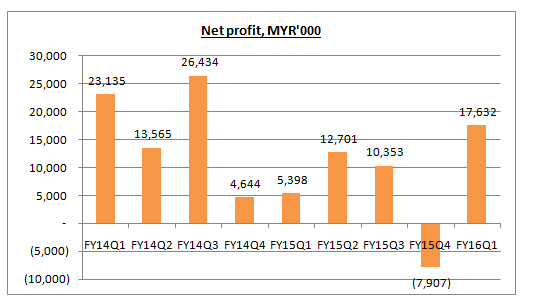

马面粉首季净利飙2.27倍

财经新闻 财经 2016-05-19 12:12

(吉隆坡18日讯)面粉和家禽综合业务赚幅走高,马面粉(MFLOUR,3662,主板消费产品股)截至3月31日首季业绩报捷,净利按年涨2.27倍,并激励今日股价扬升8.26%。

该公司首季净赚1763万2000令吉,远超上财年同期的539万8000令吉。

营业额则按年扬20%,至6亿6683万6000令吉。

马面粉指出,基于商品价格和外汇汇率持续波动,因此全球经济格局不明朗。

尽管面对不确定因素和激烈的市场竞争,不过,马面粉董事部估计今年表现仍会趋稳。【南洋网财经】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2016 | 31 Mar 2015 | 31 Mar 2016 | 31 Mar 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 666,836 | 556,060 | 666,836 | 556,060 | | 2 | Profit/(loss) before tax | 21,607 | 11,863 | 21,607 | 11,863 | | 3 | Profit/(loss) for the period | 17,268 | 7,826 | 17,268 | 7,826 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 17,632 | 5,398 | 17,632 | 5,398 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.20 | 1.00 | 3.20 | 1.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3700 | 1.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-6-2016 12:28 AM

|

显示全部楼层

发表于 3-6-2016 12:28 AM

|

显示全部楼层

Date of change | 29 May 2016 | Name | MR GEH CHENG HOOI | Age | 81 | Gender | Male | Nationality | Malaysia | Designation | Non Executive Director | Directorate | Independent and Non Executive | Type of change | Demised | Qualifications | He was a Chartered Accountant and also a Fellow of The Institute of Chartered Accountants of England and Wales (ICAEW) and a member of the Malaysian Institute of Certified Public Accountants (MICPA). | Working experience and occupation | After qualifying as a Chartered Accountant in the United Kingdom in 1959, he worked for Price Waterhouse, London as a qualified assistant in 1960/1961 before returning to Malaysia to join KPMG Peat Marwick (KPMG) in 1961. He was admitted as a partner in KPMG in 1964 and retired as senior partner in 1989. | Family relationship with any director and/or major shareholder of the listed issuer | Nil | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | Ordinary SharesIndirect interest - 1,679,000WarrantsIndirect interest - 252,000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-7-2016 02:46 AM

|

显示全部楼层

发表于 29-7-2016 02:46 AM

|

显示全部楼层

次季料重演佳绩.马面粉厂“股涨”

(吉隆坡27日讯)马面粉厂(MFLOUR,3662,主板消费品组)即将在下个月公布2016财政年第二季度业绩,投资者憧憬该公司重演首季佳绩,从而提振该公司股价上扬。

按年对比,该公司首季营业额及净利各涨19.92%及226.64%,管理层归功于面粉及家禽业务赚幅提高,并正面看待2016财政年展望。

目前,该公司面粉与家禽的营业额比例各为70.62%及29.38%。

值得注意的是,今年3月1日后,25公斤装的面粉津贴取消,而1公斤装的面粉津贴则维持不变。管理层正面看待政府相关措施,并认为面粉价格可依据市场供需来决定。

管理层也表示,大马2016年经济预期可取得4%至4.5%成长,消费者需求依旧强劲,预期公司业务也尾随成长。

股价:1令吉51仙

总股本:5亿5023万9000股

市值:8亿3086万890令吉

30天日均成交量:34万股

最新季度营业额:6亿6683万6000令吉

最新季度盈亏:净利1763万2000令吉

每股净资产:1令吉37仙

本益比:23.29倍

周息率:2.84%

大股东:郑伟志(音译)(18.23%)

文章来源:

星洲日报‧财经‧2016.07.28

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-8-2016 05:38 AM

|

显示全部楼层

发表于 3-8-2016 05:38 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | Acquisition of Additional Equity Interest in subsidiary, Dindings Poultry Processing Sdn Bhd | The Board of Directors of Malayan Flour Mills Berhad wishes to announce that the Company had on 2 August 2016 acquired an additional 1.19% equity interest in its subsidiary, Dindings Poultry Processing Sdn Bhd ("DPP") comprising 640,000 ordinary shares of RM1.00 each ("DPP Shares") from DGS Enterprise Sdn Bhd for a cash consideration of RM709,760 or at RM1.109 per DPP Share ("the Acquisition").

Please refer to the attachment for the details of the Acquisition.

This announcement is dated 2 August 2016. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5166249

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-8-2016 05:44 AM

|

显示全部楼层

发表于 18-8-2016 05:44 AM

|

显示全部楼层

本帖最后由 icy97 于 19-8-2016 03:56 AM 编辑

马面粉次季净利翻1.41倍

2016年8月19日

(吉隆坡18日讯)马面粉(MFLOUR,3662,主板消费产品股)截至6月杪次季净利按年猛涨1.41倍,净赚3064万5000令吉或每股净利5.57仙,高于上财年同期的1270万1000令吉或每股净利2.36仙。

营业额则按年扬13.55%,至6亿811万1000令吉,优于上财年同期的5亿3556万1000令吉.

累积首半年,净利按年猛涨1.66倍,至4827万7000令吉;营业额则升16.79%,报12亿7494万7000令吉。

尽管全球经济环境不确定,商品价格及外汇汇率波动,董事部预测2016财年表现持续正面。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2016 | 30 Jun 2015 | 30 Jun 2016 | 30 Jun 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 608,111 | 535,561 | 1,274,947 | 1,091,621 | | 2 | Profit/(loss) before tax | 39,873 | 15,496 | 61,480 | 27,359 | | 3 | Profit/(loss) for the period | 36,441 | 13,045 | 53,709 | 20,871 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 30,645 | 12,701 | 48,277 | 18,099 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.57 | 2.36 | 8.77 | 3.36 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.00 | 2.00 | 3.00 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4400 | 1.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-8-2016 05:45 AM

|

显示全部楼层

发表于 18-8-2016 05:45 AM

|

显示全部楼层

EX-date | 29 Aug 2016 | Entitlement date | 01 Sep 2016 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim Single Tier Dividend of 3.0 sen per ordinary share of RM0.50 sen | Period of interest payment | to | Financial Year End | 31 Dec 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 15 Sep 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 01 Sep 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit | 29 Aug 2016 | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.03 | Par Value | Malaysian Ringgit (MYR) 0.500 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-8-2016 02:15 PM

|

显示全部楼层

发表于 18-8-2016 02:15 PM

|

显示全部楼层

本帖最后由 icy97 于 18-8-2016 03:05 PM 编辑

Malayan Flour Mills Berhad - Good Day Ahead?

Author: RicheHo | Publish date: Mon, 25 Jul 2016, 11:22 AM

http://klse.i3investor.com/blogs/rhinvest/100671.jsp

Brief Background

MFLOUR is the pioneer wheat flour milling company in Malaysia, with operations located at Lumut and Pasir Gudang with a total milling capacity of 1,250 ton of wheat per day. Besides Malaysia, MFLOUR also have similar operations in both the Northern and Southern Vietnam.

Its business segments can be divided into two:

- Flour and trading in grains and other allied products

- Poultry integration

Products & Brands

Indonesia Venture

Back to year 2011, PT FKS Capital (Indonesia), Malayan Flour Mills (Malaysia) and Toyota Tsusho (Japan) had formed a partnership to create Indonesia’s newest flour milling company, PT Bungasari Flour Mills Indonesia, with 40%, 30% and 30% equity stake respectively.

Bungasari Flour Mills involved in the business of flour milling and distribution of flour products and by-products.

Bungasari Flour Mills began commercial production in the second half of year 2014 and is now producing 1,500 tonnes of flour per day. It is growing in Indonesia by catering to growing middle-income group with its large population base of 240 million.

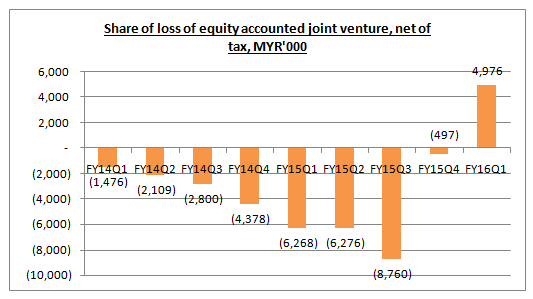

However, Bungsari Flour Mills was not doing well in FY14 and FY15 in term of financial result. Even though its revenue increased from MYR66m in FY14 to MYR392m in FY15, Bungsari Flour Mills still remained in the red due to lack of economies of scale in its operations and intense price war in FY15.

MFLOUR’s share of loss amounting to MYR21.8m was recorded in FY15, which was also the main factor for its underperforming result in FY15.

As extracted from its quarter report, MFLOUR had been hit by share of loss of Bungsari Flour Mills since FY14 and its losses were getting serious from quarter to quarter.

Having said so, Bungsari Flour Mills had finally turned over its result in FY16, by making profit for the first time. It was definitely a good sign for MFLOUR as Bungsari Flour Mills had started to contribute in FY16, as compared to a burden in FY14 and FY15.

MFLOUR expects to see sustainable profit growth for the remaining quarters in FY16 from its joint-venture business in Indonesia.

Indonesia Flour Industry

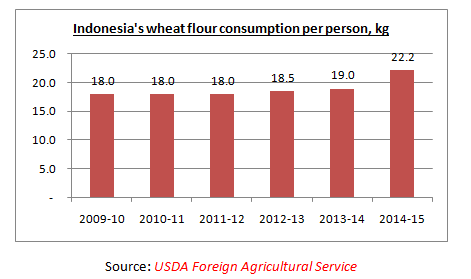

Indonesia’s wheat flour consumption per person had increased significantly in 2014-15, from 19kg to 22.2kg. Nowadays, relatively stable macro-economic conditions in Indonesia have allowed middle and upper-middle income consumers to diversify their diets to include more western-style foods like bread and pasta. Rather than eating rice three daily meals, many Indonesians have switched to eating bread or noodles for breakfast.

Instant noodle prices are currently cheaper than rice, and many more lower and middle income consumers substitute instant noodles for breakfast or dinner. As a result, the noodle industry continues to grow rapidly, consuming 70% of Indonesia’s wheat flour. Bakery industry consumption follows with 20% of flour, while household and commercial biscuit producers each consume 10%, respectively.

The single main driver of rising wheat consumption in Indonesia is the growing popularity of instant noodles. FYI, Indonesia is the second-biggest market for instant noodles and home to the world’s largest instant noodle producer, Indofood Sukses Makmur.

Due to the fact that sales of wheat-based foods rely to a large extent on middle class consumers, the growth of the wheat flour market in Indonesia is a force to be reckoned with for years to come.

Bungsari Flour Mill is expected to benefit from the current trend in Indonesia and indirectly contribute to MFLOUR’s financial result.

Source: http://www.world-grain.com/

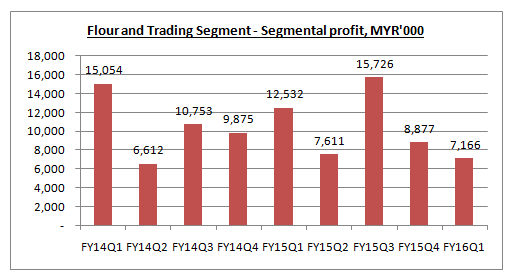

In FY15, flours & trading segment and poultry segment contributed 68% and 32% to the Group’s revenue respectively.

In term of segmental profit, flours & trading segment was still the largest contributor 60%, while poultry segment contributed the remaining 40%.

Flour & Trading Segment

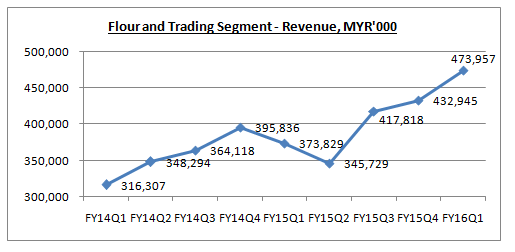

Back to its own business in Malaysia, MFLOUR’s flour & trading segment was growing in FY14 and FY15.

Its revenue from this segment had increased significantly in FY15, which contributed from higher sales volume of flour and grains. Currently, it is still on a very strong growth momentum.

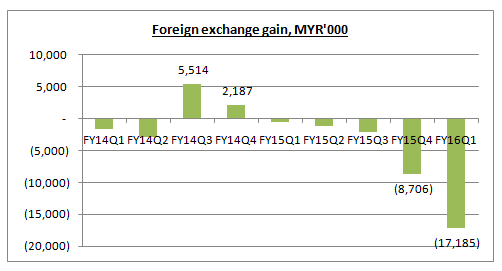

However, despite excellent result in revenue, its profit from this segment had seems to be flat and reducing. According to its explanation in quarter report, MFLOUR was heavily hit by unrealized loss on foreign currency in recent quarters.

As extracted from its quarter report, MFLOUR had accounted foreign exchange loss of MYR8.7m and MYR17.2m in FY15Q4 and FY16Q1 respectively! It was a very heavy impact for MFLOUR. If these two foreign exchange losses can be excluded from its result, initially MFLOUR’s segmental profit in FY15Q4 and FY16Q1 will be MYR17.6m and MYR24.3m respectively, a new high over the past two years.

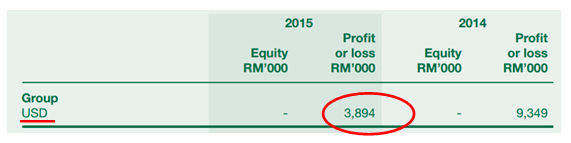

MFLOUR are exposed to foreign currency risk on sales, purchases and borrowings that are denominated in foreign currency, primarily USD. Regarding on its revenue geographical segment, it was not disclosed in MFLOUR’s annual report.

Based on its currency sensitivity analysis, for every strengthening of MYR against USD by 5%, MFLOUR will have a gain of MYR3.89m. It was because MFLOUR has a borrowing denominated in USD which worth up to MYR423m. So, theoretically MFLOUR is a beneficiary of strengthening of MYR.

However, during FY16Q1 USD/MYR had dropped from 4.20 to lowest 3.80, what is the factor behind the huge amount of foreign exchange loss? It is a big question mark.

I believe this foreign currency loss can be reduced or wiped off in the next quarter, as long as USD/MYR stabilizes and no longer that volatile.

Poultry Segment

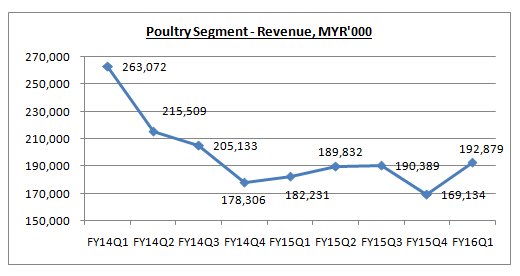

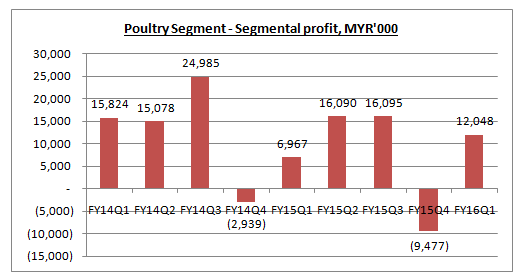

MFLOUR’s revenue from poultry segment had dropped by 15% in FY15, which mainly due to lower sales volume.

In term of margin, MFLOUR was highly depended on the live bird selling price. As in FY15Q4, the loss making of MYR9.5m from this segment was due to lower live bird selling price coupled with higher costs giving. As in FY16Q1, MFLOUR was contributed from higher live bird selling price giving rise to higher margin.

Currently, there is no excitement in MFLOUR’s poultry segment. However, in the long run, MFLOUR is in a well-positioned to benefit from the synergies derived from an integrated poultry business and the Group is working on further expansion in this segment.

As part of the expansion, in FY15 MFLOUR had increased stake in its subsidiaries, Dindings Poultry Processing and Dindings Soya & Multifeeds.

Leasing and Acquisition

In Oct 2015, MFLOUR had proposed to lease 3 pieces of land, measuring 200 acres in Lumut, Perak for MYR2.53m. The payment will be satisfied by the issuance of 1.96 million new shares, at an issue price of MYR1.29 per share.

Besides, MFLOUR also proposed to lease another 3 pieces of land, measuring 464.96 acres in Pengkalan Baru, Perak for MYR4.65mn, to be satisfied by the issuance of 3.6 million new shares at an issue price of MYR1.29 per share.

FYI, MFLOUR had been operating on the above mentioned lands for the past 25 years and 22 years respectively. The lease period of the 6 lands are for 30 years, with automatic renewal of another 30 years.

MFLOUR also plans to acquire 2.96% and 17.55% of the equity interest in Dindings Poultry Processing and Dindings Soya & Multifeeds respectively, for a combined MYR8.32m or MYR1.29 per share.

The acquisition of Dindings Poultry Processing will see MFLOUR’s stake increasing from 94.74% to 97.7%; while its stake in Dindings Soya & Multifeeds will increase from 70.21% to 87.76%.

The land leasing and acquisition above involved a total consideration of MYR15.49m which was satisfied by issuance of 12.01m new shares at an issue price of MYR1.29 per ordinary share. The new shares were listed and quoted on the Main Market of Bursa Malaysia on 5 Jan 2016.

According to MFLOUR, the proposed leasing of lands are mainly for the poultry integration business of the group, while the proposed acquisitions will facilitate the group’s aspiration to further expand its poultry integration business.

Overall, the additional profit from the stake of 2.96% in Dindings Poultry Processing and 17.55% in Dindings Soya & Multifeeds will be accounted into MFLOUR financial result from FY16 onwards.

Valuation

MFLOUR’s net profit over the past 13 quarters was as below:

FY16Q1 marked the first time where Bungsari Flour Mill started to contribute positively to the Group, however MFLOUR was hit by MYR17m foreign currency loss in that quarter too. In other words, if the foreign currency loss can be neglected, MFLOUR supposingly can deliver MYR34m net profit in FY16Q1.

The Bungsari Flour Mill had just started to bear fruit and it definitely will not be one-time off positive contribution only. Currently, USD/MYR had stabilized around 3.95 to 4.05, so foreign currency loss is expected to reduce and minimize in the remaining FY16.

So, let’s assume MFLOUR’s net profit is able to hit MYR100m in FY16 (MYR25m each quarter averagely). Based on its outstanding shares of 550.24m, MFLOUR’s earnings per share will be 18.17 cent.

With an estimated PE of 10-12x, MFLOUR will have an intrinsic value between MYR1.82 and MYR2.18. Based on its current share price MYR1.41, MFLOUR will have more than 25% potential upside.

Conclusion

In Mar 2016, the wheat flour subsidy for 25kg bag flour had been removed by the Government. This is a positive move towards a free market environment where the selling price of wheat flour will be based on market supply and demand.

Other than that, MFLOUR wishes that the government would remove the subsidy for 1kg bags of wheat flour too, so as to promote a free market in flour trading.

MFLOUR will be benefited from this removal of subsidy as it is able to price its products at a premium price.

Overall, MFLOUR’s flour sales volume was doing good and showing improvement from quarter to quarter. The only concern for MFLOUR is the foreign exchange risk. As long as USD/MYR can be stabilized, the huge amount of foreign exchange losses can be reduced.

Besides, its 30% equity stake in Bungasari Flour Mills had finally made profit for the first time. In addition with the strong consumption rate in Indonesia, Bungasari Flour Mills is expected to contribute positively and continuously to MFLOUR.

As for its poultry segment, there is no excitement. MFLOUR’s profit from this segment is highly depends on living bird price. Do take note that, the additional profit from the stake of 2.96% in Dindings Poultry Processing and 17.55% in Dindings Soya & Multifeeds will be accounted into MFLOUR financial result from FY16 onwards. It is considered a small positive note for MFLOUR.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-11-2016 07:18 PM

|

显示全部楼层

发表于 17-11-2016 07:18 PM

|

显示全部楼层

本帖最后由 icy97 于 17-11-2016 08:45 PM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2016 | 30 Sep 2015 | 30 Sep 2016 | 30 Sep 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 610,865 | 608,207 | 1,885,812 | 1,699,828 | | 2 | Profit/(loss) before tax | 15,307 | 20,954 | 76,787 | 48,313 | | 3 | Profit/(loss) for the period | 13,866 | 15,343 | 67,575 | 36,214 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 13,828 | 10,353 | 62,105 | 28,452 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.51 | 1.92 | 11.29 | 5.29 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 3.00 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4500 | 1.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-12-2016 07:06 AM

|

显示全部楼层

发表于 17-12-2016 07:06 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | Transfer of Land from Semakin Dinamik Sdn Bhd to Dindings Poultry Development Centre Sdn Bhd | The Board of Directors of Malayan Flour Mills Berhad (“MFM” or “Company”) wishes to announce that as part of the restructuring scheme of MFM Group, Dindings Poultry Development Centre Sdn Bhd (“DPDC”) had on 15 December 2016 entered into a Sale and Purchase Agreement (“Agreement”) with Semakin Dinamik Sdn Bhd (“SD”) to acquire a piece of land held under H.S.(M) 15129, Lot No. 21255, Mukim Sri Gading, Daerah Batu Pahat, Negeri Johor (“the Land Transfer”) at the consideration of RM2,200,000 which was wholly satisfied by the issuance and allotment of 2,200,000 new ordinary shares of RM1.00 in DPDC to MFM, being the sole shareholder of SD, on 16 December 2016 based on the issue price of RM1.00 per ordinary share.

Please refer to the attachement for the details of the Land Transfer.

This announcement is dated 16 December 2016. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5292033

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-1-2017 04:33 AM

|

显示全部楼层

发表于 19-1-2017 04:33 AM

|

显示全部楼层

本帖最后由 icy97 于 22-1-2017 06:32 AM 编辑

马面粉设子公司Aviota

增强数码业务

2017年1月22日

(吉隆坡21日讯)于去年12月29日成立的Aviota私人有限公司,正式成为马面粉(MFLOUR,3662,主板贸服股)独资子公司。

马面粉向马交所报备,Aviota将从上周起,已成为其独资子公司。

Aviota的注册资本为40万令吉,共有40万股,每股1令吉。至于已发行与缴足股本则为2令吉,共有2股。

Aviota的主要业务,是研发硬件、软件、建模和业务流程重组工程,以增强全面数码业务。

马面粉表示,成立Aviota对公司2017财的盈利和净资产,没有显着影响。【e南洋】

Type | Announcement | Subject | OTHERS | Description | Incorporation of a wholly-owned subsidiary - Aviota Sdn Bhd | Malayan Flour Mills Berhad ("MFM") wishes to announce the incorporation of Aviota Sdn Bhd ("Aviota") on 29 December 2016. Subsequently, on 18 January 2017, Aviota is wholly-owned by MFM.

The authorised share capital of Aviota is RM400,000.00, divided into 400,000 ordinary shares of RM1.00 each (Shares) with an issued and paid-up share capital of RM2.00, divided into 2 Shares. The intended principal activity of Aviota is to develop hardware, software, modeling and business process reengineering capabilities to deliver comprehensive digital business enhancements.

The incorporation of Aviota is not expected to have any material effect on the earnings or net assets of MFM for the financial year ending 31 December 2017.

None of the directors or substantial shareholders of MFM or persons connected to them has any interest, direct or indirect, in the said incorporation.

This announcement is dated 18 January 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-2-2017 05:42 AM

|

显示全部楼层

发表于 16-2-2017 05:42 AM

|

显示全部楼层

Date of change | 15 Feb 2017 | Name | TAN SRI MOHD SIDEK BIN HAJI HASSAN | Age | 65 | Gender | Male | Nationality | Malaysia | Designation | Director | Directorate | Independent and Non Executive | Type of change | Resignation | Reason | Petroliam Nasional Berhad (PETRONAS) has decided its Chairman to be exclusive to it, and therefore is restricted from sitting on the Board of other Public Listed Company in Malaysia except on the Board of Government Linked Companies, as a nominee of the Government. In view thereof, Tan Sri Mohd Sidek bin Haji Hassan, the Chairman of PETRONAS has resigned from Malayan Flour Mills Berhad. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-2-2017 04:56 AM

|

显示全部楼层

发表于 27-2-2017 04:56 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2016 | 31 Dec 2015 | 31 Dec 2016 | 31 Dec 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 649,339 | 602,079 | 2,538,686 | 2,301,907 | | 2 | Profit/(loss) before tax | 31,519 | -4,439 | 108,306 | 43,874 | | 3 | Profit/(loss) for the period | 22,372 | -6,810 | 89,947 | 29,404 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 15,717 | -7,907 | 77,822 | 20,545 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.86 | -1.47 | 14.14 | 3.82 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.50 | 2.00 | 6.50 | 4.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.5100 | 1.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-2-2017 05:10 AM

|

显示全部楼层

发表于 27-2-2017 05:10 AM

|

显示全部楼层

EX-date | 08 Mar 2017 | Entitlement date | 10 Mar 2017 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Second Interim Single Tier Dividend of 3.5 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Dec 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaTel: 03 78490777Fax: 03 78418151 | Payment date | 24 Mar 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 10 Mar 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit | 08 Mar 2017 | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.035 | Par Value | Malaysian Ringgit (MYR) 0.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-4-2017 02:32 AM

|

显示全部楼层

发表于 8-4-2017 02:32 AM

|

显示全部楼层

Expiry/Maturity of the securities| MALAYAN FLOUR MILLS BERHAD |

Instrument Category | Securities of PLC | Instrument Type | Warrants | Type Of Expiry | Expiry/Maturity of the securities | Mode of Satisfaction of Exercise/Conversion price | Cash | Exercise/ Strike/ Conversion Price | Malaysian Ringgit (MYR) 2.0600 | Exercise/ Conversion Ratio | 1:1 | Settlement Type / Convertible into | Physical (Shares) | Last Date & Time of Trading | 19 Apr 2017 05:00 PM | Date & Time of Suspension | 20 Apr 2017 09:00 AM | Last Date & Time for Transfer into Depositor's CDS a/c | 02 May 2017 04:00 PM | Date & Time of Expiry | 09 May 2017 05:00 PM | Date & Time for Delisting | 11 May 2017 09:00 AM |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5388641

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|