|

|

发表于 17-8-2018 06:41 AM

|

显示全部楼层

发表于 17-8-2018 06:41 AM

|

显示全部楼层

本帖最后由 icy97 于 17-8-2018 07:09 AM 编辑

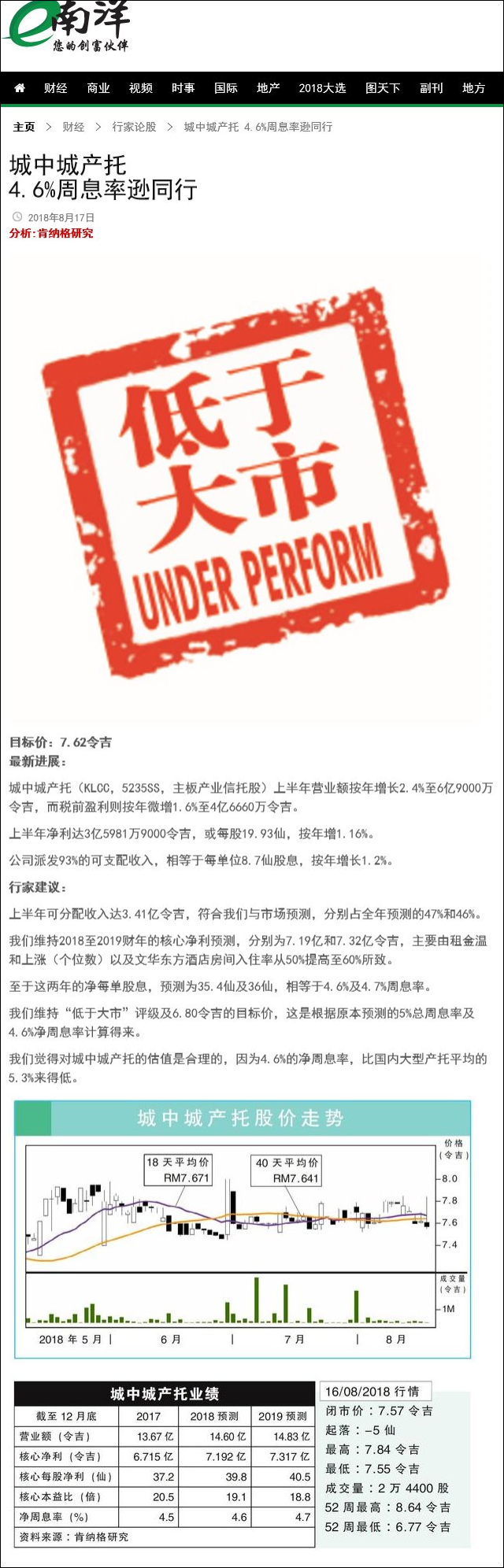

业绩表现无大惊喜 KLCC產託先涨后跌

財经 最后更新 2018年08月16日 20时59分

(吉隆坡16日讯)儘管KLCC產业信托(KLCC,5235SS,主板房產信托股)的业绩表现没太大惊喜,基本符合分析员预期,该股今日先涨后跌,早盘一度劲扬22仙或2.89%,至7.84令吉,挤身3大上升股,但午盘却由升转跌。

KLCC產业信托今早开市后衝高,但后劲乏力,最终收在7.57令吉,跌5仙或0.66%。

KLCC產业信託2018財政年次季(截至6月30日止)净利按年增长0.67%,至1亿7915万令吉;营收按年起2.2%,至3亿4500万令吉。

上半年而言,该公司的净利按年起1.45%,至3亿5982万令吉;营收增长2.4%,至6亿9011万令吉。该公司的酒店业务亏损扩大,共亏410万令吉,去年同期亏损167万令吉。

文华酒店表现疲软

文华酒店因更高的折旧费,及5月份大选结束后,大型活动减少,而交出疲软的业绩。

马银行投行认为,在竞爭激烈的环境下,该酒店未来预计面对更多挑战。

不过,丰隆投行分析员却预计,旗下酒店第2阶段的翻新计划將在第3季结束,之后会开始作出贡献。

该公司的主要零售资產--吉隆坡阳光广场(Suria KLCC),目前的出租率高企于97%。管理层预计,租金调涨率將会在1%至2%之间。

此外,该公司的办公楼出租率达到100%。

艾芬黄氏分析员认为,整体而言,该公司的资產已经来到成熟期,他预计接下来3年,公司的盈利成长將持平在1%至3%之间。

「以2019財政年预估5.1%的週息率,该公司目前的估值相比歷史记录看似合理。」

该公司在4月时获得股东同意,配售最多10%的股权。该公司旗下的大地宏图大厦(Menara Daya bumi)的第3阶段发展仍在招標中,管理层打算先锁定主要租户。

该大楼的第3阶段发展计划,预计在2021年和2022年期间完工。Lot 185和Lot M目前还在发展中,预计竣工日期在2022年,短期內料不会注入公司资產组合中。

【东方网财经】

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-9-2018 07:15 AM

|

显示全部楼层

发表于 9-9-2018 07:15 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-11-2018 03:52 AM

|

显示全部楼层

发表于 27-11-2018 03:52 AM

|

显示全部楼层

本帖最后由 icy97 于 13-12-2018 08:24 AM 编辑

办公楼出租率企稳-城中城产托第三季派息8.7仙

http://www.enanyang.my/news/20181114/办公楼出租率企稳br-城中城产托第三季派息8-7仙/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 349,480 | 340,503 | 1,039,593 | 1,014,679 | | 2 | Profit/(loss) before tax | 234,516 | 233,058 | 701,138 | 692,515 | | 3 | Profit/(loss) for the period | 209,950 | 205,105 | 624,835 | 613,390 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 181,434 | 177,701 | 541,253 | 532,384 | | 5 | Basic earnings/(loss) per share (Subunit) | 10.05 | 9.84 | 29.98 | 29.49 | | 6 | Proposed/Declared dividend per share (Subunit) | 8.70 | 8.60 | 26.10 | 26.80 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 7.2400 | 7.2200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-11-2018 03:53 AM

|

显示全部楼层

发表于 27-11-2018 03:53 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-11-2018 03:53 AM

|

显示全部楼层

发表于 27-11-2018 03:53 AM

|

显示全部楼层

| KLCC PROPERTY HOLDINGS BERHAD |

EX-date | 28 Nov 2018 | Entitlement date | 30 Nov 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | A Third Interim Dividend of 2.99 sen per ordinary share, tax exempt under single tier system. | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 28 Dec 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 30 Nov 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0299 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-11-2018 03:55 AM

|

显示全部楼层

发表于 27-11-2018 03:55 AM

|

显示全部楼层

| KLCC REAL ESTATE INVESTMENT TRUST |

EX-date | 28 Nov 2018 | Entitlement date | 30 Nov 2018 | Entitlement time | 05:00 PM | Entitlement subject | Income Distribution | Entitlement description | A Third Interim Income Distribution of 5.71 sen (taxable) | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 28 Dec 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 30 Nov 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0571 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-12-2018 07:16 AM

|

显示全部楼层

发表于 14-12-2018 07:16 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 16-1-2019 05:33 AM

|

显示全部楼层

发表于 16-1-2019 05:33 AM

|

显示全部楼层

本帖最后由 icy97 于 19-1-2019 04:01 AM 编辑

阿末尼占任城中城产托主席

http://www.enanyang.my/news/20181222/阿末尼占任城中城产托主席/

Date of change | 21 Dec 2018 | Name | DATUK AHMAD NIZAM BIN SALLEH | Age | 62 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Non Independent and Non Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Business Administration | Ohio University | | | 2 | Others | Advanced Management Program | The Wharton School, University of Pennsylvania | |

Working experience and occupation | August 2018 - present :Chairman of PETRONAS2016 - July 2018: Director of WZ Satu Berhad2010 - 2016 :Managing Director / CEO Engen Limited, South Africa2007 - 2010 :Vice President, Corporate Services PETRONAS2004 - 2007 :Managing Director / CEO Malaysia LNG Group of Companies, PETRONAS2002 - 2004 :Senior General Manager Group Treasury, PETRONAS1999 - 2002 :Senior General Manager Crude Oil Group, PETRONAS1997 - 1999 :General Manager Malaysia Crude Oil Marketing Division, PETRONAS1991 - 1995 :Deputy Project Director, LNG 2 Project PETRONAS1988 - 1991 :Head of Projects, Tender & Contract Division PETRONAS1986 - 1988 :Project Coordinator Implementation & Coordination Unit, PETRONAS1981 - 1986 :Held various positions in PETRONAS and its group including Economic and Investment Evaluation Department, Gas Development Division, Commercial Division PETRONAS Gas Berhad, Project Management Team PGU 1 and II projects | Directorships in public companies and listed issuers (if any) | 1. Petroliam Nasional Berhad |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-2-2019 03:46 AM

|

显示全部楼层

发表于 8-2-2019 03:46 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 366,348 | 352,072 | 1,405,941 | 1,366,751 | | 2 | Profit/(loss) before tax | 262,955 | 422,816 | 964,093 | 1,115,331 | | 3 | Profit/(loss) for the period | 214,085 | 400,175 | 838,920 | 1,013,565 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 183,661 | 345,516 | 724,914 | 877,900 | | 5 | Basic earnings/(loss) per share (Subunit) | 10.17 | 19.14 | 40.15 | 48.63 | | 6 | Proposed/Declared dividend per share (Subunit) | 10.90 | 10.35 | 37.00 | 36.15 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 7.2500 | 7.2200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-2-2019 03:50 AM

|

显示全部楼层

发表于 8-2-2019 03:50 AM

|

显示全部楼层

EX-date | 11 Feb 2019 | Entitlement date | 13 Feb 2019 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | A Fourth Interim Dividend of 4.63 sen per ordinary share, tax exempt under single tier system. | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 28 Feb 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 13 Feb 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0463 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-2-2019 03:52 AM

|

显示全部楼层

发表于 8-2-2019 03:52 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Revaluation of Properties | The Board of Directors of KLCC Property Holdings Berhad (“KLCCP”) wishes to announce that a revaluation exercise was conducted on the investment properties which are being held by KLCCP's subsidiaries and KLCC Real Estate Investment Trust ("KLCC REIT") [collectively known as KLCCP Stapled Group"] for long term investment purposes.

Further details of the valuation are provided in the attachment below. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6044341

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-2-2019 03:55 AM

|

显示全部楼层

发表于 8-2-2019 03:55 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 8-2-2019 03:56 AM

|

显示全部楼层

发表于 8-2-2019 03:56 AM

|

显示全部楼层

EX-date | 11 Feb 2019 | Entitlement date | 13 Feb 2019 | Entitlement time | 05:00 PM | Entitlement subject | Income Distribution | Entitlement description | A Fourth Interim Income Distribution of 6.27 sen per unit (of which 3.89 sen is taxable and 2.38 sen is non-taxable). | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 28 Feb 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 13 Feb 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0627 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-6-2019 07:01 AM

|

显示全部楼层

发表于 18-6-2019 07:01 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 353,446 | 345,112 | 353,446 | 345,112 | | 2 | Profit/(loss) before tax | 239,595 | 233,887 | 239,595 | 233,887 | | 3 | Profit/(loss) for the period | 212,630 | 208,672 | 212,630 | 208,672 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 183,958 | 180,671 | 183,958 | 180,671 | | 5 | Basic earnings/(loss) per share (Subunit) | 10.19 | 10.01 | 10.19 | 10.01 | | 6 | Proposed/Declared dividend per share (Subunit) | 8.80 | 8.70 | 8.80 | 8.70 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 7.2500 | 7.2500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-6-2019 07:02 AM

|

显示全部楼层

发表于 18-6-2019 07:02 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 18-6-2019 07:03 AM

|

显示全部楼层

发表于 18-6-2019 07:03 AM

|

显示全部楼层

| KLCC PROPERTY HOLDINGS BERHAD |

EX-date | 23 May 2019 | Entitlement date | 24 May 2019 | Entitlement time | 05:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | A First Interim Dividend of 2.52 sen per ordinary share, tax exempt under single tier system. | Period of interest payment | to | Financial Year End | 31 Dec 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 20 Jun 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 24 May 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0252 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-6-2019 07:04 AM

|

显示全部楼层

发表于 18-6-2019 07:04 AM

|

显示全部楼层

| KLCC REAL ESTATE INVESTMENT TRUST |

EX-date | 23 May 2019 | Entitlement date | 24 May 2019 | Entitlement time | 05:00 PM | Entitlement subject | Income Distribution | Entitlement description | A First Interim Income Distribution of 6.28 sen (taxable) | Period of interest payment | to | Financial Year End | 31 Dec 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 20 Jun 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 24 May 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0628 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-8-2019 06:26 AM

|

显示全部楼层

发表于 21-8-2019 06:26 AM

|

显示全部楼层

本帖最后由 icy97 于 21-8-2019 08:24 AM 编辑

城中城产托次季派息8.80仙

https://www.enanyang.my/news/20190820/城中城产托次季派息8-80仙/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 351,093 | 345,001 | 704,539 | 690,113 | | 2 | Profit/(loss) before tax | 234,022 | 232,735 | 473,617 | 466,622 | | 3 | Profit/(loss) for the period | 207,696 | 206,213 | 420,326 | 414,885 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 180,376 | 179,148 | 364,334 | 359,819 | | 5 | Basic earnings/(loss) per share (Subunit) | 9.99 | 9.92 | 20.18 | 19.93 | | 6 | Proposed/Declared dividend per share (Subunit) | 8.80 | 8.70 | 17.60 | 17.40 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 7.2600 | 7.2500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-8-2019 06:28 AM

|

显示全部楼层

发表于 21-8-2019 06:28 AM

|

显示全部楼层

| KLCC PROPERTY HOLDINGS BERHAD |

EX-date | 06 Sep 2019 | Entitlement date | 10 Sep 2019 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | A Second Interim Dividend of 2.57 sen per ordinary share, tax exempt under single tier system. | Period of interest payment | to | Financial Year End | 31 Dec 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 04 Oct 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 10 Sep 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0257 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-8-2019 06:32 AM

|

显示全部楼层

发表于 21-8-2019 06:32 AM

|

显示全部楼层

| KLCC REAL ESTATE INVESTMENT TRUST |

EX-date | 06 Sep 2019 | Entitlement date | 10 Sep 2019 | Entitlement time | 05:00 PM | Entitlement subject | Income Distribution | Entitlement description | A Second Interim Income Distribution of 6.23 sen (taxable) | Period of interest payment | to | Financial Year End | 31 Dec 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 04 Oct 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 10 Sep 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0623 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|