|

|

【PESTEC 5219 交流专区】(前名 PESTECH)

[复制链接]

[复制链接]

|

|

|

发表于 22-12-2017 06:38 AM

|

显示全部楼层

发表于 22-12-2017 06:38 AM

|

显示全部楼层

Pestech国际

柬国合约贡献大

2017年12月21日

分析:肯纳格投行研究

目标价:2令吉

最新进展

Pestech国际(PESTECH,5219 ,主板贸服股)独资子公司Pestech柬埔寨,获当地Schneitec有限公司颁发总值2600万美元(约1亿610万令吉)的合约,负责电线与变电站工程。

根据合约,该子公司将负责完成3项目,包括从柬埔寨北部的奧多棉吉省,至暹粒市的75公里左右双向电线,以及分别在奧多棉吉省和Bek Chan区兴建一座变电站。

行家建议

柬埔寨成为Pestech国际的营收增长主要来源,该公司在今年共获3项目,总值2亿3600万令吉。

虽然如此,我们仍维持2019财年财测,因为上述柬埔寨合约在我们预测内。

该合约能提振2019年营业额至6亿令吉,低于我们7亿令吉预测,意味着还需要1亿令吉合约才能达到我们2019财年的预估。

另一方面,该公司经营和转移(BOT)业务下的Diamond Power项目在今年10月起营运后,将在明年1月起,贡献长达25年的经常收入。

此外,在收购Colas铁路系统工程私人有限公司(CRSE公司)100%股权后,该公司提高在其他项目的竞标优势,如金马士-新山双线铁路等。

我们重申“超越大市”投资评级,维持2令吉的目标价。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 25-12-2017 06:32 AM

|

显示全部楼层

发表于 25-12-2017 06:32 AM

|

显示全部楼层

本帖最后由 icy97 于 26-12-2017 03:37 AM 编辑

Pestech子公司申请柬国上市

2017年12月24日

(吉隆坡23日讯)Pestech国际(PESTECH,5219 ,主板贸服股)计划将旗下Pestech(柬埔寨)有限公司,挂牌在柬埔寨证券交易所主板。

Pestech国际向交易税报备,Pestech(柬埔寨)已经向柬埔寨的证券与交易委员会和交易所提出上市申请。

随着挂牌上市,Pestech国际在Pestech(柬埔寨)的持股率,将被稀释最多39%。

惟上市后,Pestech国际将继续是Pestech(柬埔寨)的控制股东。

该公司计划通过首次公开募股发售最多3900万股普通股,相等于是扩大后缴足股本的39%。【e南洋】

Type | Announcement | Subject | OTHERS | Description | PESTECH INTERNATIONAL BERHAD ("PIB" OR "COMPANY") PROPOSED LISTING OF PESTECH (CAMBODIA) LIMITED (PCL), AN INDIRECT WHOLLY-OWNED SUBSIDIARY OF PIB ON THE MAIN BOARD OF CAMBODIA SECURITIES EXCHANGE ("CSX") ("PROPOSED LISTING") | We refer to the Company’s announcement dated 25 February 2016 in relation to the Proposed Listing.

On behalf of the Board of Directors of PIB, RHB Investment Bank Berhad is pleased to announce that the Company proposes to list PCL on the Main Board of CSX. The applications to the Securities and Exchange Commission of Cambodia and CSX in relation to the Proposed Listing have been submitted on 22 December 2017. Further details of the Proposed Listing are set out in the attachment.

This announcement is dated 22 December 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5646797

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-12-2017 02:48 AM

|

显示全部楼层

发表于 27-12-2017 02:48 AM

|

显示全部楼层

本帖最后由 icy97 于 27-12-2017 06:10 AM 编辑

PESTECH国际 – RM2.00不是梦

PESTECH创办于1991年,在2012年上市于大马主要板,旗下业务主要涉足电力输送系统的工程及解决方案服务领域。目前,集团已是一家成熟的本地综合电力技术企业,为国内外的电力公司提供电力传输设备的EPCC工程。

基于业务性质,PESTECH依赖于电力需求来推动变电站的建设数量,以应付电力负荷的增加。电力需求越高,变电站的数量越多,而集团获得承包合约的机率将更高。近几年来,东盟地区的经济增长带动发展型国家的电力基础设施建设。作为电力基础设施供应商,PESTECH旗下所有业务皆取得稳步增长。

回顾2015年,集团通过持股60%子公司Diamond Power,在柬埔寨获得一项电力输送站的25年特许经营权BOT合约,为集团基础打下一个重要的里程碑。整个工程已在2015年6月开始,并已在今年11月底竣工。

PESTECH可从中取得2项盈利收入来源,即一次性EPC工程 ,以及通过管理资产的25年期经常收入。集团在建设完毕后将负责经营这输电系统长达25年。在期间,Diamond Power将操作和维护整个电力传输系统,使系统能够平稳地运作而不受任何干扰。

根据协议,Diamond Power从预定商业运作日期开始,每年可获得经常性收入,如下:

> 2017年11月启动后的首3年 – 每年可获得USD12.3m或者RM50m

> 从第4年起直到2042年11月 – 每年可获得USD18.2m获得RM75m

据了解,这输电项目享有9年的零征税,而柬埔寨的法定企业税是20%。因此,在扣除营运费用后,Diamond Power在首3年免税期里预计每年可取得约USD9m的盈利。

另一方面,PESTECH计划在2018年将100%持有子公司Pestech (Cambodia) 在柬埔寨交易所挂牌上市。这家子公司成立于2010年,主要业务为兴建电力配电站和传输线,专注于电力需求旺盛的寮国和缅甸的电气化工作

这项上市计划有助PESTECH释放子公司的投资价值,并寻求更多区域增长机会,以及可通过柬埔寨资本市场筹资,从而为接下来的增长铺路。完成上市后,PESTECH将持有柬埔寨上市子公司的61%股权,其余39%股权由当地投资者持有。值得一提,Pestech (Cambodia) 在FY17净赚USD6.55m或RM27.5m,占集团整体盈利约30%。

此外,PESTECH在2014年进军铁路电气化业务。目前,集团负责KTM旗下巴生谷双线铁路的相关系统工程,以及参与东海岸双轨铁路计划ECRL的铁路电气化工程竞标。至今,泰国其他地区仍有火车使用柴油驱动。一旦政府逐步改用电气驱动,未来发展潜能备受看好,而PESTECH处于非常有力的位置竞标这些合约。

在今年11月,PESTECH以RM10.4m收购CRSE的100%股权。这家公司是法国Colas铁路的子公司,在大马从事跌路电子和机械相关项目的EPCC工程。PESTECH早前在竞标MRT2项目电气工程时败给CRSE。随着这项收购,MRT2项目已成为集团持有,同时也提高其他项目的竞标优势,如隆新高铁、金马士-新山双线铁路及东海岸铁路。

展望未来,PESTECH将积极拓展东南亚国家的业务,其中以印尼和菲律宾为主要焦点。东盟拥有大约625m人口,是全球第三大市场。然而,在东盟的一些国家,电力、水源、铁路和道路等基础设施仍然不足以应付当地的人口。

东盟的其中一个主要基础措施是ASEAN Power Grid,目的是在邻国之间建立电力输送线,以相互接连电力系统。这一举措的目标是降低东盟国家对于电力项目支出的要求,并减少东盟国家对国外燃料来源的依赖。电力需求高的国家可以以合理的价格向邻国购买电力,而电力资源丰富的国家可以通过售电获得收入。简短来说,东盟区域电力和铁路的基础设施发展潜能有望为PESTECH带来各种高价值项目。

PESTECH放眼在2020之前创下RM1b的营业额记录,其中一半来自传统电力传输业务,其余则来自铁路电气化业务。管理层有信心PESTECH的业绩表现可在FY18再创新高。

截至今年9月,集团持有RM1.4b的合约在手,可支撑未来2年的业绩。PESTECH在今年一共获得RM989m的新合约,而目前竞标项目则高达RM2.75b。

从技术图表来看,PESTECH自从在2015年经历一波牛市后,其股价在过去两年几乎没有任何动静,处于横摆巩固格局。虽然不知还要等多久,但是本专页认为PESTECH目前已具备突破的条件。拭目以待!

RH Research |

|

|

|

|

|

|

|

|

|

|

|

发表于 24-2-2018 05:24 AM

|

显示全部楼层

发表于 24-2-2018 05:24 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 277,960 | 119,941 | 462,838 | 222,768 | | 2 | Profit/(loss) before tax | 36,822 | 23,914 | 57,292 | 43,695 | | 3 | Profit/(loss) for the period | 28,496 | 22,229 | 46,693 | 41,273 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 22,170 | 13,159 | 33,270 | 25,100 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.90 | 1.76 | 4.36 | 3.36 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6498 | 0.6083

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-3-2018 06:45 AM

|

显示全部楼层

发表于 15-3-2018 06:45 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PESTECH INTERNATIONAL BERHAD ("PESTECH" OR "THE COMPANY") - RE-ORGANISATION OF GROUP STRUCTURE | Pursuant to Paragraph 9.19(5) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, PESTECH wishes to announce that the Company had on 14 March 2018 received notification that the Ministry of Commerce of Cambodia had approved the transfer of 1,000 shares with par value of United States Dollar 1.00 per share in PESTECH (Cambodia) Limited ("PCL"), representing the entire registered capital of PCL, from PESTECH Sdn. Bhd. (“PSB”), a wholly-owned subsidiary of the Company, to PESTECH (“Shares Transfer”).

As announced in the Company's announcement dated 22 December 2017, the Shares Transfer is part of the Proposed Internal Reorganisation to facilitate the Proposed Listing of PCL on the Cambodia Securities Exchange.

Subsequent to the Shares Transfer, PCL has become a wholly-owned subsidiary of PESTECH.

The said Shares Transfer is not expected to have any material effect on the earnings per share, net assets per share and gearing of PESTECH for the financial year ending 30 June 2018.

Save for Mr. Lim Ah Hock and Mr. Lim Pay Chuan who are the common Directors of PESTECH, PCL and PSB, none of the directors or substantial shareholders of PESTECH and/or persons connected with them has any interest, direct or indirect, in the said Shares Transfer.

This announcement is dated 14 March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-3-2018 03:28 AM

|

显示全部楼层

发表于 18-3-2018 03:28 AM

|

显示全部楼层

本帖最后由 icy97 于 18-3-2018 05:55 AM 编辑

icy97 发表于 8-11-2012 12:24 PM

Pestech 国际探寮国电力商机

财经新闻 财经 2012-11-08 11:55

(吉隆坡7日讯)Pestech国际(Pestech,5219,主板贸服股)将在寮国首都永珍(Vientiane)的经济特区,探讨电力供应的发展。

Pestech国际宣布, ...

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | PESTECH INTERNATIONAL BERHAD ("PESTECH" or "the Company") - TERMINATION OF MEMORANDUM OF UNDERSTANDING ("MOU") BETWEEN PESTECH SDN. BHD. AND UPL LAO CO., LTD ("UPL") | Further to the Company’s announcement dated 6 November 2012 in relation to the MOU with UPL to explore the establishment of power supply infrastructure to the Dongphosy Specific Economic Zone ("DSEZ") in Lao People's Democratic Republic ("Lao PDR"), the Board of Directors of PESTECH wishes to announce that the Company and UPL had mutually agreed to terminate the MOU with immediate effect (“Termination”).

Notwithstanding the Termination, the Group continues to explore for business potential in Lao PDR and shall continue to look out for other business opportunities in Lao PDR.

The termination of the MOU is not expected to have any effect on the issued share capital and substantial shareholders' shareholding of PESTECH. It is also not expected to have any material effect on the net assets, earnings per share and gearing of the Group for the financial year ending 30 June 2018.

None of the Directors, major shareholders and persons connected with the Directors and/or major shareholders of PESTECH, have any interest, direct or indirect, in the termination of the MOU.

The Board of Directors having considered all aspects of the termination of the MOU, is of the opinion that the Termination is in the best interest of PESTECH.

This announcement is dated 15 March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-5-2018 04:40 AM

|

显示全部楼层

发表于 29-5-2018 04:40 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 260,915 | 170,828 | 723,753 | 393,596 | | 2 | Profit/(loss) before tax | 17,662 | 29,862 | 74,954 | 73,557 | | 3 | Profit/(loss) for the period | 15,433 | 28,101 | 62,126 | 69,374 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 9,207 | 24,136 | 42,477 | 49,236 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.21 | 3.23 | 5.56 | 6.60 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6441 | 0.6083

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-7-2018 01:45 AM

|

显示全部楼层

发表于 11-7-2018 01:45 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PESTECH INTERNATIONAL BERHAD ("PIB" OR "COMPANY") PROPOSED LISTING OF PESTECH (CAMBODIA) PLC ("PCL"), A WHOLLY-OWNED SUBSIDIARY OF PIB ON THE MAIN BOARD OF CAMBODIA SECURITIES EXCHANGE ("CSX") ("PROPOSED LISTING") | We refer to the Company’s announcements dated 25 February 2016, 22 December 2017, 14 March 2018, 7 June 2018 and 3 July 2018 in relation to the Proposed Listing (“Announcements”). Unless otherwise defined, the abbreviations and definitions used in the Announcements shall apply herein.

Following the submission of the application to the Securities and Exchange Commission of Cambodia (“SECC”) on 22 December 2017 for the Proposed Listing, RHB Investment Bank, on behalf of the Board, is pleased to announce that the Company has received notification on 9 July 2018 that the SECC has, vide its letter dated 6 July 2018, granted the approval-in-principle to PCL, a public limited company, for the Proposed Listing in the Kingdom of Cambodia in accordance with the laws and regulations in force.

Further, SECC has granted the approval-in-principle and the registration-in-principle for the Disclosure Document of the Proposed Listing, subject to the following conditions:

(i) PCL shall appoint an independent director, establish an audit committee, a risk management committee and an internal audit unit and shall furnish to the SECC the underwriting agreement prior to obtaining the final approval from the SECC on the Proposed Listing; and

(ii) PCL and responsible parties for the Proposed Listing as well as other stakeholders shall determine the share price based on the Disclosure Document which has been approved-in-principle and registered-in-principle by the SECC and in compliance with the laws and regulations as well as other relevant guidelines of the SECC.

With the SECC’s approval-in-principle for the Proposed Listing, approval-in-principle and registration-in-principle for the Disclosure Document, and subsequently final approval to be obtained from the SECC, the Proposed Listing is now subject to and conditional upon the remaining approvals being obtained from the following parties/ authorities:

(i) the approval of CSX for the admission of PCL to its official list and the listing of and quotation for PCL’s entire enlarged issued and fully paid share capital on the Main Board of CSX;

(ii) the approval of the shareholders of PIB for the Proposed Listing at an Extraordinary General Meeting to be convened; and

(iii) any other relevant authorities and/or parties, if required.

This announcement is dated 10 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-8-2018 02:35 AM

|

显示全部楼层

发表于 24-8-2018 02:35 AM

|

显示全部楼层

本帖最后由 icy97 于 25-8-2018 01:17 AM 编辑

Type | Announcement | Subject | OTHERS | Description | PESTECH INTERNATIONAL BERHAD ("PESTECH" OR "THE COMPANY") - NOTIFICATION OF AWARD FOR SIBIYU 132/33kV SUBSTATION PROJECT | The Board of Directors of PESTECH (“Board”) wishes to announce that its wholly-owned subsidiary company, PESTECH Sdn Bhd (“PSB”) had on 23 August 2018, accepted a Notification of Award from Syarikat SESCO Berhad (a subsidiary of Sarawak Energy Berhad) for the Sibiyu 132/33kV Substation Project at a total contract amount of RM57,950,000 (Ringgit Malaysia: Fifty-Seven Million Nine Hundred and Fifty Thousand only) (hereinafter referred to as the “Project”).

The duration of the Project is 28 months and the commencement date of the Project shall be 3 September 2018.

The Project is located at about 35 minutes drive from Bintulu Airport in the Kemena Land District. Once completed, the Project is expected to provide the essential 132kV power injection into the city center of Bintulu to cater for the anticipated load demand and strengthen its power supply reliability.

The Project will contribute positively towards the revenue and earnings of PESTECH in accordance to the stages of project progress to be recognized in the financial year ending 30 June 2019 and is expected to contribute positively to the future earnings and net asset per share of the Company.

PESTECH does not foresee any exceptional risk other than the normal operational risk associated with the Project such as availability and changes in the price of raw materials. The Company will take necessary steps to mitigate the risks as and when it occurs.

None of the Directors and/or Major Shareholders and/or persons connected to them, has any interest, direct or indirect in the Project.

The Board is of the opinion that the Project is in the best interest of the Company.

This announcement is dated 23 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-8-2018 02:43 AM

|

显示全部楼层

发表于 26-8-2018 02:43 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2018 07:32 AM

|

显示全部楼层

发表于 30-8-2018 07:32 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 119,304 | 114,582 | 843,057 | 498,319 | | 2 | Profit/(loss) before tax | 17,616 | 62,418 | 92,570 | 128,302 | | 3 | Profit/(loss) for the period | 16,261 | 50,859 | 78,387 | 123,945 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 18,093 | 41,683 | 60,570 | 94,911 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.37 | 5.53 | 7.93 | 12.58 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6905 | 0.6083

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-9-2018 05:17 AM

|

显示全部楼层

发表于 26-9-2018 05:17 AM

|

显示全部楼层

本帖最后由 icy97 于 8-10-2018 02:48 AM 编辑

Type | Announcement | Subject | OTHERS | Description | PESTECH INTERNATIONAL BERHAD ("PESTECH" OR "THE COMPANY") - LETTER OF AWARD FROM SYARIKAT PEMBENAAN YEOH TIONG LAY SDN. BHD. FOR DESIGN, CONSTRUCTION, SUPPLY, INSTALLATION, COMPLETION, TESTING, COMMISSIONING AND MAINTENANCE OF THE ELECTRIFIED DOUBLE TRACK FROM GEMAS TO JOHOR BAHRU | The Board of Directors of PESTECH (“Board”) wishes to announce that its wholly-owned subsidiary company, PESTECH Technology Sdn Bhd (“PTECH”) had on 25 September 2018, accepted a Letter of Award from Syarikat Pembenaan Yeoh Tiong Lay Sdn. Bhd., under SIPP-YTL JV (a consortium between SIPP Rail Sdn. Bhd. and Syarikat Pembenaan Yeoh Tiong Lay Sdn. Bhd.), appointing PTECH as Sub-Contractor for the turnkey engineering, procurement, construction and maintenance relating to the electrification system for the electrified double track from Gemas to Johor Bahru (“the Project”) at a fixed sub-contract price of RM399,000,000 (Ringgit Malaysia: Three Hundred and Ninety-Nine Million only).

The establishment of Electrified Double Track from Gemas to Johor Bahru is the final stretch of West Coast KTMB line to be double tracked and electrified. The entire project involves the construction of 197km of double tracks, stations, electric trains, depots, land viaduct, bridges, and electrification, signalling and communication systems.

The date for completion of the Project shall be 1 April 2021.

The Project will contribute positively towards the revenue and earnings of PESTECH in accordance to the stages of project progress to be recognized in the financial years ending 30 June 2019 to 30 June 2020 and is expected to contribute positively to the future earnings and net asset per share of the Company.

PESTECH does not foresee any exceptional risk other than the normal operational risk associated with the Project such as availability and changes in the price of raw materials. The Company will take necessary steps to mitigate the risks as and when it occurs.

None of the Directors and/or Major Shareholders and/or persons connected to them, has any interest, direct or indirect in the Project.

The Board is of the opinion that the Project is in the best interest of the Company.

This announcement is dated 25 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-9-2018 07:33 AM

|

显示全部楼层

发表于 27-9-2018 07:33 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PESTECH INTERNATIONAL BERHAD ("PESTECH" OR "THE COMPANY") - ADDITIONAL INFORMATION IN RELATION TO THE LETTER OF AWARD FROM SYARIKAT PEMBENAAN YEOH TIONG LAY SDN. BHD. FOR DESIGN, CONSTRUCTION, SUPPLY, INSTALLATION, COMPLETION, TESTING, COMMISSIONING AND MAINTENANCE OF THE ELECTRIFIED DOUBLE TRACK FROM GEMAS TO JOHOR BAHRU | Reference is made to the Company’s announcement made on 25 September 2018 in relation to the award of contract by Syarikat Pembenaan Yeoh Tiong Lay Sdn. Bhd., a SIPP-YTL JV (a consortium between SIPP Rail Sdn. Bhd. and Syarikat Pembenaan Yeoh Tiong Lay Sdn. Bhd.) to PESTECH’s wholly-owned subsidiary company, PESTECH Technology Sdn Bhd (“PTECH”) appointing PTECH as Sub-Contractor for the turnkey engineering, procurement, construction and maintenance (“Works”) relating to the electrification system for the electrified double track from Gemas to Johor Bahru.

The Board wishes to inform that the commencement date for the Works is subject to the submission of the following documents by PTECH to Syarikat Pembenaan Yeoh Tiong Lay Sdn. Bhd:- - Performance Bond;

- Copies of insurance policies; and

- Registration numbers of employees under the Social Security Scheme.

This announcement is dated 26 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-10-2018 07:50 AM

|

显示全部楼层

发表于 6-10-2018 07:50 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PESTECH INTERNATIONAL BERHAD (PESTECH OR THE COMPANY)INTERNAL REORGANISATION OF GROUP STRUCTURE | Pursuant to Paragraph 9.19(5) of Bursa Malaysia Securities Berhad’s Main Market Listing Requirements, PESTECH wishes to announce that the Company has undertaken and completed an internal reorganisation of group structure, which entailed the transfer of shares in the following direct and indirect subsidiaries of the Company in the manner set out below (“Internal Reorganisation”):-

Name | Equity Interest |

Transferor |

Transferee |

Date of Completion | Enersol Co. Ltd. (“ECL”) (an indirect wholly-owned subsidiary of the Company)

| 500,000 ordinary shares

| Pestech Sdn. Bhd. (“PSB”) | PESTECH | 1 August 2018 | Systemcorp Energy Pte. Ltd. (“SEN”) (a direct 51%-owned subsidiary of the Company)

| 1,060,665 ordinary shares | PESTECH

| Pestech Energy Sdn. Bhd. (“PEN”) | 1 August 2018 |

The consequential changes in the group structure following the Internal Organisation are as follows:-

- ECL has ceased to be a wholly-owned subsidiary of PSB and is now a direct wholly-owned subsidiary of PESTECH; and

- SEN has ceased to be a direct 51%-owned subsidiary of PESTECH and is now a direct 51%-owned subsidiary of PEN. PEN is a wholly-owned subsidiary of PESTECH.

That the Internal Reorganisation is not expected to have any material effect on the earnings per share, net assets per share and gearing of PESTECH for the financial year ending 30 June 2019.

None of the directors and/or major shareholders of PESTECH or persons connected to them, has any interest, whether direct or indirect, in the Internal Reorganisation.

This announcement is dated 5 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-10-2018 05:40 AM

|

显示全部楼层

发表于 9-10-2018 05:40 AM

|

显示全部楼层

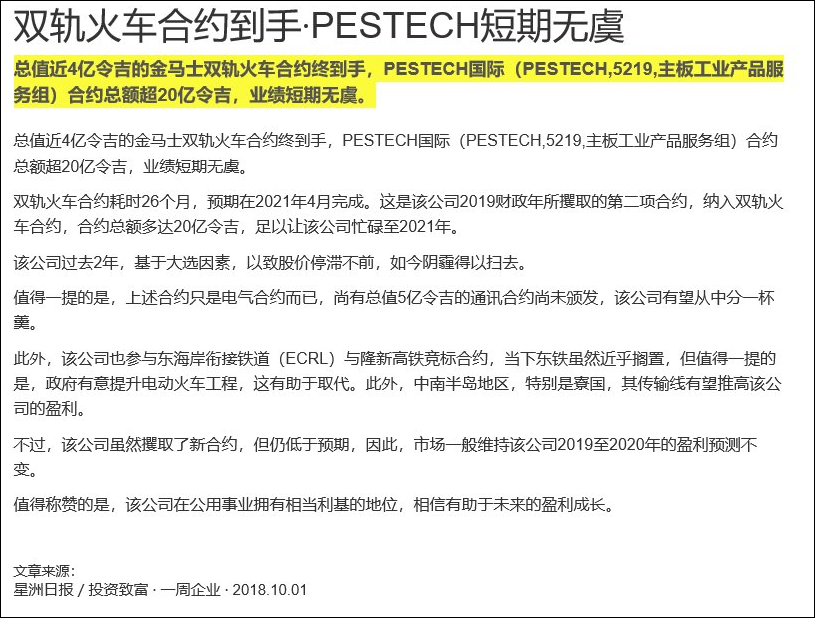

迎新合约 PESTECH股价料抬头

財经 最后更新 2018年10月3日 22时02分

PESTECH国际(PESTECH,5219,主板工业股)终於迎来新的火车工程合约,连续两年萎靡不振的股价有望重新抬头。分析员认为,除了电气化系统工程,PESTECH国际也极可能获得同一项目的信號和通讯系统工程。

PESTECH国际宣佈,独资子公司--PESTECH科技私人有限公司获颁总值3亿9900万令吉的金马士—新山双轨火车电气化系统工程。

合约工程由杨忠礼机构(YTL,4677,主板公用股)和SIPP铁路公司成立的联號公司--杨忠礼建设私人有限公司所颁发。工程预计耗时26个月完成,预期在2021年4月以前。

肯纳格研究分析员指出,上述火车项目总值5亿令吉的信號和通讯系统工程的承包商人选还未公佈。

他认为,PESTECH国际凭著和意大利铁路信號技术承包商--安萨尔多STS(Ansaldo)的合作关係,在竞投中將会拥有更大的胜算,因为国內已经没有其他通晓有关领域的承包商人选。

上述火车项目是PESTECH国际在2019財政年,获得的第2单合约工程,两项工程合计为4亿5700万令吉,使该公司的工程项目总值超过20亿令吉,可维持至2021年。

短期而言,金马士—新山双轨火车的信號和通讯系统工程,是PESTECH国际的首要目標。

另外两项潜在工程,东海岸铁路(ECRL)和隆新高铁项目的电气化系统工程,目前已经被搁置。

肯纳格研究分析员表示,政府有意升级现有的东海岸KTM路线作为替代方案,为PESTECH国际带来新的机会。

至於海外业务方面,中南半岛尤其是柬埔寨的输电路线和变电站前景仍备受看好,可推动PESTECH国际的盈利表现。

儘管过去两年PESTECH国际的盈利表现有强劲成长势头,但由於缺乏显著的利好因素,股价在过去两年持续被低估。分析员表示维持该股「跑贏大市」投资评级,目標价为1.95令吉。【东方网财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 11-10-2018 07:38 AM

|

显示全部楼层

发表于 11-10-2018 07:38 AM

|

显示全部楼层

本帖最后由 icy97 于 14-10-2018 05:21 AM 编辑

Type | Announcement | Subject | OTHERS | Description | PESTECH INTERNATIONAL BERHAD ("PESTECH" OR "THE COMPANY") - LETTER OF AWARD FROM SYARIKAT PEMBENAAN YEOH TIONG LAY SDN. BHD. TO ANSALDO STS PESTECH CONSORTIUM FOR THE DESIGN, CONSTRUCTION, SUPPLY, INSTALLATION, COMPLETION, TESTING, COMMISSIONING AND MAINTENANCE OF THE ELECTRIFIED DOUBLE TRACK FROM GEMAS TO JOHOR BAHRU ("PROJECT") | The Board of Directors of PESTECH (“Board”) wishes to announce that an unincorporated consortium formed between its wholly-owned subsidiary company, PESTECH Technology Sdn Bhd (“PTECH”) and Ansaldo STS Malaysia Sdn Bhd, i.e. ANSALDO STS PESTECH CONSORTIUM (“the Consortium”) had on 8 October 2018, accepted a Letter of Award from Syarikat Pembenaan Yeoh Tiong Lay Sdn. Bhd., a SIPP-YTL JV (a consortium between SIPP Rail Sdn. Bhd. and Syarikat Pembenaan Yeoh Tiong Lay Sdn. Bhd.)appointing the Consortium as Sub-Contractor for the turnkey engineering, procurement, construction and maintenance contract relating to the signalling systems for the Project (“Works”).

The fixed sub-contract price is RM339,000,000 (Ringgit Malaysia: Three Hundred and Thirty-Nine Million only), includes optional items worth RM19,768,820 (Ringgit Malaysia: Nineteen Million Seven Hundred and Sixty-Eight Thousand and Eight Hundred and Twenty only). The optional items, if exercised, will be allocated between the Consortium parties within the Works’ period.

Pursuant to the Consortium, the total sub-contract price for PTECH’s portion of Works is RM75,000,000 (Ringgit Malaysia: Seventy-Five Million only). This has further built up local participation for the signalling portion of the rail electrification.

The commencement date for the Works is subject to submission of the following documents by the Consortium to Syarikat Pembenaan Yeoh Tiong Lay Sdn. Bhd:-

- Performance Bond;

- Copies of insurance policies; and

- Registration numbers of employees under the Social Security Scheme.

The date for completion of the Project shall be 1 April 2021.

The Project will contribute positively towards the revenue and earnings of PESTECH in accordance to the stages of project progress to be recognized in the financial years ending 30 June 2019 to 30 June 2020 and is expected to contribute positively to the future earnings and net asset per share of the Company.

PESTECH does not foresee any exceptional risk other than the normal operational risk associated with the Project such as availability and changes in the price of raw materials. The Company will take necessary steps to mitigate the risks as and when it occurs.

None of the Directors and/or Major Shareholders and/or persons connected to them, has any interest, direct or indirect in the Project.

The Board is of the opinion that the Project is in the best interest of the Company.

This announcement is dated 9 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-10-2018 05:35 AM

|

显示全部楼层

发表于 14-10-2018 05:35 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 5-12-2018 03:43 AM

|

显示全部楼层

发表于 5-12-2018 03:43 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 124,085 | 184,878 | 124,085 | 184,878 | | 2 | Profit/(loss) before tax | 12,595 | 20,470 | 12,595 | 20,470 | | 3 | Profit/(loss) for the period | 11,642 | 18,197 | 11,642 | 18,197 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 9,950 | 11,100 | 9,950 | 11,100 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.30 | 1.45 | 1.30 | 1.45 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6361 | 0.6100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-12-2018 05:28 AM

|

显示全部楼层

发表于 18-12-2018 05:28 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 15-1-2019 01:25 AM

|

显示全部楼层

发表于 15-1-2019 01:25 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)| PESTECH INTERNATIONAL BERHAD |

Particulars of Substantial Securities HolderName | PRUDENTIAL PLC | Address | Laurence Pountney Hill

London

Ec4R 0HH

United Kingdom. | Company No. | 1397169 | Nationality/Country of incorporation | United Kingdom | Descriptions (Class) | Ordinary Shares | Name & address of registered holder | Name of registered holders:1. Eastspring Investments Small-Cap Fund 2. PBTB-Takafulink Dana Ekuiti3. PAMB-Prulink Dana Unggul4. Eastspring Investment Islamic Small-Cap Fund5. Kumpulan Wang Persaraan6. Par Fund7. Eastspring Investments Dana Dinamik8. PAMB-Prulink Golden Equity Fund II9. Pruvantage FundAddress of the above registered holders:-- Eastspring Investment Berhad, Level 12, Menara Prudential, 10, Jalan Sultan Ismail, 50250 Kuala Lumpur |

| Date interest acquired & no of securities acquired | Date interest acquired | 03 Dec 2018 | No of securities | 40,084,800 | Circumstances by reason of which Securities Holder has interest | The exposure due to acquisition of shares | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 40,084,800 | Direct (%) | 5.2 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Date of notice | 06 Dec 2018 | Date notice received by Listed Issuer | 07 Dec 2018 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|