|

|

发表于 12-3-2018 05:22 AM

|

显示全部楼层

发表于 12-3-2018 05:22 AM

|

显示全部楼层

两大促销活动发力

永旺销售额看涨20%

2018年3月8日

(吉隆坡8日讯)永旺(AEON,6599,主板贸服股)预计,在“永旺日”和“感谢日”两大促销活动期间,销售额料会增长10至20%。

执行董事裴荣裕在2018年永旺促销的推介礼结束后对媒体表示,这些促销将使120万名永旺会员受惠,这些都是刺激公司增长的重要角色。

“随着生活成本和通胀率走高,许多消费者都探讨更多方式谨慎花费,特别是购买杂货。”

消费情绪向好

他说,大选在即,再加上政府控制通胀的举措,相信今年的消费者情绪仍向好。

“2018年对消费者友善的预算案,以及令吉走强,这些因素都能推动消费者开销和零售领域的增长。”

另外,该公司今年也拨出4亿至5亿令吉的资本开销,装潢现有和新店面。

迄今,永旺在全国共营运33家百货商场兼超级市场,旗下还管理26家购物广场、3家MaxValu和3家MaxValu Prime超级市场。【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 16-4-2018 02:22 AM

|

显示全部楼层

发表于 16-4-2018 02:22 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2018 03:56 AM

|

显示全部楼层

发表于 27-4-2018 03:56 AM

|

显示全部楼层

EX-date | 12 Jun 2018 | Entitlement date | 14 Jun 2018 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final dividend of 4.0 sen per ordinary share in respect of the financial year ended 31 December 2017 | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200 Kuala LumpurTel:03-27839299Fax:03-27839222 | Payment date | 11 Jul 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 14 Jun 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.04 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-5-2018 04:51 AM

|

显示全部楼层

发表于 28-5-2018 04:51 AM

|

显示全部楼层

本帖最后由 icy97 于 4-6-2018 06:01 AM 编辑

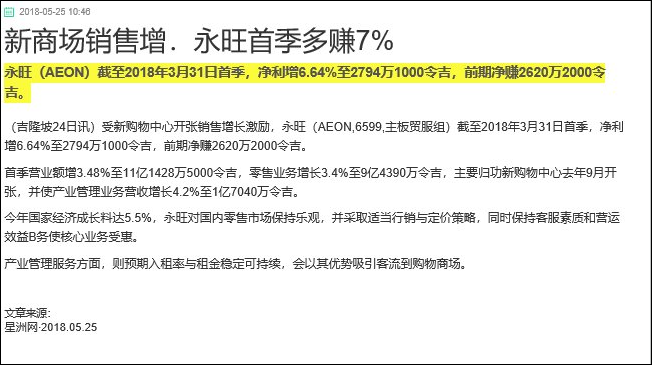

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,114,285 | 1,076,859 | 1,114,285 | 1,076,859 | | 2 | Profit/(loss) before tax | 49,778 | 42,858 | 49,778 | 42,858 | | 3 | Profit/(loss) for the period | 27,941 | 26,202 | 27,941 | 26,202 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 27,941 | 26,202 | 27,941 | 26,202 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.99 | 1.87 | 1.99 | 1.87 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4100 | 1.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-6-2018 07:24 AM

|

显示全部楼层

发表于 4-6-2018 07:24 AM

|

显示全部楼层

永旺放缓扩张步伐 今年4亿资本开销

財经 最后更新 2018年05月24日 21时32分

(吉隆坡24日讯)永旺集团(AEON,6599,主板贸服股)打算在今年拨出3亿至4亿令吉的资本开销,其中约1亿令吉用来翻修3间商场。同时,该公司表示將会静待政府接下来公布更多政策详情,才考虑会否调整商品售价。

该公司执行董事裴荣裕在今日的股东大会后,向记者表示,今年的资本支出比去年的5亿令吉和前年的7亿令吉少,是因为公司打算放缓扩张脚步。

他希望公司能够延续去年的势头,继续取得盈利成长。

「永旺集团的盈利极度依赖消费者情绪和经济大环境。我们希望能够通过优化店面、提升运营效率和引进新商品来推动盈利成长。」

该公司目前运营35家商店和27家商场。今年4月,永旺集团在古晋开设了它在东马的第1家商场。下一家商场將于明年首季在森美兰州汝来开设。今年,该公司打算翻修3家店面,即地不佬城、万达镇和双威镇的店面。

消费税(GST)將从6月1日开始调降至0%,並以销售税(SST)取代,询及永旺集团会否因此调整商品售价时,裴荣裕称,现在决定价格的调整为时尚早,还需要等待政府公佈更多详情才能做决定。

与此同时,该公司董事经理鷲泽忍认为,消费税降低至0%之后,预测消费者购买量將增加。

「消费者都在等待6月1日的到来,我们正面看待此事。恰逢开斋节到来,我们希望抓住这个机会,改善盈利表现。」

网购生意方面,该公司今年初与新加坡线上生鲜食材採购商Honestbee签署合约,合作发展网络零售业务。鷲泽忍表示,该业务的反应相当不错,包括购物人数和频率,目前每位顾客每次购买的平均消费高于100令吉。

他认为,网络零售市场將继续成长。不过,该业务目前对永旺集团的盈利贡献仍微不足道。

今年6月初,永旺集团还打算在柔佛Bukit Indah推出新的得来速(Drive-through)服务,让顾客在网上订货后到特定商店取货,首阶段只开放让顾客购买杂货。

如何改善赚幅时,裴荣裕指出,2017財政年的净利提高约15%,归功于適当的销售策略和运营开销的撙节。「我们希望通过这些努力能够继续改善赚幅。」

另一方面,裴荣裕坦言,永旺集团旗下持股持股49%的Aeon Index Living商场,目前正处于整合阶段,料无法在今年达到收支平衡。【东方网财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 15-6-2018 03:13 AM

|

显示全部楼层

发表于 15-6-2018 03:13 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 20-7-2018 06:02 AM

|

显示全部楼层

发表于 20-7-2018 06:02 AM

|

显示全部楼层

等待SST明朗化 永旺保持价格稳定

Sulhi Azman/theedgemarkets.com

July 19, 2018 15:44 pm +08

(吉隆坡19日讯)等待销售及服务税(SST)细节明朗化,永旺(Aeon Co (M) Bhd)将不会评论会否在SST落实后提高产品价格。

永旺执行董事裴荣裕表示:“在政府明确规定新税制涵盖范围和项目之前,目前很难确定这对商品和服务价格的影响。”

他在永旺代表与资政理事会会面后,向记者发表谈话。

他指出,自希望联盟政府宣布6月起消费税(GST)降至零,永旺已经降低全国26家店的所有商品价格。这提振消费者信心。

从9月起,政府将重新落实SST,其中所选项目的销售税率介于5至10%,而服务税将征6%。

裴荣裕还说,永旺没有计划在当前疲软的消费市场中,与其他业者整合业务。

“我们认为,现在不需要整合我们的业务。”

他指出,随着便利商店和非传统或网上零售商数量增加,零售市场继续充满挑战。

“便利店是面向消费者的另一种形式。我们(如永旺这样的百货商店兼超市营运商)将需要继续提升服务和产品予消费者。”

(编译:陈慧珊) |

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 06:30 AM

|

显示全部楼层

发表于 31-8-2018 06:30 AM

|

显示全部楼层

本帖最后由 icy97 于 4-9-2018 04:44 AM 编辑

联号公司减值损失拖累 永旺次季净利挫65%

Justin Lim/theedgemarkets.com

August 29, 2018 20:45 pm +08

(吉隆坡29日讯)受累于一家联号公司的亏损,永旺(AEON Co (M) Bhd)第二季净利挫跌64.47%。

该集团今日向大马交易所公布,截至6月杪次季净利为979万令吉,或每股0.7仙,低于上财年同期的2755万令吉,或每股1.96仙;营业额从10亿1000万令吉,增5.41%至10亿6000万令吉。

永旺指出,该集团在季内确认对联号公司Index Living Mall Malaysia私人有限公司的投资减值损失为801万令吉。此外,承担联号公司1140万令吉的营运亏损。

该集团表示,由泰国公司持有多数股权的家具零售商Index Living Mall,将关闭其在大马的余下门市。

综合2018财政年首半年的表现,永旺净利跌29.81%至3773万令吉,同期报5375万令吉;营业额由20亿9000万令吉,升4.41%至21亿8000万令吉。

展望未来,该集团表示,2018财年表现将受到确认Index Living投资减值损失的影响。

该集团还预计,从9月1日起实施的销售及服务税(SST)将对消费者支出和产品定价产生一些影响。

(编译:陈慧珊)

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,064,029 | 1,009,392 | 2,178,315 | 2,086,251 | | 2 | Profit/(loss) before tax | 28,745 | 47,806 | 78,524 | 90,665 | | 3 | Profit/(loss) for the period | 9,788 | 27,551 | 37,730 | 53,753 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 9,788 | 27,551 | 37,730 | 53,753 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.70 | 1.96 | 2.69 | 3.83 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4300 | 1.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 06:47 AM

|

显示全部楼层

发表于 31-8-2018 06:47 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | AEON CO. (M) BHD. ("AEON" or "Company") - Closure of Outlets of Index Living Mall Malaysia Sdn. Bhd. (1082843-T)(formerly known as AEON Index Living Sdn Bhd) | The Board of Directors of the Company wishes to announce that Index Living Mall Malaysia Sdn. Bhd. (1082843-T) (formerly known as AEON Index Living Sdn Bhd) (“ILMM"), an associate company of the Company will be closing down the remaining of its outlets in Malaysia. ILMM is a joint venture company between AEON and Index Living Mall Company Limited (“ILM”) which was incorporated in Thailand. AEON holds 49% of ILMM’s total shares and remaining 51% of ILMM’s shares are hold by ILM.

ILMM is engaged in the operations of furniture retailer and will be closing down the remaining of its outlets in Malaysia by third quarter of 2018. As such, for the second quarter result, the Company has recognised the impairment loss on its investment in the associate company which amounted to RM8.01 million and also share of its year to-date operating loss which amounted to RM13.7 million.

The closure of the associate’s outlets are expected to reduce the earnings per share and net assets per share of the Company by approximately two cents respectively for the financial year ending 31 December 2018. Being a non-cash item, the financial impact will have no bearing to the Company’s current and future cash position.

This announcement is dated 29 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-10-2018 03:37 AM

|

显示全部楼层

发表于 9-10-2018 03:37 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 18-10-2018 05:20 AM

|

显示全部楼层

发表于 18-10-2018 05:20 AM

|

显示全部楼层

本帖最后由 icy97 于 18-10-2018 06:29 AM 编辑

Type | Announcement | Subject | OTHERS | Description | AEON CO. (M) BHD. ("AEON" OR "COMPANY") Kuala Lumpur High Court and Court of Appeal Civil Suit against Gemilang Waras Sdn. Bhd. | References are made to the Company’s announcements on 9 November 2017, 7 December 2017, 30 April 2018 and 25 July 2018 pertaining to the suit against Gemilang Waras Sdn. Bhd. (496922-H) (“the Respondent”) in the High Court of Malaya in Kuala Lumpur and the appeal in the Court of Appeal (Civil Appeal) on the renewal of lease for AEON Mall Bukit Tinggi (“the Suit”).

The Board of Directors of the Company wishes to inform that the Company and the Respondent have reached an amicable settlement and entered into a Supplemental Lease Agreement dated 17 October 2018 which provides, among others, for the renewal of the lease for AEON Mall Bukit Tinggi for a term of 6 years commencing from 24 November 2017 until 23 November 2023 and the Company has the option to further renew the lease for a term of 6 years followed by a term of 3 years respectively.

In view thereof, the Company and the Respondent have jointly proceeded to withdraw the appeal and cross appeal [Civil Appeal No. W-02(NCC)(A)-1063-05/2018] before the Court of Appeal on 17 October 2018 and the Respondent has agreed and undertaken not to enforce the High Court Order dated 27 April 2018.

The settlement of the Suit is not expected to have any material financial or operational impact on the Company for the financial year ending 31 December 2018.

This announcement is dated 17 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-11-2018 07:50 AM

|

显示全部楼层

发表于 21-11-2018 07:50 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 29-12-2018 06:29 AM

|

显示全部楼层

发表于 29-12-2018 06:29 AM

|

显示全部楼层

本帖最后由 icy97 于 8-1-2019 08:11 AM 编辑

永旺第三季净利涨15%

Wong Ee Lin/theedgemarkets.com

November 28, 2018 18:59 pm +08

http://www.theedgemarkets.com/article/永旺第三季净利涨15

(吉隆坡28日讯)永旺(Aeon Co (M) Bhd)在截至今年9月杪第三季(2018财年第三季)净赚1385万令吉或每股0.99仙,比上财年同季的1208万令吉或每股0.86仙,按年上升了15%,归功于更好的商品分类带动营业额增长。

营业额按年提高10.75%至10亿6000万令吉,一年前报9亿6144万令吉。

永旺向大马交易所报备,零售业务营业额增长了12%至8亿9570万令吉,以及产业管理服务上扬5%至1亿6900万令吉,得益于在2017年9月份至2018年4月份开设的新购物广场。

累积现财年首9个月,净利按年萎缩21.65%至5158万令吉或每股3.67仙,上财年同期为6583万令吉或每股4.69仙。不过,营业额按年上涨6.41%至32亿4000万令吉。

展望未来,董事部预计,现财年的业绩仍然充满挑战,主要是生活与商业成本增加。此外,永旺的业绩也将受到其联号公司的营运和减值损失的影响,该公司选择关闭其分行。

尽管该集团预计产业管理服务的租赁率和租金仍然具有挑战性,但该集团将继续利用其竞争优势,吸引客户流量到其商场。

(编译:魏素雯)

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,064,808 | 961,441 | 3,243,122 | 3,047,692 | | 2 | Profit/(loss) before tax | 23,387 | 21,246 | 101,911 | 111,911 | | 3 | Profit/(loss) for the period | 13,851 | 12,081 | 51,581 | 65,834 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 13,851 | 12,081 | 51,581 | 65,834 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.99 | 0.86 | 3.67 | 4.69 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4000 | 1.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-3-2019 08:19 AM

|

显示全部楼层

发表于 6-3-2019 08:19 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,110,518 | 1,075,660 | 4,353,640 | 4,123,351 | | 2 | Profit/(loss) before tax | 85,127 | 81,895 | 187,038 | 193,806 | | 3 | Profit/(loss) for the period | 53,543 | 39,173 | 105,123 | 105,007 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 53,543 | 39,173 | 105,123 | 105,007 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.81 | 2.79 | 7.49 | 7.48 | | 6 | Proposed/Declared dividend per share (Subunit) | 4.00 | 4.00 | 4.00 | 4.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4400 | 1.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-3-2019 08:23 AM

|

显示全部楼层

发表于 6-3-2019 08:23 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | AEON CO. (M) BHD. (the "Company") - Proposed Final Dividend | The Board of Directors of the Company is pleased to propose a final dividend of 4.00 sen per ordinary share in respect of the financial year ended 31 December 2018 for the approval of the shareholders at the forthcoming Company's Thirty-Fourth Annual General Meeting.

The proposed entitlement and payment dates for the final dividend shall be determined at a later date and announced accordingly.

This announcement is dated 27 February 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-6-2019 07:59 AM

|

显示全部楼层

发表于 6-6-2019 07:59 AM

|

显示全部楼层

EX-date | 13 Jun 2019 | Entitlement date | 14 Jun 2019 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final dividend of 4.00 sen per ordinary share in respect of the financial year ended 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200 Kuala LumpurTel : 03-27839299Fax : 03-27839222 | Payment date | 11 Jul 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 14 Jun 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.04 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-7-2019 07:56 AM

|

显示全部楼层

发表于 6-7-2019 07:56 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,206,876 | 1,114,285 | 1,206,876 | 1,114,285 | | 2 | Profit/(loss) before tax | 55,689 | 49,778 | 55,689 | 49,778 | | 3 | Profit/(loss) for the period | 32,636 | 27,941 | 32,636 | 27,941 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 32,636 | 27,941 | 32,636 | 27,941 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.32 | 1.99 | 2.32 | 1.99 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2200 | 1.4400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-8-2019 07:04 AM

|

显示全部楼层

发表于 27-8-2019 07:04 AM

|

显示全部楼层

本帖最后由 icy97 于 27-8-2019 08:21 AM 编辑

次季净利增长一倍 惟永旺预计下半年趋软

Ahmad Naqib Idris/theedgemarkets.com

August 26, 2019 20:27 pm +08

https://www.theedgemarkets.com/article/次季净利增长一倍-惟永旺预计下半年趋软

(吉隆坡26日讯)永旺(AEON Co (M) Bhd)第二季净利按年增长一倍,因上财年同期联号公司出现减值损失。

永旺今日公布,截至6月杪次季净利报1945万令吉,同期为979万令吉;营业额从10亿6000万令吉,增3%至11亿令吉。

零售业务收入年增3%至9亿2450万令吉,主要来自新装修的门店和专卖店,以及2019年1月开业的新店。

综合2019财政年首半年,净利为5209万令吉,较同期的3773万令吉,按年跳涨38%;营业额亦从21亿8000万令吉,起6%至23亿1000万令吉。

尽管我国第二季经济增长优于预期,但该集团预计,由于全球贸易争端等国内外因素,今年下半年的形势将有所缓和。

“因此,董事部预计,本财年的表现仍将具挑战。”

永旺指出,零售业务将继续翻新特定门店,并采用合适的营销和定价策略、商品分类改革、保持优质的客户服务和营运效率。

与此同时,该集团预计物业管理服务的租用率和租金仍将面临挑战。

“公司将继续凭着自身的竞争优势,吸引更多的人潮,继续维持其购物目的地。”

(编译:陈慧珊)

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,099,486 | 1,064,029 | 2,306,362 | 2,178,315 | | 2 | Profit/(loss) before tax | 39,940 | 28,745 | 95,629 | 78,524 | | 3 | Profit/(loss) for the period | 19,454 | 9,788 | 52,090 | 37,730 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 19,454 | 9,788 | 52,090 | 37,730 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.39 | 0.70 | 3.71 | 2.69 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2400 | 1.4400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2019 09:11 AM

|

显示全部楼层

发表于 28-8-2019 09:11 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 8-9-2019 08:11 AM

|

显示全部楼层

发表于 8-9-2019 08:11 AM

|

显示全部楼层

整修商场·扩增熟食·永旺零售业务看俏

https://www.sinchew.com.my/content/content_2112521.html

(吉隆坡6日讯)永旺(AEON,6599,主板消费产品服务组)专注于整修购物中心和扩增熟食业务的策略获得分析员看好,预期零售业务将继续提振公司业务表现。

丰隆研究指出,永旺2020财政年不预期会开设新购物中心,而倾向于整修现有购物中心,未来也计划继续增设小规模商店,发展步伐稳健。

永旺2019财政年资本开销为5亿令吉,旗下产业管理服务业务赚幅改善料可持续,预料保持翻修购物中心将有助提高客户流量。

永旺旗下零售业务,丰隆料将提推动2019财政年成长主要催化因素。该公司专注翻修特定购物中心,如永旺马鲁里花园,同时扩展熟食食品领域以取得更高赚幅。

丰隆指出,永旺次季核心净利2030万令吉,首半年净利5400万令吉,符合预测,预料下半年业绩较好,维持财测不变。

兴业研究认为,永旺首半年业绩符合预测。

由于永旺为国内符合伊斯兰教义的最大购物中心,目前股价落在2020财政年预测本益比18.6倍水平交易,比其5年平均标准差-1水平,尚未反映未来成长潜能。

永旺最新业绩表现符合马银行研究预测,将2019至2021财政年财测稍微下调2.1%、上调0.4%及1.8%,特别是反映调整大马财报标准16的影响,惟预料旗下零售业务赚幅将逐渐提升。

艾芬黄氏研究维持财测不变,惟谨慎看待其前景,因净利表现虽良好,惟营运赚幅却走低。

肯纳格研究对永旺前景较为悲观,主要是预料第三季销售额将较低,因缺乏佳节利好支持,惟第四季因年终销售表现或转好,将2019至2020财政年的财测下调25%及21%,主要反映较低销售预测、有效税率调高至48%(之前为40%)、以及在大马财报标准-16将影响其借贷利息收入。

达证券指出,为了支持零售业务,永旺料将继续翻修分店,尽大化行销及定价策略、以及促进数据化及无现金交易等措施。该行对其产业管理服务业务持较谨慎态度,因营运开销比营收增长来得快,或许是租金走软所致,惟还是维持财测不变。

作者 : 李文龙

文章来源 : 星洲日报 2019-09-07 |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|