|

|

发表于 14-11-2017 03:53 AM

|

显示全部楼层

发表于 14-11-2017 03:53 AM

|

显示全部楼层

| KLCC REAL ESTATE INVESTMENT TRUST |

EX-date | 29 Nov 2017 | Entitlement date | 04 Dec 2017 | Entitlement time |

| | Entitlement subject | Interim Dividend | Entitlement description | A Third Interim Income Distribution of 4.96 sen per unit (taxable). | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 28 Dec 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 04 Dec 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0496 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-11-2017 06:13 AM

|

显示全部楼层

发表于 15-11-2017 06:13 AM

|

显示全部楼层

酒店办公楼支撑.短期欠催化剂.KLCC产业估值不再诱人

(吉隆坡14日讯)KLCC产业(KLCCP,5089,主板产业组)2017财政年9个月财报合格,分析员普遍预期酒店和办公楼资产将成为未来盈利增长动力来源,但相信短期重估催化因素匮乏,当前估值已不再诱人。

仍在探讨收购资产

KLCC产业2017财政年9个月核心净利5亿3240万令吉符合预期,达到MIDF研究全年目标的74%,而第三季核心净收入为1亿7770万令吉,按年和按季下跌0.3%和0.1%,主要是酒店业务表现良好抵销办公和零售业务疲弱表现冲击。

展望未来,肯纳格研究表示,KLCC产业现仍在探讨收购资产,并已获得股东批准10%配股献议,同时管理层也与埃克森美孚更新为期9+3+3+3年的租约,其中埃克森美孚将续租埃克森美孚大厦的60%空间,而管理层也已为其余40%空间鉴定租客。

联昌研究预见在年终假期、埃克森美孚(Exxon Mobil)大厦新租客带来贡献,以及东方文华(Mandarin Oriental)酒店入住率改善下,预期办公和零售业务将成为KLCC产业的盈利动力来源。

丰隆研究认同,称东方文华酒店第三季表现有所改善,主要是东运会拉高入住率,以及餐饮需求增加,而酒店现已落实第二期的客房整修工程,预计在2018年完工。

“我们预见在装修工程竣工,以及旅客增长支持下,未来酒店业务贡献将有所提升。”

但丰隆研究对KLCC产业办公业务前景不甚乐观,认为管理层虽看好在长期办公租约支撑下,未来表现将靠稳,但未来2至3年仍有显著的新增办公空间涌现,不预见办公领域的供过于求问题将在短期解套,因此维持未来财测不变。

整体来看,各大证券行对KLCC产业前景仍心存忧虑,主要是集团凭藉黄金地段、强大的零售资产品牌等因素值得享有估值溢价,但丰隆研究认为在缺乏增长催化下,该股估值与大马政府债券相比已不再诱人。

文章来源:

星洲日报‧财经‧报道:洪建文‧2017.11.14 |

|

|

|

|

|

|

|

|

|

|

|

发表于 25-1-2018 04:30 AM

|

显示全部楼层

发表于 25-1-2018 04:30 AM

|

显示全部楼层

本帖最后由 icy97 于 25-1-2018 06:03 AM 编辑

城中城合訂產託 末季派息10.35仙

2018年1月24日

(吉隆坡24日訊)城中城合訂產托(KLCC,5235SS,主要板產托)宣布截至去年12月底末季財報,營業額按年增加2%至3億5207萬令吉,淨利微滑0.5%至3億4552萬令吉,但每股派息10.35仙。

該公司向馬證交所報備指出,全年營業額按年增加1.7%至13億6675萬令吉,淨利跌0.9%至8億7790萬令吉,全年每股派息36.15仙。

城中城合訂產托指出,酒店營運方面,入住率提高加上較高房費,推高末季及全年營業額分別增加11.3%和11.8%,同時也成功轉虧為盈,錄得530萬令吉稅前盈利,比較2016財年虧損320萬令吉。

至于管理服務業務,因為去年承接了登嘉樓格底(Kerteh)房地產的設施管理服務,加上來自停車場的收入增加,帶動相關業務營業額增加4.1%至760萬令吉。

儘管管理服務業務營業額增加,但因為人力成本高企和較低的利息收入,管理服務業務的稅前盈利因而跌3.2%至250萬令吉。【中国报财经】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 352,072 | 344,689 | 1,366,751 | 1,343,546 | | 2 | Profit/(loss) before tax | 422,816 | 406,149 | 1,115,331 | 1,102,698 | | 3 | Profit/(loss) for the period | 400,175 | 392,809 | 1,013,565 | 1,011,027 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 345,516 | 347,128 | 877,900 | 885,971 | | 5 | Basic earnings/(loss) per share (Subunit) | 19.14 | 19.23 | 48.63 | 49.08 | | 6 | Proposed/Declared dividend per share (Subunit) | 10.35 | 9.85 | 36.15 | 35.65 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 7.2200 | 7.0900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-1-2018 04:30 AM

|

显示全部楼层

发表于 25-1-2018 04:30 AM

|

显示全部楼层

| KLCC PROPERTY HOLDINGS BERHAD |

EX-date | 08 Feb 2018 | Entitlement date | 12 Feb 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | A Fourth Interim Dividend of 5.30 sen per ordinary share, tax exempt under single tier system. | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 28 Feb 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 12 Feb 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.053 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-1-2018 04:31 AM

|

显示全部楼层

发表于 25-1-2018 04:31 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Revaluation of Properties | The Board of Directors of KLCC Property Holdings Berhad (“KLCCP”) wishes to announce that a revaluation exercise was conducted on the investment properties which are being held by KLCCP's subsidiaries and KLCC Real Estate Investment Trust ("KLCC REIT") [collectively known as KLCCP Stapled Group"] for long term investment purposes.

Further details of the valuation are provided in the attachment below.

This announcement is dated 24 January 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5674717

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-1-2018 04:32 AM

|

显示全部楼层

发表于 25-1-2018 04:32 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 25-1-2018 04:40 AM

|

显示全部楼层

发表于 25-1-2018 04:40 AM

|

显示全部楼层

| KLCC REAL ESTATE INVESTMENT TRUST |

EX-date | 08 Feb 2018 | Entitlement date | 12 Feb 2018 | Entitlement time | 05:00 PM | Entitlement subject | Income Distribution | Entitlement description | A Fourth Interim Income Distribution of 4.81 sen (taxable) and 0.24 sen (non-taxable) per unit. | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 28 Feb 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 12 Feb 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0505 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-1-2018 06:37 AM

|

显示全部楼层

发表于 26-1-2018 06:37 AM

|

显示全部楼层

产业地点策略.租金适度增长.KLCC产托钱景稳定

(吉隆坡25日讯)KLCC产托(KLCC,5235SS,主板产业投资信托组)2017财政年核心净利按年跌2.2%至6亿9500万令吉,分析员普遍认为基于办公资产地点策略、租率稳定增长,可保稳定钱景,最大的挑战是目前隆地区办公室供过于求问题。

尽管管理层认为长线办公租户可稳住表现,但丰隆研究不认为隆市区办公楼供应过剩不会在两三年解决。

不过,安联星展研究说,KLCC产托一半营收来自办公楼出租,国油双塔长达15年租约,三年一调租的调幅9%至14%,且租户纪录良好,两大主要租户为国家石油与埃克森美孚。

虽然“钱景”稳定,但联昌研究认为KLCC产托近期欠缺重大的重估催化剂,基于其规模较同侪大、地点策略、办公资产稳定,以溢价交易属合理,惟今后三财政年周息率介于4.8%与5.2%,稍逊同侪平均5.6%至5.8%。

目前旗下的大地宏图(Dayabumi)大厦资产强化晋入第三期,扩展100万方英尺总出租面积,一半为办公空间。至于KLCC阳光广场的Lot D1(130万平方英尺总出租面积)则等候适合主租户涌现,才展开发展。

联昌认为2018财政年料继续由办公室资产主导,因具100%出租率和长远租约;另外阳光KLCC大厦租户平衡措施料这个年度完成,可回复98%出租率和提供更佳租户流;同时东方文华酒店获装修酒店,下财政年完成和增出租率,获更高费率。

联昌指出,2017财政年高管理成本(高人事成本和管理服务低利息收入)使2017财政年税前盈利按年跌0.2%。

MIDF研究指出,该公司零售资产在2017财政年按年跌0.4%,主要是前财政年一次过回退租金,扣除这些料可在正面租金增长驱动而按年增1.5%。

马银行研究下调今后两年财测1%,长远前景不变。

肯纳格研究预期今明两财政年料受低个位数租金调涨所推动,东方文华入住率料50%调高至60%,料这两财政年每单位股息介于35.4仙至36.0仙之间,周息率4.5%至4.6%。

文章来源:

星洲日报‧财经‧报道:张启华‧2018.01.25 |

|

|

|

|

|

|

|

|

|

|

|

发表于 15-4-2018 04:09 AM

|

显示全部楼层

发表于 15-4-2018 04:09 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 18-5-2018 03:25 AM

|

显示全部楼层

发表于 18-5-2018 03:25 AM

|

显示全部楼层

本帖最后由 icy97 于 20-5-2018 05:14 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 345,112 | 336,657 | 345,112 | 336,657 | | 2 | Profit/(loss) before tax | 233,887 | 229,380 | 233,887 | 229,380 | | 3 | Profit/(loss) for the period | 208,672 | 203,437 | 208,672 | 203,437 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 180,671 | 176,725 | 180,671 | 176,725 | | 5 | Basic earnings/(loss) per share (Subunit) | 10.01 | 9.79 | 10.01 | 9.79 | | 6 | Proposed/Declared dividend per share (Subunit) | 8.70 | 8.60 | 8.70 | 8.60 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 7.2100 | 7.2200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-5-2018 03:25 AM

|

显示全部楼层

发表于 18-5-2018 03:25 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 18-5-2018 03:26 AM

|

显示全部楼层

发表于 18-5-2018 03:26 AM

|

显示全部楼层

EX-date | 30 May 2018 | Entitlement date | 01 Jun 2018 | Entitlement time | 05:00 PM | Entitlement subject | Income Distribution | Entitlement description | A First Interim Income Distribution of 5.72 sen (taxable) | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 29 Jun 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 01 Jun 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0572 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-5-2018 03:27 AM

|

显示全部楼层

发表于 18-5-2018 03:27 AM

|

显示全部楼层

EX-date | 30 May 2018 | Entitlement date | 01 Jun 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | A First Interim Dividend of 2.98 sen per ordinary share, tax exempt under single tier system. | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 29 Jun 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 01 Jun 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0298 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-5-2018 06:19 AM

|

显示全部楼层

发表于 20-5-2018 06:19 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 23-6-2018 08:00 AM

|

显示全部楼层

发表于 23-6-2018 08:00 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 17-7-2018 03:20 AM

|

显示全部楼层

发表于 17-7-2018 03:20 AM

|

显示全部楼层

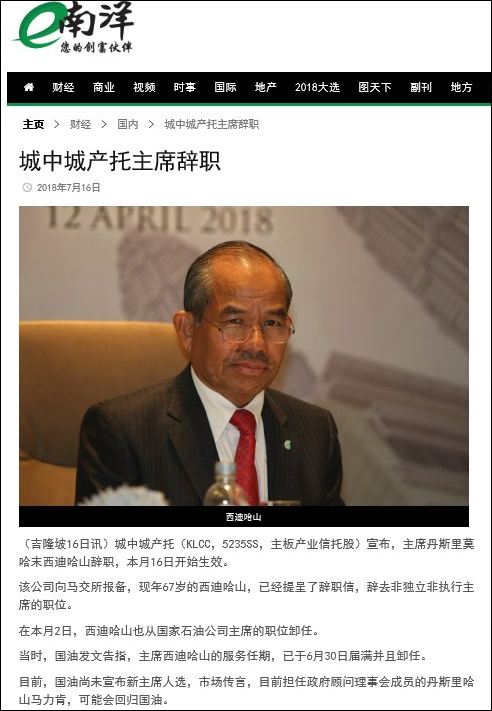

本帖最后由 icy97 于 17-7-2018 04:55 AM 编辑

Date of change | 16 Jul 2018 | Name | TAN SRI MOHD SIDEK HASSAN | Age | 67 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Non Independent and Non Executive | Type of change | Resignation | Reason | YBhg Tan Sri Mohd Sidek bin Hassan has tendered his resignation as Chairman / Director of KLCC Property Holdings Berhad effective 16 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-8-2018 12:10 AM

|

显示全部楼层

发表于 16-8-2018 12:10 AM

|

显示全部楼层

本帖最后由 icy97 于 16-8-2018 05:35 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 345,001 | 337,519 | 690,113 | 674,176 | | 2 | Profit/(loss) before tax | 232,735 | 230,077 | 466,622 | 459,457 | | 3 | Profit/(loss) for the period | 206,213 | 204,848 | 414,885 | 408,285 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 179,148 | 177,958 | 359,819 | 354,683 | | 5 | Basic earnings/(loss) per share (Subunit) | 9.92 | 9.86 | 19.93 | 19.65 | | 6 | Proposed/Declared dividend per share (Subunit) | 8.70 | 8.60 | 17.40 | 17.20 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 7.2300 | 7.2200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-8-2018 12:14 AM

|

显示全部楼层

发表于 16-8-2018 12:14 AM

|

显示全部楼层

EX-date | 29 Aug 2018 | Entitlement date | 03 Sep 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | A Second Interim Dividend of 3.05 sen per ordinary share, tax exempt under single tier system. | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 28 Sep 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 03 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0305 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-8-2018 12:15 AM

|

显示全部楼层

发表于 16-8-2018 12:15 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 16-8-2018 12:19 AM

|

显示全部楼层

发表于 16-8-2018 12:19 AM

|

显示全部楼层

EX-date | 29 Aug 2018 | Entitlement date | 03 Sep 2018 | Entitlement time | 05:00 PM | Entitlement subject | Income Distribution | Entitlement description | A Second Interim Income Distribution of 5.65 sen (taxable) | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 28 Sep 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 03 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0565 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|