|

|

【PANAMY 3719 交流专区】Panasonic制造

[复制链接]

[复制链接]

|

|

|

发表于 24-8-2017 05:55 AM

|

显示全部楼层

发表于 24-8-2017 05:55 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 327,846 | 297,789 | 327,846 | 297,789 | | 2 | Profit/(loss) before tax | 50,260 | 49,840 | 50,260 | 49,840 | | 3 | Profit/(loss) for the period | 39,576 | 38,303 | 39,576 | 38,303 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 39,576 | 38,303 | 39,579 | 38,303 | | 5 | Basic earnings/(loss) per share (Subunit) | 65.00 | 63.00 | 65.00 | 63.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 14.1800 | 13.5300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-9-2017 05:11 AM

|

显示全部楼层

发表于 7-9-2017 05:11 AM

|

显示全部楼层

原料涨消费低.松下电器赚幅承压

(吉隆坡6日讯)松下电器(PANAMY,3719,主板消费品组)首季净利扬3.3%,至3960万令吉,分析员认为原料上涨与消费情绪走低或冲击未来业绩,惟会采取具体步骤抵销赚益受压。

MIDF研究预测次季波斯湾政治波谲云诡、经济前景阴霾、出口表现受阻或放缓。国内业务料继受马币波动促使原料成本走高,国内高家债也令买气或多或少受冲击。

然而,MIDF也相信松下会继续努力减少生产成本、增强生产力,进而捎来令人满意的全年业绩。

丰隆研究也认为原料成本上涨,未来会压缩该公司盈利与赚益。不过,这要看其他更高赚益产品,是否有助抵销赚益侵蚀作用。

丰隆指出,饭煲无需发展与器械开销、美国吸尘器销售大增,皆有助抵销上述赚益受压。

由于家电营收增长11.4%驱动(越南与中东购买力改善),松下首季营收按年扬10.1%,至3亿2780万令吉;赚益跌0.3%,至15.4%。

联号公司则亏损,相比前期盈利300万令吉,本季缺发展与器械费,亦是高盈利因素之一。

同期归咎原料与高营运开销,风扇与其他产品赚益按年走低1.6%,至16.4%。

2018周息率预测达3.9%

丰隆认为,松下产能扩张与每股10令吉23仙健全的净现金情况,2018财政年周息率预测达3.9%。

文章来源:

星洲日报/财经 ‧ 报道:张启华‧2017.09.06 |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2017 01:33 AM

|

显示全部楼层

发表于 29-11-2017 01:33 AM

|

显示全部楼层

本帖最后由 icy97 于 30-11-2017 04:54 AM 编辑

次季少赚23%

PANAMY派息15仙

2017年11月25日

(吉隆坡24日讯)PANAMY(PANAMY,3719,主板消费产品股)截至9月杪次季,净利按年跌23.19%,录得2364万3000令吉,或每股净利39仙,逊于上财年同季的3078万3000令吉;不过,依然派息15仙。

公司向马交所报备,同季营业额也按年跌5.09%,从2亿9241万8000令吉,降至2亿7752万9000令吉。

PANAMY点出,次季风扇和其他产品的营业额掉22.2%。不过,随着有更多促销活动的开展,第三季的情况已有所改善。

半年赚6322万

合计首半年,PANAMY取得6321万9000令吉净利,年挫8.49%;而营业额则扬2.57%,报6亿537万5000令吉。

另一方面,PANAMY宣布派发每股15仙的中期股息,除权日和享有权日分别落在12月26日和12月28日,将在明年1月18日支付股息。

PANAMY指出,营运方面仍会持续受到劳工人员短缺和原材料走高的影响,因此将继续减低生产成本,务求在2018财年继续获利。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 277,529 | 292,418 | 605,375 | 590,207 | | 2 | Profit/(loss) before tax | 31,560 | 42,162 | 81,820 | 92,002 | | 3 | Profit/(loss) for the period | 23,643 | 30,783 | 63,219 | 69,086 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 23,643 | 30,783 | 63,219 | 69,086 | | 5 | Basic earnings/(loss) per share (Subunit) | 39.00 | 51.00 | 104.00 | 114.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 15.00 | 15.00 | 15.00 | 15.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 13.5500 | 13.5300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2017 01:33 AM

|

显示全部楼层

发表于 29-11-2017 01:33 AM

|

显示全部楼层

EX-date | 26 Dec 2017 | Entitlement date | 28 Dec 2017 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim Single Tier Dividend of 15 sen per ordinary share for the financial year ending 31 March 2018 | Period of interest payment | to | Financial Year End | 31 Mar 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM CORPORATE SERVICES (KL) SDN BHDLot 6.05, Level 6, KPMG Tower8, First AvenueBandar Utama47800 Petaling JayaTel:0377201188Fax:0377201111 | Payment date | 18 Jan 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 28 Dec 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.15 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-12-2017 06:17 AM

|

显示全部楼层

发表于 11-12-2017 06:17 AM

|

显示全部楼层

松下电器业绩逊色

(吉隆坡27日讯)松下电器(PANAMY,3719,主板消费品组)最新业绩逊色。

MIDF研究表示,松下电器2018财年上半年净利2360万令吉,表现落后预期,只占该行全年财测的43.4%。

该公司的家电业务继续强劲成长,但风扇和其它产品则下滑6.3%,因国内需求下跌以及政府安装风扇项目放缓。

该行将松下电器2018财年盈利预测下调5.82%,因为马币走强将影响出口收入,但进口原料成本也将降低。至于2019年财测不变,因预期中东需求回升,以及新增产能将带动营收和盈利成长。

该行保持“中和”评级和目标价为35令吉75仙。

文章来源:

星洲日报‧财经‧2017.11.28 |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-3-2018 07:06 AM

|

显示全部楼层

发表于 7-3-2018 07:06 AM

|

显示全部楼层

本帖最后由 icy97 于 7-3-2018 07:54 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 317,050 | 285,443 | 922,425 | 875,650 | | 2 | Profit/(loss) before tax | 50,861 | 39,737 | 132,681 | 131,739 | | 3 | Profit/(loss) for the period | 42,649 | 31,267 | 105,868 | 100,353 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 42,649 | 31,267 | 105,868 | 100,353 | | 5 | Basic earnings/(loss) per share (Subunit) | 70.00 | 51.00 | 174.00 | 165.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 15.00 | 15.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 14.2500 | 13.5300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-3-2018 05:24 AM

|

显示全部楼层

发表于 8-3-2018 05:24 AM

|

显示全部楼层

Date of change | 28 Feb 2018 | Name | MR TAKAYUKI TADANO | Age | 55 | Gender | Male | Nationality | Japan | Designation | Executive Director | Directorate | Executive | Type of change | Resignation | Reason | Completed contract of service in Malaysia |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-3-2018 05:24 AM

|

显示全部楼层

发表于 8-3-2018 05:24 AM

|

显示全部楼层

Date of change | 01 Mar 2018 | Name | MADAM KWAN WAI YUE | Age | 50 | Gender | Female | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Appointment | Qualifications | Bachelor of Accounting, University of Malaya - 1992 Member of MICPA (Certified Public Accountant) since 1995 Member of Malaysian Institute of Accountant | Working experience and occupation | Upon graduation, Madam Kwan Wai Yue ("Mdm Kwan") joined a Big-4 audit firm in Malaysia as an Audit Assistant in 1992 and was promoted to Audit Senior two years later. The portfolios of client which she audited included large multinational companies and local corporations.In 1995, Mdm Kwan joined a food manufacturing-based public listed company as Accountant and in 2000 was promoted to Financial Controller. Her role as financial controller involved overseeing the accounts department, preparation of financial reports, overseeing all tax and regulatory/compliance issues as well as contributing to decisions regarding financial strategy. Mdm Kwan joined Panasonic Manufacturing Malaysia Berhad in 2007 as Assistant General Manager of Finance Department taking charge of accounting and financial reporting. She was promoted to General Manager in 2009 and her scope of duties expanded to cover overall financial management, treasury and company secretarial functions. In 2013, following her exemplary leadership in strengthening the internal control processes, the Company promoted her to Assistant Director of Finance. In 2015, her scope of work was expanded to overseeing the Legal & Compliance department. She has currently been tasked to oversee the operations of the Information System Department. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-5-2018 03:54 AM

|

显示全部楼层

发表于 6-5-2018 03:54 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 24-5-2018 06:36 AM

|

显示全部楼层

发表于 24-5-2018 06:36 AM

|

显示全部楼层

本帖最后由 icy97 于 4-6-2018 04:07 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

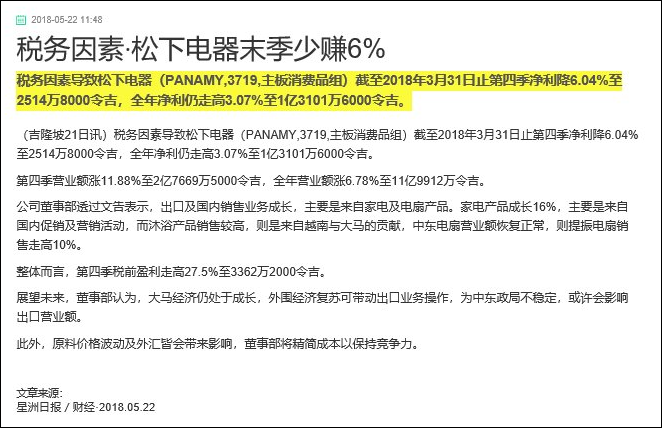

| 1 | Revenue | 276,695 | 247,314 | 1,199,120 | 1,122,964 | | 2 | Profit/(loss) before tax | 33,622 | 26,360 | 166,303 | 158,099 | | 3 | Profit/(loss) for the period | 25,148 | 26,765 | 131,016 | 127,118 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 25,148 | 26,765 | 131,016 | 127,118 | | 5 | Basic earnings/(loss) per share (Subunit) | 42.00 | 44.00 | 216.00 | 209.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 233.00 | 102.00 | 248.00 | 117.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 14.5100 | 13.5300 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-6-2018 04:26 AM

|

显示全部楼层

发表于 4-6-2018 04:26 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-7-2018 12:23 AM

|

显示全部楼层

发表于 27-7-2018 12:23 AM

|

显示全部楼层

| PANASONIC MANUFACTURING MALAYSIA BERHAD |

EX-date | 05 Sep 2018 | Entitlement date | 07 Sep 2018 | Entitlement time | 04:00 PM | Entitlement subject | Final Dividend | Entitlement description | Proposed final single tier dividend of 133 sen per ordinary share for the financial year ended 31 March 2018, subject to shareholders' approval at the forthcoming Annual General Meeting | Period of interest payment | to | Financial Year End | 31 Mar 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM CORPORATE SERVICES (KL) SDN BHDLot 6.05, Level 6, KPMG Tower8, First AvenueBandar Utama47800 Petaling JayaTel:0377201188Fax:0377201111 | Payment date | 25 Sep 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 07 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 1.33 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-7-2018 12:23 AM

|

显示全部楼层

发表于 27-7-2018 12:23 AM

|

显示全部楼层

EX-date | 05 Sep 2018 | Entitlement date | 07 Sep 2018 | Entitlement time | 04:00 PM | Entitlement subject | Special Dividend | Entitlement description | Proposed special single tier dividend of 100 sen per ordinary share for the financial year ended 31 March 2018, subject to shareholders' approval at the forthcoming Annual General Meeting | Period of interest payment | to | Financial Year End | 31 Mar 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM CORPORATE SERVICES (KL) SDN BHDLot 6.05, Level 6, KPMG Tower8, First AvenueBandar Utama47800 Petaling JayaTel:0377201188Fax:0377201111 | Payment date | 25 Sep 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 07 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 1 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-8-2018 01:51 AM

|

显示全部楼层

发表于 14-8-2018 01:51 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-8-2018 05:33 AM

|

显示全部楼层

发表于 21-8-2018 05:33 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 24-8-2018 04:53 AM

|

显示全部楼层

发表于 24-8-2018 04:53 AM

|

显示全部楼层

本帖最后由 icy97 于 31-8-2018 06:10 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

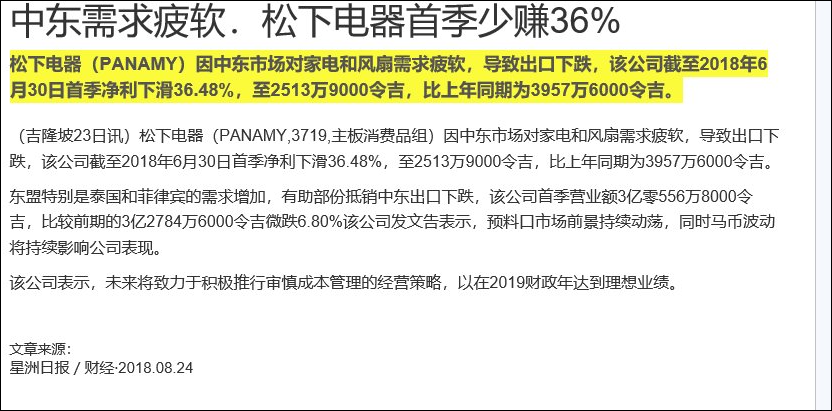

| 1 | Revenue | 305,568 | 327,846 | 305,568 | 327,846 | | 2 | Profit/(loss) before tax | 32,959 | 50,260 | 32,959 | 50,260 | | 3 | Profit/(loss) for the period | 25,139 | 39,576 | 25,139 | 39,576 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 25,139 | 39,576 | 25,139 | 39,576 | | 5 | Basic earnings/(loss) per share (Subunit) | 41.00 | 65.00 | 41.00 | 65.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 14.9300 | 14.5200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-8-2018 07:25 AM

|

显示全部楼层

发表于 25-8-2018 07:25 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 26-12-2018 07:31 AM

|

显示全部楼层

发表于 26-12-2018 07:31 AM

|

显示全部楼层

本帖最后由 icy97 于 8-1-2019 05:35 AM 编辑

次季净利增44%-panasonic制造派息15仙

http://www.chinapress.com.my/20181126/次季净利增44-panasonic制造派息15仙/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 308,807 | 277,529 | 614,375 | 605,375 | | 2 | Profit/(loss) before tax | 43,450 | 31,560 | 76,409 | 81,820 | | 3 | Profit/(loss) for the period | 34,127 | 23,643 | 59,266 | 63,219 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 34,127 | 23,643 | 59,266 | 63,219 | | 5 | Basic earnings/(loss) per share (Subunit) | 56.00 | 39.00 | 98.00 | 104.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 15.00 | 15.00 | 15.00 | 15.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 13.1600 | 14.5100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-12-2018 07:32 AM

|

显示全部楼层

发表于 26-12-2018 07:32 AM

|

显示全部楼层

EX-date | 26 Dec 2018 | Entitlement date | 28 Dec 2018 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim Single Tier Dividend of 15 sen per ordinary share for the financial year ending 31 March 2019 | Period of interest payment | to | Financial Year End | 31 Mar 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM CORPORATE SERVICES (KL) SDN BHDLot 6.05, Level 6, KPMG Tower8, First AvenueBandar Utama47800 Petaling JayaSelangor Darul EhsanTel:03-77201188Fax:03-77201111 | Payment date | 18 Jan 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 28 Dec 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.15 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-12-2018 06:47 AM

|

显示全部楼层

发表于 28-12-2018 06:47 AM

|

显示全部楼层

Date of change | 28 Nov 2018 | Name | MR TORU OKANO | Age | 60 | Gender | Male | Nationality | Japan | Designation | Executive Director | Directorate | Executive | Type of change | Resignation | Reason | Resignation consequent to retirement from executive position. |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|