|

|

发表于 30-5-2008 09:18 AM

|

显示全部楼层

发表于 30-5-2008 09:18 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2008 09:54 AM

|

显示全部楼层

发表于 30-5-2008 09:54 AM

|

显示全部楼层

瑪拿第一續發展高回酬產業

2008年5月30日

(吉隆坡29日訊)瑪拿第一(MAGNA,7617,二板建築股)在成功轉虧為盈后,持續發展其高回酬的產業,目前正進行商洽,計劃購買吉隆坡市中心的一片地庫。

該公司首席執行員林進財指出,該公司持續尋求適合發展的土地,以確保擁有穩定收入,該收購地庫計劃,預計2個月內達成。

該公司目前持有多達82公頃地庫,總產業發展值為26億令吉,而未入帳銷售為2億6000萬令吉。林進財表示,瑪拿第一目前專注于綜合性的商業發展。

「我們的商業模式是進行位于市區的口袋型(pocket-size)發展計劃,鎖定人口密度高、擁有高產業發展價值和高回酬的地方。同時,我們也確保有關產業建設于適當和擁有完善設施的地點。」

同時,林進財表示,該公司還是會集中于巴生谷一帶,至于將業務擴展海外,這是長期的計劃。

在供不應求的情況下,原料價格持續高企,對瑪拿第一來說是一種挑戰。然而,該公司也做了一些策略,來應對有關挑戰。

該公司擁有私人建築團隊,這足以減少了成本。同時,為了將原料產品價格上揚帶來的衝擊減到最低,該公司選擇大量進貨,以及對建築材料的購買進行護盤。

談及產業領域前景,林進財指出,產業領域仍有增長趨勢,但發展卻是選擇性的。

他補充,產業購買者對地點和產品的選擇性是主要的因素。

早前瑪拿第一曾表示有意轉入主板,林進財表示,在首相宣布主板和二板將合併后,該公司將會參與有關的合併。因此,該公司注重的是,投資的回酬和每股盈利,並希望能改善去年的盈利表現。

該公司希望在4 年內, 營業額達到16億令吉。截止今年3月為止,該公司的淨負債率為0.3倍。

林進財是在該公司的股東常年大會后,向記者發表談話。同時,他也借機推出其位于古晉路的產業,名為吉隆坡瑪拿城(MagnaCity Kuala Lumpur)。

有關產業將在7月份非正式推出(soft launch),預計花費4年時間完成。

http://www.orientaldaily.com.my/ ... PlB08Ma5ge83npL0aet |

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2008 12:42 PM

|

显示全部楼层

发表于 30-5-2008 12:42 PM

|

显示全部楼层

更新: May 29, 2008 18:17

專注巴生谷發展 萬拿第一放眼16億營業額

(吉隆坡29日訊)萬拿第一(MAGNA,7617,二板建築)專注巴生谷房地產發展,展望未來4年可錄得16億令吉營業額。

該公司總執行長林進財指出,旗下產業總發展值(GDV)達21億3000萬令吉,預計未來4年可取得16億令吉營業額。

上述營業額將由吉隆坡古晉路的五合一綜合計劃帶動,該計劃命名為“吉隆坡萬拿城市”,佔地約10.23英畝,總發展值高達11億令吉。

“我們今日公開登記、7月份推介,計劃第3季動工並在4年內完成所有發展。”

他說,該發展計劃將結合商店、辦公樓、服務公寓、酒店及零售商場。

關鍵在地點

他今日出席股東大會后,發表談話;列席者包括萬拿第一集團董事經理李建勝。

林進財指出,儘管現有地庫僅為82英畝,惟公司在人口稠密的城市區進行小型發展,並放眼中高檔市場,因此可錄得更高發展值。

他披露,公司正洽談在吉隆坡市區收購一塊地段,冀望兩個月內落實,該地段預料將用以發展綜合商業產業。

“目前,我們專注巴生谷地區的發展,海外市場可能是較長期計劃。”

詢及如何應對建材價格上揚,林進財指出,公司擁有建築臂膀、提前訂購鋼條及洋灰等建材、從本地及全球市場尋求供應,並設立採購原料部門,以降低成本。

他指出,過去3至6個月產業推介顯示,我國特定地區的產業市場依舊看漲。

“地點及產品是關鍵,並且需了解客戶需求及負擔能力。”

林進財說,公司現有未進賬銷售達2億6000萬令吉,負債率約為0.3倍,未來將關注提升股本回酬率及每股盈利表現。

萬拿第一07財年稅前盈利按年勁揚9.5倍,報3763萬令吉。

http://www.chinapress.com.my/content_new.asp?dt=2008-05-30&sec=business&art=0530bs06.txt |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 30-5-2008 02:30 PM

|

显示全部楼层

昨天去了AGM,看到全部管理層,林進財沒有我想像中胖,MR LEE MD DIRECTOR 很GENTLEMENT,

也看到JLN KUCHING PROJECT(接近SUNGAI MAS BUIDING),它的FLOOR PLAN讓我覺得很意外,有兩個藍色的圓圓好像人造湖 ,希望我看錯 ,希望我看錯 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 30-5-2008 02:34 PM

|

显示全部楼层

回复 180# Mr.Business 的帖子

回复 180# Mr.Business 的帖子

回复 182# scsiang82 的帖子

你們兩個手腳醬快,搶先報導 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 30-5-2008 02:40 PM

|

显示全部楼层

原帖由 blackcat98 于 16-2-2008 10:29 AM 发表

magna primaの未來四年展望長話短說

1)Magna手握6項總值20億工程,相信將在2011年完成所有工程,以4年平均值算將為magna帶來每年貢獻5億revenue*,和現在的前9月財政報表1.75億有段相當大的進步空間

2)PROFIT BEFORE TAX (PBT)

PBT=500MIL * 28%

= 140MIL

4年裡每年平均取得PBT 1.4億

3)PROFIT AFTER TAX (PAT)

PAT=140MIL * 74%

=1.036億

4)EARNING PER SHARE (EPS)**

EPS= 103MIL / 52MIL

= 1.98 PER SHARE

5)FORECAST PRICE SHARE

= EPS * P/E

= RM1.98 * 10

= RM19.80

NOTE:

*條件是100% SOLD OUT

**假設WARRANT無轉換

6)計畫3年上主板,將會吸引外資和基金青睞,預計推高股價(有些海外基金限制不能投資二板)

7)4年內預算好會有場股災,股價暴跌再所難免,但是這都不重要,一切以基本面為投資標準

我不是在吹牛 ,我是根據資料算出來 ,我是根據資料算出來 ,雖然有些誤差 ,雖然有些誤差 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 30-5-2008 02:50 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2008 03:55 PM

|

显示全部楼层

发表于 30-5-2008 03:55 PM

|

显示全部楼层

放眼全年更佳表現‧麥納首要看好產業前景

大馬財經 2008-05-29 19:02

林進財:麥納首要將續專注巴生河流域市場。

(吉隆坡)麥納首要(MAGNA,7617;二板建築組)看好產業市場前景,將繼續購置更多優質地庫,以滿足利基產業發展需求,惟將把業務重心轉向綜合商業產業發展。

續購更多優質地庫

該公司首席執行員林進財表示,產業市場持續走揚,其中部份地區的產業銷售表現異常亮眼,料在理想地點以及迎合市場需求產品帶動下,放眼現財政年能取得更好的表現。

他說,麥納首要現握有82英畝發展中地庫,其中發展總值達16億令吉的吉隆坡古晉路Magna城(Magna City)綜合產業發展將是今年的重點項目。

Magna城(Magna City)集公管公寓、精品酒店、零售中心、商業辦公樓等於一身,相關建築工程將在第3季度展開,預期耗時4至5年。

他指出,包括Magna城在內,公司現有總產業發展總值達21億3000萬令吉,料可支撐公司未來盈利表現,計劃在4年內兌現其中的16億令吉價值。

至於原料價格對公司的衝擊,他表示公司將通過內部建築公司、購買遠期原料護盤、成本控制以及成立資源採購部門等措施,積極減輕成本對盈利的影響。

林進財指出,未來公司將繼續專注巴生河流域市場,並購置更多地點良好的地庫,其中鎖定人口密度高、可快速發展的地段,以進行“口袋型”(Pocket size)發展計劃。

重心轉向綜合產業

“我們隨時都在進行洽談,而現正洽購吉隆坡城某地庫,寄望在2個月內能完成洽談工作,惟不便透露進一步詳情。”

他說,隨著市場趨勢轉向綜合型產業發展計劃,公司也將順應潮流往相同方向前進,但也不會忽略住宅產業的重要性。

詢及進軍海外市場可能,林進財透露:“我們對本地業務發展感到滿意,暫無意往外發展。”

至於轉板上市計劃進展,他表示:“我們對首相宣佈兩板合一計劃表示歡迎,並樂見成為新交易板的一份子,未來重點將落在提升投資回酬等方面,以繼續強化業績表現。”

星洲日報/財經‧2008.05.29

http://biz.sinchew-i.com/node/13311 |

|

|

|

|

|

|

|

|

|

|

|

发表于 31-5-2008 04:18 PM

|

显示全部楼层

发表于 31-5-2008 04:18 PM

|

显示全部楼层

回复 187# blackcat98 的帖子

|

不好吧,她是高消费的。每个月要消耗量是一粒magna-wa. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-6-2008 03:07 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-6-2008 04:05 PM

|

显示全部楼层

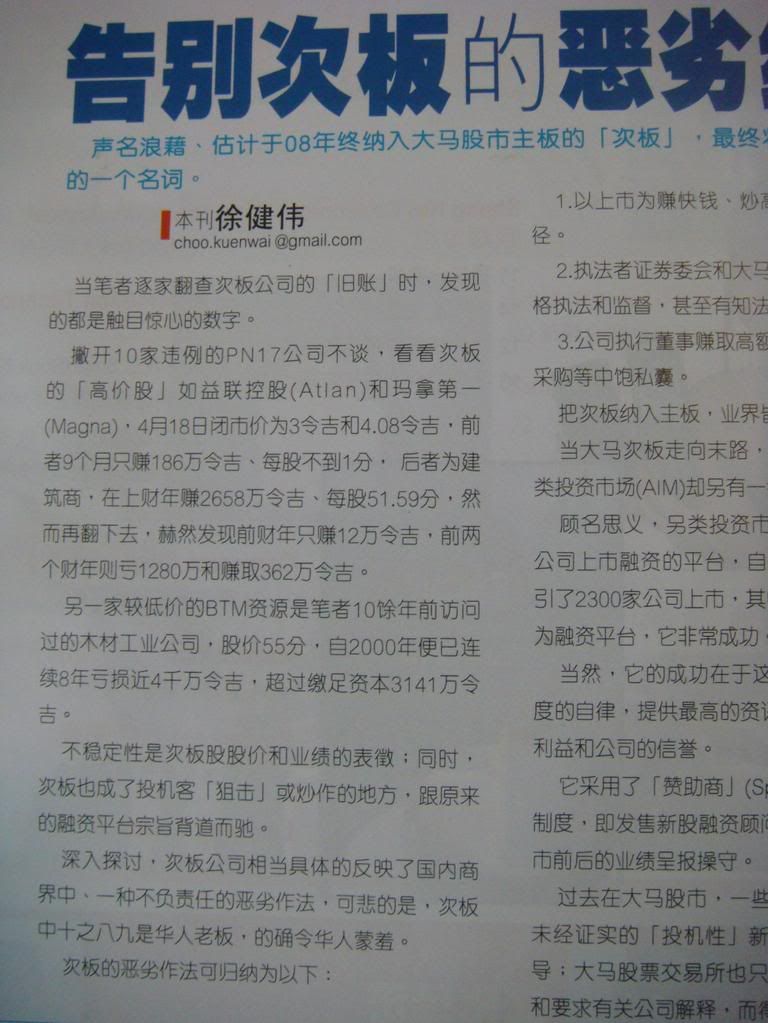

糟糕的商海編者徐健偉

拜託別沒調查清楚就亂掰,難道主板公司沒有曾經怵目驚心的數字嗎?UEM算甚麼?MAS算甚麼?

LION GROUP算甚麼?KURNIA算甚麼?

高價又怎樣?不能買嗎?巴菲特屬下公司豈不就是垃圾??低價好嗎?NSCOM夠低?不見得你掃貨?

[ 本帖最后由 blackcat98 于 9-6-2008 09:11 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 9-6-2008 10:12 AM

|

显示全部楼层

发表于 9-6-2008 10:12 AM

|

显示全部楼层

Magna Prima plans RM1b REIT

By Hamisah Hamid Published: 2008/06/09

The property developer plans to inject at least three assets into the real estate investment trust, the first is the retail mall in Magna City

PROPERTY developer Magna Prima Bhd plans to set up a RM1 billion real estate investment trust (REIT) within the next five years.

The first asset to be sold to the REIT would be a retail mall, which will be built within the company's integrated lifestyle property development, Magna City Kuala Lumpur.

Chief executive officer Lim Ching Choy said the company plans to sell at least three assets to the REIT.

"The retail mall in Magna City will be the first asset that we are going to maintain for retained income and eventually, we will inject this asset into (the) REIT.

"We are building a few more, so our REIT asset will exceed RM1 billion," he told Business Times in an interview in Kota Damansara, Selangor.

Developers typically sell their assets to a property trust to raise funds that would be used to cut debt. In most cases, REITs are also owned by developers who want to maintain control over their assets.

Lim also said that the company may raise funds from a bond sale to finance the retail mall component of Magna City.

"We want to issue bonds to match our rental income, so that the long-term asset is funded by long-term corporate debt," he said.

Magna Prima expects revenue to increase to RM1.6 billion within four years, mainly from the Magna City project. It made RM26.6 million net profit on revenue of RM344.4 million in the year to December 31 2007.

Currently, 74 per cent of the company's income comes from property development and the rest is from construction.

It expects equal contributions from the two divisions within the next three years.

Magna Prima's construction arm is currently doing in-house jobs with a total contract value of RM647 million.

Magna Prima has also bought 90 per cent of a construction firm, Pembinaan Contamaju-Infocast Sdn Bhd (PCI) to beef up its construction arm.

Its wholly-owned subsidiary, Magna Prima Construction Sdn Bhd, is involved in the construction of Dataran Otomobil, Magna View and Metro Prima Kepong, while PCI will do new projects such as U1 in Shah Alam and Magna City.

Currently, Magna Prima has a total landbank of 32.8ha, small compared with large parcels owned by other developers.

"We have RM2.13 billion gross development value (GDV) on the 32.8ha land, which will sustain us in the next four years.

"We are focusing on high-density development, so our GDV value per acre is very high compared with other developers," he said.

Magna Prima has identified two parcels of land for next development projects - one is less than 0.8ha located within the Golden Triangle area in the city and another is more than 4ha land in the highly densed suburb in Klang Valley.

"We are at the land negotiation stage, and we expect to conclude it within two months' time," he said.

The GDV of each project is estimated to be more than RM1 billion.

Lim said the company plans to focus its property development activities in Klang Valley and has no immediate plans to venture abroad.

http://www.btimes.com.my/Current_News/BTIMES/Monday/Frontpage/MAGNAONE.xml/Article/ |

|

|

|

|

|

|

|

|

|

|

|

发表于 9-6-2008 10:14 AM

|

显示全部楼层

发表于 9-6-2008 10:14 AM

|

显示全部楼层

Magna Prima CEO -- the not-so-conservative former banker

By Hamisah Hamid Published: 2008/06/09

ONE would expect that a property company run by an ex-banker would be conservative, avoiding unchartered territories.

However, Lim Ching Choy has led Magna Prima Bhd into a niche segment of the property sector.

The second board company, which only built residential property before, is now building properties under the integrated development concept.

Such developments combine high-rise apartments with lifestyle shops, signature office, retail mall and hotel.

"The concept is common in many cities in Japan, Hong Kong, Singapore, but it is very new in Malaysia.

"I'm bringing the concept from Japan, Hong Kong and Singapore to complete the country's urban city development," Lim said in an interview with Business Times last week.

So far, its projects in the Klang Valley have seen fast take-up rate.

Lim attributed the good response to the concept and its uniqueness, especially the sky garden built on top of the high-rise apartment building.

Lim, 47, was appointed Magna Prima chief executive officer on November 1 2006.

Before that, Lim, who had 22 years experience in banking and finance, was with Mah Sing Group Bhd for four years.

"I may not be a traditional brick and mortar developer, but I always think out of the box.

"I look at other industries for their good points and incorporate them in Magna Prima," he said.

Lim reads a lot of management book for knowledge and ideas and always looked at successful companies in other sectors to learn.

"For profitability, I look at Fortune 500 companies; for customer service, I look at McDonald's; for system and management, I look at banks and I look at media companies for public relations," he said.

Being an ex-banker also makes Lim very particular about cash flow, project details and financing for each project.

"When I was in banking sector, I've done a lot of property financing and have gone through two major recessions, in 1985 and 1997.

"I've seen large companies collapse because of not being able to financially manage and sustain their gearing and do planning from day one," he said.

Lim believes that each property project should be able to sustain itself.

http://www.btimes.com.my/Monday/OurPick/MAGNAbar.xml/Article |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 18-6-2008 11:48 PM

|

显示全部楼层

16 June 2008: Corporate: Magna Prima looks abroad

By Chong Jin Hun

Email us your feedback at fd@bizedge.com

Magna Prima Bhd is expanding its construction arm to spearhead the company’s foray overseas within three years, which will see it entering high-growth construction and property markets in Southeast Asia.

An overseas construction portfolio will eventually offer Magna Prima, also a property developer, the foundation to grow its real estate business abroad. The company intends to form joint ventures (JV) with foreign government entities to spur its potential overseas undertakings in the same way it entered strategic collaborations in Malaysia.

Also on the cards are more fundraising plans by the Bursa Malaysia Second Board-listed company to enable it to take on more jobs. The company may raise money via bond issues, or by roping in strategic shareholders, Magna Prima’s CEO Lim Ching Choy told The Edge during a recent interview in Petaling Jaya.

“With the construction arm being strengthened, in future, we may be able to go out within the region to look at some construction jobs.

“With more projects coming in, we may even go into bonds and commercial papers. As a growing company, we welcome local or foreign strategic partners,” says Lim, who joined Magna Prima in 2006 following a change in the company’s board of directors.

As a builder, the company’s portfolio, under the previous board, included dams, schools and hospitals, according to Lim. Its current focus is on buildings and civil engineering structures like bridges and water tanks.

To boost its construction order book, Lim says the company, already with RM647 million worth of outstanding jobs, may bid for “one or two” projects worth at least RM150 million each under the Ninth Malaysia Plan.

While Lim did not specify which countries Magna Prima plans to venture into, he did indicate its intentions to tie up with landowners abroad to spur the company’s real estate development unit.

In Malaysia, the company has two ongoing ventures with government entities. These include a tie-up with the Kuala Lumpur municipal council for the RM508 million Metro Prima property project in Kepong. It is also the turnkey contractor for the RM319 million Dataran Otomobil, a Shah Alam-based mixed development involving Perbadanan Kemajuan Negeri Selangor.

No less exciting is Magna Prima’s real estate division. Lim says the company, already with some RM2.1 billion worth of projects under its belt, is working on an upcoming luxury development on a prime piece of land in Kuala Lumpur. He did not elaborate, only indicating that an announcement will be made within two months.

“We need another piece within the Kuala Lumpur City Centre (KLCC) area, which we are now negotiating,” Lim says.

Magna Prima is essentially a niche developer which prefers to acquire “pocket-size” urban land to accommodate high value property projects. Its existing jobs include the RM321 million luxury condominium project, The Avare, which is within the KLCC area, and the RM198 million Magna Ville condominiums in Selayang.

“Before I joined this company, I did a detailed study... why it was not doing well despite having a few good projects in good locations. The answer was people,” Lim says.

Magna Prima’s earnings jumped significantly in 1Q2008. Net profit leapt almost five-fold to RM5.03 million, from RM1.01 million a year earlier, on higher earnings from Avare and Magna Ville. Revenue grew 90.2% to RM48.28 million from RM25.38 million.

The company’s earnings have been on the rise in recent years. It went from a net loss of RM10.43 million in 2005 to a net profit of RM118,471 in 2006 according to its annual report. In 2007, net profit leapt significantly to RM26.58 million.

Magna Prima declared a 7 sen per share dividend for FY2007. Based on its 53.1 million share capital, the company will have to earmark RM3.7 million, or 13.9%, of its net profit for dividends this year.

Going forward, Magna Prima’s growth path may include mergers and acquisitions as part of its plans to graduate to the Main Board. In Malaysia, a Main-Board status is deemed important as it attracts foreign investors.

In the long run, its overseas ventures will ensure wider geographical diversification to further safeguard earnings within the cyclical construction and property sectors. In addition, the idea of roping in a strategic foreign shareholder may lead to overseas business links the Malaysian company needs to excel abroad.

Magna Prima’s shares declined 10 sen to RM4.22 on June 5 with 86,000 shares changing hands.

http://www.theedgedaily.com/cms/content.jsp?id=com.tms.cms.article.Article_999409b0-cb73c03a-adf5be00-bd4f3eb2 |

|

|

|

|

|

|

|

|

|

|

|

发表于 30-6-2008 05:03 PM

|

显示全部楼层

发表于 30-6-2008 05:03 PM

|

显示全部楼层

原帖由 blackcat98 于 30-5-2008 11:54 PM 发表

你這句話令我感到不安,吃不下,睡不著,站不穩,腳在軟,手在斗,眼在乍,心在怕.....

黑猫兄,你的magna不幸被我言中了,

不知道你有没有采取什么行动? |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 30-6-2008 10:57 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 1-7-2008 08:16 AM

|

显示全部楼层

发表于 1-7-2008 08:16 AM

|

显示全部楼层

原帖由 blackcat98 于 30-6-2008 10:57 PM 发表

沒感覺自然也沒動作,我一開始就打算抓長期,預左股災參埋這次的party,

我時常拿某個掛牌建築商例子警惕自己,五年前SARS病毒爆發之際買進,今天回酬何只十倍.

没记错的话你好像有借贷买股对吧?

我还以为你会卖出部份,

缴清贷款,让剩下无债部份的继续滚 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-7-2008 11:09 PM

|

显示全部楼层

回复 197# 悶蛋 的帖子

有過這樣的念頭,可是BUYER都是1LOT,1LOT,更本丟不出貨. |

|

|

|

|

|

|

|

|

|

|

|

发表于 2-7-2008 08:46 AM

|

显示全部楼层

发表于 2-7-2008 08:46 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 6-7-2008 02:20 PM

|

显示全部楼层

原帖由 悶蛋 于 2-7-2008 08:46 AM 发表

如果是我就一点一点出,

不要为了那一点水钱跟大钱过不去,

不过现在说什么也没用了

恩,現在說甚麼都來不及了,不排除會再貸款進貨,

股災啊!越快到來越好!! |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|