|

查看: 3452|回复: 11

|

新的DMA online trading for futures系统

[复制链接]

|

|

|

新的DMA online trading for futures系统将在下个月份开始,你可以自由地自己keyin自己的orders,而且附加realtime charting, 每个月用户费应该是RM250, 除非你的volume > 某些数目 (eg 50~70)。。。。。仅仅是要和你们分享。。。不过, 我不确定什么时候开始。。。。。。。我打电话给Philip Futures,他们告诉我,下个月份开始, AMfutures 早已开始不过非官方, 接着应该是CIMB Futures 。。。还有哪一些Futures公司早已开始DMA online trading for futures。。欢迎分享。。。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-1-2009 09:16 AM

|

显示全部楼层

发表于 22-1-2009 09:16 AM

|

显示全部楼层

|

这各 rm250,没包commision right, 有没有 limited volume?? |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-1-2009 09:25 AM

|

显示全部楼层

发表于 22-1-2009 09:25 AM

|

显示全部楼层

回复 1# asiatrader98 的帖子

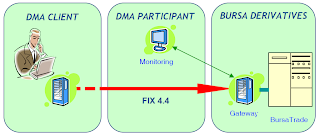

yup, but what i heard is the DMA for retailer need to go thru a firewall in the system, so the speed will me much slower (mayb few second) compare to institutional client which is directly sent the order to Bursa. And also the client need to have enough margin in order to key in the order (not so clear about this margin issue)

the rm250 is the fees for the lease line only. this service is only worth for those with volume n active trader. cos when excees an amount, the company will absort the fees, rm250.

[ 本帖最后由 lemontrees 于 22-1-2009 09:28 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 3-2-2009 12:04 PM

|

显示全部楼层

原帖由 jeniffer99 于 22-1-2009 09:16 AM 发表

这各 rm250,没包commision right, 有没有 limited volume??

好像有限制contracts to trade根据你的margin,不过确定没有包括佣金..主要是用来监督顾客的风险因为目前FBRs用来keyin的PAM没有监督风险的能力 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 3-2-2009 12:09 PM

|

显示全部楼层

原帖由 lemontrees 于 22-1-2009 09:25 AM 发表

yup, but what i heard is the DMA for retailer need to go thru a firewall in the system, so the speed will me much slower (mayb few second) compare to institutional client which is directly sent the or ...

感激你的info...期待它的到来,好像和local 成员用同样的dma。。。你怎样懂得RM250是付款给the lease line ? |

|

|

|

|

|

|

|

|

|

|

|

发表于 3-2-2009 04:26 PM

|

显示全部楼层

发表于 3-2-2009 04:26 PM

|

显示全部楼层

|

听CFBR们说的。因DMA是用其他公司的平台,like N2N,so futures company need to pay for the service。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 4-2-2009 06:47 AM

|

显示全部楼层

原帖由 lemontrees 于 3-2-2009 04:26 PM 发表

听CFBR们说的。因DMA是用其他公司的平台,like N2N,so futures company need to pay for the service。

原来如此!N2N的平台是Trader Connect。。不过听说Philip的平台不用任何的费用,好像是java的平台而且没有live图表 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-2-2009 10:14 AM

|

显示全部楼层

原帖由 asiatrader98 于 4-2-2009 06:47 AM 发表

原来如此!N2N的平台是Trader Connect。。不过听说Philip的平台不用任何的费用,好像是java的平台而且没有live图表

Philip Futures已经证实延迟几个月,AM & CIMB 到目前为止,没有消息 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 5-3-2009 05:39 PM

|

显示全部楼层

Article below captured from N2N brochure

WHAT IS DMA?

Direct Market Access (DMA) is an electronic facility that allows you to directly access

liquidity for financial securities and multiple execution venues directly without the intervention of brokers. DMA enables users to enter their orders on a screen display and have their orders sent directly to the exchange.

WHY SHOUD I CHOOSE DMA?

As of 2008, studies show, almost 38% of buy side equity shares are executed through DMA and s still growing. Though still in its infancy stages, more and more high volume traders are rapidly adopting DMA as a method to agreegate liquidity, AmInvestment now offers you the opportunity to trade in deriviates via DMA and by end of 2009, equities as well. The time saved with DMA gives the critical edge needed for user in today's electronic age. The next frontier would be to expand DMA connectivitiy into the international market.

BENEFITS OF DMA

- DMA offers lower transactions cost.

- DMA orders are not executed by brokers; instead are sent directly to the exchange so there is less chance of error or execution irregularities.

- Traders are able to take advantage of very short lived market opportunities with swift order executions via DMA.

转贴从DMA报告

DMA For Future Market

What is Direct Market Access (DMA)

As the name suggests, using DMA, and entity can trade directly in an exchange - just likes brokers do. There is no need to place an order through a broker.

Advantages of Direct Market Access (DMA)

Speed

The main advantage of DMA in that it results in faster order placement and execution.

Till now, the institutions had to convey their orders to a broker, and the broker would place the orders. This means that the same information had to be conveyed twice, which resulted in delays, and, at times, errors.

Now, with Direct Market Access, the institutions would be able to place the orders directly in the market.

Cost Saving

Cutting down an intermediary would result in significant cost savings for the institutions.

Enable Algorithmic Trading

Since the institutions would be allowed to access the market directly, they can now develop and deploy computers running complex mathematical algorithms, which would place buy and sell orders automatically.

This would be a totally new avenue, and in the future, even mutual funds specializing in algorithmic trading can be introduced. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 5-3-2009 05:42 PM

|

显示全部楼层

有没有人可以给予以下更低的佣金?

Online Trade 期货。DMA Rate (online trade)

FKLI : RM 16 per way (RM32 per round turn)

FCPO : RM 9 per way (RM18 per round turn) INTRADAY

FCPO : RM 14 per way (RM28 per round turn) OVERNIGHT |

|

|

|

|

|

|

|

|

|

|

|

发表于 5-3-2009 06:05 PM

|

显示全部楼层

发表于 5-3-2009 06:05 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 6-8-2010 01:51 PM

|

显示全部楼层

发表于 6-8-2010 01:51 PM

|

显示全部楼层

有没有人可以给予以下更低的佣金?

Online Trade 期货。DMA Rate (online trade)

FKLI : RM 16 p ...

asiatrader98 发表于 5-3-2009 05:42 PM

Which 公司可以提供以上的价格?

请以PM我! 谢谢。 |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|