|

查看: 1918|回复: 4

|

MediaRing 新加坡立通网络软件公司

[复制链接]

|

|

|

各位大大, 认为Media Ring 又怎样呢???

[ 本帖最后由 臥龍先生 于 10-4-2007 04:00 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 31-3-2007 08:15 AM

|

显示全部楼层

发表于 31-3-2007 08:15 AM

|

显示全部楼层

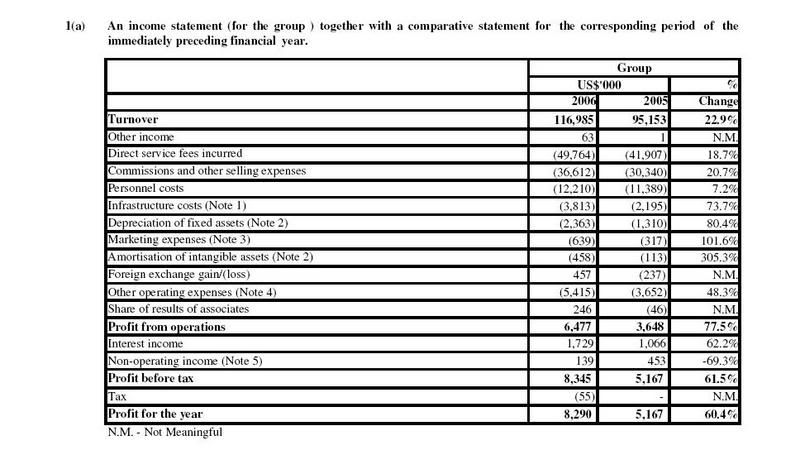

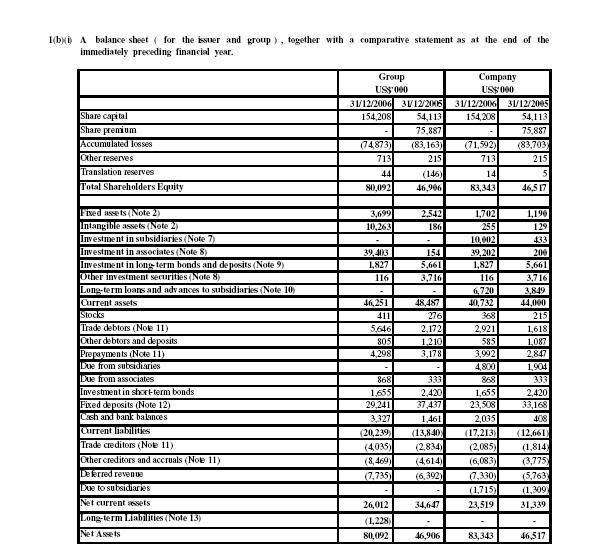

這在里把 MEDIA RING 的資料放上, 方便大家討論

MediaRing Ltd is a pure-play voice over Internet protocol (VoIP)service provider Asia. The principal activities of the Company and itssubsidiaries are marketing and sale of telecommunication services.MediaRing is also engaged in research and development, design andmarketing of telecommunication software. It delivers a range of voiceservices to carriers, enterprises, service providers and consumersworldwide. The Company achieves this through its technological edge andinterconnected global distribution network, which enables MediaRing toterminate calls in more than 240 countries, around the clock. TheCompany operates in Malaysia, Shanghai, Beijing, Hong Kong, Taiwan,Japan, United States America and Cambodia. It operates in threesegments: Retail Operations, Carrier Operations and Others. TheCompany's wholly owned subsidiaries include MediaRing.com, Inc, i2u PteLtd, MediaRing TC, Inc and MediaRing (Hong Kong) Limited.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-4-2007 01:40 PM

|

显示全部楼层

发表于 10-4-2007 01:40 PM

|

显示全部楼层

Spotlight on MediaRing

At a glance

Last Price (S$) 0.41

YTD (%) +24.2

Issued shares (m) 1,150.67

Market cap (S$ m) 471.77

52-wk range (S$) 0.275 - 0.53

3M avg volume (m) 15.67

2008 P/E (x)* N/A

P/BV (x) 3.8

*Bloomberg Consensus

Description: MediaRing researches, develops, designs, and markets telecommunication software. The company also provides international telephony services and Internet voice services.

Immediate outlook: The stock rose more than 31% since our last technical buy note (see trading Idea 19 Jan). The share price hit a high of S$0.48, even surpassing our MT target of S$0.45. It broke out of its consolidation triangle yesterday. Both technical indicators are

looking bullish right now. Technical Buy now at S$0.39-0.41 and place a stop below its 200-day SMA, at S$0.355. The ST breakout target is S$0.48.

Medium term outlook (2-6 months): The stock’s long-term outlook is neutral with a positive bias. It is still stuck in its 2-year consolidation triangle. MT indicators are about to turn positive again. Hence, we think a breakout beckons sometime in the short to mediumterm. LT investors should buy half now and accumulate the rest on any weakness as the medium term target points to S$0.54. |

|

|

|

|

|

|

|

|

|

|

|

发表于 8-6-2007 11:57 AM

|

显示全部楼层

发表于 8-6-2007 11:57 AM

|

显示全部楼层

Spotlight on MediaRing

At a glance

Last Price (S$) 0.425

YTD (%) +28.8

Issued shares (m) 1,152.31

Market cap (S$ m) 489.73

52-wk range (S$) 0.275 - 0.48

3M avg volume (m) 9.51

2008 P/E (x)* N/A

P/BV (x) 4.0

*Bloomberg Consensus

The bulls are calling

Description: MediaRing researches, develops, designs and markets telecommunication

software. The company also provides international telephony services and Internet voice

services.

Immediate outlook: The stock is on the verge of breaking out of its consolidation triangle.

MACD continued to edge higher while RSI has hooked up again. Both indicators are

supportive of a breakout taking place soon. Technical Buy now at S$0.40-0.425, in

anticipation of the breakout. Place a stop at S$0.38. The short term breakout target is

S$0.48.

Medium term outlook (2-6 months): The stock’s long term outlook is neutral with a

positive bias. It is still stuck in its 2-year consolidation triangle. Medium term indicators are

turning positive again. Hence, we think a breakout beckons sometime in the short to

medium-term. Long term investors should buy half now and accumulate the rest on any

weakness as the medium term target points to S$0.56. |

|

|

|

|

|

|

|

|

|

|

|

发表于 8-6-2007 12:08 PM

|

显示全部楼层

发表于 8-6-2007 12:08 PM

|

显示全部楼层

|

MediaRing – Internet telephony company MediaRing accepted a sweetened takeover offer by Connect Holdings for its stake in Pacific Internet yesterday, against market expectations that it might make a counter offer. This will pave the way for Connect's offer for PacNet to go through. Including MediaRing's 29.3 per cent stake in PacNet and the acceptances PacNet had received as at June 5, Connect's stake in PacNet is well above the minimum requirement of 50 per cent to make the offer successful. Connect yesterday raised its offer price to US$11 net in cash for each PacNet share from US$10. This is a 20.75 per cent premium to PacNet's closing price of US$9.11 on Jan 11, the last trading day before the bid was announced. Saying the offer price is 'final', Connect has extended the closing date from yesterday to June 22. |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|