|

查看: 1786|回复: 1

|

有听过 Abyss 下一代的游戏的 独角兽?

[复制链接]

|

|

|

本帖最后由 aidj 于 8-2-2018 12:04 AM 编辑

不熟悉游戏。 请这里大大给宝贵的反馈。再此谢过。

发现Ta举荐制度分为5层,觉得有点M L M。

邀请码 : https://www.theabyss.com/invite/y4kgb7

Join 进一步了解更多

警告:本文仅供参考,不构成任何投资买卖及其他建议,否则后果自行承担,投资有风险,入市需谨慎!

来源:互联网

=================

Feb 2 7min read

The Abyss Smart Contract Redeveloped in Compliance with DAICO Concept

After adopting the DAICO concept, we had to redevelop the project’s Smart Contract to get all the innovative features, we’re bringing to the crypto industry, embedded in its code. The Smart Contract is now exposed on the Github. It is currently being audited by independent reputable auditor New Alchemy ($3 615 324 627 total market cap of their clients as of Feb 3, 2018). This requires greater financial resources and time, but it is well worth it, though.

Below is a detailed description with code examples for your consideration and further understanding.

During The Abyss Token Sale (DAICO) the project will utilize three Smart Contracts:

- The Crowdsale smart contract;

- The Tokens smart contract.

The Fund contract is meant for storing contributed ETH.

The Tokens contract is created automatically after the start of crowdsale. It is meant for generating tokens, which will be locked and can not be transferred until the end of crowdsale. If crowdsale ends successfully (at least the Soft Cap level is reached), tokens are unlocked and can be freely transferred from wallet to wallet.

.

Crowdsale

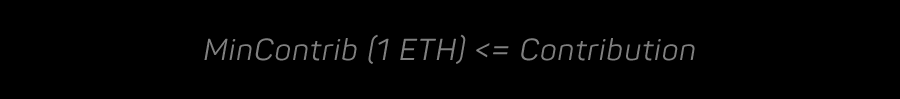

When contribution is made, the contract verifies that its amount corresponds to:

Days 1–7

Days 8+

If contribution is made within crowdsale start-end delta time, the respective amount of tokens (with bonus tokens also considered) is generated by the Tokens contract, while ETH is sent and stored at the Fund contract. This scheme is operational until the end of crowdsale.

Processing of contributed ETH

.

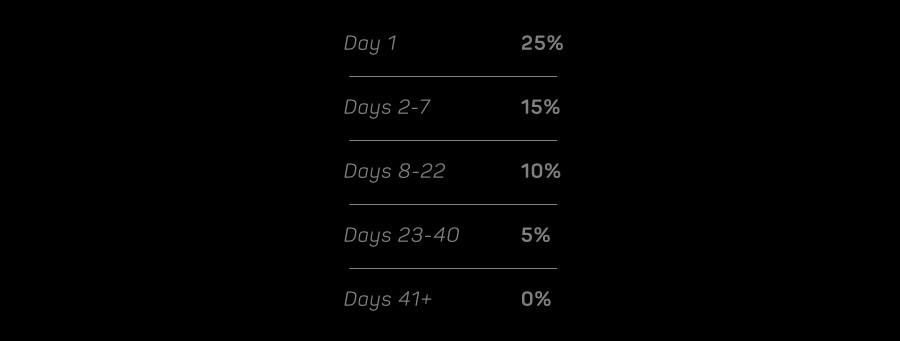

Bonus program

During crowdsale bonus program will be operational, with bonus tokens generated by the Tokens smart contract.

The Tokens contract is created automatically after the start of crowdsale. It is meant for generating tokens, which will be locked and can not be transferred until the end of crowdsale. If crowdsale ends successfully (at least the Soft Cap level is reached), tokens are unlocked and can be freely transferred from wallet to wallet.

.

Crowdsale results

The crowdsale may result in:

- Failing to reach the Soft Cap level;

- Reaching the Soft Cap level.

Soft Cap not reached

If the project fails to reach the Soft Cap level (5000 ETH), tokens remain locked and can not be transferred from one user wallet to another.

The Fund automatically switches to the CrowdsaleRefund mode, returning the raised ETH to contributors and burning company, reserve and all bonus tokens.

Crowdsale refund

Soft Cap / Hard Cap reached

Raising the Soft Cap means the project either reached the Hard Cap (50 000 ETH), or not.

The total funds raised are verified so that the Hard Cap level is not exceeded. If the Hard Cap is exceeded, the excess is returned to respective contributor. On reaching the Hard Cap level, the crowdsale stops.

.

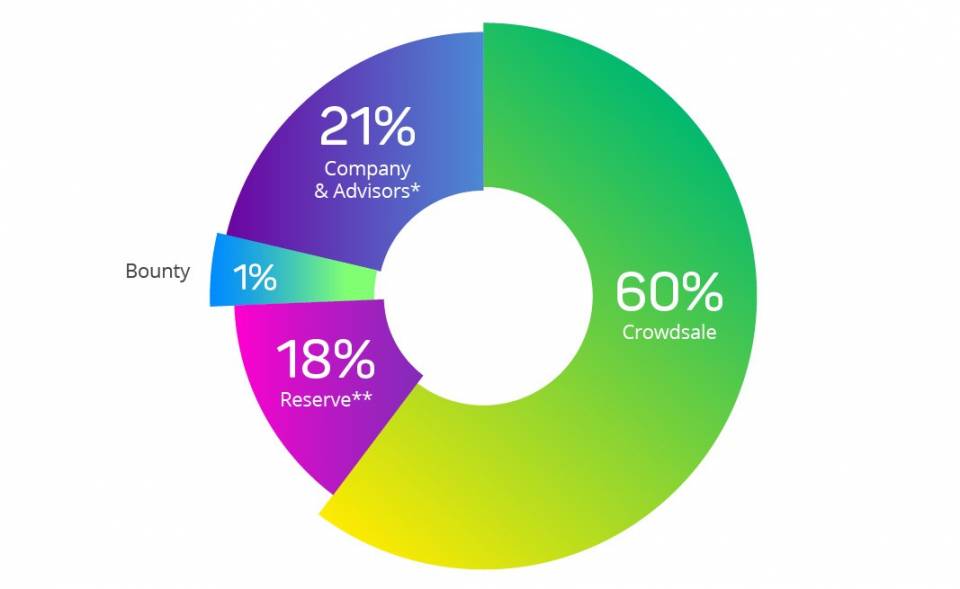

Tokens distribution

After the crowdsale is complete:

- The company tokens are transferred to the companyTokenswallet;

- The referral program tokens are transferred to the referralTokenswallet;

- The reserve tokens are transferred to the reserveTokenswallet;

- The advisors tokens are transferred to the advisorsTokenWallet;

- The bounty tokens are transferred to the bountyTokenWallet.

Finalizing of Crowdsale

The company, reserve, advisors and bounty tokens are distributed by smart contract as follows:

Tokens Distribution

*The Company allocation of ABYSS tokens will have a vesting period of 1 year, 50% vesting each 6 months, with a 6 month cliff. Advisors tokens are not subject to vesting period and will be transferred to the project’s advisors after the end of Token Sale.

**The Reserve tokens (18% of total token supply) will be frozen for 6 months. The reserve will be used to provide motivational rewards to players and also to bring new games to the platform.

.

Withdrawal of funds

After the crowdsale is complete, the Fund contract switches to the TeamWithdraw mode, allowing the project’s team to withdraw the raised funds.

There are two ways the raised funds can be disbursed by the Fund contract to the developing team:

1. Tap (wei/sec)—a reasonable maximum amount that team can receive from the Fund contract per month. The initial project’s tap, established by smart contract, is 115740740740740 (wei/sec) = 300 ETH/month. The tap is meant for supporting the platform’s development process. If the tap is not disbursed, it keeps accumulating over time;

2. Buffer—a one-time extra sum for project’s purposes. The initial buffer is 0 ETH.

Tap and Buffer withdraw

Polls

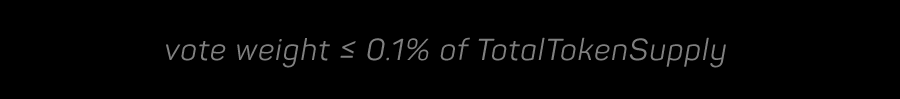

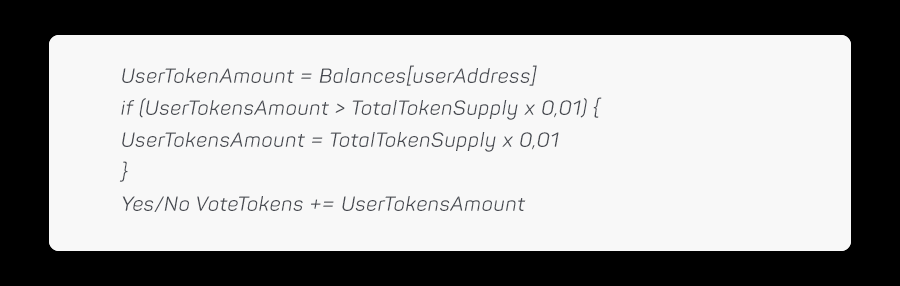

If the team needs more funds for whichever reason, it can launch a poll either for raising the tap or receiving the buffer. Token holders can vote, depending on the amount of tokens they hold on their wallets (N, where N≠0), if they approve of the disbursement of extra funds or not.

The company and the reserve tokens do not have a right to vote. Prevention (Proof-of-Stake algorithm) protocols have been included to protect against abuse by large token holders like exchanges. The weight of each Ethereum-wallet’s vote is limited by a certain amount of tokens:

To prevent the abuse of the system, the %, by which the tap may be raised at a time, is limited to 50% of the initial amount. The tap can be raised only once in 14 days period;

The contributors are duly informed of time and date of a new poll. The poll is announced by the team at least 4 days before the start, with the voting process lasting 3 days.

After the poll is closed, votes are not accepted:

The voting results are visible to all participants.

The team is not allowed to launch two parallel same-type polls. But the tap poll may well be conducted at the same time as the buffer poll.

.

Quorum

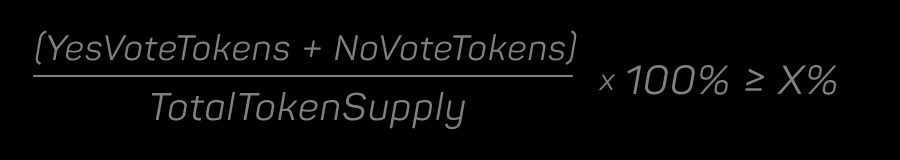

The amount of tokens needed to participate in the poll is calculated this way:

The poll is considered fulfilled, if a certain quorum is reached (X% of TotalTokenSupply):

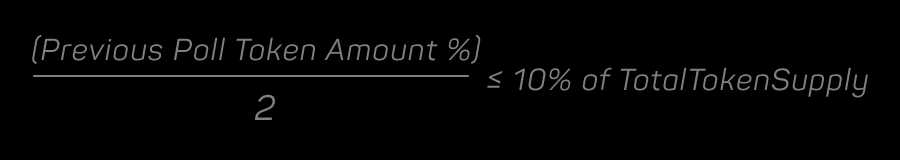

The first poll though requires no quorum (X%=0). The required quorum for all subsequent polls is adjusted automatically, and calculated this way:

This is due to the large amount of tokens locked. Locked tokens are eligible to vote with, however, transferring them from wallet to wallet is technically impossible.

If YesVoteTokens > NoVoteTokens, the tap amount is raised / buffer is received. Or vice-versa.

Oracles and the project’s shut down

The Oracles (the appointed industry professionals, with established reputation in the relevant field), would have the exclusive right to hold the poll for project’s shut down, leading to the remaining funds returned to contributors.

In case the Oracles see that the project team shows the unsatisfactory performance (failing to implement it), with wallets of their own, they initiate the shut-down poll.

Oracle voting creation and voting results processing

If the contributors vote YesVoteTokens > NoVoteTokens, this results in the project’s shut down, and burning the company and reserve tokens.

.

Refund

The project’s shut down and the refund is similar to refund, initiated on not reaching the Soft Cap level during the crowdsale.

Project’s shutdown voting creation

After burning the company and reserve tokens, the contributed ETH is returned, with user’s tokens bought out at the rate of the day, calculated with formula:

From this moment, the Smart Contract is closed.

.

The U.S. citizens and residents

Under relevant U.S. securities regulations, tokens sold to U.S. accredited investors will be subject to a vesting period of 1 year.

The Token Sale (DAICO) Hard Cap in the U.S. is 20 000 ETH, with:

Days 1–7

Days 8+

If the U.S. Hard Cap is reached by March 1, starting from this day, the accredited U.S. participants may still contribute until the Token Sale (DAICO) stops, reaching the project’s Hard Cap (50 000 ETH).

This approach is also applied to the non-U.S. Token Sale (DAICO) participants in the rest of the world. On reaching 30 000 ETH by March 1, the non-U.S. participants may still contribute until the Token Sale (DAICO) stops, reaching the project’s Hard Cap (50 000 ETH).

.

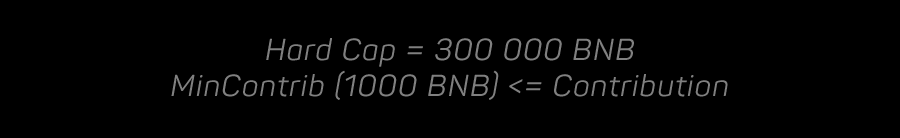

Binance (BNB) tokens

We have additional Hard Cap for our Token Sale and it will be nominated in BNB tokens with:

BNB tokens are not subject to vesting period and can be withdrawn by the developing team for the project’s purposes (if needed) after the end of crowdsale.

BNB tokens contributions are not considered in the Soft Cap. However, in case the Soft Cap is not reached, there will be possibility to return BNB tokens to the wallets they were sent from without our intervention.

Course for BNB will be set in a few days before the start of Token Sale depending on the ETH market rate. BNB tokens are accepted from the international (non U.S.) participants only.

Process of BNB contribution

.

Conclusion

The Abyss Token Sale (DAICO) is scheduled for February 7, 2018 (15:00 UTC), closing on April 1, 2018 (15:00 UTC).

We believe that this system gives an unprecedented level of security, transparency and control, at the same time representing a refreshing development for an ICO practice that has produced so many fraudulent schemes.

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 11-2-2018 09:24 PM

来自手机

|

显示全部楼层

Bitcoin Nano——18.6.30 发布

在游戏行业的应用实践 |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|