|

|

http://readforalife.blogspot.com/2010/06/01072010-padini-vs-hingyiap-group.html

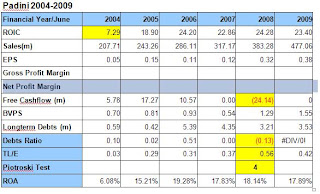

As you can see above, Padini’s ROE is better, sales growth is faster.But Hing Yiap had improved since year 2008. Currently it has achieve3Q2010 EPS as 0.2797, estimated to achieve EPS=0.30 in this year, thusit is trading way too low in P/E. As you can see above, Padini’s ROE is better, sales growth is faster.But Hing Yiap had improved since year 2008. Currently it has achieve3Q2010 EPS as 0.2797, estimated to achieve EPS=0.30 in this year, thusit is trading way too low in P/E.

Yet, its dividend payout is quite well. Look at its pass year’s payout

Year Dividend Div Yield %

2009 0.0812 7.12%

2008 0.075 6.58%

2007 0.04 3.51%

2006 0.02 1.75%

2005 0.01 0.88% |

|