|

|

发表于 18-6-2017 02:32 AM

|

显示全部楼层

发表于 18-6-2017 02:32 AM

|

显示全部楼层

吉朗遭索赔897万

2017年6月7日

(吉隆坡6日讯)吉朗(ZELAN,2283,主板建筑股)独资子公司吉朗建筑,遭Macon Charter私人有限公司索偿185万5263欧元(约897万令吉)。

该公司今日向交易所报备,Macon Charter向吉朗建筑申索89万5000欧元(约433万令吉)欠款、66万7428欧元(约323万令吉)外部勘察开销、29万2835欧元(约142万令吉)逾期付款利息、总额5%年率利息与成本。

去年,Macon Charter曾向吉朗建筑索偿同等数额。

同时,法官也驳回吉朗建筑于3月10日提出的申索反诉。

该公司表示,会寻求法律意见,维护吉朗建筑的利益。【e南洋】

Type | Announcement | Subject | MATERIAL LITIGATION | Description | IN THE MATTER OF KUALA LUMPUR HIGH COURT (COMMERCIAL DIVISION) ADMIRALTY IN PERSONAM NO.: WA-27NCC-85-12/2016 BETWEEN MACON CHARTER B.V. (AS PLAINTIFF) AND ZELAN CONSTRUCTION SDN BHD (AS DEFENDANT) | Further to the announcement on 14 December 2016, Zelan Berhad wishes to announce that on 5 June 2017, its wholly-owned subsidiary, Zelan Construction Sdn Bhd (“ZCSB” or “Defendant”) was informed by its solicitors that on 2 June 2017, the Judge has allowed Macon Charter B.V.’s (“MCBV” or “Plaintiff”) application for summary judgment against ZCSB with costs of RM8,000.00 to the Plaintiff and subject to the allocator fees. In its application for summary judgment, MCBV claimed for the following reliefs: (a) EUR895,000 being admitted outstanding Third Payment under the Settlement Agreement;

(b) EUR667,428,09 being outstanding agreed outsurvey costs;

(c) EUR292,834.98 being agreed late payment interest as at 7 December 2016 pursuant to Clause 4 of the Settlement Agreement;

(d) Interest at the rate of 5% per annum on the sum of EUR1,855,263.07 from the date of commencement of this action to date of full realisation; and

(e) Costs.

ZCSB’s solicitors further informed that ZCSB’s counterclaims raised in its Amended Defence and Counterclaim dated 10 March 2017 for the following reliefs was dismissed by the Judge: (a) For a declaration that the Settlement Agreement dated 2 September 2016 is void and/or unenforceable;

(b) Alternatively, that Clause 4 of the Settlement Agreement dated 2 September 2016 is a penalty interest clause and is void and/or unenforceable;

(c) That the total Downtime, estimated to be EURO723,860.00, be determined and assessed by this Honorable Court and to be paid by the Plaintiff to the Defendant;

(d) Alternatively, for the total Downtime, estimated to be EURO723,860.00, be determined and assessed by this Honorable Court and to be set off against the Plaintiff’s claims herein;

(e) That the total Payment on Behalf, estimated to be RM1,069,416.87 be determined and assessed by this Honorable Court and to be paid by the Plaintiff to the Defendant;

(f) Alternatively, for the total Payment on Behalf, estimated to be RM1,069,416.87 be determined and assessed by this Honorable Court and to be set off against the Plaintiff’s claims herein;

(g) That the Plaintiff’s claim for Outsurvey costs be dismissed in its entirety;

(h) Alternatively, for the Outsurvey costs to be assessed by this Honorable Court and to be set off against the Plaintiff’s claims herein;

(i) Further or alternatively to prayers (c) to (h) above, for damages to be assessed by this Honorable Court; and

(j) Interest at the statutory rate of 5% per annum on all sums due to the Defendant from its due date until full realisation thereof.

In view of the above decision, the trial dates fixed on the 13 to 16 June 2017 have been vacated. ZCSB has not received any duly approved draft Judgment, nor been served with a sealed Judgment.

In the interim, ZCSB will be seeking legal advice and will take appropriate steps to safeguard ZCSB’s interests.

This announcement is dated 5 June 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-8-2017 04:59 AM

|

显示全部楼层

发表于 6-8-2017 04:59 AM

|

显示全部楼层

本帖最后由 icy97 于 8-8-2017 02:54 AM 编辑

与Meena控股仲裁案

吉朗调高索赔额至6.48亿

2017年8月8日

(吉隆坡7日讯)吉朗(ZELAN,2283,主板建筑股)宣布,向Meena控股索赔的损失,从4亿5276万阿联酋迪拉姆(约5亿2765万令吉),调高至5亿5592万阿联酋迪拉姆(6亿4786万令吉)。

吉朗在上周五向交易所报备,在提呈给仲裁庭的案情陈述书中,独资子公司吉朗控股(大马)私人有限公司已调高索赔损失数额。

该公司调高索赔损失,是因为各种索赔项目金额因为时间流逝而增加,也是基于编制最初索赔额后所取得的新文件,因而决定调整索赔金额。

吉朗控股指Meena控股,违反有关位于阿布达比的Meena大厦综合发展项目的合约,而在去年8月提出仲裁申请。【e南洋】

Type | Announcement | Subject | MATERIAL LITIGATION | Description | IN THE MATTER OF ARBITRATION BETWEEN ZELAN HOLDINGS (M) SDN BHD (AS CLAIMANT) AND MEENA HOLDINGS LLC ["MH"] (AS RESPONDENT) IN THE INTERNATIONAL COURT OF ARBITRATION, INTERNATIONAL CHAMBER OF COMMERCE | Further to the announcement on 19 August 2016, Zelan Berhad wishes to announce that its wholly owned subsidiary, Zelan Holdings (M) Sdn Bhd (“ZHSB”) has revised the amount of its claim against MH to AED555,915,446.44 as contained in its Statement of Case submitted to the Arbitral Tribunal. The increase is largely due to various items of claims which have increased through effluxion of time and also based on documents received subsequent to the compilation of the initial amount claimed.

This Announcement is dated 4 August 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-8-2017 03:38 AM

|

显示全部楼层

发表于 23-8-2017 03:38 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 11,495 | 56,493 | 45,126 | 117,884 | | 2 | Profit/(loss) before tax | -2,408 | 8,904 | 4,762 | -27,388 | | 3 | Profit/(loss) for the period | -5,459 | 7,377 | 1,667 | -30,196 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -5,449 | 7,384 | 1,678 | -30,189 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.64 | 0.87 | 0.20 | -3.57 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1600 | 0.1600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-11-2017 07:09 AM

|

显示全部楼层

发表于 14-11-2017 07:09 AM

|

显示全部楼层

吉朗遭索賠數額提高至7.5億

2017年11月13日

(吉隆坡13日訊)吉朗(ZELAN,2283,主要板建築)接獲Meena控股發出辯護聲明和反訴信函,將早前索賠數額上調至6億5435萬迪拉姆或約7.46億令吉。

該公司向馬證交所報備,Meena控股原本在2016年10月7日提出的索賠數額為5億9100萬迪拉姆(約6.7億令吉),如今提高索賠數額,主要包括修改工作、原料虧損、承包商成本超支賠償等費用。

吉朗表示,將會在適當的時候回應有關反訴。【中国报财经】

Type | Announcement | Subject | MATERIAL LITIGATION | Description | IN THE MATTER OF ARBITRATION BETWEEN ZELAN HOLDINGS (M) SDN BHD (AS CLAIMANT) AND MEENA HOLDINGS LLC ["MH"] (AS RESPONDENT) IN THE INTERNATIONAL COURT OF ARBITRATION, INTERNATIONAL CHAMBER OF COMMERCE | Further to the announcement on 7 October 2016, Zelan Berhad wishes to announce that its wholly owned subsidiary, Zelan Holdings (M) Sdn Bhd (“ZHSB”) has received MH’s Statement of Defence and Counterclaim dated 9 November 2017 whereby MH has revised its counterclaim against ZHSB to the sum of AED654,346,367.00 (plus sums to be determined) for the following items:

1) Rectification / alteration of the façade works; 2) Structural strengthening and repair works in walls and columns, together with necessary associated repairs and rework for the basement B1 and B2 slabs, the waterproofing and the retaining walls; 3) MEP replacement work and necessary associated rework; 4) Loss of materials on Site; 5) Extra-over costs for the replacement contractor; 6) Consultant fees to complete the Project; 7) Loss of rental and revenue from the Project as a result of delayed completion; 8) Return of Subcontractor advance payment; 9) Costs of ZHSB’s wrongful Court proceedings; 10) Standstill costs of the Site; 11) Other costs and losses; 12) MH’s costs of the arbitration; and 13) Interest on all sums due to MH.

ZHSB will be filing its Statement of Reply to Defence and Defence to Counterclaim in due course.

This Announcement is dated 13 November 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2017 12:15 AM

|

显示全部楼层

发表于 29-11-2017 12:15 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 8,557 | 39,793 | 53,683 | 157,677 | | 2 | Profit/(loss) before tax | -10,257 | 78 | -5,495 | -27,310 | | 3 | Profit/(loss) for the period | -10,108 | 281 | -8,441 | -29,915 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -10,099 | 270 | -8,421 | -29,919 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.20 | 0.03 | -1.00 | -3.54 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1500 | 0.1600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-12-2017 05:35 AM

|

显示全部楼层

发表于 9-12-2017 05:35 AM

|

显示全部楼层

Date of change | 01 Dec 2017 | Name | ENCIK REZLAN BIN GOON | Age | 48 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Others | Qualifications | Bachelor in Accountancy (Hon), MARA University of Technology.A member of CPA Australia and a member of the Malaysian Institute of Accountants. | Working experience and occupation | Senior Finance Manager, Tadmax Indah Power Sdn Bhd (January 2017-June 2017)Senior Cost Controller-Project, Carigali Hess Operating Company Sdn Bhd (May 2011-November 2016)Team Leader Cost Control IT - (ROW) BP Business Service Centre Asia Sdn Bhd (January 2010-April 2011)Finance Manager, BP Asia Pacific (Malaysia) Sdn Bhd (November 2007-December 2009)Finance Analyst, BP Asia Pacific (Malaysia) Sdn Bhd (April 2005-October 2007)Application Analyst, BP (Malaysia) Sdn Bhd (April 2000-March 2005)Accountant, BP (Malaysia) Sdn Bhd (April 1998-March 2000)Group Accountant, Ancom Energy and Services Sdn BhdSenior Auditor, Arthur Andersen & Co (Now merged with Ernst & Young) | Directorships in public companies and listed issuers (if any) | None | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | None |

| Remarks : | | Encik Rezlan Bin Goon has been appointed as General Manager, Finance, who is primarily responsible for the management of the financial affairs of Zelan Berhad effective 1 December 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2018 04:50 AM

|

显示全部楼层

发表于 13-1-2018 04:50 AM

|

显示全部楼层

Date of change | 12 Jan 2018 | Name | DATO SRI CHE KHALIB BIN MOHAMAD NOH | Age | 52 | Gender | Male | Nationality | Malaysia | Designation | Director | Directorate | Non Independent and Non Executive | Type of change | Resignation | Reason | Due to other management responsibilities and commitments. | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No | Qualifications | 1. Fellow of the Association of Chartered Certified Accountant (United Kingdom)2. Chartered Accountant (Malaysia) | Working experience and occupation | Dato' Sri Che Khalib began his career with Messrs. Ernst & Young in 1989 and later joined Bumiputra Merchant Bankers Berhad. Between 1992 and 1999, he served in several companies within the Renong Group. In June 1999, he joined Ranhill Utilities Berhad as Chief Executive Officer. He then assumed the position of Managing Director and Chief Executive Officer of KUB Malaysia Berhad. On 1 July 2004, Dato Sri Che Khalib was appointed as the President/Chief Executive Officer of Tenaga Nasional Berhad (TNB) where he served TNB for 8 years until the completion of his contract on 30 June 2012. He later joined DRB-HICOM Berhad as Chief Operating Officer of Finance, Strategy and Planning in July 2012. Dato' Sri Che Khalib was previously a member of the Board and the Executive Committee of Khazanah Nasional Berhad from 2000 until 2004. He also served as a Board member within the United Engineers Malaysia Berhad Group of companies and Bank Industri & Teknologi Malaysia Berhad. Dato Sri Che Khalib currently sits on the Board of MMC Corporation Berhad, Gas Malaysia Berhad, Malakoff Berhad, Johor Port Berhad, MMC Engineering Group Berhad, Aliran Ihsan Resources Berhad, Bank Muamalat Malaysia Berhad, NCB Holdings Berhad, Kontena Nasional Berhad, Northport (Malaysia) Berhad and several private limited companies. | Family relationship with any director and/or major shareholder of the listed issuer | Dato' Sri Che Khalib bin Mohamad Noh has no relationship with and is not related to any director and/or major shareholder of Zelan Berhad except by virtue of being a nominee Director of MMC Corporation Berhad, a major shareholder of Zelan Berhad. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-2-2018 03:42 AM

|

显示全部楼层

发表于 10-2-2018 03:42 AM

|

显示全部楼层

Date of change | 07 Feb 2018 | Name | ENCIK REZLAN BIN GOON | Age | 48 | Gender | Male | Nationality | Malaysia | Type of change | Resignation | Designation | Others | Reason | To pursue other career opportunity. | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No | Qualifications | Bachelor in Accountancy (Hon), MARA University of Technology.A member of CPA Australia and a member of the Malaysian Institute of Accountants. | Working experience and occupation | Senior Finance Manager, Tadmax Indah Power Sdn Bhd (January 2017-June 2017)Senior Cost Controller-Project, Carigali Hess Operating Company Sdn Bhd (May 2011-November 2016)Team Leader Cost Control IT - (ROW) BP Business Service Centre Asia Sdn Bhd (January 2010-April 2011)Finance Manager, BP Asia Pacific (Malaysia) Sdn Bhd (November 2007-December 2009)Finance Analyst, BP Asia Pacific (Malaysia) Sdn Bhd (April 2005-October 2007)Application Analyst, BP (Malaysia) Sdn Bhd (April 2000-March 2005)Accountant, BP (Malaysia) Sdn Bhd (April 1998-March 2000)Group Accountant, Ancom Energy and Services Sdn BhdSenior Auditor, Arthur Andersen & Co (Now merged with Ernst & Young) | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | None |

| Remarks : | | Encik Mohd Nasir bin Hj. Md Saad has been appointed as Acting Head of Finance, who is primarily responsible for the management of the financial affairs of Zelan Berhad effective 8 February 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-2-2018 01:03 AM

|

显示全部楼层

发表于 20-2-2018 01:03 AM

|

显示全部楼层

本帖最后由 icy97 于 21-2-2018 02:28 AM 编辑

应收账款减值扩大

吉朗末季亏5910万

2018年2月21日

(吉隆坡20日讯)吉朗(ZELAN,2283,主板建筑股)截至去年12月杪的2017财年末季,净亏按年扩大至5909万8000令吉,或每股6.99仙。

吉朗日前向交易所报备,2016财年同期的净亏为3770万4000令吉,或每股4.46仙。

据财报解释,由于大马国际回教大学(IIUM)和Meena Plaza项目的长期应收账款的账面减值幅度扩大,从2016财年同期的2370万令吉,提高至4340万令吉。

再加上,国外子公司面临的外汇账面亏损,导致该季净亏按年扩大。

全年净亏收窄

吉朗营业额也从2016财年的6511万3000令吉,剧减73.3%至1738万7000令吉,归咎于不少大型项目已经完成,包括吊桥工程、武吉免登城市中心(BBCC)相关项目,以及原料装卸设施码头项目。

累计全年,净亏从前年的6762万3000令吉或每股8仙,稍微收窄至6751万9000令吉或每股7.99仙;营业额按年减少96.8%,至7107万令吉。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 17,387 | 65,113 | 71,070 | 222,790 | | 2 | Profit/(loss) before tax | -59,343 | -39,746 | -64,838 | -67,056 | | 3 | Profit/(loss) for the period | -59,115 | -37,697 | -67,556 | -67,612 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -59,098 | -37,704 | -67,519 | -67,623 | | 5 | Basic earnings/(loss) per share (Subunit) | -6.99 | -4.46 | -7.99 | -8.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0900 | 0.1600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-4-2018 03:06 AM

|

显示全部楼层

发表于 22-4-2018 03:06 AM

|

显示全部楼层

Type | Announcement | Subject | MATERIAL LITIGATION | Description | IN THE MATTER OF ARBITRATION BETWEEN HITACHI LIMITED (AS CLAIMANT) AND ZELAN HOLDINGS (M) SDN BHD (AS RESPONDENT) IN THE INTERNATIONAL COURT OF ARBITRATION, INTERNATIONAL CHAMBER OF COMMERCE | Zelan Berhad (“ZB”) wishes to announce that its wholly owned subsidiary, Zelan Holdings (M) Sdn Bhd (“ZHSB”), has on 16 April 2018 received from the Secretariat of the International Court of Arbitration, International Chamber of Commerce (“ICC”) a Request For Arbitration dated 29 March 2018 issued under ICC Rules of Arbitration by Hitachi Limited (“Hitachi”) as the Claimant against ZHSB as the Respondent in respect of disputes and differences arising from the Nominated Sub-Contract for the Supply, Delivery, Installation, Testing & Commissioning of Water Cooled Chiller Package No. MEP/005 between Hitachi Plant Technologies Ltd and ZHSB dated 15 May 2012 (“Sub-Contract”) in relation to Meena Plaza Mixed Use Development Project in Abu Dhabi, United Arab Emirates.

Hitachi is claiming against ZHSB, inter alia, an aggregate amount of AED15,218,642.25 for the following:

(a) works done and materials on-site; (b) materials off-site and subcontractor’s claims; (c) suspension cost; (d) demobilisation cost; and (e) interest on amounts certified.

ZHSB shall take all necessary steps to defend or safeguard ZHSB’s interests in the arbitration proceedings, including but not limited to seeking legal advice on the merits of the claims by Hitachi.

This Announcement is dated 17 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2018 05:20 AM

|

显示全部楼层

发表于 27-4-2018 05:20 AM

|

显示全部楼层

Date of change | 25 Apr 2018 | Name | DATO' ABDULLAH BIN MOHD YUSOF | Age | 79 | Gender | Male | Nationality | Malaysia | Designation | Director | Directorate | Independent and Non Executive | Type of change | Demised |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-5-2018 02:00 AM

|

显示全部楼层

发表于 9-5-2018 02:00 AM

|

显示全部楼层

本帖最后由 icy97 于 11-5-2018 02:21 AM 编辑

Type | Announcement | Subject | AUDIT REPORT - MODIFIED OPINION / MATERIAL UNCERTAINTY RELATED TO GOING CONCERN

MATERIAL UNCERTAINTY RELATED TO GOING CONCERN | Description | STATEMENT OF MATERIAL UNCERTAINTY RELATED TO GOING CONCERN OF THE GROUP AND THE COMPANY IN RESPECT OF ZELAN BERHADS STATUTORY FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2017 | Pursuant to Paragraph 9.19(37) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of Zelan Berhad (the “Company”) wishes to announce that its external auditors, Messrs. PricewaterhouseCooper PLT, has issued a statement of “Material Uncertainty Related to Going Concern of the Group and the Company” in respect of the Company’s financial statements for the financial year ended 30 December 2017.

Please refer to attachment below for further details.

This announcement is dated 30 April 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5780973

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-5-2018 05:51 AM

|

显示全部楼层

发表于 29-5-2018 05:51 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 20,513 | 33,631 | 20,513 | 33,631 | | 2 | Profit/(loss) before tax | -2,677 | 7,170 | -2,677 | 7,170 | | 3 | Profit/(loss) for the period | -3,342 | 7,126 | -3,342 | 7,126 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -3,342 | 7,127 | -3,342 | 7,127 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.40 | 0.84 | -0.40 | 0.84 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0900 | 0.0800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-6-2018 06:59 PM

来自手机

|

显示全部楼层

发表于 28-6-2018 06:59 PM

来自手机

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 4-7-2018 01:18 AM

|

显示全部楼层

发表于 4-7-2018 01:18 AM

|

显示全部楼层

Date of change | 01 Jul 2018 | Name | ENCIK KAMARUDDIN BIN ABD KARIM | Age | 58 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Operating Officer | Qualifications | Bachelor of Science in Civil Engineering, Universiti Teknologi Mara (UiTM), Shah Alam, Selangor. | Working experience and occupation | He has more than thirty (30) years experience in construction management. He started his career with Maraputra Sdn Bhd in 1985. Between 1990 and 1996, he served Percon Corporation Sdn Bhd and has held various managerial positions. He later joined Kenneison Brother Sdn Bhd as General Manager in 1996. He then assumed the position of Managing Director of Sureman Sdn Bhd in 1999 before joining HRA Teguh Sdn Bhd in 2004 as Senior Project Manager. He has been with Zelan Berhad ("Zelan" or "Company") since 2009 and had held various positions within Zelan Group. He was assigned as Head of Planning & Monitoring, Head of Business Development and General Manager, Special Projects before he assumed the position of Chief Operating Officer of the Company. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2018 04:32 AM

|

显示全部楼层

发表于 28-8-2018 04:32 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 34,360 | 11,495 | 54,873 | 45,126 | | 2 | Profit/(loss) before tax | -6,818 | -2,408 | -9,495 | 4,762 | | 3 | Profit/(loss) for the period | -6,159 | -5,459 | -9,501 | 1,667 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -6,159 | -5,449 | -9,501 | 1,678 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.73 | -0.64 | -1.12 | 0.20 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0700 | 0.0800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-10-2018 07:57 AM

|

显示全部楼层

发表于 6-10-2018 07:57 AM

|

显示全部楼层

本帖最后由 icy97 于 9-10-2018 05:04 AM 编辑

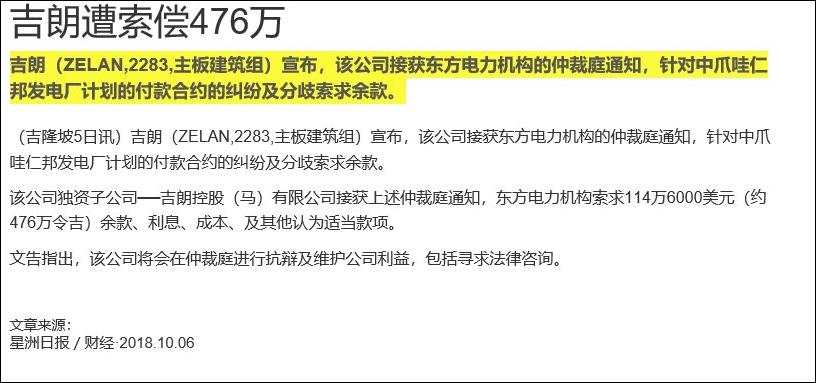

Type | Announcement | Subject | MATERIAL LITIGATION | Description | IN THE MATTER OF ARBITRATION BETWEEN DONGFANG ELECTRIC CORPORATION (AS CLAIMANT) AND ZELAN HOLDINGS (M) SDN BHD (AS RESPONDENT) UNDER THE INTERNATIONAL ARBITRATION ACT AND ARBITRATION RULES OF THE SINGAPORE INTERNATIONAL ARBITRATION CENTRE | Zelan Berhad (“ZB”) wishes to announce that its wholly owned subsidiary, Zelan Holdings (M) Sdn Bhd (“ZHSB”) has on 5 October 2018 received from the Dongfang Electric Corporation (“DEC”) a Notice of Arbitration dated 4 October 2018 issued against ZHSB in respect of disputes and differences arising from the Settlement Agreement dated 30 June 2014, between DEC and ZHSB in relation to the Supplies, the Supervision for Erection, Testing and Commissioning Services, the Power Plant Commissioning, and the Boiler, Turbine, Generator Performance Tests for the 2 x (300-400MW) Coal-Fired Steam Power Plant located at Rembang, Central Java, Indonesia.

DEC is claiming against ZHSB, inter alia, for the following:

(a) the balance outstanding of USD1,146,000.00; (b) interest; (c) cost; and (d) any other reliefs deem fit.

ZHSB shall take all necessary steps to defend or safeguard ZHSB’s interests in the arbitration proceedings, including but not limited to seeking legal advice on the merits of the claims by DEC.

This Announcement is dated 5 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-12-2018 06:59 AM

|

显示全部楼层

发表于 19-12-2018 06:59 AM

|

显示全部楼层

吉朗败诉需赔cdsb266万

http://www.sinchew.com.my/node/1815450/

Type | Announcement | Subject | MATERIAL LITIGATION | Description | MATERIAL LITIGATION IN THE MATTER OF ARBITRATION PROCEEDING AT ASIAN INTERNATIONAL ARBITRATION CENTRE (AIAC) (FORMERLY KNOWN AS KUALA LUMPUR REGIONAL CENTRE FOR ARBITRATION (KLRCA)) REF. NO.: KLRCA/D/ADM-487-2017 BETWEEN CLAMSHELL DREDGING SDN BHD (AS THE CLAIMANT) AND ZELAN CONSTRUCTION SDN BHD (AS THE RESPONDENT) | Zelan Berhad (“Company”) would like to announce that its wholly owned subsidiary, Zelan Construction Sdn Bhd (“ZCSB or the Respondent”), was informed by its solicitors that on 22 November 2018 the Arbitral Tribunal had issued its award after the full trial of the matter wherein the Arbitral Tribunal ordered as follows:-

(a) It is declared that ZCSB had terminated the Contracts; (b) ZCSB is to pay the Claimant the sum of RM2,664,528.41 including GST of 6% thereon; (c) ZCSB is to pay interest at the rate of 5% per annum on the sum of RM2,664,528.41 from 30.6.2016 until full payment; (d) ZCSB to pay 90% of the costs to be assessed to the Claimant; and (e) ZCSB’s counterclaim is hereby dismissed without costs.

The decision in relation to the assessment of costs in respect of item (d) above will be given after submission of written submission by the respective parties. The Company will make further announcement on any materials development on this matter from time to time.

This Announcement is dated 23 November 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-1-2019 07:25 AM

|

显示全部楼层

发表于 2-1-2019 07:25 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 18,470 | 8,557 | 73,343 | 53,683 | | 2 | Profit/(loss) before tax | -5,300 | -10,257 | -14,795 | -5,495 | | 3 | Profit/(loss) for the period | -5,535 | -10,108 | -15,036 | -8,441 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -5,535 | -10,099 | -15,036 | -8,421 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.66 | -1.20 | -1.78 | -1.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0600 | 0.0800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-1-2019 07:51 AM

|

显示全部楼层

发表于 2-1-2019 07:51 AM

|

显示全部楼层

Date of change | 01 Dec 2018 | Name | ENCIK KAMARUDDIN BIN ABD KARIM | Age | 58 | Gender | Male | Nationality | Malaysia | Type of change | Others | Designation | Chief Operating Officer | Description | Encik Kamaruddin Bin Abd Karim to resume his earlier position in the Company with effect from 1 December 2018 |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information |

| | | Working experience and occupation | He has more than thirty (30) years experience in construction management. He started his career with Maraputra Sdn Bhd in 1985. Between 1990 and 1996, he served Percon Corporation Sdn Bhd and has held various managerial positions. He later joined Kenneison Brother Sdn Bhd as General Manager in 1996. He then assumed the position of Managing Director of Sureman Sdn Bhd in 1999 before joining HRA Teguh Sdn Bhd in 2004 as Senior Project Manager. He has been with Zelan Berhad ("Zelan" or "Company") since 2009 and had held various positions within Zelan Group. He was assigned as Head of Planning & Monitoring, Head of Business Development and General Manager, Special Projects before he assumed the position of Chief Operating Officer of the Company. |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|