|

|

【EDGENTA 1368 交流专区】(前名 FABER)

[复制链接]

[复制链接]

|

|

|

发表于 4-6-2018 05:52 AM

|

显示全部楼层

发表于 4-6-2018 05:52 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 12-6-2018 03:57 AM

|

显示全部楼层

发表于 12-6-2018 03:57 AM

|

显示全部楼层

本帖最后由 icy97 于 16-6-2018 03:09 AM 编辑

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | UEM EDGENTA BERHAD ("UEM Edgenta" or "the Company")- RELATED PARTY TRANSACTIONS BETWEEN OPUS INTERNATIONAL (M) BERHAD AND BORNEO HIGHWAY PDP SDN BHD | Pursuant to Paragraph 10.08(1) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad (“MMLR”), the Board of Directors of UEM Edgenta wishes to announce that Opus International (M) Berhad (“OIM”), a wholly-owned subsidiary of Opus Group Berhad, which in turn is a wholly-owned subsidiary of UEM Edgenta, had entered into the following contracts with Borneo Highway PDP Sdn Bhd (“BHP”), a related party to the Company:-

i. Pelaksanaan Projek Lebuhraya Pan Borneo Sabah – Study on asphaltic mix options to address limited granite resources and subgrade California Bearing Ratio (“CBR”) for Pavement Design Optimisation (“Transaction 1”); and

ii. Pelaksanaan Projek Lebuhraya Pan Borneo Sabah – Technical Support Services (“Transaction 2”),

(collectively referred to as the “Transactions”).

This announcement is dated 1 June 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 06:11 AM

|

显示全部楼层

发表于 31-8-2018 06:11 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 546,134 | 508,285 | 1,006,924 | 925,340 | | 2 | Profit/(loss) before tax | 47,729 | 32,840 | 90,237 | 65,382 | | 3 | Profit/(loss) for the period | 34,630 | 30,714 | 65,133 | 60,830 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 33,405 | 27,372 | 62,956 | 54,655 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.02 | 3.29 | 7.57 | 6.57 | | 6 | Proposed/Declared dividend per share (Subunit) | 6.00 | 8.00 | 6.00 | 8.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7400 | 1.9000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 06:22 AM

|

显示全部楼层

发表于 31-8-2018 06:22 AM

|

显示全部楼层

EX-date | 10 Oct 2018 | Entitlement date | 12 Oct 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Single Tier Interim Dividend of 6.0 sen per ordinary share for the financial year ending 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaTel: 03-7849 0777Fax: 03-7841 8151 / 8152 | Payment date | 31 Oct 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 12 Oct 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-9-2018 07:11 AM

|

显示全部楼层

发表于 9-9-2018 07:11 AM

|

显示全部楼层

本帖最后由 icy97 于 10-9-2018 05:48 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-9-2018 05:35 AM

|

显示全部楼层

发表于 19-9-2018 05:35 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 30-12-2018 07:53 AM

|

显示全部楼层

发表于 30-12-2018 07:53 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 528,327 | 523,114 | 1,535,251 | 1,448,454 | | 2 | Profit/(loss) before tax | 25,092 | 32,113 | 115,329 | 97,495 | | 3 | Profit/(loss) for the period | 17,947 | 49,097 | 83,080 | 109,927 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 17,555 | 38,721 | 80,511 | 93,376 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.11 | 4.66 | 9.68 | 11.23 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 6.00 | 8.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7100 | 1.9000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-1-2019 07:49 AM

|

显示全部楼层

发表于 26-1-2019 07:49 AM

|

显示全部楼层

Notice of Person Ceasing (Section 139 of CA 2016)Particulars of Substantial Securities HolderName | LEMBAGA TABUNG HAJI | Address | 201, Jalan Tun Razak

Kuala Lumpur

50400 Wilayah Persekutuan

Malaysia. | Company No. | Act 535 (Tabung Haji Act 1995) | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Date of cessation | 28 Dec 2018 | Name & address of registered holder | Lembaga Tabung Haji201, Jalan Tun Razak, 50400 Kuala Lumpur. |

No of securities disposed | 48,313,300 | Circumstances by reason of which a person ceases to be a substantial shareholder | Transfer of shares to Urusharta Jamaah Sdn Bhd as a result of the restructuring exercise - 48,313,300 units. | Nature of interest | Direct Interest |  | Date of notice | 28 Dec 2018 | Date notice received by Listed Issuer | 31 Dec 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-2-2019 05:31 AM

|

显示全部楼层

发表于 26-2-2019 05:31 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 647,354 | 672,312 | 2,182,605 | 2,120,766 | | 2 | Profit/(loss) before tax | 82,887 | 75,427 | 198,216 | 172,922 | | 3 | Profit/(loss) for the period | 69,089 | 324,833 | 152,169 | 434,760 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 67,727 | 324,811 | 148,238 | 418,187 | | 5 | Basic earnings/(loss) per share (Subunit) | 8.14 | 39.06 | 17.83 | 50.29 | | 6 | Proposed/Declared dividend per share (Subunit) | 8.00 | 23.00 | 14.00 | 31.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.8100 | 1.9000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-2-2019 06:34 AM

|

显示全部楼层

发表于 26-2-2019 06:34 AM

|

显示全部楼层

EX-date | 16 Apr 2019 | Entitlement date | 18 Apr 2019 | Entitlement time | 05:00 PM | Entitlement subject | Second interim dividend | Entitlement description | Single Tier Second Interim Dividend of 8.0 sen per ordinary share for the financial year ended 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378418088Fax:0378418100 | Payment date | 09 May 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 18 Apr 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.08 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-6-2019 02:57 AM

|

显示全部楼层

发表于 7-6-2019 02:57 AM

|

显示全部楼层

Date of change | 29 Apr 2019 | Name | DR SAMAN @ SAIMY BIN ISMAIL | Age | 72 | Gender | Male | Nationality | Malaysia | Designation | Director | Directorate | Independent and Non Executive | Type of change | Demised |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2019 07:36 AM

|

显示全部楼层

发表于 22-6-2019 07:36 AM

|

显示全部楼层

Date of change | 15 May 2019 | Name | ENCIK AMIR HAMZAH BIN AZIZAN | Age | 52 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Non Independent and Non Executive | Type of change | Retirement |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Bachelor of Science Degree in Management (Majored in Finance and Economics) | Syracuse University, United States of America | | | 2 | Others | Corporate Finance Evening Programme | London Business School, United Kingdom | | | 3 | Others | Stanford Executive Programme | Stanford University, United States of America | |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-6-2019 06:10 AM

|

显示全部楼层

发表于 28-6-2019 06:10 AM

|

显示全部楼层

Date of change | 24 May 2019 | Name | TAN SRI DR AZMIL KHALILI BIN DATO' KHALID | Age | 58 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Independent and Non Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Doctorate | Science (Honorary) | University of Hertfordshire, Hatfield, England | | | 2 | Masters | Business Administration | California State University, Dominguez Hills | | | 3 | Degree | Bachelor of Science in Civil Engineering | Northrop University, Los Angeles, California | | | 4 | Degree | Bachelor of Science in Civil Engineering | University of Hertfordshire, Hatfield, England | |

Working experience and occupation | Tan Sri Dr Azmil began his career with a United Kingdom company, Tarmac National Construction. Upon his return to Malaysia, he worked for Trust International Insurance and Citibank NA. Tan Sri Dr Azmil was the President and Chief Executive Officer of both The AlloyMtd Group and ANIH Berhad from April 2011 to August 2017. He joined MTD Capital Bhd in 1993 as General Manager of Corporate Planning and held the position of Group Managing Director and Chief Executive Director in March 1996 before assuming the position as Group President and Chief Executive Officer of The MTD Group from April 2005 to April 2011. He was the President and Chief Executive Officer of MTD Capital Bhd's listed subsidiary namely, MTD ACPI Engineering Berhad and was also the Chairman of MTD Walkers PLC, a foreign subsidiary of MTD Capital Bhd listed on the Colombo Stock Exchange in the Republic of Sri Lanka.Tan Sri Dr Azmil also sits on the Boards of UEM Sunrise Berhad, Reach Energy Berhad and ANIH Berhad. He is the Chairman of the Malaysia-Philippines Business Council. | Directorships in public companies and listed issuers (if any) | 1. UEM Sunrise Berhad2. Reach Energy Berhad2. ANIH Berhad |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-7-2019 07:15 AM

|

显示全部楼层

发表于 5-7-2019 07:15 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 515,876 | 460,790 | 515,876 | 460,790 | | 2 | Profit/(loss) before tax | 46,036 | 42,508 | 46,036 | 42,508 | | 3 | Profit/(loss) for the period | 33,475 | 30,503 | 33,475 | 30,503 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 32,664 | 29,551 | 32,664 | 29,551 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.93 | 3.55 | 3.93 | 3.55 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7600 | 1.8100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-7-2019 07:30 AM

|

显示全部楼层

发表于 14-7-2019 07:30 AM

|

显示全部楼层

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | UEM EDGENTA BERHAD ("UEM EDGENTA" OR THE "COMPANY")- MEMORANDUM OF UNDERSTANDING ENTERED INTO BETWEEN LEMBAGA LEBUHRAYA MALAYSIA, LEMBAGA PEMBANGUNAN INDUSTRI PEMBINAAN MALAYSIA AND UEM EDGENTA TO EXPLORE POTENTIAL COLLABORATION OPPORTUNITIES TO ENHANCE BEST PRACTICES AND COMPETENCIES FOR MAINTENANCE OF HIGHWAYS IN MALAYSIA | The Board of Directors of UEM Edgenta is pleased to announce that UEM Edgenta had on 18 June 2019, entered into a Memorandum of Understanding with Lembaga Lebuhraya Malaysia (“LLM”) and Lembaga Pembangunan Industri Pembinaan Malaysia (“CIDB”) to explore potential collaboration opportunities between LLM, CIDB and UEM Edgenta.

This announcement is dated 18 June 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6194749

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2019 05:32 AM

|

显示全部楼层

发表于 22-7-2019 05:32 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | UEM EDGENTA BERHAD ("UEM EDGENTA" OR "COMPANY")- ACCEPTANCE OF CONTRACTS FOR THE PROVISION OF HOSPITAL SUPPORT SERVICES IN SINGAPORE BY UEMS SOLUTIONS PTE LTD, AN INDIRECT 97.46% SUBSIDIARY OF THE COMPANY | UEM Edgenta is pleased to announce that UEMS Solutions Pte Ltd, an indirect 97.46% subsidiary of the Company has on 4 July 2019 accepted contracts for the provision of hospital support services, which include housekeeping and portering services, to the Ministry of Health of Singapore’s restructured hospitals.

This announcement is dated 4 July 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6214129

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2019 07:32 AM

|

显示全部楼层

发表于 28-8-2019 07:32 AM

|

显示全部楼层

本帖最后由 icy97 于 29-8-2019 03:58 AM 编辑

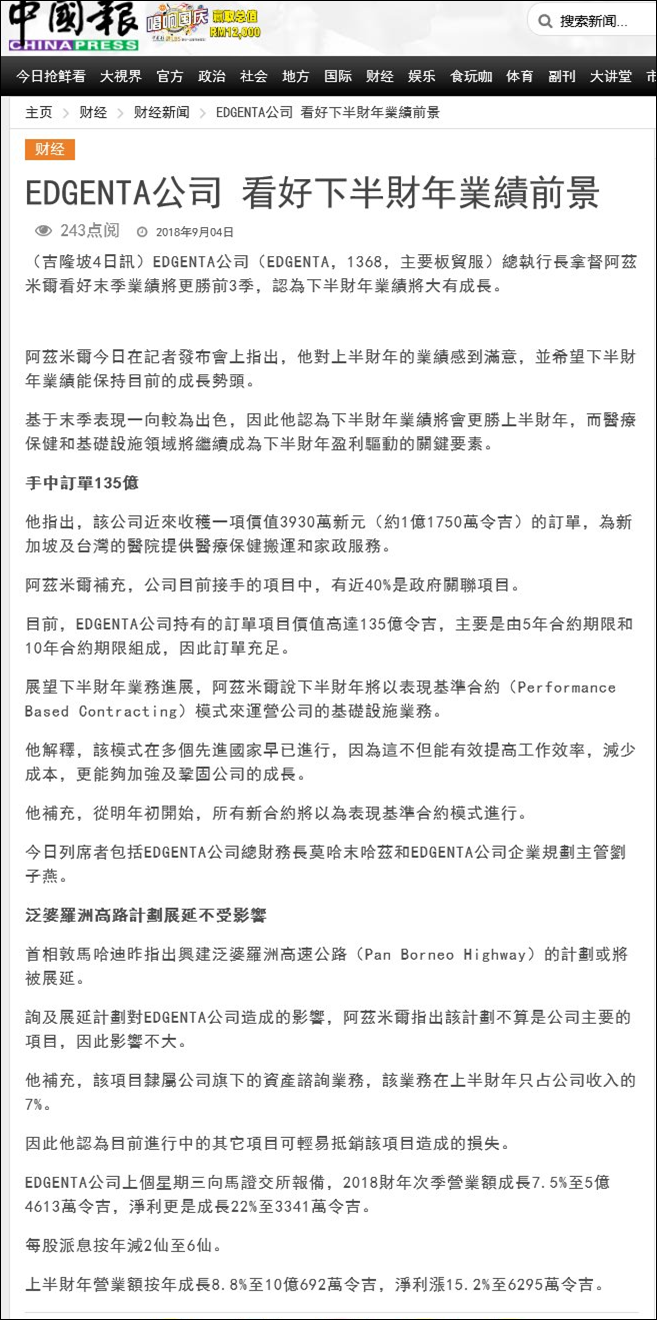

医疗后勤带动‧UEM前线次季多赚3%

https://www.sinchew.com.my/content/content_2107324.html

(吉隆坡27日讯)医疗后勤支援发功,推高UEM前线(EDGENTA,1368,主板工业产品服务组)截至2019年6月30日止第二季净利增2.85%至3435万6000令吉,首半年净利报6702万令吉,升6.46%。

第二季营业额起9.02%至5亿9541万8000令吉,首半年营业额报11亿1129万4000令吉,升10.37%。

派息6仙

该公司宣布派发6仙股息,除权日与享有日分别落在9月9及10日。

公司董事经理兼首席执行员拿督阿兹米尔马里肯透过文告表示,首半年业绩成长主要是来自医疗后勤支援,该业务营业额与税前盈利各增19.7%及25.9%,归功区域新加坡及台湾新合约的贡献。

基建服务首半年营业额起2.2%,主要是来自大马大道维修服务,而印尼也提供长远成长的机会。资产咨询顾问服务营业额跌1.9%,因期限快结束。

马里肯表示,医疗支援服务持续成为该公司成长动力,截至今年6月,公司攫取5亿4006万令吉合约,主要来自新加坡卫生部的贡献。

目前,该公司共为大马、新加坡、台湾及印度不同的医院提供相关服务,服务数量超过300家。

文章来源 : 星洲日报 2019-08-28

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 595,418 | 546,134 | 1,111,294 | 1,006,924 | | 2 | Profit/(loss) before tax | 46,756 | 47,729 | 92,792 | 90,237 | | 3 | Profit/(loss) for the period | 34,650 | 34,630 | 68,125 | 65,133 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 34,356 | 33,405 | 67,020 | 62,956 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.13 | 4.02 | 8.06 | 7.57 | | 6 | Proposed/Declared dividend per share (Subunit) | 6.00 | 6.00 | 6.00 | 6.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.8100 | 1.8100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2019 07:39 AM

|

显示全部楼层

发表于 28-8-2019 07:39 AM

|

显示全部楼层

EX-date | 09 Oct 2019 | Entitlement date | 10 Oct 2019 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Single Tier Interim Dividend of 6.0 sen per ordinary share for the financial year ending 31 December 2019 | Period of interest payment | to | Financial Year End | 31 Dec 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 31 Oct 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 10 Oct 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-9-2019 07:34 AM

|

显示全部楼层

发表于 4-9-2019 07:34 AM

|

显示全部楼层

icy97 发表于 14-1-2016 01:46 AM

UEM阳光 易健达 联营综合城镇管理

财经 2016年01月13日

(吉隆坡13日讯)UEM阳光(UEMS,5148,主板產业股)、易健达(EDGENTA,1368,主板贸服股),与大马依斯干达玛迪尼私人有限公司(Medini Iskandar Malay ...

Type | Announcement | Subject | OTHERS | Description | UEM EDGENTA BERHAD ("UEM EDGENTA" OR "THE COMPANY")- TERMINATION OF JOINT VENTURE SHAREHOLDERS' AGREEMENT MADE BETWEEN UEM SUNRISE EDGENTA TMS SDN. BHD. ("UEMSET") AND TOWNSHIP MANAGEMENT SERVICES SDN. BHD. ("TMS") | Reference is made to the Company’s announcements dated 13 January 2016 and 12 February 2016 in relation to the Joint Venture Shareholders’ Agreement dated 13 January 2016 (“JVSHA”) entered into between UEMSET, an indirect 70% subsidiary of UEM Edgenta and TMS on 13 January 2016 to establish and operate Edgenta TMS Sdn Bhd (“ETSB”).

The Board of Directors of UEM Edgenta wishes to announce that UEMSET, an indirect 70% subsidiary of the Company had on 1 September 2019, entered into a Termination Agreement with TMS to terminate the JVSHA entered with TMS (“Termination Agreement/Termination”).

This announcement is dated 3 September 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6274773

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-9-2019 07:07 AM

|

显示全部楼层

发表于 5-9-2019 07:07 AM

|

显示全部楼层

本帖最后由 icy97 于 5-9-2019 07:41 AM 编辑

受惠狮城医疗支援合约 易健达加速成长

财经 发布于 2019年09月04日

https://www.orientaldaily.com.my/news/business/2019/09/04/305134

(吉隆坡4日讯)易健达(EDGENTA,1368,主板工业股)相信,其医疗支援服务(HSS)业务有望从新加坡如火如荼的医疗改革中受惠,加速公司接下来的增长步伐。

惟,易健达董事经理兼首席执行员拿督阿兹米尔不愿向媒体透露更多详情,仅表示狮城合约价值更高、期限更长。

“重组计划还未完成,但我们必定会参与竞标,也有信心可赢取更多合约。”该公司于7月4日获新加坡卫生部颁发价值最高5亿4006万令吉合约。

然而,上述合约赚幅低于平均的8.5%,询及接下来的狮城合约会否出现相同情况,阿兹米尔表示,公司会以具竞争力的价格竞标。“我们盼望,可透过卓越营运策略与先进技术推高新合约的赚幅。”

易健达2019财政年上半年(截至6月30日止)营收按年涨10.4%,至11亿1130万令吉;净利则按年起4.6%,至6810万令吉,主要是医疗支援服务录得正面增长,占整体净利51%,而基建解决方案业务旗下的基建服务(InfraServices)则贡献35%净利。截至次季杪,易健达手握总值132亿令吉合约。

除了新加坡以外,易健达在大马、台湾与印度皆有医疗支援业务,并可对未来增长作出贡献。

探讨印尼商机

阿兹米尔披露,易健达正探讨在印尼其它长期成长的机会,包括进军当地医疗支援业务。“我们在印尼已经有生意,是长期策略的一部份。同时,我们也正探讨与当地业者合作,进一步发展我们的业务。”

但他强调,这项计划目前仍在初始阶段。目前,易健达正为印尼长达115公里的Cipali高速大道提供基建保养服务。

另一边厢,市场在2个月前传出易健达的母公司--马友乃德(UEM)会在11月向员工提出互惠遣散计划(MSS),并在明年轮到子公司“瘦身”。阿兹米尔对此回应道,易健达不会有任何的MSS。

此外,阿兹米尔表示,不会涉足第3轮大型太阳能发电项目(LSS3)提供设施管理服务。管理层会专注在公司擅长的领域。 |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|